Key Insights

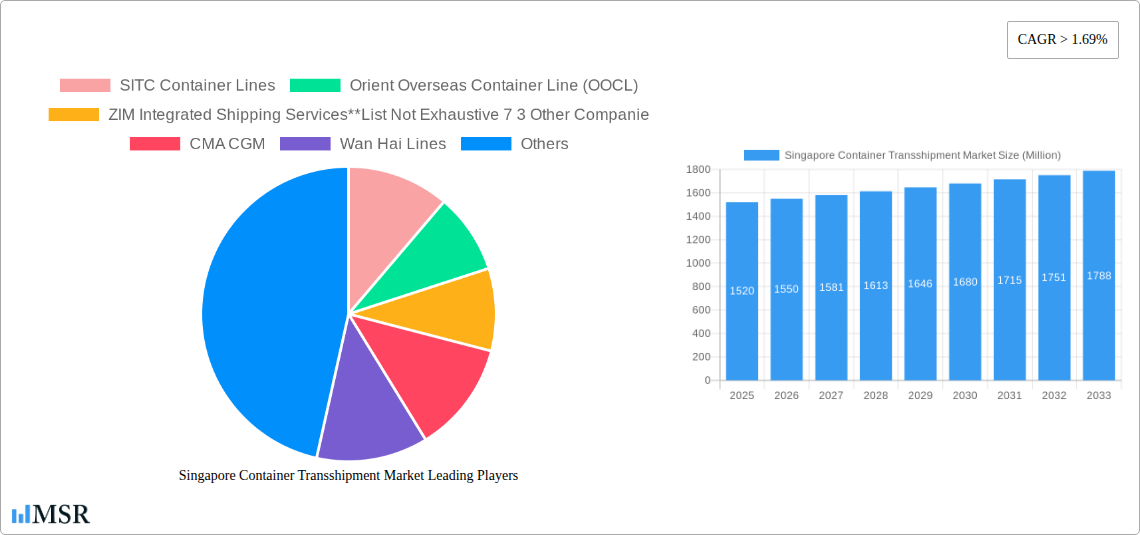

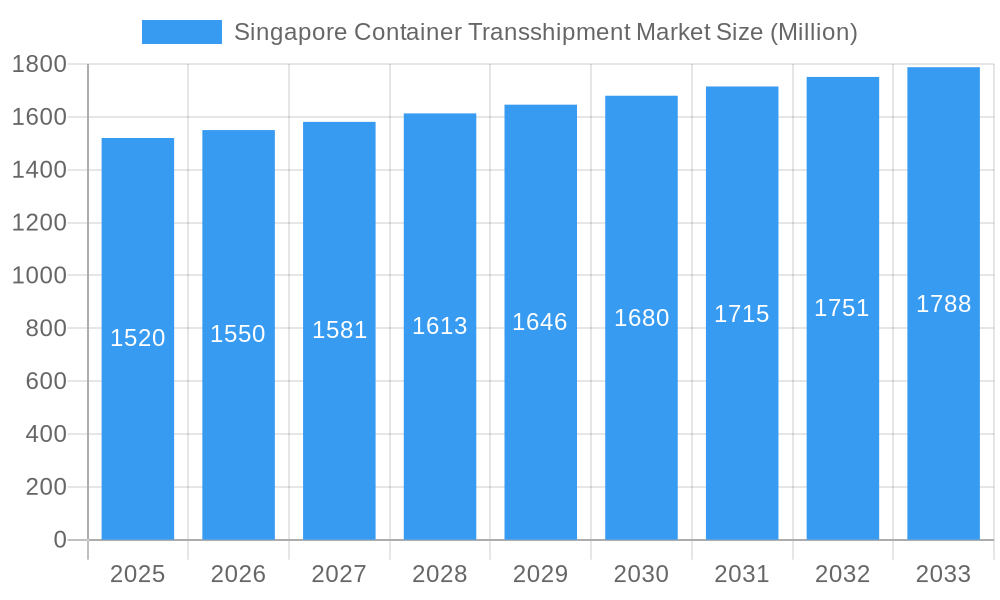

The Singapore container transshipment market, valued at $1.52 billion in 2025, is projected to experience robust growth, driven by the nation's strategic geographical location, well-developed port infrastructure, and its role as a crucial hub in global maritime trade. A Compound Annual Growth Rate (CAGR) exceeding 1.69% is anticipated from 2025 to 2033, indicating a consistently expanding market. This growth is fueled by increasing global trade volumes, particularly within Asia-Pacific, and the rising demand for efficient and reliable container shipping services. The market is segmented by container type (general and refrigerated) and end-user industries, with significant contributions from automotive, mining & minerals, agriculture, chemicals & petrochemicals, pharmaceuticals, food & beverages, and retail sectors. Growth will likely be spurred by investments in port modernization and technological advancements, such as automation and digitalization, improving efficiency and reducing operational costs. However, potential constraints include global economic fluctuations, geopolitical uncertainties, and competition from other established transshipment hubs in the region. The leading players, including Maersk Line, MSC, CMA CGM, and others, are actively investing in fleet expansion, service enhancements, and strategic partnerships to maintain their market share in this dynamic and competitive landscape. The focus on sustainability and environmental regulations also presents both challenges and opportunities for market players, driving the adoption of eco-friendly technologies and practices.

Singapore Container Transshipment Market Market Size (In Billion)

The continued expansion of the Singapore container transshipment market is expected to be supported by factors such as the increasing demand for just-in-time delivery systems across various industries, the growth of e-commerce and its associated logistics requirements, and the ongoing efforts to enhance connectivity and reduce transit times. Furthermore, Singapore's commitment to fostering a favorable business environment, including efficient customs procedures and regulatory frameworks, will continue to attract both domestic and international investment. However, challenges such as port congestion during peak seasons, rising fuel costs, and workforce availability will need to be effectively addressed to ensure sustainable and long-term growth. The market's future trajectory will also be shaped by technological advancements in areas such as autonomous shipping and blockchain technology, which have the potential to transform shipping operations and logistics management. Competition from rival ports in the region will remain intense, necessitating continuous innovation and strategic adaptation by market players to maintain their competitive advantage.

Singapore Container Transshipment Market Company Market Share

Singapore Container Transshipment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Singapore container transshipment market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unravels the market's dynamics, growth drivers, challenges, and future opportunities. The report leverages extensive data analysis and incorporates key industry developments to provide actionable intelligence on this crucial sector. The market size in 2025 is estimated at xx Million USD, with a CAGR of xx% predicted for the forecast period.

Singapore Container Transshipment Market Market Concentration & Dynamics

The Singapore container transshipment market exhibits a moderately concentrated landscape, dominated by global players like Maersk Line, Mediterranean Shipping Company (MSC), and CMA CGM, alongside significant regional players such as Pacific International Lines (PIL) and Wan Hai Lines. Market share dynamics are influenced by factors such as fleet size, operational efficiency, strategic alliances, and technological advancements. The high concentration is further emphasized by the presence of a handful of major terminal operators. Innovation is driven by investments in automation, digitalization (as seen in the HERE Technologies and PSA Singapore collaboration), and sustainable practices.

The regulatory framework, governed by the Maritime and Port Authority of Singapore (MPA), is largely conducive to market growth, promoting efficiency and transparency. However, evolving global regulations related to emissions and security remain a dynamic aspect. Substitute products, primarily alternative modes of transportation like air freight and rail, pose a limited threat given Singapore's strategic location and established infrastructure. End-user trends demonstrate a growing demand for faster, more reliable, and cost-effective shipping solutions across diverse sectors. M&A activities in the sector are relatively frequent, primarily focused on enhancing operational capacity, expanding geographical reach, and integrating technological capabilities. The number of M&A deals in the past five years averaged approximately xx deals annually, with a significant portion involving smaller players being acquired by larger conglomerates.

Singapore Container Transshipment Market Industry Insights & Trends

The Singapore container transshipment market is experiencing robust growth, fueled by several key factors. Singapore's strategic geographical location as a crucial hub within Asia's bustling trade routes serves as a pivotal driver. The burgeoning economies of Southeast Asia and increasing global trade volumes contribute significantly to the market expansion. Technological advancements such as automation, AI-driven optimization, and blockchain-based tracking systems are enhancing efficiency and transparency across the supply chain. Evolving consumer behaviors, including increased demand for faster delivery times and improved supply chain visibility, necessitate further technological enhancements and innovative solutions within the industry. Furthermore, Singapore's commitment to sustainability through initiatives promoting green shipping and efficient port operations is influencing the market trajectory. The projected growth trajectory indicates a significant expansion, expected to reach xx Million USD by 2033.

Key Markets & Segments Leading Singapore Container Transshipment Market

Dominant Segment: The general cargo segment currently constitutes the largest share of the market, driven by the high volume of general merchandise being transported globally. Refrigerated containers are also a significant and growing segment, underpinned by the rising demand for temperature-sensitive goods.

Leading End-Users: The automotive, retail, and food & beverage sectors represent significant end-users of container transshipment services, reflecting strong demand across these consumer-driven industries. The chemicals & petrochemicals, and pharmaceuticals sectors are also vital contributors.

Regional Dominance: Singapore's strategically central position in Asia is critical to its dominance.

Growth Drivers:

- Robust economic growth in Southeast Asia.

- Expansion of manufacturing and industrial activities.

- Rising consumer spending and demand for imported goods.

- Development of advanced port infrastructure and technology.

- Supportive government policies.

The dominance of general cargo reflects the broad range of goods transported through the port, while the growth of refrigerated containers underlines the increasing importance of perishable goods trade. The concentration among end-users highlights the importance of key economic sectors driving the demand for efficient shipping solutions.

Singapore Container Transshipment Market Product Developments

Recent product innovations focus on enhanced container tracking and management systems, improved security features, and sustainable container designs. These advancements address market demands for greater efficiency, visibility, and environmental responsibility. The integration of IoT sensors, AI-powered analytics, and blockchain technology improves transparency and reduces the risk of loss or damage. These features deliver a competitive edge by providing better visibility, improved decision-making, and cost reduction for shipping companies and their clients.

Challenges in the Singapore Container Transshipment Market Market

Significant challenges include maintaining efficient port operations amidst rising container volumes, navigating global supply chain disruptions, and managing escalating costs associated with fuel, labor, and infrastructure maintenance. These factors lead to potential delays and increased costs for businesses relying on Singapore's transshipment services. Furthermore, intense competition among shipping lines and terminal operators necessitates continuous investment in infrastructure and technology to remain competitive.

Forces Driving Singapore Container Transshipment Market Growth

Key growth drivers include the robust expansion of the global economy, increasing industrialization in Southeast Asia, government support for infrastructure development, and technological advancements in port operations and shipping logistics. The continuous improvement of Singapore's port infrastructure, coupled with technological innovation, maintains its competitive edge. These factors create synergistic effects, further reinforcing the market's long-term growth prospects.

Long-Term Growth Catalysts in the Singapore Container Transshipment Market

Long-term growth is driven by continued investments in port infrastructure, automation, and digital technologies that enable faster and more efficient cargo handling. Strategic partnerships between terminal operators, shipping lines, and technology providers further enhance operational efficiency. The expansion of e-commerce and the growth of cross-border trade will contribute to a sustained increase in demand for container transshipment services, solidifying Singapore's position as a global logistics hub.

Emerging Opportunities in Singapore Container Transshipment Market

Emerging opportunities include expanding cold chain logistics capabilities to meet the growing demand for perishable goods, utilizing advanced data analytics to optimize port operations and improve supply chain efficiency, and investing in sustainable shipping technologies to meet environmental regulations and enhance corporate sustainability profiles. Exploring new trade routes and strengthening connectivity with emerging economies will further expand market opportunities.

Leading Players in the Singapore Container Transshipment Market Sector

- SITC Container Lines

- Orient Overseas Container Line (OOCL)

- ZIM Integrated Shipping Services

- CMA CGM

- Wan Hai Lines

- NYK Line

- Hapag-Lloyd

- Pacific International Lines (PIL)

- Mediterranean Shipping Company (MSC)

- Maersk Line

- Evergreen Marine Corporation

Key Milestones in Singapore Container Transshipment Market Industry

February 2024: Maersk announced a USD 500 Million investment to expand its Southeast Asian supply chain infrastructure, adding 480,000 sqm capacity by 2026. This significantly enhances its operational capacity and strengthens its position in the region.

February 2024: HERE Technologies partnered with PSA Singapore to revolutionize the container truck ecosystem, aiming for greater efficiency in goods movement within the world's second busiest container port (38.8 Million TEUs handled in 2023). This collaboration highlights technological advancements enhancing port operations.

Strategic Outlook for Singapore Container Transshipment Market Market

The Singapore container transshipment market is poised for sustained growth, driven by increasing global trade, technological advancements, and strategic investments in infrastructure and digitalization. The continued focus on enhancing efficiency, sustainability, and supply chain resilience will shape the future of the market, offering significant opportunities for businesses operating within this dynamic sector. The ongoing integration of technology, coupled with Singapore’s proactive approach to infrastructure development and regulatory support, will secure its position as a leading global transshipment hub.

Singapore Container Transshipment Market Segmentation

-

1. Container Type

- 1.1. General

- 1.2. Refrigerator

-

2. End-User

- 2.1. Automotive

- 2.2. Mining & Minerals

- 2.3. Agriculture

- 2.4. Chemicals & Petrochemicals

- 2.5. Pharmaceuticals

- 2.6. Food & Beverages

- 2.7. Retail

- 2.8. Other End Users

Singapore Container Transshipment Market Segmentation By Geography

- 1. Singapore

Singapore Container Transshipment Market Regional Market Share

Geographic Coverage of Singapore Container Transshipment Market

Singapore Container Transshipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 1.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce is Booming the Market; Increasing Intra-Regional Trade

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor; Competition From the Global Players

- 3.4. Market Trends

- 3.4.1. Increasing Trade Activities are Boosting the Market Growth in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Container Transshipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Container Type

- 5.1.1. General

- 5.1.2. Refrigerator

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automotive

- 5.2.2. Mining & Minerals

- 5.2.3. Agriculture

- 5.2.4. Chemicals & Petrochemicals

- 5.2.5. Pharmaceuticals

- 5.2.6. Food & Beverages

- 5.2.7. Retail

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Container Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SITC Container Lines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orient Overseas Container Line (OOCL)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ZIM Integrated Shipping Services**List Not Exhaustive 7 3 Other Companie

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CMA CGM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wan Hai Lines

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NYK Line

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hapag-Lloyd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pacific International Lines (PIL)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mediterranean Shipping Company (MSC)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Maersk Line

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Evergreen Marine Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 SITC Container Lines

List of Figures

- Figure 1: Singapore Container Transshipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Container Transshipment Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Container Transshipment Market Revenue Million Forecast, by Container Type 2020 & 2033

- Table 2: Singapore Container Transshipment Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Singapore Container Transshipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Singapore Container Transshipment Market Revenue Million Forecast, by Container Type 2020 & 2033

- Table 5: Singapore Container Transshipment Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Singapore Container Transshipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Container Transshipment Market?

The projected CAGR is approximately > 1.69%.

2. Which companies are prominent players in the Singapore Container Transshipment Market?

Key companies in the market include SITC Container Lines, Orient Overseas Container Line (OOCL), ZIM Integrated Shipping Services**List Not Exhaustive 7 3 Other Companie, CMA CGM, Wan Hai Lines, NYK Line, Hapag-Lloyd, Pacific International Lines (PIL), Mediterranean Shipping Company (MSC), Maersk Line, Evergreen Marine Corporation.

3. What are the main segments of the Singapore Container Transshipment Market?

The market segments include Container Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.52 Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce is Booming the Market; Increasing Intra-Regional Trade.

6. What are the notable trends driving market growth?

Increasing Trade Activities are Boosting the Market Growth in the Country.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor; Competition From the Global Players.

8. Can you provide examples of recent developments in the market?

February 2024: A.P. Moller-Maersk (Maersk) announced more than USD 500 million in investment to expand its supply chain infrastructure to support Southeast Asia's emergence as a global production hub and a consumption powerhouse. Maersk’s planned three-year investment will target its Logistics & Services arm. Still, at the same time, a substantial amount of investment will also be channeled into its Ocean and Terminals infrastructure. By 2026, Maersk expects to add nearly 480,000 sqm capacity spread across Malaysia, Indonesia, Singapore, and the Philippines. With these investments, Maersk will be able to better serve customers with mega distribution centers that are strategically located, sustainable, and equipped with advanced automation to drive increased efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Container Transshipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Container Transshipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Container Transshipment Market?

To stay informed about further developments, trends, and reports in the Singapore Container Transshipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence