Key Insights

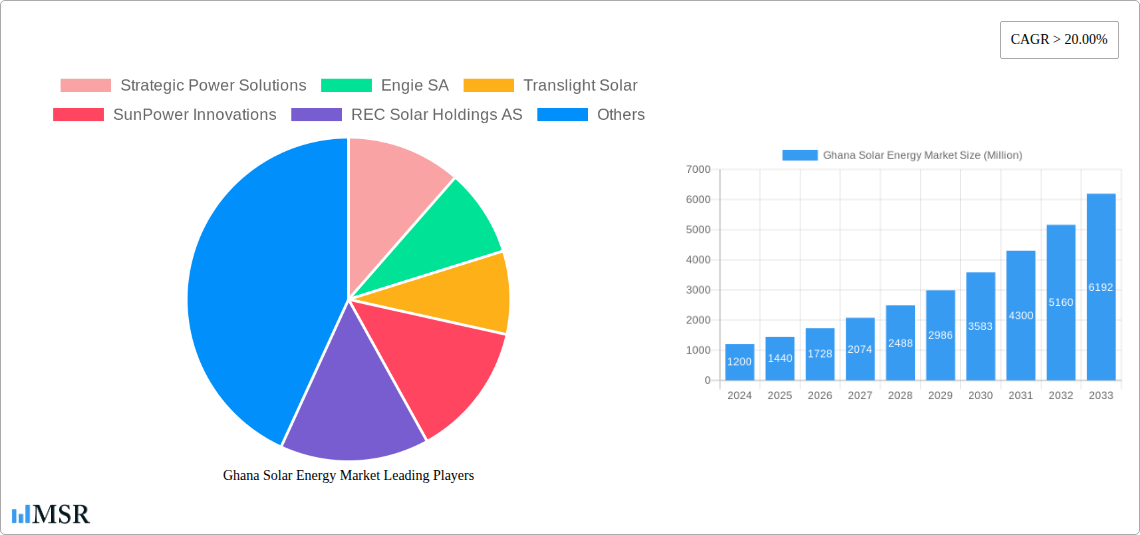

The Ghana Solar Energy Market is poised for substantial expansion, driven by increasing government support, a growing demand for clean energy, and declining solar technology costs. With an estimated market size of USD 1.2 billion in 2024, the sector is projected to experience a robust Compound Annual Growth Rate (CAGR) of 20% throughout the forecast period. This growth is primarily fueled by the nation's commitment to diversifying its energy mix and reducing reliance on fossil fuels, particularly in light of energy security concerns and the rising costs of traditional power generation. Furthermore, the increasing adoption of solar for both utility-scale projects and distributed rooftop installations signifies a maturing market ready to embrace renewable energy solutions across various applications. Investments in grid modernization and energy storage are also expected to play a crucial role in enabling higher penetrations of solar power.

Ghana Solar Energy Market Market Size (In Billion)

Key market drivers include favorable government policies such as tax incentives and feed-in tariffs, coupled with increasing private sector investments in renewable energy projects. The abundance of solar irradiance in Ghana presents a significant natural advantage, making solar power a cost-effective and sustainable energy alternative. The market segments are likely to see significant growth in both ground-mounted and rooftop solar installations, catering to diverse energy needs from large-scale power generation to residential and commercial applications. While the market benefits from strong growth potential, potential restraints could include challenges related to grid integration, financing accessibility for smaller players, and the need for skilled labor in installation and maintenance. However, the overarching trend points towards a dynamic and rapidly evolving solar energy landscape in Ghana.

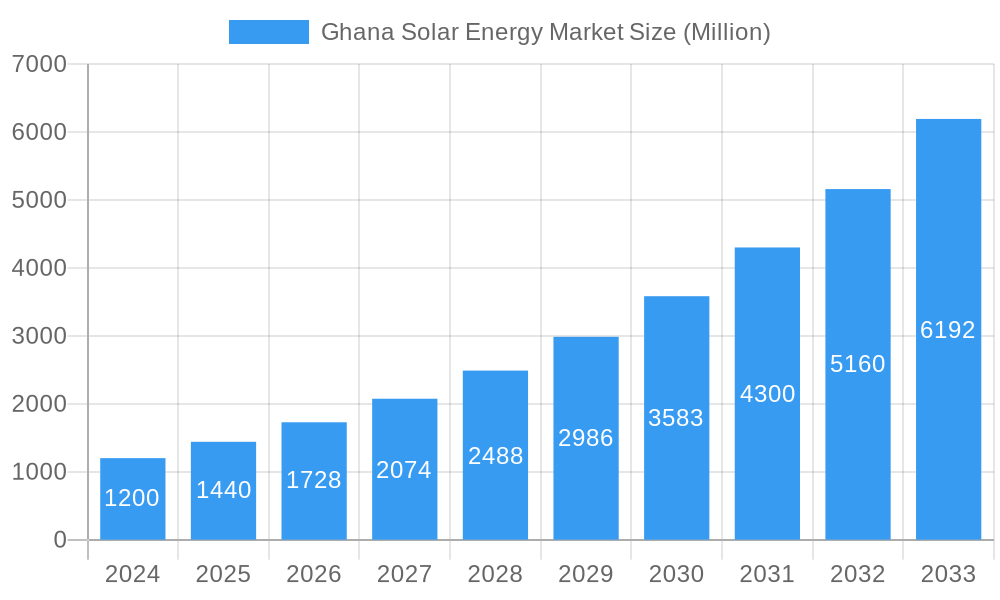

Ghana Solar Energy Market Company Market Share

Ghana Solar Energy Market Report: Driving Sustainable Power Solutions for a Brighter Future

This comprehensive report, "Ghana Solar Energy Market," offers an in-depth analysis of the burgeoning solar energy sector in Ghana, projecting substantial growth and transformative opportunities. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this research provides critical insights for stakeholders looking to capitalize on Ghana's clean energy transition. The report delves into market dynamics, industry trends, key market segments, product developments, challenges, growth drivers, emerging opportunities, leading players, and crucial industry milestones, all presented with actionable data and strategic outlooks.

Ghana Solar Energy Market Market Concentration & Dynamics

The Ghana solar energy market is characterized by a moderate level of concentration, with key players actively investing and expanding their presence. Strategic Power Solutions, Engie SA, and JinkoSolar Holdings Co Ltd are among the prominent entities shaping the competitive landscape. Innovation ecosystems are fostered through collaborations and pilot projects, such as the feasibility study for floating solar power plants on Lake Volta. Regulatory frameworks, while evolving, are increasingly supportive of renewable energy deployment, attracting significant foreign investment. Substitute products, primarily traditional fossil fuels, continue to face declining competitiveness against the cost-effectiveness of solar solutions. End-user trends are shifting towards decentralized energy generation and enhanced grid stability. Merger and acquisition (M&A) activities are anticipated to rise as larger players seek to consolidate market share and acquire innovative technologies. While precise M&A deal counts and individual company market share figures require specific data, the overarching trend indicates a dynamic market poised for significant expansion.

Ghana Solar Energy Market Industry Insights & Trends

The Ghana solar energy market is experiencing robust growth, driven by a confluence of factors aimed at enhancing energy security and sustainability. Market size is projected to reach $1.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 18.5% during the forecast period (2025-2033). This upward trajectory is significantly influenced by the government's ambitious renewable energy targets and the increasing demand for reliable electricity access across the nation. Technological advancements in solar photovoltaic (PV) technology, including higher efficiency panels and improved storage solutions, are making solar power more competitive and accessible. Evolving consumer behaviors, spurred by rising electricity costs from conventional sources and a growing environmental consciousness, are further accelerating the adoption of solar energy for both residential and commercial applications. The economic benefits, such as reduced operational expenses and the creation of green jobs, are also substantial. Strategic investments in grid infrastructure to accommodate intermittent renewable energy sources are crucial for sustained growth. The decreasing cost of solar components, coupled with favorable financing options, is democratizing access to solar energy, paving the way for widespread adoption. Furthermore, international partnerships and development aid are playing a pivotal role in funding large-scale solar projects and capacity building initiatives, solidifying the market's positive outlook. The overall industry is poised for transformative expansion, driven by innovation, policy support, and market demand.

Key Markets & Segments Leading Ghana Solar Energy Market

The Ghana solar energy market is primarily dominated by the Ground-mounted solar segment, which commands a significant market share due to its suitability for large-scale utility projects and its cost-effectiveness in terms of installation and maintenance. This dominance is fueled by several key drivers:

- Economic Growth & Industrial Demand: Ghana's expanding economy and growing industrial base necessitate a stable and affordable energy supply. Large ground-mounted solar farms can efficiently meet this demand, contributing to industrial development and economic competitiveness.

- Infrastructure Development: The availability of suitable land, particularly in rural and peri-urban areas, coupled with ongoing investments in grid infrastructure, makes ground-mounted installations a practical and scalable solution for powering communities and industries.

- Government Support & Policy Incentives: Policies aimed at promoting renewable energy and attracting foreign investment have directly benefited the ground-mounted segment. These include tax incentives, feed-in tariffs, and streamlined permitting processes for utility-scale projects.

- Cost-Effectiveness for Large-Scale Deployment: The economics of solar power generation are most favorable at scale. Ground-mounted systems allow for the optimization of land use and the procurement of solar panels and associated equipment in bulk, leading to lower per-unit costs.

- Grid Integration Capabilities: Large ground-mounted solar plants are often designed with grid integration in mind, allowing for stable power injection into the national grid and contributing to overall energy security.

While the Rooftop Solar segment is also experiencing growth, particularly in the residential and commercial sectors driven by a desire for energy independence and cost savings, it currently plays a secondary role compared to the expansive potential of ground-mounted systems in meeting Ghana's overall energy demands. The sheer capacity and utility-scale deployment enabled by ground-mounted solar installations position it as the leading segment in driving the Ghana solar energy market forward.

Ghana Solar Energy Market Product Developments

Product development in Ghana's solar energy market is increasingly focused on enhancing efficiency, durability, and grid integration. Innovations include the deployment of higher-efficiency bifacial solar panels, which capture sunlight from both sides, maximizing energy yield. Advancements in battery storage technology are crucial for addressing the intermittency of solar power, enabling reliable energy supply even after sunset. Furthermore, the exploration of floating solar PV technology, as highlighted by recent feasibility studies on Lake Volta, signifies a forward-thinking approach to land-use optimization and the utilization of large water bodies for energy generation. Smart grid technologies are also being integrated to improve the management and distribution of solar power, ensuring greater grid stability and responsiveness. These developments collectively contribute to making solar energy more competitive, accessible, and a cornerstone of Ghana's sustainable energy future.

Challenges in the Ghana Solar Energy Market Market

Despite its promising growth, the Ghana solar energy market faces several challenges. Regulatory hurdles and bureaucratic complexities in land acquisition and permitting can cause project delays. Supply chain disruptions for key components, particularly in the wake of global events, can impact project timelines and costs. Financing accessibility for smaller-scale projects and individual consumers remains a concern, despite growing investor interest. Moreover, intermittency of solar power requires robust energy storage solutions and grid modernization, which are still under development. Skilled workforce availability for installation, maintenance, and advanced technical roles is another area needing continuous development to support the sector's expansion.

Forces Driving Ghana Solar Energy Market Growth

The Ghana solar energy market's growth is propelled by strong technological advancements, leading to more efficient and cost-effective solar panels and storage systems. Economic factors, such as the decreasing cost of solar technology and the potential for significant savings on electricity bills for consumers and businesses, are powerful incentives. Regulatory support from the Ghanaian government, including renewable energy policies, tax incentives, and international collaborations, plays a crucial role in attracting investment and facilitating project development. The urgent need for increased energy access and the desire for a cleaner energy mix to combat climate change are also significant drivers.

Challenges in the Ghana Solar Energy Market Market

Long-term growth catalysts for the Ghana solar energy market lie in continued innovation and strategic market expansion. Significant advancements in energy storage solutions will be critical to overcome the intermittency of solar power and ensure a stable, 24/7 electricity supply, making solar a more attractive primary energy source. Furthermore, fostering deeper partnerships between local and international entities will unlock greater capital, technological transfer, and expertise. Expanding the reach of solar energy into underserved rural communities through innovative financing models and micro-grid solutions will also be a key growth accelerator, driving energy independence and socio-economic development.

Emerging Opportunities in Ghana Solar Energy Market

Emerging opportunities in the Ghana solar energy market are diverse and promising. The potential for large-scale floating solar power plants on water bodies like Lake Volta presents a unique and underutilized avenue for significant energy generation, minimizing land-use conflicts. The growth of distributed solar energy systems, including rooftop solar for residential and commercial use, offers opportunities for enhanced energy resilience and cost savings for end-users. Furthermore, the integration of solar-powered mini-grids in off-grid rural areas can electrify communities, fostering economic development and improving livelihoods. The increasing demand for solar-powered irrigation systems in the agricultural sector also represents a substantial untapped market.

Leading Players in the Ghana Solar Energy Market Sector

- Strategic Power Solutions

- Engie SA

- Translight Solar

- SunPower Innovations

- REC Solar Holdings AS

- Trina Solar Ltd

- Abengoa SA

- JinkoSolar Holdings Co Ltd

- Redavia Solar Power

Key Milestones in Ghana Solar Energy Market Industry

- September 2022: The Volta River Authority (VRA), with support from the German Development Bank KfW, appointed Multiconsult to assess the feasibility of installing a floating solar power plant on Lake Volta and the Kpong hydropower reservoir. This study includes an environmental impact assessment, marking a significant step towards exploring innovative solar solutions.

- August 2022: The Volta River Authority (VRA) completed the commissioning of the Kaleo solar PV plant in the Nadowli-Kaleo district, Upper West Region. This 13 MWp plant is the first phase of a proposed 28 MWp facility, demonstrating tangible progress in expanding solar energy capacity.

Strategic Outlook for Ghana Solar Energy Market Market

The strategic outlook for the Ghana solar energy market is exceptionally positive, fueled by ongoing technological innovation and robust policy support. The market is poised for sustained expansion, driven by the increasing demand for clean, reliable, and affordable electricity. Key growth accelerators include the continued reduction in solar PV and battery storage costs, making solar solutions more competitive than ever. Strategic investments in grid infrastructure upgrades and the development of advanced energy management systems will further enhance the integration of solar power. The exploration and eventual implementation of large-scale floating solar projects and the continued adoption of distributed solar systems will unlock significant new capacity and market segments. These factors collectively position Ghana to achieve its renewable energy targets and emerge as a leader in sustainable energy development in West Africa.

Ghana Solar Energy Market Segmentation

-

1. Development

- 1.1. Ground-mounted

- 1.2. Rooftop Solar

Ghana Solar Energy Market Segmentation By Geography

- 1. Ghana

Ghana Solar Energy Market Regional Market Share

Geographic Coverage of Ghana Solar Energy Market

Ghana Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Policies4.; Reduced Cost of Solar Energy Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Financing Options Coupled with Difficulties in Integrating Residential Solar PV Systems in Regions like Africa

- 3.4. Market Trends

- 3.4.1. Rooftop Solar Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ghana Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Development

- 5.1.1. Ground-mounted

- 5.1.2. Rooftop Solar

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Ghana

- 5.1. Market Analysis, Insights and Forecast - by Development

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Strategic Power Solutions

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Engie SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Translight Solar

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SunPower Innovations

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 REC Solar Holdings AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Trina Solar Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abengoa SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 JinkoSolar Holdings Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Redavia Solar Power

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Strategic Power Solutions

List of Figures

- Figure 1: Ghana Solar Energy Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Ghana Solar Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Ghana Solar Energy Market Revenue undefined Forecast, by Development 2020 & 2033

- Table 2: Ghana Solar Energy Market Volume gigawatt Forecast, by Development 2020 & 2033

- Table 3: Ghana Solar Energy Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Ghana Solar Energy Market Volume gigawatt Forecast, by Region 2020 & 2033

- Table 5: Ghana Solar Energy Market Revenue undefined Forecast, by Development 2020 & 2033

- Table 6: Ghana Solar Energy Market Volume gigawatt Forecast, by Development 2020 & 2033

- Table 7: Ghana Solar Energy Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Ghana Solar Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ghana Solar Energy Market?

The projected CAGR is approximately 20%.

2. Which companies are prominent players in the Ghana Solar Energy Market?

Key companies in the market include Strategic Power Solutions, Engie SA, Translight Solar, SunPower Innovations, REC Solar Holdings AS, Trina Solar Ltd, Abengoa SA, JinkoSolar Holdings Co Ltd, Redavia Solar Power.

3. What are the main segments of the Ghana Solar Energy Market?

The market segments include Development.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Policies4.; Reduced Cost of Solar Energy Systems.

6. What are the notable trends driving market growth?

Rooftop Solar Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Lack of Financing Options Coupled with Difficulties in Integrating Residential Solar PV Systems in Regions like Africa.

8. Can you provide examples of recent developments in the market?

September 2022: The Volta River Authority, with the support of the German Development Bank KfW, has appointed the Norwegian engineering consultancy Multiconsult to assess the feasibility of installing a floating solar power plant in Ghana. Multiconsult performed a feasibility study and an environmental impact assessment regarding floating solar power plants on Lake Volta, the world's largest artificial lake, and the Kpong hydropower reservoir in Ghana.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ghana Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ghana Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ghana Solar Energy Market?

To stay informed about further developments, trends, and reports in the Ghana Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence