Key Insights

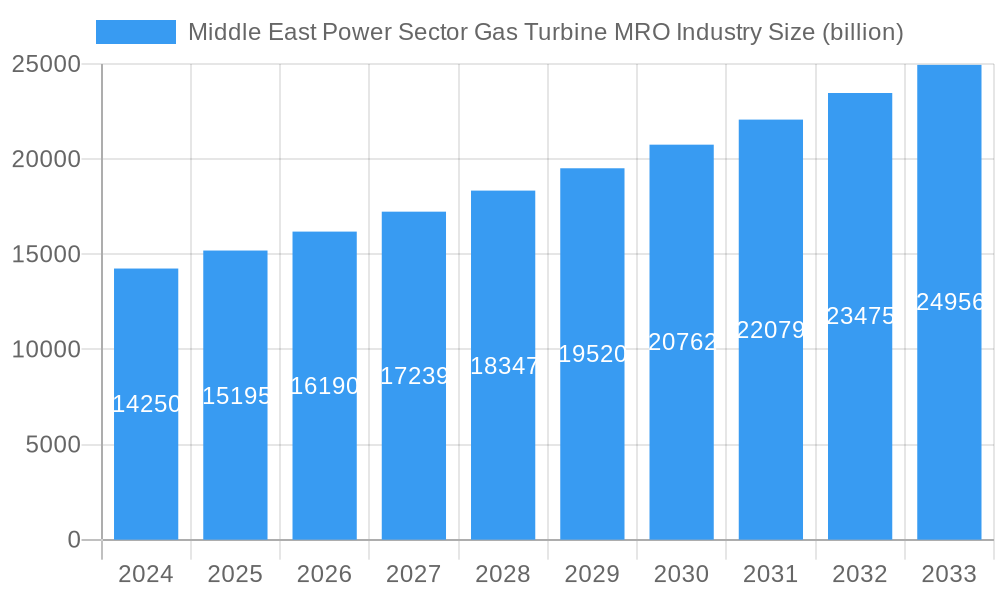

The Middle East Power Sector Gas Turbine Maintenance, Repair, and Overhaul (MRO) market is poised for substantial growth, reflecting the region's increasing reliance on gas turbines for power generation and industrial applications. With an estimated market size of USD 14.25 billion in 2024, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 6.6% through 2033. This robust growth is underpinned by a confluence of critical drivers, including the expanding energy demand driven by population growth and industrialization, significant investments in new power infrastructure, and the ongoing need to maintain the operational efficiency and lifespan of existing gas turbine fleets. The push for greater energy security and the transition towards cleaner energy sources, where gas turbines play a pivotal role in providing baseload and flexible power, further bolster this positive trajectory. The primary service types within this market encompass maintenance, repair, and overhaul, each crucial for ensuring the reliability and performance of these vital assets.

Middle East Power Sector Gas Turbine MRO Industry Market Size (In Billion)

Despite the optimistic outlook, the market faces certain restraints that could influence its pace. These may include the upfront capital expenditure required for advanced MRO facilities, the availability of skilled labor and specialized technicians, and the potential for supply chain disruptions. Furthermore, evolving environmental regulations and the increasing adoption of renewable energy sources might, over the long term, influence the demand for gas turbine MRO services. However, the sheer scale of existing gas turbine installations and the continued need for their reliable operation in the Middle East's energy mix ensure a sustained demand for MRO services. Key players like Siemens AG, General Electric Company, and Mitsubishi Heavy Industries Ltd are instrumental in shaping the market through technological advancements, service innovation, and strategic partnerships, contributing to the overall health and competitiveness of the Middle East gas turbine MRO landscape.

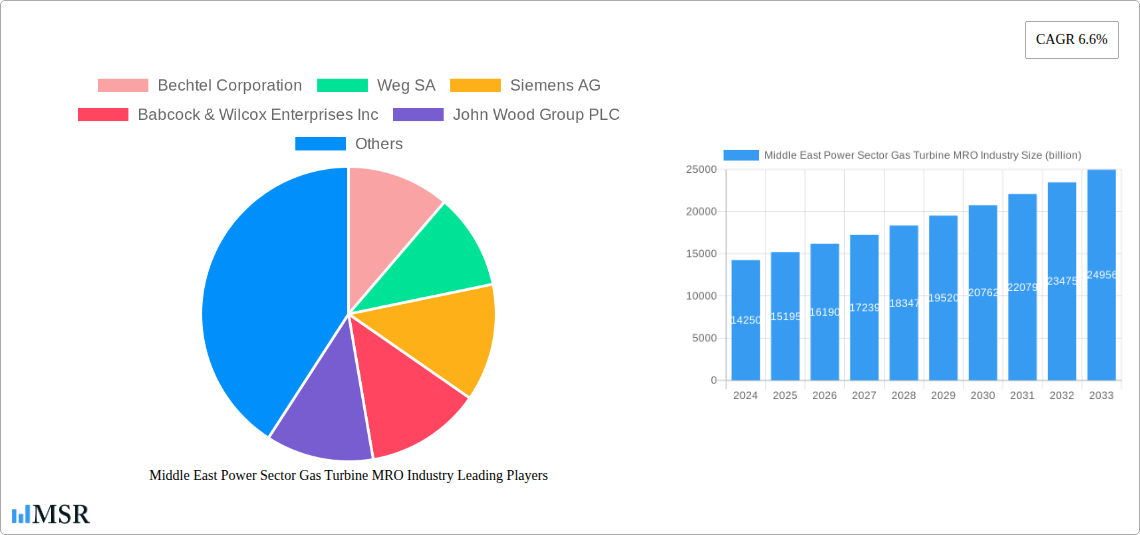

Middle East Power Sector Gas Turbine MRO Industry Company Market Share

Here is an SEO-optimized, engaging report description for the Middle East Power Sector Gas Turbine MRO Industry:

Middle East Power Sector Gas Turbine MRO Industry Market Concentration & Dynamics

The Middle East power sector gas turbine MRO (Maintenance, Repair, and Overhaul) market is characterized by a moderate to high concentration, driven by the significant investments in power generation infrastructure across the region. Key players like General Electric Company, Siemens AG, and Mitsubishi Heavy Industries Ltd. hold substantial market shares, leveraging their extensive portfolios of original equipment manufacturing (OEM) and decades of operational expertise. The innovation ecosystem is robust, with a growing emphasis on digital transformation, predictive maintenance solutions, and advanced component repair technologies. Regulatory frameworks, while evolving, generally favor safety standards and localized content requirements, influencing market entry and operational strategies. Substitute products, such as advancements in renewable energy integration, present a growing but not yet dominant threat to gas turbine reliance. End-user trends are shifting towards greater operational efficiency, reduced downtime, and cost optimization, directly impacting MRO service demands. Mergers and acquisitions (M&A) activities, while not as frequent as in more mature markets, are strategic, focusing on expanding service capabilities and geographical reach. For instance, recent M&A deals have aimed to consolidate specialized repair capabilities and integrate digital service platforms. The estimated M&A deal count in the historical period (2019-2024) is approximately 5, with a total deal value estimated in the billions.

Middle East Power Sector Gas Turbine MRO Industry Industry Insights & Trends

The Middle East power sector gas turbine MRO market is poised for significant growth, projected to reach an estimated market size of $12.5 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period of 2025–2033. This upward trajectory is underpinned by several pivotal growth drivers. The escalating demand for electricity, fueled by rapid population growth, urbanization, and ambitious economic development initiatives across the GCC and North Africa, is a primary catalyst. Governments are heavily investing in expanding their power generation capacities, with a strong emphasis on upgrading existing infrastructure and ensuring the reliability of gas turbine fleets, which form the backbone of their energy grids. Technological disruptions are playing a crucial role, with the integration of Industry 4.0 technologies such as AI-powered predictive maintenance, IoT sensors for real-time performance monitoring, and advanced digital twins enabling proactive issue identification and resolution. This shift from reactive to predictive maintenance significantly reduces unplanned downtime and extends the operational life of gas turbines, a critical factor for power producers aiming for optimal asset utilization. Evolving consumer behaviors, from the perspective of power utilities, are centered on seeking cost-effective and efficient MRO solutions. This includes a preference for long-term service agreements that offer predictable costs and guaranteed performance levels, as well as a demand for localized MRO services to reduce lead times and transportation costs. The push towards decarbonization and improved environmental performance is also influencing MRO strategies, with a focus on enhancing the efficiency of existing gas turbines and supporting the transition to cleaner fuels. The report's comprehensive analysis during the study period of 2019–2033, with a base year of 2025, will delve deeper into these dynamics, providing actionable insights for industry stakeholders navigating this evolving landscape. The estimated market size for the historical period (2019-2024) was approximately $8.9 billion.

Key Markets & Segments Leading Middle East Power Sector Gas Turbine MRO Industry

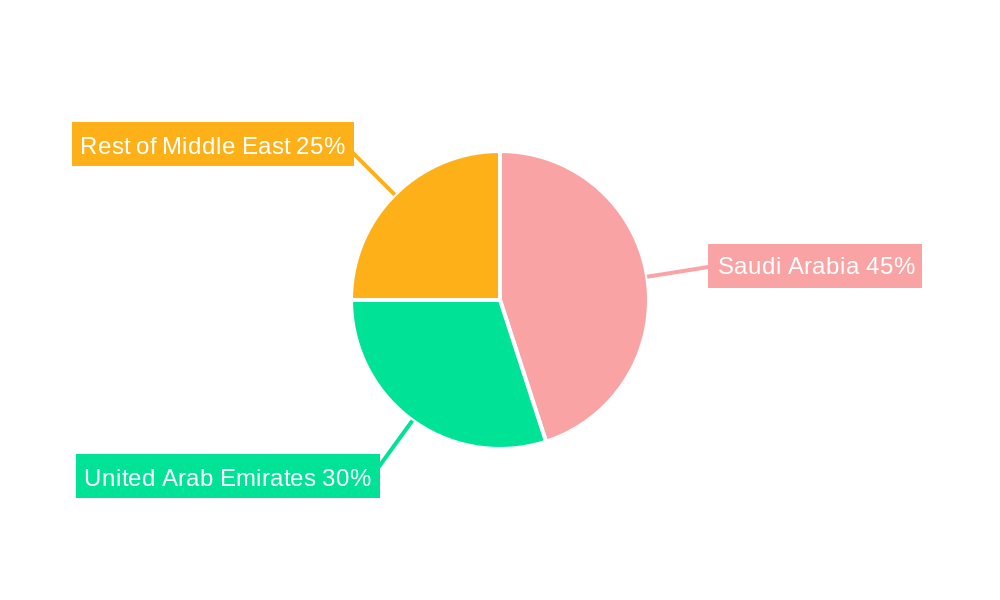

The Middle East Power Sector Gas Turbine MRO Industry is largely dominated by the Saudi Arabia and United Arab Emirates geographies, accounting for an estimated 65% of the total market share in the base year of 2025.

Saudi Arabia: A Dominant Force in Gas Turbine MRO

Saudi Arabia's dominance is driven by its colossal investments in power infrastructure to meet soaring domestic demand and its role as a global energy hub. The Kingdom's Vision 2030 plan emphasizes significant expansion and modernization of its power generation capacity, with gas turbines being a cornerstone of its energy mix.

- Drivers of Dominance:

- Massive Infrastructure Projects: Large-scale industrial, urban development, and desalination projects necessitate a robust and reliable power supply, driving demand for gas turbine MRO.

- Aging Fleet Modernization: A substantial portion of Saudi Arabia's gas turbine fleet requires regular maintenance, repair, and overhaul to ensure operational efficiency and compliance with stringent environmental regulations.

- Government Support and Local Content Policies: The Saudi government actively promotes local manufacturing and service capabilities, encouraging partnerships and investments in domestic MRO facilities.

- Strategic Importance of Energy Security: Ensuring uninterrupted power supply is a national priority, leading to substantial budgets allocated for gas turbine maintenance.

United Arab Emirates: Powering Innovation and Expansion

The UAE, a leader in economic diversification and technological adoption, also presents a substantial market for gas turbine MRO services. Its focus on smart cities, renewable energy integration alongside traditional power sources, and hosting major international events require a highly reliable and efficient power grid.

- Drivers of Dominance:

- Diversified Economy and Tourism: The UAE's thriving tourism and business sectors demand a consistent and high-quality power supply.

- Advanced Technological Adoption: The nation readily embraces cutting-edge MRO technologies, including digital solutions and predictive analytics, to optimize asset performance.

- Hosting of Global Events: Major international events and conferences necessitate peak power performance and rapid response MRO capabilities.

- Strategic Location: The UAE serves as a logistical hub, facilitating efficient MRO service delivery across the wider Middle East region.

Rest of Middle East: Emerging Growth Pockets

While Saudi Arabia and the UAE lead, the "Rest of Middle East" segment, encompassing countries like Qatar, Kuwait, Oman, Bahrain, and others in North Africa, presents significant and growing opportunities. These nations are also undertaking substantial power generation expansion projects to meet their own development goals. The increasing adoption of gas turbine technology in these regions, coupled with a growing awareness of the importance of proactive MRO for asset longevity and cost efficiency, is fueling market growth. Investments in renewable energy are also being complemented by ensuring the reliability of existing conventional power sources, creating a sustained demand for gas turbine MRO. The repair segment is particularly poised for growth in these emerging markets as the installed base matures.

Segment Analysis: Maintenance, Repair, and Overhaul

- Maintenance: This segment is the largest, driven by the routine servicing requirements of the vast gas turbine fleet in the region. Predictive and preventive maintenance strategies are increasingly being adopted, leading to a consistent demand for specialized maintenance services.

- Repair: As the installed base of gas turbines ages, the demand for component repair services is escalating. Advancements in repair technologies, including additive manufacturing and advanced coatings, are making repairs more viable and cost-effective, contributing significantly to market growth.

- Overhaul: While less frequent than maintenance and repair, overhaul services represent a high-value segment. The increasing complexity of gas turbine technology and the drive for extended operational life are spurring demand for comprehensive overhaul solutions.

Middle East Power Sector Gas Turbine MRO Industry Product Developments

Product developments in the Middle East power sector gas turbine MRO industry are predominantly focused on enhancing efficiency, extending operational lifespan, and enabling predictive capabilities. Innovations in advanced materials science are leading to the development of more durable turbine blades and components, capable of withstanding higher temperatures and pressures, thereby improving fuel efficiency and reducing emissions. Digitalization is a key driver, with the introduction of sophisticated AI-driven analytics platforms for remote monitoring and predictive maintenance, allowing for proactive identification of potential failures and optimized service scheduling. Furthermore, advancements in repair technologies, including laser cladding and additive manufacturing (3D printing), are revolutionizing the repair of critical components, offering faster turnaround times and reduced costs compared to traditional methods. These technological advancements are crucial for maintaining the competitiveness and reliability of the region's substantial gas turbine fleet.

Challenges in the Middle East Power Sector Gas Turbine MRO Industry Market

The Middle East Power Sector Gas Turbine MRO Industry faces several challenges that can impact growth and operational efficiency. Skilled Labor Shortage is a significant hurdle, with a high demand for experienced engineers and technicians specializing in complex gas turbine maintenance. Supply Chain Volatility for critical spare parts, particularly those sourced internationally, can lead to extended downtime and increased costs. Intense Competitive Pressure from established OEMs and independent service providers necessitates continuous innovation and cost optimization. Furthermore, Navigating Diverse Regulatory Landscapes across different countries within the region can add complexity to operations and compliance efforts. The estimated impact of extended downtime due to spare part shortages can be in the range of 10-15% of annual maintenance costs.

Forces Driving Middle East Power Sector Gas Turbine MRO Industry Growth

Several key forces are driving the growth of the Middle East Power Sector Gas Turbine MRO Industry. The increasing energy demand across the region, fueled by population growth and economic development, is necessitating the expansion and reliable operation of power generation facilities. Government initiatives and investments in infrastructure development and energy security are providing substantial impetus. The aging gas turbine fleet across the Middle East requires continuous maintenance and modernization to ensure efficiency and compliance. Furthermore, technological advancements in MRO services, such as digitalization and predictive maintenance, are enhancing operational performance and reducing costs, making these services more attractive. The commitment to improving energy efficiency and reducing carbon emissions also drives demand for advanced MRO solutions that optimize gas turbine performance.

Challenges in the Middle East Power Sector Gas Turbine MRO Industry Market

Long-term growth in the Middle East Power Sector Gas Turbine MRO Industry is contingent upon effectively addressing persistent challenges. The ongoing digital transformation demands significant upfront investment in technology and skilled personnel to implement and manage advanced systems like AI and IoT. Geopolitical instability in certain sub-regions can disrupt supply chains and deter investment. The increasing complexity of gas turbine technology requires continuous upskilling and reskilling of the workforce to keep pace with advancements. Moreover, the pressure to decarbonize the energy sector presents both an opportunity and a challenge, as it may lead to a gradual shift away from solely gas-based power generation in the long term, requiring MRO providers to adapt their service portfolios.

Emerging Opportunities in Middle East Power Sector Gas Turbine MRO Industry

Emerging opportunities in the Middle East Power Sector Gas Turbine MRO Industry are abundant and offer significant growth potential. The increasing adoption of dual-fuel gas turbines capable of running on natural gas and hydrogen presents a new frontier for MRO services, requiring specialized expertise and equipment. The rise of independent power producers (IPPs) and the privatization of power sectors in several Middle Eastern countries are creating new customer segments and driving demand for competitive MRO solutions. Furthermore, the growing focus on asset life extension programs and performance upgrades for existing gas turbine fleets offers lucrative avenues for service providers. The development of localized advanced repair and remanufacturing capabilities for critical components also presents a significant opportunity to reduce reliance on international supply chains and enhance service delivery efficiency.

Leading Players in the Middle East Power Sector Gas Turbine MRO Industry Sector

- General Electric Company

- Siemens AG

- Mitsubishi Heavy Industries Ltd

- Babcock & Wilcox Enterprises Inc

- John Wood Group PLC

- Sulzer AG

- Bechtel Corporation

- Weg SA

- Flour Corporation

Key Milestones in Middle East Power Sector Gas Turbine MRO Industry Industry

- 2019: Increased investment in digital MRO solutions by major OEMs to enhance predictive maintenance capabilities.

- 2020: Growing emphasis on localized MRO services and partnerships to meet national content requirements in Saudi Arabia and UAE.

- 2021: Introduction of advanced component repair technologies, including 3D printing for turbine parts, by leading MRO providers.

- 2022: Significant tender awards for long-term service agreements for new and existing gas turbine power plants across the GCC.

- 2023: Increased focus on sustainability and emission reduction technologies, driving demand for MRO services that optimize gas turbine efficiency.

- 2024 (Estimated): Continued consolidation and strategic collaborations within the MRO sector to expand service offerings and market reach.

Strategic Outlook for Middle East Power Sector Gas Turbine MRO Industry Market

The strategic outlook for the Middle East Power Sector Gas Turbine MRO Industry is exceptionally positive, driven by sustained demand for reliable power generation and increasing investments in advanced technologies. Key growth accelerators include the ongoing expansion of gas turbine fleets, the imperative for efficient operation and maintenance of existing assets, and the growing adoption of digital MRO solutions for predictive analytics and remote diagnostics. Strategic opportunities lie in developing specialized MRO services for emerging fuel sources like hydrogen, expanding localized repair and manufacturing capabilities to reduce lead times, and forging strong partnerships with national utilities and IPPs. The market is expected to witness further innovation in repair technologies and a continued shift towards outcome-based service agreements, ensuring long-term growth and profitability for MRO providers in this dynamic region.

Middle East Power Sector Gas Turbine MRO Industry Segmentation

-

1. Service Type

- 1.1. Maintenance

- 1.2. Repair

- 1.3. Overhaul

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Rest of Middle East

Middle East Power Sector Gas Turbine MRO Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Rest of Middle East

Middle East Power Sector Gas Turbine MRO Industry Regional Market Share

Geographic Coverage of Middle East Power Sector Gas Turbine MRO Industry

Middle East Power Sector Gas Turbine MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies and Incentives4.; Environmental Concerns

- 3.3. Market Restrains

- 3.3.1. 4.; Fossil Fuel Subsidies

- 3.4. Market Trends

- 3.4.1. Maintenance Sector is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Maintenance

- 5.1.2. Repair

- 5.1.3. Overhaul

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. United Arab Emirates

- 5.2.3. Rest of Middle East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Saudi Arabia Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Maintenance

- 6.1.2. Repair

- 6.1.3. Overhaul

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. United Arab Emirates

- 6.2.3. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. United Arab Emirates Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Maintenance

- 7.1.2. Repair

- 7.1.3. Overhaul

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. United Arab Emirates

- 7.2.3. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Rest of Middle East Middle East Power Sector Gas Turbine MRO Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Maintenance

- 8.1.2. Repair

- 8.1.3. Overhaul

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. United Arab Emirates

- 8.2.3. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Bechtel Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Weg SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Siemens AG

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Babcock & Wilcox Enterprises Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 John Wood Group PLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Sulzer AG

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 General Electric Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Flour Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Mitsubishi Heavy Industries Ltd

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Bechtel Corporation

List of Figures

- Figure 1: Middle East Power Sector Gas Turbine MRO Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East Power Sector Gas Turbine MRO Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East Power Sector Gas Turbine MRO Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Middle East Power Sector Gas Turbine MRO Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Middle East Power Sector Gas Turbine MRO Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Middle East Power Sector Gas Turbine MRO Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 5: Middle East Power Sector Gas Turbine MRO Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Middle East Power Sector Gas Turbine MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Middle East Power Sector Gas Turbine MRO Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 8: Middle East Power Sector Gas Turbine MRO Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Middle East Power Sector Gas Turbine MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Middle East Power Sector Gas Turbine MRO Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 11: Middle East Power Sector Gas Turbine MRO Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Middle East Power Sector Gas Turbine MRO Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Power Sector Gas Turbine MRO Industry?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Middle East Power Sector Gas Turbine MRO Industry?

Key companies in the market include Bechtel Corporation, Weg SA, Siemens AG, Babcock & Wilcox Enterprises Inc, John Wood Group PLC, Sulzer AG, General Electric Company, Flour Corporation, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Middle East Power Sector Gas Turbine MRO Industry?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.25 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies and Incentives4.; Environmental Concerns.

6. What are the notable trends driving market growth?

Maintenance Sector is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fossil Fuel Subsidies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Power Sector Gas Turbine MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Power Sector Gas Turbine MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Power Sector Gas Turbine MRO Industry?

To stay informed about further developments, trends, and reports in the Middle East Power Sector Gas Turbine MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence