Key Insights

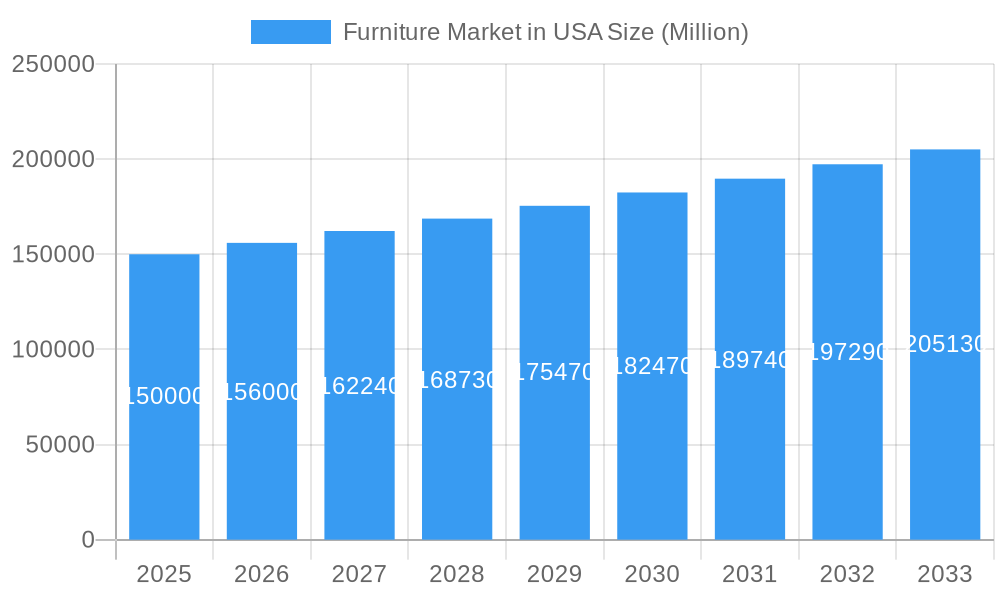

The United States furniture market is projected for significant expansion, expected to reach $193.6 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.74%. This growth is driven by rising disposable incomes, increasing consumer demand for personalized and aesthetically appealing home décor, and the ongoing trend of home improvement and remote work, which stimulates demand for comfortable and functional furniture, particularly for home offices. The recovery and expansion of the hospitality sector, alongside new construction and renovation projects, also contribute to market strength. E-commerce platforms are increasingly influencing distribution channels by offering enhanced convenience and a wider product selection, challenging traditional retail models. Innovations in sustainable materials are further shaping market evolution.

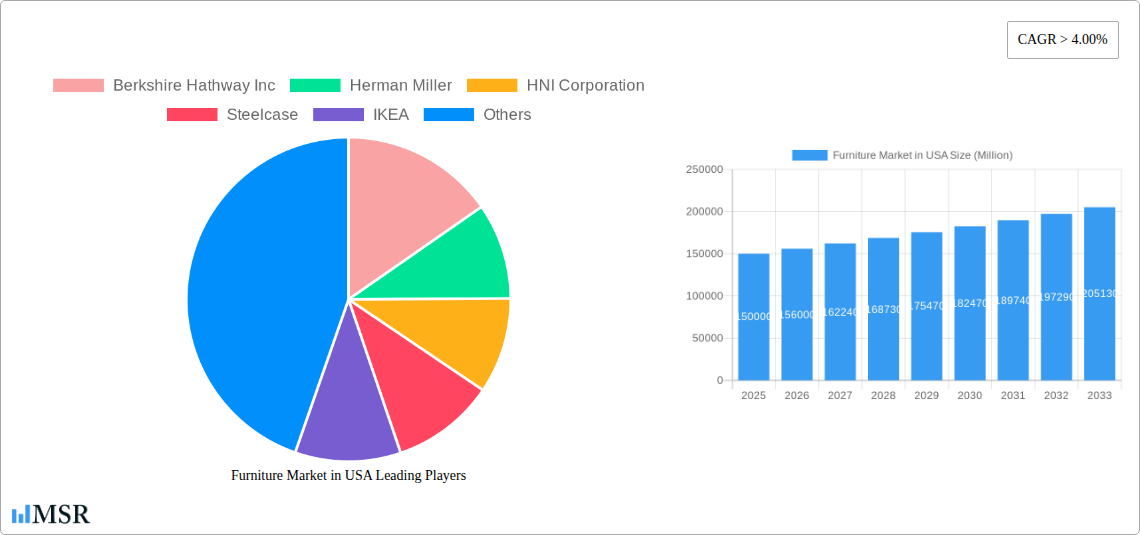

Furniture Market in USA Market Size (In Billion)

Key market restraints include escalating raw material costs, supply chain volatility, and inflationary pressures affecting consumer purchasing power. However, the market's resilience, supported by essential consumer needs and evolving lifestyles, is anticipated to offset these challenges. The market is segmenting dynamically, with a notable increase in demand for eco-friendly and customizable furniture. The "Other Materials" segment, featuring sustainable options like bamboo and recycled plastics, is poised for accelerated growth. The online distribution channel is expected to capture an increasing market share as consumers embrace digital shopping. Leading companies are investing in product innovation, direct-to-consumer strategies, and sustainable manufacturing to maintain a competitive advantage.

Furniture Market in USA Company Market Share

This comprehensive report provides a definitive analysis of the US furniture market. Covering the period from 2019 to 2033, with a focus on the base year 2025, this research details market dynamics, industry trends, and future growth. Gain actionable insights into key segments, product innovations, and strategic outlooks essential for stakeholders, manufacturers, distributors, and investors.

Furniture Market in USA Market Concentration & Dynamics

The USA Furniture Market exhibits a moderately concentrated landscape, with several dominant players and a significant number of smaller, specialized manufacturers. In the historical period (2019-2024), key mergers and acquisitions have reshaped market dynamics. Notably, the 2021 acquisition of Knoll Inc. by Herman Miller Inc. for $1.8 billion marked a significant consolidation, creating a formidable entity in the office furniture and high-end home furniture segments. This transaction, along with others, reflects a trend towards consolidation driven by the pursuit of economies of scale and enhanced product portfolios. Innovation ecosystems are thriving, fueled by investments in sustainable materials and smart furniture technologies. Regulatory frameworks, primarily concerning environmental standards and consumer safety, are increasingly influential. Substitute products, such as modular and DIY furniture solutions, present a growing challenge, while end-user trends towards personalization, sustainability, and comfort continue to shape demand. The M&A deal count has been steady, with an estimated xx deals annually in the forecast period (2025-2033). Market share shifts are expected as companies adapt to evolving consumer preferences and technological advancements.

Furniture Market in USA Industry Insights & Trends

The USA Furniture Market is projected to experience robust growth, driven by several interconnected factors throughout the study period (2019-2033). The market size is estimated to reach approximately $180 Billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.2% during the forecast period (2025-2033). Key growth drivers include the sustained demand for home furniture, bolstered by a strong housing market, increasing urbanization, and a growing preference for aesthetically pleasing and functional living spaces. The post-pandemic emphasis on home office setups continues to fuel demand for ergonomic and stylish office furniture. Technological disruptions are rapidly transforming the industry, with a growing adoption of e-commerce platforms and the integration of smart features into furniture pieces, such as wireless charging capabilities and adjustable settings. Evolving consumer behaviors are characterized by a heightened awareness of sustainability, leading to increased demand for eco-friendly materials and ethical manufacturing practices. Furthermore, the desire for personalized and customized furniture solutions is on the rise, pushing manufacturers to offer a wider range of design options and materials. The Hospitality sector is also recovering and expanding, contributing to market growth through increased demand for furniture in hotels, restaurants, and other leisure establishments. The accessibility and convenience of online shopping, coupled with improved logistics, are further accelerating market expansion.

Key Markets & Segments Leading Furniture Market in USA

The USA Furniture Market is segmented across various materials, applications, and distribution channels, each contributing to the overall market's vitality. Home Furniture remains the largest application segment, driven by residential construction, home renovation activities, and a persistent consumer desire for comfortable and stylish living environments. The Wood material segment continues to dominate due to its aesthetic appeal, durability, and versatility, particularly in traditional and contemporary home furniture designs. However, the Metal and Plastic segments are gaining traction, especially in modern and industrial-style furniture, as well as in more affordable home furniture and certain office furniture applications. The Online distribution channel has witnessed exponential growth, disrupting traditional retail models. This channel offers unparalleled convenience, a wider selection, and competitive pricing, making it a preferred choice for a significant portion of consumers. The increasing penetration of e-commerce, coupled with sophisticated digital marketing strategies, has cemented its position as a leading distribution channel. The Specialty Stores segment, encompassing furniture showrooms and design studios, caters to consumers seeking high-end, customized, or expert advice, thereby holding a significant market share. The Office Furniture segment is experiencing a resurgence, driven by hybrid work models that necessitate redesigned workspaces with a focus on collaboration and employee well-being.

Material Dominance:

- Wood: Continues to be the primary material, favored for its aesthetic appeal, durability, and wide range of finishes. Economic growth and infrastructure development support the demand for wood furniture.

- Metal: Growing in popularity for its modern aesthetic, strength, and use in various furniture types, including outdoor and industrial-inspired pieces.

- Plastic: Essential for affordable and functional furniture, particularly in commercial settings and for budget-conscious consumers.

Application Dominance:

- Home Furniture: The largest segment, driven by consumer spending on home improvement and decor, and a growing trend towards personalized living spaces.

- Office Furniture: Experiencing a revival due to hybrid work models and the need for ergonomic, collaborative workspaces.

Distribution Channel Dominance:

- Online: Leading the charge with its convenience, vast selection, and competitive pricing, supported by robust digital infrastructure.

- Specialty Stores: Cater to a premium market, offering curated selections and expert design services.

Furniture Market in USA Product Developments

Product innovation in the USA Furniture Market is characterized by a strong emphasis on functionality, aesthetics, and sustainability. Companies are increasingly investing in research and development to create smarter, more adaptable furniture solutions. This includes the integration of smart technology for enhanced comfort and convenience, such as adjustable ergonomic chairs and beds with integrated climate control. The demand for modular and multi-functional furniture is rising, catering to smaller living spaces and evolving lifestyle needs. Furthermore, a significant push towards sustainable product development is evident, with manufacturers exploring recycled materials, responsibly sourced wood, and eco-friendly manufacturing processes. The incorporation of biophilic design principles, bringing natural elements into furniture, is also a growing trend, enhancing well-being and aesthetic appeal in both home furniture and office furniture applications.

Challenges in the Furniture Market in USA Market

The USA Furniture Market faces several significant challenges that could impact its growth trajectory. Supply chain disruptions, stemming from global events and logistical complexities, continue to pose a risk, leading to increased lead times and material costs. Rising raw material prices, particularly for wood and metals, directly affect production costs and can squeeze profit margins. Intense competitive pressures from both established players and new entrants, especially those leveraging direct-to-consumer models, necessitate continuous innovation and cost management. Regulatory hurdles, related to environmental compliance, import/export policies, and product safety standards, add complexity and compliance costs for manufacturers. Furthermore, fluctuating economic conditions and consumer spending power can create demand volatility. The quantifiable impact of these challenges, such as an estimated 5-7% increase in production costs due to supply chain issues, needs careful strategic navigation.

Forces Driving Furniture Market in USA Growth

Several key forces are propelling the growth of the USA Furniture Market. The sustained strength of the US housing market, characterized by new constructions and robust home resale activity, directly fuels demand for home furniture. Economic recovery and increasing consumer disposable income provide the financial capacity for furniture purchases. Technological advancements, particularly in e-commerce and digital design tools, are enhancing market accessibility and enabling personalized customer experiences. Growing consumer awareness and preference for sustainable and ethically produced goods are driving demand for eco-friendly furniture options. The ongoing evolution of work dynamics, with a rise in hybrid and remote work, is creating new opportunities for office furniture designed for comfort, flexibility, and collaboration. Government initiatives promoting sustainable manufacturing and construction further support market expansion.

Challenges in the Furniture Market in USA Market

Long-term growth catalysts in the USA Furniture Market are deeply rooted in innovation and strategic market expansion. Continued investment in sustainable materials and manufacturing processes will not only meet growing consumer demand but also foster brand loyalty and market differentiation. The exploration and integration of advanced technologies, such as 3D printing and AI-driven design platforms, offer opportunities to streamline production, reduce waste, and offer highly customized products. Strategic partnerships and collaborations between furniture manufacturers, designers, and technology providers can unlock new product categories and distribution channels. Furthermore, expanding into underserved or emerging demographic segments within the US, such as the aging population requiring specialized furniture, or capitalizing on the increasing demand for smart home integration, presents significant long-term growth potential.

Emerging Opportunities in Furniture Market in USA

Emerging opportunities within the USA Furniture Market are diverse and ripe for exploitation. The burgeoning market for smart furniture, seamlessly integrating technology into everyday pieces, presents significant potential for innovation and premium pricing. The growing emphasis on sustainability and circular economy principles is creating opportunities for companies that can offer recycled, upcycled, or biodegradable furniture solutions. The increasing demand for personalized and customizable furniture through online platforms and bespoke services caters to a growing consumer desire for unique products. Furthermore, the expansion of the rental furniture market, driven by younger demographics and a preference for flexibility, offers a novel revenue stream. Opportunities also lie in catering to specialized needs, such as ergonomic furniture for home offices and accessible furniture for individuals with disabilities.

Leading Players in the Furniture Market in USA Sector

- Berkshire Hathway Inc.

- Herman Miller

- HNI Corporation

- Steelcase

- IKEA

- Williams Sonoma

- American Signature

- Rooms To Go

- TJX

- Haworth

- Ashley Homestore Corporation

Key Milestones in Furniture Market in USA Industry

- 2021: America's two most celebrated manufacturers of modern furnishings and accessories for both the office and home, Herman Miller and Knoll, become a single powerhouse design entity.

- 2021: Knoll Inc., the storied Montgomery County furniture and textile designer and manufacturer, is being acquired by longtime competitor Herman Miller Inc. for $1.8 billion.

Strategic Outlook for Furniture Market in USA Market

The strategic outlook for the USA Furniture Market is characterized by a continued focus on digital transformation, sustainability, and consumer-centric innovation. Companies that successfully integrate advanced e-commerce capabilities, offer personalized customer experiences, and prioritize eco-friendly production will likely achieve market leadership. Strategic investments in research and development for smart furniture and modular designs will cater to evolving lifestyle needs. Furthermore, exploring new market segments, such as the growing demand for outdoor living furniture and specialized healthcare furniture, presents significant growth accelerators. Building resilient supply chains and fostering collaborative partnerships will be crucial for navigating market complexities and ensuring sustained profitability in the dynamic American furniture landscape.

Furniture Market in USA Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Materials

-

2. Application

- 2.1. Home Furniture

- 2.2. Office Furniture

- 2.3. Hospitality

- 2.4. Other Furniture

-

3. Distribution Channel

- 3.1. Supermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

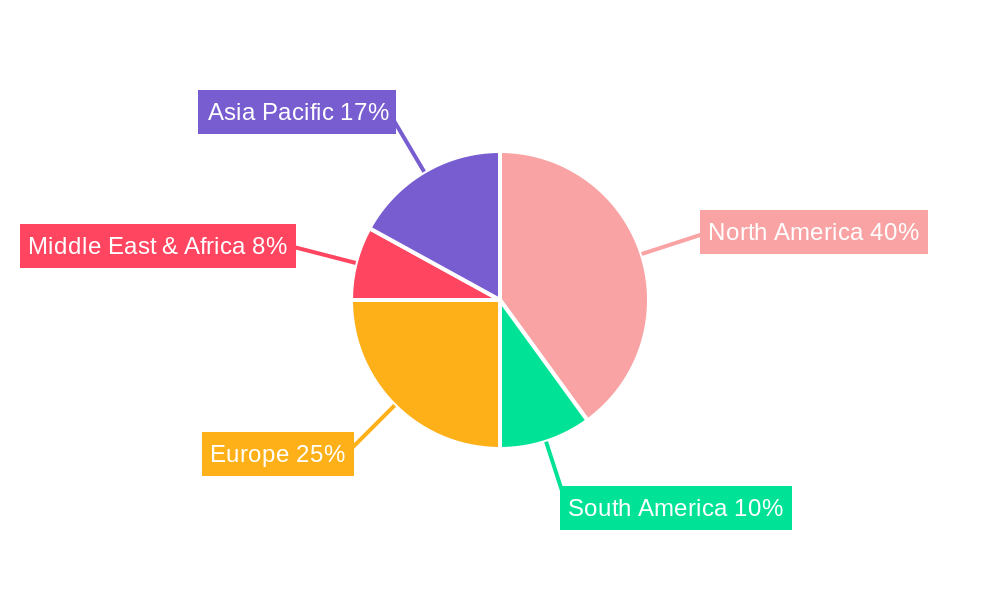

Furniture Market in USA Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Furniture Market in USA Regional Market Share

Geographic Coverage of Furniture Market in USA

Furniture Market in USA REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Tech-Integrated Furniture are Helping to Grow the Market

- 3.3. Market Restrains

- 3.3.1. Raw Material Cost Barrier to Growth

- 3.4. Market Trends

- 3.4.1. Home Furniture Segment is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Furniture Market in USA Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Home Furniture

- 5.2.2. Office Furniture

- 5.2.3. Hospitality

- 5.2.4. Other Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Furniture Market in USA Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Wood

- 6.1.2. Metal

- 6.1.3. Plastic

- 6.1.4. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Home Furniture

- 6.2.2. Office Furniture

- 6.2.3. Hospitality

- 6.2.4. Other Furniture

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America Furniture Market in USA Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Wood

- 7.1.2. Metal

- 7.1.3. Plastic

- 7.1.4. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Home Furniture

- 7.2.2. Office Furniture

- 7.2.3. Hospitality

- 7.2.4. Other Furniture

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Furniture Market in USA Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Wood

- 8.1.2. Metal

- 8.1.3. Plastic

- 8.1.4. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Home Furniture

- 8.2.2. Office Furniture

- 8.2.3. Hospitality

- 8.2.4. Other Furniture

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa Furniture Market in USA Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Wood

- 9.1.2. Metal

- 9.1.3. Plastic

- 9.1.4. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Home Furniture

- 9.2.2. Office Furniture

- 9.2.3. Hospitality

- 9.2.4. Other Furniture

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets

- 9.3.2. Specialty Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific Furniture Market in USA Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Wood

- 10.1.2. Metal

- 10.1.3. Plastic

- 10.1.4. Other Materials

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Home Furniture

- 10.2.2. Office Furniture

- 10.2.3. Hospitality

- 10.2.4. Other Furniture

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets

- 10.3.2. Specialty Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Berkshire Hathway Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Herman Miller

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HNI Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Steelcase

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IKEA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Williams Sonoma

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 American Signature

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rooms To Go

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TJX**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Haworth

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ashley Homestore Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Berkshire Hathway Inc

List of Figures

- Figure 1: Global Furniture Market in USA Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Furniture Market in USA Revenue (billion), by Material 2025 & 2033

- Figure 3: North America Furniture Market in USA Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Furniture Market in USA Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Furniture Market in USA Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Furniture Market in USA Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: North America Furniture Market in USA Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Furniture Market in USA Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Furniture Market in USA Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Furniture Market in USA Revenue (billion), by Material 2025 & 2033

- Figure 11: South America Furniture Market in USA Revenue Share (%), by Material 2025 & 2033

- Figure 12: South America Furniture Market in USA Revenue (billion), by Application 2025 & 2033

- Figure 13: South America Furniture Market in USA Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America Furniture Market in USA Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: South America Furniture Market in USA Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Furniture Market in USA Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Furniture Market in USA Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Furniture Market in USA Revenue (billion), by Material 2025 & 2033

- Figure 19: Europe Furniture Market in USA Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe Furniture Market in USA Revenue (billion), by Application 2025 & 2033

- Figure 21: Europe Furniture Market in USA Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Furniture Market in USA Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Europe Furniture Market in USA Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Furniture Market in USA Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Furniture Market in USA Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Furniture Market in USA Revenue (billion), by Material 2025 & 2033

- Figure 27: Middle East & Africa Furniture Market in USA Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East & Africa Furniture Market in USA Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East & Africa Furniture Market in USA Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa Furniture Market in USA Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Furniture Market in USA Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Furniture Market in USA Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Furniture Market in USA Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Furniture Market in USA Revenue (billion), by Material 2025 & 2033

- Figure 35: Asia Pacific Furniture Market in USA Revenue Share (%), by Material 2025 & 2033

- Figure 36: Asia Pacific Furniture Market in USA Revenue (billion), by Application 2025 & 2033

- Figure 37: Asia Pacific Furniture Market in USA Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific Furniture Market in USA Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Furniture Market in USA Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Furniture Market in USA Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Furniture Market in USA Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Furniture Market in USA Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Global Furniture Market in USA Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Furniture Market in USA Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Furniture Market in USA Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Furniture Market in USA Revenue billion Forecast, by Material 2020 & 2033

- Table 6: Global Furniture Market in USA Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Furniture Market in USA Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Furniture Market in USA Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Furniture Market in USA Revenue billion Forecast, by Material 2020 & 2033

- Table 13: Global Furniture Market in USA Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Furniture Market in USA Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Furniture Market in USA Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Furniture Market in USA Revenue billion Forecast, by Material 2020 & 2033

- Table 20: Global Furniture Market in USA Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Global Furniture Market in USA Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Furniture Market in USA Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Furniture Market in USA Revenue billion Forecast, by Material 2020 & 2033

- Table 33: Global Furniture Market in USA Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Furniture Market in USA Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Furniture Market in USA Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Furniture Market in USA Revenue billion Forecast, by Material 2020 & 2033

- Table 43: Global Furniture Market in USA Revenue billion Forecast, by Application 2020 & 2033

- Table 44: Global Furniture Market in USA Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Furniture Market in USA Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Furniture Market in USA Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Furniture Market in USA?

The projected CAGR is approximately 3.74%.

2. Which companies are prominent players in the Furniture Market in USA?

Key companies in the market include Berkshire Hathway Inc, Herman Miller, HNI Corporation, Steelcase, IKEA, Williams Sonoma, American Signature, Rooms To Go, TJX**List Not Exhaustive, Haworth, Ashley Homestore Corporation.

3. What are the main segments of the Furniture Market in USA?

The market segments include Material, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 193.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Tech-Integrated Furniture are Helping to Grow the Market.

6. What are the notable trends driving market growth?

Home Furniture Segment is Driving the Market.

7. Are there any restraints impacting market growth?

Raw Material Cost Barrier to Growth.

8. Can you provide examples of recent developments in the market?

In 2021,America's two most celebrated manufacturers of modern furnishings and accessories for both the office and home, Herman Miller and Knoll, become a single powerhouse design entity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Furniture Market in USA," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Furniture Market in USA report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Furniture Market in USA?

To stay informed about further developments, trends, and reports in the Furniture Market in USA, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence