Key Insights

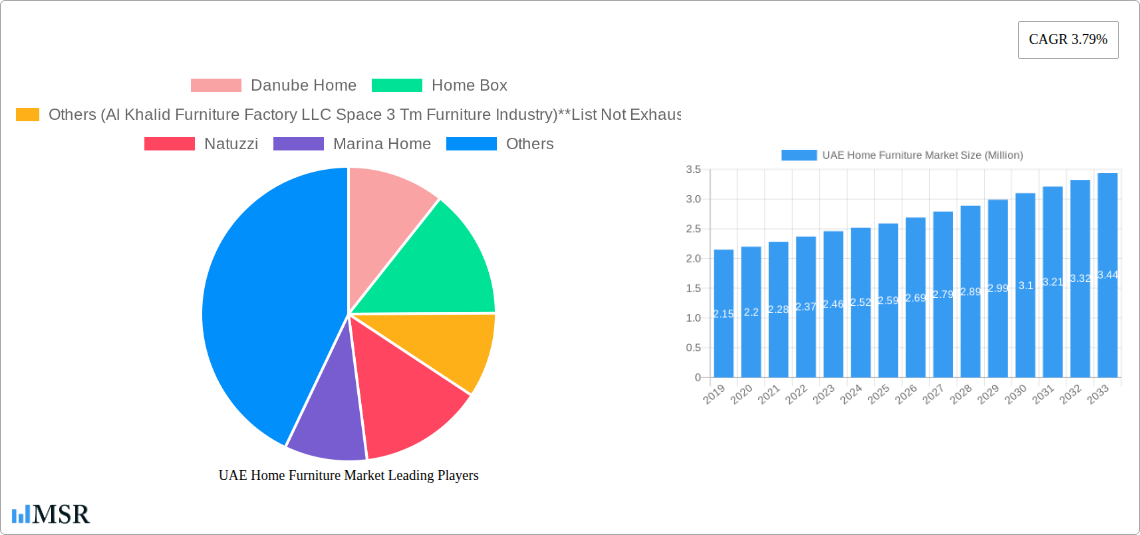

The United Arab Emirates (UAE) Home Furniture Market is poised for significant growth, with an estimated market size of USD 2.59 billion. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 3.79% from 2025 to 2033, indicating a steady and robust upward trajectory. This expansion is fueled by a burgeoning population, increasing disposable incomes, and a strong demand for aesthetically pleasing and functional living spaces. The demand for diverse furniture types, including living room, kitchen, dining room, and bedroom furniture, is a primary driver. The market is further propelled by substantial infrastructure development and ongoing urbanization projects across the Emirates, particularly in Dubai and Abu Dhabi, which necessitate new home furnishings. The increasing preference for modern and luxury furniture, coupled with a growing influence of international design trends, also contributes to market expansion. E-commerce penetration and the growth of online furniture retailers are revolutionizing distribution channels, offering consumers greater convenience and wider product selections, thus playing a pivotal role in reaching a broader customer base and catering to evolving purchasing habits.

UAE Home Furniture Market Market Size (In Million)

Despite the positive outlook, certain factors may influence the market's pace. While the market is expanding, the presence of a competitive landscape with both established international brands and local players necessitates continuous innovation and competitive pricing strategies. The cost of raw materials, particularly for wood and metal furniture, can present a challenge, impacting profit margins and potentially influencing final product prices. However, the UAE's strategic location and strong trade agreements are likely to mitigate some of these supply chain complexities. The rising popularity of sustainable and eco-friendly furniture, driven by increasing environmental awareness among consumers, presents a significant opportunity for market players to innovate and cater to this niche. Furthermore, the continuous evolution of interior design trends and the demand for customized furniture solutions will shape the product offerings and strategies of companies operating within this dynamic market.

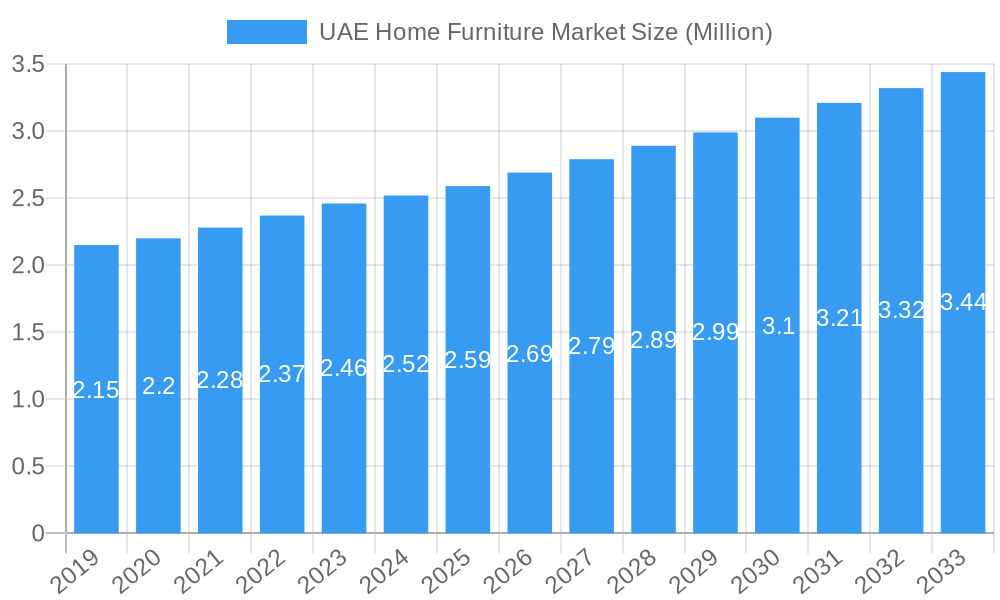

UAE Home Furniture Market Company Market Share

This in-depth report provides a comprehensive analysis of the UAE home furniture market, offering strategic insights into its dynamics, trends, and future outlook. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this study is an essential resource for industry stakeholders, including manufacturers, retailers, distributors, investors, and policymakers seeking to understand and capitalize on the burgeoning Dubai furniture market, Abu Dhabi furniture sector, and Sharjah furniture trends.

UAE Home Furniture Market Market Concentration & Dynamics

The UAE home furniture market exhibits a moderate to high level of concentration, driven by the presence of established global players and ambitious local manufacturers. Innovation is a key differentiator, with companies constantly introducing new designs, materials, and smart furniture solutions to cater to evolving consumer preferences. The regulatory framework, while generally supportive of business growth, involves adherence to import/export regulations and product safety standards. Substitute products, such as secondhand furniture and DIY solutions, present a minor challenge, but the demand for quality and stylish home furnishings in UAE remains robust. End-user trends are shifting towards sustainable materials, customizable options, and online purchasing convenience. Merger and acquisition activities are anticipated to increase as larger entities seek to expand their market share and product portfolios. Based on available data, the market share of leading players is estimated to be significant, with M&A deal counts showing a gradual upward trend in the past five years.

UAE Home Furniture Market Industry Insights & Trends

The UAE home furniture market size is projected to experience robust growth, fueled by several key factors. A rapidly expanding expatriate population, coupled with a burgeoning local demographic, drives consistent demand for new and updated home furnishings. The government’s continuous investment in infrastructure development and its ambition to become a global hub for tourism and business attract a steady influx of residents and visitors, further stimulating the residential furniture market in Dubai and other Emirates. Technological advancements are transforming the industry, with the rise of e-commerce platforms, virtual reality (VR) for furniture visualization, and the integration of smart technologies in furniture pieces. These innovations enhance the customer experience and broaden market reach. Evolving consumer behaviors are characterized by a growing preference for sustainable and eco-friendly products, a desire for personalized and modular furniture solutions, and an increasing reliance on online channels for research and purchasing. The luxury furniture market UAE is also experiencing significant expansion, driven by high-net-worth individuals seeking premium and bespoke pieces. The projected CAGR for the UAE home furniture market is estimated to be between 6% and 8% over the forecast period, indicating a healthy and sustained growth trajectory. The market is expected to reach an estimated value of XX Million by 2033.

Key Markets & Segments Leading UAE Home Furniture Market

The UAE home furniture market is characterized by the dominance of Dubai as the primary commercial and residential hub, attracting the largest share of sales and development. This is intrinsically linked to its status as a global destination and its high population density.

Emirates Dominance:

- Dubai: Leading the market due to its status as a global business and tourism hub, high disposable incomes, and a continuous influx of expatriates.

- Abu Dhabi: The capital city also contributes significantly to the market, driven by government initiatives and a growing affluent population.

- Sharjah: Shows steady growth, appealing to a different demographic segment with its more affordable housing options and family-oriented lifestyle.

- Others (e.g., Ajman, Ras Al Khaimah): These emerging markets are witnessing incremental growth, driven by affordable living and developing infrastructure.

Material Segment:

- Wood Furniture: Continues to hold a substantial market share due to its perceived durability, aesthetic appeal, and versatility in design, especially in the high-end furniture Dubai segment.

- Metal Furniture: Gaining traction for its modern appeal, especially in minimalist and industrial-themed interior designs.

- Plastic and Other Furniture: Popular for budget-friendly options and specific functional applications, particularly in hospitality and rental properties.

Type Segment:

- Living Room Furniture: Dominates the market, reflecting its importance as a central gathering space and a reflection of personal style.

- Bedroom Furniture: Remains a consistent performer, with demand driven by new home purchases and renovations.

- Kitchen Furniture: Experiencing growing demand as integrated kitchen designs become more popular, requiring custom and modular solutions.

- Dining Room Furniture: Essential for many households, with evolving trends towards multi-functional and space-saving designs.

Distribution Channel Segment:

- Home Centers: Continue to be a primary channel, offering a wide variety of products under one roof, catering to mass-market appeal.

- Online Stores: Experiencing exponential growth, driven by convenience, wider selection, and competitive pricing, making it a crucial channel for online furniture shopping UAE.

- Flagship Stores & Specialty Stores: Cater to niche markets and luxury segments, offering curated collections and personalized customer service for designer furniture UAE.

The economic growth, infrastructure development, and increasing disposable incomes in these key Emirates are the primary drivers for the dominance of these segments. The rising popularity of online shopping and the demand for stylish and functional living spaces are further propelling these trends. The UAE home furniture market is valued at XX Million in the base year 2025.

UAE Home Furniture Market Product Developments

Product innovation in the UAE home furniture market is a key differentiator. Manufacturers are focusing on sustainable materials, smart technology integration, and modular designs that cater to compact living spaces. The introduction of eco-friendly wood alternatives, recycled plastics, and energy-efficient smart furniture is gaining traction. Applications range from aesthetically pleasing home decor to functional solutions that enhance comfort and convenience, such as adjustable desks and integrated charging ports. The market relevance of these developments lies in their ability to meet the growing consumer demand for environmentally conscious and technologically advanced home solutions, providing a competitive edge for companies like Danube Home and Home Centre.

Challenges in the UAE Home Furniture Market Market

Despite robust growth, the UAE home furniture market faces several challenges. Intense competition from both international and local players puts pressure on profit margins. Supply chain disruptions, particularly concerning the sourcing of raw materials and logistics, can lead to increased costs and delivery delays. Stringent import regulations and customs duties can also impact pricing and product availability. Furthermore, changing consumer tastes require continuous adaptation and investment in new designs and materials, posing a significant challenge for smaller manufacturers. The estimated market value of affected segments due to these challenges is XX Million.

Forces Driving UAE Home Furniture Market Growth

Several forces are propelling the UAE home furniture market. Economic diversification initiatives and a strong focus on tourism and real estate development continue to drive demand for residential and commercial furnishings. The increasing disposable income of residents, coupled with a significant expatriate population that frequently relocates, fuels continuous purchasing of home decor UAE. Government support for the manufacturing sector and favorable business policies create a conducive environment for growth. Furthermore, the growing adoption of e-commerce platforms is expanding market reach and accessibility, making it easier for consumers to purchase modern furniture Dubai.

Challenges in the UAE Home Furniture Market Market

Long-term growth catalysts in the UAE home furniture market are multifaceted. Continued urbanization and the development of new residential projects, particularly in Dubai and Abu Dhabi, will create a sustained demand for furniture. The increasing awareness and preference for sustainable and ethically sourced products present an opportunity for companies to differentiate themselves and capture a growing market segment. Strategic partnerships and collaborations, such as those observed between local entities and international brands, will continue to enrich product offerings and expand market penetration. The focus on smart home technologies and the integration of furniture with digital ecosystems will also be a significant long-term growth driver.

Emerging Opportunities in UAE Home Furniture Market

Emerging opportunities in the UAE home furniture market are abundant. The burgeoning interest in bespoke and custom-designed furniture offers a lucrative niche for specialized manufacturers and designers. The growing demand for eco-friendly and sustainable furniture presents a significant avenue for growth, with consumers increasingly willing to invest in ethically produced items. The expansion of e-commerce, including the adoption of Augmented Reality (AR) for virtual furniture placement, is revolutionizing the customer experience and opening new sales channels. Furthermore, the increasing popularity of smaller living spaces and multi-functional furniture presents an opportunity for innovative solutions that maximize utility and aesthetic appeal in compact furniture UAE. The potential market size for these emerging opportunities is estimated to be XX Million.

Leading Players in the UAE Home Furniture Market Sector

- Danube Home

- Home Box

- Natuzzi

- Marina Home

- Pottery Barn

- PAN Emirates Home Furnishings

- Home Centre

- Homes R Us

- Royal Furniture

- Inter IKEA Group

- The FITOUT (through collaborations)

- Vivium Holding (through collaborations)

- Others (Al Khalid Furniture Factory LLC, Space 3, Tm Furniture Industry)

Key Milestones in UAE Home Furniture Market Industry

- June 2023: The FITOUT partnered with Gurian, an Italian furniture manufacturing company, to diversify product offerings and introduce Italian luxury furniture to the UAE market, impacting the high-end segment.

- June 2023: Vivium Holding announced a strategic distribution agreement with Kettal, a Spanish outdoor furniture brand, including the debut of Kettal's first store in the UAE, enhancing the outdoor furniture segment and brand portfolio.

Strategic Outlook for UAE Home Furniture Market Market

The strategic outlook for the UAE home furniture market is highly positive, driven by a combination of sustained economic growth, evolving consumer preferences, and technological advancements. Future market potential lies in catering to the increasing demand for sustainable and smart furniture solutions, as well as personalized and modular designs. Strategic opportunities include expanding e-commerce capabilities, fostering collaborations with international brands, and investing in innovative product development. The continued focus on luxury and premium segments, alongside affordable and functional options, will ensure a diverse and dynamic market landscape. The UAE home furniture market is poised for continued expansion and innovation, driven by these key accelerators, with an estimated market value reaching XX Million by 2033.

UAE Home Furniture Market Segmentation

-

1. Material

- 1.1. Wood Furniture

- 1.2. Metal Furniture

- 1.3. Plastic and Other Furniture

-

2. Type

- 2.1. Living Room Furniture

- 2.2. Kitchen Furniture

- 2.3. Dining Room Furniture

- 2.4. Bedroom Furniture

- 2.5. Other Furniture

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Flagship Stores

- 3.3. Specialty Stores

- 3.4. Online Stores

- 3.5. Other Distribution Channels

-

4. Emirates

- 4.1. Dubai

- 4.2. Abu Dhabi

- 4.3. Sharjah

- 4.4. Others

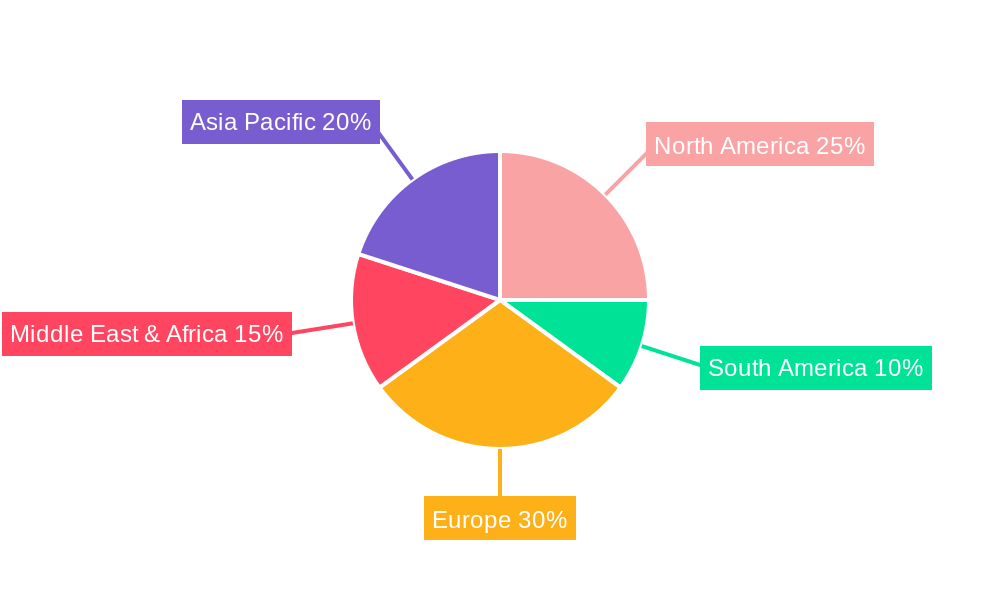

UAE Home Furniture Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Home Furniture Market Regional Market Share

Geographic Coverage of UAE Home Furniture Market

UAE Home Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market

- 3.3. Market Restrains

- 3.3.1. Economic Fluctuations; High Competition in the Furniture Market

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Kitchen Furniture is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Home Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood Furniture

- 5.1.2. Metal Furniture

- 5.1.3. Plastic and Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Living Room Furniture

- 5.2.2. Kitchen Furniture

- 5.2.3. Dining Room Furniture

- 5.2.4. Bedroom Furniture

- 5.2.5. Other Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Flagship Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online Stores

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Emirates

- 5.4.1. Dubai

- 5.4.2. Abu Dhabi

- 5.4.3. Sharjah

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America UAE Home Furniture Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Wood Furniture

- 6.1.2. Metal Furniture

- 6.1.3. Plastic and Other Furniture

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Living Room Furniture

- 6.2.2. Kitchen Furniture

- 6.2.3. Dining Room Furniture

- 6.2.4. Bedroom Furniture

- 6.2.5. Other Furniture

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Home Centers

- 6.3.2. Flagship Stores

- 6.3.3. Specialty Stores

- 6.3.4. Online Stores

- 6.3.5. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Emirates

- 6.4.1. Dubai

- 6.4.2. Abu Dhabi

- 6.4.3. Sharjah

- 6.4.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America UAE Home Furniture Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Wood Furniture

- 7.1.2. Metal Furniture

- 7.1.3. Plastic and Other Furniture

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Living Room Furniture

- 7.2.2. Kitchen Furniture

- 7.2.3. Dining Room Furniture

- 7.2.4. Bedroom Furniture

- 7.2.5. Other Furniture

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Home Centers

- 7.3.2. Flagship Stores

- 7.3.3. Specialty Stores

- 7.3.4. Online Stores

- 7.3.5. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Emirates

- 7.4.1. Dubai

- 7.4.2. Abu Dhabi

- 7.4.3. Sharjah

- 7.4.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe UAE Home Furniture Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Wood Furniture

- 8.1.2. Metal Furniture

- 8.1.3. Plastic and Other Furniture

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Living Room Furniture

- 8.2.2. Kitchen Furniture

- 8.2.3. Dining Room Furniture

- 8.2.4. Bedroom Furniture

- 8.2.5. Other Furniture

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Home Centers

- 8.3.2. Flagship Stores

- 8.3.3. Specialty Stores

- 8.3.4. Online Stores

- 8.3.5. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Emirates

- 8.4.1. Dubai

- 8.4.2. Abu Dhabi

- 8.4.3. Sharjah

- 8.4.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa UAE Home Furniture Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Wood Furniture

- 9.1.2. Metal Furniture

- 9.1.3. Plastic and Other Furniture

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Living Room Furniture

- 9.2.2. Kitchen Furniture

- 9.2.3. Dining Room Furniture

- 9.2.4. Bedroom Furniture

- 9.2.5. Other Furniture

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Home Centers

- 9.3.2. Flagship Stores

- 9.3.3. Specialty Stores

- 9.3.4. Online Stores

- 9.3.5. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Emirates

- 9.4.1. Dubai

- 9.4.2. Abu Dhabi

- 9.4.3. Sharjah

- 9.4.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific UAE Home Furniture Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Wood Furniture

- 10.1.2. Metal Furniture

- 10.1.3. Plastic and Other Furniture

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Living Room Furniture

- 10.2.2. Kitchen Furniture

- 10.2.3. Dining Room Furniture

- 10.2.4. Bedroom Furniture

- 10.2.5. Other Furniture

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Home Centers

- 10.3.2. Flagship Stores

- 10.3.3. Specialty Stores

- 10.3.4. Online Stores

- 10.3.5. Other Distribution Channels

- 10.4. Market Analysis, Insights and Forecast - by Emirates

- 10.4.1. Dubai

- 10.4.2. Abu Dhabi

- 10.4.3. Sharjah

- 10.4.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Danube Home

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Home Box

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Others (Al Khalid Furniture Factory LLC Space 3 Tm Furniture Industry)**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Natuzzi

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Marina Home

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pottery Barn

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PAN Emirates Home Furnishings

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Home Centre

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Homes R Us

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Royal Furniture

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Inter IKEA Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Danube Home

List of Figures

- Figure 1: Global UAE Home Furniture Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UAE Home Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 3: North America UAE Home Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America UAE Home Furniture Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America UAE Home Furniture Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America UAE Home Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America UAE Home Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America UAE Home Furniture Market Revenue (Million), by Emirates 2025 & 2033

- Figure 9: North America UAE Home Furniture Market Revenue Share (%), by Emirates 2025 & 2033

- Figure 10: North America UAE Home Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America UAE Home Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America UAE Home Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 13: South America UAE Home Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 14: South America UAE Home Furniture Market Revenue (Million), by Type 2025 & 2033

- Figure 15: South America UAE Home Furniture Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: South America UAE Home Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: South America UAE Home Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: South America UAE Home Furniture Market Revenue (Million), by Emirates 2025 & 2033

- Figure 19: South America UAE Home Furniture Market Revenue Share (%), by Emirates 2025 & 2033

- Figure 20: South America UAE Home Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 21: South America UAE Home Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe UAE Home Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 23: Europe UAE Home Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 24: Europe UAE Home Furniture Market Revenue (Million), by Type 2025 & 2033

- Figure 25: Europe UAE Home Furniture Market Revenue Share (%), by Type 2025 & 2033

- Figure 26: Europe UAE Home Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 27: Europe UAE Home Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 28: Europe UAE Home Furniture Market Revenue (Million), by Emirates 2025 & 2033

- Figure 29: Europe UAE Home Furniture Market Revenue Share (%), by Emirates 2025 & 2033

- Figure 30: Europe UAE Home Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe UAE Home Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa UAE Home Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 33: Middle East & Africa UAE Home Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 34: Middle East & Africa UAE Home Furniture Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East & Africa UAE Home Furniture Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East & Africa UAE Home Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 37: Middle East & Africa UAE Home Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Middle East & Africa UAE Home Furniture Market Revenue (Million), by Emirates 2025 & 2033

- Figure 39: Middle East & Africa UAE Home Furniture Market Revenue Share (%), by Emirates 2025 & 2033

- Figure 40: Middle East & Africa UAE Home Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa UAE Home Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UAE Home Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 43: Asia Pacific UAE Home Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 44: Asia Pacific UAE Home Furniture Market Revenue (Million), by Type 2025 & 2033

- Figure 45: Asia Pacific UAE Home Furniture Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Asia Pacific UAE Home Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 47: Asia Pacific UAE Home Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Asia Pacific UAE Home Furniture Market Revenue (Million), by Emirates 2025 & 2033

- Figure 49: Asia Pacific UAE Home Furniture Market Revenue Share (%), by Emirates 2025 & 2033

- Figure 50: Asia Pacific UAE Home Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific UAE Home Furniture Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Home Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global UAE Home Furniture Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global UAE Home Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global UAE Home Furniture Market Revenue Million Forecast, by Emirates 2020 & 2033

- Table 5: Global UAE Home Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global UAE Home Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 7: Global UAE Home Furniture Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global UAE Home Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global UAE Home Furniture Market Revenue Million Forecast, by Emirates 2020 & 2033

- Table 10: Global UAE Home Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global UAE Home Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 15: Global UAE Home Furniture Market Revenue Million Forecast, by Type 2020 & 2033

- Table 16: Global UAE Home Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 17: Global UAE Home Furniture Market Revenue Million Forecast, by Emirates 2020 & 2033

- Table 18: Global UAE Home Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global UAE Home Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 23: Global UAE Home Furniture Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global UAE Home Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global UAE Home Furniture Market Revenue Million Forecast, by Emirates 2020 & 2033

- Table 26: Global UAE Home Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global UAE Home Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 37: Global UAE Home Furniture Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global UAE Home Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global UAE Home Furniture Market Revenue Million Forecast, by Emirates 2020 & 2033

- Table 40: Global UAE Home Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global UAE Home Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 48: Global UAE Home Furniture Market Revenue Million Forecast, by Type 2020 & 2033

- Table 49: Global UAE Home Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 50: Global UAE Home Furniture Market Revenue Million Forecast, by Emirates 2020 & 2033

- Table 51: Global UAE Home Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific UAE Home Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Home Furniture Market?

The projected CAGR is approximately 3.79%.

2. Which companies are prominent players in the UAE Home Furniture Market?

Key companies in the market include Danube Home, Home Box, Others (Al Khalid Furniture Factory LLC Space 3 Tm Furniture Industry)**List Not Exhaustive, Natuzzi, Marina Home, Pottery Barn, PAN Emirates Home Furnishings, Home Centre, Homes R Us, Royal Furniture, Inter IKEA Group.

3. What are the main segments of the UAE Home Furniture Market?

The market segments include Material, Type, Distribution Channel, Emirates.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market.

6. What are the notable trends driving market growth?

Increasing Demand for Kitchen Furniture is Driving the Market.

7. Are there any restraints impacting market growth?

Economic Fluctuations; High Competition in the Furniture Market.

8. Can you provide examples of recent developments in the market?

In June 2023, The FITOUT, a prominent provider of comprehensive interior solutions in the Middle East and a subsidiary of Union Properties, partnered with Gurian, an Italian furniture manufacturing company. This collaboration aims to diversify product offerings and introduce Italy's finest luxury furniture to the UAE market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Home Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Home Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Home Furniture Market?

To stay informed about further developments, trends, and reports in the UAE Home Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence