Key Insights

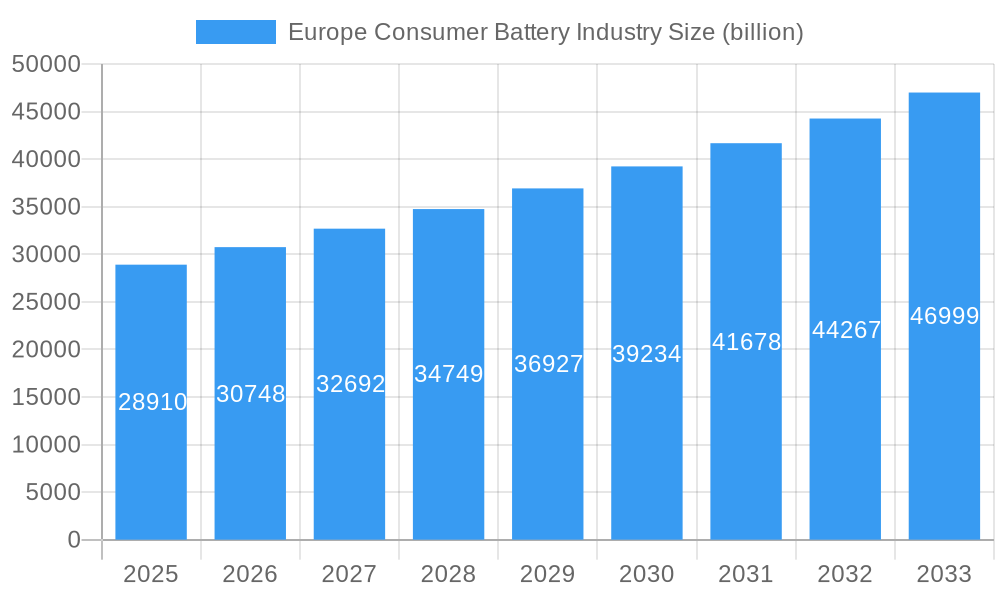

The Europe Consumer Battery Industry is poised for significant growth, projected to reach an estimated $28.91 billion in 2025. This robust expansion is driven by several key factors, including the increasing demand for portable electronics, the growing adoption of smart home devices, and the widespread use of batteries in toys and personal care appliances. The market's upward trajectory is further bolstered by technological advancements in battery chemistry, leading to improved energy density, longer lifespan, and faster charging capabilities. Lithium-ion batteries are expected to dominate the market, owing to their superior performance and widespread application in a multitude of consumer products, from smartphones and laptops to electric toothbrushes and portable speakers. Emerging trends such as the development of more sustainable and eco-friendly battery solutions, coupled with innovations in battery management systems, are also shaping the market's future.

Europe Consumer Battery Industry Market Size (In Billion)

The industry is anticipated to witness a Compound Annual Growth Rate (CAGR) of 6.3% from 2025 to 2033, indicating a sustained period of expansion. While the market is largely driven by consumer demand for convenience and connectivity, certain restraints need to be addressed. These include fluctuating raw material prices, particularly for lithium and cobalt, which can impact manufacturing costs. Furthermore, increasing regulatory scrutiny concerning battery disposal and recycling presents both a challenge and an opportunity for companies to invest in circular economy models. Key players in the European consumer battery market, including Samsung SDI Co. Ltd., LG Chem Ltd., and Duracell Inc., are actively engaged in research and development to innovate and maintain a competitive edge, focusing on enhancing battery safety, efficiency, and recyclability. The regional market is characterized by a strong presence of established manufacturers and a growing consumer base, particularly in Western European countries.

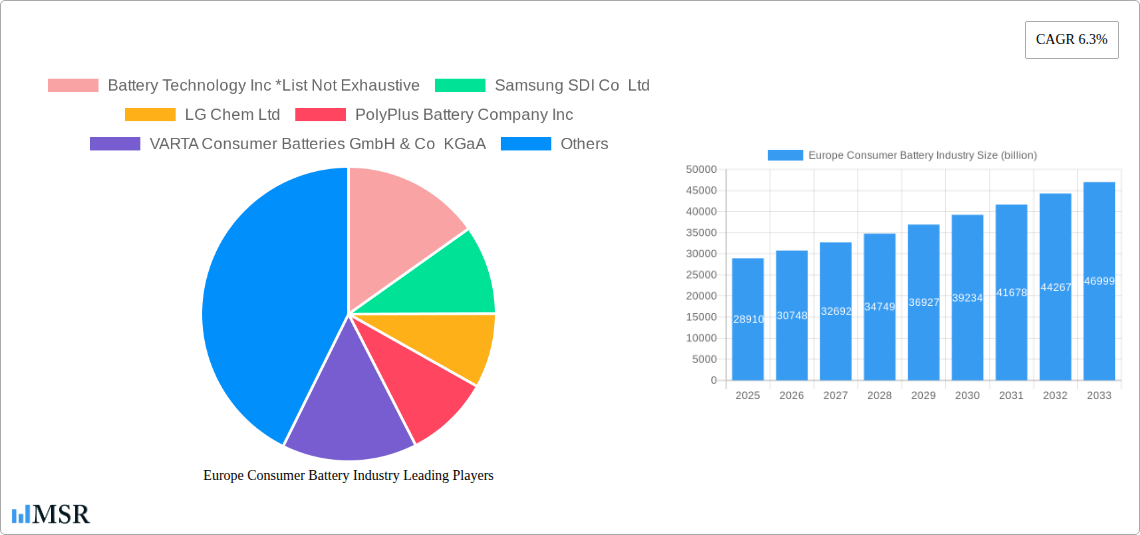

Europe Consumer Battery Industry Company Market Share

Uncover the future of the European consumer battery market with our comprehensive report, meticulously crafted for industry stakeholders. Spanning the historical period of 2019–2024 and projecting to 2033, with a base year of 2025, this report delivers critical insights into market dynamics, technological advancements, and strategic opportunities. Dive deep into the Europe Consumer Battery Industry, exploring segments like Lithium-ion, Zinc-Carbon, Alkaline, Nickel Metal Hydride, Nickel Cadmium, and Others. Discover the driving forces behind the Europe Consumer Battery Industry market growth, understand key markets and the impact of industry developments.

This in-depth analysis, covering the forecast period of 2025–2033, is essential for anyone looking to navigate and capitalize on the evolving Europe Consumer Battery Industry. We provide actionable intelligence on market concentration, competitive landscapes, and emerging trends, ensuring you stay ahead in this dynamic sector.

Europe Consumer Battery Industry Market Concentration & Dynamics

The Europe Consumer Battery Industry is characterized by a moderate level of market concentration, with a few dominant players holding significant market share, yet a substantial number of smaller and specialized companies contributing to innovation and competition. Innovation ecosystems are flourishing, particularly around advancements in Lithium-ion battery technology, driven by increased demand for portable electronics and electric vehicles. Regulatory frameworks, such as the EU Battery Regulation, are increasingly shaping the industry by focusing on sustainability, recyclability, and ethical sourcing. Substitute products, while present, have seen their market share diminish as consumer preference shifts towards higher-performance and longer-lasting battery solutions. End-user trends are overwhelmingly favoring rechargeable batteries, driven by cost savings and environmental consciousness. Mergers and acquisitions (M&A) activities are on the rise as larger companies seek to consolidate market position, acquire innovative technologies, and expand their geographic reach. For instance, there were an estimated 10-15 significant M&A deals in the Europe Consumer Battery Industry between 2021 and 2023. The market share of Lithium-ion batteries is projected to exceed 60% by 2025, while Alkaline batteries maintain a steady, albeit declining, share.

Europe Consumer Battery Industry Industry Insights & Trends

The Europe Consumer Battery Industry is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer behaviors, and supportive economic and regulatory landscapes. The estimated market size for the Europe Consumer Battery Industry is projected to reach approximately $30 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of around 5.5% during the forecast period of 2025–2033. This growth is fueled by the relentless demand for portable power solutions across a wide spectrum of applications. The proliferation of smart devices, including smartphones, laptops, wearables, and IoT devices, continues to be a primary market driver. Consumers are increasingly seeking batteries with higher energy density, faster charging capabilities, and longer lifespans, pushing manufacturers to invest heavily in research and development.

Technological disruptions are a defining feature of this market. Beyond advancements in Lithium-ion battery chemistry, such as solid-state batteries, research into alternative chemistries and improved manufacturing processes is accelerating. This includes enhancements in Alkaline and Nickel Metal Hydride technologies to offer more competitive alternatives for specific applications where cost-effectiveness and safety are paramount. The Zinc-Carbon segment, while traditionally a lower-end market, is finding niche applications where basic power is sufficient and cost is a critical factor.

Evolving consumer behaviors are also playing a crucial role. There is a growing awareness and demand for sustainable and ethically sourced products. Consumers are increasingly looking for batteries that are recyclable and have a reduced environmental footprint. This trend is influencing product design, manufacturing processes, and end-of-life management strategies within the Europe Consumer Battery Industry. The convenience of wireless charging and the demand for longer battery life in devices are pushing the boundaries of what consumers expect. Furthermore, the rise of the "prosumer" – individuals who are more engaged and informed about product specifications and environmental impact – is influencing purchasing decisions. The increasing adoption of rechargeable batteries over single-use options, driven by both economic and environmental considerations, is a significant trend. The market is also seeing a rise in the demand for specialized batteries tailored for specific applications, from medical devices to industrial equipment, further diversifying the Europe Consumer Battery Industry.

Key Markets & Segments Leading Europe Consumer Battery Industry

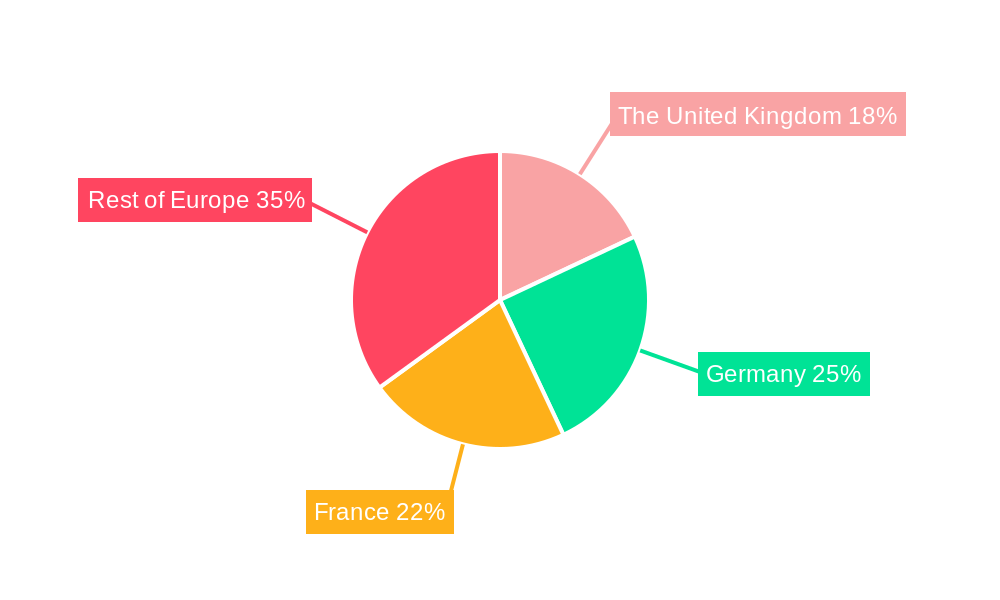

The Europe Consumer Battery Industry is witnessing leadership from specific regions and technology types, driven by diverse economic and infrastructural factors. Germany, the UK, and France consistently emerge as dominant markets due to their strong consumer electronics sectors, high disposable incomes, and advanced technological adoption rates. The Lithium-ion segment is unequivocally leading the charge in market value and growth trajectory. This dominance is underpinned by its superior energy density, rechargeability, and versatility, making it the go-to technology for virtually all modern portable electronic devices, from smartphones and laptops to power tools and electric vehicles.

Dominance Drivers for Lithium-ion:

- Technological Superiority: Higher energy density allows for smaller, lighter devices with longer operational times.

- Rechargeability & Longevity: Offers a more sustainable and cost-effective solution over the long term compared to primary batteries.

- Versatile Applications: Essential for the burgeoning electric vehicle market, consumer electronics, and growing demand for portable power solutions.

- Innovation Ecosystem: Significant R&D investment in improving charging speeds, safety, and lifespan.

- Regulatory Support: Increasingly favored by environmental regulations aimed at reducing waste.

While Lithium-ion dominates in terms of value and innovation, the Alkaline battery segment continues to hold a significant market share, particularly in regions with a strong reliance on low-cost, high-volume applications such as remote controls, toys, and basic electronic gadgets. Its widespread availability and established manufacturing infrastructure ensure its continued relevance, especially in countries with lower average disposable incomes within Europe.

The Zinc-Carbon segment, though facing intense competition, retains a presence in the most budget-conscious markets and for applications with extremely low power demands and infrequent usage. Its historical significance and low production cost make it a fallback option in specific niche markets.

Nickel Metal Hydride (NiMH) and Nickel Cadmium (NiCd) batteries, while largely superseded by Lithium-ion for many applications due to their lower energy density and "memory effect" issues, still find application in specific legacy devices or where their particular discharge characteristics are required. However, their market share is steadily declining.

The "Others" category encompasses a range of emerging and specialized battery technologies, including various primary battery chemistries designed for specific long-life, low-drain applications, and early-stage development of next-generation batteries. The growth within this category is largely driven by niche industrial applications and forward-looking R&D efforts. The overall market landscape is a complex interplay of established technologies and rapidly advancing ones, with Lithium-ion firmly at the forefront of Europe Consumer Battery Industry growth.

Europe Consumer Battery Industry Product Developments

Product developments in the Europe Consumer Battery Industry are sharply focused on enhancing energy density, improving charging speeds, and extending lifespan. Manufacturers are innovating Lithium-ion chemistries, such as NMC (Nickel Manganese Cobalt) and NCA (Nickel Cobalt Aluminum), to deliver more power for longer durations in devices. Solid-state battery technology, promising enhanced safety and even higher energy density, is a key area of research and development, with initial market entries anticipated within the forecast period. Beyond Lithium-ion, advancements in Alkaline battery technology are focusing on reducing self-discharge rates and improving performance in cold temperatures. The market relevance is directly tied to addressing consumer demand for convenience, sustainability, and reliable power for an ever-expanding range of electronic devices. Competitive advantages are being carved out through innovations in battery management systems (BMS) that optimize performance and safety, as well as through more sustainable manufacturing and recycling processes.

Challenges in the Europe Consumer Battery Industry Market

The Europe Consumer Battery Industry faces several significant challenges that impact its growth and operational efficiency. Regulatory hurdles are a primary concern, with stringent environmental regulations regarding battery production, recycling, and disposal requiring substantial investment in compliance and sustainable practices. Supply chain disruptions, exacerbated by geopolitical factors and the concentration of raw material sourcing, present ongoing risks. For instance, fluctuations in the price of lithium and cobalt can significantly impact production costs, potentially increasing the price of batteries by an estimated 5-10% in volatile periods. Furthermore, intense competitive pressures from both established global players and emerging manufacturers, particularly from Asia, necessitate continuous innovation and cost optimization to maintain market share. The challenge of developing truly circular economy models for batteries, ensuring high recycling rates and minimizing environmental impact, also remains a critical hurdle.

Forces Driving Europe Consumer Battery Industry Growth

The Europe Consumer Battery Industry is propelled by several potent growth forces that underscore its expanding market potential. The ubiquitous demand for portable power across a rapidly increasing array of consumer electronics, including smartphones, laptops, wearables, and IoT devices, forms a fundamental driver. Technological advancements in battery chemistry, particularly the ongoing improvements in Lithium-ion technology, are enabling higher energy densities, faster charging, and longer lifespans, directly meeting consumer expectations. Supportive regulatory frameworks, such as those promoting electric mobility and sustainable energy solutions, are further incentivizing battery development and adoption. The economic growth and increasing disposable income in key European markets also translate to higher consumer spending on electronic devices, and consequently, on the batteries that power them.

Challenges in the Europe Consumer Battery Industry Market

Long-term growth catalysts in the Europe Consumer Battery Industry are intricately linked to innovation and market expansion. The continuous pursuit of next-generation battery technologies, such as solid-state batteries, promises significant leaps in safety, energy density, and charging speeds, opening up entirely new application possibilities. Strategic partnerships between battery manufacturers, device makers, and raw material suppliers are crucial for securing supply chains and fostering collaborative R&D. Expanding into emerging markets within Europe that are still in the nascent stages of consumer electronics adoption presents a significant avenue for growth. Furthermore, the development of advanced battery recycling infrastructure and the establishment of a truly circular economy for batteries will not only address environmental concerns but also create new revenue streams and reduce reliance on virgin raw materials, solidifying long-term sustainable growth for the Europe Consumer Battery Industry.

Emerging Opportunities in Europe Consumer Battery Industry

Emerging opportunities in the Europe Consumer Battery Industry are diverse and promise to reshape the market landscape. The escalating demand for batteries in the electric vehicle (EV) sector, even for consumer-facing smaller EVs and e-bikes, represents a substantial growth frontier. The burgeoning Internet of Things (IoT) market, with its vast network of connected devices requiring reliable and long-lasting power sources, presents another significant opportunity. Advancements in battery recycling technologies and the establishment of a robust circular economy are creating opportunities for companies focused on sustainability and resource recovery. Furthermore, the increasing consumer preference for smart home devices and wearable technology continues to drive demand for compact, high-performance batteries. Innovations in battery-as-a-service models and energy storage solutions for residential use also present emerging avenues for market expansion and revenue generation within the Europe Consumer Battery Industry.

Leading Players in the Europe Consumer Battery Industry Sector

- Battery Technology Inc

- Samsung SDI Co Ltd

- LG Chem Ltd

- PolyPlus Battery Company Inc

- VARTA Consumer Batteries GmbH & Co KGaA

- Jiangmen TWD Technology Co Ltd

- TianJin Lishen Battery Joint-Stock CO LTD

- GS Yuasa Corporation

- Duracell Inc

- Maxell Holdings Ltd

Key Milestones in Europe Consumer Battery Industry Industry

- 2020: VARTA Consumer Batteries GmbH & Co KGaA launches its new generation of high-performance Alkaline batteries, boosting performance by an estimated 10%.

- 2021: LG Chem Ltd announces significant investment in solid-state battery research, aiming for commercialization by 2027.

- 2022: Duracell Inc introduces its extended-life AA and AAA batteries, extending product lifespan by an estimated 20% in key applications.

- 2023: The EU Battery Regulation proposal gains momentum, setting stricter targets for recycling and sustainability, impacting manufacturing processes across the board.

- 2023: Samsung SDI Co Ltd unveils advancements in nickel-rich cathode materials for Lithium-ion batteries, promising increased energy density for electric vehicles.

- 2024: GS Yuasa Corporation announces strategic partnerships to secure raw material supply chains for Lithium-ion battery production in Europe.

- 2024: PolyPlus Battery Company Inc demonstrates breakthroughs in its Lithium-Air battery technology, though still in early development.

Strategic Outlook for Europe Consumer Battery Industry Market

The strategic outlook for the Europe Consumer Battery Industry is one of robust and sustained growth, driven by technological innovation, expanding applications, and a strong focus on sustainability. Key growth accelerators will include continued advancements in Lithium-ion battery technology, leading to higher energy densities and faster charging times, crucial for the burgeoning electric vehicle and portable electronics markets. The increasing emphasis on circular economy principles and battery recycling will not only drive regulatory compliance but also present opportunities for new business models. Strategic investments in European-based manufacturing and R&D will be critical for companies to mitigate supply chain risks and capitalize on growing regional demand. The market is set for significant expansion, with companies that can offer high-performance, sustainable, and cost-effective battery solutions poised to capture the largest share of this dynamic and evolving sector.

Europe Consumer Battery Industry Segmentation

-

1. Technology Type

- 1.1. Lithium-ion

- 1.2. Zinc-Carbon

- 1.3. Alkaline

- 1.4. Nickel Metal Hydride

- 1.5. Nickel Cadmium

- 1.6. Others

Europe Consumer Battery Industry Segmentation By Geography

- 1. The United Kingdom

- 2. Germany

- 3. France

- 4. Rest of Europe

Europe Consumer Battery Industry Regional Market Share

Geographic Coverage of Europe Consumer Battery Industry

Europe Consumer Battery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Policies4.; Reduced Cost of Solar Energy Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Financing Options Coupled with Difficulties in Integrating Residential Solar PV Systems in Regions like Africa

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Consumer Battery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 5.1.1. Lithium-ion

- 5.1.2. Zinc-Carbon

- 5.1.3. Alkaline

- 5.1.4. Nickel Metal Hydride

- 5.1.5. Nickel Cadmium

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. The United Kingdom

- 5.2.2. Germany

- 5.2.3. France

- 5.2.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 6. The United Kingdom Europe Consumer Battery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 6.1.1. Lithium-ion

- 6.1.2. Zinc-Carbon

- 6.1.3. Alkaline

- 6.1.4. Nickel Metal Hydride

- 6.1.5. Nickel Cadmium

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 7. Germany Europe Consumer Battery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 7.1.1. Lithium-ion

- 7.1.2. Zinc-Carbon

- 7.1.3. Alkaline

- 7.1.4. Nickel Metal Hydride

- 7.1.5. Nickel Cadmium

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 8. France Europe Consumer Battery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 8.1.1. Lithium-ion

- 8.1.2. Zinc-Carbon

- 8.1.3. Alkaline

- 8.1.4. Nickel Metal Hydride

- 8.1.5. Nickel Cadmium

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 9. Rest of Europe Europe Consumer Battery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 9.1.1. Lithium-ion

- 9.1.2. Zinc-Carbon

- 9.1.3. Alkaline

- 9.1.4. Nickel Metal Hydride

- 9.1.5. Nickel Cadmium

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Battery Technology Inc *List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Samsung SDI Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 LG Chem Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PolyPlus Battery Company Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 VARTA Consumer Batteries GmbH & Co KGaA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Jiangmen TWD Technology Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 TianJin Lishen Battery Joint-Stock CO LTD

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 GS Yuasa Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Duracell Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Maxell Holdings Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Battery Technology Inc *List Not Exhaustive

List of Figures

- Figure 1: Europe Consumer Battery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Consumer Battery Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Consumer Battery Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 2: Europe Consumer Battery Industry Volume K Units Forecast, by Technology Type 2020 & 2033

- Table 3: Europe Consumer Battery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Consumer Battery Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 5: Europe Consumer Battery Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 6: Europe Consumer Battery Industry Volume K Units Forecast, by Technology Type 2020 & 2033

- Table 7: Europe Consumer Battery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Europe Consumer Battery Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 9: Europe Consumer Battery Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 10: Europe Consumer Battery Industry Volume K Units Forecast, by Technology Type 2020 & 2033

- Table 11: Europe Consumer Battery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Consumer Battery Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Europe Consumer Battery Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 14: Europe Consumer Battery Industry Volume K Units Forecast, by Technology Type 2020 & 2033

- Table 15: Europe Consumer Battery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Consumer Battery Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Europe Consumer Battery Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 18: Europe Consumer Battery Industry Volume K Units Forecast, by Technology Type 2020 & 2033

- Table 19: Europe Consumer Battery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Europe Consumer Battery Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Consumer Battery Industry?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Europe Consumer Battery Industry?

Key companies in the market include Battery Technology Inc *List Not Exhaustive, Samsung SDI Co Ltd, LG Chem Ltd, PolyPlus Battery Company Inc, VARTA Consumer Batteries GmbH & Co KGaA, Jiangmen TWD Technology Co Ltd, TianJin Lishen Battery Joint-Stock CO LTD, GS Yuasa Corporation, Duracell Inc, Maxell Holdings Ltd.

3. What are the main segments of the Europe Consumer Battery Industry?

The market segments include Technology Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.91 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Policies4.; Reduced Cost of Solar Energy Systems.

6. What are the notable trends driving market growth?

Lithium-ion Battery to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Lack of Financing Options Coupled with Difficulties in Integrating Residential Solar PV Systems in Regions like Africa.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Consumer Battery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Consumer Battery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Consumer Battery Industry?

To stay informed about further developments, trends, and reports in the Europe Consumer Battery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence