Key Insights

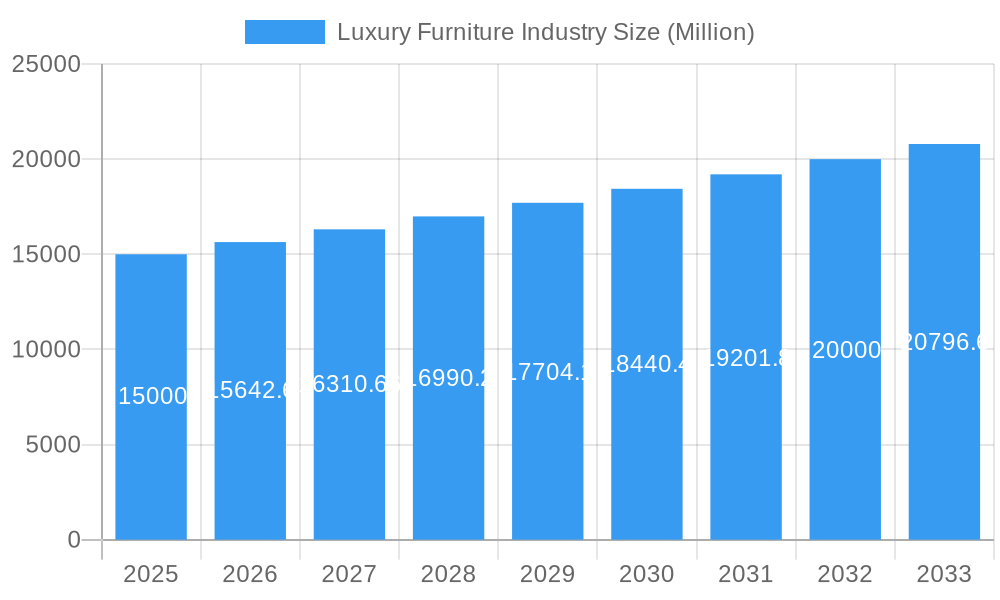

The global luxury furniture market, valued at approximately $27.19 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 6.6% from 2025 to 2033. This expansion is driven by increasing disposable incomes in emerging economies, a growing preference for personalized and bespoke pieces, the rise of e-commerce, and a strong focus on sustainable materials. The trend towards creating "experiential" home spaces further stimulates demand.

Luxury Furniture Industry Market Size (In Billion)

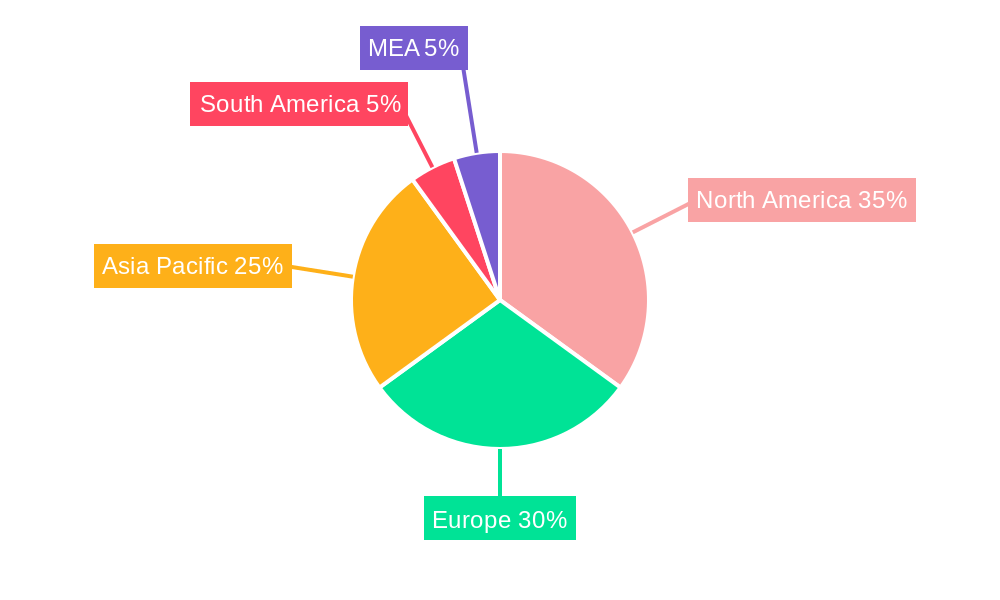

The market is segmented by product type, distribution channel, and end-user. While the residential segment currently dominates, the commercial sector shows promising growth potential, particularly in upscale hospitality and office interiors. Key players include established luxury brands and emerging niche players. Geographic variations exist, with North America and Europe holding significant market shares, and Asia-Pacific poised for rapid expansion. Challenges include fluctuating raw material costs, supply chain disruptions, and the need to balance luxury with sustainability.

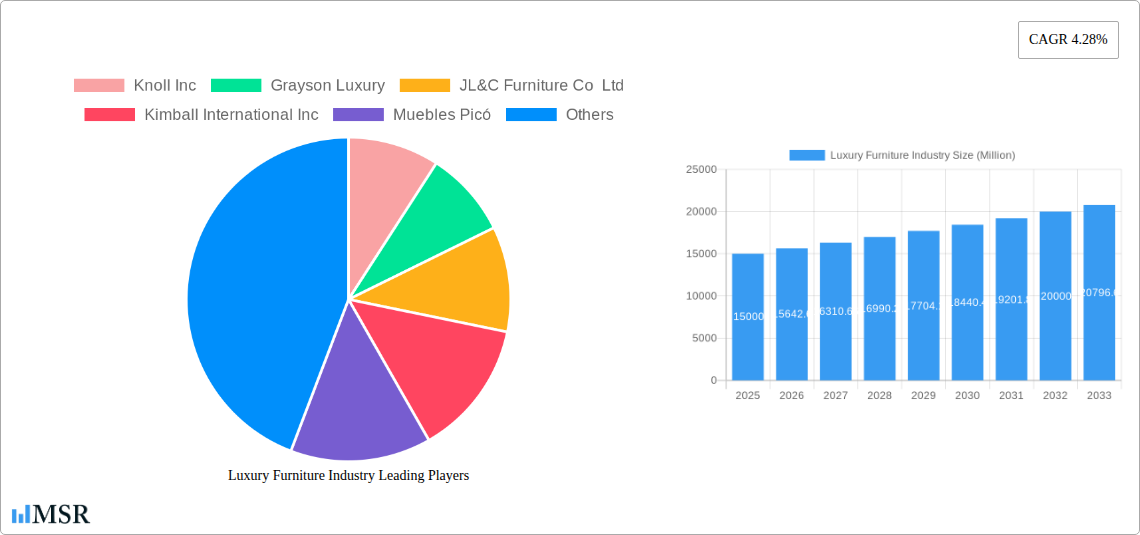

Luxury Furniture Industry Company Market Share

Luxury Furniture Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the luxury furniture industry, projecting a market value exceeding $XX Million by 2033. Leveraging data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. It examines market concentration, key segments (lighting, tables, chairs, sofas, beds, cabinets, and accessories), distribution channels, and end-user trends (residential and commercial). Leading players like Knoll Inc, Grayson Luxury, and Cassina SpA are analyzed, alongside emerging trends and opportunities shaping the future of luxury furniture.

Luxury Furniture Industry Market Concentration & Dynamics

The luxury furniture market exhibits moderate concentration, with several key players holding significant market share. Knoll Inc, Kimball International Inc, and Cassina SpA are among the established brands commanding considerable market presence. However, the landscape is dynamic, marked by both organic growth strategies and significant mergers & acquisitions (M&A) activity.

- Market Share: Knoll Inc holds an estimated XX% market share in 2025, while Kimball International Inc commands approximately XX%. Other players such as Cassina SpA and Grayson Luxury contribute to the remaining share. Precise figures are subject to continuous market fluctuation.

- M&A Activity: The industry has witnessed a notable increase in M&A activity in recent years, exceeding XX deals in the period 2019-2024. A key example is the acquisition of Marge Carson by Linly Designs in October 2022.

- Innovation Ecosystems: The luxury furniture industry fosters continuous innovation through collaborations with designers and technological advancements in manufacturing processes.

- Regulatory Frameworks: Regulations concerning material sourcing, manufacturing processes, and product safety influence market dynamics. These vary significantly across different global regions.

- Substitute Products: The market faces competition from other luxury home décor items and substitute materials, posing a moderate challenge.

- End-User Trends: A growing preference for sustainable and ethically sourced materials, alongside the increasing demand for personalized and bespoke furniture, drives industry evolution.

Luxury Furniture Industry Industry Insights & Trends

The global luxury furniture market is experiencing robust growth, projected to reach $XX Million by 2033, with a compound annual growth rate (CAGR) of XX% during the forecast period (2025-2033). This growth is propelled by several key factors:

The rising disposable incomes in emerging economies, particularly in Asia and the Middle East, fuel demand for high-end furniture. Increasing urbanization and a preference for sophisticated home interiors also contribute to the growth. Furthermore, the rise of e-commerce has broadened access to luxury brands and products, stimulating market expansion. Technological advancements, like 3D printing and AI-driven design tools, improve manufacturing efficiency and product customization, driving innovation and market expansion. Shifting consumer preferences towards experiential purchases and a growing appreciation for unique craftsmanship also contribute significantly to market expansion. The market is expected to witness a further surge in demand from the commercial sector, driven by an increase in high-end hospitality projects and corporate office renovations.

Key Markets & Segments Leading Luxury Furniture Industry

The North American and European markets currently dominate the luxury furniture industry. However, rapid economic growth in Asia-Pacific is expected to fuel substantial market expansion in the coming years.

Dominant Segments:

- Product: Chairs and sofas maintain the largest market share due to high demand in both residential and commercial settings.

- Distribution Channel: Flagship stores remain a primary distribution channel, emphasizing brand experience and exclusivity. However, online channels are witnessing a marked increase in sales.

- End User: The residential segment holds the larger market share; however, the commercial sector is experiencing substantial growth, driven by rising investments in hospitality and corporate spaces.

Growth Drivers by Region:

- North America: Strong economic conditions and a preference for high-quality furniture fuel growth.

- Europe: Established luxury markets with high brand awareness sustain robust demand.

- Asia-Pacific: Rapid economic growth and a rising middle class drive substantial market expansion.

Luxury Furniture Industry Product Developments

Recent product innovations focus on sustainable materials, ergonomic designs, and smart functionalities. Manufacturers are incorporating technological advancements, such as augmented reality (AR) and virtual reality (VR) tools, to enhance the customer experience and personalize product offerings. This trend enhances competitive advantage and drives market appeal by aligning with the growing demand for bespoke furniture and responsible sourcing.

Challenges in the Luxury Furniture Industry Market

The luxury furniture market faces challenges including:

- Supply Chain Disruptions: Global supply chain issues lead to increased material costs and delivery delays, impacting profitability.

- Economic Slowdowns: Economic uncertainty can dampen consumer spending, affecting demand for luxury goods.

- Intense Competition: Competition among established brands and emerging players is fierce, necessitating continuous innovation and strong brand building.

Forces Driving Luxury Furniture Industry Growth

Key growth drivers include:

- Technological Advancements: Innovation in design and manufacturing processes enables production of high-quality, bespoke furniture.

- Economic Growth: Rising disposable incomes in key markets fuel demand for luxury goods.

- Favorable Regulatory Environments: Supportive government policies in some regions encourage industry growth.

Long-Term Growth Catalysts in the Luxury Furniture Industry Market

Long-term growth will be fueled by continued technological innovations, strategic partnerships across design houses and manufacturing, and expansion into new and emerging markets, particularly in Asia-Pacific. Focus on sustainable practices and customer-centric designs will attract new customer segments while maintaining appeal within the existing target audience.

Emerging Opportunities in Luxury Furniture Industry

Emerging opportunities include:

- Sustainable and Ethical Sourcing: Consumers are increasingly demanding environmentally and socially responsible products.

- Customization and Personalization: Tailored furniture designs cater to individual preferences and lifestyles.

- Smart Home Integration: Integrating technology into furniture enhances functionality and user experience.

Leading Players in the Luxury Furniture Industry Sector

- Knoll Inc

- Grayson Luxury

- JL&C Furniture Co Ltd

- Kimball International Inc

- Muebles Picó

- iola Furniture

- Duresta Upholstery Ltd

- Brown Jordan International

- Ralph Lauren Corporation

- Boca Da Lobo

- Nella Vetrina Giovanni Visentin S R L

- Valderamobili S R L

- Molteni Group

- Luxury Living Group

- PICO SA

- Crate & Barrel

- Century Furniture LLC

- Cassina SpA

Key Milestones in Luxury Furniture Industry Industry

- October 2022: Marge Carson acquisition by Linly Designs expands the market reach of high-quality handcrafted furniture.

- September 2022: Muebles Picó's new outdoor collection blurs lines between indoor and outdoor living, creating a new market segment.

Strategic Outlook for Luxury Furniture Industry Market

The luxury furniture market exhibits significant growth potential, driven by technological innovations, rising affluence, and a growing preference for high-quality, bespoke designs. Strategic partnerships, focus on sustainability, and expansion into new markets will be key to achieving long-term success. The market is poised for continued expansion, driven by the unique confluence of consumer preferences and technological advancements.

Luxury Furniture Industry Segmentation

-

1. Product

- 1.1. Lighting

- 1.2. Tables

- 1.3. Chairs and Sofas

- 1.4. Beds

- 1.5. Cabinets

- 1.6. Accessories

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Home Centers

- 2.2. Flagship Stores

- 2.3. Specialty Stores

- 2.4. Online

- 2.5. Other Distribution Channels

-

3. End User

- 3.1. Residential

- 3.2. Commercial

Luxury Furniture Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Luxury Furniture Industry Regional Market Share

Geographic Coverage of Luxury Furniture Industry

Luxury Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Wine Consumption Culture is Driving the Wine Cooler Market; Increasing Hospitality Industry's Wine Offering is Driving the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Costs of Wine Coolers Act as a Restraint

- 3.4. Market Trends

- 3.4.1. Growing Urbanization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Lighting

- 5.1.2. Tables

- 5.1.3. Chairs and Sofas

- 5.1.4. Beds

- 5.1.5. Cabinets

- 5.1.6. Accessories

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Home Centers

- 5.2.2. Flagship Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Luxury Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Lighting

- 6.1.2. Tables

- 6.1.3. Chairs and Sofas

- 6.1.4. Beds

- 6.1.5. Cabinets

- 6.1.6. Accessories

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Home Centers

- 6.2.2. Flagship Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Luxury Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Lighting

- 7.1.2. Tables

- 7.1.3. Chairs and Sofas

- 7.1.4. Beds

- 7.1.5. Cabinets

- 7.1.6. Accessories

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Home Centers

- 7.2.2. Flagship Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Luxury Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Lighting

- 8.1.2. Tables

- 8.1.3. Chairs and Sofas

- 8.1.4. Beds

- 8.1.5. Cabinets

- 8.1.6. Accessories

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Home Centers

- 8.2.2. Flagship Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South America Luxury Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Lighting

- 9.1.2. Tables

- 9.1.3. Chairs and Sofas

- 9.1.4. Beds

- 9.1.5. Cabinets

- 9.1.6. Accessories

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Home Centers

- 9.2.2. Flagship Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East and Africa Luxury Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Lighting

- 10.1.2. Tables

- 10.1.3. Chairs and Sofas

- 10.1.4. Beds

- 10.1.5. Cabinets

- 10.1.6. Accessories

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Home Centers

- 10.2.2. Flagship Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online

- 10.2.5. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Knoll Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Grayson Luxury

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JL&C Furniture Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kimball International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Muebles Picó

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 iola Furniture

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Duresta Upholstery Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Brown Jordan International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ralph Lauren Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Boca Da Lobo

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Other Companies (Nella Vetrina Giovanni Visentin S R L Valderamobili S R L Molteni Group Luxury Living Group PICO SA Crate & Barrel and Century Furniture LLC)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cassina SpA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Knoll Inc

List of Figures

- Figure 1: Global Luxury Furniture Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Luxury Furniture Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Luxury Furniture Industry Revenue (billion), by Product 2025 & 2033

- Figure 4: North America Luxury Furniture Industry Volume (K Unit), by Product 2025 & 2033

- Figure 5: North America Luxury Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Luxury Furniture Industry Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Luxury Furniture Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 8: North America Luxury Furniture Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 9: North America Luxury Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Luxury Furniture Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Luxury Furniture Industry Revenue (billion), by End User 2025 & 2033

- Figure 12: North America Luxury Furniture Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Luxury Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Luxury Furniture Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Luxury Furniture Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Luxury Furniture Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Luxury Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Luxury Furniture Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Luxury Furniture Industry Revenue (billion), by Product 2025 & 2033

- Figure 20: Europe Luxury Furniture Industry Volume (K Unit), by Product 2025 & 2033

- Figure 21: Europe Luxury Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Europe Luxury Furniture Industry Volume Share (%), by Product 2025 & 2033

- Figure 23: Europe Luxury Furniture Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 24: Europe Luxury Furniture Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 25: Europe Luxury Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: Europe Luxury Furniture Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 27: Europe Luxury Furniture Industry Revenue (billion), by End User 2025 & 2033

- Figure 28: Europe Luxury Furniture Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Luxury Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Luxury Furniture Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Luxury Furniture Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Luxury Furniture Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Luxury Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Luxury Furniture Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Luxury Furniture Industry Revenue (billion), by Product 2025 & 2033

- Figure 36: Asia Pacific Luxury Furniture Industry Volume (K Unit), by Product 2025 & 2033

- Figure 37: Asia Pacific Luxury Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 38: Asia Pacific Luxury Furniture Industry Volume Share (%), by Product 2025 & 2033

- Figure 39: Asia Pacific Luxury Furniture Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Luxury Furniture Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 41: Asia Pacific Luxury Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 42: Asia Pacific Luxury Furniture Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 43: Asia Pacific Luxury Furniture Industry Revenue (billion), by End User 2025 & 2033

- Figure 44: Asia Pacific Luxury Furniture Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Luxury Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Luxury Furniture Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Luxury Furniture Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Luxury Furniture Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Luxury Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Luxury Furniture Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Luxury Furniture Industry Revenue (billion), by Product 2025 & 2033

- Figure 52: South America Luxury Furniture Industry Volume (K Unit), by Product 2025 & 2033

- Figure 53: South America Luxury Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 54: South America Luxury Furniture Industry Volume Share (%), by Product 2025 & 2033

- Figure 55: South America Luxury Furniture Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 56: South America Luxury Furniture Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 57: South America Luxury Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: South America Luxury Furniture Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: South America Luxury Furniture Industry Revenue (billion), by End User 2025 & 2033

- Figure 60: South America Luxury Furniture Industry Volume (K Unit), by End User 2025 & 2033

- Figure 61: South America Luxury Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: South America Luxury Furniture Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: South America Luxury Furniture Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: South America Luxury Furniture Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: South America Luxury Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Luxury Furniture Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Luxury Furniture Industry Revenue (billion), by Product 2025 & 2033

- Figure 68: Middle East and Africa Luxury Furniture Industry Volume (K Unit), by Product 2025 & 2033

- Figure 69: Middle East and Africa Luxury Furniture Industry Revenue Share (%), by Product 2025 & 2033

- Figure 70: Middle East and Africa Luxury Furniture Industry Volume Share (%), by Product 2025 & 2033

- Figure 71: Middle East and Africa Luxury Furniture Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 72: Middle East and Africa Luxury Furniture Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 73: Middle East and Africa Luxury Furniture Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 74: Middle East and Africa Luxury Furniture Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 75: Middle East and Africa Luxury Furniture Industry Revenue (billion), by End User 2025 & 2033

- Figure 76: Middle East and Africa Luxury Furniture Industry Volume (K Unit), by End User 2025 & 2033

- Figure 77: Middle East and Africa Luxury Furniture Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: Middle East and Africa Luxury Furniture Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: Middle East and Africa Luxury Furniture Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: Middle East and Africa Luxury Furniture Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Luxury Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Luxury Furniture Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Furniture Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Luxury Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Global Luxury Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Luxury Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Luxury Furniture Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Luxury Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Luxury Furniture Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Luxury Furniture Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Luxury Furniture Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Global Luxury Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: Global Luxury Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Luxury Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Luxury Furniture Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global Luxury Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Luxury Furniture Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Luxury Furniture Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Luxury Furniture Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 18: Global Luxury Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 19: Global Luxury Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: Global Luxury Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Luxury Furniture Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 22: Global Luxury Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Global Luxury Furniture Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Luxury Furniture Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Luxury Furniture Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 26: Global Luxury Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 27: Global Luxury Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Luxury Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Luxury Furniture Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 30: Global Luxury Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 31: Global Luxury Furniture Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global Luxury Furniture Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global Luxury Furniture Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 34: Global Luxury Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 35: Global Luxury Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Luxury Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Luxury Furniture Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 38: Global Luxury Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 39: Global Luxury Furniture Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global Luxury Furniture Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Luxury Furniture Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 42: Global Luxury Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 43: Global Luxury Furniture Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Luxury Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Luxury Furniture Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 46: Global Luxury Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 47: Global Luxury Furniture Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Luxury Furniture Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Furniture Industry?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Luxury Furniture Industry?

Key companies in the market include Knoll Inc, Grayson Luxury, JL&C Furniture Co Ltd, Kimball International Inc, Muebles Picó, iola Furniture, Duresta Upholstery Ltd, Brown Jordan International, Ralph Lauren Corporation, Boca Da Lobo, Other Companies (Nella Vetrina Giovanni Visentin S R L Valderamobili S R L Molteni Group Luxury Living Group PICO SA Crate & Barrel and Century Furniture LLC), Cassina SpA.

3. What are the main segments of the Luxury Furniture Industry?

The market segments include Product, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.19 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Wine Consumption Culture is Driving the Wine Cooler Market; Increasing Hospitality Industry's Wine Offering is Driving the Market.

6. What are the notable trends driving market growth?

Growing Urbanization is Driving the Market.

7. Are there any restraints impacting market growth?

High Initial Costs of Wine Coolers Act as a Restraint.

8. Can you provide examples of recent developments in the market?

In October 2022, Marge Carson, a manufacturer of handcrafted furniture based in California, was purchased by Linly Designs, an interior design and retail business in Chicago. The Marge Carson furniture line is famous not just in the United States but also around the world for its high quality, proportional forms, and textiles in the industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Furniture Industry?

To stay informed about further developments, trends, and reports in the Luxury Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence