Key Insights

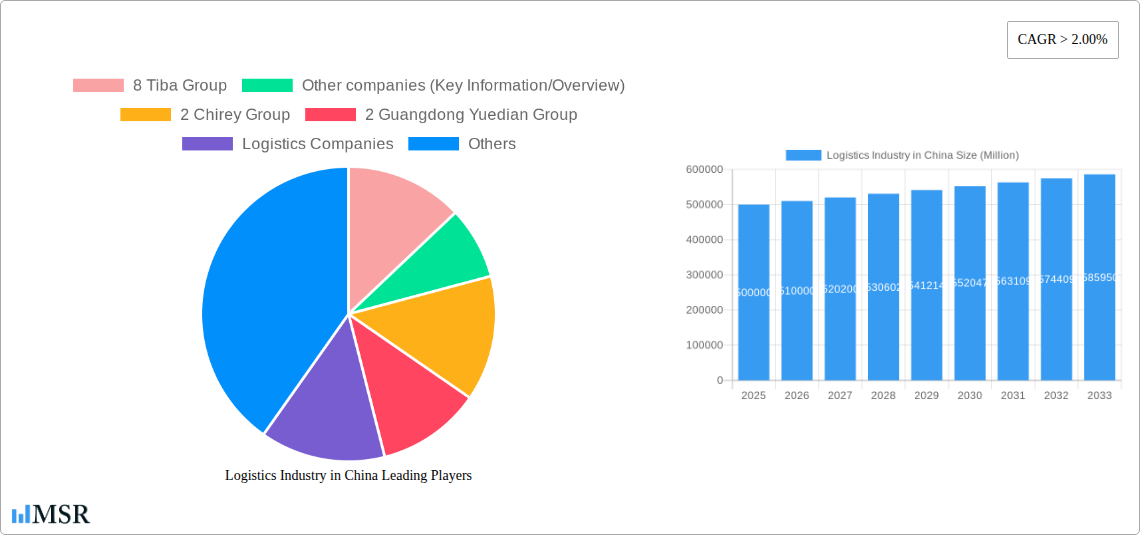

China's logistics market is a significant contributor to national economic expansion, projecting substantial growth. The market is estimated to reach $200 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.5%. This upward trend is driven by the rapid growth of e-commerce, escalating industrial output demanding efficient supply chains, and ongoing government investments in transportation and warehousing infrastructure. The market is segmented by service type, including transportation, forwarding, warehousing, and value-added services, catering to diverse end-user industries such as oil and gas, petrochemicals, mining, energy, construction, and manufacturing. Major domestic and international logistics providers, including Sinotrans and Kuehne + Nagel, compete in this dynamic sector.

Logistics Industry in China Market Size (In Billion)

Despite market strengths, challenges persist, including rising labor costs, evolving environmental regulations, and potential geopolitical disruptions. Emerging technologies like automation and big data analytics offer both opportunities for efficiency gains and challenges in adaptation and investment, particularly for smaller enterprises. Future market expansion hinges on the adaptability of logistics providers to technological advancements and the evolving regulatory environment. Strategic understanding of these dynamics is essential for both established and new market participants seeking success in China's lucrative logistics landscape.

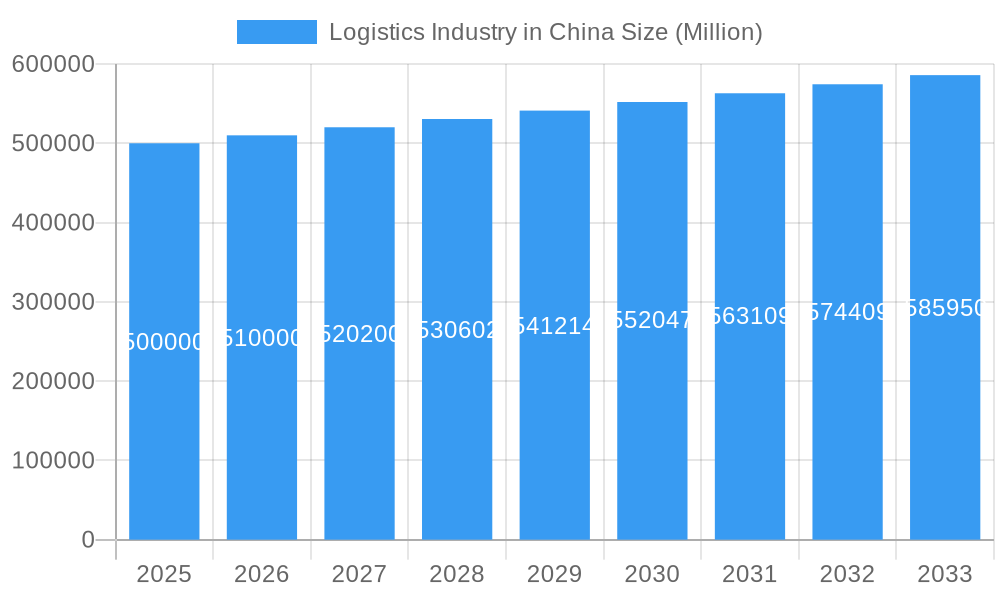

Logistics Industry in China Company Market Share

Logistics Industry in China: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Chinese logistics industry, encompassing market size, key players, growth drivers, and future trends. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for businesses seeking to understand and capitalize on opportunities within this rapidly evolving sector. Millions are used for all values.

Logistics Industry in China Market Concentration & Dynamics

The Chinese logistics market exhibits a complex interplay of concentration, innovation, and regulatory influence. While a few large players dominate certain segments, the market also features a large number of smaller, specialized logistics providers. Market share is highly fragmented, with no single company controlling a significant majority. However, larger companies like Sinotrans (HK) Logistics Ltd. and Kerry Logistics Network Limited hold considerable influence.

Market Concentration Metrics (2024 Estimates):

- Top 5 players’ combined market share: xx%

- Top 10 players’ combined market share: xx%

- Average market share of top 50 players: xx%

Innovation Ecosystem: China's logistics sector is undergoing rapid technological transformation, driven by advancements in e-commerce, automation, and data analytics. The government's push for digitalization is further accelerating innovation.

Regulatory Framework: Government regulations play a significant role, impacting everything from licensing and safety standards to environmental regulations. Recent emphasis on green logistics and sustainable practices is shaping industry dynamics.

Substitute Products/Services: The rise of alternative transportation modes and the expansion of e-commerce platforms introduce some substitutability, although the core logistics functions remain crucial.

End-User Trends: The manufacturing, e-commerce, and energy sectors are key end-users, driving demand for efficient and reliable logistics solutions. Growing urbanization and rising consumer expectations are influencing demand for faster delivery and greater transparency.

M&A Activities: The number of M&A deals in the Chinese logistics sector has seen fluctuations over the past few years, reflecting periods of consolidation and strategic expansion.

- 2021: xx Million USD in M&A deal value, xx deals

- 2022: xx Million USD in M&A deal value, xx deals

- 2023 (YTD): xx Million USD in M&A deal value, xx deals

Logistics Industry in China Industry Insights & Trends

The Chinese logistics market is characterized by robust growth, driven by factors such as rapid e-commerce expansion, increasing industrial output, and the government's infrastructure development initiatives. The market size is projected to reach xx Million USD by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033.

Technological disruptions, such as the adoption of automation, artificial intelligence (AI), and the Internet of Things (IoT), are reshaping the industry landscape. Evolving consumer behaviors, particularly the rise of online shopping and demand for faster delivery, are placing significant pressure on logistics providers to improve efficiency and enhance customer experiences. The integration of blockchain technology for enhanced supply chain transparency and traceability is also gaining momentum. Government initiatives aimed at improving infrastructure, such as high-speed rail and port expansion, are creating opportunities for logistics companies. However, challenges remain, including labor costs, infrastructure bottlenecks in certain regions, and environmental concerns.

Key Markets & Segments Leading Logistics Industry in China

Dominant Regions/Segments: Coastal regions, particularly those around major ports such as Shanghai and Shenzhen, dominate the logistics sector due to their advanced infrastructure and proximity to manufacturing and export hubs. The transportation segment, specifically road freight, currently holds the largest market share within the “By Service” category. Among the end-users, the manufacturing sector is the most significant driver of demand.

Drivers for Dominant Segments:

- Transportation (Road Freight): Extensive road network, flexible delivery options, cost-effectiveness for shorter distances.

- Manufacturing: High manufacturing output, significant reliance on efficient logistics for raw materials and finished goods.

- Coastal Regions: Proximity to major ports, established infrastructure, high concentration of businesses.

Detailed Dominance Analysis: The concentration of manufacturing activities and the extensive road network in coastal regions creates a synergistic effect, leading to high demand for road freight services. The government’s focus on infrastructure development further strengthens this dominance.

Logistics Industry in China Product Developments

Recent product innovations in China's logistics sector focus on enhanced efficiency, transparency, and sustainability. This includes the implementation of advanced technologies such as automated warehousing systems, AI-powered route optimization software, and real-time tracking systems. Companies are emphasizing green logistics solutions, such as electric vehicles and optimized routes to minimize environmental impact, driven by both regulatory pressures and consumer demand. The competitive edge is increasingly determined by technological sophistication and efficient service delivery.

Challenges in the Logistics Industry in China Market

The Chinese logistics market faces several challenges, including increasing labor costs impacting operational expenses, infrastructure limitations in certain regions causing delivery delays, and intense competition from both domestic and international players. Regulatory changes and complex customs procedures contribute to operational complexities. These factors can impact efficiency, profitability, and overall market growth. Specific quantifiable impacts vary depending on the segment and company, but generally increase costs and reduce profit margins.

Forces Driving Logistics Industry in China Growth

Several factors drive growth in China's logistics sector. The rapid expansion of e-commerce necessitates efficient delivery networks. Government initiatives, such as investment in infrastructure and the promotion of digitalization, create favorable conditions for growth. The increasing industrial output in several sectors drives demand for logistics services. The ongoing development of a more robust and interconnected transportation network also enhances the efficiency and capacity of the market.

Challenges in the Logistics Industry in China Market

Long-term growth in China's logistics industry is fueled by technological advancements like AI and automation, strategic partnerships between logistics providers and e-commerce companies, and expansion into new markets both domestically and internationally. This expansion includes developing underserved regions and engaging in cross-border logistics operations.

Emerging Opportunities in Logistics Industry in China

Emerging opportunities include the increasing demand for last-mile delivery solutions in urban areas, the growth of cross-border e-commerce requiring international logistics capabilities, and the adoption of innovative technologies like drone delivery and autonomous vehicles. Specializing in niche sectors like cold chain logistics for pharmaceuticals and perishables also presents significant growth potential.

Leading Players in the Logistics Industry in China Sector

- 8 Tiba Group

- 2 Chirey Group

- 2 Guangdong Yuedian Group

- 14 Kuehne + Nagel (Kuehne + Nagel)

- 12 Global Star Logistics (China) Co Ltd

- 1 China Gezhouba Group Corporation International Engineering Company

- 3 China National Chemical Engineering Group

- 7 CJ Smart Cargo

- 15 Agility Logistics Pvt Ltd (Agility Logistics)

- 1 Broekman Logistics

- Rhenus Logistics

- Trans Global Projects Group (TGP)

- S F Systems(Group)Ltd

- Ziegler Group

- Dextrans Worldwide Group

- GEFCO S A

- Keyun Group

- Dolphin Logistcis Co Ltd

- TPL Project Stock Company

- Shanghai Beetle Supply Chain Management Company Limited

- 6 Sinotrans (HK) Logistics Ltd (Sinotrans)

- 4 Kerry Logistics Network Limited (Kerry Logistics)

- 13 Sunshine Int'l Logistics Co ltd

- 10 InterMax Logistics Solution Limited

- 5 Trans Global Projects Group (TGP)

- 5 China Civil Engineering Construction Corporation

- 9 Mitsubishi Logistics Corporation (Mitsubishi Logistics)

- 1 COSCO Shipping Logistics Co Ltd (COSCO Shipping)

- 4 China Railway Construction Corporation

- 3 Translink International Logistics Group

- 11 Wangfoong Transportation Ltd

Key Milestones in Logistics Industry in China Industry

- January 2023: Maersk's agreement for a green and smart logistics center in Shanghai's Lin-gang area, signifying a push for sustainable logistics.

- January 2022: Launch of the Ocean Alliance Day 7 Product, featuring LNG-powered vessels, reflecting the industry's response to environmental regulations.

Strategic Outlook for Logistics Industry in China Market

The Chinese logistics industry holds immense long-term potential, driven by continuous infrastructure development, technological innovation, and the expansion of e-commerce. Strategic opportunities lie in leveraging technology to enhance efficiency, focusing on sustainable practices, and expanding into new market segments and geographic regions. Companies that can adapt to the evolving landscape and adopt innovative solutions will be best positioned for success.

Logistics Industry in China Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Forwarding

- 1.3. Warehousing

- 1.4. Other Value-added Services

-

2. End-user

- 2.1. Oil and Gas, Petrochemical

- 2.2. Mining and Quarrying

- 2.3. Energy and Power

- 2.4. Construction

- 2.5. Manufacturing

- 2.6. Other En

Logistics Industry in China Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Logistics Industry in China Regional Market Share

Geographic Coverage of Logistics Industry in China

Logistics Industry in China REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies4.; Growth of E-commerce

- 3.3. Market Restrains

- 3.3.1. 4.; Cost - Intensive4.; Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Wind power is expected to propel the demand for project logistics services through the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Forwarding

- 5.1.3. Warehousing

- 5.1.4. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Oil and Gas, Petrochemical

- 5.2.2. Mining and Quarrying

- 5.2.3. Energy and Power

- 5.2.4. Construction

- 5.2.5. Manufacturing

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Forwarding

- 6.1.3. Warehousing

- 6.1.4. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Oil and Gas, Petrochemical

- 6.2.2. Mining and Quarrying

- 6.2.3. Energy and Power

- 6.2.4. Construction

- 6.2.5. Manufacturing

- 6.2.6. Other En

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. South America Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Forwarding

- 7.1.3. Warehousing

- 7.1.4. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Oil and Gas, Petrochemical

- 7.2.2. Mining and Quarrying

- 7.2.3. Energy and Power

- 7.2.4. Construction

- 7.2.5. Manufacturing

- 7.2.6. Other En

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Forwarding

- 8.1.3. Warehousing

- 8.1.4. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Oil and Gas, Petrochemical

- 8.2.2. Mining and Quarrying

- 8.2.3. Energy and Power

- 8.2.4. Construction

- 8.2.5. Manufacturing

- 8.2.6. Other En

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East & Africa Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Forwarding

- 9.1.3. Warehousing

- 9.1.4. Other Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Oil and Gas, Petrochemical

- 9.2.2. Mining and Quarrying

- 9.2.3. Energy and Power

- 9.2.4. Construction

- 9.2.5. Manufacturing

- 9.2.6. Other En

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Asia Pacific Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Forwarding

- 10.1.3. Warehousing

- 10.1.4. Other Value-added Services

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Oil and Gas, Petrochemical

- 10.2.2. Mining and Quarrying

- 10.2.3. Energy and Power

- 10.2.4. Construction

- 10.2.5. Manufacturing

- 10.2.6. Other En

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 8 Tiba Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Other companies (Key Information/Overview)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 2 Chirey Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 2 Guangdong Yuedian Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Logistics Companies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 14 Kuehne + Nagel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 12 Global Star Logistics (China) Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 1 China Gezhouba Group Corporation International Engineering Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 3 China National Chemical Engineering Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 7 CJ Smart Cargo

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 15 Agility Logistics Pvt Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 1 Broekman Logistics Rhenus Logistics Trans Global Projects Group (TGP) S F Systems(Group)Ltd Ziegler Group Dextrans Worldwide Group GEFCO S A Keyun Group Dolphin Logistcis Co Ltd TPL Project Stock Company Shanghai Beetle Supply Chain Management Company Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 6 Sinotrans (HK) Logistics Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Engineering/EPC Companies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 4 Kerry Logistics Network Limited

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 13 Sunshine Int'l Logistics Co ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 10 InterMax Logistics Solution Limited

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 5 Trans Global Projects Group (TGP)

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 5 China Civil Engineering Construction Corporation*

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 9 Mitsubishi Logistics Corporation

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 1 COSCO Shipping Logistics Co Ltd

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 4 China Railway Construction Corporation

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 3 Translink International Logistics Group

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 11 Wangfoong Transportation Ltd

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 8 Tiba Group

List of Figures

- Figure 1: Global Logistics Industry in China Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 3: North America Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 5: North America Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 9: South America Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 10: South America Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 11: South America Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 12: South America Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 15: Europe Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 16: Europe Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 17: Europe Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Europe Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 21: Middle East & Africa Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 22: Middle East & Africa Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 23: Middle East & Africa Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Middle East & Africa Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 27: Asia Pacific Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 28: Asia Pacific Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 29: Asia Pacific Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Asia Pacific Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Logistics Industry in China Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 11: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 12: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 17: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 18: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 29: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 30: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 38: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 39: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logistics Industry in China?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Logistics Industry in China?

Key companies in the market include 8 Tiba Group, Other companies (Key Information/Overview), 2 Chirey Group, 2 Guangdong Yuedian Group, Logistics Companies, 14 Kuehne + Nagel, 12 Global Star Logistics (China) Co Ltd, 1 China Gezhouba Group Corporation International Engineering Company, 3 China National Chemical Engineering Group, 7 CJ Smart Cargo, 15 Agility Logistics Pvt Ltd, 1 Broekman Logistics Rhenus Logistics Trans Global Projects Group (TGP) S F Systems(Group)Ltd Ziegler Group Dextrans Worldwide Group GEFCO S A Keyun Group Dolphin Logistcis Co Ltd TPL Project Stock Company Shanghai Beetle Supply Chain Management Company Limited, 6 Sinotrans (HK) Logistics Ltd, Engineering/EPC Companies, 4 Kerry Logistics Network Limited, 13 Sunshine Int'l Logistics Co ltd, 10 InterMax Logistics Solution Limited, 5 Trans Global Projects Group (TGP), 5 China Civil Engineering Construction Corporation*, 9 Mitsubishi Logistics Corporation, 1 COSCO Shipping Logistics Co Ltd, 4 China Railway Construction Corporation, 3 Translink International Logistics Group, 11 Wangfoong Transportation Ltd.

3. What are the main segments of the Logistics Industry in China?

The market segments include Service, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 200 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies4.; Growth of E-commerce.

6. What are the notable trends driving market growth?

Wind power is expected to propel the demand for project logistics services through the forecast period.

7. Are there any restraints impacting market growth?

4.; Cost - Intensive4.; Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

January 2023: Maersk and the administrative body of the Shanghai Free Trade Zone signed a land grant agreement late in December 2022 for the Lin-gang new area. This is the first green and smart flagship logistics center from Maersk to open in China. It has low or very low greenhouse gas emissions. The project will begin in the third quarter of 2024 and cost 174 million US dollars.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logistics Industry in China," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logistics Industry in China report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logistics Industry in China?

To stay informed about further developments, trends, and reports in the Logistics Industry in China, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence