Key Insights

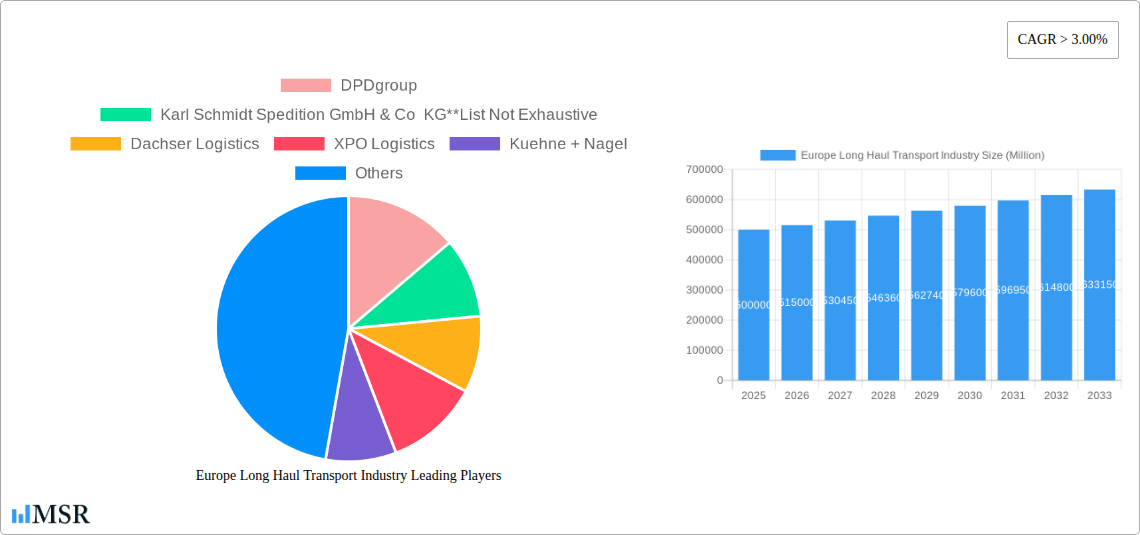

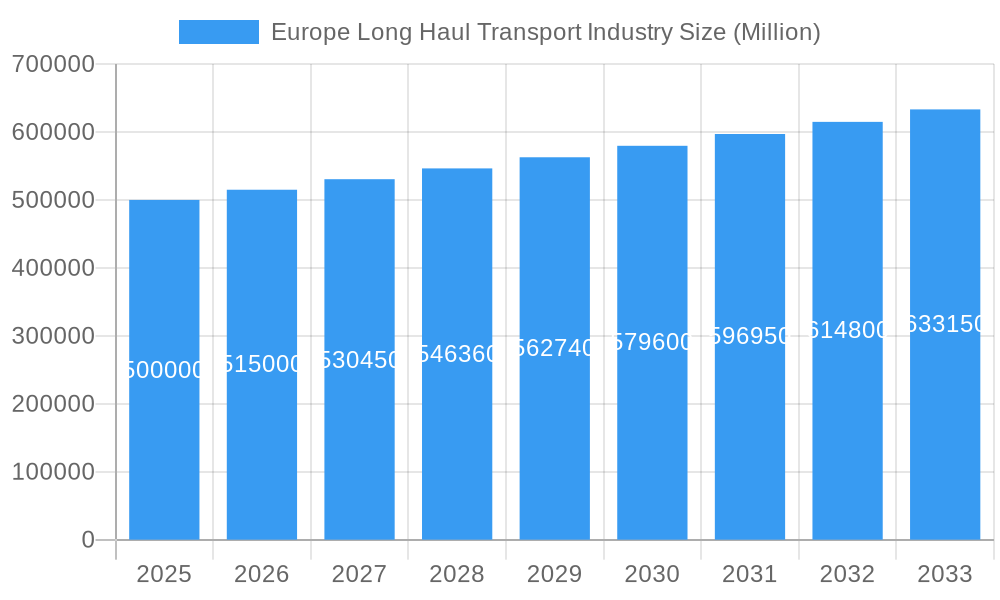

The European long-haul transport market, valued at 554.8 billion in 2025, is projected for steady growth with a Compound Annual Growth Rate (CAGR) of 1.9% from 2025 to 2033. This expansion is driven by e-commerce growth, increasing cross-border trade, and demand from key sectors like construction, manufacturing, and automotive. Challenges include fuel price volatility, driver shortages, environmental regulations, and infrastructure limitations. The market is segmented by destination, end-user, and country. Key players are actively engaged in strategic initiatives and technological advancements. The competitive landscape features both large global providers and smaller regional firms, with a growing emphasis on digitalization, automation, and sustainability. Germany, the UK, and France are the leading national markets. The forecast period anticipates continued growth, influenced by macroeconomic conditions and geopolitical events.

Europe Long Haul Transport Industry Market Size (In Billion)

Understanding these evolving trends and challenges is vital for market participants and new entrants.

Europe Long Haul Transport Industry Company Market Share

Europe Long Haul Transport Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the European long haul transport industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this study examines market dynamics, key players, emerging trends, and future growth potential. The report leverages extensive data and analysis to provide actionable intelligence across key segments and geographies.

Europe Long Haul Transport Industry Market Concentration & Dynamics

The European long haul transport market is characterized by a moderately concentrated landscape, with a few dominant players commanding significant market share. However, a diverse range of smaller operators also contribute significantly, fostering competition and innovation. Key players include DPDgroup, Karl Schmidt Spedition GmbH & Co KG, Dachser Logistics, XPO Logistics, Kuehne + Nagel, FIEGE Logistics, Ceva Logistics Limited, Deutsche Post DHL Group, Bollore Logistics, Rhenus Logistics, and DSV Panalpina. The market share of the top five players is estimated at xx%, reflecting a dynamic competitive environment. Innovation is driven by technological advancements, such as AI and big data analytics, as demonstrated by Trucksters' recent Series B funding. The regulatory landscape, including emissions standards and driver regulations, significantly impacts market operations. Substitute products, such as rail and air freight, present competitive challenges. End-user trends, particularly toward sustainable and efficient logistics solutions, are shaping market demand. The historical period (2019-2024) witnessed xx M&A deals, while the forecast period (2025-2033) anticipates xx deals, reflecting ongoing consolidation and expansion.

Europe Long Haul Transport Industry Industry Insights & Trends

The European long haul transport market exhibits substantial growth, driven by increasing e-commerce, globalization, and industrial expansion. The market size in 2025 is estimated at €xx Million, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. Technological disruptions, including autonomous vehicles and advanced telematics, are transforming operational efficiency and safety. Consumer behavior shifts towards faster and more reliable delivery services are influencing demand. The adoption of sustainable practices, including electric and alternative fuel vehicles, is gaining momentum in response to environmental concerns and regulatory pressures. Market growth is further fueled by infrastructure improvements and cross-border trade expansion. However, challenges remain, including driver shortages, fluctuating fuel prices, and geopolitical uncertainties.

Key Markets & Segments Leading Europe Long Haul Transport Industry

By Destination: Cross-border transportation constitutes a larger market share compared to domestic transportation, driven by increased international trade and supply chain globalization.

By End User: The Manufacturing and Automotive sector is the leading end-user segment, followed by Distributive Trade. The growth of these segments directly correlates with the overall growth of the long haul transport industry. The Oil and Gas and Quarrying sector also contributes significantly.

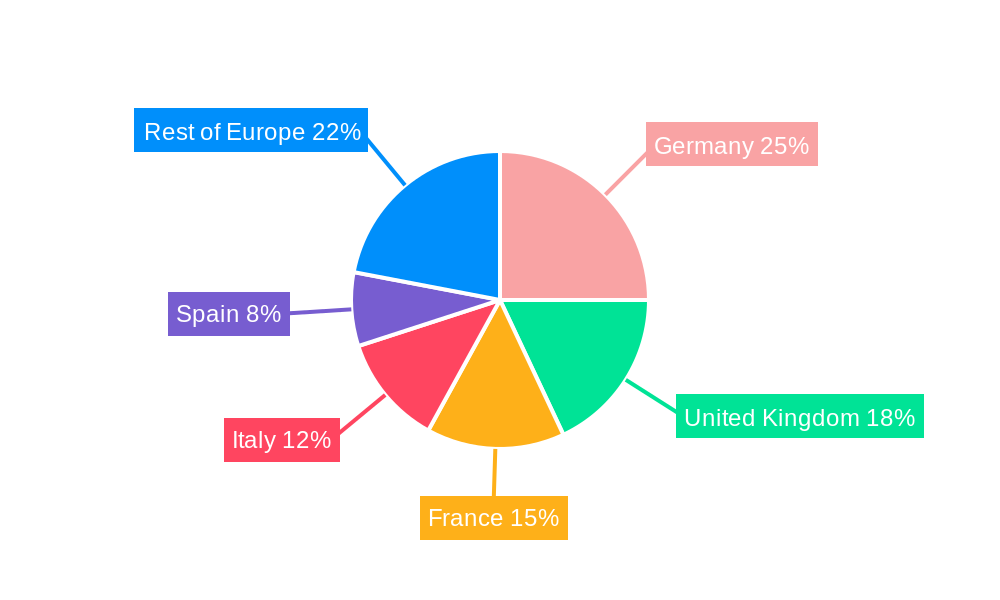

By Country: Germany holds the largest market share, followed by the United Kingdom, France, and Italy. Germany's strong manufacturing base and central location within Europe contribute to its dominance. The UK's position reflects its significance in international trade.

Growth Drivers:

- Robust economic growth across Europe

- Expansion of e-commerce and related logistics needs

- Development of efficient transportation infrastructure, particularly in key corridors

- Increasing cross-border trade facilitated by EU regulations and agreements

Europe Long Haul Transport Industry Product Developments

Recent product innovations focus on enhancing efficiency, sustainability, and safety. This includes the adoption of telematics systems for real-time tracking and fleet management, the integration of AI and big data analytics for optimized routing and delivery, and the increasing use of electric and alternative fuel vehicles. These advancements provide significant competitive advantages, improving delivery times, reducing operational costs, and minimizing environmental impact.

Challenges in the Europe Long Haul Transport Industry Market

The industry faces significant challenges including driver shortages, contributing to increased labor costs and operational constraints. Stricter emission regulations increase compliance costs, while fluctuating fuel prices impact profitability. Intense competition among established players and the emergence of new entrants further pressure margins. Supply chain disruptions caused by geopolitical events or pandemics can lead to significant delays and increased costs. These challenges can collectively reduce overall market growth and profitability for individual businesses. The overall impact is estimated to reduce market growth by xx% in the next five years.

Forces Driving Europe Long Haul Transport Industry Growth

Several key factors contribute to the growth of the European long haul transport industry. Technological advancements such as AI-powered route optimization and electric vehicle adoption enhance efficiency and sustainability. Expanding e-commerce fuels demand for fast and reliable delivery services. Government initiatives promoting infrastructure development and sustainable transportation further support the sector's growth. Favorable economic conditions and increased cross-border trade further boost market expansion.

Challenges in the Europe Long Haul Transport Industry Market

Long-term growth is contingent upon overcoming various challenges. Addressing the driver shortage through attracting and retaining talent is crucial. Investing in sustainable transport solutions is essential to comply with stricter environmental regulations and reduce carbon emissions. Building resilient supply chains to mitigate disruptions and enhancing digitalization to improve efficiency are also critical. Strategic partnerships and mergers and acquisitions will shape the industry's competitive landscape and long-term growth.

Emerging Opportunities in Europe Long Haul Transport Industry

Emerging opportunities lie in the adoption of autonomous vehicles, offering potential cost savings and efficiency gains. The expansion into last-mile delivery solutions and specialized transport services caters to growing niche markets. Investing in green logistics solutions with electric and alternative fuel vehicles aligns with environmental sustainability goals. Further penetration into emerging markets within Europe and developing innovative technologies for improved supply chain visibility creates significant growth potentials.

Leading Players in the Europe Long Haul Transport Industry Sector

- DPDgroup

- Karl Schmidt Spedition GmbH & Co KG

- Dachser Logistics

- XPO Logistics

- Kuehne + Nagel

- FIEGE Logistics

- Ceva Logistics Limited

- Deutsche Post DHL Group

- Bollore Logistics

- Rhenus Logistics

- DSV Panalpina

Key Milestones in Europe Long Haul Transport Industry Industry

July 2023: Trucksters secures €33 Million in Series B funding, focusing on electrification of long-haul routes. This signifies a major push towards sustainable practices and technological innovation within the sector.

March 2023: The ECTN Alliance (CEVA Logistics, ENGIE, and SANEF) launches, aiming to build a network of low-carbon energy truck terminals. This initiative reflects the industry's commitment to decarbonization and represents a significant step towards sustainable long-haul transportation.

Strategic Outlook for Europe Long Haul Transport Industry Market

The European long haul transport industry is poised for continued growth, driven by technological advancements, evolving consumer demands, and a growing focus on sustainability. Strategic opportunities exist for companies to invest in innovative technologies, develop sustainable logistics solutions, and expand into emerging markets. The industry's future success hinges on adapting to evolving regulatory landscapes, addressing labor shortages, and building resilient supply chains. The market is anticipated to experience robust growth in the coming years, with significant potential for expansion and increased efficiency.

Europe Long Haul Transport Industry Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. Cross-border

-

2. End User

- 2.1. Construction

- 2.2. Oil and Gas and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Manufacturing and Automotive

- 2.5. Distributive Trade

- 2.6. Other End-Users (Pharmaceutical and Healthcare)

Europe Long Haul Transport Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Long Haul Transport Industry Regional Market Share

Geographic Coverage of Europe Long Haul Transport Industry

Europe Long Haul Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth In E-commerce is driving the market4.; Growing in Cross Border Activities is driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Shortage of Skilled labor

- 3.4. Market Trends

- 3.4.1. Shrinking Automotive Sector May Impact the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Long Haul Transport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. Cross-border

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Construction

- 5.2.2. Oil and Gas and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Manufacturing and Automotive

- 5.2.5. Distributive Trade

- 5.2.6. Other End-Users (Pharmaceutical and Healthcare)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DPDgroup

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Karl Schmidt Spedition GmbH & Co KG**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dachser Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 XPO Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuehne + Nagel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FIEGE Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ceva Logistics Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Deutsche Post DHL Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bollore Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rhenus Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DSV Panalpina

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DPDgroup

List of Figures

- Figure 1: Europe Long Haul Transport Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Long Haul Transport Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Long Haul Transport Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Europe Long Haul Transport Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Europe Long Haul Transport Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Long Haul Transport Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 5: Europe Long Haul Transport Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Europe Long Haul Transport Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Long Haul Transport Industry?

The projected CAGR is approximately 1.9%.

2. Which companies are prominent players in the Europe Long Haul Transport Industry?

Key companies in the market include DPDgroup, Karl Schmidt Spedition GmbH & Co KG**List Not Exhaustive, Dachser Logistics, XPO Logistics, Kuehne + Nagel, FIEGE Logistics, Ceva Logistics Limited, Deutsche Post DHL Group, Bollore Logistics, Rhenus Logistics, DSV Panalpina.

3. What are the main segments of the Europe Long Haul Transport Industry?

The market segments include Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 554.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth In E-commerce is driving the market4.; Growing in Cross Border Activities is driving the market.

6. What are the notable trends driving market growth?

Shrinking Automotive Sector May Impact the Market Growth.

7. Are there any restraints impacting market growth?

4.; Shortage of Skilled labor.

8. Can you provide examples of recent developments in the market?

July 2023: Trucksters, a Spanish road freight operator which has disrupted the long-haul sector with the use of AI and big data, has closed a Series B round of €33 million. The new capital injection, backed up by new and existing investors, will be used to fulfil some of the company’s strategic objectives including electrifying its routes, potentially making Trucksters the first electric long-haul operator in Europe

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Long Haul Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Long Haul Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Long Haul Transport Industry?

To stay informed about further developments, trends, and reports in the Europe Long Haul Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence