Key Insights

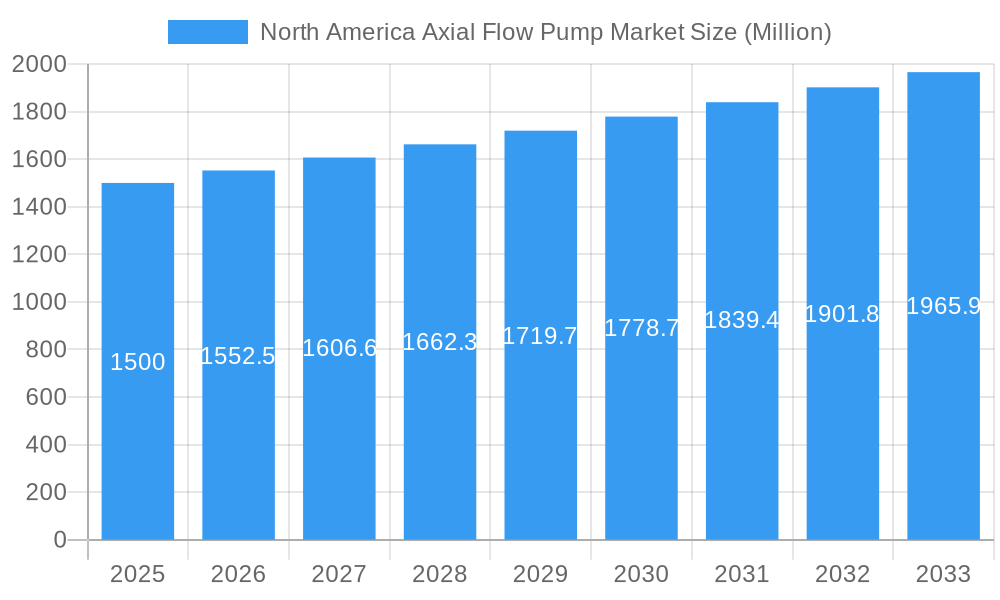

The North American axial flow pump market, valued at approximately $688.7 million in 2024, is projected to experience significant expansion. A Compound Annual Growth Rate (CAGR) of 2% forecasts the market to reach an estimated $831.5 million by 2033. This growth is underpinned by substantial investments in infrastructure development, particularly in water and wastewater treatment, and burgeoning power generation projects. The oil and gas sector, despite price volatility, remains a key contributor, especially for high-pressure pumps in pipeline operations. Advancements in energy-efficient pump designs and the increasing adoption of sustainable industrial practices are further propelling market demand.

North America Axial Flow Pump Market Market Size (In Million)

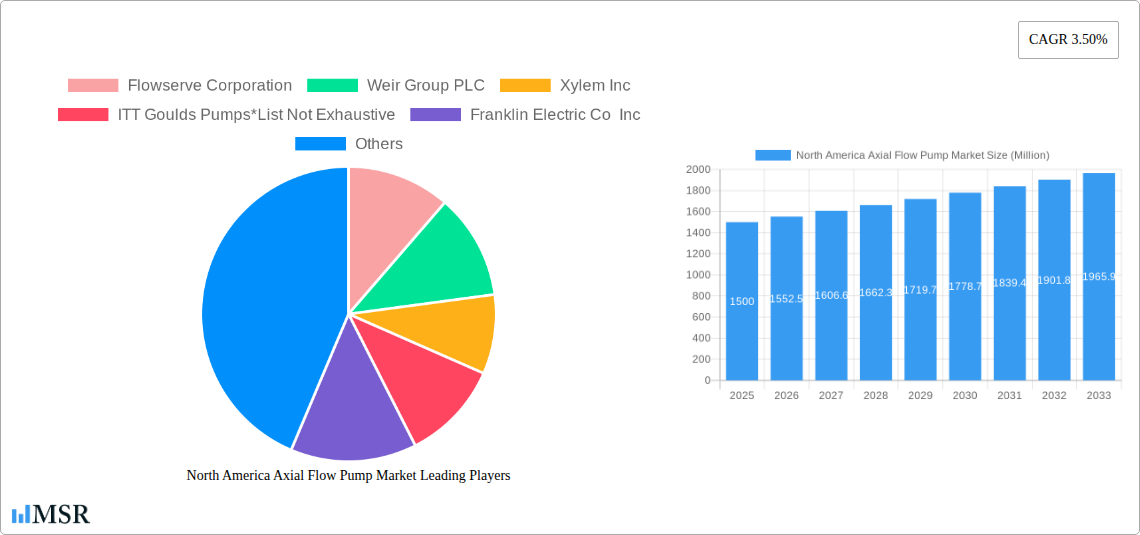

Potential growth constraints include raw material price volatility and supply chain uncertainties. While stringent environmental regulations encourage sustainable technologies, they may increase manufacturing costs. Market segmentation indicates robust demand across all pressure categories, with multi-stage pumps showing increased adoption due to their superior efficiency in demanding applications. Horizontal pump configurations are prevalent, aligning with diverse industrial needs. Leading companies like Flowserve, Weir Group, Xylem, and Grundfos are actively pursuing innovation and strategic acquisitions to enhance their market standing and drive further expansion in the North American axial flow pump sector. The United States commands the largest market share, attributed to its extensive industrial base and critical infrastructure investments.

North America Axial Flow Pump Market Company Market Share

North America Axial Flow Pump Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America axial flow pump market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025, this report meticulously examines market dynamics, growth drivers, key segments, leading players, and emerging opportunities within this crucial sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Axial Flow Pump Market Concentration & Dynamics

The North American axial flow pump market exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the presence of numerous smaller, specialized firms fosters a dynamic competitive environment. Innovation is driven by the need for improved energy efficiency, enhanced reliability, and the incorporation of smart technologies. Stringent environmental regulations, particularly concerning energy consumption and emissions, are shaping market dynamics. Substitute products, such as centrifugal pumps, pose some competitive pressure, but the unique advantages of axial flow pumps in specific applications limit this impact. End-user trends, such as the increasing demand for water and wastewater treatment solutions and the growth of renewable energy projects, significantly influence market growth. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, mostly focused on consolidating market share and expanding product portfolios.

- Market Share: Top 5 players hold approximately xx% of the market share.

- M&A Activity: An average of xx M&A deals per year were recorded between 2019 and 2024.

- Innovation Ecosystems: Collaborative partnerships between pump manufacturers and technology providers are driving innovation in areas such as sensor integration and predictive maintenance.

- Regulatory Frameworks: Compliance with environmental regulations is a key driver of product development and market evolution.

North America Axial Flow Pump Market Industry Insights & Trends

The North American axial flow pump market is experiencing robust growth, propelled by several key factors. The expanding infrastructure development across various sectors, including water and wastewater treatment, power generation, and oil and gas, is a significant driver. Increasing demand for efficient and reliable pumping solutions in these sectors fuels market expansion. Technological advancements, such as the integration of smart sensors and advanced materials, are enhancing pump performance and durability, further boosting market growth. Furthermore, the rising focus on energy efficiency and sustainability is driving the adoption of energy-saving pump designs and technologies. The market size is estimated to be xx Million in 2025 and is projected to grow to xx Million by 2033.

Key Markets & Segments Leading North America Axial Flow Pump Market

The water and wastewater treatment sector represents the largest end-use segment, driving the majority of the market demand. Within the type segment, horizontal axial flow pumps dominate due to their ease of installation and maintenance. High-pressure pumps are experiencing strong growth owing to increasing demands in various industrial applications. Multi-stage pumps are preferred for applications requiring higher pressure heads. Geographic dominance is primarily concentrated in the US and Canada, fueled by robust infrastructure investments and industrial activities.

- Growth Drivers:

- Significant investments in water infrastructure projects.

- Expansion of the oil and gas industry.

- Increasing adoption of renewable energy sources.

- Growing demand for efficient and sustainable pumping solutions.

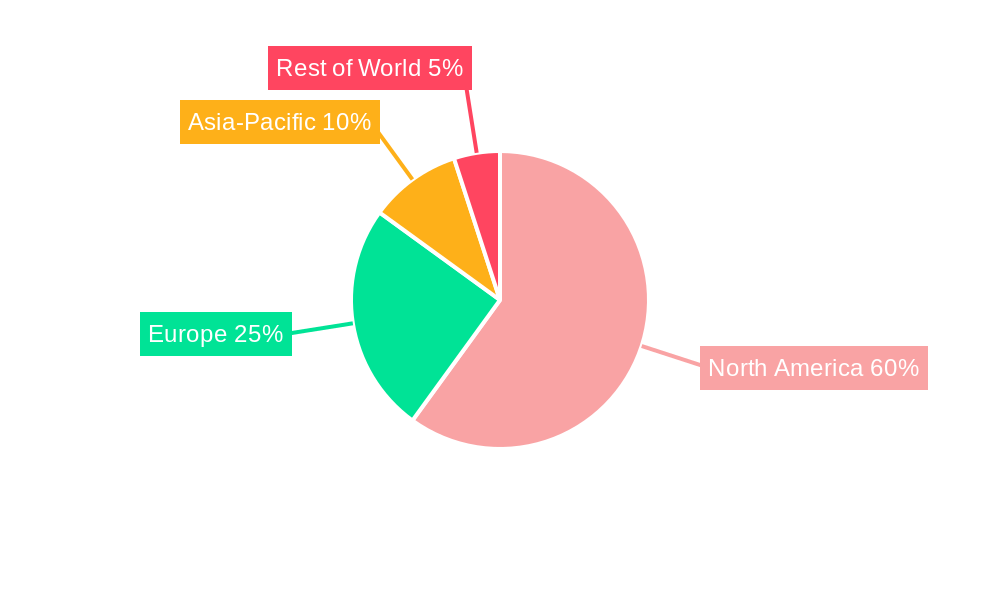

- Dominance Analysis: The US dominates the market due to a higher concentration of industrial activities and extensive infrastructure projects. The Canadian market is also expanding due to investments in resource extraction and infrastructure upgrades.

North America Axial Flow Pump Market Product Developments

Recent product developments focus on enhancing energy efficiency, incorporating smart technologies for predictive maintenance, and improving durability. Manufacturers are actively incorporating advanced materials, such as composite materials and high-strength alloys, to improve pump performance and lifespan. The integration of IoT sensors allows for real-time monitoring and data analysis, enabling predictive maintenance and minimizing downtime. These developments are providing manufacturers with a competitive edge in a market increasingly driven by efficiency and reliability.

Challenges in the North America Axial Flow Pump Market Market

The North America axial flow pump market faces several challenges, including the volatility of raw material prices impacting production costs, supply chain disruptions affecting product availability, and intense competition from both established and emerging players. Furthermore, stringent environmental regulations and the need for compliance can add to operational complexities and costs. These challenges, while significant, are not insurmountable and are being addressed by manufacturers through various strategies including vertical integration and strategic partnerships.

Forces Driving North America Axial Flow Pump Market Growth

Several factors are driving market growth. Firstly, the increasing focus on infrastructure development and modernization creates significant demand for efficient and reliable pumping solutions. Secondly, the growing adoption of renewable energy sources like hydropower necessitates pumps for efficient energy generation and distribution. Thirdly, the strict environmental regulations necessitate energy-efficient and sustainable pumping technologies. Finally, technological advancements are continuously improving the efficiency and performance of axial flow pumps, increasing their adoption across various industrial sectors.

Long-Term Growth Catalysts in the North America Axial Flow Pump Market

Long-term growth is fueled by ongoing innovation in materials science, leading to lighter, more durable pumps. Strategic partnerships between pump manufacturers and technology companies are boosting the integration of smart technologies. Furthermore, market expansion into emerging sectors, such as desalination and agricultural irrigation, promises significant future growth.

Emerging Opportunities in North America Axial Flow Pump Market

Significant opportunities exist in integrating advanced automation and control systems into axial flow pump systems. The expanding renewable energy sector, especially hydropower and offshore wind, presents significant growth prospects for customized pump solutions. Finally, the increasing demand for water-efficient irrigation solutions within the agricultural sector opens up a substantial new market segment.

Leading Players in the North America Axial Flow Pump Market Sector

- Flowserve Corporation

- Weir Group PLC

- Xylem Inc

- ITT Goulds Pumps

- Franklin Electric Co Inc

- KSB SE & Co KGaA

- Patterson Pump Company

- Sulzer AG

- Pentair PLC

- Grundfos AS

Key Milestones in North America Axial Flow Pump Market Industry

- March 2022: Flowserve Corporation launched its Energy Advantage program, focusing on energy-efficient flow control solutions. This initiative is expected to drive adoption of energy-efficient pumps.

- June 2021: PJSC LUKOIL and Baker Hughes collaborated on energy-efficient electric submersible pumps (ESP) with permanent magnet motors (PMM), indicating a shift towards sustainable technologies in the oil and gas sector. This indirectly impacts the demand for high-efficiency axial flow pumps in related applications.

Strategic Outlook for North America Axial Flow Pump Market Market

The North America axial flow pump market presents a strong outlook, characterized by consistent growth driven by infrastructure investments and technological advancements. Strategic opportunities lie in focusing on energy efficiency, integrating smart technologies, and expanding into new and emerging markets. Companies that effectively adapt to evolving regulatory landscapes and leverage innovative solutions will be well-positioned to capture significant market share in the coming years.

North America Axial Flow Pump Market Segmentation

-

1. Type

- 1.1. Horizontal

- 1.2. Vertical

-

2. Pressure

- 2.1. Low pressure

- 2.2. High Pressure

-

3. Stage

- 3.1. Single-stage

- 3.2. Multi-stage

-

4. End Use

- 4.1. Oil and Gas

- 4.2. Power Generation

- 4.3. Water and Wastewater Treatment

- 4.4. Chemical Industry

- 4.5. Agriculture & Fisheries

- 4.6. Others

-

5. Geography

- 5.1. United States

- 5.2. Canada

- 5.3. Mexico

North America Axial Flow Pump Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Axial Flow Pump Market Regional Market Share

Geographic Coverage of North America Axial Flow Pump Market

North America Axial Flow Pump Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Infrastructure Development4.; Rising Emphasis Water and Wastewater Management

- 3.3. Market Restrains

- 3.3.1. 4.; Volatility in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Oil and Gas Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Axial Flow Pump Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Horizontal

- 5.1.2. Vertical

- 5.2. Market Analysis, Insights and Forecast - by Pressure

- 5.2.1. Low pressure

- 5.2.2. High Pressure

- 5.3. Market Analysis, Insights and Forecast - by Stage

- 5.3.1. Single-stage

- 5.3.2. Multi-stage

- 5.4. Market Analysis, Insights and Forecast - by End Use

- 5.4.1. Oil and Gas

- 5.4.2. Power Generation

- 5.4.3. Water and Wastewater Treatment

- 5.4.4. Chemical Industry

- 5.4.5. Agriculture & Fisheries

- 5.4.6. Others

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Axial Flow Pump Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Horizontal

- 6.1.2. Vertical

- 6.2. Market Analysis, Insights and Forecast - by Pressure

- 6.2.1. Low pressure

- 6.2.2. High Pressure

- 6.3. Market Analysis, Insights and Forecast - by Stage

- 6.3.1. Single-stage

- 6.3.2. Multi-stage

- 6.4. Market Analysis, Insights and Forecast - by End Use

- 6.4.1. Oil and Gas

- 6.4.2. Power Generation

- 6.4.3. Water and Wastewater Treatment

- 6.4.4. Chemical Industry

- 6.4.5. Agriculture & Fisheries

- 6.4.6. Others

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. United States

- 6.5.2. Canada

- 6.5.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Axial Flow Pump Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Horizontal

- 7.1.2. Vertical

- 7.2. Market Analysis, Insights and Forecast - by Pressure

- 7.2.1. Low pressure

- 7.2.2. High Pressure

- 7.3. Market Analysis, Insights and Forecast - by Stage

- 7.3.1. Single-stage

- 7.3.2. Multi-stage

- 7.4. Market Analysis, Insights and Forecast - by End Use

- 7.4.1. Oil and Gas

- 7.4.2. Power Generation

- 7.4.3. Water and Wastewater Treatment

- 7.4.4. Chemical Industry

- 7.4.5. Agriculture & Fisheries

- 7.4.6. Others

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. United States

- 7.5.2. Canada

- 7.5.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Axial Flow Pump Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Horizontal

- 8.1.2. Vertical

- 8.2. Market Analysis, Insights and Forecast - by Pressure

- 8.2.1. Low pressure

- 8.2.2. High Pressure

- 8.3. Market Analysis, Insights and Forecast - by Stage

- 8.3.1. Single-stage

- 8.3.2. Multi-stage

- 8.4. Market Analysis, Insights and Forecast - by End Use

- 8.4.1. Oil and Gas

- 8.4.2. Power Generation

- 8.4.3. Water and Wastewater Treatment

- 8.4.4. Chemical Industry

- 8.4.5. Agriculture & Fisheries

- 8.4.6. Others

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. United States

- 8.5.2. Canada

- 8.5.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Flowserve Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Weir Group PLC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Xylem Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 ITT Goulds Pumps*List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Franklin Electric Co Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 KSB SE & Co KGaA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Patterson Pump Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Sulzer AG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Pentair PLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Grundfos AS

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Flowserve Corporation

List of Figures

- Figure 1: North America Axial Flow Pump Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Axial Flow Pump Market Share (%) by Company 2025

List of Tables

- Table 1: North America Axial Flow Pump Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: North America Axial Flow Pump Market Revenue million Forecast, by Pressure 2020 & 2033

- Table 3: North America Axial Flow Pump Market Revenue million Forecast, by Stage 2020 & 2033

- Table 4: North America Axial Flow Pump Market Revenue million Forecast, by End Use 2020 & 2033

- Table 5: North America Axial Flow Pump Market Revenue million Forecast, by Geography 2020 & 2033

- Table 6: North America Axial Flow Pump Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: North America Axial Flow Pump Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: North America Axial Flow Pump Market Revenue million Forecast, by Pressure 2020 & 2033

- Table 9: North America Axial Flow Pump Market Revenue million Forecast, by Stage 2020 & 2033

- Table 10: North America Axial Flow Pump Market Revenue million Forecast, by End Use 2020 & 2033

- Table 11: North America Axial Flow Pump Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: North America Axial Flow Pump Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: North America Axial Flow Pump Market Revenue million Forecast, by Type 2020 & 2033

- Table 14: North America Axial Flow Pump Market Revenue million Forecast, by Pressure 2020 & 2033

- Table 15: North America Axial Flow Pump Market Revenue million Forecast, by Stage 2020 & 2033

- Table 16: North America Axial Flow Pump Market Revenue million Forecast, by End Use 2020 & 2033

- Table 17: North America Axial Flow Pump Market Revenue million Forecast, by Geography 2020 & 2033

- Table 18: North America Axial Flow Pump Market Revenue million Forecast, by Country 2020 & 2033

- Table 19: North America Axial Flow Pump Market Revenue million Forecast, by Type 2020 & 2033

- Table 20: North America Axial Flow Pump Market Revenue million Forecast, by Pressure 2020 & 2033

- Table 21: North America Axial Flow Pump Market Revenue million Forecast, by Stage 2020 & 2033

- Table 22: North America Axial Flow Pump Market Revenue million Forecast, by End Use 2020 & 2033

- Table 23: North America Axial Flow Pump Market Revenue million Forecast, by Geography 2020 & 2033

- Table 24: North America Axial Flow Pump Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Axial Flow Pump Market?

The projected CAGR is approximately 2%.

2. Which companies are prominent players in the North America Axial Flow Pump Market?

Key companies in the market include Flowserve Corporation, Weir Group PLC, Xylem Inc, ITT Goulds Pumps*List Not Exhaustive, Franklin Electric Co Inc, KSB SE & Co KGaA, Patterson Pump Company, Sulzer AG, Pentair PLC, Grundfos AS.

3. What are the main segments of the North America Axial Flow Pump Market?

The market segments include Type, Pressure, Stage, End Use, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 688.7 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Infrastructure Development4.; Rising Emphasis Water and Wastewater Management.

6. What are the notable trends driving market growth?

Oil and Gas Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatility in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

In March 2022, Flowserve Corporation announced the launch of its new Energy Advantage program, a comprehensive flow control approach aimed at helping customers reduce carbon footprint and lower total cost of ownership, by providing flow control products and services for the global infrastructure market. With Energy Advantage, Flowserve's engineering expertise, systematic data-driven evaluation process, and complete product and service offering can help customers optimize pump and valve power consumption to achieve increased energy efficiency

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Axial Flow Pump Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Axial Flow Pump Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Axial Flow Pump Market?

To stay informed about further developments, trends, and reports in the North America Axial Flow Pump Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence