Key Insights

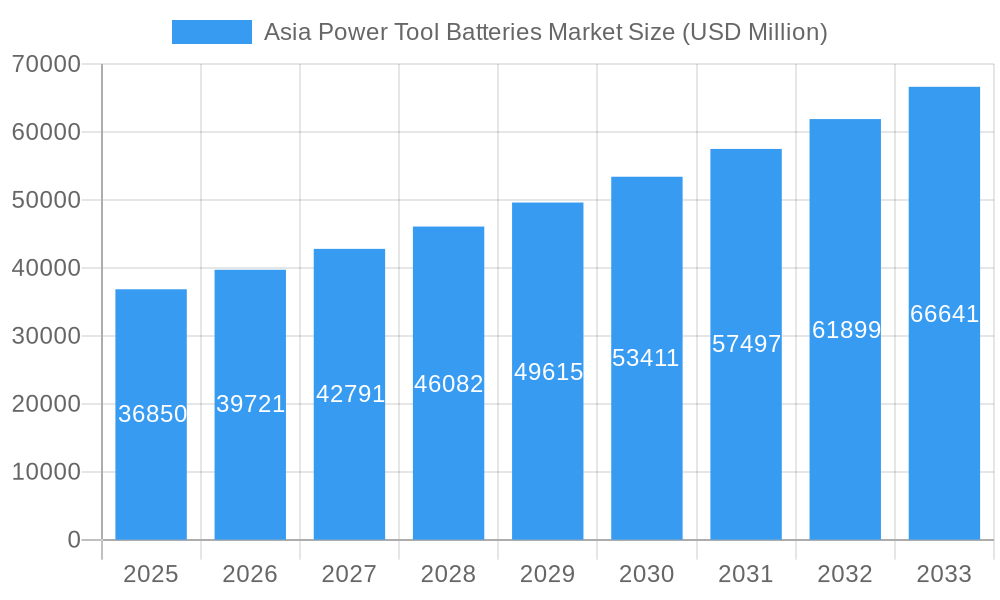

The Asia Power Tool Batteries Market is poised for significant expansion, projected to reach USD 36.85 billion in 2025. This robust growth is fueled by a compelling compound annual growth rate (CAGR) of 7.7% during the forecast period of 2025-2033. A primary driver for this surge is the increasing adoption of lithium-ion battery technology, offering superior performance, longer runtimes, and faster charging capabilities compared to older alternatives like Nickel Cadmium. The burgeoning construction sector across the region, particularly in developing economies, is a major catalyst, demanding a higher volume of power tools and, consequently, their battery counterparts. Furthermore, the growing DIY culture and the rise of professional tradespeople are contributing to sustained demand. Government initiatives promoting infrastructure development and renewable energy projects also indirectly boost the power tool market, creating a ripple effect on battery sales.

Asia Power Tool Batteries Market Market Size (In Billion)

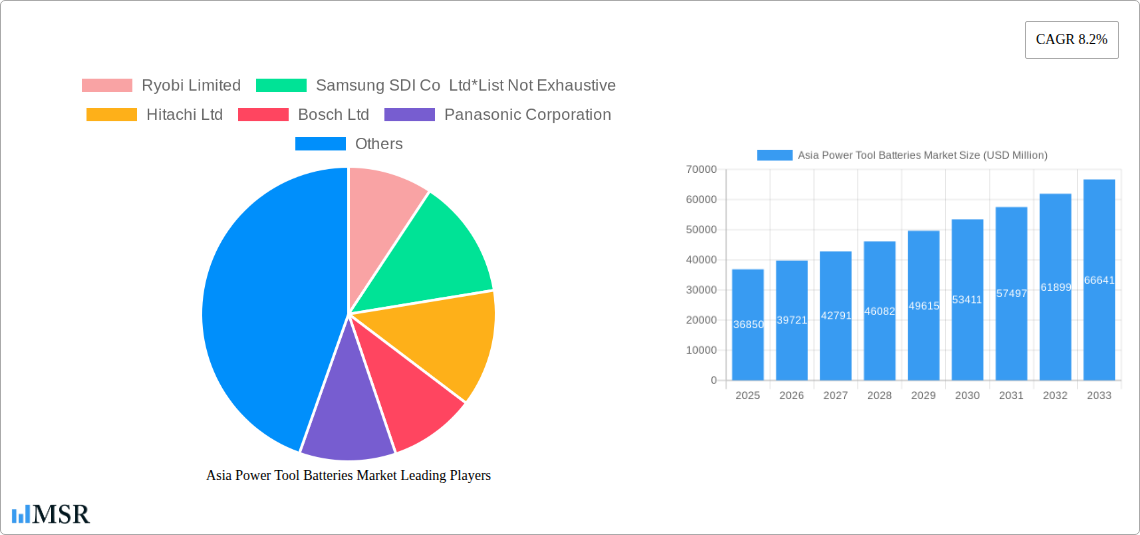

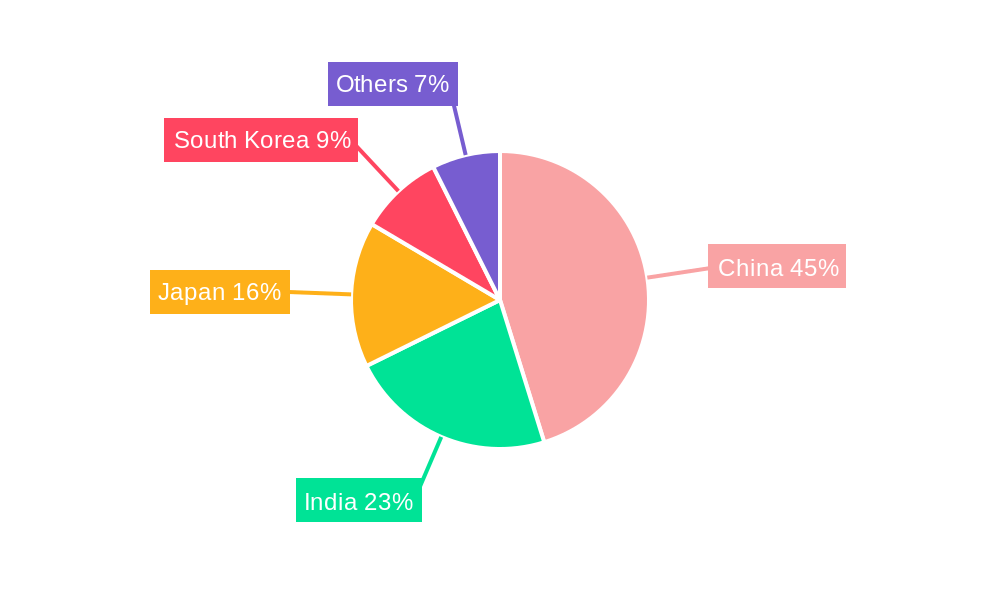

The market's trajectory is also shaped by evolving trends such as the development of smart batteries with enhanced safety features and connectivity, alongside a focus on battery recycling and sustainability. However, certain restraints might temper the growth rate. Fluctuations in raw material prices, especially for lithium and cobalt, can impact manufacturing costs and consumer prices. Intense competition among established players and emerging local manufacturers, including prominent companies like Ryobi Limited, Samsung SDI Co Ltd, Hitachi Ltd, Bosch Ltd, Panasonic Corporation, and Makita Corporation, necessitates continuous innovation and competitive pricing strategies. Geographically, China and India are expected to be dominant markets due to their large populations, rapid industrialization, and significant investments in construction and manufacturing. South Korea and Japan will also remain crucial contributors, driven by their advanced technological landscape and established market presence.

Asia Power Tool Batteries Market Company Market Share

Unlock unparalleled insights into the booming Asia Power Tool Batteries Market with our in-depth report, covering critical trends, competitive landscapes, and future growth trajectories. This essential resource is designed for manufacturers, suppliers, distributors, investors, and all stakeholders seeking to capitalize on the robust expansion of cordless power tools across the region. Our analysis spans from 2019 to 2033, with a base year of 2025, providing a detailed historical overview and a precise forecast.

Asia Power Tool Batteries Market Market Concentration & Dynamics

The Asia Power Tool Batteries Market exhibits a moderately concentrated landscape, with established global players and emerging regional manufacturers vying for market share. Innovation ecosystems are flourishing, driven by significant R&D investments in advanced battery technologies like Lithium-ion. Regulatory frameworks are evolving, with a growing emphasis on environmental sustainability and battery safety standards, impacting manufacturing processes and product lifecycles. Substitute products, such as corded power tools and less advanced battery chemistries, continue to pose a challenge, albeit with a decreasing market impact due to the superior performance of modern battery solutions. End-user trends favor increased adoption of cordless tools in construction, manufacturing, and DIY segments, fueled by demand for portability and efficiency. Mergers and Acquisitions (M&A) activities are expected to rise as companies seek to consolidate market positions, expand technological capabilities, and gain access to new geographical markets. Based on our analysis, the market is projected to witness an average of 3-5 significant M&A deals annually between 2025 and 2033. Key players like Ryobi Limited, Samsung SDI Co Ltd, Hitachi Ltd, Bosch Ltd, Panasonic Corporation, and Makita Corporation are strategically positioning themselves through product innovation and market expansion to maintain or increase their market share, which currently averages around 15-20% for the top 5 players.

Asia Power Tool Batteries Market Industry Insights & Trends

The Asia Power Tool Batteries Market is poised for substantial growth, projected to reach an estimated USD 18.5 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 7.2% from 2019 to 2033. This expansion is primarily driven by the escalating demand for cordless power tools across diverse sectors, including construction, automotive, manufacturing, and the burgeoning DIY market. Technological advancements are at the forefront of this growth, with Lithium-ion battery technology dominating due to its superior energy density, longer lifespan, and faster charging capabilities compared to Nickel Cadmium and other older chemistries. The increasing focus on urbanization and infrastructure development across Asia, particularly in emerging economies like India and Southeast Asian nations, is creating a sustained demand for power tools and, consequently, their batteries. Furthermore, the growing trend of home renovation and DIY projects, amplified by accessible online tutorials and affordable tool options, is a significant catalyst for market expansion. Manufacturers are continuously investing in research and development to enhance battery performance, reduce weight, and improve safety features, addressing consumer concerns and driving product innovation. The shift towards smart technologies and the integration of IoT capabilities in power tools also presents an avenue for advanced battery solutions that can monitor usage, optimize performance, and facilitate remote diagnostics, further fueling market evolution.

Key Markets & Segments Leading Asia Power Tool Batteries Market

The Lithium-ion battery technology segment is unequivocally leading the Asia Power Tool Batteries Market, driven by its inherent advantages and widespread adoption. Within geographies, China stands as the dominant market, owing to its massive manufacturing base, substantial construction activities, and a rapidly growing DIY consumer segment.

Dominance of Lithium-ion Technology:

China's Market Leadership:

Japan's Mature Market and Innovation: While China leads in volume, Japan represents a mature market with high adoption rates and a strong emphasis on quality and innovation. Japanese manufacturers are at the forefront of developing advanced battery management systems and integrating smart features.

India's Emerging Potential: India's rapidly developing economy, coupled with increasing infrastructure projects and a growing awareness of professional trades, presents significant untapped potential for power tool battery market growth.

Asia Power Tool Batteries Market Product Developments

Recent product developments are revolutionizing the Asia Power Tool Batteries Market. Innovations are centered on enhancing energy density, improving charging speeds, and increasing the durability and lifespan of batteries. For instance, the introduction of advanced cell designs and materials in Lithium-ion batteries is enabling lighter and more compact power tool solutions without compromising on power output. The integration of smart battery management systems, offering real-time performance monitoring and diagnostics, is also a key trend, enhancing user experience and tool efficiency.

Challenges in the Asia Power Tool Batteries Market Market

Despite robust growth, the Asia Power Tool Batteries Market faces several challenges. Intense price competition among manufacturers, particularly for entry-level products, can squeeze profit margins. The fluctuating prices of raw materials, such as lithium, cobalt, and nickel, directly impact manufacturing costs and market stability. Furthermore, the disposal and recycling of used batteries pose environmental concerns and require the development of robust and cost-effective recycling infrastructure across the region. Supply chain disruptions, exacerbated by geopolitical factors and global events, can also affect the availability and cost of essential components.

Forces Driving Asia Power Tool Batteries Market Growth

Several powerful forces are propelling the Asia Power Tool Batteries Market forward. The relentless push towards cordless convenience and efficiency in professional trades and DIY applications is a primary driver. Government initiatives promoting infrastructure development and smart city projects across Asia are creating sustained demand for construction and industrial power tools. Technological advancements in Lithium-ion battery chemistry, leading to improved performance, longer life, and faster charging, are making cordless tools increasingly attractive. The growing disposable income and rising middle class in many Asian countries are fueling consumer spending on home improvement and DIY projects, further boosting the demand for power tool batteries.

Challenges in the Asia Power Tool Batteries Market Market

Long-term growth catalysts for the Asia Power Tool Batteries Market lie in continued technological innovation and strategic market expansion. The development of next-generation battery chemistries beyond current Lithium-ion capabilities, such as solid-state batteries, holds immense promise for even higher energy densities and enhanced safety. Strategic partnerships between battery manufacturers and power tool companies will foster deeper integration and co-development of optimized battery-tool systems. Expanding into emerging markets within Southeast Asia and Oceania, where the adoption of cordless power tools is still in its nascent stages, presents significant untapped potential. Focus on sustainability through improved battery recycling initiatives and the development of batteries with longer lifespans will also contribute to long-term market resilience and consumer acceptance.

Emerging Opportunities in Asia Power Tool Batteries Market

Emerging opportunities in the Asia Power Tool Batteries Market are diverse and lucrative. The increasing demand for specialized power tools in niche industries like renewable energy installation (solar panel mounting) and advanced manufacturing presents new avenues. The growing trend of connected tools and the integration of IoT capabilities offer opportunities for "smart" batteries that provide data analytics and predictive maintenance. Furthermore, the expansion of the electric vehicle (EV) ecosystem is driving advancements in battery technology and manufacturing, which can have spillover benefits for the power tool battery sector. Developing eco-friendly and recyclable battery solutions will also appeal to environmentally conscious consumers and businesses, creating a competitive edge.

Leading Players in the Asia Power Tool Batteries Market Sector

Key Milestones in Asia Power Tool Batteries Market Industry

Strategic Outlook for Asia Power Tool Batteries Market Market

The strategic outlook for the Asia Power Tool Batteries Market is overwhelmingly positive, driven by a confluence of technological innovation, increasing end-user demand, and favorable economic conditions. Key growth accelerators include the continued dominance of Lithium-ion technology, the expansion of cordless tool adoption across professional and consumer segments, and the ongoing infrastructure development projects across the region. Companies that focus on developing high-performance, durable, and cost-effective battery solutions, while also investing in robust recycling programs, will be well-positioned for sustained success. Strategic partnerships, technological collaborations, and targeted market expansion into high-growth geographies are crucial for capturing market share and driving long-term value creation in this dynamic sector.

-

- Superior Energy Density: Allows for longer runtimes and more powerful tool performance.

- Lighter Weight: Enhances user comfort and portability of power tools.

- Faster Charging: Reduces downtime for professional and DIY users.

- Longer Cycle Life: Offers better value and reduced replacement frequency.

- Environmental Benefits: Lower self-discharge rates and fewer hazardous materials compared to older chemistries.

-

- Vast Manufacturing Hub: China is a global leader in the production of power tools and their components, including batteries, leading to economies of scale and competitive pricing.

- Robust Infrastructure Development: Continuous government investment in infrastructure projects, including high-speed rail, airports, and urban development, fuels demand for construction power tools.

- Rapid Urbanization: The migration of populations to cities necessitates new housing and commercial constructions, directly impacting power tool sales.

- Growing DIY Culture: An increasing middle class and greater disposable income are contributing to the rise of home improvement projects and DIY activities.

- Technological Adoption: Chinese consumers are quick to adopt new technologies, readily embracing the benefits of Lithium-ion powered cordless tools.

- Ryobi Limited

- Samsung SDI Co Ltd

- Hitachi Ltd

- Bosch Ltd

- Panasonic Corporation

- Makita Corporation

- October 2021: DEWALT, a Stanley Black & Decker brand with Jobsite Solutions, announced the global launch of the DEWALT POWERSTACK 20V MAX Compact Battery, a next-generation technological that marks a new era of advanced performance for DEWALT cordless power tools.

- March 2021: Lowe's Companies Inc. and Chevron announced the exclusive launch of FLEX, a line of cutting-edge, cordless power tools. The first FLEX tools, accessories, batteries, and chargers will be available on the company website and nationwide stores.

Asia Power Tool Batteries Market Segmentation

-

1. Technology Type

- 1.1. Lithium-ion

- 1.2. Nickel Cadmium

- 1.3. Others

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Others

Asia Power Tool Batteries Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Others

Asia Power Tool Batteries Market Regional Market Share

Geographic Coverage of Asia Power Tool Batteries Market

Asia Power Tool Batteries Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Initiatives and Increasing Private Investments

- 3.3. Market Restrains

- 3.3.1. 4.; Declining Lithium-ion Battery Prices

- 3.4. Market Trends

- 3.4.1. The Lithium-ion Type is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Power Tool Batteries Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 5.1.1. Lithium-ion

- 5.1.2. Nickel Cadmium

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Others

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 6. China Asia Power Tool Batteries Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 6.1.1. Lithium-ion

- 6.1.2. Nickel Cadmium

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 7. India Asia Power Tool Batteries Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 7.1.1. Lithium-ion

- 7.1.2. Nickel Cadmium

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 8. Japan Asia Power Tool Batteries Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 8.1.1. Lithium-ion

- 8.1.2. Nickel Cadmium

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 9. South Korea Asia Power Tool Batteries Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 9.1.1. Lithium-ion

- 9.1.2. Nickel Cadmium

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 10. Others Asia Power Tool Batteries Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology Type

- 10.1.1. Lithium-ion

- 10.1.2. Nickel Cadmium

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Technology Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ryobi Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samsung SDI Co Ltd*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hitachi Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bosch Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Panasonic Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Makita Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Ryobi Limited

List of Figures

- Figure 1: Asia Power Tool Batteries Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Power Tool Batteries Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Power Tool Batteries Market Revenue undefined Forecast, by Technology Type 2020 & 2033

- Table 2: Asia Power Tool Batteries Market Volume K Unit Forecast, by Technology Type 2020 & 2033

- Table 3: Asia Power Tool Batteries Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Asia Power Tool Batteries Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: Asia Power Tool Batteries Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Asia Power Tool Batteries Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Asia Power Tool Batteries Market Revenue undefined Forecast, by Technology Type 2020 & 2033

- Table 8: Asia Power Tool Batteries Market Volume K Unit Forecast, by Technology Type 2020 & 2033

- Table 9: Asia Power Tool Batteries Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Asia Power Tool Batteries Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: Asia Power Tool Batteries Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Asia Power Tool Batteries Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Asia Power Tool Batteries Market Revenue undefined Forecast, by Technology Type 2020 & 2033

- Table 14: Asia Power Tool Batteries Market Volume K Unit Forecast, by Technology Type 2020 & 2033

- Table 15: Asia Power Tool Batteries Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Asia Power Tool Batteries Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: Asia Power Tool Batteries Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Asia Power Tool Batteries Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Asia Power Tool Batteries Market Revenue undefined Forecast, by Technology Type 2020 & 2033

- Table 20: Asia Power Tool Batteries Market Volume K Unit Forecast, by Technology Type 2020 & 2033

- Table 21: Asia Power Tool Batteries Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: Asia Power Tool Batteries Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Asia Power Tool Batteries Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Asia Power Tool Batteries Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Asia Power Tool Batteries Market Revenue undefined Forecast, by Technology Type 2020 & 2033

- Table 26: Asia Power Tool Batteries Market Volume K Unit Forecast, by Technology Type 2020 & 2033

- Table 27: Asia Power Tool Batteries Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Asia Power Tool Batteries Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Asia Power Tool Batteries Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Asia Power Tool Batteries Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Asia Power Tool Batteries Market Revenue undefined Forecast, by Technology Type 2020 & 2033

- Table 32: Asia Power Tool Batteries Market Volume K Unit Forecast, by Technology Type 2020 & 2033

- Table 33: Asia Power Tool Batteries Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 34: Asia Power Tool Batteries Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 35: Asia Power Tool Batteries Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Asia Power Tool Batteries Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Power Tool Batteries Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Asia Power Tool Batteries Market?

Key companies in the market include Ryobi Limited, Samsung SDI Co Ltd*List Not Exhaustive, Hitachi Ltd, Bosch Ltd, Panasonic Corporation, Makita Corporation.

3. What are the main segments of the Asia Power Tool Batteries Market?

The market segments include Technology Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Initiatives and Increasing Private Investments.

6. What are the notable trends driving market growth?

The Lithium-ion Type is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Declining Lithium-ion Battery Prices.

8. Can you provide examples of recent developments in the market?

In October 2021, DEWALT, a Stanley Black & Decker brand with Jobsite Solutions, announced the global launch of the DEWALT POWERSTACK 20V MAX Compact Battery, a next-generation technological that marks a new era of advanced performance for DEWALT cordless power tools.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Power Tool Batteries Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Power Tool Batteries Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Power Tool Batteries Market?

To stay informed about further developments, trends, and reports in the Asia Power Tool Batteries Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence