Key Insights

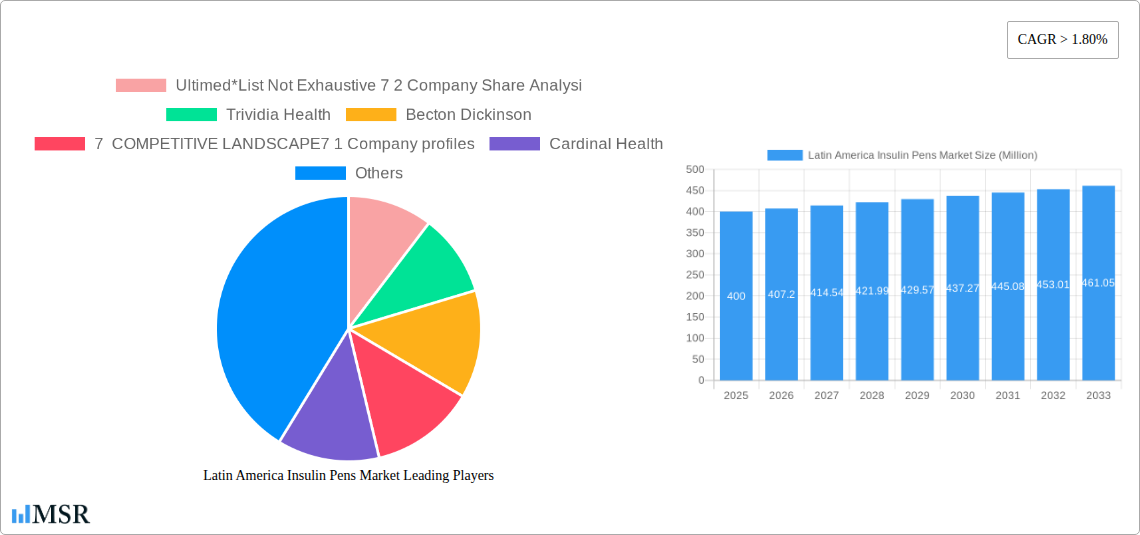

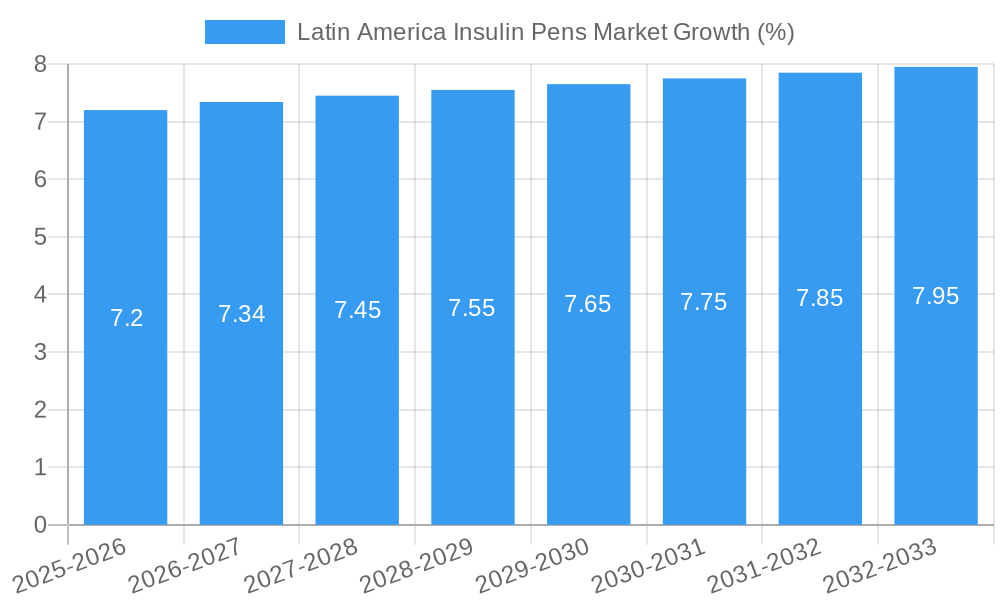

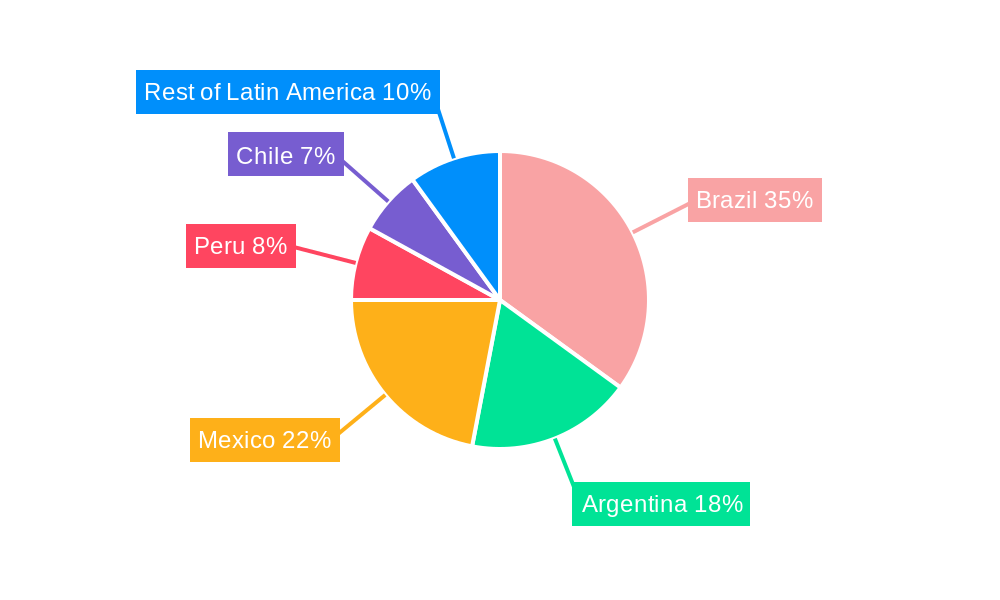

The Latin American insulin pens market, valued at $400 million in 2025, is projected to experience robust growth, driven by rising diabetes prevalence, increasing disposable incomes, and expanding healthcare infrastructure across the region. The market's Compound Annual Growth Rate (CAGR) exceeding 1.80% signifies consistent expansion over the forecast period (2025-2033). Key segments within this market include disposable insulin pens and cartridges for reusable pens, with disposable pens currently holding a larger market share due to convenience and affordability. Brazil, Argentina, and Mexico represent the largest national markets, fueled by high diabetic populations and improving access to modern diabetes management tools. Growth is also anticipated in countries like Peru and Chile as healthcare systems continue to develop and awareness of diabetes management improves. Competitive forces are shaping the market landscape, with major players like Becton Dickinson, Cardinal Health, and Arkray competing based on product innovation, distribution networks, and cost-effectiveness. However, challenges such as inconsistent healthcare access, affordability issues, and the prevalence of counterfeit medical products remain significant restraints, particularly in less developed areas of Latin America. The market is expected to witness increased adoption of advanced insulin delivery technologies in the coming years.

Further growth hinges on sustained investment in diabetes education and awareness programs to enhance early diagnosis and treatment adherence. The expansion of government-sponsored healthcare initiatives focused on chronic disease management and the increasing availability of insurance coverage will also contribute significantly to market expansion. Furthermore, the growing preference for convenient and user-friendly insulin delivery systems will drive demand for disposable insulin pens, while the cost-effectiveness of reusable pens with replaceable cartridges will continue to attract a segment of the market. The introduction of innovative insulin pen technologies with features such as dose reminders and improved accuracy will further fuel market growth. The overall market outlook remains positive, projecting continued expansion and opportunity for key players operating within this dynamic healthcare sector.

Latin America Insulin Pens Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America insulin pens market, covering market dynamics, industry trends, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for stakeholders seeking actionable insights into this rapidly evolving market.

Latin America Insulin Pens Market Market Concentration & Dynamics

This section analyzes the competitive landscape of the Latin America insulin pens market, assessing market concentration, innovation, regulatory frameworks, substitute products, end-user trends, and mergers & acquisitions (M&A) activity. The market exhibits a moderately concentrated structure, with a few key players holding significant market share. However, the presence of numerous smaller players also contributes to market dynamism.

- Market Concentration: xx% market share held by the top 5 players in 2024.

- Innovation Ecosystem: A growing focus on smart insulin pens and connected devices is driving innovation.

- Regulatory Frameworks: Varying regulatory landscapes across Latin American countries influence market access and product approvals.

- Substitute Products: The market faces competition from alternative diabetes management therapies.

- End-User Trends: Increasing prevalence of diabetes and growing awareness are fueling market demand.

- M&A Activity: A moderate level of M&A activity was observed between 2019 and 2024, with xx deals recorded. These activities mainly focused on expanding market reach and product portfolios.

Latin America Insulin Pens Market Industry Insights & Trends

This section delves into the key factors driving the growth of the Latin America insulin pens market, including market size, CAGR, technological advancements, and changing consumer preferences. The market is projected to experience robust growth over the forecast period (2025-2033), driven by rising diabetes prevalence, increasing healthcare expenditure, and the introduction of innovative insulin delivery devices. The market size was valued at $xx Million in 2024 and is projected to reach $xx Million by 2033, registering a CAGR of xx% during the forecast period. Technological advancements, particularly the integration of smart features and digital health platforms, are reshaping the market landscape. Consumer preferences are shifting towards convenient, user-friendly devices that offer enhanced monitoring and personalized insulin delivery.

Key Markets & Segments Leading Latin America Insulin Pens Market

This section identifies the leading regions, countries, and segments within the Latin America insulin pens market. The market is geographically diverse, with significant contributions from various countries. Disposable insulin pens dominate the market in terms of volume, driven by factors like affordability and ease of use. However, the segment of cartridges in reusable pens is witnessing significant growth due to its cost-effectiveness in the long run.

Dominant Segments and Drivers:

- Disposable Insulin Pens: This segment holds the largest market share, propelled by higher affordability and convenience.

- Cartridges in Reusable Pens: This segment is experiencing faster growth due to increased patient preference for long-term cost savings.

Key Market Drivers:

- Rising Diabetes Prevalence: The surge in diabetes cases across Latin America is the primary growth driver.

- Increasing Healthcare Expenditure: Growing investment in healthcare infrastructure supports market expansion.

- Government Initiatives: Regulatory support and initiatives to improve diabetes management contribute to market growth.

Latin America Insulin Pens Market Product Developments

Significant product innovations are transforming the insulin pen market. The integration of smart technology, such as Bluetooth connectivity, allows for data tracking and remote monitoring, improving patient compliance and treatment outcomes. These advancements provide competitive advantages, enhancing user experience and ultimately driving market expansion. Reusable pen systems with improved cartridge designs are gaining traction due to their cost-effectiveness and sustainability appeal.

Challenges in the Latin America Insulin Pens Market Market

The Latin America insulin pens market faces several challenges, including:

- High Cost of Insulin: Accessibility remains a significant barrier for many patients.

- Regulatory Hurdles: Varying regulatory approvals across different countries create complexities for market entry.

- Supply Chain Disruptions: Global supply chain challenges impact product availability and pricing.

- Competition: Intense competition from both established and emerging players creates pressure on pricing and market share.

Forces Driving Latin America Insulin Pens Market Growth

The Latin America insulin pens market is driven by:

- Technological Advancements: Smart insulin pens with enhanced features are driving growth.

- Economic Growth: Increased disposable incomes in certain regions boost healthcare spending.

- Favorable Regulatory Landscape: Government support for diabetes management is crucial.

- Growing Awareness: Increased public awareness about diabetes and its management improves diagnosis rates.

Long-Term Growth Catalysts in the Latin America Insulin Pens Market

Long-term growth will be driven by continued innovation, strategic partnerships between manufacturers and healthcare providers, and expansion into new markets within Latin America. The development of affordable, accessible, and user-friendly insulin pens tailored to the specific needs of the region will play a critical role in sustaining market growth.

Emerging Opportunities in Latin America Insulin Pens Market

Emerging opportunities lie in the development of patient-centric solutions, such as personalized insulin delivery systems, improved data analytics for better disease management, and expansion into underserved markets. The integration of telehealth and digital health platforms is also opening new avenues for market growth.

Leading Players in the Latin America Insulin Pens Market Sector

- Ultimed

- Trividia Health

- Becton Dickinson

- Cardinal Health

- Arkray

Key Milestones in Latin America Insulin Pens Market Industry

- July 2023: Gan & Lee secured a contract to supply 1.34 Million cartridges of 3 mL insulin aspart injections and 67,000 reusable insulin pens to Brazil.

- March 2022: Novo Nordisk launched NovoPen 6 and NovoPen Echo Plus smart insulin pens in the United Kingdom. While not directly in Latin America, this highlights the global trend toward smart pen technology.

Strategic Outlook for Latin America Insulin Pens Market Market

The Latin America insulin pens market presents significant growth opportunities for companies that can adapt to the region’s unique challenges and leverage technological advancements. A strategic focus on affordability, accessibility, and patient-centric solutions is crucial for success. Future market potential is substantial, driven by the rising prevalence of diabetes and continuous improvements in insulin delivery technology.

Latin America Insulin Pens Market Segmentation

-

1. Device

- 1.1. Disposable Insulin Pens

- 1.2. Cartridges in Reusable Pens

-

2. Geography

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Rest of Latin America

Latin America Insulin Pens Market Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Rest of Latin America

Latin America Insulin Pens Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Early Diagnosis of Chronic Conditions; Increasing Incidence of Trauma and Accidents; Surge in the Number of Surgical Procedures Carried Out Worldwide

- 3.3. Market Restrains

- 3.3.1. Blood Contaminations and Other Complications; Injury Caused During Blood Collection

- 3.4. Market Trends

- 3.4.1. Rising diabetes prevalence in Latin America is driving the market in the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Disposable Insulin Pens

- 5.1.2. Cartridges in Reusable Pens

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Mexico

- 5.3.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. Brazil Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Disposable Insulin Pens

- 6.1.2. Cartridges in Reusable Pens

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Mexico

- 6.2.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Mexico Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Disposable Insulin Pens

- 7.1.2. Cartridges in Reusable Pens

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Mexico

- 7.2.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Rest of Latin America Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Disposable Insulin Pens

- 8.1.2. Cartridges in Reusable Pens

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Mexico

- 8.2.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Brazil Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 12. Peru Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 13. Chile Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Latin America Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Ultimed*List Not Exhaustive 7 2 Company Share Analysi

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Trividia Health

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Becton Dickinson

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 7 COMPETITIVE LANDSCAPE7 1 Company profiles

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Cardinal Health

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Arkray

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.1 Ultimed*List Not Exhaustive 7 2 Company Share Analysi

List of Figures

- Figure 1: Latin America Insulin Pens Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Insulin Pens Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Insulin Pens Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Insulin Pens Market Revenue Million Forecast, by Device 2019 & 2032

- Table 3: Latin America Insulin Pens Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Latin America Insulin Pens Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Insulin Pens Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Insulin Pens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Insulin Pens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Insulin Pens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Insulin Pens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Insulin Pens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Insulin Pens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Insulin Pens Market Revenue Million Forecast, by Device 2019 & 2032

- Table 13: Latin America Insulin Pens Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Latin America Insulin Pens Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Latin America Insulin Pens Market Revenue Million Forecast, by Device 2019 & 2032

- Table 16: Latin America Insulin Pens Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Latin America Insulin Pens Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Latin America Insulin Pens Market Revenue Million Forecast, by Device 2019 & 2032

- Table 19: Latin America Insulin Pens Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Latin America Insulin Pens Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Insulin Pens Market?

The projected CAGR is approximately > 1.80%.

2. Which companies are prominent players in the Latin America Insulin Pens Market?

Key companies in the market include Ultimed*List Not Exhaustive 7 2 Company Share Analysi, Trividia Health, Becton Dickinson, 7 COMPETITIVE LANDSCAPE7 1 Company profiles, Cardinal Health, Arkray.

3. What are the main segments of the Latin America Insulin Pens Market?

The market segments include Device, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.4 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Early Diagnosis of Chronic Conditions; Increasing Incidence of Trauma and Accidents; Surge in the Number of Surgical Procedures Carried Out Worldwide.

6. What are the notable trends driving market growth?

Rising diabetes prevalence in Latin America is driving the market in the forecast period.

7. Are there any restraints impacting market growth?

Blood Contaminations and Other Complications; Injury Caused During Blood Collection.

8. Can you provide examples of recent developments in the market?

July 2023: Gan & Lee emerged as the successful bidder for the insulin aspart injections and reusable insulin pen products developed by the company to Brazil. The initial consignment of these products has already been dispatched to brazil, signifying the fulfillment of the initial round of deliveries. The shipment encompasses a total of 1.34 million cartridges of 3 mL insulin aspart injections and 67,000 reusable insulin pens.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Insulin Pens Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Insulin Pens Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Insulin Pens Market?

To stay informed about further developments, trends, and reports in the Latin America Insulin Pens Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence