Key Insights

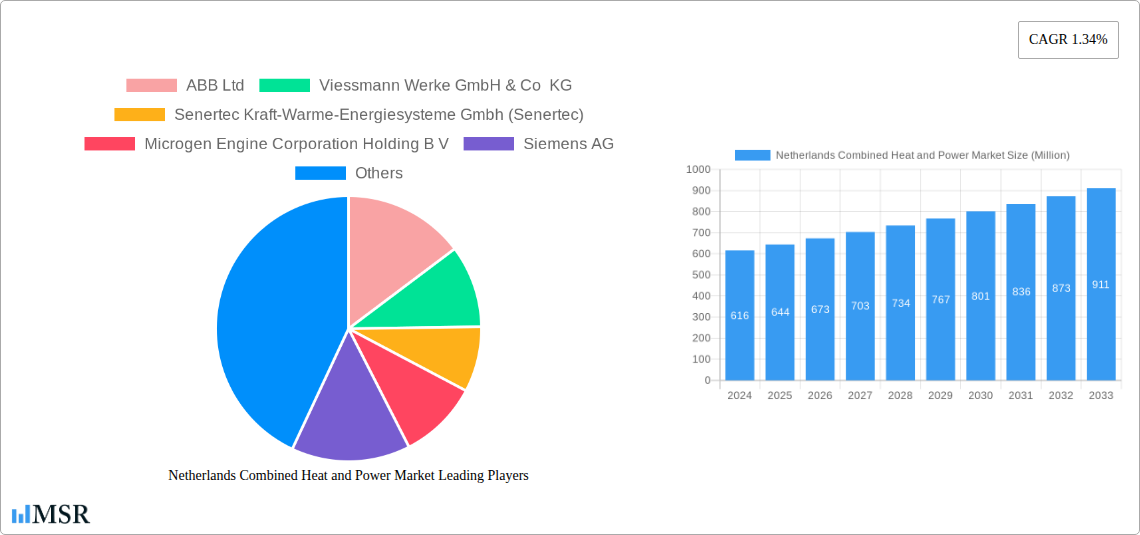

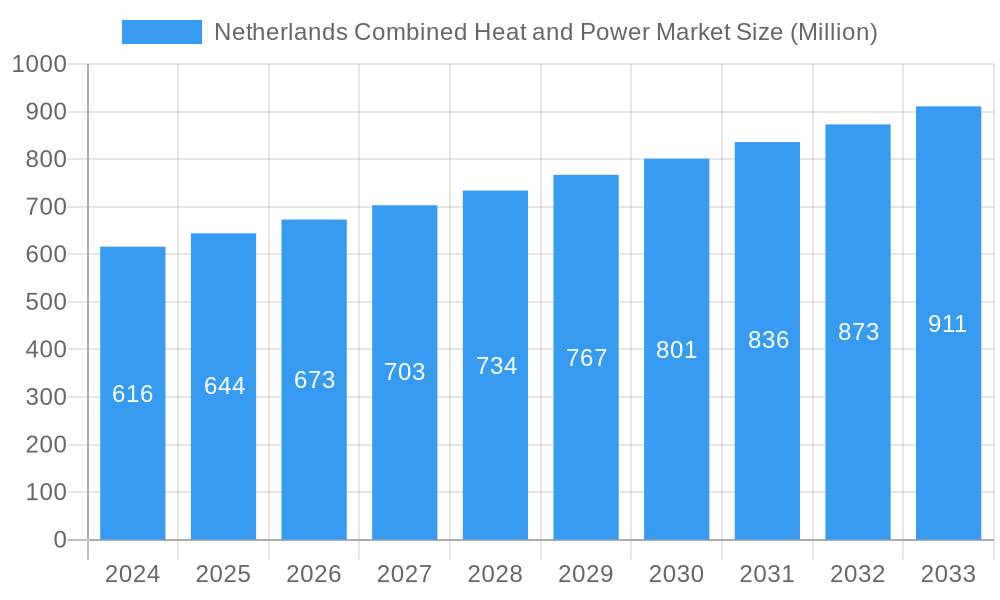

The Netherlands Combined Heat and Power (CHP) market is poised for significant growth, driven by an increasing focus on energy efficiency and decarbonization. With a market size estimated at €616 million in 2024, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.6% through 2033. This growth is propelled by a strong governmental push for sustainable energy solutions, aiming to reduce reliance on fossil fuels and meet ambitious climate targets. Key drivers include the adoption of renewable energy sources within CHP systems, making them a more environmentally friendly option, and the inherent efficiency benefits of generating both electricity and heat simultaneously, thereby minimizing energy waste. Furthermore, the industrial and utility sectors are increasingly investing in CHP for their operational efficiency and cost savings, while the residential sector is seeing growing interest in smaller-scale, decentralized CHP units for improved building energy performance.

Netherlands Combined Heat and Power Market Market Size (In Million)

Despite its promising trajectory, the market faces certain restraints, including the initial capital investment required for CHP installations and the evolving regulatory landscape concerning grid integration and energy policies. However, ongoing technological advancements in areas like advanced heat recovery and integration with smart grids are expected to mitigate these challenges. The market's segmentation by fuel type reveals a gradual shift towards renewable energy sources, with natural gas remaining a significant contributor due to its established infrastructure and relative affordability. Companies like ABB Ltd, Siemens AG, and Caterpillar Inc. are at the forefront, offering innovative CHP solutions and contributing to the market's expansion. The Netherlands, as a region with a strong commitment to sustainability and energy innovation, is expected to be a key player in this evolving market.

Netherlands Combined Heat and Power Market Company Market Share

Netherlands Combined Heat and Power Market: Driving Energy Efficiency and Sustainability

This comprehensive report provides an in-depth analysis of the Netherlands Combined Heat and Power (CHP) market, exploring its growth trajectories, key drivers, emerging trends, and competitive landscape. With a focus on optimizing energy utilization and reducing carbon emissions, the Dutch CHP sector is poised for significant expansion. This report delves into the market dynamics from 2019–2033, with a base year of 2025 and a forecast period extending to 2033. We offer actionable insights for industry stakeholders, including manufacturers, energy providers, policymakers, and investors, seeking to capitalize on the burgeoning Dutch energy transition. Discover key strategies for navigating challenges and leveraging opportunities in this dynamic market.

Netherlands Combined Heat and Power Market Market Concentration & Dynamics

The Netherlands Combined Heat and Power market exhibits a moderate level of market concentration. A handful of prominent players, including Siemens AG, General Electric Company, ABB Ltd, and Viessmann Werke GmbH & Co KG, hold significant market shares, driving innovation and setting industry benchmarks. The innovation ecosystem is characterized by a strong emphasis on R&D, particularly in developing more efficient and cost-effective CHP systems, including those powered by renewable energy sources. The regulatory framework, driven by the Dutch government's commitment to decarbonization and energy efficiency targets, plays a crucial role in shaping market dynamics. Supportive policies and incentives for cogeneration and decentralized energy production are key enablers. Substitute products, such as standalone boilers and renewable energy systems, pose a competitive challenge, but the inherent efficiency and cost-saving benefits of CHP systems continue to drive demand. End-user trends reveal a growing preference for integrated energy solutions and a keen interest in reducing operational costs and environmental impact, particularly within the industrial and commercial segments. Merger and acquisition (M&A) activities, while not at an extremely high volume, are observed as key players seek to consolidate their market position and expand their technological capabilities. Anticipate a steady stream of strategic partnerships aimed at advancing sustainable energy solutions.

Netherlands Combined Heat and Power Market Industry Insights & Trends

The Netherlands Combined Heat and Power market is experiencing robust growth, fueled by a strong impetus towards energy efficiency and the nation's ambitious climate goals. The market size is projected to reach XX billion by 2033, with a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. A primary growth driver is the increasing demand for cost-effective energy solutions across all sectors, especially in light of volatile energy prices. The industrial sector, with its high energy consumption, is a significant contributor to market expansion as companies increasingly adopt industrial CHP to reduce operating expenses and improve their sustainability profile. The commercial sector, including large institutions and businesses, is also witnessing a rise in CHP adoption for heating, cooling, and electricity generation. Furthermore, government incentives and supportive policies aimed at promoting decentralized energy generation and cogeneration are creating a favorable environment for market players. Technological disruptions are playing a pivotal role, with advancements in turbine technology, heat recovery systems, and the integration of renewable energy sources like biomass and geothermal energy into CHP systems. The development of smaller-scale, modular CHP units is also opening up new application possibilities, particularly in the residential sector. Evolving consumer behaviors, driven by increased environmental awareness and a desire for energy independence, are further accelerating the adoption of CHP solutions. The ongoing Dutch energy transition, aiming for a lower carbon footprint, places CHP at the forefront of achieving these objectives by maximizing energy utilization and minimizing waste heat. The market is also seeing increased investment in research and development to enhance the efficiency, reliability, and environmental performance of CHP systems, paving the way for future growth.

Key Markets & Segments Leading Netherlands Combined Heat and Power Market

The Netherlands Combined Heat and Power market is dominated by specific applications and fuel types, reflecting the nation's energy landscape and policy priorities.

Dominant Application Segments:

Industrial: The industrial segment stands as a cornerstone of the Dutch CHP market.

- Driver: High energy intensity of manufacturing processes, coupled with the significant cost savings and emission reduction benefits offered by industrial CHP systems.

- Dominance Analysis: Industries such as food processing, chemicals, and paper manufacturing have consistently invested in CHP solutions to meet their substantial heating and electricity demands. The ability of CHP to provide reliable, on-site power and heat makes it indispensable for maintaining operational continuity and competitiveness. The push towards industrial decarbonization further strengthens this segment's lead.

Commercial: The commercial segment represents another substantial and growing area for CHP adoption.

- Driver: Increasing demand for efficient heating, cooling, and electricity in large commercial buildings, such as hospitals, hotels, and office complexes, alongside a growing focus on corporate sustainability initiatives.

- Dominance Analysis: The economic advantages of reduced energy bills, coupled with the ability to enhance building energy resilience, are key attractions for commercial entities. Integration with district heating networks also plays a role in expanding CHP's reach within this segment.

Residential: While historically a smaller segment, the residential sector is showing promising growth.

- Driver: Government support for district heating networks powered by CHP, coupled with the development of smaller, more efficient residential CHP units (micro-CHP).

- Dominance Analysis: The focus here is often on providing sustainable heating and hot water to multiple dwellings through residential CHP systems. As energy efficiency becomes a higher priority for homeowners and developers, this segment is expected to gain more traction.

Utility: The utility segment plays a crucial role in the broader energy infrastructure.

- Driver: The need for efficient and flexible power generation, particularly in supporting the integration of intermittent renewable energy sources.

- Dominance Analysis: Large-scale CHP plants operated by utilities contribute significantly to the overall electricity and heat supply, often feeding into district heating networks and providing grid stability.

Dominant Fuel Types:

Natural Gas: Remains a prevalent fuel source due to its availability, relatively lower emissions compared to other fossil fuels, and established infrastructure.

- Driver: Cost-effectiveness, high efficiency, and technological maturity of natural gas-fired CHP systems.

- Dominance Analysis: The vast majority of existing and new CHP installations in the Netherlands utilize natural gas as their primary fuel, owing to its established supply chain and the well-developed technology for its efficient combustion.

Renewable Energy Sources: This category is rapidly gaining prominence, aligning with the Netherlands' ambitious sustainability agenda.

- Driver: Government mandates and incentives to decarbonize the energy sector, leading to increased adoption of biomass, biogas, and waste-to-energy CHP systems.

- Dominance Analysis: The recent surge in renewable energy generation in the Netherlands, with renewables producing 32.3 billion kilowatt-hours and accounting for 53% of total electricity output in the first half of 2024, highlights a significant shift. Wind power's contribution is particularly notable, influencing the broader energy mix and creating opportunities for renewable-based CHP. This trend is expected to drive significant growth in renewable-fueled CHP.

Other Fuel Types: Includes fuels like hydrogen and waste heat from industrial processes.

- Driver: Emerging technologies and a drive for greater circular economy principles.

- Dominance Analysis: While currently a smaller segment, the utilization of waste heat from industrial processes in industrial CHP applications and the exploration of hydrogen as a future fuel for CHP systems represent areas of significant future potential and innovation.

Netherlands Combined Heat and Power Market Product Developments

Product development in the Netherlands Combined Heat and Power market is characterized by a strong emphasis on enhancing efficiency, sustainability, and integration capabilities. Key innovations include the development of more advanced turbine technologies for higher power output and improved heat recovery efficiency. There is a growing focus on modular and scalable CHP systems, allowing for customized solutions across various applications, from large industrial complexes to smaller commercial buildings and even residential installations. The integration of renewable energy sources such as biomass, biogas, and waste heat into CHP systems is a significant trend, aligning with the Netherlands' decarbonization goals. Furthermore, smart control systems and digital integration are enabling better performance monitoring, predictive maintenance, and optimized energy management, enhancing the overall value proposition of CHP solutions.

Challenges in the Netherlands Combined Heat and Power Market Market

Despite its strong growth potential, the Netherlands Combined Heat and Power market faces several hurdles.

- Regulatory Complexity: Navigating evolving regulations and obtaining permits for CHP installations can be time-consuming and complex, impacting project timelines.

- Intermittency of Renewables: While renewable energy sources are gaining traction, integrating them seamlessly with CHP systems to ensure consistent heat and power supply requires sophisticated management and backup solutions.

- High Initial Investment: The upfront cost of installing CHP systems can be a barrier, particularly for smaller businesses and residential projects, despite long-term cost savings.

- Competition from Alternatives: Standalone renewable energy solutions and grid-supplied electricity, especially with increasing renewable penetration, present ongoing competition.

- Infrastructure Limitations: Expanding district heating networks to accommodate broader CHP integration can require significant investment and planning.

Forces Driving Netherlands Combined Heat and Power Market Growth

Several powerful forces are propelling the growth of the Netherlands Combined Heat and Power market.

- Energy Efficiency Mandates: Government policies and targets aimed at reducing overall energy consumption and promoting efficient energy utilization are a primary catalyst.

- Decarbonization Efforts: The Netherlands' commitment to achieving ambitious climate goals and reducing greenhouse gas emissions makes CHP, with its ability to optimize energy use and integrate renewables, a crucial technology.

- Economic Incentives: Subsidies, tax credits, and favorable feed-in tariffs for cogeneration and renewable energy-based CHP systems are encouraging investment.

- Technological Advancements: Continuous innovation in CHP technology, leading to higher efficiencies, lower emissions, and increased reliability, is making systems more attractive and cost-effective.

- Volatile Energy Prices: The fluctuating costs of traditional energy sources drive businesses and consumers to seek more stable and cost-efficient on-site energy generation solutions like CHP.

Challenges in the Netherlands Combined Heat and Power Market Market

The long-term growth of the Netherlands Combined Heat and Power market is underpinned by several enduring growth catalysts. The sustained political will and supportive regulatory framework dedicated to the energy transition and sustainable energy solutions will continue to provide a stable foundation for investment and development. Ongoing advancements in CHP technology, particularly in areas like hybridization with renewable sources, carbon capture integration, and increased fuel flexibility (including hydrogen readiness), will unlock new applications and enhance performance. Strategic partnerships between technology providers, energy utilities, and industrial end-users are expected to drive innovation and facilitate wider adoption. Furthermore, the increasing demand for energy security and resilience, especially in the face of global geopolitical uncertainties, will favor decentralized CHP systems that can operate independently or in conjunction with the grid. The growing awareness of the economic and environmental benefits of cogeneration among businesses and consumers will fuel sustained demand.

Emerging Opportunities in Netherlands Combined Heat and Power Market

The Netherlands Combined Heat and Power market is ripe with emerging opportunities for innovation and expansion. The increasing focus on district heating and cooling networks presents a significant avenue for growth, with CHP systems serving as the backbone for these integrated energy infrastructures. The burgeoning circular economy initiatives are creating opportunities for CHP systems that can utilize waste heat from industrial processes or even organic waste streams as fuel sources. As the Netherlands pushes towards greater electrification of transport and industry, the role of CHP in providing reliable, on-site electricity and heat, potentially powered by green hydrogen in the future, becomes even more critical. Furthermore, the development of smart grid technologies and the integration of digital solutions for energy management offer opportunities for enhanced operational efficiency and new service models in the Dutch energy market. The trend towards greater decentralization of energy production also opens doors for smaller-scale, modular CHP solutions tailored for specific commercial and residential needs.

Leading Players in the Netherlands Combined Heat and Power Market Sector

- ABB Ltd

- Viessmann Werke GmbH & Co KG

- Senertec Kraft-Warme-Energiesysteme Gmbh (Senertec)

- Microgen Engine Corporation Holding B V

- Siemens AG

- Caterpillar Inc

- Centrica PLC

- General Electric Company

- BDR Thermea Group BV

- Capstone Turbine Corporation

Key Milestones in Netherlands Combined Heat and Power Market Industry

- First Half of 2024: Renewable energy sources generated more electricity than fossil fuels in the Netherlands for the first time. Renewables produced 32.3 billion kilowatt-hours, accounting for 53% of the total electricity output, with wind power significantly contributing to this increase. This milestone underscores the growing momentum towards sustainable energy and directly impacts the market for renewable-based CHP solutions.

- 2023: Increased government investment and incentives for district heating network expansion, directly benefiting CHP system deployment in urban areas.

- 2022: Introduction of new regulations aimed at enhancing energy efficiency standards for industrial and commercial buildings, driving demand for integrated solutions like CHP.

- 2021: Significant advancements in biomass and biogas-fueled CHP technology demonstrated, offering more sustainable alternatives to natural gas.

- 2020: Rise in adoption of micro-CHP units for residential applications, indicating a growing market for smaller-scale, decentralized energy generation.

- 2019: Launch of several pilot projects exploring the use of hydrogen in CHP systems, signaling a future direction for the technology.

Strategic Outlook for Netherlands Combined Heat and Power Market Market

The strategic outlook for the Netherlands Combined Heat and Power market is overwhelmingly positive, driven by a confluence of supportive government policies, technological innovation, and a clear societal push towards sustainability. Growth accelerators include the continued expansion of district heating and cooling infrastructure, creating significant demand for CHP as a primary energy source. The increasing integration of renewable energy sources into CHP systems, such as biomass and biogas, will further enhance the environmental credentials and market appeal of these solutions. Furthermore, advancements in smart grid technologies and digital integration will enable more efficient operation, predictive maintenance, and optimized energy management, unlocking new service-based revenue streams. The anticipated growth in sectors like industrial manufacturing, commercial real estate, and potentially even residential applications, fueled by energy cost savings and decarbonization imperatives, presents substantial market potential. Strategic opportunities lie in developing and deploying highly efficient, flexible, and hybrid CHP systems that can adapt to evolving energy landscapes and embrace future fuels like hydrogen.

Netherlands Combined Heat and Power Market Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial and Utility

-

2. Fuel Type

- 2.1. Natural Gas

- 2.2. Renewable Energy Sources

- 2.3. Other Fuel Types

Netherlands Combined Heat and Power Market Segmentation By Geography

- 1. Netherlands

Netherlands Combined Heat and Power Market Regional Market Share

Geographic Coverage of Netherlands Combined Heat and Power Market

Netherlands Combined Heat and Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Industries such as chemicals

- 3.2.2 paper

- 3.2.3 and pulp require reliable and efficient power solutions

- 3.2.4 making CHP systems an attractive option. The chemical sector

- 3.2.5 in particular

- 3.2.6 is expected to continue driving demand for natural gas-based CHP due to its established infrastructure and logistics.

- 3.3. Market Restrains

- 3.3.1 The increasing share of renewable energy sources

- 3.3.2 such as wind and solar

- 3.3.3 presents challenges for integrating CHP systems into the grid. The variability of renewable energy can affect the efficiency and operation of CHP plants

- 3.4. Market Trends

- 3.4.1 Natural gas has traditionally been the primary fuel for CHP systems in the Netherlands

- 3.4.2 accounting for over 70% of fuel usage. This trend is expected to continue

- 3.4.3 driven by the chemical sector's substantial demand for CHP

- 3.4.4 which benefits from natural gas's efficiency and environmental compatibility.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Combined Heat and Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial and Utility

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Natural Gas

- 5.2.2. Renewable Energy Sources

- 5.2.3. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Viessmann Werke GmbH & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Senertec Kraft-Warme-Energiesysteme Gmbh (Senertec)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Microgen Engine Corporation Holding B V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Centrica PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BDR Thermea Group BV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Capstone Turbine Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Netherlands Combined Heat and Power Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Netherlands Combined Heat and Power Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Combined Heat and Power Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Netherlands Combined Heat and Power Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 3: Netherlands Combined Heat and Power Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Netherlands Combined Heat and Power Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Netherlands Combined Heat and Power Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 6: Netherlands Combined Heat and Power Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Combined Heat and Power Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Netherlands Combined Heat and Power Market?

Key companies in the market include ABB Ltd, Viessmann Werke GmbH & Co KG, Senertec Kraft-Warme-Energiesysteme Gmbh (Senertec), Microgen Engine Corporation Holding B V, Siemens AG, Caterpillar Inc, Centrica PLC, General Electric Company, BDR Thermea Group BV, Capstone Turbine Corporation.

3. What are the main segments of the Netherlands Combined Heat and Power Market?

The market segments include Application, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Industries such as chemicals. paper. and pulp require reliable and efficient power solutions. making CHP systems an attractive option. The chemical sector. in particular. is expected to continue driving demand for natural gas-based CHP due to its established infrastructure and logistics..

6. What are the notable trends driving market growth?

Natural gas has traditionally been the primary fuel for CHP systems in the Netherlands. accounting for over 70% of fuel usage. This trend is expected to continue. driven by the chemical sector's substantial demand for CHP. which benefits from natural gas's efficiency and environmental compatibility..

7. Are there any restraints impacting market growth?

The increasing share of renewable energy sources. such as wind and solar. presents challenges for integrating CHP systems into the grid. The variability of renewable energy can affect the efficiency and operation of CHP plants.

8. Can you provide examples of recent developments in the market?

In the first half of 2024, renewable energy sources generated more electricity than fossil fuels in the Netherlands for the first time. Renewables produced 32.3 billion kilowatt-hours, accounting for 53% of the total electricity output, with wind power significantly contributing to this increase.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Combined Heat and Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Combined Heat and Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Combined Heat and Power Market?

To stay informed about further developments, trends, and reports in the Netherlands Combined Heat and Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence