Key Insights

The Japan agricultural machinery market, valued at $3.9 billion in the base year 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.51%. This growth is propelled by the escalating demand for efficient, technologically advanced equipment to mitigate labor shortages and meet rising food production needs amidst diminishing arable land. Government-led modernization and sustainability initiatives further fuel market expansion. The market is segmented by product type (tractors, planting, harvesting, haying, and irrigation machinery) and horsepower. Tractors, particularly those in the 21-50 HP range, hold a significant market share. The increasing adoption of precision agriculture technologies, including GPS-guided machinery and automated systems, is a transformative trend shaping future growth.

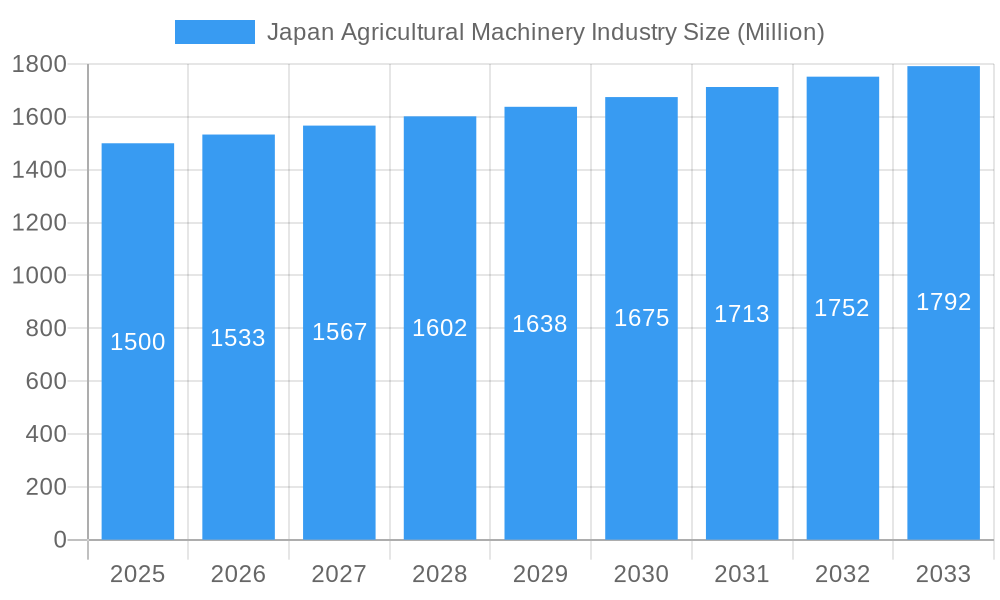

Japan Agricultural Machinery Industry Market Size (In Billion)

However, substantial initial investment for advanced machinery and volatile agricultural commodity prices present market expansion challenges. Key trends include a preference for compact utility tractors and a heightened focus on sustainable farming practices.

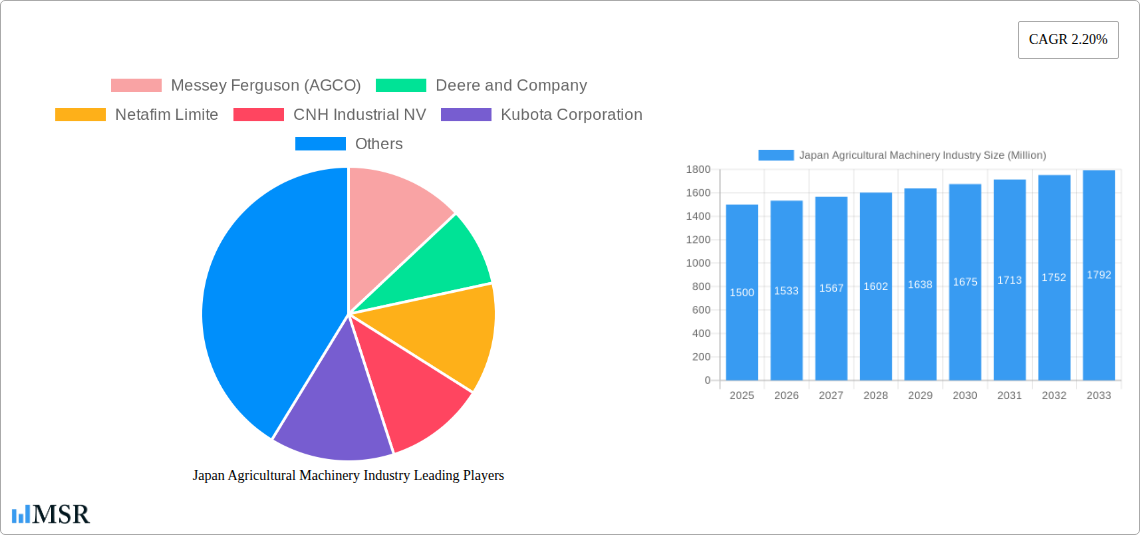

Japan Agricultural Machinery Industry Company Market Share

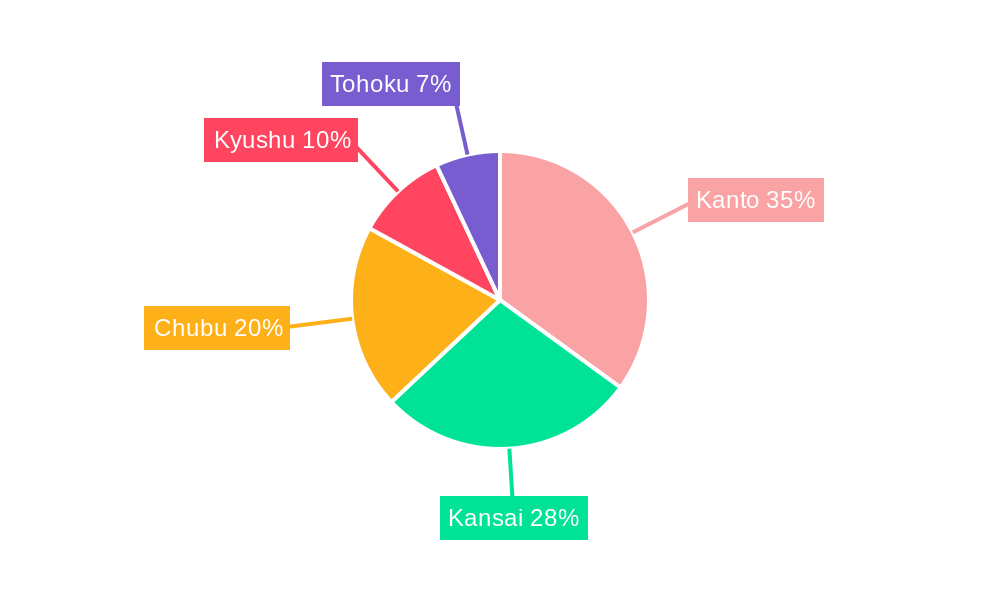

Geographically, the Kanto, Kansai, and Chubu regions are anticipated to command the largest market shares due to their concentrated arable land and agricultural activities. Leading players such as Kubota Corporation, Yanmar Company Limited, and Mahindra & Mahindra Ltd. dominate through established brand recognition and extensive distribution networks. Intensifying competition from global manufacturers offering innovative solutions and competitive pricing strategies is notable. Future growth hinges on continued government support for agricultural modernization and the widespread adoption of smart farming technologies by Japanese farmers.

Japan Agricultural Machinery Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Japan agricultural machinery industry, covering market dynamics, key segments, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data analysis to provide actionable insights into the $XX Million market, revealing key trends and opportunities within the Japanese agricultural landscape.

Japan Agricultural Machinery Industry Market Concentration & Dynamics

The Japanese agricultural machinery market exhibits a moderately concentrated structure, dominated by a few key players like Kubota Corporation and Yanmar Company Limited, alongside international giants such as Deere & Company and AGCO. These companies hold a significant market share, estimated at xx% collectively in 2024. However, the presence of several smaller, specialized players contributes to a dynamic competitive landscape. Innovation ecosystems are fostering technological advancements, particularly in automation and precision agriculture. The regulatory framework, while generally supportive of agricultural modernization, presents some challenges regarding import regulations and environmental standards. Substitute products, such as manual labor or older machinery, still exist but are steadily losing market share to technologically advanced solutions. End-user trends indicate a growing demand for efficient, high-performance machinery, particularly in the high horsepower tractor segment. M&A activity in the industry has been relatively modest in recent years, with only xx significant deals recorded between 2019 and 2024.

- Market Share: Kubota and Yanmar combined hold an estimated xx% of the market.

- M&A Activity: xx major mergers and acquisitions recorded between 2019 and 2024.

- Regulatory Landscape: Focus on environmental compliance and import regulations.

- Innovation Ecosystem: Strong focus on automation, precision agriculture, and data-driven solutions.

Japan Agricultural Machinery Industry Industry Insights & Trends

The Japanese agricultural machinery market is experiencing steady growth, driven by factors like increasing farm mechanization, the aging farming population (necessitating automation), and government initiatives promoting agricultural modernization. The market size reached an estimated $XX Million in 2024 and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching $XX Million by 2033. Technological disruptions, including the adoption of precision farming technologies, autonomous tractors, and IoT-enabled machinery, are reshaping the industry. Evolving consumer behaviors include a growing preference for higher-efficiency, technologically advanced machinery, coupled with increased demand for services and support from manufacturers.

Key Markets & Segments Leading Japan Agricultural Machinery Industry

The Japanese domestic market represents the core market for agricultural machinery. Within this market, the tractor segment dominates, with a particular focus on high horsepower (above 50HP) models due to the country's often challenging terrain and the need for efficient large-scale operations. Utility tractors and row crop tractors are also prevalent.

Dominant Segments:

- Tractors: Above 50 HP segment demonstrating strongest growth.

- Ploughing & Cultivating Machinery: High demand driven by large-scale farming.

- Harvesting Machinery: Increasing adoption of advanced harvesting technologies.

Growth Drivers:

- Economic Growth: Increasing disposable incomes leading to higher farm investment.

- Government Support: Subsidies and incentives for modernizing agricultural practices.

- Technological Advancements: Adoption of precision agriculture and automation.

Japan Agricultural Machinery Industry Product Developments

Recent product innovations have centered on increased automation, precision farming capabilities, and enhanced efficiency. Manufacturers are integrating GPS technology, sensors, and data analytics to optimize farming operations. Autonomous tractors, like the one unveiled by John Deere, represent a significant leap forward in reducing labor costs and increasing productivity. These advancements enhance operational efficiency and create competitive edges for manufacturers.

Challenges in the Japan Agricultural Machinery Industry Market

The industry faces challenges such as a shrinking agricultural workforce, increasing input costs, and intense competition. Supply chain disruptions due to global events can also significantly impact production and availability. Stringent environmental regulations and import tariffs create barriers for both domestic and international manufacturers. These factors can potentially hinder market expansion and increase production costs.

Forces Driving Japan Agricultural Machinery Industry Growth

Technological advancements in automation, precision agriculture, and data analytics are key drivers. Government initiatives to support agricultural modernization and rising consumer demand for high-quality produce are also fueling growth. Economic factors such as increased disposable incomes and rising food prices further stimulate investments in advanced agricultural machinery.

Long-Term Growth Catalysts in Japan Agricultural Machinery Industry

Long-term growth is fueled by strategic partnerships, technological innovation (particularly in AI and robotics for farming), and expansion into new markets. Investments in research and development, coupled with the adoption of sustainable agricultural practices, will be crucial for long-term success.

Emerging Opportunities in Japan Agricultural Machinery Industry

Emerging opportunities include the expansion of precision agriculture technologies, the development of autonomous and robotic systems for various farming tasks, and the integration of data analytics for optimized farm management. Focus on sustainable agriculture practices and the development of environmentally friendly machinery offer significant growth potentials.

Leading Players in the Japan Agricultural Machinery Industry Sector

- AGCO Corp

- Deere and Company

- CNH Industrial NV

- Kubota Corporation

- Mahindra & Mahindra Ltd

- Kukje Machinery Company Limited

- Kubota Tractor Corp

- Agrale

- Yanmar Company Limited

- Messey Ferguson (AGCO)

- Netafim Limite

Key Milestones in Japan Agricultural Machinery Industry Industry

- November 2021: John Deere updates its 6R Tractor lineup, introducing models with increased horsepower capabilities.

- January 2022: John Deere unveils a fully autonomous tractor at CES 2022, signifying a significant advancement in automation technology.

- October 2022: Kubota Corporation opens a Global Institute of Technology in Osaka, focusing on research and development for new product advancements.

Strategic Outlook for Japan Agricultural Machinery Industry Market

The Japanese agricultural machinery market holds significant long-term growth potential driven by technological advancements and supportive government policies. Companies focusing on innovation, sustainable practices, and strategic partnerships are well-positioned to capture significant market share and benefit from the expanding market. The increasing adoption of automation and precision agriculture promises to continue to shape the industry's trajectory.

Japan Agricultural Machinery Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Japan Agricultural Machinery Industry Segmentation By Geography

- 1. Japan

Japan Agricultural Machinery Industry Regional Market Share

Geographic Coverage of Japan Agricultural Machinery Industry

Japan Agricultural Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. The Need to Increase Farm Productivity Triggers the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Agricultural Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Messey Ferguson (AGCO)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deere and Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Netafim Limite

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CNH Industrial NV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kubota Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mahindra & Mahindra Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kukje Machinery Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kubota Tractor Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AGCO Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Agrale

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yanmar Company Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Messey Ferguson (AGCO)

List of Figures

- Figure 1: Japan Agricultural Machinery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Agricultural Machinery Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Agricultural Machinery Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Japan Agricultural Machinery Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Japan Agricultural Machinery Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Japan Agricultural Machinery Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Japan Agricultural Machinery Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Japan Agricultural Machinery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Japan Agricultural Machinery Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Japan Agricultural Machinery Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Japan Agricultural Machinery Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Japan Agricultural Machinery Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Japan Agricultural Machinery Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Japan Agricultural Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Agricultural Machinery Industry?

The projected CAGR is approximately 5.51%.

2. Which companies are prominent players in the Japan Agricultural Machinery Industry?

Key companies in the market include Messey Ferguson (AGCO), Deere and Company, Netafim Limite, CNH Industrial NV, Kubota Corporation, Mahindra & Mahindra Ltd, Kukje Machinery Company Limited, Kubota Tractor Corp, AGCO Corp, Agrale, Yanmar Company Limited.

3. What are the main segments of the Japan Agricultural Machinery Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

The Need to Increase Farm Productivity Triggers the Demand.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

October 2022: Kubota company opened the Global Institute of Technology in Osaka, Japan which aims to increase research and development for new product developments per the region's business landscape and needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Agricultural Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Agricultural Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Agricultural Machinery Industry?

To stay informed about further developments, trends, and reports in the Japan Agricultural Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence