Key Insights

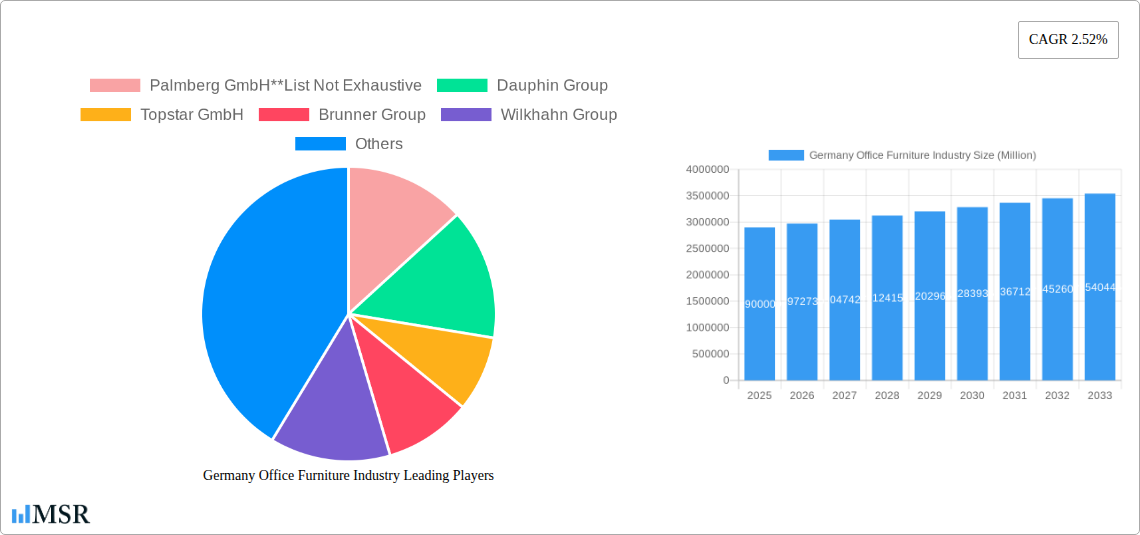

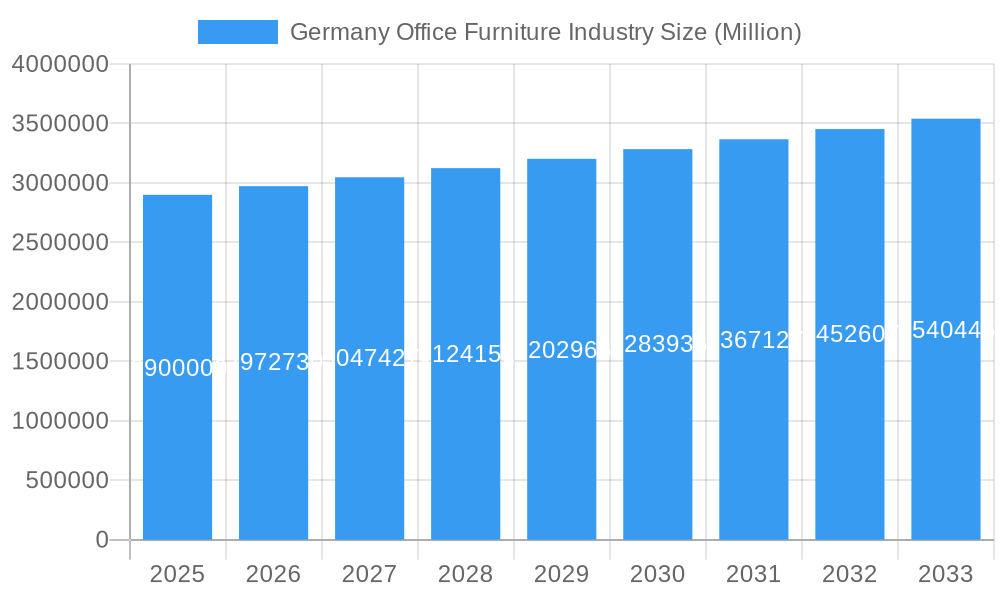

The Germany office furniture market is poised for steady growth, projected to reach a substantial value by 2033. With a Compound Annual Growth Rate (CAGR) of 2.52%, the market is expected to expand from its current estimated value of €2.90 million (base year 2025) to significantly higher figures throughout the forecast period. This sustained expansion is driven by several key factors. A primary driver is the increasing demand for ergonomic and aesthetically pleasing office furniture, reflecting a growing awareness of employee well-being and productivity. Companies are investing in modern workspaces that foster collaboration and creativity, leading to a greater emphasis on functional yet stylish furniture solutions. Furthermore, the ongoing evolution of work models, including the hybrid work environment, necessitates adaptable and flexible furniture arrangements that can accommodate both in-office and remote work setups. Government initiatives promoting workspace renovation and the increasing number of new office constructions also contribute to this positive market trajectory. The market is characterized by a dynamic competitive landscape, featuring established German manufacturers renowned for their quality and design, alongside international players vying for market share.

Germany Office Furniture Industry Market Size (In Million)

The German office furniture market is segmented into key areas including production, consumption, imports, exports, and price trends. Production analysis reveals a strong domestic manufacturing base, characterized by innovation and a focus on sustainable materials and processes. Consumption patterns highlight a shift towards intelligent furniture solutions, smart office designs, and furniture that supports diverse working styles. Import and export analyses indicate Germany's significant role as both a producer and consumer of office furniture within the European Union and globally. While the market benefits from strong domestic demand, it also faces certain restraints. These include fluctuating raw material costs, which can impact profitability, and increasing competition, particularly from lower-cost manufacturing regions. However, the premium quality, durability, and design excellence associated with German-made office furniture continue to provide a competitive advantage. The market’s future growth will likely be shaped by technological advancements in furniture design, a continued focus on sustainability, and the ability of manufacturers to adapt to evolving workplace demands and economic conditions.

Germany Office Furniture Industry Company Market Share

Germany Office Furniture Industry: Comprehensive Market Analysis and Growth Forecast (2019-2033)

Unlock unparalleled insights into the dynamic Germany office furniture market. This definitive report, meticulously researched and packed with actionable data, navigates the complex landscape of office furniture production, consumption, imports, exports, and pricing trends from 2019 to 2033. With a base year of 2025 and a robust forecast period, gain a competitive edge by understanding key market drivers, emerging opportunities, and the strategic imperatives shaping this vital industry. Explore granular data on market concentration, innovation ecosystems, regulatory influences, and the evolving demands of end-users. Identify dominant segments and geographical strengths within production, consumption, import/export dynamics, and price fluctuations. Delve into groundbreaking product developments, analyze significant challenges and growth catalysts, and discover emerging opportunities within this thriving sector. Featuring in-depth analysis of leading players and key industry milestones, this report is an indispensable resource for manufacturers, distributors, investors, and policymakers seeking to capitalize on the future of German office furniture.

Germany Office Furniture Industry Market Concentration & Dynamics

The Germany office furniture industry exhibits a moderately concentrated market structure, characterized by the presence of established, leading manufacturers alongside a growing number of agile niche players. Innovation ecosystems are robust, driven by a strong emphasis on design excellence, ergonomic solutions, and sustainable manufacturing practices. Regulatory frameworks, particularly concerning workplace safety, environmental standards (e.g., FSC, Blauer Engel certifications), and accessibility, significantly influence product development and market entry. Substitute products, such as modular and flexible workspace solutions, are gaining traction, pushing traditional furniture manufacturers to adapt. End-user trends are increasingly focused on hybrid work models, employee well-being, and the creation of collaborative and adaptable office environments. Mergers and acquisitions (M&A) activities, while not excessively frequent, are strategic, aimed at consolidating market share, acquiring specialized technologies, or expanding geographical reach. For instance, the Sedus Stoll AG and Watson Furniture Group global partnership signifies a strategic move towards enhanced global reach and product synergy.

- Market Concentration: Moderate, with key players holding significant market share.

- Innovation Ecosystems: Strong, driven by design, ergonomics, and sustainability.

- Regulatory Frameworks: Influential in product design and market entry standards.

- Substitute Products: Flexible and modular solutions are emerging as key competitors.

- End-User Trends: Focus on hybrid work, well-being, and collaborative spaces.

- M&A Activities: Strategic acquisitions and partnerships for market expansion and technological advancement.

- M&A Deal Counts: Limited but impactful strategic collaborations.

Germany Office Furniture Industry Industry Insights & Trends

The Germany office furniture industry is poised for sustained growth, propelled by several interconnected factors. The estimated market size for office furniture in Germany is projected to reach XX Million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately X.XX% during the forecast period of 2025–2033. A primary growth driver is the ongoing evolution of workplace design, fueled by the widespread adoption of hybrid work models. Companies are investing in creating more dynamic, flexible, and employee-centric office spaces that cater to both collaboration and focused individual work. This trend necessitates a move away from traditional fixed desking towards modular furniture systems, ergonomic seating, and acoustically optimized environments. Technological disruptions, such as the integration of smart furniture with features like integrated charging ports, adjustable height controls, and connectivity solutions, are also shaping consumer preferences and driving demand for advanced products. Evolving consumer behaviors, particularly among younger generations of employees, emphasize sustainability, aesthetics, and personalization in their workspace. The increasing demand for ergonomic seating solutions, driven by heightened awareness of employee health and productivity, represents a significant market opportunity. Furthermore, corporate social responsibility initiatives and a growing preference for eco-friendly materials and manufacturing processes are influencing purchasing decisions, favoring manufacturers who demonstrate a strong commitment to sustainability. The resurgence of in-office collaboration post-pandemic is also a key trend, leading to increased investment in communal work areas, meeting rooms, and breakout spaces, all of which require specialized furniture solutions. The German government's continued focus on economic stability and investment in commercial real estate further underpins the steady demand for office furniture.

Key Markets & Segments Leading Germany Office Furniture Industry

The Production Analysis of the Germany office furniture industry is dominated by a strong manufacturing base located primarily in the western and southern regions of Germany, known for their industrial heritage and skilled workforce. These regions benefit from excellent infrastructure and proximity to raw material suppliers and key export markets. The Consumption Analysis reveals a high demand for office furniture across major economic hubs, particularly in metropolitan areas like Berlin, Munich, Hamburg, and Frankfurt, where a significant concentration of businesses and corporate headquarters are located. The increasing adoption of flexible work policies has also spurred demand in smaller cities and suburban business parks, broadening the consumption landscape.

In terms of the Import Market Analysis (Value & Volume), Germany is a significant importer of office furniture, with key sourcing countries including Poland, Vietnam, and China, often for specific product categories or to supplement domestic production. The import value is estimated to reach XX Million in 2025, with volumes projected at XX Million units. This segment is driven by competitive pricing for certain components and finished goods. The Export Market Analysis (Value & Volume) highlights Germany's strength as a leading exporter of high-quality, design-led office furniture. Key export destinations include France, the United Kingdom, the Netherlands, and the United States, valued at an estimated XX Million in 2025, with volumes around XX Million units. This is fueled by the reputation of German engineering and design excellence. The Price Trend Analysis indicates a stable to moderate upward trend, influenced by rising raw material costs, energy prices, and labor expenses, alongside a premium pricing strategy for innovative and design-intensive products.

- Production Dominance: Western and Southern Germany, driven by industrial infrastructure and skilled labor.

- Consumption Dominance: Major economic hubs and metropolitan areas, with growing demand in smaller business centers.

- Import Drivers: Competitive pricing for specific product segments, component sourcing.

- Export Drivers: Reputation for quality, design, engineering prowess, and innovation.

- Price Trend Influencers: Raw material costs, energy, labor, and product innovation.

Germany Office Furniture Industry Product Developments

Recent product developments in the Germany office furniture industry are sharply focused on enhancing the hybrid work experience, promoting well-being, and embracing sustainability. Innovations include intelligent furniture systems with integrated technology for seamless connectivity and personalized control. Ergonomic advancements continue to be a key area, with a rise in highly adjustable seating and workstations designed to support diverse body types and working postures. The incorporation of smart materials, such as antimicrobial surfaces and acoustically enhancing fabrics, is also gaining prominence. Furthermore, the industry is witnessing a surge in modular and reconfigurable furniture designs that allow for easy adaptation to changing office layouts and functional needs. The use of recycled and bio-based materials, alongside circular design principles, is becoming a crucial differentiator, reflecting a strong market demand for eco-conscious solutions.

Challenges in the Germany Office Furniture Industry Market

Despite its robust growth, the Germany office furniture market faces several significant challenges. Fluctuations in raw material prices, particularly for wood, metal, and plastics, can impact profitability and pricing strategies. Increasing energy costs and logistical complexities within global supply chains also pose considerable hurdles. Intense competition from both domestic and international manufacturers, including lower-cost imports, requires continuous innovation and cost optimization. Evolving workplace trends, while driving demand, also necessitate rapid adaptation of product lines and business models, which can be resource-intensive. Regulatory compliance for evolving environmental and safety standards also adds to the operational burden.

Forces Driving Germany Office Furniture Industry Growth

The growth of the Germany office furniture industry is propelled by a confluence of powerful forces. The widespread adoption of hybrid work models is a primary catalyst, compelling businesses to invest in flexible, ergonomic, and collaborative workspace solutions. Technological advancements, including the integration of smart features and sustainable materials, are creating new product categories and enhancing user experience. A growing emphasis on employee well-being and productivity is driving demand for high-quality, ergonomic furniture. Furthermore, government initiatives promoting sustainable development and circular economy principles are fostering innovation and creating opportunities for eco-friendly products. The strong reputation of German design and manufacturing excellence continues to be a significant advantage in both domestic and international markets.

Challenges in the Germany Office Furniture Industry Market

Long-term growth catalysts for the Germany office furniture industry are deeply rooted in innovation and strategic market positioning. The continued development of smart office furniture, integrating technology for enhanced functionality and user experience, will be a key differentiator. The expansion of subscription-based furnishing models, like that pioneered by NORNORM, offers recurring revenue streams and appeals to companies seeking flexible workspace solutions. Strategic partnerships, such as the global alliance between Sedus Stoll AG and Watson Furniture Group, are crucial for expanding market reach and accessing new technologies. Investment in research and development focused on sustainable materials, circular design, and biophilic office concepts will further solidify Germany's leadership position. Embracing digitalization in sales, marketing, and customer service will also be vital for future success.

Emerging Opportunities in Germany Office Furniture Industry

Emerging opportunities in the Germany office furniture industry are abundant, driven by evolving workspace paradigms and consumer preferences. The burgeoning demand for home office furniture solutions, as hybrid work solidifies its presence, presents a significant growth avenue. The increasing focus on creating adaptable and multi-functional spaces within corporate environments, catering to both collaboration and focused work, opens doors for modular and reconfigurable furniture systems. The development of acoustically optimized furniture and partitions is gaining traction as noise management becomes a critical factor in open-plan offices. Furthermore, the growing awareness and demand for sustainable and ethically sourced furniture present opportunities for manufacturers committed to environmental responsibility and circular economy principles. The integration of smart technology into furniture for enhanced productivity and well-being is another key emerging trend.

Leading Players in the Germany Office Furniture Industry Sector

- Palmberg GmbH

- Dauphin Group

- Topstar GmbH

- Brunner Group

- Wilkhahn Group

- Assmann Buromobel

- Interstuhl

- Sedus

- Vitra

- VS

Key Milestones in Germany Office Furniture Industry Industry

- May 2023: Sedus Stoll AG, the Germany based office furniture giant, and US based Watson Furniture Group have announced a new global partnership. The global partnership is a logical next step in the development of their businesses. Shared values and similar market strategies and expertise in the areas of technology and manufacturing are an excellent stepping stone to strategic cooperation.

- July 2022: ANDREU WORLD opened a new showroom in Germany, where the most recent products coexist in a single space. Some of the most internationally reputed designers created the products, such as Patricia Urquiola, Philippe Starck, Alfredo Häberli, Jasper Morrison, and Benjamin Hubert.

- May 2022: NORNORM, a subscription-based furnishing service offering radically affordable workspace solutions through circular renting models, is expanding its business to the German market. The startup, headquartered in Copenhagen, was founded in 2020 by former IKEA manager Anders Jespen and investor and Skype co-creator Jonas Kjellberg.

Strategic Outlook for Germany Office Furniture Industry Market

The strategic outlook for the Germany office furniture industry market is exceptionally positive, driven by a commitment to innovation, sustainability, and adaptability. Future growth will be accelerated by the continued demand for flexible and ergonomic workspace solutions supporting hybrid work models. Companies that prioritize the integration of smart technologies, offer customizable and modular designs, and demonstrate a strong commitment to eco-friendly manufacturing practices will gain a significant competitive advantage. Strategic partnerships and collaborations, both domestically and internationally, will be crucial for expanding market reach and fostering technological advancements. The industry's ability to anticipate and respond to evolving end-user needs, coupled with a focus on high-quality German engineering and design, positions it for sustained leadership and profitable growth in the coming years. Investment in circular economy principles and the development of products with extended lifecycles will also be key growth accelerators.

Germany Office Furniture Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

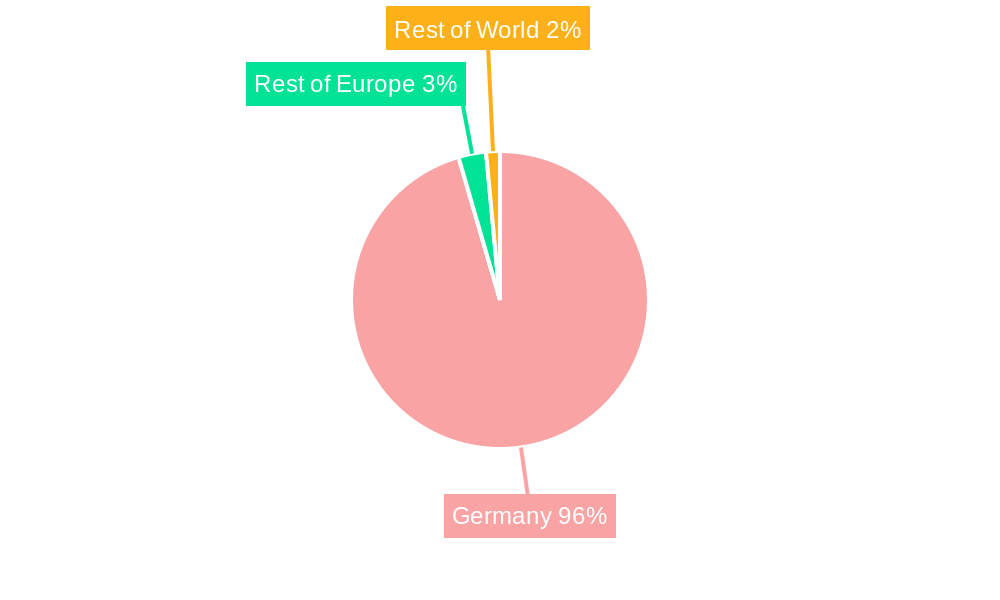

Germany Office Furniture Industry Segmentation By Geography

- 1. Germany

Germany Office Furniture Industry Regional Market Share

Geographic Coverage of Germany Office Furniture Industry

Germany Office Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increase in Office Spaces and Commercial Construction is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Office Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Palmberg GmbH**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dauphin Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Topstar GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Brunner Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wilkhahn Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Assmann Buromobel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Interstuhl

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sedus

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vitra

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Palmberg GmbH**List Not Exhaustive

List of Figures

- Figure 1: Germany Office Furniture Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Office Furniture Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Office Furniture Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Germany Office Furniture Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Germany Office Furniture Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Germany Office Furniture Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Germany Office Furniture Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Germany Office Furniture Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Germany Office Furniture Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Germany Office Furniture Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Germany Office Furniture Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Germany Office Furniture Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Germany Office Furniture Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Germany Office Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Office Furniture Industry?

The projected CAGR is approximately 2.52%.

2. Which companies are prominent players in the Germany Office Furniture Industry?

Key companies in the market include Palmberg GmbH**List Not Exhaustive, Dauphin Group, Topstar GmbH, Brunner Group, Wilkhahn Group, Assmann Buromobel, Interstuhl, Sedus, Vitra, VS.

3. What are the main segments of the Germany Office Furniture Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Office Spaces and Commercial Construction is Driving the Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices is Restraining the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Sedus Stoll AG, the Germany based office furniture giant, and US based Watson Furniture Group have announced a new global partnership. the global partnership is a logical next step in the development of their businesses. Shared values and similar market strategies and expertise in the areas of technology and manufacturing are an excellent stepping stone to strategic cooperation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Office Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Office Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Office Furniture Industry?

To stay informed about further developments, trends, and reports in the Germany Office Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence