Key Insights

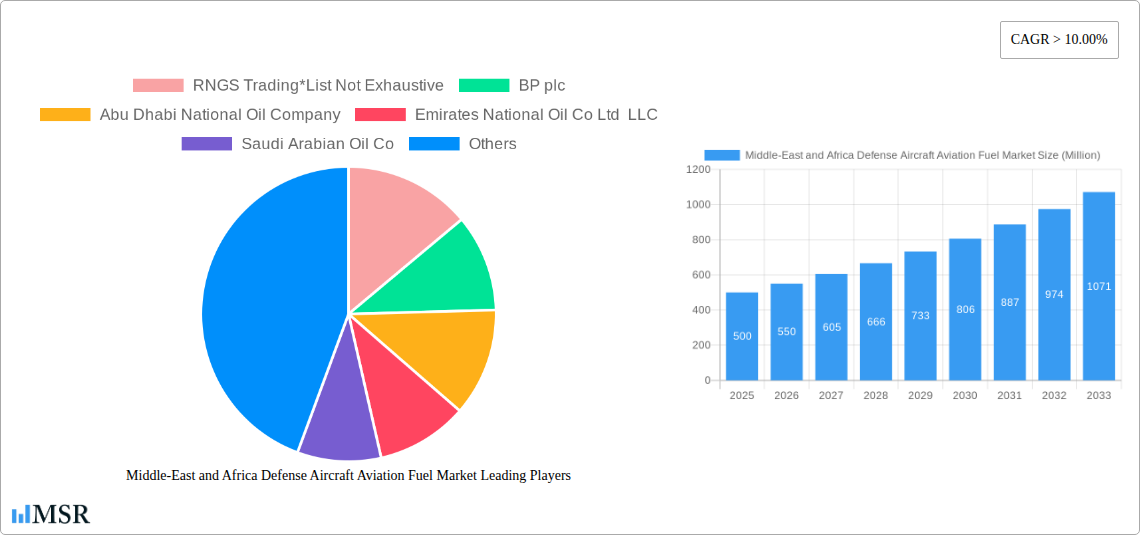

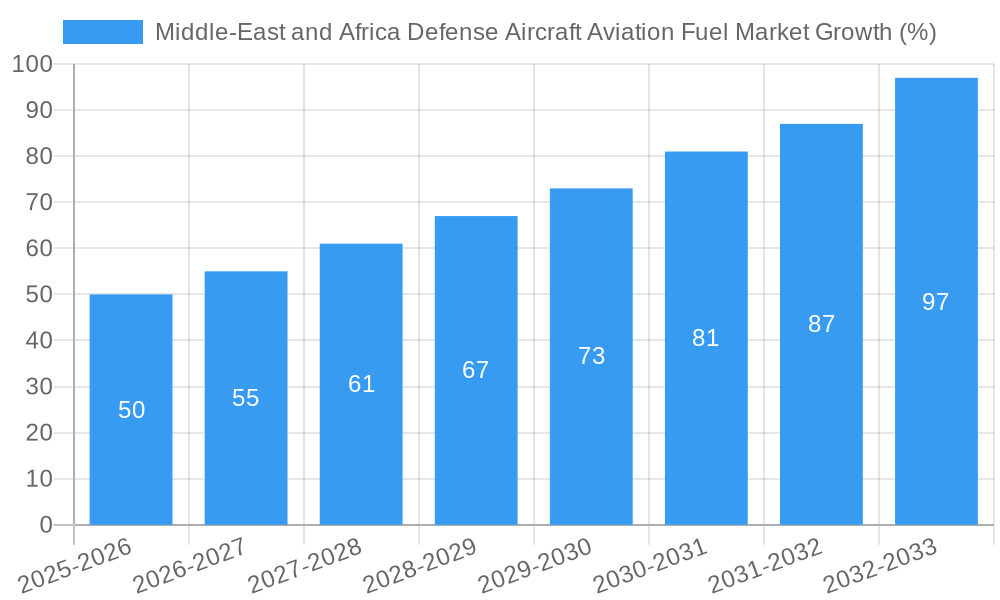

The Middle East and Africa Defense Aircraft Aviation Fuel market is experiencing robust growth, driven by increasing military spending, modernization of air forces, and rising geopolitical tensions in the region. The market, currently valued at approximately $X million (estimated based on provided CAGR and market size data for a different region; a precise figure would require specific Middle East and Africa market size data for 2025), is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 10% from 2025 to 2033. Key growth drivers include the expanding fleets of military aircraft across nations in the Middle East and Africa, the need for reliable fuel supplies to support ongoing operations, and increasing investments in defense infrastructure. The market is segmented primarily by fuel type, with Aviation Turbine Fuel (ATF) currently dominating, although Aviation Biofuel is emerging as a significant contributor, driven by environmental concerns and sustainability initiatives. Major players such as BP plc, Saudi Arabian Oil Co, and regional players like Emirates National Oil Co Ltd LLC are actively competing in this market.

The market's growth is also shaped by several trends, including the increasing adoption of advanced aircraft technologies demanding specialized fuels, the focus on enhancing fuel efficiency to reduce operational costs, and the development of sustainable aviation fuel alternatives. However, challenges exist, including fluctuating crude oil prices impacting fuel costs, geopolitical instability creating supply chain disruptions, and logistical complexities related to fuel transportation and storage in diverse geographical terrains within the Middle East and Africa. The market's future trajectory will hinge upon strategic government policies on military spending, technological advancements in fuel efficiency, the pace of biofuel adoption, and overall regional political stability. Analyzing these factors will be crucial for companies seeking to successfully navigate and thrive within this dynamic market. Note: For more precise market sizing and projections, regionally specific market research data is essential.

Middle-East and Africa Defense Aircraft Aviation Fuel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle-East and Africa Defense Aircraft Aviation Fuel market, offering invaluable insights for stakeholders across the aviation fuel supply chain. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, identifies key trends, and forecasts future growth. It examines various segments, including Aviation Turbine Fuel (ATF) and Aviation Biofuel, and profiles leading players like BP plc, Abu Dhabi National Oil Company, and World Fuel Services Corp.

Middle-East and Africa Defense Aircraft Aviation Fuel Market Concentration & Dynamics

This section analyzes the competitive landscape, regulatory environment, and market forces shaping the Middle-East and Africa Defense Aircraft Aviation Fuel market. We assess market concentration using metrics like Herfindahl-Hirschman Index (HHI) – estimated at xx in 2025 – and examine the impact of mergers and acquisitions (M&A). The study period (2019-2024) witnessed xx M&A deals, indicating a moderately consolidated market. Innovation within the sector is primarily driven by advancements in fuel efficiency and sustainability initiatives, including the increasing adoption of biofuels. Stringent regulatory frameworks focusing on fuel quality and environmental compliance significantly influence market players' strategies. The availability of substitute products, although limited, presents a challenge to the market's growth. End-user trends reflect an increasing demand for higher-quality, more sustainable aviation fuels, driven by both environmental concerns and operational efficiency requirements.

Middle-East and Africa Defense Aircraft Aviation Fuel Market Industry Insights & Trends

The Middle-East and Africa Defense Aircraft Aviation Fuel market is experiencing significant growth, driven by increasing defense spending and modernization efforts across the region. The market size reached an estimated xx Million in 2025, showcasing a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is further fueled by expanding air forces and the need for efficient and reliable fuel supply chains. Technological advancements, such as the development of sustainable aviation fuels (SAFs), are reshaping the industry landscape, while evolving consumer behavior—a growing preference for environmentally friendly options—is impacting procurement strategies. Increased geopolitical instability and conflicts in the region are also contributing to the demand for aviation fuel, although the impact is complex and presents both opportunities and challenges for market players. The forecast period (2025-2033) projects continued growth, with the market size expected to reach xx Million by 2033.

Key Markets & Segments Leading Middle-East and Africa Defense Aircraft Aviation Fuel Market

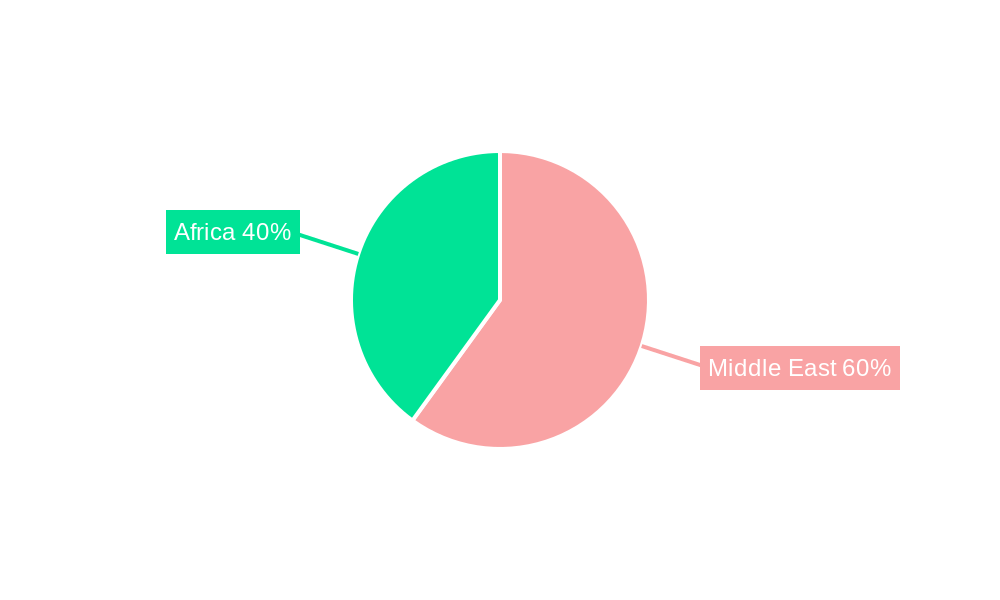

Dominant Region/Country: The Middle East is the dominant region, driven by high defense spending and a significant number of military air bases. Specifically, countries like Saudi Arabia, UAE, and Egypt represent key markets due to their substantial air forces and robust defense budgets.

Dominant Fuel Type: Aviation Turbine Fuel (ATF) currently dominates the market, accounting for xx% of the total volume in 2025. However, Aviation Biofuel is experiencing rapid growth fueled by sustainability initiatives and environmental regulations.

Drivers for ATF Dominance:

- Strong demand from military aircraft operations.

- Established supply chains and infrastructure.

- Lower production costs compared to biofuels.

Drivers for Biofuel Growth:

- Increasing environmental awareness and regulations.

- Government incentives and support for renewable fuels.

- Technological advancements in biofuel production, leading to improved efficiency and cost-competitiveness.

The continued dominance of ATF is expected, yet the growth of biofuel is poised to challenge this in the long term, driven by growing environmental concerns and government policies. The growth in both segments is heavily influenced by military modernization programs and regional geopolitical dynamics.

Middle-East and Africa Defense Aircraft Aviation Fuel Market Product Developments

Recent product innovations focus on enhancing fuel efficiency, reducing emissions, and improving fuel quality. Advancements in additive technology, for example, aim to optimize engine performance and extend aircraft lifespan. The market is also witnessing the introduction of new biofuel blends, designed to meet stringent environmental standards while maintaining operational effectiveness. These developments provide competitive edges by improving operational efficiency and reducing environmental impact, aligning with growing industry and consumer demands for sustainable aviation fuel.

Challenges in the Middle-East and Africa Defense Aircraft Aviation Fuel Market Market

Significant challenges include volatile geopolitical situations affecting supply chain stability. This results in price fluctuations and potential disruptions. Furthermore, regulatory hurdles and inconsistent standards across different countries complicate market operations. Finally, intense competition among established players, coupled with emerging regional suppliers, creates pricing pressures and limits profit margins for existing market participants. The estimated impact of these challenges on market growth is a reduction of xx% during the forecast period.

Forces Driving Middle-East and Africa Defense Aircraft Aviation Fuel Market Growth

Key growth drivers include increasing defense budgets across the region, modernization of existing air forces, and the rising demand for advanced military aircraft. Technological advancements, particularly the development of sustainable aviation fuels (SAFs), are creating new growth opportunities. Furthermore, supportive government policies and regulations encouraging the use of biofuels further stimulate market expansion.

Long-Term Growth Catalysts in the Middle-East and Africa Defense Aircraft Aviation Fuel Market

Long-term growth will be fueled by ongoing investments in military modernization, strategic partnerships between fuel suppliers and defense contractors to ensure a stable supply chain, and expansion into new markets within Africa and the Middle East. Further advancements in biofuel technology and increased adoption of sustainable practices will also significantly drive market growth.

Emerging Opportunities in Middle-East and Africa Defense Aircraft Aviation Fuel Market

Emerging opportunities include the growing demand for sustainable aviation fuels (SAFs) driven by environmental regulations and growing consumer awareness. The expansion of military air operations in previously underserved regions of Africa presents considerable growth potential. New technological solutions, like advanced fuel storage and distribution systems, offer improved efficiency and resilience to market participants.

Leading Players in the Middle-East and Africa Defense Aircraft Aviation Fuel Market Sector

- RNGS Trading

- BP plc

- Abu Dhabi National Oil Company

- Emirates National Oil Co Ltd LLC

- Saudi Arabian Oil Co

- World Fuel Services Corp

Key Milestones in Middle-East and Africa Defense Aircraft Aviation Fuel Market Industry

March 2022: The U.S. Central Command's announcement to sell F-15 Eagle fighter jets to Egypt signifies increased demand for aviation fuel in the Egyptian market. This bolsters the market's growth.

February 2023: The UAE's agreement to export L-15 advanced trainer jets signals a potential increase in regional defense cooperation and related aviation fuel requirements. This indirectly boosts demand for high-quality aviation fuel.

Strategic Outlook for Middle-East and Africa Defense Aircraft Aviation Fuel Market Market

The future of the Middle-East and Africa Defense Aircraft Aviation Fuel market is bright, with significant growth potential driven by defense modernization initiatives, rising demand for sustainable aviation fuels, and the expansion of air operations across the region. Strategic opportunities lie in securing long-term supply contracts, investing in sustainable fuel technologies, and developing robust supply chains that can withstand geopolitical uncertainties. The market's future growth is strongly linked to the continued commitment to military modernization and the adoption of more eco-friendly aviation fuels.

Middle-East and Africa Defense Aircraft Aviation Fuel Market Segmentation

-

1. Fuel Type

- 1.1. Aviation Turbine Fuel (ATF)

- 1.2. Aviation Biofuel

-

2. Geography

- 2.1. United Arab Emirates

- 2.2. Saudi Arabia

- 2.3. Rest of Middle-East and Africa

Middle-East and Africa Defense Aircraft Aviation Fuel Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Rest of Middle East and Africa

Middle-East and Africa Defense Aircraft Aviation Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Production4.; Rising Upstream Oil and Gas Investments

- 3.3. Market Restrains

- 3.3.1. 4.; Plans to Diversify the Power Generation Mix by Adoption of Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Aviation Turbine Fuel (ATF) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Aviation Turbine Fuel (ATF)

- 5.1.2. Aviation Biofuel

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United Arab Emirates

- 5.2.2. Saudi Arabia

- 5.2.3. Rest of Middle-East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. United Arab Emirates Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Aviation Turbine Fuel (ATF)

- 6.1.2. Aviation Biofuel

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United Arab Emirates

- 6.2.2. Saudi Arabia

- 6.2.3. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Saudi Arabia Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Aviation Turbine Fuel (ATF)

- 7.1.2. Aviation Biofuel

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United Arab Emirates

- 7.2.2. Saudi Arabia

- 7.2.3. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Rest of Middle East and Africa Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Aviation Turbine Fuel (ATF)

- 8.1.2. Aviation Biofuel

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United Arab Emirates

- 8.2.2. Saudi Arabia

- 8.2.3. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. South Africa Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 10. Sudan Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 11. Uganda Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 12. Tanzania Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 13. Kenya Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Africa Middle-East and Africa Defense Aircraft Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 RNGS Trading*List Not Exhaustive

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 BP plc

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Abu Dhabi National Oil Company

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Emirates National Oil Co Ltd LLC

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Saudi Arabian Oil Co

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 World Fuel Services Corp

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.1 RNGS Trading*List Not Exhaustive

List of Figures

- Figure 1: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle-East and Africa Defense Aircraft Aviation Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 3: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 13: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 16: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 19: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Middle-East and Africa Defense Aircraft Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Defense Aircraft Aviation Fuel Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Middle-East and Africa Defense Aircraft Aviation Fuel Market?

Key companies in the market include RNGS Trading*List Not Exhaustive, BP plc, Abu Dhabi National Oil Company, Emirates National Oil Co Ltd LLC, Saudi Arabian Oil Co, World Fuel Services Corp.

3. What are the main segments of the Middle-East and Africa Defense Aircraft Aviation Fuel Market?

The market segments include Fuel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Production4.; Rising Upstream Oil and Gas Investments.

6. What are the notable trends driving market growth?

Aviation Turbine Fuel (ATF) to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Plans to Diversify the Power Generation Mix by Adoption of Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

March 2022: U.S. Central Command informed the Senate Armed Services Committee that the United States would sell F-15 Eagle fighter jets to Egypt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Defense Aircraft Aviation Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Defense Aircraft Aviation Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Defense Aircraft Aviation Fuel Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Defense Aircraft Aviation Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence