Key Insights

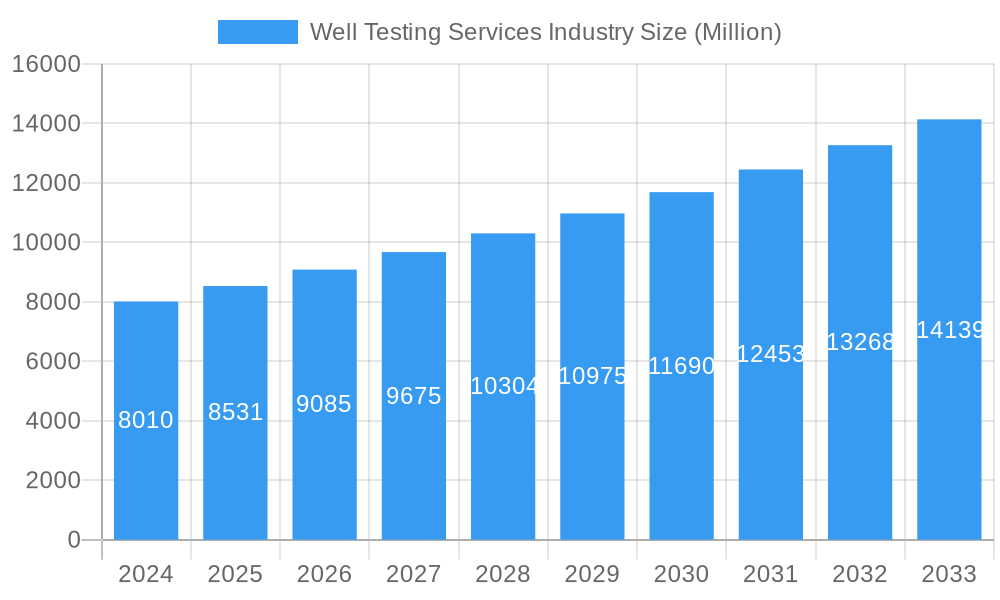

The global Well Testing Services industry is poised for significant expansion, projected to reach USD 8.01 billion in 2024 and grow at a robust CAGR of 6.5% from 2025 to 2033. This impressive growth trajectory is driven by several key factors, including the increasing demand for efficient hydrocarbon exploration and production, particularly in emerging markets. As oil and gas companies strive to optimize recovery rates and reduce operational costs, the need for sophisticated well testing services – encompassing exploration, appraisal, development, and production phases – becomes paramount. Furthermore, advancements in technology, such as the deployment of digital solutions for real-time data analysis and improved predictive capabilities, are significantly enhancing the efficiency and accuracy of well testing, thus fueling market demand. The industry is also experiencing a surge in investments in both onshore and offshore projects, with a particular focus on challenging environments requiring specialized expertise.

Well Testing Services Industry Market Size (In Billion)

The market's expansion is further supported by the ongoing need to maintain production from mature fields and to identify new reserves to meet global energy demands. While the market exhibits strong growth potential, it also faces certain restraints. These include the volatility of crude oil prices, which can impact exploration and production budgets, and increasing environmental regulations that necessitate more sustainable and technologically advanced testing methods. However, the industry is adapting by focusing on innovative solutions that minimize environmental impact and enhance operational safety. Key players in the market, including established giants like Schlumberger, Halliburton, and Baker Hughes, alongside specialized firms, are actively investing in research and development to offer comprehensive service portfolios across all stages of the well lifecycle and in diverse deployment locations. The Asia Pacific region is emerging as a significant growth area, driven by substantial investments in exploration and production activities.

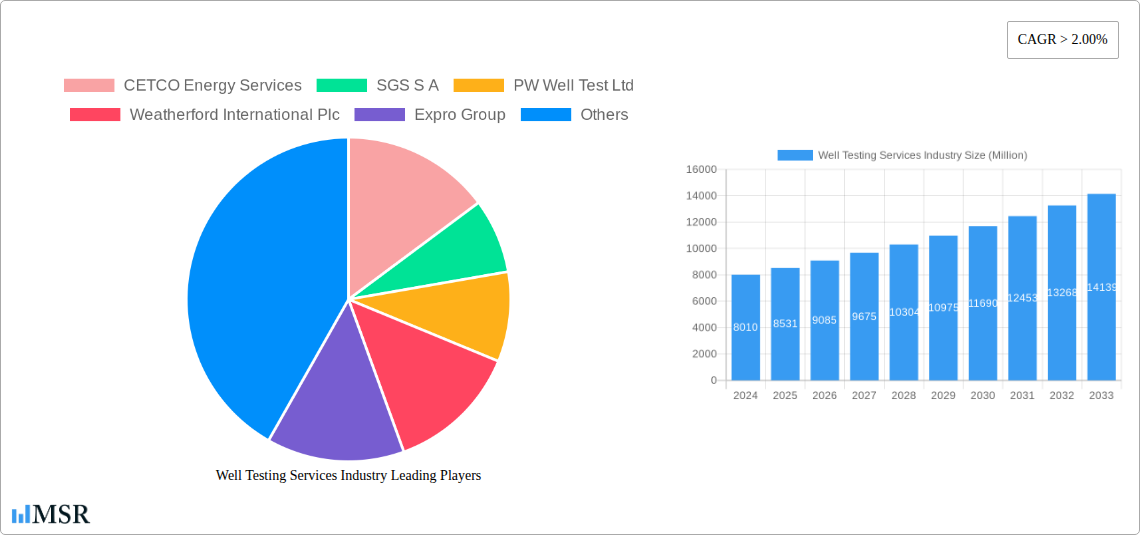

Well Testing Services Industry Company Market Share

Unlock the Future of Energy: Comprehensive Well Testing Services Industry Report (2019-2033)

Gain unparalleled insights into the global Well Testing Services Industry with this definitive report, meticulously crafted to empower industry stakeholders. Spanning the historical period of 2019-2024 and projecting growth through 2033, this analysis offers a deep dive into market dynamics, key players, and transformative trends. Discover the driving forces behind the billion-dollar well testing market, from exploration to production, and understand the strategic imperatives for success in an evolving energy landscape. This report is your essential guide to navigating the onshore and offshore well testing services sector.

Well Testing Services Industry Market Concentration & Dynamics

The Well Testing Services Industry exhibits a moderate to high market concentration, with leading players like Schlumberger Limited, Halliburton Company, Baker Hughes Company, and Weatherford International Plc holding significant market shares. These giants, alongside specialized firms such as TETRA Technologies Inc, Expro Group, SGS S A, CETCO Energy Services, PW Well Test Ltd, and China Oilfield Secvices Limited, shape the innovation ecosystem through continuous R&D investments and strategic partnerships. Regulatory frameworks, particularly concerning environmental standards and safety protocols, are becoming increasingly stringent, influencing operational methodologies and cost structures. The emergence of advanced digital technologies, including AI and IoT for real-time data analysis and predictive maintenance, is a key innovation driver. Substitute products, while limited in the core well testing function, can include advancements in seismic imaging and reservoir simulation that reduce the need for extensive field testing. End-user trends point towards a growing demand for cost-efficient, environmentally friendly, and faster testing solutions, driven by the need to optimize production from both conventional and unconventional reserves. Mergers and acquisitions (M&A) activity remains a strategic lever for market consolidation and capability expansion. In the historical period (2019-2024), we observed approximately XX M&A deals, contributing to an estimated market share shift of xx% amongst the top five players.

Well Testing Services Industry Industry Insights & Trends

The Well Testing Services Industry is poised for significant expansion, driven by a confluence of factors impacting the global energy sector. The market size is projected to reach approximately $XX billion by the base year 2025, with a robust Compound Annual Growth Rate (CAGR) of xx% forecasted during the period 2025–2033. This growth is primarily fueled by sustained global energy demand, necessitating efficient hydrocarbon exploration, appraisal, and production. Technological disruptions are revolutionizing how well testing is conducted. The integration of digital solutions, such as real-time data acquisition, cloud-based analytics platforms, and artificial intelligence (AI) for predictive reservoir characterization, is enhancing accuracy, efficiency, and safety. Remote monitoring capabilities are reducing operational costs and personnel exposure in hazardous environments, particularly in offshore operations. Evolving consumer behaviors, translated into increased pressure for sustainable energy practices, are also influencing the industry. Companies are investing in greener testing technologies and optimizing operations to minimize environmental footprints. Furthermore, the growing focus on maximizing recovery from mature fields and exploring marginal reserves is creating continuous demand for specialized well testing services. The shift towards natural gas as a transitional fuel also presents a significant growth avenue. The increasing complexity of reservoirs, including deepwater and unconventional plays, requires sophisticated testing methodologies, driving innovation in specialized equipment and expertise. The industry is also witnessing a trend towards integrated service offerings, where well testing is bundled with other upstream services, providing a more comprehensive solution to operators. The global energy transition, while a long-term shift, is also creating opportunities for well testing in areas like geothermal energy and carbon capture utilization and storage (CCUS) projects, which often require similar subsurface characterization techniques. The ongoing geopolitical landscape and its impact on energy security also underscore the importance of efficient resource development, thereby supporting the demand for reliable well testing services. The strategic investments in new exploration and production (E&P) activities, especially in emerging markets, will further bolster the market. The increasing adoption of advanced analytical tools to interpret complex well test data is leading to better reservoir management and production optimization.

Key Markets & Segments Leading Well Testing Services Industry

The Well Testing Services Industry is dominated by several key markets and segments, each exhibiting unique growth drivers and strategic importance.

Stage: Exploration, Appraisal, & Development

- Economic Growth: Robust global economic expansion directly correlates with increased energy consumption, driving upstream E&P activities and, consequently, the demand for comprehensive well testing services during the initial stages of field development.

- Resource Discovery: Continued exploration efforts aimed at discovering new hydrocarbon reserves, particularly in frontier regions, are pivotal. Successful discoveries necessitate thorough appraisal and development testing to assess commercial viability.

- Technological Advancements: Innovations in seismic imaging, drilling technology, and reservoir modeling enable access to previously uneconomical or challenging reservoirs, thereby expanding the scope for exploration and appraisal testing.

- Investment in New Projects: Higher capital expenditure by oil and gas companies in greenfield projects directly translates to increased demand for well testing services.

This segment is crucial as it forms the foundational stage for any hydrocarbon asset. Accurate data obtained through well testing at this juncture is paramount for making critical investment decisions and designing effective production strategies. The Exploration, Appraisal, & Development phase accounts for a significant portion of the market, estimated at xx% of the total market value in the base year 2025. Companies involved in early-stage field assessment rely heavily on sophisticated diagnostic testing to understand reservoir properties, flow dynamics, and potential production challenges. The development phase further necessitates transient and production testing to optimize well design and facility planning.

Stage: Production

- Maximizing Recovery: In mature fields, well testing is vital for monitoring reservoir performance, identifying declining production trends, and implementing enhanced oil recovery (EOR) or improved oil recovery (IOR) techniques.

- Operational Efficiency: Ongoing production testing ensures that wells are operating optimally, identifying any anomalies or inefficiencies that could impact output or lead to costly downtime.

- Regulatory Compliance: Many jurisdictions require periodic production testing to ensure wells are producing within permitted limits and in an environmentally responsible manner.

The Production stage, representing approximately xx% of the market in 2025, is characterized by a continuous need for monitoring and optimization. This involves routine testing to track wellhead performance, reservoir pressure, and fluid composition, enabling operators to maintain consistent production levels and extend the economic life of the field.

Location of Deployment: Onshore

- Accessibility: Onshore operations generally offer better accessibility and logistical advantages, making them more cost-effective for certain types of testing.

- Conventional and Unconventional Resources: A substantial portion of global hydrocarbon production occurs onshore, encompassing both conventional reservoirs and vast unconventional plays like shale gas and tight oil, all requiring extensive well testing.

- Infrastructure Development: Established onshore infrastructure facilitates the deployment of testing equipment and personnel.

The Onshore segment, estimated at xx% of the market in 2025, is a cornerstone of global hydrocarbon supply. The sheer volume of onshore wells and the ongoing exploration and development of unconventional resources ensure a sustained demand for well testing services.

Location of Deployment: Offshore

- Deepwater Exploration: The pursuit of reserves in deepwater and ultra-deepwater environments presents significant opportunities for specialized offshore well testing services, where complexities and risks are higher.

- Technological Sophistication: Offshore operations demand highly advanced and robust well testing equipment and methodologies capable of withstanding challenging subsea conditions.

- Increasing Energy Demand: As onshore resources mature, the focus increasingly shifts to offshore reserves to meet global energy demands, driving investment in this segment.

The Offshore segment, representing xx% of the market in 2025, is a high-value proposition characterized by technological complexity and higher operational costs. The development of new offshore fields, particularly in deep and ultra-deepwater regions, requires specialized expertise and equipment for effective well testing.

Well Testing Services Industry Product Developments

Product innovations in the Well Testing Services Industry are centered on enhancing accuracy, efficiency, and safety. Advanced digital sensors and real-time data transmission systems are becoming standard, allowing for instantaneous analysis of reservoir parameters. Automated testing units and modular equipment designs are improving deployment speed and reducing on-site operational footprint. Furthermore, the development of intelligent diagnostics tools that leverage AI and machine learning to interpret complex test data is providing deeper reservoir insights. These advancements contribute to better production optimization, reduced downtime, and improved cost-effectiveness, giving service providers a competitive edge.

Challenges in the Well Testing Services Industry Market

The Well Testing Services Industry faces several significant challenges. Stringent environmental regulations and the increasing focus on emissions reduction necessitate investments in cleaner technologies and operational practices, potentially increasing costs. Geopolitical instability and fluctuating oil prices can lead to project delays and reduced capital expenditure by operators, impacting demand. Intense competition among established players and emerging niche providers can lead to price wars and pressure on profit margins. Furthermore, the availability of skilled personnel for complex offshore and specialized onshore operations remains a critical concern. Supply chain disruptions, as witnessed in recent years, can also impact the timely delivery of critical equipment and components.

Forces Driving Well Testing Services Industry Growth

Key forces driving the Well Testing Services Industry growth include the insatiable global demand for energy, which necessitates continuous exploration and production activities. Technological advancements, particularly in digital solutions like IoT, AI, and advanced analytics, are enhancing the efficiency, accuracy, and safety of well testing operations. The ongoing need to optimize production from existing fields and develop complex, unconventional, and deepwater reserves also fuels demand. Furthermore, a supportive regulatory environment that encourages responsible resource development and the increasing focus on maximizing hydrocarbon recovery from mature assets are significant growth accelerators.

Challenges in the Well Testing Services Industry Market

Long-term growth catalysts for the Well Testing Services Industry are rooted in continuous innovation and strategic market expansion. The development of novel testing methodologies for emerging energy sources, such as geothermal and hydrogen production, presents a significant growth avenue. Strategic partnerships and collaborations between service providers and technology firms will foster the development of integrated, digital-first solutions. Furthermore, expanding service offerings into new geographic regions with untapped hydrocarbon potential and focusing on providing high-value, data-driven insights rather than just testing execution will solidify market leadership and ensure sustained growth.

Emerging Opportunities in Well Testing Services Industry

Emerging opportunities in the Well Testing Services Industry are abundant. The growing global emphasis on energy transition is creating demand for well testing services in areas like carbon capture, utilization, and storage (CCUS) and geothermal energy exploration, which share similar subsurface characterization needs. The increasing adoption of digital twins and predictive analytics for reservoir management offers new revenue streams. The development of advanced, autonomous testing systems that can operate with minimal human intervention in remote or hazardous locations presents a significant technological frontier. Furthermore, offering specialized testing services for unconventional reservoirs with complex geology and for marginal field developments will cater to specific market needs.

Leading Players in the Well Testing Services Industry Sector

- CETCO Energy Services

- SGS S A

- PW Well Test Ltd

- Weatherford International Plc

- Expro Group

- TETRA Technologies Inc

- Baker Hughes Company

- Halliburton Company

- Schlumberger Limited

- China Oilfield Secvices Limited

Key Milestones in Well Testing Services Industry Industry

- 2019: Increased investment in AI-driven data analytics for faster reservoir characterization.

- 2020: Introduction of advanced remote monitoring and control systems for offshore well testing.

- 2021: Significant M&A activity to consolidate market share and expand service portfolios.

- 2022: Development of more environmentally friendly testing fluids and methodologies.

- 2023: Enhanced focus on integrated digital platforms for seamless data management across the well lifecycle.

- 2024: Emergence of specialized testing solutions for geothermal and CCUS projects.

Strategic Outlook for Well Testing Services Industry Market

The strategic outlook for the Well Testing Services Industry market is characterized by a strong emphasis on technological integration, sustainability, and diversified service offerings. Growth accelerators will include the continued adoption of digital technologies for enhanced efficiency and data-driven decision-making, alongside a focus on developing and deploying environmentally responsible solutions. Expanding into new energy sectors and offering value-added consulting services based on comprehensive test data analysis will be crucial for capturing future market potential and achieving sustainable growth in this dynamic industry.

Well Testing Services Industry Segmentation

-

1. Stage

- 1.1. Exploration, Appraisal, & Development

- 1.2. Production

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

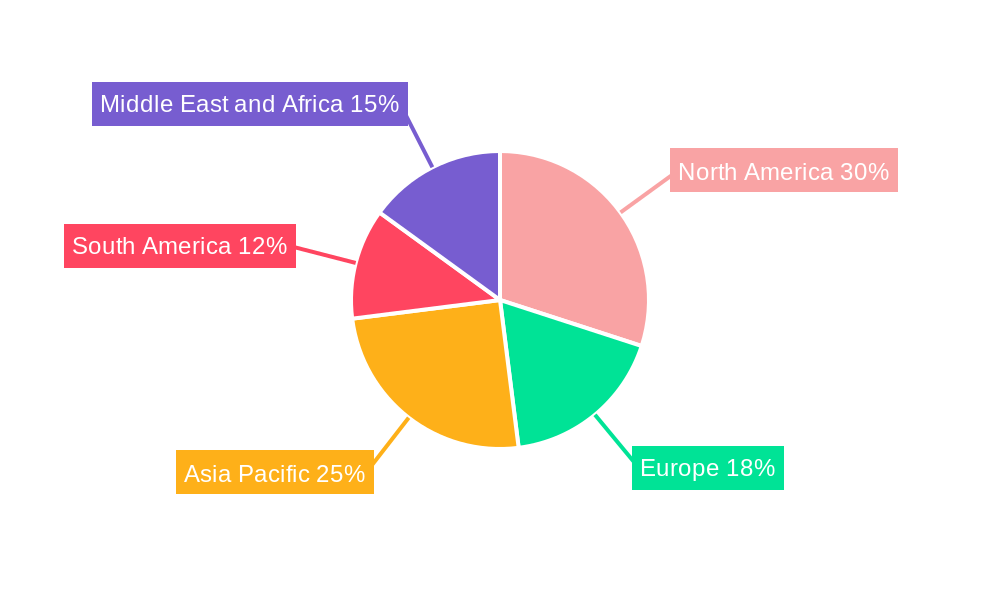

Well Testing Services Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Well Testing Services Industry Regional Market Share

Geographic Coverage of Well Testing Services Industry

Well Testing Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Exploration in Offshore Areas4.; The Strengthening of Crude Oil Prices

- 3.2.2 Making the Upstream Activities Economically Feasible

- 3.3. Market Restrains

- 3.3.1. 4.; Shifting to Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Well Testing Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Stage

- 5.1.1. Exploration, Appraisal, & Development

- 5.1.2. Production

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Stage

- 6. North America Well Testing Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Stage

- 6.1.1. Exploration, Appraisal, & Development

- 6.1.2. Production

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.1. Market Analysis, Insights and Forecast - by Stage

- 7. Europe Well Testing Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Stage

- 7.1.1. Exploration, Appraisal, & Development

- 7.1.2. Production

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.1. Market Analysis, Insights and Forecast - by Stage

- 8. Asia Pacific Well Testing Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Stage

- 8.1.1. Exploration, Appraisal, & Development

- 8.1.2. Production

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.1. Market Analysis, Insights and Forecast - by Stage

- 9. South America Well Testing Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Stage

- 9.1.1. Exploration, Appraisal, & Development

- 9.1.2. Production

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.1. Market Analysis, Insights and Forecast - by Stage

- 10. Middle East and Africa Well Testing Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Stage

- 10.1.1. Exploration, Appraisal, & Development

- 10.1.2. Production

- 10.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.2.1. Onshore

- 10.2.2. Offshore

- 10.1. Market Analysis, Insights and Forecast - by Stage

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CETCO Energy Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SGS S A

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PW Well Test Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Weatherford International Plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Expro Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TETRA Technologies Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Baker Hughes Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Halliburton Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schlumberger Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 China Oilfield Secvices Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CETCO Energy Services

List of Figures

- Figure 1: Global Well Testing Services Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Well Testing Services Industry Revenue (undefined), by Stage 2025 & 2033

- Figure 3: North America Well Testing Services Industry Revenue Share (%), by Stage 2025 & 2033

- Figure 4: North America Well Testing Services Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 5: North America Well Testing Services Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 6: North America Well Testing Services Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Well Testing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Well Testing Services Industry Revenue (undefined), by Stage 2025 & 2033

- Figure 9: Europe Well Testing Services Industry Revenue Share (%), by Stage 2025 & 2033

- Figure 10: Europe Well Testing Services Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 11: Europe Well Testing Services Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 12: Europe Well Testing Services Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Well Testing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Well Testing Services Industry Revenue (undefined), by Stage 2025 & 2033

- Figure 15: Asia Pacific Well Testing Services Industry Revenue Share (%), by Stage 2025 & 2033

- Figure 16: Asia Pacific Well Testing Services Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 17: Asia Pacific Well Testing Services Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 18: Asia Pacific Well Testing Services Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Well Testing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Well Testing Services Industry Revenue (undefined), by Stage 2025 & 2033

- Figure 21: South America Well Testing Services Industry Revenue Share (%), by Stage 2025 & 2033

- Figure 22: South America Well Testing Services Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 23: South America Well Testing Services Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 24: South America Well Testing Services Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Well Testing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Well Testing Services Industry Revenue (undefined), by Stage 2025 & 2033

- Figure 27: Middle East and Africa Well Testing Services Industry Revenue Share (%), by Stage 2025 & 2033

- Figure 28: Middle East and Africa Well Testing Services Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 29: Middle East and Africa Well Testing Services Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 30: Middle East and Africa Well Testing Services Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Well Testing Services Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Well Testing Services Industry Revenue undefined Forecast, by Stage 2020 & 2033

- Table 2: Global Well Testing Services Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 3: Global Well Testing Services Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Well Testing Services Industry Revenue undefined Forecast, by Stage 2020 & 2033

- Table 5: Global Well Testing Services Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 6: Global Well Testing Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Well Testing Services Industry Revenue undefined Forecast, by Stage 2020 & 2033

- Table 8: Global Well Testing Services Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 9: Global Well Testing Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Well Testing Services Industry Revenue undefined Forecast, by Stage 2020 & 2033

- Table 11: Global Well Testing Services Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 12: Global Well Testing Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Well Testing Services Industry Revenue undefined Forecast, by Stage 2020 & 2033

- Table 14: Global Well Testing Services Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 15: Global Well Testing Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Well Testing Services Industry Revenue undefined Forecast, by Stage 2020 & 2033

- Table 17: Global Well Testing Services Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 18: Global Well Testing Services Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Well Testing Services Industry?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Well Testing Services Industry?

Key companies in the market include CETCO Energy Services, SGS S A, PW Well Test Ltd, Weatherford International Plc, Expro Group, TETRA Technologies Inc, Baker Hughes Company, Halliburton Company, Schlumberger Limited, China Oilfield Secvices Limited.

3. What are the main segments of the Well Testing Services Industry?

The market segments include Stage, Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Exploration in Offshore Areas4.; The Strengthening of Crude Oil Prices. Making the Upstream Activities Economically Feasible.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Shifting to Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Well Testing Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Well Testing Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Well Testing Services Industry?

To stay informed about further developments, trends, and reports in the Well Testing Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence