Key Insights

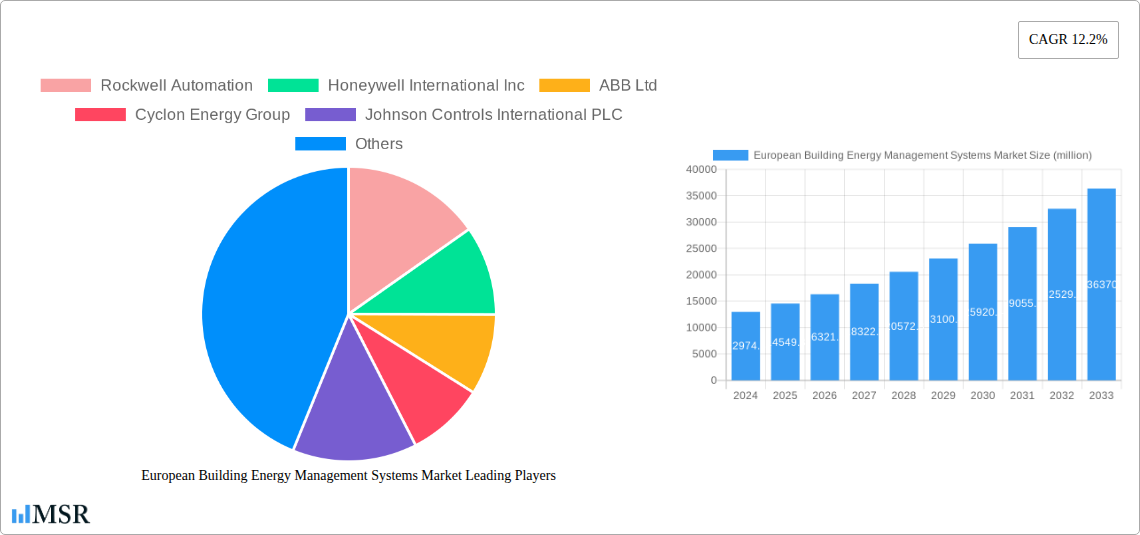

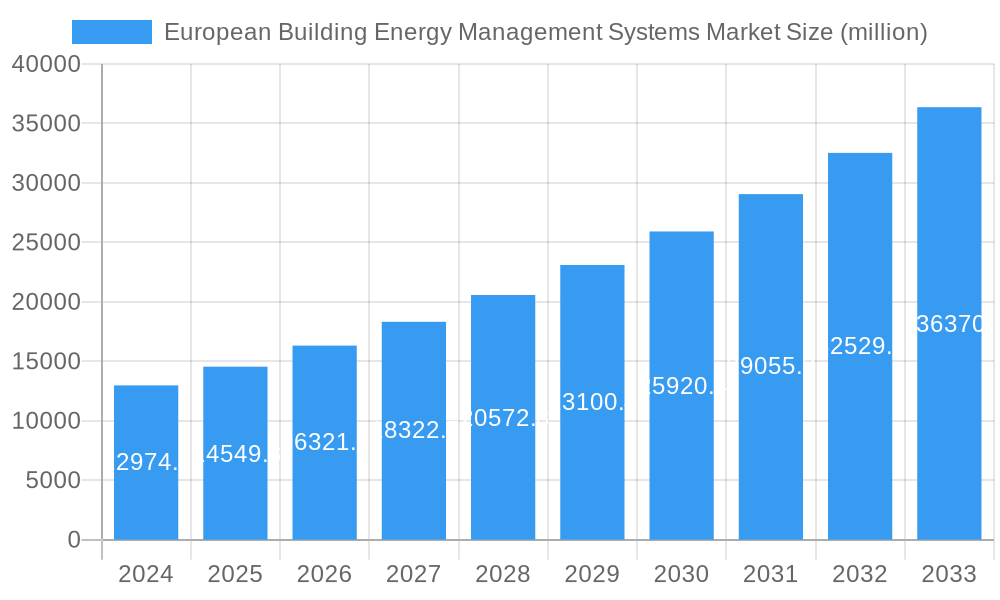

The European Building Energy Management Systems (BEMS) market is poised for substantial growth, driven by escalating energy costs, stringent environmental regulations, and the increasing demand for smart and sustainable buildings. With an estimated market size of $12,974.6 million in 2024, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 12.2% through 2033. This robust expansion is fueled by the widespread adoption of software solutions, which enable sophisticated monitoring, control, and optimization of energy consumption within buildings. The hardware component, including sensors, smart meters, and actuators, is also critical in facilitating these advanced functionalities, ensuring that both new constructions and retrofitted older buildings can leverage BEMS effectively. The residential sector is witnessing a significant surge in interest, as homeowners become more conscious of their energy footprints and the financial benefits of reduced consumption. Simultaneously, commercial and industrial sectors are increasingly integrating BEMS to meet corporate sustainability goals and achieve operational efficiencies.

European Building Energy Management Systems Market Market Size (In Billion)

The European market's trajectory is heavily influenced by key drivers such as government initiatives promoting energy efficiency and carbon reduction, coupled with technological advancements in IoT and AI, which are enhancing the capabilities of BEMS. These systems are becoming more intelligent, offering predictive analytics and automated responses to optimize energy usage based on occupancy, weather forecasts, and real-time energy prices. While the market is experiencing strong growth, certain restraints, such as the high initial investment costs for some advanced BEMS solutions and the need for skilled professionals for installation and maintenance, could pose challenges. However, the long-term benefits in terms of energy savings, reduced operational expenses, and improved environmental performance are widely recognized, making BEMS a crucial investment for the future of sustainable building management across Europe. Leading companies like Siemens AG, Schneider Electric SE, and Honeywell International Inc. are at the forefront, innovating and expanding their offerings to meet this dynamic market demand.

European Building Energy Management Systems Market Company Market Share

Unlock significant growth opportunities within the burgeoning European Building Energy Management Systems (BEMS) market. This comprehensive report, spanning the historical period of 2019-2024 and forecasting to 2033 with a 2025 base and estimated year, delivers actionable intelligence for industry stakeholders. Discover key market dynamics, emerging trends, and competitive landscapes shaping the future of energy efficiency in European buildings. The European Building Energy Management Systems market is poised for robust expansion, driven by stringent environmental regulations, increasing energy costs, and a growing awareness of the need for sustainable building operations. This report is your essential guide to navigating this dynamic sector.

The global building energy management market is experiencing a paradigm shift, with Europe at the forefront of adopting advanced BEMS solutions. This report delves deep into the intricacies of the European BEMS market, providing crucial insights into market size, growth projections, and the competitive forces at play. With the smart building market rapidly evolving, understanding the nuances of BEMS deployment and adoption is critical for success.

European Building Energy Management Systems Market Market Concentration & Dynamics

The European Building Energy Management Systems market exhibits a moderate to high market concentration, with key players like Siemens AG, Schneider Electric SE, Johnson Controls International PLC, and Honeywell International Inc. dominating a significant share. The innovation ecosystem is characterized by continuous advancements in IoT integration, AI-driven analytics, and cloud-based platforms. Regulatory frameworks, such as the EU’s Energy Performance of Buildings Directive (EPBD), are a primary catalyst, mandating higher energy efficiency standards and encouraging BEMS adoption. Substitute products, while present in the form of basic automation systems, lack the comprehensive optimization capabilities of advanced BEMS. End-user trends reveal a strong preference for solutions that offer cost savings, enhanced occupant comfort, and reduced environmental impact. Mergers and acquisitions (M&A) activities are moderately frequent, indicating strategic consolidation and expansion efforts by leading companies seeking to broaden their portfolios and market reach. For instance, approximately 15-20 M&A deals have been observed annually in the broader building automation space, with a growing focus on BEMS capabilities. The estimated market share of the top 5 players is expected to be around 55-65% by 2025.

European Building Energy Management Systems Market Industry Insights & Trends

The European Building Energy Management Systems market is experiencing significant growth, projected to reach an estimated XXX million Euros by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is fueled by a confluence of factors, including escalating energy prices, increasing environmental consciousness among building owners and occupants, and government mandates for energy efficiency improvements. Technological disruptions are a major trend, with the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) revolutionizing how buildings are managed. AI algorithms are enabling predictive maintenance, optimizing HVAC systems in real-time, and personalizing occupant comfort, thereby reducing energy wastage. IoT devices provide granular data on energy consumption across various building components, allowing for more precise analysis and control. Evolving consumer behaviors, particularly a heightened demand for sustainable and healthy living and working environments, are also pushing the adoption of BEMS. Building owners are recognizing BEMS not just as a cost-saving measure but as a value-added feature that enhances property appeal and occupant well-being. The increasing digitalization of the building sector, coupled with the drive towards smart cities and sustainable urban development, further solidifies the market's upward trajectory. The demand for data-driven insights and proactive energy management solutions is paramount, making BEMS an indispensable tool for modern building operations. The market is also witnessing a surge in demand for integrated solutions that combine energy management with security, comfort, and operational efficiency.

Key Markets & Segments Leading European Building Energy Management Systems Market

The Commercial segment is currently the dominant force in the European Building Energy Management Systems market, driven by significant investments in energy efficiency upgrades within office buildings, retail spaces, and hospitality establishments. Factors such as high operational costs, the need for compliance with stringent energy performance regulations, and the desire to enhance tenant comfort and productivity are key drivers for BEMS adoption in this sector.

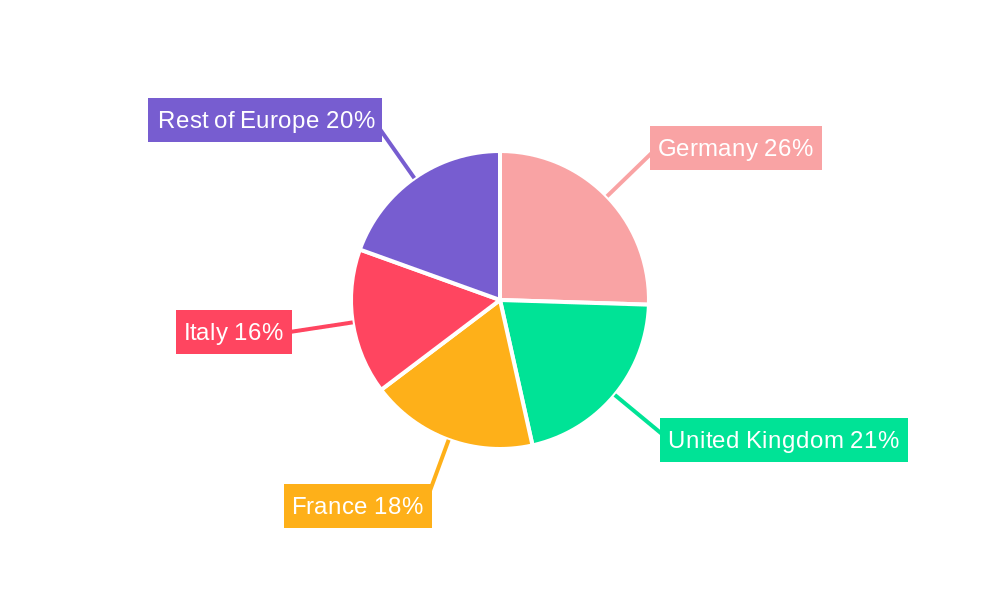

- Dominant Region: Western Europe, particularly countries like Germany, the UK, France, and the Netherlands, leads the market due to mature economies, strong regulatory frameworks, and a high concentration of commercial and industrial infrastructure.

- Dominant Segment (Deployment): Commercial

- Drivers: High energy consumption in office buildings and retail outlets, stringent energy performance mandates, desire for operational cost reduction, focus on occupant comfort and productivity, and increasing adoption of smart building technologies.

- Detailed Dominance Analysis: Commercial buildings, accounting for an estimated XX% of the total market revenue in the base year of 2025, benefit from economies of scale in BEMS implementation. Large commercial spaces offer substantial energy savings potential, making the return on investment (ROI) for BEMS solutions more attractive. The presence of sophisticated building management teams and a greater willingness to invest in advanced technologies further solidify the commercial segment's leadership.

- Dominant Segment (Type): Software

- Drivers: Increasing sophistication of BEMS platforms, growing adoption of cloud-based solutions, demand for advanced analytics and reporting, integration capabilities with other building systems (HVAC, lighting, security), and the development of AI-powered optimization features.

- Detailed Dominance Analysis: The software component of BEMS is crucial for data analysis, control, and optimization. As buildings become more interconnected, the demand for intelligent software that can process vast amounts of data from various sensors and devices to drive energy savings is paramount. Cloud-based software solutions offer scalability, remote access, and easier integration, making them highly attractive to building owners and facility managers. The estimated market share for BEMS software is expected to reach XX% of the total market by 2025.

- Emerging Segments: The Residential segment is showing promising growth, driven by the increasing adoption of smart home technologies and a growing consumer awareness of energy conservation. The Industrial segment, while mature in its adoption of automation, is increasingly integrating BEMS for enhanced process efficiency and predictive maintenance, particularly in manufacturing and data center operations.

European Building Energy Management Systems Market Product Developments

Recent product developments in the European Building Energy Management Systems market are focused on enhancing interoperability, intelligence, and user-friendliness. Manufacturers are integrating advanced AI and machine learning algorithms to enable predictive analytics, automated fault detection, and optimized energy consumption based on real-time occupancy and external weather conditions. The development of modular and scalable BEMS solutions, often cloud-based, allows for easier integration with existing building infrastructure and provides flexibility for future upgrades. Emphasis is also being placed on user interfaces that offer intuitive control and comprehensive reporting dashboards, empowering facility managers with actionable insights. The cybersecurity of BEMS platforms is another critical area of development, ensuring the protection of sensitive building data and operational integrity.

Challenges in the European Building Energy Management Systems Market Market

Despite the robust growth, the European Building Energy Management Systems market faces several challenges. High upfront investment costs for sophisticated BEMS solutions can be a barrier for smaller building owners or those with limited capital. Lack of skilled personnel to install, operate, and maintain complex BEMS can hinder widespread adoption. Fragmented regulatory landscapes across different European countries, while generally pushing for efficiency, can create complexities in compliance for multinational corporations. Interoperability issues between different vendors' systems and legacy building infrastructure can also pose integration challenges. Furthermore, data security and privacy concerns surrounding the vast amounts of data collected by BEMS need to be addressed effectively to build trust among stakeholders. The supply chain for critical hardware components can also be subject to disruptions, impacting project timelines and costs.

Forces Driving European Building Energy Management Systems Market Growth

Several key forces are propelling the growth of the European Building Energy Management Systems market. Stringent government regulations and policies aimed at reducing carbon emissions and improving building energy performance are paramount. The increasing cost of energy, both electricity and gas, incentivizes building owners to invest in solutions that reduce consumption and operational expenses. Technological advancements, particularly in IoT, AI, and cloud computing, are making BEMS more powerful, accessible, and cost-effective. A growing environmental consciousness and corporate social responsibility initiatives are driving demand for sustainable building solutions. Finally, the desire for enhanced occupant comfort and productivity within buildings is a significant driver, as BEMS can optimize internal environments for better well-being.

Challenges in the European Building Energy Management Systems Market Market

The long-term growth catalysts for the European Building Energy Management Systems market are multifaceted. The continued evolution of AI and machine learning will enable even more sophisticated predictive capabilities, autonomous building management, and personalized energy optimization. The expansion of smart grid integration will allow BEMS to play a crucial role in demand-response programs and energy arbitrage. Increased adoption of renewable energy sources within buildings will necessitate advanced BEMS to effectively manage and integrate these sources. Furthermore, the growing trend of retrofitting older buildings with smart technologies presents a massive opportunity for BEMS providers. Partnerships between BEMS vendors, utility companies, and real estate developers will foster innovation and create integrated solutions for a more sustainable built environment. The drive towards circular economy principles in building design and operation will also influence BEMS development, focusing on lifecycle energy management.

Emerging Opportunities in European Building Energy Management Systems Market

Emerging opportunities in the European Building Energy Management Systems market are abundant. The digital twin concept, creating virtual replicas of buildings, offers unprecedented opportunities for simulation, optimization, and predictive maintenance using BEMS data. The increasing demand for healthier indoor environments, driven by post-pandemic awareness, is creating opportunities for BEMS to integrate air quality monitoring and control systems. The growth of the data center sector and its substantial energy demands presents a significant market for specialized BEMS solutions. The development of open-source BEMS platforms could foster greater innovation and reduce vendor lock-in. Furthermore, the burgeoning electric vehicle (EV) charging infrastructure within commercial and residential buildings presents an opportunity for BEMS to manage charging loads efficiently and integrate them with overall building energy strategies.

Leading Players in the European Building Energy Management Systems Market Sector

- Rockwell Automation

- Honeywell International Inc.

- ABB Ltd

- Cyclon Energy Group

- Johnson Controls International PLC

- Siemens AG

- Schneider Electric SE

- Veolia Environment SA

- EnerNOC Inc

- IBM Common Stock

Key Milestones in European Building Energy Management Systems Market Industry

- November 2021: Lyon Confluence initiated a significant urban redevelopment project in Lyon, France, incorporating green and energy efficiency objectives for renovated buildings. This project emphasizes the use of smart meters, BEMS, heat meters, and energy production systems for data collection from smart buildings, highlighting the growing importance of integrated energy management in urban renewal.

- June 2021: Geonordo Environmental Technologies launched the "Collecteif" project, a four-year initiative to implement energy management systems for smart buildings across France, Italy, Norway, and Cyprus. Conducted in collaboration with the Norwegian University of Science and Technology (NTNU), innovative SMEs, academic institutions, building owners, and energy providers, this project underscores the collaborative approach and cross-border efforts to advance BEMS adoption and showcase its benefits in diverse European contexts.

Strategic Outlook for European Building Energy Management Systems Market Market

The strategic outlook for the European Building Energy Management Systems market is exceptionally bright. Continued investment in research and development, particularly in AI, edge computing, and data analytics, will drive the creation of more intelligent and autonomous BEMS. Strategic partnerships between technology providers, energy utilities, and real estate developers will be crucial for delivering integrated, end-to-end solutions. The increasing focus on decarbonization and net-zero targets will further accelerate BEMS adoption across all building types. Future growth will be fueled by the expansion of BEMS into new applications, such as smart grids, smart cities, and the integration of building operations with transportation networks. The market is expected to witness a shift towards more outcome-based service models, where vendors guarantee energy savings and performance improvements.

European Building Energy Management Systems Market Segmentation

-

1. Type

- 1.1. Software

- 1.2. Hardware

-

2. Deployment

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

European Building Energy Management Systems Market Segmentation By Geography

- 1. Germany

- 2. Italy

- 3. United Kingdom

- 4. France

- 5. Rest of Europe

European Building Energy Management Systems Market Regional Market Share

Geographic Coverage of European Building Energy Management Systems Market

European Building Energy Management Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuation in Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. The Residential Sector Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Building Energy Management Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Software

- 5.1.2. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. Italy

- 5.3.3. United Kingdom

- 5.3.4. France

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany European Building Energy Management Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Software

- 6.1.2. Hardware

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Italy European Building Energy Management Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Software

- 7.1.2. Hardware

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. United Kingdom European Building Energy Management Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Software

- 8.1.2. Hardware

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France European Building Energy Management Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Software

- 9.1.2. Hardware

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe European Building Energy Management Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Software

- 10.1.2. Hardware

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rockwell Automation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ABB Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cyclon Energy Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson Controls International PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schneider Electric SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Veolia Environment SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EnerNOC Inc *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 IBM Common Stock

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Rockwell Automation

List of Figures

- Figure 1: European Building Energy Management Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: European Building Energy Management Systems Market Share (%) by Company 2025

List of Tables

- Table 1: European Building Energy Management Systems Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: European Building Energy Management Systems Market Revenue million Forecast, by Deployment 2020 & 2033

- Table 3: European Building Energy Management Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: European Building Energy Management Systems Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: European Building Energy Management Systems Market Revenue million Forecast, by Deployment 2020 & 2033

- Table 6: European Building Energy Management Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: European Building Energy Management Systems Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: European Building Energy Management Systems Market Revenue million Forecast, by Deployment 2020 & 2033

- Table 9: European Building Energy Management Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: European Building Energy Management Systems Market Revenue million Forecast, by Type 2020 & 2033

- Table 11: European Building Energy Management Systems Market Revenue million Forecast, by Deployment 2020 & 2033

- Table 12: European Building Energy Management Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: European Building Energy Management Systems Market Revenue million Forecast, by Type 2020 & 2033

- Table 14: European Building Energy Management Systems Market Revenue million Forecast, by Deployment 2020 & 2033

- Table 15: European Building Energy Management Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: European Building Energy Management Systems Market Revenue million Forecast, by Type 2020 & 2033

- Table 17: European Building Energy Management Systems Market Revenue million Forecast, by Deployment 2020 & 2033

- Table 18: European Building Energy Management Systems Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Building Energy Management Systems Market?

The projected CAGR is approximately 12.2%.

2. Which companies are prominent players in the European Building Energy Management Systems Market?

Key companies in the market include Rockwell Automation, Honeywell International Inc, ABB Ltd, Cyclon Energy Group, Johnson Controls International PLC, Siemens AG, Schneider Electric SE, Veolia Environment SA, EnerNOC Inc *List Not Exhaustive, IBM Common Stock.

3. What are the main segments of the European Building Energy Management Systems Market?

The market segments include Type, Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD 12974.6 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector.

6. What are the notable trends driving market growth?

The Residential Sector Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Fluctuation in Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

In November 2021, Lyon Confluence, the France-based public company, announced that it had started the urban redevelopment project in the city of Lyon, France. The project also includes the green and energy efficiency objectives of the buildings that are to be renovated. The devices and systems used for the data collection from the smart buildings include smart meters, building energy management systems, heat meters, and energy production systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Building Energy Management Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Building Energy Management Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Building Energy Management Systems Market?

To stay informed about further developments, trends, and reports in the European Building Energy Management Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence