Key Insights

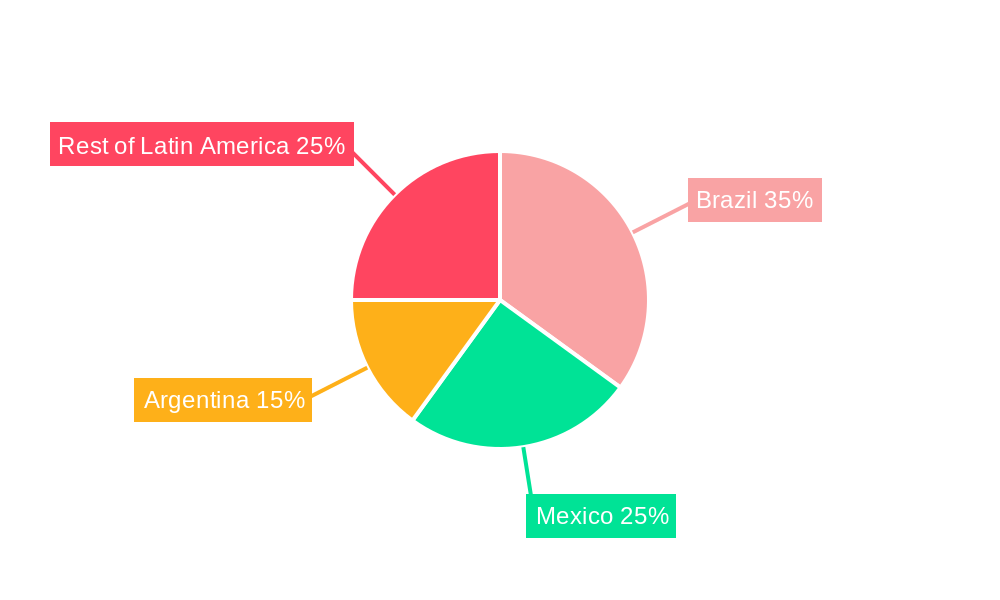

The Latin American non-lethal weapons market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3% from 2025 to 2033. This expansion is driven by several key factors. Increasing instances of civil unrest and the need for effective crowd control measures are prompting law enforcement agencies across the region to adopt non-lethal technologies. Furthermore, the rising adoption of advanced technologies, such as directed energy weapons and electroshock weapons, among military and security forces is fueling market demand. Growth is particularly strong in countries like Brazil, Mexico, and Argentina, reflecting their relatively large populations and higher levels of internal security concerns. The market is segmented by end-user (law enforcement, military) and weapon type (area denial systems, ammunition, explosives, gases and sprays, directed energy weapons, electroshock weapons). While the precise market size in 2025 is not provided, considering a global market size exceeding several billion dollars and applying the regional context of Latin America, we can logically infer a sizeable market in the hundreds of millions of dollars. The segment of gases and sprays currently dominates the market, given their widespread adoption, but directed energy weapons and electroshock weapons are emerging as high-growth segments due to technological advancements and potential for improved effectiveness.

Market restraints include budgetary constraints faced by some Latin American nations, potentially limiting large-scale procurement of advanced non-lethal weapons. Furthermore, regulatory hurdles surrounding the deployment and use of certain non-lethal technologies, as well as concerns regarding their potential for misuse, pose challenges to market growth. However, these challenges are likely to be outweighed by the increasing prioritization of public safety and security across the region. The presence of key players such as Lamperd Less Lethal Inc., Rheinmetall AG, and Axon (Taser International Inc.) indicates a high level of competition and the availability of technologically advanced solutions in the market. The forecast period (2025-2033) promises continued expansion, influenced by government investments in security and ongoing technological innovation within the sector.

Latin America Non-lethal Weapons Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America Non-lethal Weapons Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report meticulously examines market dynamics, trends, key players, and future growth prospects. The market size in 2025 is estimated at xx Million, exhibiting a CAGR of xx% during the forecast period.

Latin America Non-lethal Weapons Market Market Concentration & Dynamics

The Latin American non-lethal weapons market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. Market share data for 2024 indicates that Axon (Taser International Inc) holds approximately xx%, followed by Rheinmetall AG with xx%, and Lamperd Less Lethal Inc with xx%. The remaining market share is distributed among several smaller regional players and specialized manufacturers.

The market's dynamism is shaped by several factors:

- Innovation Ecosystems: Ongoing R&D efforts are driving the development of advanced non-lethal technologies, including directed energy weapons and improved chemical agents, fostering market innovation.

- Regulatory Frameworks: Varying regulatory landscapes across Latin American nations significantly impact market growth. Stringent regulations in some countries can hinder market penetration while more lenient policies can accelerate adoption. The recent Chilean Senate proposal to reform gun laws (January 2022) exemplifies this dynamic and will likely influence demand for non-lethal alternatives.

- Substitute Products: The availability of alternative crowd control methods and less lethal options, as well as the perception of their effectiveness, can influence the adoption of non-lethal weapons.

- End-User Trends: Growing demand from law enforcement agencies and military forces for enhanced crowd control and riot management solutions is a primary growth driver. The increasing adoption of less-lethal options reflects changing policing strategies and concerns about the use of lethal force.

- M&A Activities: The number of mergers and acquisitions (M&A) in the sector has been moderate in recent years, with xx deals recorded between 2019 and 2024. These activities generally focus on expanding product portfolios and market reach.

Latin America Non-lethal Weapons Market Industry Insights & Trends

The Latin American non-lethal weapons market is projected to witness significant growth throughout the forecast period. Market growth is fueled by several key factors: increasing instances of civil unrest and protests demanding effective but less-harmful crowd control measures; modernization of law enforcement and military forces; heightened concerns about collateral damage during conflicts and security operations; and an increasing preference for less lethal options to minimize casualties and enhance public trust.

Technological advancements, particularly in directed energy weapons and electroshock devices, are revolutionizing the sector. These advancements are leading to more precise, effective, and versatile non-lethal options. Consumer behavior is also shifting towards demanding more sophisticated and reliable non-lethal solutions, placing increased pressure on manufacturers to innovate and improve their products. The overall market exhibits resilience despite economic fluctuations, as the demand for security and crowd control remains relatively stable across different economic scenarios.

Key Markets & Segments Leading Latin America Non-lethal Weapons Market

The largest segment within the Latin American non-lethal weapons market is currently Law Enforcement, accounting for xx% of the overall market share in 2024. This is driven by increasing urbanization, rising crime rates, and the need for effective crowd control mechanisms in major cities across the region. The Military segment also exhibits strong growth, representing xx% of the market. Within the product type categories, Gases and Sprays currently dominate the market due to widespread adoption and relatively lower cost compared to more technologically advanced options.

Drivers for Law Enforcement Segment Dominance:

- High demand for crowd control solutions in urban areas

- Government spending on security and law enforcement

- Modernization of policing strategies and tactics

Drivers for Military Segment Growth:

- Demand for effective solutions for riot control in conflict zones

- Need for less-lethal options to minimize collateral damage

- Increased investment in defense and security by governments

The country-level analysis reveals that Brazil and Mexico, driven by their large populations and higher incidence of civil unrest, hold the largest market shares within the region. However, other countries, especially those experiencing political instability or facing significant internal security challenges, are also exhibiting noteworthy market growth.

Latin America Non-lethal Weapons Market Product Developments

Recent product innovations focus on enhancing the precision, effectiveness, and safety of non-lethal weapons. This includes the development of more sophisticated directed energy weapons with improved targeting capabilities and less-lethal ammunition with reduced risk of causing serious injury. For example, Lamperd Less Lethal Inc.'s January 2021 introduction of the NewVRMD system highlights a focus on vehicle-based crowd control solutions, enhancing officer safety. These advancements offer manufacturers a competitive edge by providing law enforcement and military forces with more effective and reliable options.

Challenges in the Latin America Non-lethal Weapons Market Market

The Latin America non-lethal weapons market faces several challenges: Firstly, inconsistent and often stringent regulatory frameworks across different countries create obstacles for market entry and expansion. Secondly, supply chain disruptions, particularly concerning specialized components and raw materials, can impact production and delivery timelines. Lastly, intense competition among established players and the emergence of new entrants creates pressure on pricing and profit margins.

Forces Driving Latin America Non-lethal Weapons Market Growth

Key growth drivers include technological advancements, leading to more effective and precise non-lethal weapons; increased government spending on security and defense; growing demand for crowd control solutions in urban areas; and evolving policing strategies emphasizing de-escalation tactics. The rise of civil unrest and political instability in certain regions is also fueling demand for these products.

Challenges in the Latin America Non-lethal Weapons Market Market

Long-term growth depends on continued innovation in non-lethal technologies, fostering strategic partnerships between manufacturers and end-users to develop solutions aligned with evolving needs, and expanding market reach into under-served regions. Successful market penetration will require overcoming regulatory obstacles and adapting to diverse local contexts.

Emerging Opportunities in Latin America Non-lethal Weapons Market

Significant opportunities exist in developing specialized non-lethal weapons for specific applications (e.g., anti-drone technologies). Expanding into new markets with growing security concerns presents promising growth potential. Furthermore, leveraging technological advancements such as AI and machine learning for improved targeting and safety features can create new competitive advantages.

Leading Players in the Latin America Non-lethal Weapons Market Sector

- Lamperd Less Lethal Inc

- Rheinmetall AG

- Zarc International

- Condor Non-Lethal Technologies

- Genasys Inc

- Combined Systems Inc

- Axon (Taser International Inc)

- Safariland LLC

Key Milestones in Latin America Non-lethal Weapons Market Industry

- January 2021: Lamperd Less Lethal Inc. launched the NewVRMD system, expanding its riot control product line. This enhanced market competitiveness and provided a safer option for crowd control.

- January 2022: The Chilean Senate's vote on gun law reform could significantly impact the demand for non-lethal alternatives, possibly increasing market growth in Chile.

Strategic Outlook for Latin America Non-lethal Weapons Market Market

The Latin America non-lethal weapons market is poised for sustained growth driven by technological innovation, increasing demand from both law enforcement and military sectors, and a growing need for effective yet less harmful crowd control solutions. Strategic opportunities lie in focusing on product differentiation, establishing robust supply chains, and proactively engaging with regulatory bodies to navigate evolving legal landscapes. The market's future success will depend on a combination of technological advancements and adaptable business strategies.

Latin America Non-lethal Weapons Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Latin America Non-lethal Weapons Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Non-lethal Weapons Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries

- 3.3. Market Restrains

- 3.3.1. ; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies

- 3.4. Market Trends

- 3.4.1. Law Enforcement Segment Held the Largest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Brazil Latin America Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Non-lethal Weapons Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Lamperd Less Lethal Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Rheinmetall AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Zarc International

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Condor Non-Lethal Technologies

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Genasys Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Combined Systems Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Axon (Taser International Inc )

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Safariland LLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Lamperd Less Lethal Inc

List of Figures

- Figure 1: Latin America Non-lethal Weapons Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Non-lethal Weapons Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Brazil Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Argentina Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Peru Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Chile Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Latin America Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 16: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 17: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 20: Latin America Non-lethal Weapons Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Chile Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Colombia Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Mexico Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Peru Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Venezuela Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Ecuador Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Bolivia Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Paraguay Latin America Non-lethal Weapons Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Non-lethal Weapons Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Latin America Non-lethal Weapons Market?

Key companies in the market include Lamperd Less Lethal Inc, Rheinmetall AG, Zarc International, Condor Non-Lethal Technologies, Genasys Inc, Combined Systems Inc, Axon (Taser International Inc ), Safariland LLC.

3. What are the main segments of the Latin America Non-lethal Weapons Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries.

6. What are the notable trends driving market growth?

Law Enforcement Segment Held the Largest Share.

7. Are there any restraints impacting market growth?

; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies.

8. Can you provide examples of recent developments in the market?

In January 2022, The Chilean Senate will vote on the proposal to reform their Gun Law, an initiative that the Chamber had already approved, seeking to establish new regulations on using and possessing these objects within the nation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Non-lethal Weapons Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Non-lethal Weapons Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Non-lethal Weapons Market?

To stay informed about further developments, trends, and reports in the Latin America Non-lethal Weapons Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence