Key Insights

The German Combined Heat and Power (CHP) market is projected to experience robust growth, with an estimated market size of $32.02 billion by 2025, and a Compound Annual Growth Rate (CAGR) of 5.3% through 2033. This expansion is driven by Germany's commitment to energy efficiency and decarbonization policies, notably the 'Energiewende' (energy transition), which promotes decentralized energy generation. Key applications span residential, commercial (hotels, hospitals, offices), and industrial sectors (manufacturing, data centers), all seeking to optimize energy costs and meet sustainability goals. The utility sector is also adapting, with a shift towards flexible, smaller-scale decentralized generation.

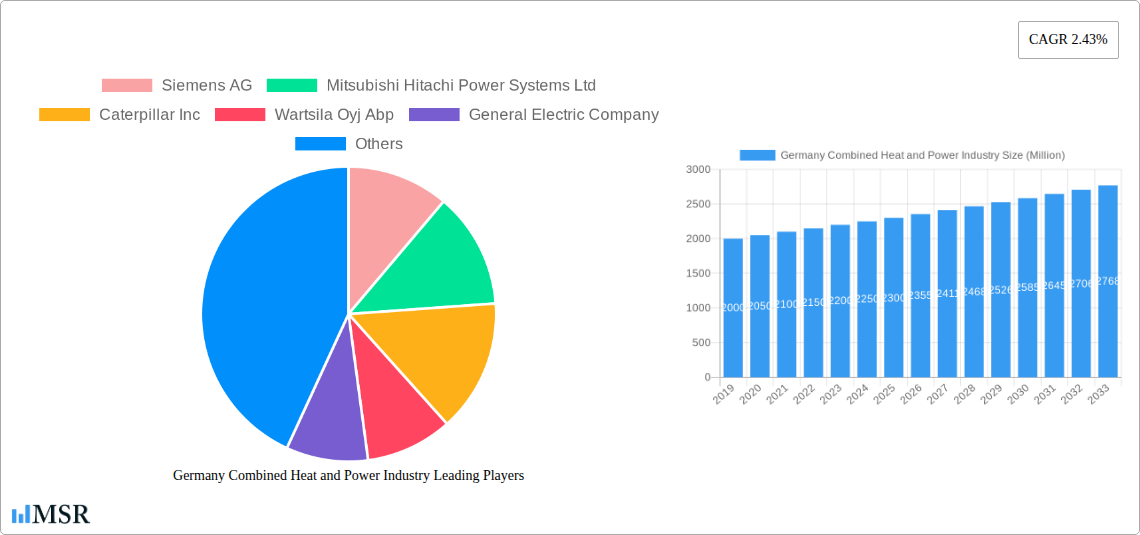

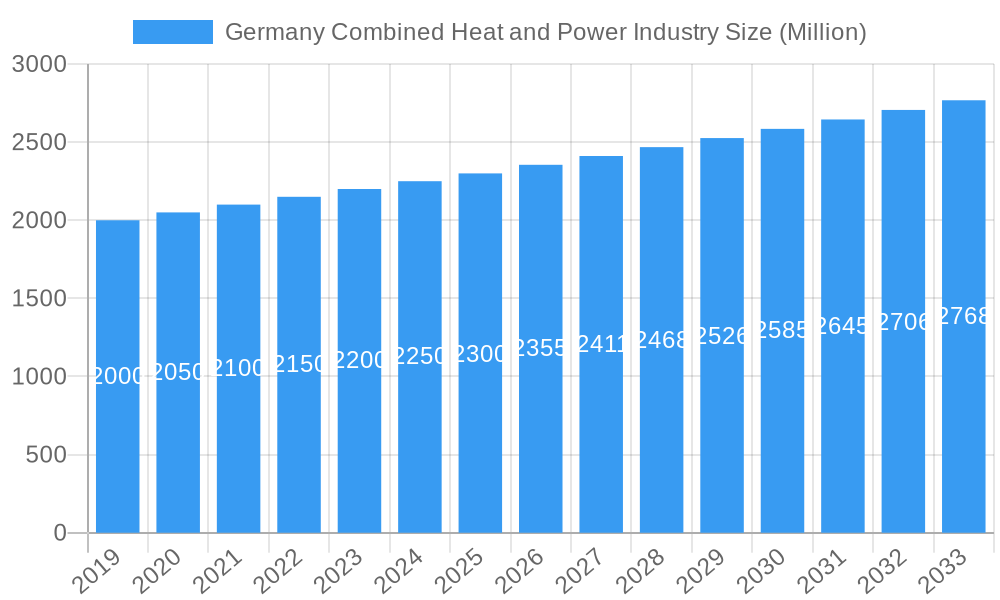

Germany Combined Heat and Power Industry Market Size (In Billion)

Natural gas currently leads fuel types due to availability and lower emissions. However, there is increasing interest in renewable fuels like biogas and hydrogen, aligning with long-term renewable energy objectives. While government support and environmental awareness are positive factors, high initial investment costs can be a barrier. Evolving regulations and the integration of intermittent renewables also present challenges. Technological advancements in efficiency and smart grid integration are expected to mitigate these issues, ensuring sustained market growth. Key players include Siemens AG, Mitsubishi Hitachi Power Systems Ltd, and General Electric Company.

Germany Combined Heat and Power Industry Company Market Share

This comprehensive report analyzes the Germany Combined Heat and Power (CHP) industry, also known as Kraft-Wärme-Kopplung (KWK). Covering the period from 2019 to 2033, with 2025 as the base year and a forecast period from 2025 to 2033, it provides crucial insights into market dynamics, growth drivers, challenges, and opportunities. Utilizing high-ranking keywords such as CHP Germany, KWK market, cogeneration Germany, district heating Germany, renewable energy Germany, energy efficiency Germany, power generation Germany, industrial CHP, residential CHP, commercial CHP, utility CHP, natural gas CHP, this report is essential for stakeholders navigating the evolving German CHP landscape.

Germany Combined Heat and Power Industry Market Concentration & Dynamics

The Germany Combined Heat and Power (CHP) industry exhibits a moderate level of market concentration, with a few large players dominating significant portions of the market share, alongside a growing number of specialized and smaller enterprises. Innovation is primarily driven by advancements in engine efficiency, emission control technologies, and the integration of digital solutions for optimized energy management. The regulatory framework plays a pivotal role, with government incentives, feed-in tariffs, and stringent environmental regulations significantly shaping market dynamics and encouraging the adoption of CHP solutions. While direct substitute products for the integrated energy efficiency of CHP are limited, advancements in renewable energy generation and storage technologies present indirect competition. End-user trends are shifting towards decentralized energy generation, increased demand for sustainable and low-carbon energy solutions, and the desire for cost savings through energy efficiency. Mergers and acquisitions (M&A) activities are observed as companies seek to expand their technological capabilities, market reach, and service portfolios. For instance, a significant M&A deal count in the historical period (2019-2024) reflects consolidation and strategic partnerships aimed at strengthening competitive positions. Market share distribution is influenced by the technological expertise, installed base, and service networks of leading companies.

Germany Combined Heat and Power Industry Industry Insights & Trends

The Germany Combined Heat and Power (CHP) industry is experiencing robust growth, driven by Germany's strong commitment to energy transition (Energiewende) and its ambitious climate targets. The market size of the German CHP sector is projected to grow at a significant Compound Annual Growth Rate (CAGR) during the forecast period (2025–2033). This expansion is fueled by increasing demand for energy efficiency, driven by rising energy costs and a growing awareness of environmental sustainability. Technological disruptions are at the forefront, with ongoing innovations in highly efficient gas engines, advanced control systems, and the integration of CHP with renewable energy sources like solar and wind power. The development of smart grids and digital platforms is enabling more sophisticated energy management and optimization, further enhancing the appeal of CHP. Evolving consumer behaviors are also a key trend, with a growing preference for decentralized and resilient energy solutions, particularly within the residential, commercial, and industrial segments. Businesses are increasingly recognizing the economic benefits of CHP, including reduced operational costs and a smaller carbon footprint. Utility companies are exploring CHP as a reliable and flexible source of power and heat, complementing intermittent renewable sources. The historical period (2019–2024) has seen a steady increase in installed CHP capacity, laying the groundwork for continued growth. The push for decarbonization is a central theme, prompting the development of CHP systems that can utilize cleaner fuels and contribute to a more sustainable energy mix. The market is also witnessing a rise in modular and scalable CHP solutions, catering to a wider range of applications and facility sizes. The government's supportive policies, including subsidies and regulatory incentives for KWK generation, are instrumental in fostering this growth trajectory. The integration of district heating networks powered by CHP is another significant trend, contributing to efficient heat distribution across urban areas. The overall industry landscape is characterized by a dynamic interplay of technological advancement, policy support, and evolving market demands.

Key Markets & Segments Leading Germany Combined Heat and Power Industry

The Germany Combined Heat and Power (CHP) industry is characterized by strong performance across several key segments, with the Industrial segment often leading in terms of installed capacity and energy output. This dominance is driven by the significant and continuous demand for heat and power in manufacturing processes, where the energy savings and operational cost reductions offered by CHP are particularly impactful. The Commercial segment, encompassing large buildings, hotels, and hospitals, is also a substantial contributor, driven by the need for reliable and cost-effective energy solutions. The Utility segment plays a crucial role in large-scale power and heat generation, often feeding into extensive district heating networks, which are prevalent and expanding in many German cities. The Residential segment, while typically involving smaller-scale units, is witnessing growth due to increasing interest in decentralized energy and reduced heating costs.

Fuel Type Dominance:

- Natural Gas stands as the dominant fuel type for CHP systems in Germany.

- Drivers: Availability of natural gas infrastructure, relatively lower emission profiles compared to coal and oil, high energy efficiency, and government incentives often favor natural gas-powered CHP. Economic growth and the increasing reliance on stable energy supplies further bolster its position.

- Coal has historically been a significant fuel, but its role is diminishing due to stricter environmental regulations and the ongoing energy transition away from fossil fuels.

- Drivers (declining): Existing infrastructure and high thermal output were key historical drivers. However, carbon emission targets are rapidly phasing out its prominence.

- Oil is primarily used in smaller or niche applications where natural gas is not readily available or for specific industrial processes.

- Drivers: Availability in specific locations, flexibility for certain applications. Its market share is comparatively smaller.

- Other Fuel Types, including biomass, biogas, and waste heat recovery, are gaining traction as Germany prioritizes renewable and sustainable energy sources.

- Drivers: Environmental sustainability, policy support for renewable energy integration, and the circular economy principles are driving the adoption of these fuel types, contributing to the diversification of the CHP energy mix.

The interplay between these fuel types and application segments dictates the overall market structure and growth potential within the German CHP market.

Germany Combined Heat and Power Industry Product Developments

Recent product developments in the Germany Combined Heat and Power (CHP) industry focus on enhancing efficiency, reducing emissions, and integrating advanced digital technologies. Innovations include the development of highly efficient gas engines with improved thermal recovery capabilities, enabling higher electricity generation from the same fuel input. There's a growing emphasis on modular and scalable CHP units that can be customized for a wider range of applications, from individual buildings to industrial complexes. Furthermore, the integration of AI and IoT for real-time performance monitoring, predictive maintenance, and optimized energy dispatch is a significant trend, increasing operational flexibility and economic benefits for users.

Challenges in the Germany Combined Heat and Power Industry Market

The Germany Combined Heat and Power (CHP) industry faces several significant challenges that impact its growth and widespread adoption. Regulatory hurdles, including complex permitting processes and evolving subsidy schemes, can create uncertainty for investors and developers. Supply chain issues, particularly concerning the availability of specialized components and skilled labor for installation and maintenance, can lead to project delays and increased costs. Competitive pressures from rapidly advancing renewable energy technologies like solar PV and wind power, coupled with increasingly efficient grid-scale energy storage solutions, present an ongoing challenge. The high upfront capital investment required for CHP installations also remains a barrier for some potential adopters, despite the long-term operational cost savings. The phase-out of coal-fired power plants and the transition towards greener energy sources also create a dynamic environment requiring continuous adaptation.

Forces Driving Germany Combined Heat and Power Industry Growth

Several key forces are driving the growth of the Germany Combined Heat and Power (CHP) industry. The overarching energy transition (Energiewende) policy in Germany, with its strong focus on decarbonization and renewable energy integration, creates a favorable environment for energy-efficient technologies like CHP. Rising energy prices for electricity and heating are making the cost savings offered by CHP increasingly attractive to both industrial and commercial entities. Technological advancements, particularly in the efficiency and reliability of gas engines and control systems, are enhancing the performance and economic viability of CHP solutions. Furthermore, the growing awareness of environmental sustainability and the desire to reduce carbon footprints are pushing businesses and municipalities to adopt cleaner and more efficient energy generation methods. Government incentives and subsidies, such as those for Kraft-Wärme-Kopplung (KWK), also play a crucial role in stimulating investment and deployment.

Challenges in the Germany Combined Heat and Power Industry Market

Long-term growth catalysts for the Germany Combined Heat and Power (CHP) industry are rooted in ongoing innovation and strategic market expansion. Continued advancements in fuel flexibility, enabling CHP systems to effectively utilize a wider range of sustainable fuels like hydrogen blends and synthetic gases, will be crucial for long-term relevance in a decarbonized energy future. The development of more integrated and intelligent smart grid solutions will further enhance the flexibility and value of CHP in balancing the grid. Strategic partnerships between CHP manufacturers, energy service providers, and renewable energy developers are creating new business models and expanding market reach. Furthermore, the increasing demand for localized and resilient energy solutions, particularly in the face of geopolitical uncertainties, will continue to fuel the adoption of decentralized CHP.

Emerging Opportunities in Germany Combined Heat and Power Industry

Emerging opportunities in the Germany Combined Heat and Power (CHP) industry are significant and diverse. The expanding district heating networks across German cities present a substantial market for large-scale CHP plants providing low-carbon heat. The integration of CHP with renewable energy sources, such as solar thermal or geothermal, offers hybrid solutions with enhanced sustainability credentials. The increasing focus on industrial decarbonization and the circular economy is creating opportunities for CHP systems that can utilize waste heat from industrial processes or generate heat and power from biogas and biomass. The development of digitalization and AI-driven optimization platforms for CHP operations presents an opportunity to improve efficiency, reduce costs, and offer advanced energy management services to customers. Furthermore, the growing trend of electrification of heating in some sectors also creates opportunities for CHP to provide the necessary electrical power efficiently.

Leading Players in the Germany Combined Heat and Power Industry Sector

- Siemens AG

- Mitsubishi Hitachi Power Systems Ltd

- Caterpillar Inc

- Wartsila Oyj Abp

- General Electric Company

- MAN Energy Solutions

- 2G Energy AG

- Viessmann Group

- BHKW-Infozentrum

- Bosch Thermotechnology

Key Milestones in Germany Combined Heat and Power Industry Industry

- 2023: TotalEnergies acquired Quadra Energy, a leading German renewable electricity aggregator with a 9 GW virtual power plant. This strategic move aligns with TotalEnergies' broader strategy to expand its footprint in Germany's dynamic renewable energy market, potentially influencing the integration of distributed energy resources and enhancing the overall grid flexibility, which indirectly benefits the CHP sector by fostering a more integrated energy ecosystem.

- 2022: Increased government funding and subsidies for the deployment of new Kraft-Wärme-Kopplung (KWK) systems were announced, aimed at boosting energy efficiency and reducing CO2 emissions across industrial and commercial sectors.

- 2021: Several key manufacturers launched new generations of highly efficient gas engines with lower emission footprints, specifically designed for the German market, responding to stringent environmental regulations and customer demand for sustainable solutions.

- 2020: A significant increase in the adoption of modular and containerized CHP units was observed, catering to the growing demand for flexible and decentralized energy generation in commercial and smaller industrial applications.

Strategic Outlook for Germany Combined Heat and Power Industry Market

The strategic outlook for the Germany Combined Heat and Power (CHP) industry is characterized by continued growth fueled by the nation's unwavering commitment to energy efficiency and climate targets. Key growth accelerators include the ongoing expansion of district heating networks, the increasing integration of CHP with renewable energy sources, and the demand for decentralized energy solutions. Further advancements in hydrogen-ready CHP technology and the utilization of synthetic fuels will be critical for long-term competitiveness in a decarbonized economy. Strategic opportunities lie in developing comprehensive energy service packages, leveraging digitalization for optimized performance and grid integration, and targeting sectors with high heat and power demands that are prioritizing cost savings and reduced environmental impact. The industry is poised for sustained development as Germany progresses on its path towards a more sustainable and resilient energy future.

Germany Combined Heat and Power Industry Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial and Utility

-

2. Fuel Type

- 2.1. Natural Gas

- 2.2. Coal

- 2.3. Oil

- 2.4. Other Fuel Types

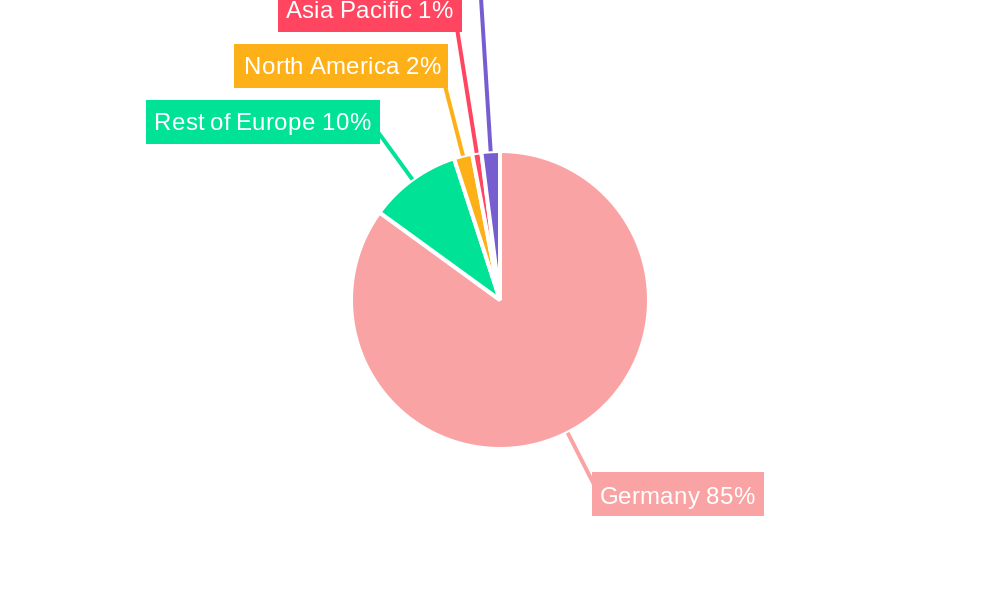

Germany Combined Heat and Power Industry Segmentation By Geography

- 1. Germany

Germany Combined Heat and Power Industry Regional Market Share

Geographic Coverage of Germany Combined Heat and Power Industry

Germany Combined Heat and Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Industries such as sugar

- 3.2.2 chemicals

- 3.2.3 and paper & pulp require a consistent and efficient power supply. CHP systems meet this demand by providing both electricity and heat

- 3.2.4 enhancing operational efficiency and reducing energy costs.

- 3.3. Market Restrains

- 3.3.1 The increasing cost of natural gas poses a challenge to the economic viability of natural gas-based CHP systems

- 3.3.2 potentially deterring investment and adoption.

- 3.4. Market Trends

- 3.4.1 There's a growing trend to transition CHP systems from natural gas to renewable fuels like green hydrogen. Germany plans to construct gas-fired power plants that are hydrogen-ready

- 3.4.2 aligning with its broader energy transition goals.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Combined Heat and Power Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial and Utility

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Natural Gas

- 5.2.2. Coal

- 5.2.3. Oil

- 5.2.4. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Siemens AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Hitachi Power Systems Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Caterpillar Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wartsila Oyj Abp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MAN Energy Solutions

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 2G Energy AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Viessmann Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BHKW-Infozentrum

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bosch Thermotechnology

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Siemens AG

List of Figures

- Figure 1: Germany Combined Heat and Power Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Combined Heat and Power Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Combined Heat and Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Germany Combined Heat and Power Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 3: Germany Combined Heat and Power Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Combined Heat and Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Germany Combined Heat and Power Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 6: Germany Combined Heat and Power Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Combined Heat and Power Industry?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Germany Combined Heat and Power Industry?

Key companies in the market include Siemens AG, Mitsubishi Hitachi Power Systems Ltd, Caterpillar Inc, Wartsila Oyj Abp, General Electric Company, MAN Energy Solutions, 2G Energy AG, Viessmann Group, BHKW-Infozentrum, Bosch Thermotechnology.

3. What are the main segments of the Germany Combined Heat and Power Industry?

The market segments include Application, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Industries such as sugar. chemicals. and paper & pulp require a consistent and efficient power supply. CHP systems meet this demand by providing both electricity and heat. enhancing operational efficiency and reducing energy costs..

6. What are the notable trends driving market growth?

There's a growing trend to transition CHP systems from natural gas to renewable fuels like green hydrogen. Germany plans to construct gas-fired power plants that are hydrogen-ready. aligning with its broader energy transition goals..

7. Are there any restraints impacting market growth?

The increasing cost of natural gas poses a challenge to the economic viability of natural gas-based CHP systems. potentially deterring investment and adoption..

8. Can you provide examples of recent developments in the market?

TotalEnergies acquired Quadra Energy, a leading German renewable electricity aggregator with a 9 GW virtual power plant. This move aligns with TotalEnergies' strategy to expand its footprint in Germany's renewable energy market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Combined Heat and Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Combined Heat and Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Combined Heat and Power Industry?

To stay informed about further developments, trends, and reports in the Germany Combined Heat and Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence