Key Insights

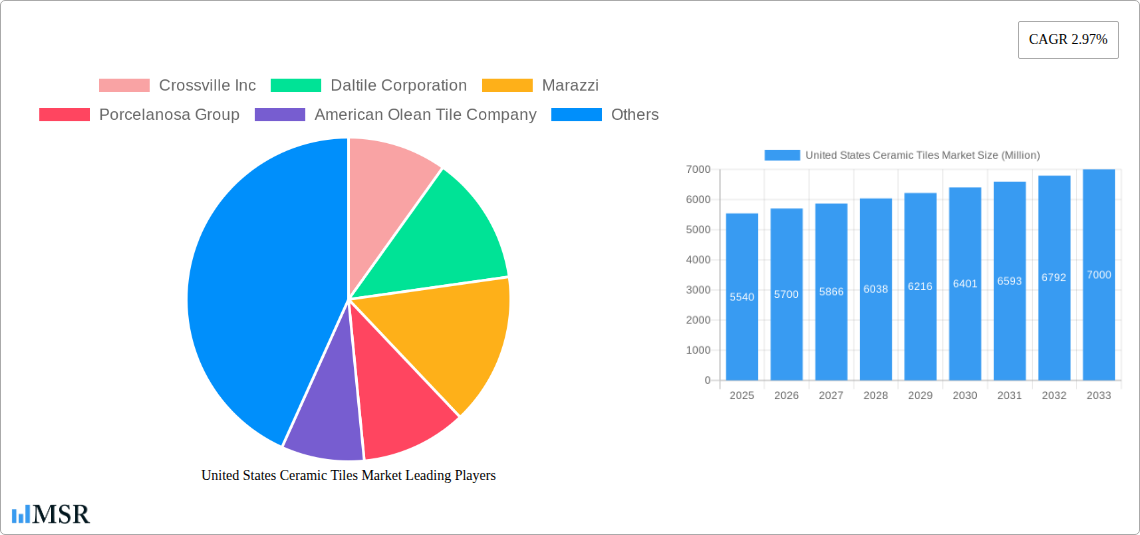

The United States ceramic tile market, valued at approximately $5.54 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing popularity of ceramic tiles in residential and commercial construction, fueled by their durability, aesthetic versatility, and cost-effectiveness compared to other flooring and wall cladding materials, is a primary driver. The resurgence of renovation projects in existing homes, coupled with robust new construction activity, further contributes to market expansion. Specific trends impacting the market include a shift towards larger format tiles, increased demand for sustainable and eco-friendly options (e.g., recycled content tiles), and the growing adoption of innovative digital printing techniques for creating intricate designs. While rising raw material costs and supply chain disruptions pose some challenges, the market's inherent resilience and the ongoing preference for ceramic tiles in various applications suggest continued growth. The segment breakdown reveals a strong demand for glazed and porcelain tiles within both residential and commercial sectors, with home centers and specialty stores forming the dominant distribution channels. Competition within the market is robust, with both established players and emerging brands vying for market share through innovation and strategic partnerships.

United States Ceramic Tiles Market Market Size (In Billion)

The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) of 2.97%, indicating a gradual yet consistent expansion. This growth is expected to be influenced by several factors, including continued economic growth, increasing disposable incomes, and government initiatives promoting sustainable construction practices. The geographic distribution of the market reveals a strong presence in the United States, with regional variations driven by factors such as construction activity, housing markets, and consumer preferences. The segment showing the highest growth potential is likely to be the residential segment, driven by the continuing trend of home renovations and new construction. This is further reinforced by the anticipated growth in the replacement and renovation construction type segment. Continued innovation in product design and the adoption of digital marketing strategies by key players will also contribute to maintaining positive market dynamics over the forecast period.

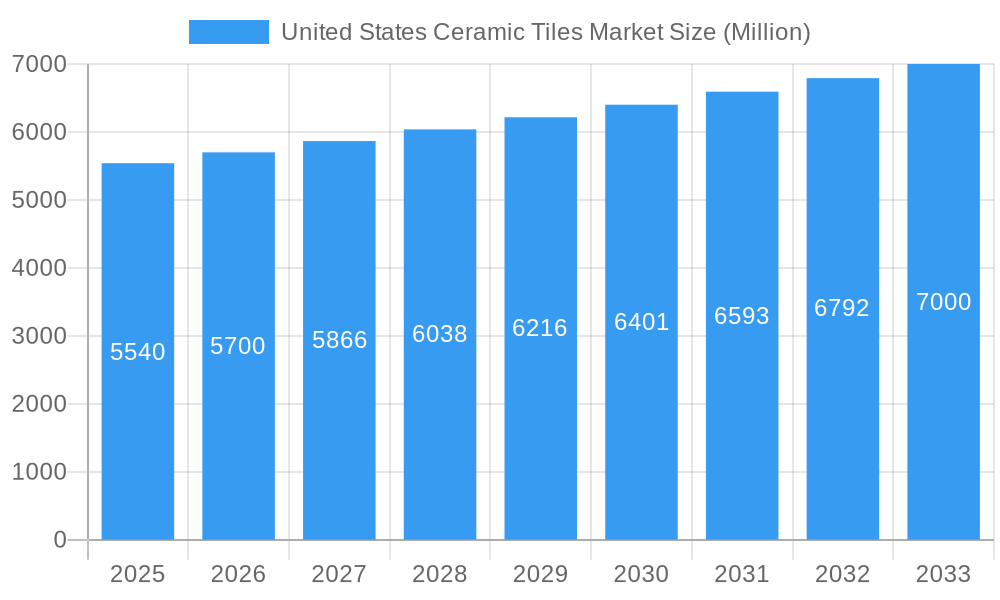

United States Ceramic Tiles Market Company Market Share

United States Ceramic Tiles Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States ceramic tiles market, covering market size, segmentation, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry stakeholders, investors, and anyone seeking a thorough understanding of this dynamic market. The report is meticulously structured to offer actionable insights, avoiding any placeholders and providing predicted values where necessary.

United States Ceramic Tiles Market Market Concentration & Dynamics

The United States ceramic tiles market exhibits a moderately concentrated structure, with a few major players holding significant market share. Market leaders like Mohawk Industries, Daltile Corporation, and Crossville Inc. benefit from established brand recognition and extensive distribution networks. However, a number of smaller players and regional businesses actively compete, especially in niche segments. The market is characterized by ongoing innovation in product design, material technology, and manufacturing processes. Regulatory frameworks, particularly those concerning environmental sustainability and worker safety, significantly influence operational costs and product development. Substitute products, such as vinyl, wood, and stone alternatives, present a continuous challenge, requiring ceramic tile manufacturers to emphasize features like durability, aesthetic appeal, and cost-effectiveness. End-user trends, particularly towards larger format tiles and customized designs, are driving product innovation. The market has witnessed a noticeable increase in M&A activity, including a xx% rise in deals between 2020 and 2024, indicating a trend towards consolidation and expansion. Key M&A activities include:

- Mohawk Industries' acquisition of Vitromex (USD 293 Million).

- Shaw Industries' investment in Watershed Solar LLC.

The market share distribution amongst the top five players is estimated at approximately xx% in 2025, leaving a substantial xx% share for other prominent players and smaller businesses.

United States Ceramic Tiles Market Industry Insights & Trends

The United States ceramic tiles market is experiencing robust growth, projected at a CAGR of xx% during the forecast period (2025-2033). The market size in 2025 is estimated at USD xx Million, reflecting an increase from USD xx Million in 2019. This growth is propelled by several factors, including the burgeoning construction industry, particularly in the residential sector. Increased disposable income and favorable housing market conditions contribute to this demand. Furthermore, technological advancements, such as the introduction of large-format tiles and digitally printed designs, are expanding aesthetic possibilities and driving consumer preference. Evolving consumer behaviors prioritize sustainable and eco-friendly options, placing pressure on manufacturers to embrace environmentally responsible practices. A rising focus on interior design trends, including a growing demand for luxurious, high-end tiles in both residential and commercial spaces, is fostering market expansion. These factors, combined with the ongoing growth in commercial construction projects—particularly in hospitality, retail, and healthcare—are expected to drive continued market expansion.

Key Markets & Segments Leading United States Ceramic Tiles Market

The United States ceramic tiles market demonstrates robust growth across various segments. The dominant segments in terms of market share are:

By Product: Porcelain tiles maintain a significant lead due to their superior durability and water resistance, holding approximately xx% of the market share in 2025. Glazed tiles remain popular for their aesthetic versatility, accounting for xx% of the market.

By Application: Floor tiles command the largest share, exceeding xx% in 2025, owing to their functional role in construction. The demand for wall tiles is significant, contributing approximately xx% to the total market.

By Construction Type: New construction accounts for the highest share at approximately xx%, while replacement and renovation projects contribute a substantial xx%, reflecting the cyclical nature of the industry.

By End-User: The residential sector dominates the market with an estimated xx% share in 2025, due to the significant volume of new housing construction and renovation. The commercial sector, though smaller, presents considerable growth opportunities, particularly in large-scale projects.

By Distribution Channel: Home centers remain the primary distribution channel, holding approximately xx% market share, closely followed by specialty stores and distributors. Online sales are growing steadily, though they still constitute a relatively smaller portion.

Growth Drivers: Key factors driving growth across segments include robust economic activity, increasing infrastructure development, and favorable government policies supporting construction projects.

United States Ceramic Tiles Market Product Developments

Recent years have witnessed significant product innovations in the US ceramic tile market. Manufacturers are focusing on developing larger format tiles, enhancing durability, and creating more sustainable products. Technological advancements in digital printing have enabled the creation of highly realistic designs and custom patterns. Scratch-resistant and stain-resistant coatings are increasingly integrated into new products, improving their lifespan and appeal. These innovations provide manufacturers with a competitive edge, enabling them to cater to sophisticated consumer preferences.

Challenges in the United States Ceramic Tiles Market Market

The United States ceramic tiles market faces several challenges. Fluctuations in raw material prices, particularly clay and energy costs, directly impact profitability. Supply chain disruptions can lead to production delays and increased costs. Intense competition from substitute materials like vinyl and laminate flooring exerts constant pressure on prices and market share. Furthermore, stringent environmental regulations impose compliance costs. These factors combine to create significant hurdles for players in the market, impacting both profitability and growth potential. The total estimated impact of these challenges on market growth is predicted at approximately xx% in 2025.

Forces Driving United States Ceramic Tiles Market Growth

Several factors contribute to the growth of the US ceramic tile market. The ongoing expansion of the construction industry, fueled by economic growth and population increase, presents a major driver. Government initiatives to improve infrastructure further stimulate demand for building materials. Furthermore, technological advancements in tile production, including larger formats and improved durability, enhance the appeal of ceramic tiles over alternatives. Finally, increasing awareness of the environmental benefits of certain ceramic tile manufacturing processes is leading to increased adoption.

Challenges in the United States Ceramic Tiles Market Market

Long-term growth in the United States ceramic tiles market will rely on continuous innovation, strategic partnerships, and expanding into new market segments. Manufacturers must invest in research and development to create sustainable, high-performance products. Collaboration with architects and designers can lead to increased market adoption. Furthermore, exploration of new export markets will help diversify revenue streams and bolster long-term growth.

Emerging Opportunities in United States Ceramic Tiles Market

The US ceramic tiles market offers several emerging opportunities. The increasing adoption of sustainable materials presents a key opportunity for manufacturers to leverage their environmental credentials. Growing demand for large-format tiles and customized designs allows for product diversification and premium pricing. The expanding online retail channel creates avenues for direct consumer engagement and increased sales. Finally, targeting specific niche markets, such as high-end residential projects or commercial developments with unique aesthetic requirements, provides significant growth potential.

Leading Players in the United States Ceramic Tiles Market Sector

Key Milestones in United States Ceramic Tiles Market Industry

- June 2022: Mohawk Industries, Inc. announced the acquisition of Vitromex, strengthening its market position.

- February 2023: Shaw Industries' investment in Watershed Solar LLC highlights a focus on sustainability and renewable energy. This move positions Shaw Industries as a leader in environmentally responsible practices within the ceramic tile industry and could attract environmentally conscious consumers.

Strategic Outlook for United States Ceramic Tiles Market Market

The United States ceramic tiles market holds substantial growth potential. Manufacturers who prioritize innovation, sustainability, and strategic partnerships will be best positioned to capture market share. Focusing on the growing demand for large-format, high-performance, and eco-friendly tiles will be crucial. Leveraging digital marketing and e-commerce to reach a wider consumer base will further enhance market penetration. The ability to adapt to changing consumer preferences and effectively manage supply chain challenges will be essential for long-term success in this dynamic market.

United States Ceramic Tiles Market Segmentation

-

1. Product

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Other Products

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Other Tiles

-

3. Construction Type

- 3.1. New Construction

- 3.2. Replacement & Renovation

-

4. End User

- 4.1. Residential

- 4.2. Commercial

-

5. Distribution Channel

- 5.1. Home Centers

- 5.2. Specialty Stores

- 5.3. Online

- 5.4. Distributors

- 5.5. Other Distribution Channels

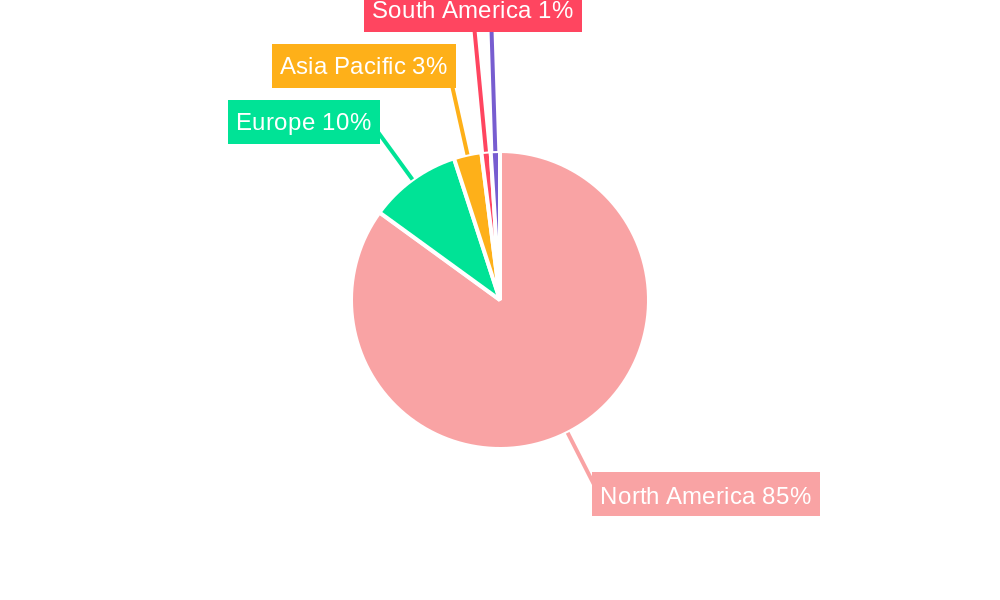

United States Ceramic Tiles Market Segmentation By Geography

- 1. United States

United States Ceramic Tiles Market Regional Market Share

Geographic Coverage of United States Ceramic Tiles Market

United States Ceramic Tiles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Construction and Renovation Activities; Rising Preference for Sustainable and Eco-Friendly Materials

- 3.3. Market Restrains

- 3.3.1. Price and Installation Costs; Competition from Alternative Materials

- 3.4. Market Trends

- 3.4.1. Increasing Consumption of Ceramic Tiles is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Other Tiles

- 5.3. Market Analysis, Insights and Forecast - by Construction Type

- 5.3.1. New Construction

- 5.3.2. Replacement & Renovation

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Residential

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.5.1. Home Centers

- 5.5.2. Specialty Stores

- 5.5.3. Online

- 5.5.4. Distributors

- 5.5.5. Other Distribution Channels

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Crossville Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Daltile Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Marazzi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Porcelanosa Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 American Olean Tile Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shaw Industries

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Emser Tile

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roca Tile

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Florida Tile Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jeffrey Court

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Other Prominent Players**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mohawk Industries

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Crossville Inc

List of Figures

- Figure 1: United States Ceramic Tiles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Ceramic Tiles Market Share (%) by Company 2025

List of Tables

- Table 1: United States Ceramic Tiles Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United States Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: United States Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 4: United States Ceramic Tiles Market Revenue Million Forecast, by End User 2020 & 2033

- Table 5: United States Ceramic Tiles Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Ceramic Tiles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: United States Ceramic Tiles Market Revenue Million Forecast, by Product 2020 & 2033

- Table 8: United States Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: United States Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 10: United States Ceramic Tiles Market Revenue Million Forecast, by End User 2020 & 2033

- Table 11: United States Ceramic Tiles Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: United States Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Ceramic Tiles Market?

The projected CAGR is approximately 2.97%.

2. Which companies are prominent players in the United States Ceramic Tiles Market?

Key companies in the market include Crossville Inc, Daltile Corporation, Marazzi, Porcelanosa Group, American Olean Tile Company, Shaw Industries, Emser Tile, Roca Tile, Florida Tile Inc, Jeffrey Court, Other Prominent Players**List Not Exhaustive, Mohawk Industries.

3. What are the main segments of the United States Ceramic Tiles Market?

The market segments include Product, Application, Construction Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Construction and Renovation Activities; Rising Preference for Sustainable and Eco-Friendly Materials.

6. What are the notable trends driving market growth?

Increasing Consumption of Ceramic Tiles is Driving the Market.

7. Are there any restraints impacting market growth?

Price and Installation Costs; Competition from Alternative Materials.

8. Can you provide examples of recent developments in the market?

February 2023: Shaw Industries Group, Inc. announced that it completed the purchase of a controlling interest in Watershed Solar LLC. Watershed Solar provides patented renewable energy solutions. The technology, branded PowerCap, supplies low-profile, high-output solar arrays on top of landfills, coal ash closures, and rooftops, turning liabilities or underused spaces into renewable energy assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Ceramic Tiles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Ceramic Tiles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Ceramic Tiles Market?

To stay informed about further developments, trends, and reports in the United States Ceramic Tiles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence