Key Insights

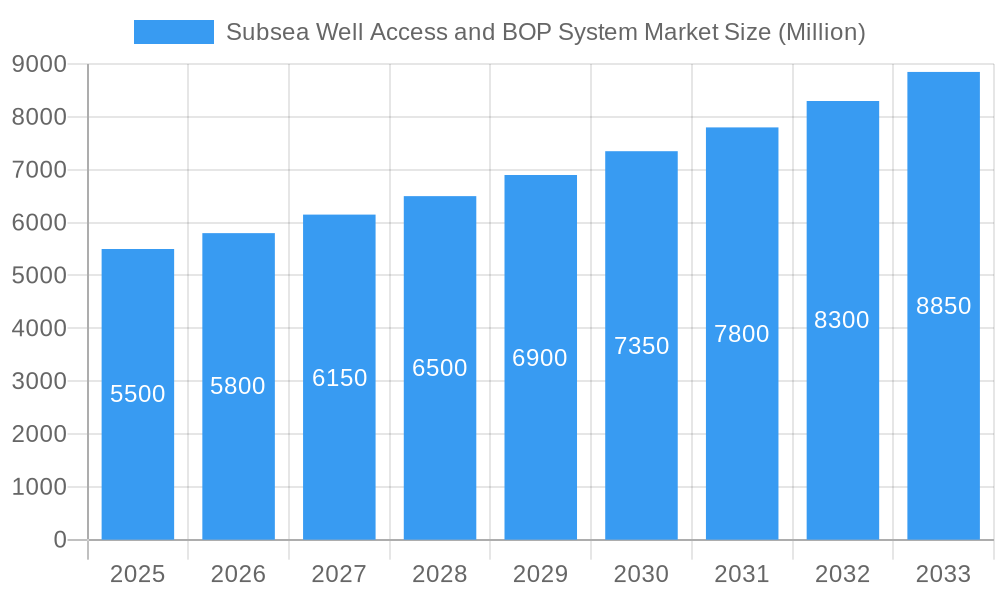

The Subsea Well Access and BOP System Market is projected for significant expansion, driven by escalating global energy demands and the increasing complexity of offshore exploration and production. With an estimated market size of 11.88 billion and a Compound Annual Growth Rate (CAGR) of 10.73%, this sector is crucial for offshore oil and gas operations. The base year of 2025 signifies a pivotal point for continued strong performance. Growth is fueled by the necessity for advanced subsea well access and Blowout Preventer (BOP) systems, essential for safety and environmental protection in deepwater and harsh environments. Technological advancements in subsea robotics, automation, and data analytics are enhancing system efficiency and reliability, vital for unlocking new reserves and maintaining production. This trajectory reflects a strategic shift towards more challenging offshore frontiers, requiring sophisticated well intervention and control solutions.

Subsea Well Access and BOP System Market Market Size (In Billion)

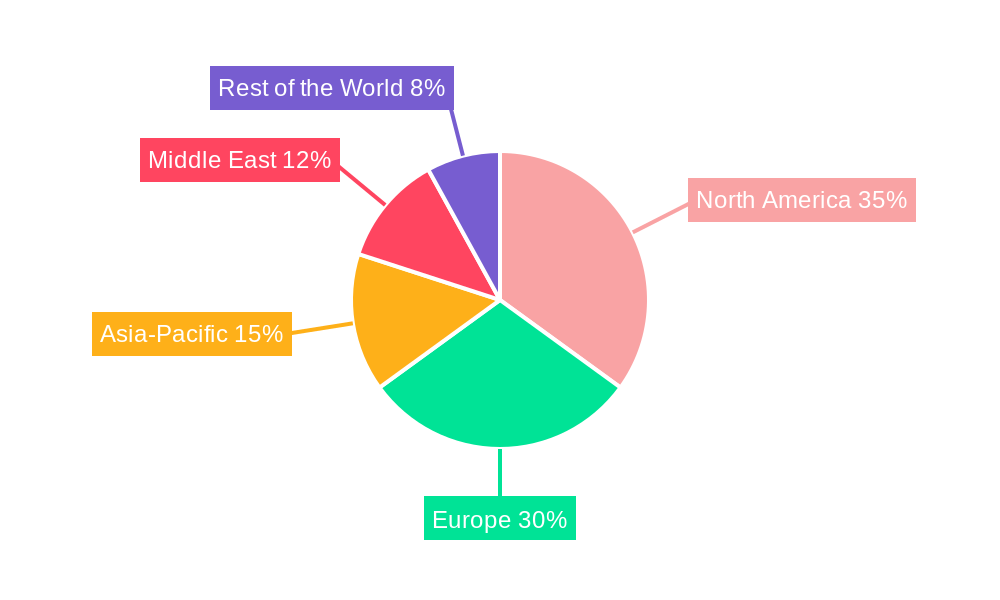

The forecast period from 2025 to 2033 anticipates sustained growth, propelled by substantial investments in offshore oil and gas infrastructure, particularly in regions with untapped deepwater potential. Increased focus on enhanced oil recovery (EOR) techniques and subsea asset maintenance will drive consistent demand. Stringent global regulatory requirements for safety and environmental compliance mandate the use of advanced BOP systems, creating a steady market for upgrades and new installations. Regional dynamics will be key, with North America and Europe likely to lead market share, followed by emerging markets in Asia-Pacific and the Middle East as they expand offshore capabilities. The continuous pursuit of operational efficiency, cost reduction, and uncompromising safety standards solidifies the indispensable role of subsea well access and BOP systems in the global energy landscape.

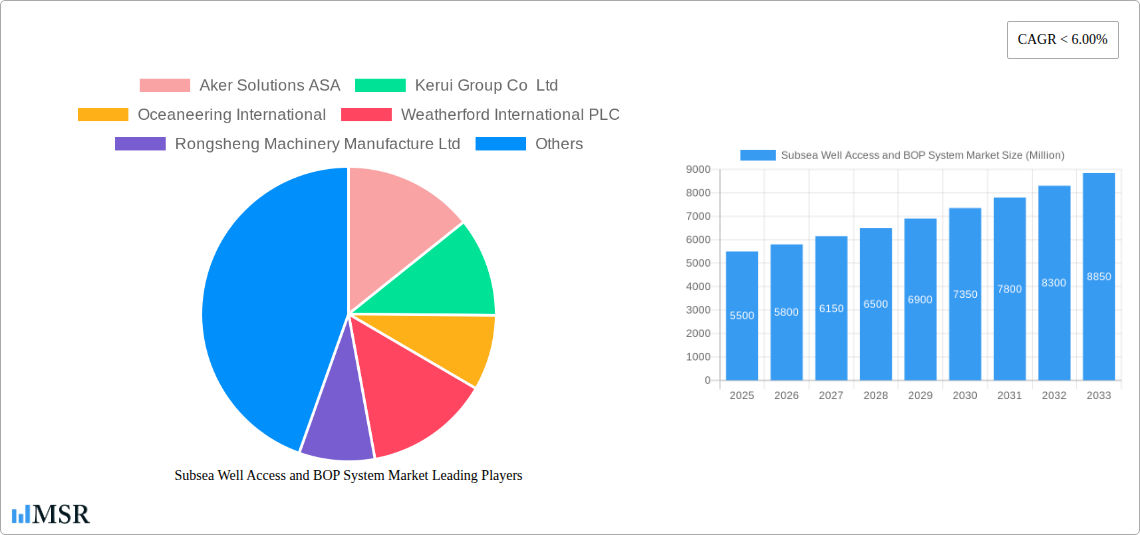

Subsea Well Access and BOP System Market Company Market Share

Subsea Well Access and BOP System Market: Comprehensive Industry Analysis & Forecast (2019-2033)

Unlock the future of offshore energy exploration and production with this definitive report on the Subsea Well Access and BOP System Market. This in-depth analysis provides critical insights into the rapidly evolving landscape of subsea well access technologies and Blowout Preventer (BOP) systems. Spanning a comprehensive study period from 2019 to 2033, with a base year of 2025, this report is meticulously crafted to equip industry stakeholders, investors, and strategists with the actionable intelligence needed to navigate this dynamic sector. Explore market size, growth projections, key trends, emerging technologies, and competitive strategies that will shape the subsea oil and gas industry for years to come.

Subsea Well Access and BOP System Market Market Concentration & Dynamics

The Subsea Well Access and BOP System Market is characterized by a moderate level of market concentration, with a few dominant global players and a scattering of specialized regional providers. Innovation ecosystems are flourishing, driven by the relentless pursuit of enhanced safety, efficiency, and cost reduction in deepwater operations. Regulatory frameworks, particularly concerning environmental protection and operational safety standards, continue to influence technology development and market entry. The threat of substitute products is relatively low in the core subsea well access and BOP system segments, given the specialized nature of these critical offshore components. End-user trends are heavily influenced by fluctuating oil prices, increasing demand for deepwater reserves, and a growing emphasis on carbon-efficient extraction methods. Merger and acquisition (M&A) activities, while not at an all-time high, remain a strategic tool for key players to expand their portfolios, gain market share, and acquire cutting-edge technologies. An estimated XX M&A deals have been recorded throughout the historical period, reflecting consolidation and strategic partnerships. Market share distribution sees key companies holding significant percentages, with estimates suggesting the top 5 players commanding over 60% of the global market.

- Key Dynamics:

- Focus on ultra-deepwater exploration and production.

- Increasing demand for integrated subsea solutions.

- Stringent safety and environmental regulations driving technological advancements.

- Impact of energy transition on long-term investment cycles.

- Competitive Landscape: Dominated by companies offering comprehensive subsea equipment and services.

- Innovation Drivers: Enhanced drilling efficiency, reduced operational downtime, and improved safety protocols.

Subsea Well Access and BOP System Market Industry Insights & Trends

The Subsea Well Access and BOP System Market is poised for robust growth, projected to reach an estimated market size of $XX Billion by 2033. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at XX%. This expansion is primarily fueled by the accelerating global demand for oil and gas, coupled with the increasing necessity to tap into previously uneconomical deepwater and ultra-deepwater reserves. Technological disruptions are at the forefront of market evolution. The integration of artificial intelligence (AI) and machine learning (ML) into BOP systems for predictive maintenance and enhanced operational control is gaining traction. Advanced sensor technologies are improving real-time monitoring and diagnostics, enabling quicker responses to potential issues and minimizing downtime. Furthermore, the development of more compact, modular, and remotely operated well access systems is crucial for reducing the footprint and complexity of offshore operations, thereby lowering associated costs. Evolving consumer behaviors, in this context, translate to operators demanding greater reliability, reduced environmental impact, and a more predictable cost of ownership. The push for enhanced safety standards and the need to mitigate risks in harsh offshore environments also serve as significant growth drivers. The market is witnessing a trend towards sophisticated, all-electric BOPs offering faster response times and lower maintenance requirements compared to their hydraulic counterparts. Additionally, the increasing adoption of digital twins for simulating and optimizing subsea operations is set to revolutionize how well access and BOP systems are designed, deployed, and managed. The market is also responding to the global energy transition by developing technologies that can support a more diverse range of subsea activities, including those related to carbon capture and storage (CCS) and offshore renewable energy infrastructure. The ongoing investment in deepwater exploration by national oil companies and international oil majors continues to underpin demand for these specialized systems.

- Market Size: Expected to reach $XX Billion by 2033.

- CAGR (2025-2033): XX%

- Key Growth Factors:

- Increasing deepwater oil and gas exploration activities.

- Technological advancements in automation and digitalization.

- Stringent safety regulations mandating advanced BOP functionalities.

- Growing demand for efficient and cost-effective subsea intervention solutions.

Key Markets & Segments Leading Subsea Well Access and BOP System Market

The global Subsea Well Access and BOP System Market is experiencing significant leadership from a combination of dominant regions and specialized segments. North America, particularly the United States Gulf of Mexico, remains a powerhouse due to its mature deepwater exploration and production infrastructure. However, regions like Asia Pacific, driven by substantial investments in offshore energy by countries such as China and Southeast Asian nations, are rapidly emerging as critical growth markets. The dominance is further amplified by the increasing exploration activities in frontier basins, necessitating advanced subsea capabilities.

Within the Subsea Well Access System segment, Rig-based Well Access Systems currently hold a leading position. This is attributed to the continuous activity in offshore drilling operations, where rigs are equipped with sophisticated systems for well intervention and completion. The inherent flexibility and established operational protocols associated with rig-based systems contribute to their widespread adoption. However, Vessel-based Well Access Systems are exhibiting strong growth potential, driven by their suitability for riserless operations and complex well intervention tasks in ultra-deepwater environments. The development of specialized intervention vessels equipped with advanced tower systems is expanding the capabilities and applications of this segment.

In the Subsea BOP System segment, Ram BOPs have historically dominated due to their robust design and proven reliability in high-pressure, high-temperature (HPHT) environments. They are indispensable for critical well control functions, offering superior sealing capabilities. Concurrently, Annular BOPs are gaining significant traction, particularly for their versatility in sealing around various wellbore geometries and their role in managing different wellbore pressures. The increasing complexity of subsea wells and the need for adaptable BOP solutions are driving the adoption of annular BOPs. The trend towards more compact and efficient designs, along with advanced control systems for both types of BOPs, is further fueling market expansion. The strategic importance of these systems in ensuring well integrity and preventing environmental incidents solidifies their leading role in offshore operations.

- Dominant Region: North America (primarily United States Gulf of Mexico) and rapidly growing Asia Pacific.

- Leading Subsea Well Access System Type: Rig-based Well Access Systems.

- Drivers: Ongoing offshore drilling campaigns, established infrastructure, cost-effectiveness for routine operations.

- Detailed Dominance: Rig-based systems benefit from the persistent need for drilling rigs in various offshore basins. Their integration with existing rig designs and the well-defined operational procedures make them a go-to solution for many operators.

- Leading Subsea BOP System Type: Ram BOPs.

- Drivers: Proven reliability in harsh environments, critical well control functions, suitability for HPHT wells.

- Detailed Dominance: Ram BOPs are the cornerstone of subsea well control, offering unparalleled safety and containment capabilities. Their robust construction and ability to shear and seal effectively under extreme conditions make them essential for deepwater operations.

- Emerging Segment Growth: Vessel-based Well Access Systems and Annular BOPs are experiencing significant growth due to advancements in technology and evolving operational demands.

Subsea Well Access and BOP System Market Product Developments

Product innovation is a critical driver in the Subsea Well Access and BOP System Market. Recent developments include the introduction of more compact and modular well intervention tower systems, designed for easier deployment and reduced vessel load-outs. Advances in subsea BOP technology focus on enhanced sealing capabilities, faster response times through all-electric actuation, and integrated digital monitoring systems for predictive maintenance. For instance, the development of advanced annulus seals, like Baker Hughes' MS-2 Annulus Seal, aims to significantly reduce operational rig expenses by simplifying wellhead installation and minimizing rig trips. These innovations are crucial for improving operational efficiency, reducing costs, and enhancing the safety and reliability of subsea operations, providing a distinct competitive edge for companies investing in R&D.

Challenges in the Subsea Well Access and BOP System Market Market

The Subsea Well Access and BOP System Market faces several significant challenges. Regulatory hurdles, particularly concerning the stringent safety and environmental standards for deepwater operations, can lead to extended approval processes and increased compliance costs. Supply chain disruptions, exacerbated by geopolitical instability and material shortages, can impact production timelines and the availability of critical components, potentially costing the market billions in delayed projects. Competitive pressures from established players and emerging technologies necessitate continuous innovation, which can be capital-intensive. Furthermore, the fluctuating price of crude oil can directly influence investment decisions in offshore exploration and production, thereby affecting the demand for subsea equipment and services. The high upfront investment required for developing and deploying advanced subsea systems also presents a considerable barrier.

- Key Restraints:

- Stringent and evolving regulatory compliance requirements.

- Vulnerability to global supply chain disruptions and material shortages.

- Intense competition and the need for substantial R&D investment.

- Volatility in oil and gas prices impacting capital expenditure.

Forces Driving Subsea Well Access and BOP System Market Growth

Several powerful forces are driving the growth of the Subsea Well Access and BOP System Market. The increasing global energy demand, coupled with the maturation of onshore reserves, is pushing oil and gas companies to explore and produce from more challenging deepwater and ultra-deepwater environments. Technological advancements in subsea equipment, including higher pressure and temperature ratings, increased automation, and improved reliability, are making these operations more feasible and cost-effective. Furthermore, a strong emphasis on enhanced safety protocols and environmental protection in offshore operations mandates the use of state-of-the-art BOP systems and well access solutions, thereby stimulating market demand. Government initiatives supporting energy independence and offshore resource development also play a crucial role.

- Key Growth Accelerators:

- Rising global energy demand necessitating deepwater exploration.

- Technological advancements in subsea system design and functionality.

- Strict safety and environmental regulations mandating advanced solutions.

Challenges in the Subsea Well Access and BOP System Market Market

The Subsea Well Access and BOP System Market is poised for sustained growth, propelled by several long-term catalysts. The ongoing development of ultra-deepwater fields, characterized by their immense reserves, continues to drive demand for sophisticated subsea infrastructure. Innovations in materials science and manufacturing processes are enabling the creation of lighter, stronger, and more durable subsea equipment, expanding operational capabilities and reducing deployment costs. Strategic partnerships and collaborations between technology providers and oilfield service companies are fostering the development of integrated solutions that enhance efficiency and reduce project timelines. Furthermore, the increasing focus on subsea processing and tie-back technologies, allowing for the development of smaller or more remote fields economically, presents a significant long-term growth avenue.

Emerging Opportunities in Subsea Well Access and BOP System Market

Emerging opportunities in the Subsea Well Access and BOP System Market are abundant, driven by both technological innovation and evolving industry needs. The growing interest in decarbonization is creating opportunities for subsea systems designed for carbon capture and storage (CCS) projects, requiring specialized well integrity and injection technologies. The expansion of offshore renewable energy, such as floating wind farms, may create a need for similar subsea access and infrastructure capabilities, adaptable for new energy applications. Furthermore, the increasing adoption of digitalization and Industry 4.0 principles presents opportunities for the development of smart, data-driven subsea systems that offer enhanced predictive maintenance and remote operational control. The development of more cost-effective and standardized subsea technologies could also unlock new markets and applications.

- Key Opportunities:

- Development of subsea solutions for carbon capture and storage (CCS).

- Adaptation of technologies for offshore renewable energy infrastructure.

- Implementation of AI and IoT for enhanced subsea system management.

- Growth in subsea processing and tie-back projects for marginal fields.

Leading Players in the Subsea Well Access and BOP System Market Sector

- Aker Solutions ASA

- Kerui Group Co Ltd

- Oceaneering International

- Weatherford International PLC

- Rongsheng Machinery Manufacture Ltd

- Baker Hughes Company

- Halliburton Company

- National-Oilwell Varco Inc

- Schlumberger Limited

- TechnipFMC PLC

- Expro Holdings UK2 Limited

Key Milestones in Subsea Well Access and BOP System Market Industry

- June 2022: FTAI Ocean, a Fortress Transportation and Infrastructure Investors LLC division, received a new well-intervention tower system from Osbit. This 40-meter tall, 1,300-tonne system is designed to enable riser- and riderless-based well intervention operations in up to 1,500 meters of water, showcasing advancements in vessel-based well access capabilities.

- May 2022: Baker Hughes introduced the MS-2 Annulus Seal, a novel subsea wellhead technology designed to significantly reduce operating rig expenses by lowering overall wellhead installation costs through fewer rig trips. This highlights a key innovation in subsea wellhead technology aimed at improving operational efficiency and cost savings.

Strategic Outlook for Subsea Well Access and BOP System Market Market

The strategic outlook for the Subsea Well Access and BOP System Market is one of sustained innovation and expansion. Key growth accelerators include the continued global demand for oil and gas, particularly from challenging deepwater reserves, which necessitates advanced subsea technologies. The increasing integration of digitalization, AI, and automation within subsea systems promises enhanced operational efficiency, predictive maintenance, and improved safety, creating significant market opportunities. Furthermore, the diversification of offshore energy activities, including a potential role in carbon capture and storage and offshore renewables, presents new avenues for growth and technological adaptation. Companies that can offer integrated, cost-effective, and highly reliable subsea solutions, while prioritizing safety and environmental stewardship, are best positioned for success in this evolving market landscape. Strategic partnerships and continued investment in research and development will be crucial for maintaining a competitive edge.

Subsea Well Access and BOP System Market Segmentation

-

1. Subsea Well Access System - Type

- 1.1. Vessel-based Well Access Systems

- 1.2. Rig-based Well Access Systems

-

2. Subsea BOP System - Type

- 2.1. Annular BOP

- 2.2. Ram BOP

Subsea Well Access and BOP System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Russia

- 2.2. United Kingdom

- 2.3. Norway

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. Australia

- 3.2. China

- 3.3. India

- 3.4. Indonesia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Venezuela

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Iran

- 5.3. Qatar

- 5.4. Egypt

- 5.5. Rest of Middle East and Africa

Subsea Well Access and BOP System Market Regional Market Share

Geographic Coverage of Subsea Well Access and BOP System Market

Subsea Well Access and BOP System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Improved Viability Of Offshore Oil And Gas Projects4.; Rising Deep Water Oil & Gas Exploration And Production Activities In The Americas

- 3.2.2 Asia-pacific

- 3.2.3 And Middle-east & Africa Region

- 3.3. Market Restrains

- 3.3.1. 4.; Ban On Offshore Exploration And Production Activities In Multiple Regions

- 3.4. Market Trends

- 3.4.1. Vessel-based Well Access Systems to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Subsea Well Access and BOP System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Subsea Well Access System - Type

- 5.1.1. Vessel-based Well Access Systems

- 5.1.2. Rig-based Well Access Systems

- 5.2. Market Analysis, Insights and Forecast - by Subsea BOP System - Type

- 5.2.1. Annular BOP

- 5.2.2. Ram BOP

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Subsea Well Access System - Type

- 6. North America Subsea Well Access and BOP System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Subsea Well Access System - Type

- 6.1.1. Vessel-based Well Access Systems

- 6.1.2. Rig-based Well Access Systems

- 6.2. Market Analysis, Insights and Forecast - by Subsea BOP System - Type

- 6.2.1. Annular BOP

- 6.2.2. Ram BOP

- 6.1. Market Analysis, Insights and Forecast - by Subsea Well Access System - Type

- 7. Europe Subsea Well Access and BOP System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Subsea Well Access System - Type

- 7.1.1. Vessel-based Well Access Systems

- 7.1.2. Rig-based Well Access Systems

- 7.2. Market Analysis, Insights and Forecast - by Subsea BOP System - Type

- 7.2.1. Annular BOP

- 7.2.2. Ram BOP

- 7.1. Market Analysis, Insights and Forecast - by Subsea Well Access System - Type

- 8. Asia Pacific Subsea Well Access and BOP System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Subsea Well Access System - Type

- 8.1.1. Vessel-based Well Access Systems

- 8.1.2. Rig-based Well Access Systems

- 8.2. Market Analysis, Insights and Forecast - by Subsea BOP System - Type

- 8.2.1. Annular BOP

- 8.2.2. Ram BOP

- 8.1. Market Analysis, Insights and Forecast - by Subsea Well Access System - Type

- 9. South America Subsea Well Access and BOP System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Subsea Well Access System - Type

- 9.1.1. Vessel-based Well Access Systems

- 9.1.2. Rig-based Well Access Systems

- 9.2. Market Analysis, Insights and Forecast - by Subsea BOP System - Type

- 9.2.1. Annular BOP

- 9.2.2. Ram BOP

- 9.1. Market Analysis, Insights and Forecast - by Subsea Well Access System - Type

- 10. Middle East and Africa Subsea Well Access and BOP System Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Subsea Well Access System - Type

- 10.1.1. Vessel-based Well Access Systems

- 10.1.2. Rig-based Well Access Systems

- 10.2. Market Analysis, Insights and Forecast - by Subsea BOP System - Type

- 10.2.1. Annular BOP

- 10.2.2. Ram BOP

- 10.1. Market Analysis, Insights and Forecast - by Subsea Well Access System - Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aker Solutions ASA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kerui Group Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Oceaneering International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Weatherford International PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rongsheng Machinery Manufacture Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baker Hughes Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Halliburton Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 National-Oilwell Varco Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schlumberger Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TechnipFMC PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Expro Holdings UK2 Limited*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Aker Solutions ASA

List of Figures

- Figure 1: Global Subsea Well Access and BOP System Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Subsea Well Access and BOP System Market Revenue (billion), by Subsea Well Access System - Type 2025 & 2033

- Figure 3: North America Subsea Well Access and BOP System Market Revenue Share (%), by Subsea Well Access System - Type 2025 & 2033

- Figure 4: North America Subsea Well Access and BOP System Market Revenue (billion), by Subsea BOP System - Type 2025 & 2033

- Figure 5: North America Subsea Well Access and BOP System Market Revenue Share (%), by Subsea BOP System - Type 2025 & 2033

- Figure 6: North America Subsea Well Access and BOP System Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Subsea Well Access and BOP System Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Subsea Well Access and BOP System Market Revenue (billion), by Subsea Well Access System - Type 2025 & 2033

- Figure 9: Europe Subsea Well Access and BOP System Market Revenue Share (%), by Subsea Well Access System - Type 2025 & 2033

- Figure 10: Europe Subsea Well Access and BOP System Market Revenue (billion), by Subsea BOP System - Type 2025 & 2033

- Figure 11: Europe Subsea Well Access and BOP System Market Revenue Share (%), by Subsea BOP System - Type 2025 & 2033

- Figure 12: Europe Subsea Well Access and BOP System Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Subsea Well Access and BOP System Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Subsea Well Access and BOP System Market Revenue (billion), by Subsea Well Access System - Type 2025 & 2033

- Figure 15: Asia Pacific Subsea Well Access and BOP System Market Revenue Share (%), by Subsea Well Access System - Type 2025 & 2033

- Figure 16: Asia Pacific Subsea Well Access and BOP System Market Revenue (billion), by Subsea BOP System - Type 2025 & 2033

- Figure 17: Asia Pacific Subsea Well Access and BOP System Market Revenue Share (%), by Subsea BOP System - Type 2025 & 2033

- Figure 18: Asia Pacific Subsea Well Access and BOP System Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Subsea Well Access and BOP System Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Subsea Well Access and BOP System Market Revenue (billion), by Subsea Well Access System - Type 2025 & 2033

- Figure 21: South America Subsea Well Access and BOP System Market Revenue Share (%), by Subsea Well Access System - Type 2025 & 2033

- Figure 22: South America Subsea Well Access and BOP System Market Revenue (billion), by Subsea BOP System - Type 2025 & 2033

- Figure 23: South America Subsea Well Access and BOP System Market Revenue Share (%), by Subsea BOP System - Type 2025 & 2033

- Figure 24: South America Subsea Well Access and BOP System Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Subsea Well Access and BOP System Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Subsea Well Access and BOP System Market Revenue (billion), by Subsea Well Access System - Type 2025 & 2033

- Figure 27: Middle East and Africa Subsea Well Access and BOP System Market Revenue Share (%), by Subsea Well Access System - Type 2025 & 2033

- Figure 28: Middle East and Africa Subsea Well Access and BOP System Market Revenue (billion), by Subsea BOP System - Type 2025 & 2033

- Figure 29: Middle East and Africa Subsea Well Access and BOP System Market Revenue Share (%), by Subsea BOP System - Type 2025 & 2033

- Figure 30: Middle East and Africa Subsea Well Access and BOP System Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Subsea Well Access and BOP System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Subsea Well Access System - Type 2020 & 2033

- Table 2: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Subsea BOP System - Type 2020 & 2033

- Table 3: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Subsea Well Access System - Type 2020 & 2033

- Table 5: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Subsea BOP System - Type 2020 & 2033

- Table 6: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Subsea Well Access System - Type 2020 & 2033

- Table 11: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Subsea BOP System - Type 2020 & 2033

- Table 12: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Russia Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Subsea Well Access System - Type 2020 & 2033

- Table 18: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Subsea BOP System - Type 2020 & 2033

- Table 19: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Australia Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: China Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Indonesia Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Subsea Well Access System - Type 2020 & 2033

- Table 26: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Subsea BOP System - Type 2020 & 2033

- Table 27: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Venezuela Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Subsea Well Access System - Type 2020 & 2033

- Table 32: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Subsea BOP System - Type 2020 & 2033

- Table 33: Global Subsea Well Access and BOP System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Iran Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Qatar Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Egypt Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Subsea Well Access and BOP System Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Subsea Well Access and BOP System Market?

The projected CAGR is approximately 10.73%.

2. Which companies are prominent players in the Subsea Well Access and BOP System Market?

Key companies in the market include Aker Solutions ASA, Kerui Group Co Ltd, Oceaneering International, Weatherford International PLC, Rongsheng Machinery Manufacture Ltd, Baker Hughes Company, Halliburton Company, National-Oilwell Varco Inc, Schlumberger Limited, TechnipFMC PLC, Expro Holdings UK2 Limited*List Not Exhaustive.

3. What are the main segments of the Subsea Well Access and BOP System Market?

The market segments include Subsea Well Access System - Type, Subsea BOP System - Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.88 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Improved Viability Of Offshore Oil And Gas Projects4.; Rising Deep Water Oil & Gas Exploration And Production Activities In The Americas. Asia-pacific. And Middle-east & Africa Region.

6. What are the notable trends driving market growth?

Vessel-based Well Access Systems to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Ban On Offshore Exploration And Production Activities In Multiple Regions.

8. Can you provide examples of recent developments in the market?

June 2022: FTAI Ocean, a Fortress Transportation and Infrastructure Investors LLC division, received a new well-intervention tower system from a UK-based company, Osbit. The system is 40 meters tall and comprises 1,300 tonnes of equipment. Osbit claims that the system will allow riser- and riderless-based well intervention operations in up to 1,500 meters of water.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Subsea Well Access and BOP System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Subsea Well Access and BOP System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Subsea Well Access and BOP System Market?

To stay informed about further developments, trends, and reports in the Subsea Well Access and BOP System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence