Key Insights

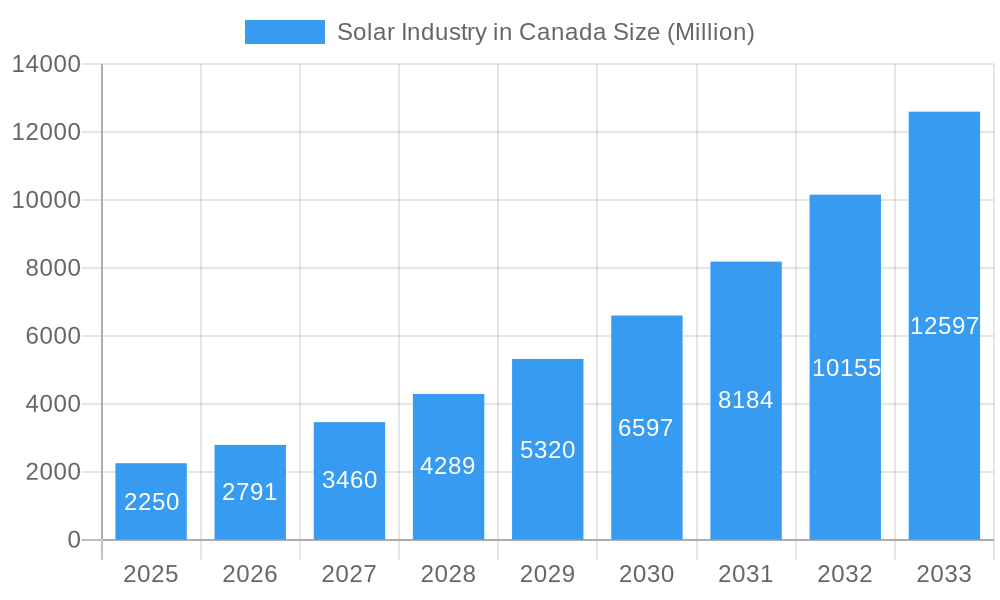

The Canadian solar industry is poised for remarkable growth, with an estimated market size of $2.25 billion in 2025. This surge is driven by a compelling CAGR of 23.9%, indicating a robust expansion trajectory through the forecast period ending in 2033. Key drivers propelling this growth include supportive government policies, increasing demand for clean energy solutions, declining solar technology costs, and a growing awareness of climate change imperatives. Canada's commitment to renewable energy targets, coupled with significant investment in solar infrastructure, is creating a fertile ground for both utility-scale projects and distributed generation. Technological advancements, particularly in solar photovoltaic (PV) efficiency and energy storage integration, are further enhancing the attractiveness and feasibility of solar power across the nation. The industry is witnessing a strong adoption of solar PV, which is expected to continue dominating the market, while Concentrated Solar Power (CSP) may see niche applications or further development in specific regions.

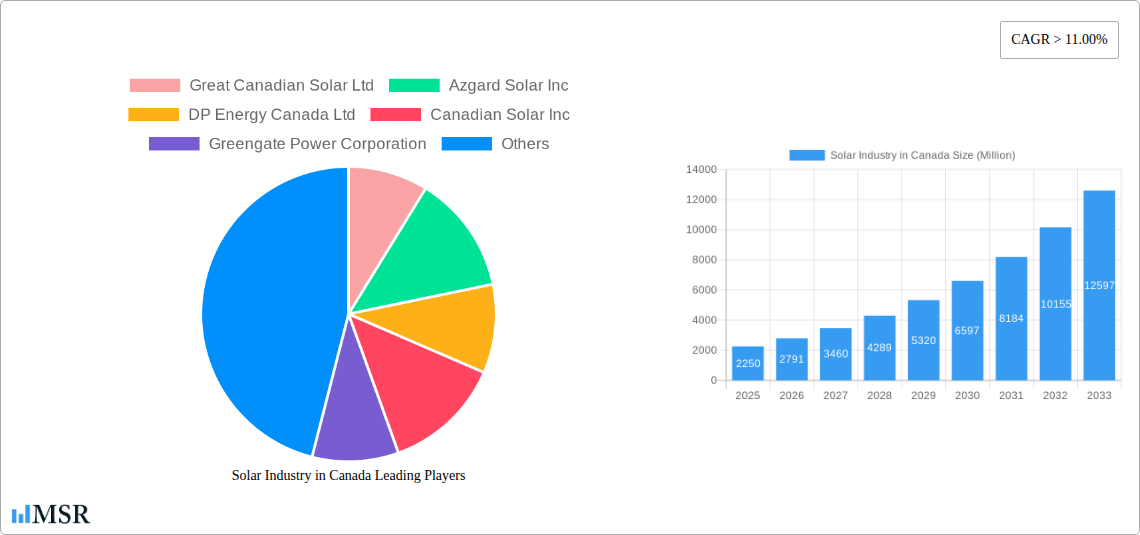

Solar Industry in Canada Market Size (In Billion)

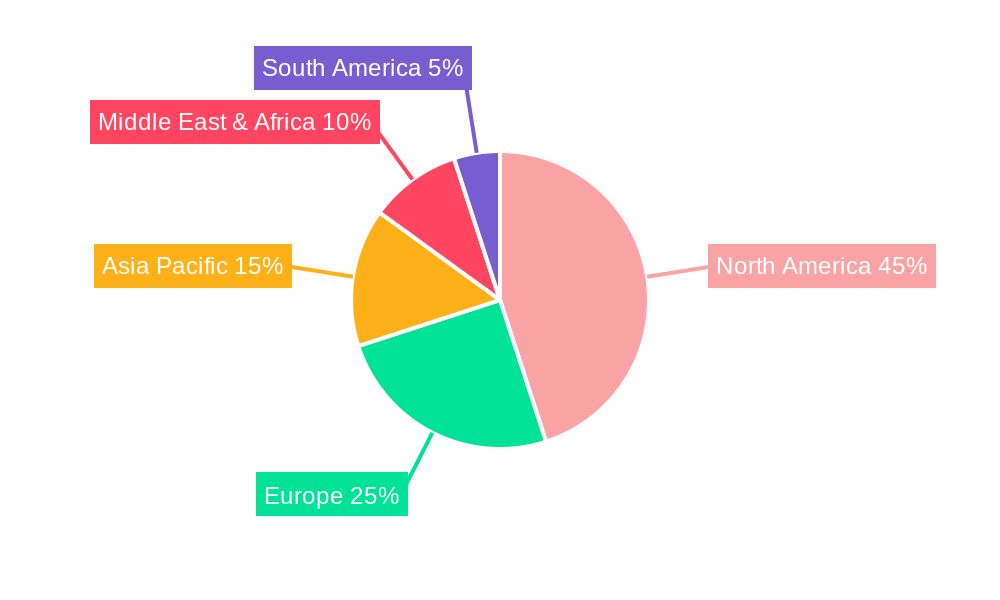

Several factors contribute to the industry's strong growth. Favorable investment climates, tax incentives, and net metering policies encourage both residential and commercial adoption. The evolving energy landscape, marked by a shift away from fossil fuels, positions solar energy as a critical component of Canada's future energy mix. While the market faces certain restraints, such as upfront installation costs and grid integration challenges, these are being progressively addressed through innovative financing models and advancements in grid management technologies. Leading companies like Canadian Solar Inc., Azgard Solar Inc., and BluEarth Renewables Inc. are actively investing in R&D and project development, further accelerating market expansion. The market's regional dynamics show a strong concentration in North America, with significant potential in other regions as renewable energy adoption gains momentum globally.

Solar Industry in Canada Company Market Share

Unlock the potential of Canada's booming solar energy sector with this in-depth market intelligence report. Analyzing from 2019–2033, with a base year of 2025, this report provides unparalleled insights into the Canadian solar market. We delve into the growth drivers, technological advancements in Solar Photovoltaic (PV) and Concentrated Solar Power (CSP), and the regulatory frameworks shaping the future of renewable energy in Canada. This is your essential guide to understanding the solar energy landscape, market concentration, and emerging opportunities within one of the world's most promising clean energy markets.

Solar Industry in Canada Market Concentration & Dynamics

The Canadian solar industry is experiencing dynamic shifts, moving towards increased, yet not fully consolidated, market concentration. While a few dominant players are emerging, the presence of numerous agile and specialized firms prevents a completely oligopolistic structure. Key indicators of this evolution include a projected increase in market share for leading companies like Canadian Solar Inc. and Azgard Solar Inc. over the forecast period. Innovation ecosystems are flourishing, particularly in provinces like Ontario and Alberta, driven by research institutions and supportive provincial policies. The regulatory framework, while evolving, remains a significant influence, with federal and provincial incentives playing a crucial role in project development. Substitute products, primarily fossil fuels and other renewable sources, continue to present competition, but the economic and environmental advantages of solar are increasingly evident. End-user trends are shifting towards greater adoption of distributed solar generation and large-scale utility projects, fueled by corporate sustainability goals and declining solar panel costs. Merger and acquisition (M&A) activities are on the rise, with approximately 15-20 significant M&A deals anticipated between 2024 and 2028, indicating strategic consolidation and investment in this rapidly expanding sector. The market is poised for substantial growth, driven by a strong commitment to decarbonization and energy independence.

Solar Industry in Canada Industry Insights & Trends

The Canadian solar industry is projected for robust expansion, with an estimated market size of over $35 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 18% from 2025 to 2033. This remarkable growth is primarily fueled by a confluence of favorable factors including increasing government support, declining technology costs, and a growing societal demand for clean energy solutions. The commitment to meet ambitious climate targets is a significant market growth driver, prompting substantial investments in both utility-scale solar farms and distributed generation projects. Technological disruptions are at the forefront of this industry's evolution. Advancements in solar photovoltaic (PV) technology, such as higher efficiency solar panels and improved battery storage solutions, are making solar power more reliable and cost-effective. The integration of artificial intelligence and machine learning in solar farm management is further optimizing energy output and operational efficiency. Evolving consumer behaviors are also playing a pivotal role. Homeowners and businesses are increasingly adopting solar energy for cost savings, energy independence, and to align with their environmental values. Corporate Power Purchase Agreements (PPAs) are becoming a standard mechanism for securing long-term, stable revenue streams for solar projects, attracting significant private sector investment. The increasing electrification of transportation and heating systems also presents a substantial opportunity for solar power to meet growing electricity demands. The regulatory landscape, with initiatives like carbon pricing and renewable energy mandates, continues to provide a stable and predictable environment for investment and development. The Canadian solar market is not just a growing industry; it's a fundamental pillar of Canada's sustainable future, attracting significant global investment and fostering domestic innovation.

Key Markets & Segments Leading Solar Industry in Canada

The Solar Photovoltaic (PV) segment overwhelmingly dominates the Canadian solar industry, accounting for an estimated 95% of the market share in 2025. This dominance is driven by a multitude of factors, making PV the cornerstone of Canada's solar energy expansion.

- Economic Growth & Cost-Effectiveness: The declining cost of solar PV panels and associated technologies has made solar power economically competitive, often surpassing traditional energy sources in new installations. This affordability is a primary driver for widespread adoption across residential, commercial, and utility-scale projects.

- Infrastructure & Scalability: Solar PV systems are highly scalable, adaptable to various geographic locations and project sizes. From rooftop installations on individual homes to vast solar farms spanning hundreds of megawatts, PV technology offers flexibility that is crucial for meeting diverse energy needs across Canada.

- Government Incentives & Policy Support: Federal and provincial governments have implemented various incentive programs, tax credits, and net-metering policies that significantly bolster the economic viability of solar PV projects. These supportive frameworks reduce the financial risk for investors and consumers.

- Environmental Consciousness & Decarbonization Goals: A strong and growing public awareness of climate change and Canada's commitment to reducing greenhouse gas emissions are powerful motivators for adopting solar PV, a clean and renewable energy source.

While Concentrated Solar Power (CSP) technology holds potential, its market penetration in Canada remains nascent. CSP is more geographically specific, requiring consistent direct sunlight, which is less prevalent across much of Canada compared to regions in the southern United States or North Africa. The higher upfront capital costs and complex engineering requirements of CSP also present a barrier to widespread adoption in the current Canadian market. However, ongoing research and development in CSP, particularly in more favorable southern regions of the country, could lead to niche applications or hybrid systems in the future. For the foreseeable future, the trajectory of the Canadian solar industry is inextricably linked to the continued growth and innovation within the Solar Photovoltaic (PV) segment. The sheer volume of installations, technological advancements, and supportive policies all underscore PV's leading position.

Solar Industry in Canada Product Developments

Product development in the Canadian solar industry is characterized by continuous innovation aimed at enhancing efficiency, reducing costs, and improving integration. Advances in solar photovoltaic (PV) technology are leading to higher power output per panel, with new materials and manufacturing processes enabling increased energy generation even in less-than-ideal weather conditions. Bifacial solar panels, capable of capturing sunlight from both sides, are gaining traction, offering significant performance boosts. Battery storage solutions are also seeing rapid development, becoming more affordable, energy-dense, and integrated with solar systems to provide reliable power during off-peak generation hours. Smart solar inverters with advanced monitoring and control capabilities are enabling greater grid integration and demand response management. These technological advancements are crucial for driving down the levelized cost of electricity (LCOE) for solar power and expanding its market applicability.

Challenges in the Solar Industry in Canada Market

Despite significant growth, the Canadian solar industry faces several challenges. Regulatory hurdles, including complex permitting processes and inconsistent interprovincial policies, can slow down project development. Supply chain disruptions, exacerbated by global events, can lead to increased material costs and extended lead times for solar components. Grid integration issues, particularly for smaller utilities or areas with aging infrastructure, require substantial investment in grid modernization to accommodate the increasing influx of solar power. Furthermore, competition from established energy sources and intermittency concerns, though increasingly mitigated by storage solutions, remain factors that require ongoing attention and technological advancement. The Canadian market is also sensitive to financing availability and interest rate fluctuations, which can impact the economic feasibility of large-scale projects.

Forces Driving Solar Industry in Canada Growth

The Canadian solar industry is propelled by powerful growth forces. Technological advancements in solar panel efficiency and energy storage are making solar increasingly competitive and reliable. Economic drivers, including the declining cost of solar technology and attractive investment opportunities, are spurring significant capital deployment. Government policies, such as renewable energy mandates, tax incentives, and carbon pricing mechanisms, create a supportive and predictable environment for growth. The increasing demand for clean energy from consumers, corporations committed to sustainability, and provinces striving for energy independence further amplifies these forces. These combined factors create a compelling case for continued and accelerated expansion of solar energy across Canada.

Challenges in the Solar Industry in Canada Market

The long-term growth of the Canadian solar market is bolstered by ongoing innovations in solar technology, such as perovskite solar cells and advanced manufacturing techniques, promising even higher efficiencies and lower costs. Strategic partnerships between developers, manufacturers, and financial institutions are crucial for de-risking large-scale projects and unlocking new investment avenues. Market expansions into new geographical regions within Canada, leveraging diverse solar resources, and the development of integrated energy solutions combining solar, storage, and smart grid technologies represent significant long-term growth catalysts.

Emerging Opportunities in Solar Industry in Canada

Emerging opportunities in the Canadian solar industry are diverse and promising. The integration of solar with electric vehicle (EV) charging infrastructure presents a significant growth avenue, creating symbiotic energy ecosystems. The development of community solar projects is opening up access to solar energy for a broader range of consumers, including renters and those without suitable rooftop spaces. Advances in green hydrogen production powered by solar energy offer a pathway for decarbonizing heavy industries. Furthermore, the increasing demand for energy resilience and microgrids in remote communities and critical infrastructure is creating new market segments for solar and storage solutions. Exploring novel financing models and developing specialized solar applications for agriculture and industry also represent untapped potential.

Leading Players in the Solar Industry in Canada Sector

- Great Canadian Solar Ltd

- Azgard Solar Inc

- DP Energy Canada Ltd

- Canadian Solar Inc

- Greengate Power Corporation

- AMP Solar Group Inc

- miEnergy Inc

- BluEarth Renewables Inc

- Gorkon Industries

- Quadra Power Inc

Key Milestones in Solar Industry in Canada Industry

- January 2023: Neon, a French renewable energy developer, commenced construction of a 93 MW solar project in Alberta, operated by ATCO Electric. Commissioning is expected in 2024, with power sales through PPAs and the electricity market.

- October 2022: TC Energy Corporation announced pre-construction activities for the Saddlebrook Solar Project near Aldersyde, Alberta. This USD 146 million investment marks TC Energy's first Canadian solar project, designed to generate approximately 81 megawatts, enough to power 20,000 homes annually. Initial construction includes installing solar panels on TC Energy property.

Strategic Outlook for Solar Industry in Canada Market

The strategic outlook for the Canadian solar industry is exceptionally strong, characterized by sustained growth driven by government policy, technological innovation, and increasing market demand. Future market potential lies in the further integration of solar power into the national grid, with a focus on grid modernization and enhanced storage capabilities. Strategic opportunities include the expansion of distributed generation, the development of large-scale solar farms in regions with high solar irradiance, and the creation of hybrid renewable energy projects. Partnerships for offshore wind and solar integration, as well as advancements in solar manufacturing within Canada, represent further avenues for growth. The industry is poised to play a pivotal role in Canada's transition to a low-carbon economy, attracting significant investment and driving economic prosperity.

Solar Industry in Canada Segmentation

-

1. Technology

- 1.1. Solar Photovoltaic (PV)

- 1.2. Concentrated Solar Power (CSP)

Solar Industry in Canada Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Solar Industry in Canada Regional Market Share

Geographic Coverage of Solar Industry in Canada

Solar Industry in Canada REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Demand for Coal Based Power Generation Sector4.; Ease of Availability of Coal for Various Sectors

- 3.2.2 Such as Transport

- 3.2.3 Residential

- 3.2.4 Commercial and Others

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Solar Photovoltaic (PV) Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Solar Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Solar Photovoltaic (PV)

- 5.1.2. Concentrated Solar Power (CSP)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Solar Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Solar Photovoltaic (PV)

- 6.1.2. Concentrated Solar Power (CSP)

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. South America Solar Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Solar Photovoltaic (PV)

- 7.1.2. Concentrated Solar Power (CSP)

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Europe Solar Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Solar Photovoltaic (PV)

- 8.1.2. Concentrated Solar Power (CSP)

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East & Africa Solar Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Solar Photovoltaic (PV)

- 9.1.2. Concentrated Solar Power (CSP)

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Asia Pacific Solar Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Solar Photovoltaic (PV)

- 10.1.2. Concentrated Solar Power (CSP)

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Great Canadian Solar Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Azgard Solar Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DP Energy Canada Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Canadian Solar Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Greengate Power Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AMP Solar Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 miEnergy Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BluEarth Renewables Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gorkon Industries

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Quadra Power Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Great Canadian Solar Ltd

List of Figures

- Figure 1: Global Solar Industry in Canada Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Solar Industry in Canada Volume Breakdown (Gigawatt, %) by Region 2025 & 2033

- Figure 3: North America Solar Industry in Canada Revenue (undefined), by Technology 2025 & 2033

- Figure 4: North America Solar Industry in Canada Volume (Gigawatt), by Technology 2025 & 2033

- Figure 5: North America Solar Industry in Canada Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Solar Industry in Canada Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America Solar Industry in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 8: North America Solar Industry in Canada Volume (Gigawatt), by Country 2025 & 2033

- Figure 9: North America Solar Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Solar Industry in Canada Volume Share (%), by Country 2025 & 2033

- Figure 11: South America Solar Industry in Canada Revenue (undefined), by Technology 2025 & 2033

- Figure 12: South America Solar Industry in Canada Volume (Gigawatt), by Technology 2025 & 2033

- Figure 13: South America Solar Industry in Canada Revenue Share (%), by Technology 2025 & 2033

- Figure 14: South America Solar Industry in Canada Volume Share (%), by Technology 2025 & 2033

- Figure 15: South America Solar Industry in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 16: South America Solar Industry in Canada Volume (Gigawatt), by Country 2025 & 2033

- Figure 17: South America Solar Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Solar Industry in Canada Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Solar Industry in Canada Revenue (undefined), by Technology 2025 & 2033

- Figure 20: Europe Solar Industry in Canada Volume (Gigawatt), by Technology 2025 & 2033

- Figure 21: Europe Solar Industry in Canada Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Europe Solar Industry in Canada Volume Share (%), by Technology 2025 & 2033

- Figure 23: Europe Solar Industry in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Solar Industry in Canada Volume (Gigawatt), by Country 2025 & 2033

- Figure 25: Europe Solar Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Solar Industry in Canada Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa Solar Industry in Canada Revenue (undefined), by Technology 2025 & 2033

- Figure 28: Middle East & Africa Solar Industry in Canada Volume (Gigawatt), by Technology 2025 & 2033

- Figure 29: Middle East & Africa Solar Industry in Canada Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Middle East & Africa Solar Industry in Canada Volume Share (%), by Technology 2025 & 2033

- Figure 31: Middle East & Africa Solar Industry in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 32: Middle East & Africa Solar Industry in Canada Volume (Gigawatt), by Country 2025 & 2033

- Figure 33: Middle East & Africa Solar Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa Solar Industry in Canada Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Solar Industry in Canada Revenue (undefined), by Technology 2025 & 2033

- Figure 36: Asia Pacific Solar Industry in Canada Volume (Gigawatt), by Technology 2025 & 2033

- Figure 37: Asia Pacific Solar Industry in Canada Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Asia Pacific Solar Industry in Canada Volume Share (%), by Technology 2025 & 2033

- Figure 39: Asia Pacific Solar Industry in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 40: Asia Pacific Solar Industry in Canada Volume (Gigawatt), by Country 2025 & 2033

- Figure 41: Asia Pacific Solar Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Solar Industry in Canada Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Solar Industry in Canada Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Global Solar Industry in Canada Volume Gigawatt Forecast, by Technology 2020 & 2033

- Table 3: Global Solar Industry in Canada Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Solar Industry in Canada Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 5: Global Solar Industry in Canada Revenue undefined Forecast, by Technology 2020 & 2033

- Table 6: Global Solar Industry in Canada Volume Gigawatt Forecast, by Technology 2020 & 2033

- Table 7: Global Solar Industry in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Global Solar Industry in Canada Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 9: United States Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: United States Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 11: Canada Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 13: Mexico Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Mexico Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 15: Global Solar Industry in Canada Revenue undefined Forecast, by Technology 2020 & 2033

- Table 16: Global Solar Industry in Canada Volume Gigawatt Forecast, by Technology 2020 & 2033

- Table 17: Global Solar Industry in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Global Solar Industry in Canada Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 19: Brazil Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Brazil Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 21: Argentina Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Argentina Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 25: Global Solar Industry in Canada Revenue undefined Forecast, by Technology 2020 & 2033

- Table 26: Global Solar Industry in Canada Volume Gigawatt Forecast, by Technology 2020 & 2033

- Table 27: Global Solar Industry in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Global Solar Industry in Canada Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 31: Germany Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 33: France Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: France Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 35: Italy Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Italy Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 37: Spain Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Spain Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 39: Russia Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Russia Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 41: Benelux Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Benelux Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 43: Nordics Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Nordics Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 47: Global Solar Industry in Canada Revenue undefined Forecast, by Technology 2020 & 2033

- Table 48: Global Solar Industry in Canada Volume Gigawatt Forecast, by Technology 2020 & 2033

- Table 49: Global Solar Industry in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Global Solar Industry in Canada Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 51: Turkey Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Turkey Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 53: Israel Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Israel Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 55: GCC Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: GCC Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 57: North Africa Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: North Africa Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 59: South Africa Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: South Africa Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 63: Global Solar Industry in Canada Revenue undefined Forecast, by Technology 2020 & 2033

- Table 64: Global Solar Industry in Canada Volume Gigawatt Forecast, by Technology 2020 & 2033

- Table 65: Global Solar Industry in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 66: Global Solar Industry in Canada Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 67: China Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: China Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 69: India Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: India Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 71: Japan Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Japan Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 73: South Korea Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: South Korea Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 75: ASEAN Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: ASEAN Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 77: Oceania Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Oceania Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific Solar Industry in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific Solar Industry in Canada Volume (Gigawatt) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Solar Industry in Canada?

The projected CAGR is approximately 23.9%.

2. Which companies are prominent players in the Solar Industry in Canada?

Key companies in the market include Great Canadian Solar Ltd, Azgard Solar Inc, DP Energy Canada Ltd, Canadian Solar Inc, Greengate Power Corporation, AMP Solar Group Inc, miEnergy Inc, BluEarth Renewables Inc, Gorkon Industries, Quadra Power Inc.

3. What are the main segments of the Solar Industry in Canada?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Coal Based Power Generation Sector4.; Ease of Availability of Coal for Various Sectors. Such as Transport. Residential. Commercial and Others.

6. What are the notable trends driving market growth?

Solar Photovoltaic (PV) Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

In January 2023, Neon, a French renewable energy developer, commenced construction of a solar project of 93 MW capacity in the Alberta province of Canada. The operator of the solar power plant is ATCO Electric. The commissioning of the project is expected to be in 2024, which would sell power through power purchase agreements (PPAs) and the electricity market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Solar Industry in Canada," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Solar Industry in Canada report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Solar Industry in Canada?

To stay informed about further developments, trends, and reports in the Solar Industry in Canada, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence