Key Insights

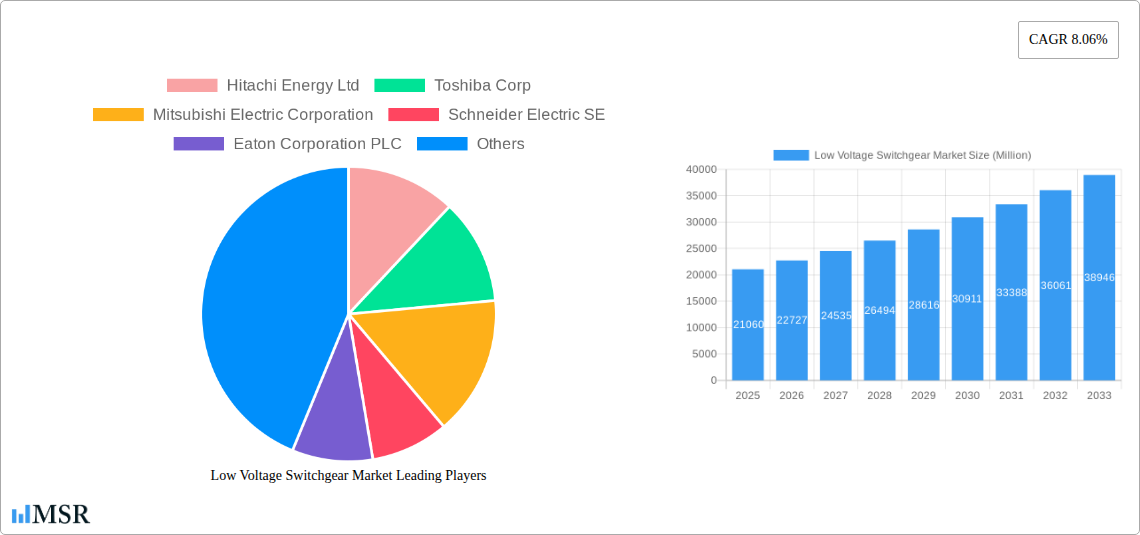

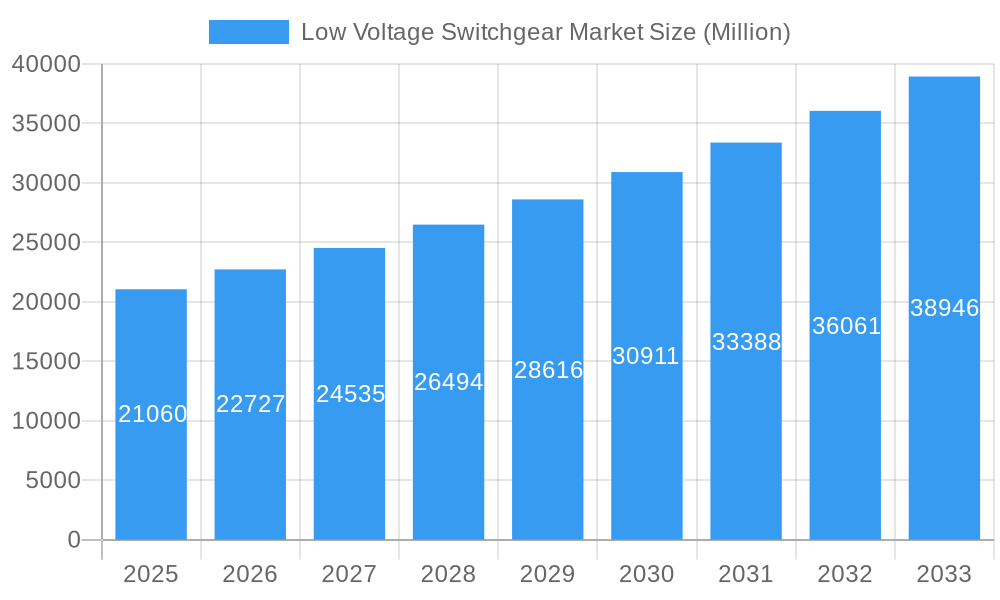

The global Low Voltage Switchgear Market is projected for robust expansion, estimated at 21.06 million value units. This growth is underpinned by a significant Compound Annual Growth Rate (CAGR) of 8.06%, indicating a dynamic and expanding sector. Key drivers fueling this market's ascent include the escalating demand for electricity driven by industrialization and urbanization, particularly in emerging economies. The ongoing need for modernizing aging electrical infrastructure, coupled with stringent safety regulations mandating the use of advanced switchgear for power distribution and control, also plays a crucial role. Furthermore, the increasing adoption of renewable energy sources, which necessitate sophisticated grid management solutions, is a significant contributor to market growth. The market is segmented across various voltage levels, with Low Voltage, Medium Voltage, and High Voltage all contributing to the overall ecosystem. The primary end-users are Power Utilities, followed by the Industrial Sector, and Commercial and Residential segments, each with distinct needs and adoption rates for switchgear technology.

Low Voltage Switchgear Market Market Size (In Billion)

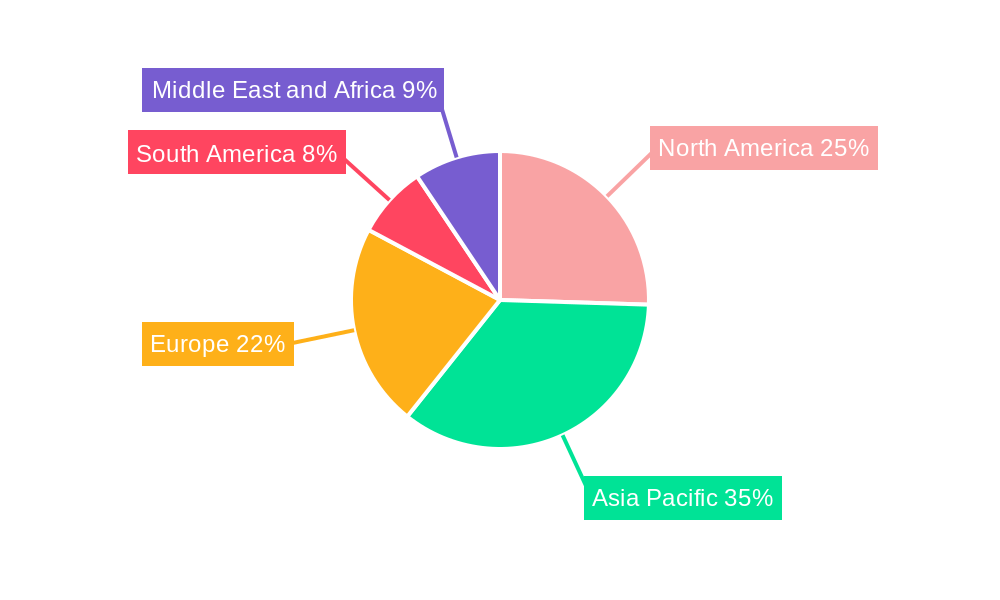

The Low Voltage Switchgear Market is characterized by several key trends. The integration of smart technologies, such as IoT and advanced analytics, into switchgear for enhanced monitoring, control, and predictive maintenance is gaining traction. This shift towards smart grids and digitalization allows for more efficient energy management and improved grid reliability. While the market exhibits strong growth, certain restraints are also present. High initial investment costs for advanced switchgear systems can pose a barrier for some smaller utilities or businesses. Additionally, supply chain complexities and fluctuations in raw material prices can impact profitability and product availability. Geographically, the market exhibits significant regional variations. North America and Europe, with their established infrastructure and focus on grid modernization, are mature markets. However, the Asia Pacific region is anticipated to witness the most substantial growth, driven by rapid industrial development, increasing energy consumption, and government initiatives to expand electrification.

Low Voltage Switchgear Market Company Market Share

Unlocking the Future: A Comprehensive Analysis of the Global Low Voltage Switchgear Market (2019–2033)

**Gain unparalleled insights into the dynamic **Low Voltage Switchgear Market, a critical component of global power distribution and industrial operations. This in-depth report provides a 360-degree view of the market, meticulously analyzing trends, drivers, challenges, and opportunities from 2019 to 2033, with a base year of 2025. Essential for power utilities, industrial manufacturers, commercial developers, and residential builders, this report equips you with the strategic intelligence to navigate this rapidly evolving landscape and secure your competitive edge.

The Low Voltage Switchgear Market is projected to reach an estimated value of $XX Billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. Historical data from 2019–2024 indicates a steady upward trajectory, driven by global electrification efforts and the increasing demand for reliable and efficient power management solutions.

Low Voltage Switchgear Market Market Concentration & Dynamics

The Low Voltage Switchgear Market exhibits a moderate to high concentration, characterized by the significant presence of established global players and a growing number of regional manufacturers. Innovation ecosystems are thriving, fueled by advancements in smart grid technologies, digitalization, and the integration of renewable energy sources. Regulatory frameworks are progressively emphasizing safety standards, energy efficiency, and the phasing out of hazardous materials like SF6, impacting product development and market entry strategies. Substitute products, while present in niche applications, are largely unable to fully replace the comprehensive protection and control offered by advanced switchgear solutions. End-user trends reveal a strong demand for compact, modular, and intelligent switchgear with enhanced monitoring and remote control capabilities, driven by urbanization and the proliferation of smart buildings. Mergers and acquisitions (M&A) activities are a key dynamic, with major players strategically acquiring smaller innovative companies to expand their product portfolios and geographical reach. The report quantifies these M&A deal counts and provides estimated market share breakdowns for key players.

Low Voltage Switchgear Market Industry Insights & Trends

The Low Voltage Switchgear Market is experiencing robust growth, propelled by several key factors. The increasing global demand for electricity, particularly in emerging economies undergoing rapid industrialization and urbanization, is a primary driver. Furthermore, the ongoing global transition towards renewable energy sources, such as solar and wind power, necessitates sophisticated low voltage switchgear for grid integration and efficient power management. Advancements in technology are transforming the market, with a significant trend towards the adoption of smart switchgear solutions. These solutions incorporate advanced digital technologies like IoT, AI, and cloud computing to enable real-time monitoring, predictive maintenance, and remote control, thereby enhancing operational efficiency and reducing downtime. The increasing focus on energy efficiency and sustainability is also pushing the demand for low voltage switchgear that can optimize energy consumption and minimize energy losses. The industrial sector continues to be a major consumer, with investments in factory automation and modernization driving the need for reliable power distribution systems. The commercial and residential sectors are also witnessing significant growth, fueled by the construction of smart buildings, data centers, and the increasing adoption of electric vehicles. The global market size for low voltage switchgear was estimated at $XX Billion in 2025, with an anticipated CAGR of XX% during the forecast period.

Key Markets & Segments Leading Low Voltage Switchgear Market

The Low Voltage Switchgear Market is characterized by dominant regions and segments that are steering its growth trajectory.

Dominant Region: Asia Pacific is emerging as the largest and fastest-growing market for low voltage switchgear. This dominance is attributed to:

- Rapid Economic Growth: Sustained economic development in countries like China, India, and Southeast Asian nations is driving substantial investments in infrastructure, including power generation, transmission, and distribution networks.

- Urbanization: The continuous influx of population into urban centers necessitates the expansion and modernization of power grids to meet the escalating demand from residential, commercial, and industrial consumers.

- Industrial Expansion: The region's strong manufacturing base and its role as a global production hub result in high demand for reliable low voltage switchgear in factories, plants, and industrial complexes.

- Government Initiatives: Supportive government policies promoting electrification, smart grid development, and renewable energy integration further bolster market growth.

Dominant Segments:

- Voltage Level: Low Voltage: This segment naturally forms the bedrock of the market, catering to a vast array of applications across all end-user sectors. Its widespread use in buildings, small to medium-sized industries, and localized distribution networks makes it a consistent revenue generator.

- End User: Industrial Sector: The industrial sector is a powerhouse for low voltage switchgear demand.

- Driver: Industrial Automation and Modernization: The continuous push for automation, Industry 4.0 adoption, and upgrades in manufacturing facilities requires robust and intelligent switchgear for efficient power distribution and control.

- Driver: Energy Intensive Operations: Sectors like chemicals, metals, and heavy manufacturing rely heavily on uninterrupted power supply, making reliable low voltage switchgear indispensable.

- Driver: Safety and Compliance: Stringent safety regulations in industrial environments mandate the use of high-performance low voltage switchgear to prevent electrical hazards and ensure operational safety.

The Power Utilities segment also remains a significant contributor, driven by the need to maintain and upgrade existing grids, integrate distributed energy resources, and enhance grid resilience. The Commercial and Residential segments are experiencing escalating growth due to the increasing construction of smart buildings, data centers, and the electrification of transportation and home appliances.

Low Voltage Switchgear Market Product Developments

Recent product developments in the Low Voltage Switchgear Market are characterized by a strong emphasis on digitalization, enhanced safety features, and environmental sustainability. Manufacturers are increasingly integrating smart technologies such as IoT sensors, communication modules, and advanced diagnostics into their switchgear offerings. This enables real-time monitoring, remote control, predictive maintenance, and seamless integration with smart grid infrastructure. Innovations also focus on miniaturization, modular designs for easier installation and scalability, and the development of circuit breakers with improved interruption capacities and arc flash mitigation technologies. The shift towards SF6-free technologies is another key development, driven by environmental concerns and regulations. Companies are investing in research and development to offer alternative insulating gases and vacuum interrupter technologies that provide equivalent performance with a reduced environmental footprint, thereby gaining a competitive edge in eco-conscious markets.

Challenges in the Low Voltage Switchgear Market Market

Despite its strong growth potential, the Low Voltage Switchgear Market faces several significant challenges. Stringent regulatory compliance across different regions, particularly concerning safety standards and environmental regulations (e.g., restrictions on SF6 gas), can increase product development costs and time-to-market. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, can lead to increased lead times and impact profit margins. Intense competition from both established players and emerging manufacturers, particularly in price-sensitive markets, puts pressure on pricing strategies. Furthermore, the need for skilled labor for installation, maintenance, and troubleshooting of increasingly complex smart switchgear systems presents a human capital challenge. The significant upfront investment required for advanced low voltage switchgear can also be a barrier for smaller businesses and in price-sensitive developing economies.

Forces Driving Low Voltage Switchgear Market Growth

The Low Voltage Switchgear Market is propelled by a confluence of powerful growth drivers. The relentless global demand for electricity, fueled by industrialization, urbanization, and the increasing adoption of electric vehicles and smart devices, forms the fundamental bedrock of market expansion. The ongoing digital transformation of the power sector, leading to smart grid initiatives and the integration of renewable energy sources, necessitates advanced and intelligent low voltage switchgear for effective management and control. Government policies worldwide, focusing on grid modernization, energy security, and the promotion of sustainable energy practices, further stimulate investment in switchgear infrastructure. Technological advancements, such as the development of compact, efficient, and highly reliable low voltage switchgear with enhanced safety features and improved energy efficiency, are creating new market opportunities and driving product adoption.

Challenges in the Low Voltage Switchgear Market Market

Several long-term growth catalysts are shaping the future of the Low Voltage Switchgear Market. The continuous evolution and integration of digital technologies, including artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), within switchgear systems will unlock new levels of predictive maintenance, operational efficiency, and grid autonomy. Strategic partnerships and collaborations between traditional switchgear manufacturers and technology companies are fostering innovation and accelerating the development of next-generation smart grid solutions. The increasing focus on decentralized power generation and microgrids is creating demand for flexible and modular low voltage switchgear that can seamlessly integrate various energy sources and optimize local energy distribution. Furthermore, the expansion of electrification into new sectors and applications, such as electric mobility infrastructure and advanced building management systems, will continue to drive sustained market growth.

Emerging Opportunities in Low Voltage Switchgear Market

Emerging opportunities in the Low Voltage Switchgear Market are abundant and ripe for exploration. The growing adoption of distributed energy resources (DERs), including rooftop solar and battery storage systems, presents a significant opportunity for smart and adaptive low voltage switchgear solutions capable of bidirectional power flow and grid stabilization. The burgeoning data center industry, with its insatiable demand for reliable and efficient power distribution, is another key growth area. Furthermore, the increasing focus on electrification in developing nations, coupled with government initiatives to improve energy access and infrastructure, opens up vast untapped markets for cost-effective and robust low voltage switchgear. The trend towards smart cities and intelligent buildings will also drive demand for integrated and automated switchgear systems that enhance building management and energy efficiency. The development of advanced cybersecurity features for connected switchgear is also an emerging area of opportunity, addressing critical concerns in the digitalized power landscape.

Leading Players in the Low Voltage Switchgear Market Sector

- Hitachi Energy Ltd

- Toshiba Corp

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Eaton Corporation PLC

- Powell Industries Inc

- Siemens Energy AG

- General Electric Company

- Hyosung Heavy Industries Corp

- Bharat Heavy Electricals Limited

Key Milestones in Low Voltage Switchgear Market Industry

- September 2021: The National grid awarded Linxon a six-year project valued at GBP 1 billion to rewire South London. This initiative involves the design, supply, installation, and commissioning of connection bays at two existing National Grid substation sites, modifications at two other sites, and the construction of a new seven-bay 400/132 kV gas-insulated switchgear substation at Bengeworth Road, significantly impacting the demand for high-performance switchgear solutions.

- September 2021: GE Renewable Energy's Grid Solution business secured a contract for Sweden's first SF6-free gas-insulated switchgear. This groundbreaking development, involving installation at the Vattenfall Eldistribution AB Lindhov substation, signals a strong industry shift towards environmentally friendly alternatives and influences future product development strategies within the low voltage switchgear sector.

Strategic Outlook for Low Voltage Switchgear Market Market

The strategic outlook for the Low Voltage Switchgear Market is exceptionally positive, driven by ongoing global electrification, the imperative for grid modernization, and the accelerating digital transformation of the energy sector. Key growth accelerators include continued investment in smart grid technologies, fostering the demand for intelligent and interconnected switchgear. The increasing integration of renewable energy sources and the growth of microgrids will necessitate flexible and adaptive low voltage switchgear solutions. Furthermore, the expanding industrial automation landscape and the development of smart cities will provide sustained demand. Strategic opportunities lie in developing advanced, cost-effective solutions for emerging markets, focusing on enhancing cybersecurity features for connected devices, and investing in SF6-free and other sustainable switchgear technologies to meet stringent environmental regulations and market preferences. Companies that prioritize innovation, strategic partnerships, and a customer-centric approach will be best positioned to capitalize on the significant future market potential.

Low Voltage Switchgear Market Segmentation

-

1. Voltage Level

- 1.1. Low Voltage

- 1.2. Medium Voltage

- 1.3. High Voltage

-

2. End User

- 2.1. Power Utilities

- 2.2. Industrial Sector

- 2.3. Commercial and Residential

Low Voltage Switchgear Market Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. South America

- 5. Middle East and Africa

Low Voltage Switchgear Market Regional Market Share

Geographic Coverage of Low Voltage Switchgear Market

Low Voltage Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Infrastructure Projects in the Region

- 3.3. Market Restrains

- 3.3.1. 4.; High Operations and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. High Voltage Level Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Voltage Level

- 5.1.1. Low Voltage

- 5.1.2. Medium Voltage

- 5.1.3. High Voltage

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Power Utilities

- 5.2.2. Industrial Sector

- 5.2.3. Commercial and Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Voltage Level

- 6. North America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Voltage Level

- 6.1.1. Low Voltage

- 6.1.2. Medium Voltage

- 6.1.3. High Voltage

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Power Utilities

- 6.2.2. Industrial Sector

- 6.2.3. Commercial and Residential

- 6.1. Market Analysis, Insights and Forecast - by Voltage Level

- 7. Asia Pacific Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Voltage Level

- 7.1.1. Low Voltage

- 7.1.2. Medium Voltage

- 7.1.3. High Voltage

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Power Utilities

- 7.2.2. Industrial Sector

- 7.2.3. Commercial and Residential

- 7.1. Market Analysis, Insights and Forecast - by Voltage Level

- 8. Europe Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Voltage Level

- 8.1.1. Low Voltage

- 8.1.2. Medium Voltage

- 8.1.3. High Voltage

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Power Utilities

- 8.2.2. Industrial Sector

- 8.2.3. Commercial and Residential

- 8.1. Market Analysis, Insights and Forecast - by Voltage Level

- 9. South America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Voltage Level

- 9.1.1. Low Voltage

- 9.1.2. Medium Voltage

- 9.1.3. High Voltage

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Power Utilities

- 9.2.2. Industrial Sector

- 9.2.3. Commercial and Residential

- 9.1. Market Analysis, Insights and Forecast - by Voltage Level

- 10. Middle East and Africa Low Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Voltage Level

- 10.1.1. Low Voltage

- 10.1.2. Medium Voltage

- 10.1.3. High Voltage

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Power Utilities

- 10.2.2. Industrial Sector

- 10.2.3. Commercial and Residential

- 10.1. Market Analysis, Insights and Forecast - by Voltage Level

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hitachi Energy Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toshiba Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitsubishi Electric Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Schneider Electric SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eaton Corporation PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Powell Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens Energy AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 General Electric Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hyosung Heavy Industries Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bharat Heavy Electricals Limited*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hitachi Energy Ltd

List of Figures

- Figure 1: Global Low Voltage Switchgear Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Low Voltage Switchgear Market Revenue (Million), by Voltage Level 2025 & 2033

- Figure 3: North America Low Voltage Switchgear Market Revenue Share (%), by Voltage Level 2025 & 2033

- Figure 4: North America Low Voltage Switchgear Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Low Voltage Switchgear Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Low Voltage Switchgear Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Low Voltage Switchgear Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific Low Voltage Switchgear Market Revenue (Million), by Voltage Level 2025 & 2033

- Figure 9: Asia Pacific Low Voltage Switchgear Market Revenue Share (%), by Voltage Level 2025 & 2033

- Figure 10: Asia Pacific Low Voltage Switchgear Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Asia Pacific Low Voltage Switchgear Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Asia Pacific Low Voltage Switchgear Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Low Voltage Switchgear Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Low Voltage Switchgear Market Revenue (Million), by Voltage Level 2025 & 2033

- Figure 15: Europe Low Voltage Switchgear Market Revenue Share (%), by Voltage Level 2025 & 2033

- Figure 16: Europe Low Voltage Switchgear Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Europe Low Voltage Switchgear Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Low Voltage Switchgear Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Low Voltage Switchgear Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Low Voltage Switchgear Market Revenue (Million), by Voltage Level 2025 & 2033

- Figure 21: South America Low Voltage Switchgear Market Revenue Share (%), by Voltage Level 2025 & 2033

- Figure 22: South America Low Voltage Switchgear Market Revenue (Million), by End User 2025 & 2033

- Figure 23: South America Low Voltage Switchgear Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: South America Low Voltage Switchgear Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Low Voltage Switchgear Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Low Voltage Switchgear Market Revenue (Million), by Voltage Level 2025 & 2033

- Figure 27: Middle East and Africa Low Voltage Switchgear Market Revenue Share (%), by Voltage Level 2025 & 2033

- Figure 28: Middle East and Africa Low Voltage Switchgear Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Middle East and Africa Low Voltage Switchgear Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa Low Voltage Switchgear Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Low Voltage Switchgear Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Level 2020 & 2033

- Table 2: Global Low Voltage Switchgear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Low Voltage Switchgear Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Level 2020 & 2033

- Table 5: Global Low Voltage Switchgear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Low Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Level 2020 & 2033

- Table 8: Global Low Voltage Switchgear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Low Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Level 2020 & 2033

- Table 11: Global Low Voltage Switchgear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Low Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Level 2020 & 2033

- Table 14: Global Low Voltage Switchgear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Low Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Level 2020 & 2033

- Table 17: Global Low Voltage Switchgear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Low Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Low Voltage Switchgear Market?

The projected CAGR is approximately 8.06%.

2. Which companies are prominent players in the Low Voltage Switchgear Market?

Key companies in the market include Hitachi Energy Ltd, Toshiba Corp, Mitsubishi Electric Corporation, Schneider Electric SE, Eaton Corporation PLC, Powell Industries Inc, Siemens Energy AG, General Electric Company, Hyosung Heavy Industries Corp, Bharat Heavy Electricals Limited*List Not Exhaustive.

3. What are the main segments of the Low Voltage Switchgear Market?

The market segments include Voltage Level, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.06 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Infrastructure Projects in the Region.

6. What are the notable trends driving market growth?

High Voltage Level Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Operations and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

In September 2021, the National grid awarded Linxon a six-year length, GBP 1 billion project to rewire South London via 32 km of deep underground tunnels. Linxon will design, supply, install, and commission connection bays at two existing National Grid substation sites, undertake modification works at two other sites, and construct a new seven-bay 400/132 kV gas-insulated switchgear substation at Bengeworth Road.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Low Voltage Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Low Voltage Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Low Voltage Switchgear Market?

To stay informed about further developments, trends, and reports in the Low Voltage Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence