Key Insights

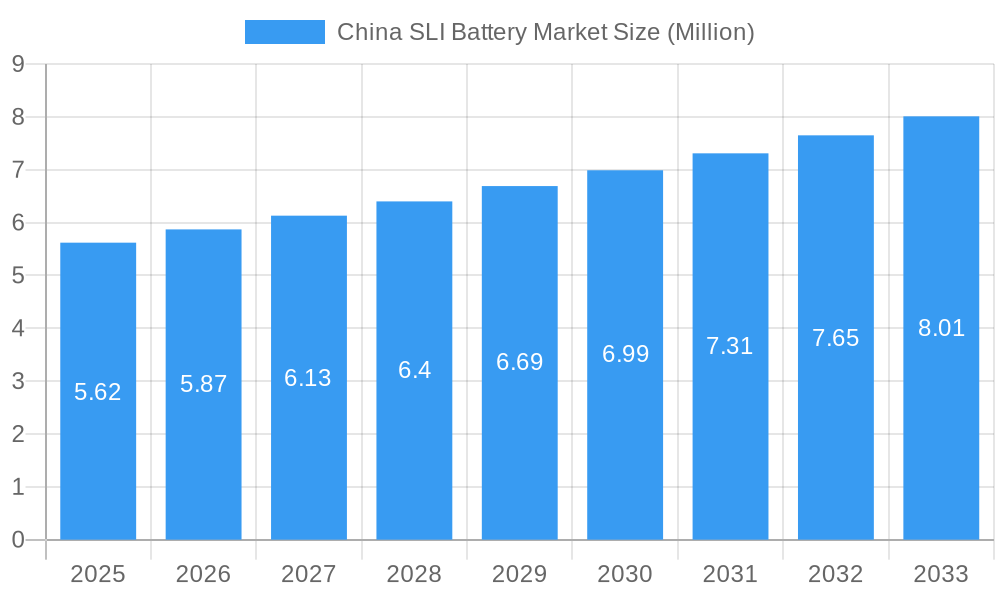

The China SLI (Starting, Lighting, Ignition) battery market is poised for robust expansion, with a current market size of approximately USD 5.62 billion in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 4.46% through 2033. This growth is primarily fueled by the sustained demand for new vehicles, a significant increase in automotive production and sales within China, and the continuous evolution of automotive technologies that necessitate reliable power solutions. The increasing adoption of advanced automotive features, such as sophisticated infotainment systems, driver-assistance technologies, and more powerful lighting systems, directly translates into a higher demand for high-performance SLI batteries. Furthermore, the burgeoning aftermarket for vehicle maintenance and replacement parts plays a crucial role in sustaining this market's upward trajectory. The market is also witnessing a shift towards more advanced battery chemistries and designs, driven by the need for enhanced durability, longer service life, and improved performance under diverse environmental conditions.

China SLI Battery Market Market Size (In Million)

The market segmentation reveals a dynamic landscape. VRLA (Valve Regulated Lead-Acid) batteries are expected to dominate the market due to their superior performance, low maintenance requirements, and cost-effectiveness, making them the preferred choice for a wide array of automotive applications. Flooded batteries will continue to hold a significant share, especially in the more budget-conscious segments of the automotive market. While the "Other End Users" segment, encompassing applications beyond traditional automotive, is showing promising growth, the automotive sector remains the primary driver of SLI battery demand. Key players like CATL, Gotion Inc., and GS Yuasa International Ltd. are at the forefront of innovation, investing heavily in research and development to meet the evolving needs of the automotive industry. However, challenges such as the increasing complexity of battery management systems and the fluctuating prices of raw materials like lead could present some headwinds to sustained, rapid growth.

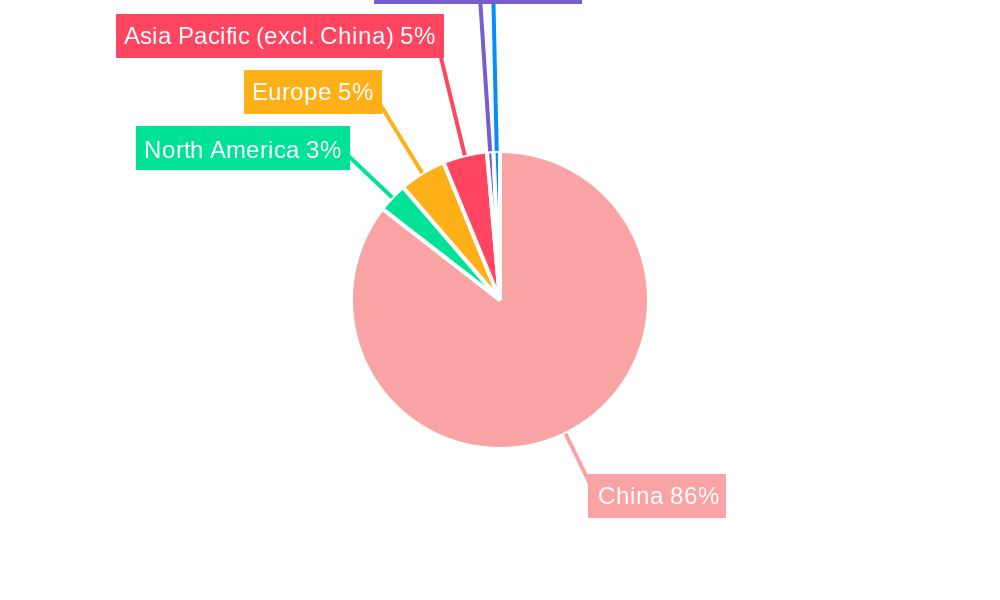

China SLI Battery Market Company Market Share

China SLI Battery Market Analysis 2019-2033: Dominance, Innovation, and Future Growth Drivers

Gain unparalleled insights into the dynamic China SLI (Starting, Lighting, Ignition) battery market with this comprehensive report. Covering a study period from 2019 to 2033, with a base year of 2025, this analysis delves into market concentration, industry trends, segmentation, product developments, challenges, growth drivers, emerging opportunities, leading players, and key milestones. This report is your definitive guide to understanding the current landscape and future trajectory of the China SLI battery market, essential for automotive battery suppliers, industrial battery manufacturers, lead-acid battery producers, and energy storage solution providers.

China SLI Battery Market Market Concentration & Dynamics

The China SLI battery market exhibits a moderate to high concentration, with a few dominant players holding significant market share, while a substantial number of smaller manufacturers cater to specific regional demands. Innovation ecosystems are rapidly evolving, driven by increasing demand for higher energy density, longer lifespan, and improved performance in SLI batteries. Regulatory frameworks, while evolving, are increasingly focused on environmental compliance and battery recycling, impacting manufacturing processes and material sourcing. Substitute products, such as lithium-ion batteries, are gaining traction in certain niche applications, but the cost-effectiveness and established infrastructure of lead-acid SLI batteries continue to maintain their stronghold. End-user trends are heavily influenced by the burgeoning automotive sector, with a growing demand for reliable and efficient starting power for both traditional internal combustion engine vehicles and the burgeoning electric vehicle (EV) market's auxiliary power needs. Mergers and acquisitions (M&A) activities are on the rise as larger companies seek to consolidate their market position and acquire advanced technologies. For instance, recent years have seen several strategic alliances aimed at enhancing production capacity and research & development capabilities in the China battery market. The market share analysis reveals that major players are continuously investing in upgrading their production lines and expanding their product portfolios to meet diverse customer requirements. The M&A deal count is projected to increase as companies strategically position themselves for future growth and competition.

China SLI Battery Market Industry Insights & Trends

The China SLI battery market is projected to witness robust growth, with an estimated market size of approximately USD 5,500 Million in the base year 2025, and is poised for significant expansion, reaching an estimated USD 7,200 Million by 2033. This impressive growth trajectory translates to a Compound Annual Growth Rate (CAGR) of approximately 3.5% over the forecast period (2025-2033). Key growth drivers include the sustained expansion of the Chinese automotive industry, which remains a primary consumer of SLI batteries, even with the rise of electric vehicles, as traditional vehicles continue to dominate the existing fleet and require reliable starting power. The increasing adoption of advanced battery technologies, such as enhanced flooded batteries and Valve Regulated Lead-Acid (VRLA) batteries with improved cycle life and reliability, is also fueling market expansion. Furthermore, evolving consumer behaviors, characterized by a preference for longer-lasting and maintenance-free battery solutions, are pushing manufacturers to innovate. Technological disruptions, particularly in battery chemistry and design, are leading to the development of more efficient and environmentally friendly SLI batteries. The report details how advancements in materials science and manufacturing processes are enhancing the performance characteristics of both Flooded Battery and VRLA Battery segments. The integration of smart battery management systems is also a growing trend, providing users with real-time performance data and predictive maintenance capabilities. The demand for high-performance SLI batteries for commercial vehicles, heavy-duty trucks, and off-road machinery also contributes significantly to the market's upward trend. The increasing focus on battery recycling and sustainable manufacturing practices is also shaping industry trends, with companies investing in greener production methods and closed-loop recycling systems. The historical period (2019-2024) showcased a steady increase in demand, setting a strong foundation for the forecasted growth.

Key Markets & Segments Leading China SLI Battery Market

The automotive segment is unequivocally the dominant force driving the China SLI battery market. This dominance is underpinned by several key factors, including the sheer volume of vehicles manufactured and operating within China, which boasts the world's largest automotive market. The continued prevalence of internal combustion engine (ICE) vehicles, alongside the auxiliary power requirements of electric vehicles (EVs), ensures a sustained demand for SLI batteries.

- Automotive End User Dominance:

- Economic Growth & Vehicle Production: China's robust economic growth fuels consistent vehicle production and sales, directly translating to a higher demand for SLI batteries.

- Fleet Size: The vast existing fleet of ICE vehicles requires regular battery replacement, creating a perpetual replacement market.

- EV Auxiliary Power: Even in EVs, SLI batteries are crucial for powering essential vehicle functions when the main traction battery is offline or for starting the vehicle.

- Micro-vehicle and Scooter Market: The burgeoning market for micro-vehicles and scooters, often powered by smaller lead-acid batteries, represents a significant volume driver.

Beyond the automotive sector, Other End Users also contribute to the market's breadth, albeit to a lesser extent. This includes applications in:

- Backup Power Systems: For telecommunications, data centers, and critical infrastructure, where reliable backup power is paramount.

- Industrial Equipment: Powering forklifts, sweepers, and other industrial machinery.

- Recreational Vehicles (RVs) and Marine Applications: Providing starting and auxiliary power for these specialized vehicles.

Within the Type segment, the Flooded Battery segment continues to hold a significant share due to its cost-effectiveness and proven reliability in a wide range of applications. However, the VRLA Battery segment is experiencing rapid growth, driven by demand for enhanced performance, maintenance-free operation, and superior deep cycling capabilities, making them increasingly preferred for modern vehicles and backup power solutions. The EBF Battery (Enhanced Flooded Battery) is also gaining traction as a performance-oriented evolution of traditional flooded batteries.

China SLI Battery Market Product Developments

Product development in the China SLI battery market is focused on enhancing performance, extending lifespan, and improving environmental sustainability. Innovations include the introduction of enhanced flooded batteries (EFBs) and absorbed glass mat (AGM) VRLA batteries that offer superior starting power and deep cycling capabilities, crucial for vehicles with start-stop technology and higher electrical demands. Manufacturers are also investing in advanced lead alloys and paste formulations to reduce self-discharge rates and improve charge acceptance. The integration of smart battery technology, enabling real-time monitoring and diagnostics, is another key development, offering end-users greater control and predictive maintenance insights. These advancements aim to address the evolving needs of the automotive sector and other industrial applications, providing a competitive edge in a rapidly changing market.

Challenges in the China SLI Battery Market Market

The China SLI battery market faces several significant challenges that can impede growth and profitability. Stringent environmental regulations and the increasing cost of lead, a primary raw material, pose substantial operational hurdles for manufacturers. The highly competitive landscape, characterized by numerous players, can lead to price wars and compressed profit margins. Supply chain disruptions, particularly concerning raw materials and components, can impact production schedules and increase costs. Furthermore, the growing adoption of lithium-ion batteries in niche automotive applications and energy storage systems presents a long-term competitive threat, necessitating continuous innovation and cost optimization for lead-acid SLI batteries.

Forces Driving China SLI Battery Market Growth

The China SLI battery market is propelled by several potent growth forces. The continuous expansion of the automotive industry, both in terms of new vehicle sales and the vast existing fleet, remains the primary driver. Technological advancements in battery chemistry and manufacturing processes are leading to the development of more efficient, durable, and reliable SLI batteries. Government initiatives promoting vehicle ownership and infrastructure development indirectly boost demand. Furthermore, the increasing demand for backup power solutions in telecommunications, data centers, and other critical sectors provides a significant secondary growth avenue. The cost-effectiveness and established recycling infrastructure of lead-acid batteries also continue to make them a preferred choice for many applications.

Challenges in the China SLI Battery Market Market

The China SLI battery market is poised for sustained long-term growth driven by several key catalysts. Ongoing research and development in lead-acid battery technology are leading to incremental improvements in performance, cycle life, and energy efficiency, ensuring their continued relevance. The global push towards electrification, while posing a long-term challenge, also presents opportunities for SLI batteries to power auxiliary systems in electric vehicles. Strategic partnerships and collaborations between battery manufacturers, automotive OEMs, and raw material suppliers are fostering innovation and streamlining production. Market expansion into emerging economies within Asia and Africa, where cost-effective and reliable SLI batteries are in high demand, also represents a significant long-term growth opportunity.

Emerging Opportunities in China SLI Battery Market

Emerging opportunities in the China SLI battery market lie in the development of advanced lead-acid battery technologies that can compete more effectively with emerging alternatives. This includes the exploration of hybrid battery solutions and the optimization of EBF and AGM technologies for enhanced performance. The growing demand for industrial batteries in expanding sectors like logistics and e-commerce presents a significant opportunity. Furthermore, a strong focus on sustainable manufacturing and the circular economy, including enhanced recycling processes and the development of batteries with a higher percentage of recycled content, can unlock new market segments and appeal to environmentally conscious consumers and businesses.

Leading Players in the China SLI Battery Market Sector

- GS Yuasa International Ltd

- Tianneng Battery Group Co

- Leoch International Technology Limited Inc

- Contemporary Amperex Technology Co Limited

- Gotion Inc

- Farasis Energy (GanZhou) Co Ltd

- Clarios International Inc

- Guangzhou NPP Power Co Ltd

- Qingyuan Yiyuan Power Supply Co Ltd

- EVE Energy Co Ltd

- Narada Power

Key Milestones in China SLI Battery Market Industry

- March 2024: Narada Power secured a USD 45 million contract from China Tower for VRLA batteries, highlighting the demand for reliable backup power systems.

- January 2024: BYD initiated the construction of a new battery facility in Xuzhou, China, with an investment of USD 1.4 billion and an annual capacity of 30 GWh, targeting micro vehicles and scooters.

Strategic Outlook for China SLI Battery Market Market

The strategic outlook for the China SLI battery market is characterized by a strong emphasis on technological innovation, cost optimization, and market diversification. Manufacturers will continue to invest in R&D to enhance the performance and lifespan of lead-acid batteries, particularly focusing on advanced EBF and AGM technologies. Expanding product portfolios to cater to the evolving needs of the automotive sector, including the auxiliary power requirements of EVs, will be critical. Furthermore, exploring opportunities in the industrial battery segment and in emerging international markets will be key growth accelerators. A commitment to sustainable manufacturing practices and robust recycling initiatives will also be crucial for long-term success and regulatory compliance.

China SLI Battery Market Segmentation

-

1. Type

- 1.1. Flooded Battery

- 1.2. VRLA Battery

- 1.3. EBF Battery

-

2. End User

- 2.1. Automotive

- 2.2. Other End Users

China SLI Battery Market Segmentation By Geography

- 1. China

China SLI Battery Market Regional Market Share

Geographic Coverage of China SLI Battery Market

China SLI Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Automotive Industry4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Automotive Industry4.; Supportive Government Policies

- 3.4. Market Trends

- 3.4.1. VRLA Battery to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China SLI Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flooded Battery

- 5.1.2. VRLA Battery

- 5.1.3. EBF Battery

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GS Yuasa International Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tianneng Battery Group Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Leoch International Technology Limited Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Contemporary Amperex Technology Co Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gotion Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Farasis Energy (GanZhou) Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Clarios International Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Guangzhou NPP Power Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qingyuan Yiyuan Power Supply Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EVE Energy Co Ltd*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GS Yuasa International Ltd

List of Figures

- Figure 1: China SLI Battery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China SLI Battery Market Share (%) by Company 2025

List of Tables

- Table 1: China SLI Battery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China SLI Battery Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: China SLI Battery Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: China SLI Battery Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: China SLI Battery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China SLI Battery Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: China SLI Battery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: China SLI Battery Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: China SLI Battery Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: China SLI Battery Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: China SLI Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China SLI Battery Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China SLI Battery Market?

The projected CAGR is approximately 4.46%.

2. Which companies are prominent players in the China SLI Battery Market?

Key companies in the market include GS Yuasa International Ltd, Tianneng Battery Group Co, Leoch International Technology Limited Inc, Contemporary Amperex Technology Co Limited, Gotion Inc, Farasis Energy (GanZhou) Co Ltd, Clarios International Inc, Guangzhou NPP Power Co Ltd, Qingyuan Yiyuan Power Supply Co Ltd, EVE Energy Co Ltd*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi.

3. What are the main segments of the China SLI Battery Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.62 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Automotive Industry4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

VRLA Battery to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Growing Automotive Industry4.; Supportive Government Policies.

8. Can you provide examples of recent developments in the market?

March 2024: Narada Power secured a USD 45 million contract from China Tower for VRLA batteries. This deal focuses on providing backup power systems to the state-owned telecoms giant. Narada emphasized that this contract highlights the strategic importance of its collaborative lead battery chemistry development, which is tailored for a diverse set of industrial applications, including SLI.January 2024: Chinese automotive giant BYD initiated the construction of a new battery facility in Xuzhou, China. With an impressive investment of USD 1.4 billion, this facility is set to boast an annual capacity of 30 gigawatt-hours (GWh). The batteries manufactured here are earmarked for automotive use, specifically targeting micro vehicles and scooters. BYD's subsidiary, Findreams Battery, and tricycle manufacturer Huaihai Group inked the agreement for this venture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China SLI Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China SLI Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China SLI Battery Market?

To stay informed about further developments, trends, and reports in the China SLI Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence