Key Insights

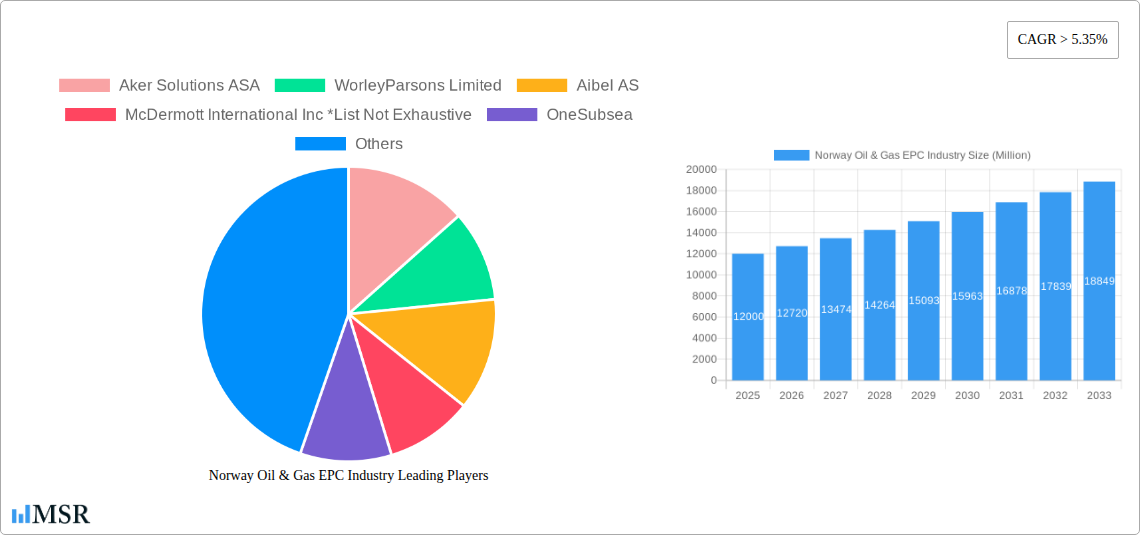

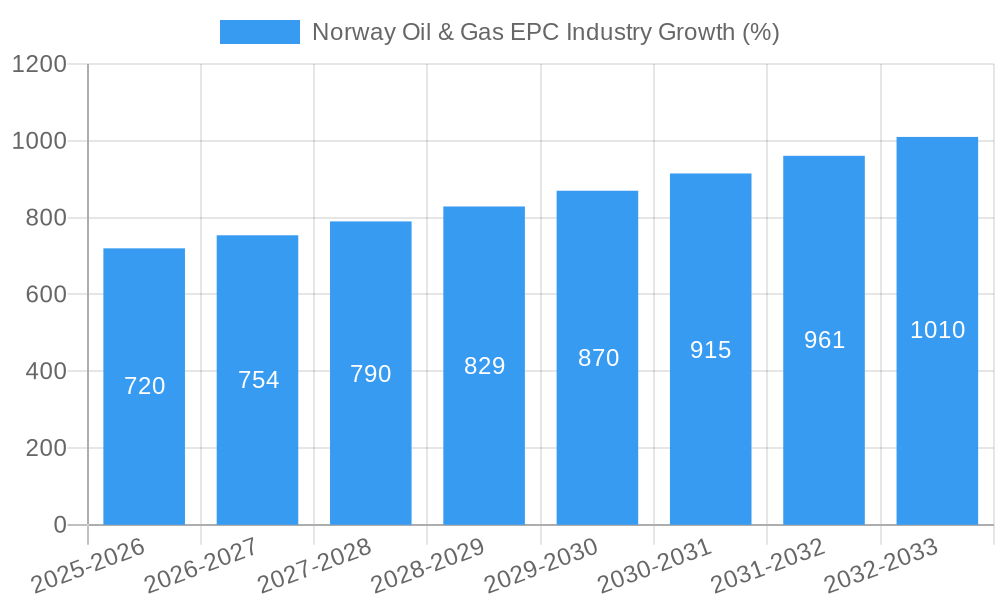

The Norwegian Oil & Gas EPC (Engineering, Procurement, and Construction) industry, currently experiencing robust growth with a CAGR exceeding 5.35%, presents a lucrative market opportunity. Driven by sustained investment in upstream oil and gas exploration and production, coupled with ongoing projects to enhance midstream infrastructure, like pipelines and LNG export facilities, the sector is poised for significant expansion through 2033. The robust demand is fueled by Norway's continued role as a major oil and gas producer, even amidst the global energy transition. While fluctuating global energy prices represent a potential restraint, Norway's strategic location and commitment to responsible energy practices mitigate this risk. The upstream segment, encompassing exploration and production, accounts for a substantial portion of the market, reflecting significant capital expenditures in this area. The midstream sector, focusing on transportation and processing, experiences substantial growth driven by capacity expansions and new pipeline projects aimed at optimizing efficiency and export capabilities. The downstream sector, encompassing refining and petrochemical production, shows steady growth aligned with domestic demand and export strategies. Key players like Aker Solutions ASA, WorleyParsons Limited, and Aibel AS, along with international firms, contribute significantly to the industry’s dynamism. The market's growth trajectory is expected to remain positive, driven by ongoing investments in both established and new fields, further bolstering Norway's position as a key player in the global energy market. The industry's future success hinges on balancing exploration and production with sustainable practices and integration of renewable energy technologies into the broader energy infrastructure.

The Norwegian Oil & Gas EPC market is segmented into upstream, midstream, and downstream sectors, each contributing to the overall growth. While the exact market size for 2025 is not provided, based on the given CAGR and assuming a reasonable base year market size (e.g., $10 billion in 2019), we can project a significant increase by 2025 and beyond. Market segmentation analysis reveals that the upstream sector's growth is tied closely to oil and gas production forecasts. The midstream segment's development is intricately linked to the expansion of pipeline infrastructure and LNG export capacity, ensuring efficient transportation and access to global markets. The downstream segment is primarily influenced by the refinement capacity, domestic demand, and export opportunities. The concentration of major EPC players in Norway indicates a competitive yet consolidated landscape, suggesting opportunities for both large-scale and specialized service providers. Future growth depends on factors such as government policies, regulatory frameworks, technological advancements, and global energy demands. A sustained commitment to sustainable practices and diversification into renewable energy solutions will be crucial for long-term success.

Norway Oil & Gas EPC Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Norway Oil & Gas Engineering, Procurement, and Construction (EPC) industry, offering critical insights for stakeholders, investors, and industry professionals. We delve into market dynamics, key segments, leading players, and future growth potential, covering the period from 2019 to 2033. The report leverages extensive data analysis and forecasts to provide actionable intelligence on the Norwegian Oil & Gas EPC landscape.

Norway Oil & Gas EPC Industry Market Concentration & Dynamics

The Norwegian Oil & Gas EPC market exhibits a moderately concentrated structure, dominated by several major international and domestic players. Key players like Aker Solutions ASA, WorleyParsons Limited, Aibel AS, McDermott International Inc., OneSubsea, Subsea 7 SA, John Wood Group PLC, and TechnipFMC PLC hold significant market share, though the exact figures vary across segments. However, the market also supports a number of smaller, specialized EPC firms, contributing to a dynamic competitive environment.

Innovation within the sector is driven by a strong emphasis on sustainable practices, technological advancements in subsea engineering and digitalization, and the ongoing need for enhanced efficiency and safety measures. The regulatory framework in Norway is robust, emphasizing environmental protection and stringent safety regulations, which impact operational costs and project timelines. Substitute products, such as renewable energy sources, are increasingly competitive, necessitating innovation and cost optimization within the oil and gas EPC sector. End-user trends show a growing focus on efficient and environmentally responsible energy production, influencing project selection and technological choices. Mergers and acquisitions (M&A) activity has been notable in recent years, with xx major deals recorded between 2019 and 2024, primarily aimed at consolidating market share and enhancing technological capabilities. Market share analysis reveals that the top five players account for approximately xx% of the total market revenue.

Norway Oil & Gas EPC Industry Industry Insights & Trends

The Norwegian Oil & Gas EPC market is experiencing consistent growth, driven primarily by ongoing exploration and production activities on the Norwegian Continental Shelf. The market size, estimated at USD xx billion in 2025, is projected to reach USD xx billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Several factors contribute to this growth, including increasing investments in offshore oil and gas infrastructure, the development of new oil and gas fields, and the ongoing demand for natural gas in Europe. Technological advancements, particularly in subsea technologies and digitalization, are further enhancing operational efficiency and driving down costs. However, fluctuating oil and gas prices, along with increasing regulatory scrutiny and the global transition towards renewable energy, pose challenges to sustained growth. Consumer behaviors, driven by environmental concerns, influence the demand for cleaner energy solutions, demanding innovation and adaptation within the industry.

Key Markets & Segments Leading Norway Oil & Gas EPC Industry

Upstream:

- Market Overview: The upstream sector is the largest segment within the Norwegian Oil & Gas EPC market, primarily driven by exploration, development, and production of oil and gas reserves.

- Market Size & Demand Forecast: USD xx billion (2025), projected to reach USD xx billion (2033).

- Upstream Oil & Gas Spending (NOK billion): xx (2010-2024), projected to reach xx (2025-2033).

- Production Forecast (million barrels per day): xx (2025-2033).

- Production Per Company (million Sm3 oil equivalents): Data varies significantly between companies. Aker Solutions ASA, for example, might produce xx million Sm3 oil equivalents in 2025.

- Key EPC Projects: Numerous projects involving expansion of existing fields and development of new discoveries are driving upstream EPC activity.

Midstream:

- Market Overview: This sector focuses on transportation and processing of oil and gas. Norway's extensive pipeline network and LNG export infrastructure constitute key aspects of this sector.

- Market Size & Demand Forecast: USD xx billion (2025), projected to reach USD xx billion (2033).

- Key Oil & Gas Pipelines: The report details xx key pipelines on the Norwegian Continental Shelf.

- LNG Export (billion cubic meters): xx (2012-2024), projected to reach xx (2025-2033).

- Key EPC Projects: Pipeline maintenance, expansions, and new infrastructure projects drive EPC demand in this sector.

Downstream:

- Market Overview: The downstream sector includes refining and distribution of oil and gas products.

- Market Size & Demand Forecast: USD xx billion (2025), projected to reach USD xx billion (2033).

- Oil Refinery Throughput Capacity (thousand barrels per day): xx (2025), projected to reach xx (2033).

- Key EPC Projects: Refining upgrades and capacity expansion projects are driving downstream EPC activity.

Dominant Segment: The Upstream segment is currently the dominant sector within the Norwegian Oil & Gas EPC market.

Norway Oil & Gas EPC Industry Product Developments

Recent product innovations focus on enhanced subsea technologies, digitalization solutions for improved operational efficiency, and environmentally friendly equipment and processes. These advancements aim to reduce operational costs, enhance safety, and minimize environmental impact, providing a competitive edge in a challenging market landscape.

Challenges in the Norway Oil & Gas EPC Industry Market

The Norwegian Oil & Gas EPC market faces several challenges: stringent environmental regulations increasing project costs and timelines, volatile oil and gas prices impacting project viability, skilled labor shortages, and intense competition from international EPC firms. Supply chain disruptions have also impacted project execution and cost efficiency, with a quantifiable impact of xx% on project delays in 2022.

Forces Driving Norway Oil & Gas EPC Industry Growth

Key growth drivers include substantial investment in new oil and gas field development, ongoing expansion of existing infrastructure, the continued demand for natural gas in Europe, and government support for the energy sector. Technological advancements, particularly in subsea technologies and digitalization, are enhancing efficiency and reducing costs. Government incentives and regulatory frameworks supporting technological innovation also contribute significantly.

Long-Term Growth Catalysts in the Norway Oil & Gas EPC Industry Market

Long-term growth will be fueled by continued exploration and production activities, strategic partnerships between EPC firms and energy companies, and expansion into new markets within renewable energy infrastructure projects. Innovation in carbon capture and storage technologies (CCS) will also be a major driver, alongside investments in new energy solutions that maintain the nation’s energy production independence.

Emerging Opportunities in Norway Oil & Gas EPC Industry

Emerging opportunities include increased focus on decommissioning of older oil and gas infrastructure, growing demand for subsea services, and the development of new technologies for offshore wind energy projects. Furthermore, the potential for carbon capture, utilization, and storage (CCUS) projects presents significant opportunities for specialized EPC firms.

Leading Players in the Norway Oil & Gas EPC Industry Sector

- Aker Solutions ASA

- WorleyParsons Limited

- Aibel AS

- McDermott International Inc.

- OneSubsea

- Subsea 7 SA

- John Wood Group PLC

- TechnipFMC PLC

Key Milestones in Norway Oil & Gas EPC Industry Industry

- May 2022: Equinor and partners announced a USD 940 million investment in the Halten East gas and condensate field development. This signifies a commitment to further production and highlights the ongoing demand for natural gas in the region.

- December 2022: Aker BP and partners announced an investment of over USD 20.5 billion in developing several oil and gas fields off Norway, signifying massive future investment in Norwegian Oil & Gas infrastructure.

Strategic Outlook for Norway Oil & Gas EPC Market

The Norwegian Oil & Gas EPC market presents a robust outlook for the next decade. Continued investments in exploration and production, coupled with advancements in technologies, will sustain growth, while challenges related to sustainability and regulatory changes will demand innovation and strategic adaptation. The focus on energy security and the transition towards a lower-carbon future presents opportunities for EPC companies specializing in carbon capture and storage and renewable energy infrastructure projects. This, coupled with the existing mature oil and gas operations, offers significant long-term potential for EPC companies that can adapt strategically to the evolving industry landscape.

Norway Oil & Gas EPC Industry Segmentation

- 1. Midstream

- 2. Downstream

- 3. Upstream

Norway Oil & Gas EPC Industry Segmentation By Geography

- 1. Norway

Norway Oil & Gas EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improved Viability Of Offshore Oil And Gas Projects

- 3.3. Market Restrains

- 3.3.1. Ban On Offshore Exploration And Production Activities In Multiple Regions

- 3.4. Market Trends

- 3.4.1. Upstream Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Oil & Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Midstream

- 5.2. Market Analysis, Insights and Forecast - by Downstream

- 5.3. Market Analysis, Insights and Forecast - by Upstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Midstream

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Aker Solutions ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WorleyParsons Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aibel AS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 McDermott International Inc *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OneSubsea

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Subsea 7 SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 John Wood Group PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TechnipFMC PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Aker Solutions ASA

List of Figures

- Figure 1: Norway Oil & Gas EPC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Oil & Gas EPC Industry Share (%) by Company 2024

List of Tables

- Table 1: Norway Oil & Gas EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Oil & Gas EPC Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 3: Norway Oil & Gas EPC Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 4: Norway Oil & Gas EPC Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 5: Norway Oil & Gas EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Norway Oil & Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Norway Oil & Gas EPC Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 8: Norway Oil & Gas EPC Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 9: Norway Oil & Gas EPC Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 10: Norway Oil & Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Oil & Gas EPC Industry?

The projected CAGR is approximately > 5.35%.

2. Which companies are prominent players in the Norway Oil & Gas EPC Industry?

Key companies in the market include Aker Solutions ASA, WorleyParsons Limited, Aibel AS, McDermott International Inc *List Not Exhaustive, OneSubsea, Subsea 7 SA, John Wood Group PLC, TechnipFMC PLC.

3. What are the main segments of the Norway Oil & Gas EPC Industry?

The market segments include Midstream, Downstream, Upstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Improved Viability Of Offshore Oil And Gas Projects.

6. What are the notable trends driving market growth?

Upstream Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

Ban On Offshore Exploration And Production Activities In Multiple Regions.

8. Can you provide examples of recent developments in the market?

In May 2022, Equinor and partners submitted a plan to develop a cluster of gas and condensate discoveries in the Norwegian Sea for USD 940 million. The Halten East contains reserves of around 100 million barrels of oil equivalent, 60% of which is natural gas, and is expected to begin exporting to Europe in 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Oil & Gas EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Oil & Gas EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Oil & Gas EPC Industry?

To stay informed about further developments, trends, and reports in the Norway Oil & Gas EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence