Key Insights

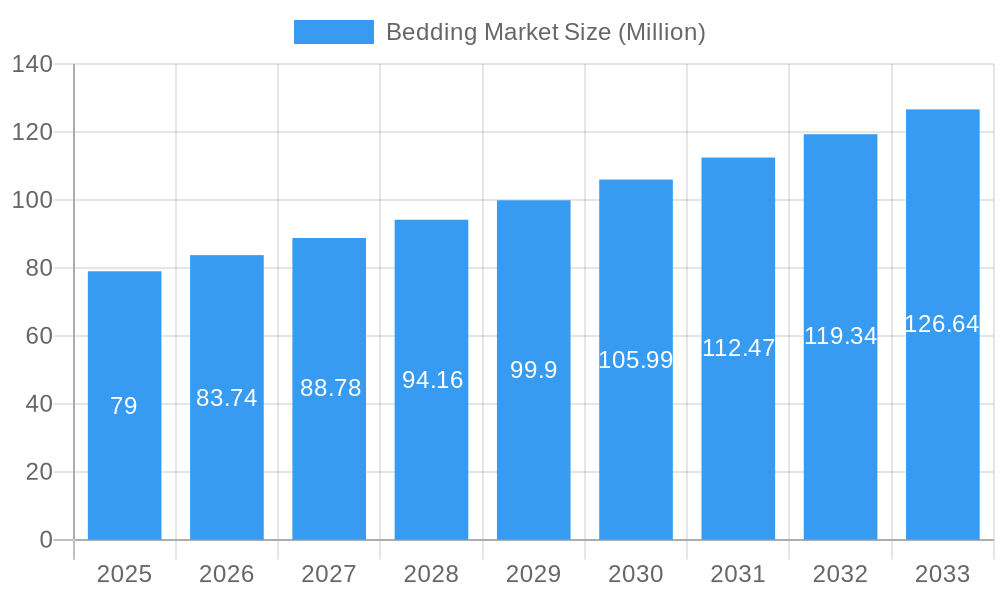

The global Bedding Market is experiencing robust growth, projected to reach approximately USD 79 million in value, driven by a healthy Compound Annual Growth Rate (CAGR) of 6.00% throughout the forecast period from 2025 to 2033. This expansion is fueled by evolving consumer preferences for comfort, style, and improved sleep quality. The Home Bedding segment is anticipated to be a significant contributor, with increasing disposable incomes and a growing emphasis on home décor driving demand for premium and aesthetically pleasing bedding options. Similarly, the Hotel Bedding segment is poised for growth, as the hospitality industry invests in enhancing guest experiences through superior bedding products. Emerging economies, particularly in the Asia Pacific region, are expected to witness substantial market penetration due to rapid urbanization and a rising middle class.

Bedding Market Market Size (In Million)

Several key trends are shaping the Bedding Market landscape. The increasing adoption of online distribution channels is democratizing access to a wider variety of bedding products, from luxury brands to budget-friendly options, catering to diverse consumer needs. Furthermore, a growing awareness of the health benefits associated with quality sleep is propelling the demand for innovative bedding solutions, including those made from sustainable and hypoallergenic materials. While the market benefits from strong growth drivers, challenges such as intense competition among established and emerging players, and potential price sensitivity in certain consumer segments, require strategic market approaches. However, the overall outlook for the Bedding Market remains highly positive, indicating a sustained upward trajectory for the foreseeable future.

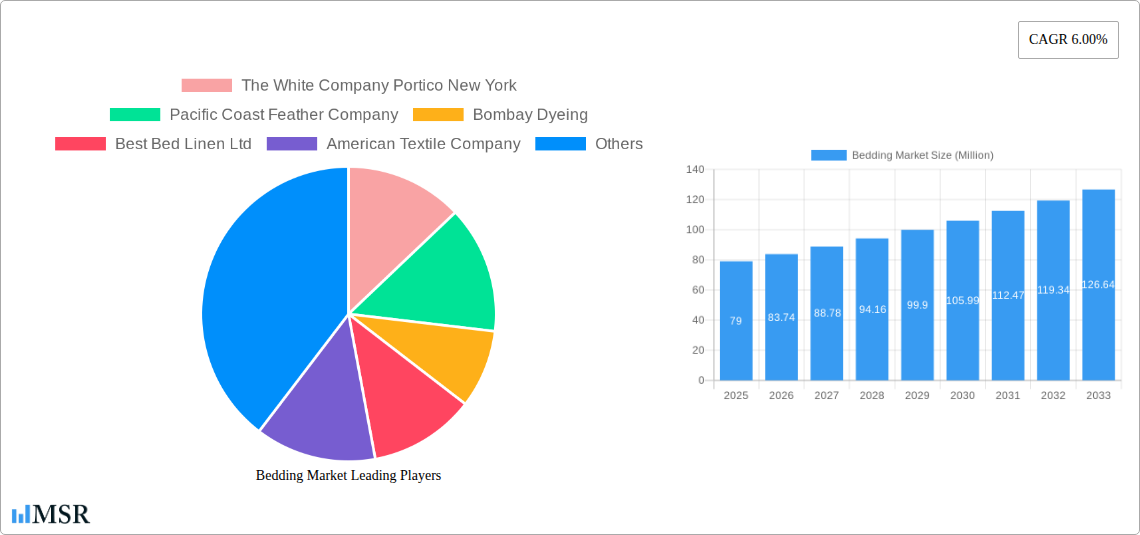

Bedding Market Company Market Share

This in-depth report provides a definitive analysis of the global Bedding Market, encompassing a comprehensive study from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. Delving into historical data from 2019–2024, this report offers actionable insights for industry stakeholders, including bedding manufacturers, retailers, suppliers, and investors. Discover key market trends, growth drivers, emerging opportunities, and the competitive landscape featuring leading companies like The White Company, Portico New York, Pacific Coast Feather Company, Bombay Dyeing, Best Bed Linen Ltd, American Textile Company, Serena and Lily Inc, Hollander Sleep Products LLC, Casper Sleep Inc, Beaumont & Brown, Crane & Canopy Inc, Sleep Number Corporation, Serta Simmons Bedding, Tempur Sealy International Inc, and Boll and Branch LLC. This report is your essential guide to navigating the dynamic home bedding and hotel bedding sectors, understanding distribution channels such as supermarkets/hypermarkets, specialty stores, and online platforms, and capitalizing on the substantial growth potential of the luxury bedding market.

Bedding Market Market Concentration & Dynamics

The global Bedding Market exhibits a dynamic and evolving concentration landscape. While a few major bedding manufacturers hold significant market share, particularly in the luxury bedding and smart mattress segments, the market also features a growing number of specialized and niche players contributing to a vibrant innovation ecosystem. The home bedding market and hotel bedding market are influenced by distinct regulatory frameworks concerning material safety, fire retardancy, and product labeling, which vary by region. The proliferation of sustainable bedding options and eco-friendly materials, such as organic cotton and recycled polyester, is increasingly impacting end-user purchasing decisions. The threat of substitute products, while present in the form of alternative sleep solutions, remains relatively low due to the intrinsic demand for comfortable and supportive bedding. Merger and acquisition (M&A) activities within the bedding industry are a key indicator of market consolidation and strategic expansion. In recent years, we have observed a steady count of M&A deals, driven by companies seeking to enhance their product portfolios, expand their geographical reach, and gain access to new technologies and customer bases. Analyzing these market share shifts and M&A trends is crucial for understanding the competitive intensity and future trajectory of the bedding market. Key metrics such as the CAGR of the bedding market and the market size of luxury bedding will be thoroughly explored.

Bedding Market Industry Insights & Trends

The Bedding Market is poised for robust growth, driven by a confluence of factors including rising disposable incomes, increasing urbanization, and a growing consumer awareness regarding the importance of quality sleep. The home bedding market is experiencing a significant uplift due to the “nesting” trend, where consumers are investing more in home comfort and aesthetics. Simultaneously, the hotel bedding market continues its upward trajectory, fueled by a resurgence in travel and tourism, with hotels increasingly focusing on premium guest experiences, often through superior bedding. Technological disruptions are playing a pivotal role, with the rise of smart mattresses and connected bedding solutions offering personalized sleep tracking, temperature regulation, and health monitoring capabilities. This innovation is a key driver for luxury bedding brands seeking to differentiate themselves. Evolving consumer behaviors underscore a growing preference for sustainable bedding, organic bedding, and products that align with ethical and environmental values. Consumers are also increasingly reliant on online channels for purchasing bedding products, driving the growth of online bedding sales and demanding seamless e-commerce experiences. The global bedding market size is projected to reach approximately $XX Million by 2033, exhibiting a compound annual growth rate (CAGR) of XX% during the forecast period (2025–2033). This growth is underpinned by increasing demand for premium and specialized bedding options, including hypoallergenic bedding and ergonomic pillow designs. The competitive landscape is characterized by continuous innovation in material science and design, aiming to enhance comfort, durability, and therapeutic benefits. Key players are investing heavily in research and development to introduce products that cater to diverse sleep needs and preferences, further accelerating market expansion.

Key Markets & Segments Leading Bedding Market

The global Bedding Market is dominated by several key markets and segments that are driving significant growth and innovation.

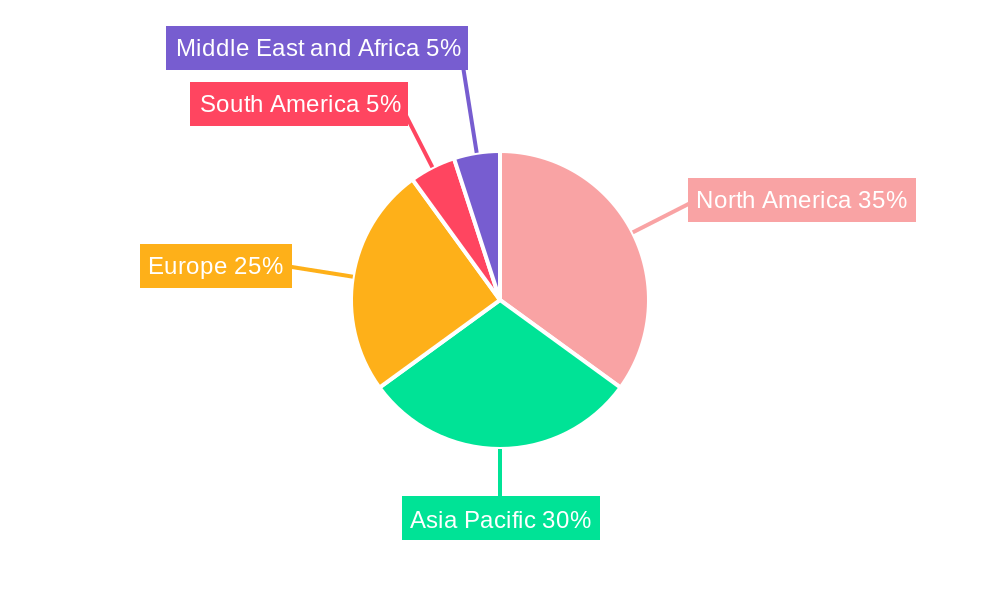

- Dominant Region: North America and Europe currently lead the global bedding market, characterized by high disposable incomes, a mature retail infrastructure, and a strong consumer preference for premium and technologically advanced bedding solutions. Economic growth in these regions, coupled with a well-established e-commerce ecosystem, further bolsters their dominance.

- Dominant Type: Home Bedding: The Home Bedding segment consistently outperforms, driven by factors such as increasing home ownership, a growing emphasis on interior décor, and the rising popularity of online home goods retailers. The demand for luxury bedding, organic bedding, and sustainable bedding within this segment is particularly strong, reflecting evolving consumer values.

- Dominant Distribution Channel: Online: The Online distribution channel has emerged as a pivotal force in the bedding market. Its convenience, vast product selection, and competitive pricing have made it a preferred platform for consumers. The growth of direct-to-consumer (DTC) bedding brands has further accelerated this trend, allowing for greater customer engagement and personalized marketing efforts.

Detailed analysis of market dominance reveals that the luxury bedding market is experiencing substantial expansion, with consumers willing to invest in high-quality materials and innovative features. The hotel bedding market also presents a significant growth avenue, as the hospitality industry prioritizes guest comfort and experience, leading to increased procurement of premium bedding supplies. The increasing adoption of specialized bedding, such as orthopedic mattresses and hypoallergenic pillows, further segments the market and caters to specific health and wellness needs. The presence of major players like The White Company and Boll and Branch LLC in the luxury bedding sector highlights the premiumization trend. Furthermore, the expansion of specialty stores focusing on sleep solutions and the increasing presence of bedding products in supermarkets/hypermarkets indicate a multi-channel approach to reaching a broader consumer base.

Bedding Market Product Developments

Product innovation remains a critical differentiator in the Bedding Market. Companies are heavily investing in research and development to create advanced bedding solutions. Notable developments include the integration of cooling technologies in mattresses and pillows to enhance sleep comfort, the use of antimicrobial fabrics to promote hygiene, and the introduction of customizable firmness levels in mattresses. The rise of smart bedding, exemplified by Sleep Number Corporation's advancements in sleep tracking and diagnostic capabilities, is transforming the industry. Furthermore, there's a growing emphasis on sustainable bedding materials, such as organic cotton, bamboo, and recycled plastics, appealing to environmentally conscious consumers. These innovations not only enhance product performance but also offer a competitive edge in a rapidly evolving market. The development of hypoallergenic and eczema-friendly bedding caters to a growing segment of consumers with specific health concerns.

Challenges in the Bedding Market Market

The Bedding Market faces several challenges that could impede its growth trajectory. Fierce competition from both established brands and new entrants, particularly in the online space, can lead to price wars and reduced profit margins. Volatile raw material costs, including cotton, wool, and synthetic fibers, can significantly impact manufacturing expenses and product pricing. Evolving consumer preferences for sustainability and ethical sourcing necessitate continuous adaptation of supply chains and manufacturing processes, which can be costly and complex. Furthermore, navigating diverse international regulations concerning product safety, labeling, and environmental standards requires significant investment and operational agility. Supply chain disruptions, as witnessed during global events, can also lead to production delays and increased logistics costs, impacting the availability and affordability of bedding products.

Forces Driving Bedding Market Growth

Several potent forces are propelling the Bedding Market forward. The increasing global awareness of sleep's importance for overall health and well-being is a primary catalyst, driving demand for higher quality and more specialized bedding solutions. Growing disposable incomes in emerging economies are enabling a larger consumer base to invest in premium home bedding and upgrade their sleep environments. The continued expansion of the e-commerce sector, facilitated by enhanced logistics and online marketing strategies, provides broader access to a wider array of bedding products. Technological advancements, particularly in materials science and smart home integration, are leading to innovative products like smart mattresses and temperature-regulating bedding, appealing to a tech-savvy demographic. The sustained growth of the hospitality industry, with its emphasis on guest comfort, also fuels consistent demand for hotel bedding.

Challenges in the Bedding Market Market

While growth is evident, the Bedding Market must also contend with enduring challenges. The mature nature of some developed markets presents saturation concerns, necessitating a focus on product differentiation and innovation to capture market share. The significant upfront investment required for advanced manufacturing technologies, such as those for smart bedding, can be a barrier for smaller players. Intense price competition, especially within the mid-range bedding segment, can squeeze profit margins and limit reinvestment in R&D. Furthermore, building and maintaining strong brand loyalty in a crowded marketplace requires continuous efforts in marketing, customer service, and product quality assurance. The increasing consumer demand for sustainable bedding and transparent ethical sourcing also adds complexity, requiring significant adjustments in supply chain management and manufacturing practices to meet stringent environmental and social standards.

Emerging Opportunities in Bedding Market

The Bedding Market is ripe with emerging opportunities, particularly in catering to evolving consumer needs and leveraging technological advancements. The burgeoning sustainable bedding and organic bedding segments present substantial growth potential as consumer consciousness around environmental impact intensifies. The development and adoption of smart bedding and connected sleep solutions represent a significant frontier, offering personalized sleep experiences and health monitoring capabilities. Expansion into emerging economies with growing middle classes and increasing disposable incomes offers vast untapped markets for both home bedding and hotel bedding. Furthermore, the rising demand for specialized bedding, such as orthopedic, hypoallergenic, and cooling products, creates opportunities for niche brands and product innovation. Partnerships between bedding manufacturers and technology companies can accelerate the development of cutting-edge sleep solutions, further expanding market reach and customer engagement. The increasing trend of wellness tourism also opens avenues for high-end, therapeutic bedding products.

Leading Players in the Bedding Market Sector

- The White Company

- Portico New York

- Pacific Coast Feather Company

- Bombay Dyeing

- Best Bed Linen Ltd

- American Textile Company

- Serena and Lily Inc

- Hollander Sleep Products LLC

- Casper Sleep Inc

- Beaumont & Brown

- Crane & Canopy Inc

- Sleep Number Corporation

- Serta Simmons Bedding

- Tempur Sealy International Inc

- Boll and Branch LLC

Key Milestones in Bedding Market Industry

- March 2023: VFI Group partnered with US-based Setra Simmons to manufacture high-end bedding in India. The collaboration includes setting up two units for manufacturing high-end luxury mattresses for the Indian market, signaling expansion in premium segments and international collaborations.

- January 2022: Sleep Number, a US-based manufacturer of smart mattresses and bedding products, announced the latest 360 Smart Bed range upgrades. It includes detecting potential sleep problems such as insomnia and sleep apnea, highlighting the significant advancement in smart technology integration and health-focused bedding.

Strategic Outlook for Bedding Market Market

The strategic outlook for the Bedding Market is exceptionally positive, driven by a sustained demand for improved sleep quality and enhanced home comfort. Key growth accelerators include the continued innovation in sustainable bedding and smart bedding technologies, which cater to increasingly discerning consumer preferences. Strategic partnerships and collaborations, similar to the VFI Group and Setra Simmons venture, will be crucial for market expansion, particularly in emerging regions and for accessing new manufacturing capabilities. Companies that prioritize a robust online presence, combined with exceptional customer experience, will be well-positioned to capture a larger share of the growing online bedding sales. Further investment in research and development to introduce differentiated products addressing specific health and wellness needs will be paramount. The focus on premiumization within the luxury bedding market and the steady demand from the hospitality sector will ensure continued revenue streams. Understanding and adapting to evolving consumer values, such as ethical sourcing and environmental responsibility, will be fundamental for long-term success and brand loyalty in the global bedding industry.

Bedding Market Segmentation

-

1. Type

- 1.1. Home Bedding

- 1.2. Hotel Bedding

-

2. Distribution Channel

- 2.1. Supermarkets / Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Bedding Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of the North America

-

2. Asia Pacific

- 2.1. India

- 2.2. China

- 2.3. Australia

- 2.4. Rest of the Asia Pacific

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Rest of the Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of the South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of the Middle East and Africa

Bedding Market Regional Market Share

Geographic Coverage of Bedding Market

Bedding Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Residential and bedroom spaces driving the market; Rising Personal Consumer Consumption expenditure

- 3.3. Market Restrains

- 3.3.1. Rising demand for Mattress Bases are limited to the young generation age.; Negative impact of Supply chain disruption and Inflation on the market post covid

- 3.4. Market Trends

- 3.4.1. Home Bedding is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bedding Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Home Bedding

- 5.1.2. Hotel Bedding

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets / Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Bedding Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Home Bedding

- 6.1.2. Hotel Bedding

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets / Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Bedding Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Home Bedding

- 7.1.2. Hotel Bedding

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets / Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Bedding Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Home Bedding

- 8.1.2. Hotel Bedding

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets / Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Bedding Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Home Bedding

- 9.1.2. Hotel Bedding

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets / Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Bedding Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Home Bedding

- 10.1.2. Hotel Bedding

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets / Hypermarkets

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The White Company Portico New York

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pacific Coast Feather Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bombay Dyeing

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Best Bed Linen Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 American Textile Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Serena and Lily Inc **List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hollander Sleep Products LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Casper Sleep Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Beaumont & Brown

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Crane & Canopy Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sleep Number Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Serta Simmons Bedding

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Tempur Sealy International Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Boll and Branch LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 The White Company Portico New York

List of Figures

- Figure 1: Global Bedding Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Bedding Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Bedding Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Bedding Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Bedding Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Bedding Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Bedding Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific Bedding Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Asia Pacific Bedding Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Asia Pacific Bedding Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Asia Pacific Bedding Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Asia Pacific Bedding Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Bedding Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Bedding Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Bedding Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Bedding Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe Bedding Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Bedding Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Bedding Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Bedding Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Bedding Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Bedding Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Bedding Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Bedding Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Bedding Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Bedding Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Bedding Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Bedding Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Bedding Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Bedding Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Bedding Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bedding Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Bedding Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Bedding Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Bedding Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Bedding Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Bedding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of the North America Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Bedding Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Bedding Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Bedding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: India Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: China Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Australia Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of the Asia Pacific Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Bedding Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Bedding Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Global Bedding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of the Europe Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Bedding Market Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global Bedding Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Bedding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of the South America Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Bedding Market Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Bedding Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 32: Global Bedding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of the Middle East and Africa Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bedding Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Bedding Market?

Key companies in the market include The White Company Portico New York, Pacific Coast Feather Company, Bombay Dyeing, Best Bed Linen Ltd, American Textile Company, Serena and Lily Inc **List Not Exhaustive, Hollander Sleep Products LLC, Casper Sleep Inc, Beaumont & Brown, Crane & Canopy Inc, Sleep Number Corporation, Serta Simmons Bedding, Tempur Sealy International Inc, Boll and Branch LLC.

3. What are the main segments of the Bedding Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 79 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Residential and bedroom spaces driving the market; Rising Personal Consumer Consumption expenditure.

6. What are the notable trends driving market growth?

Home Bedding is Dominating the Market.

7. Are there any restraints impacting market growth?

Rising demand for Mattress Bases are limited to the young generation age.; Negative impact of Supply chain disruption and Inflation on the market post covid.

8. Can you provide examples of recent developments in the market?

March 2023: VFI Group partnered with US-based Setra Simmons to manufacture high-end bedding in India. The collaboration includes setting up two units for manufacturing high-end luxury mattresses for the Indian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bedding Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bedding Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bedding Market?

To stay informed about further developments, trends, and reports in the Bedding Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence