Key Insights

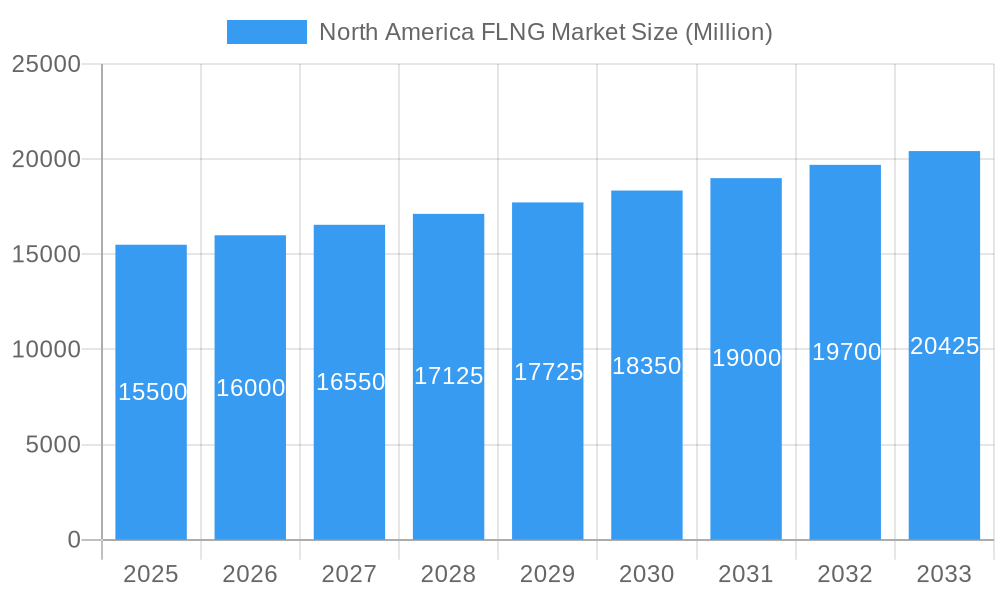

The North American Floating Liquefied Natural Gas (FLNG) market is projected for substantial expansion, fueled by escalating demand for cleaner energy and abundant regional natural gas reserves. With a base year of 2024, the market size is estimated at $26,615.3 million and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 5.8%. This growth is primarily driven by the increasing adoption of natural gas as a transitional fuel, displacing coal, and the inherent logistical and cost efficiencies of FLNG for accessing remote or underdeveloped gas fields. Technological enhancements in FLNG infrastructure are further improving operational efficiency and reducing complexity, thereby increasing investor and energy company interest. North America's pursuit of energy independence and security also supports the demand for FLNG's flexible and scalable LNG solutions.

North America FLNG Market Market Size (In Billion)

Despite robust growth prospects, challenges such as high initial capital expenditure for FLNG facilities and evolving regulatory environments warrant attention. However, the increasing focus on environmental regulations and the imperative to monetize stranded gas assets are expected to be significant drivers that will overcome these restraints. The market is segmented by key North American regions, with the United States and Canada as primary contributors, while Mexico and other parts of North America are showing growing interest. Leading entities including Shell PLC, Chiyoda Corporation, and Technip Energies NV are pioneering innovation and project development, shaping the competitive landscape and accelerating FLNG technology adoption. The strategic significance of North America's FLNG capabilities for both domestic supply and global exports will continue to spur investment and innovation.

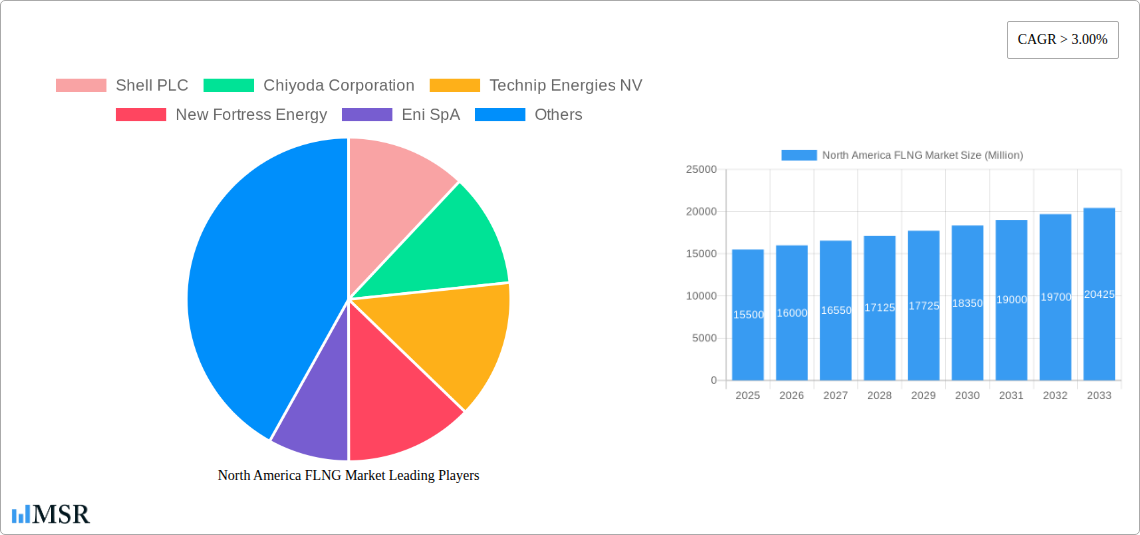

North America FLNG Market Company Market Share

North America FLNG Market: Unlocking Natural Gas Export Potential & Dominance in Liquefied Natural Gas Production

This comprehensive report delves into the dynamic North America Floating Liquefied Natural Gas (FLNG) market, providing an in-depth analysis of its growth trajectory, key drivers, and future outlook. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025–2033, this research is indispensable for stakeholders seeking to navigate the evolving landscape of LNG export, offshore liquefaction, and natural gas infrastructure development in the region. The report offers granular insights into market concentration, industry trends, leading segments, product innovations, challenges, and emerging opportunities, crucial for strategic decision-making in the North American LNG sector.

North America FLNG Market Market Concentration & Dynamics

The North America FLNG market is characterized by a moderate level of concentration, with a few prominent players dominating key aspects of project development and technology provision. Innovation ecosystems are thriving, driven by advancements in FLNG technology, offshore gas processing, and floating LNG vessel design. Regulatory frameworks, while evolving, are a significant factor influencing project timelines and investment decisions. The availability of abundant natural gas reserves, particularly in the United States, acts as a primary substitute for higher-cost energy sources, bolstering the demand for FLNG solutions. End-user trends indicate a growing appetite for reliable and flexible LNG supply chains, especially in emerging markets seeking energy security. Mergers and acquisitions (M&A) activities, though not as prevalent as in more mature energy markets, are anticipated to increase as companies seek to consolidate their position and acquire specialized FLNG capabilities. The market share of leading companies is highly competitive, with Shell PLC, Chiyoda Corporation, and Technip Energies NV holding significant influence in engineering, procurement, and construction (EPC) contracts. The number of significant M&A deals in the FLNG space remains relatively low, reflecting the capital-intensive nature and long project lifecycles, but strategic partnerships and joint ventures are common.

North America FLNG Market Industry Insights & Trends

The North America FLNG market is poised for substantial growth, fueled by a confluence of factors including the region's vast natural gas reserves, technological advancements in floating LNG production, and increasing global demand for liquefied natural gas. The market size is projected to reach approximately XXX Billion USD by 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. Key growth drivers include the escalating need for energy diversification and security in import-dependent nations, coupled with the cost-effectiveness and environmental benefits associated with utilizing cleaner-burning natural gas. Technological disruptions, such as the development of smaller, modular FLNG units and enhanced offshore liquefaction processes, are enabling greater flexibility and accessibility for stranded gas fields. Evolving consumer behaviors, particularly the growing awareness of climate change and the push for lower-carbon energy solutions, further accelerate the adoption of LNG. The competitive landscape is intensifying as companies vie for lucrative EPC contracts and project development opportunities. The North American LNG export capacity is expanding rapidly, positioning the region as a crucial supplier to global markets. This expansion is driven by both greenfield projects and the optimization of existing infrastructure, with a particular focus on enhancing the efficiency and sustainability of FLNG operations. The integration of advanced digital technologies for real-time monitoring and predictive maintenance is also a significant trend, promising to optimize operational uptime and reduce costs for FLNG facilities.

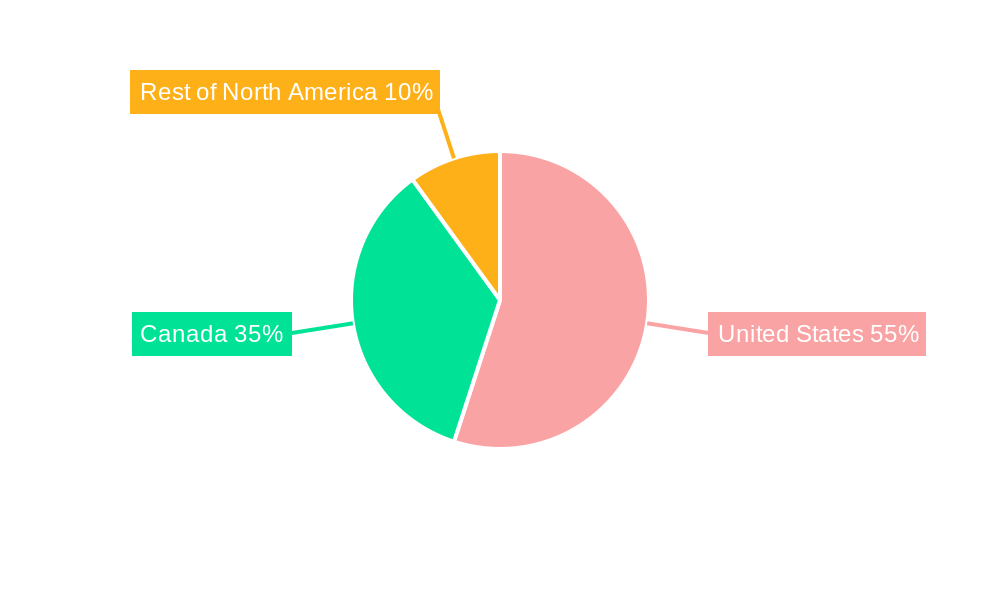

Key Markets & Segments Leading North America FLNG Market

The United States stands as the undisputed leader in the North America FLNG market, driven by its extensive onshore natural gas production and its strategic location for global export.

- United States:

- Economic Growth: Robust domestic economic growth and the need for energy security fuel demand for LNG.

- Infrastructure Development: Significant investment in pipelines, liquefaction terminals, and supporting offshore infrastructure.

- Abundant Natural Gas Reserves: Access to vast shale gas reserves provides a cost-competitive feedstock for LNG production.

- Export Demand: High global demand for LNG from Asia and Europe creates substantial export opportunities.

The dominance of the United States is further underscored by its proactive approach to developing floating LNG solutions to tap into offshore gas reserves and enhance export capabilities. The country's extensive coastline and access to deepwater ports make it an ideal location for FLNG projects. The regulatory environment, while complex, is generally supportive of energy exports, incentivizing further development.

- Canada:

- Resource Potential: Significant natural gas reserves, particularly in Western Canada, offer substantial growth potential.

- Infrastructure Expansion: Ongoing development of LNG export terminals on the Pacific coast is a key catalyst.

- Environmental Regulations: Stringent environmental regulations necessitate advanced and cleaner liquefaction technologies.

Canada's FLNG market is in a nascent stage of development but holds considerable promise. Investments in new liquefaction facilities, coupled with the ongoing development of the Canadian LNG sector, are expected to drive its market share. The nation's commitment to environmental stewardship will likely favor FLNG technologies with lower emissions profiles.

- Rest of North America:

- Mexico: Growing domestic energy demand and strategic proximity to the United States present opportunities for LNG imports and potential future export developments.

- Caribbean Nations: Increasing demand for cleaner energy solutions and the potential for FLNG to serve as mobile and flexible supply options.

The "Rest of North America" segment, primarily Mexico and Caribbean nations, represents a growing demand center. Mexico's reliance on natural gas imports and its proximity to US supply chains create a unique market dynamic. Caribbean nations are increasingly looking towards LNG to diversify their energy sources away from more expensive and less environmentally friendly alternatives, with FLNG offering a flexible solution for smaller-scale demand.

North America FLNG Market Product Developments

Product developments in the North America FLNG market are centered on enhancing efficiency, reducing environmental impact, and increasing modularity. Advancements in liquefaction technologies are leading to more compact and energy-efficient FLNG units. Innovations in offshore mooring and transfer systems are improving operational reliability and safety. The development of smaller, modular FLNG vessels offers greater flexibility for tapping into marginal or remote gas fields, opening up new market segments. These technological advancements are crucial for maintaining a competitive edge and meeting the evolving demands of the global LNG market, particularly in terms of cost-effectiveness and reduced operational footprints.

Challenges in the North America FLNG Market Market

The North America FLNG market faces several challenges that could impact its growth trajectory.

- Regulatory Hurdles: Complex and evolving permitting processes and environmental regulations can lead to project delays and increased costs.

- Supply Chain Constraints: The specialized nature of FLNG components and the global demand for skilled labor can create bottlenecks in the supply chain.

- Capital Intensity: The significant upfront investment required for FLNG projects poses a barrier to entry for smaller players and can impact project financing.

- Geopolitical Instability: Global geopolitical events can affect LNG prices and demand, creating uncertainty for long-term investment decisions.

- Competition from Renewables: The growing adoption of renewable energy sources presents an indirect competitive challenge.

Quantifiable impacts include potential project delays of 6-12 months due to regulatory reviews and cost overruns of 5-10% stemming from supply chain disruptions.

Forces Driving North America FLNG Market Growth

Several key forces are driving the expansion of the North America FLNG market.

- Technological Advancements: Innovations in FLNG vessel design, liquefaction processes, and offshore engineering are reducing costs and improving efficiency.

- Economic Factors: The abundance of low-cost natural gas in North America, coupled with increasing global demand for cleaner energy, makes FLNG highly attractive.

- Energy Security Needs: Many countries are seeking to diversify their energy sources, and LNG, facilitated by FLNG, offers a reliable and flexible alternative.

- Environmental Regulations: The global push for lower-carbon emissions favors natural gas as a transitional fuel, boosting demand for LNG.

- Strategic Location: North America's proximity to major LNG import markets, particularly in Asia and Europe, provides a competitive advantage for exports.

Challenges in the North America FLNG Market Market

Addressing the long-term growth catalysts within the North America FLNG market involves strategic investments and proactive engagement with evolving industry dynamics. Continued innovation in FLNG technology, focusing on enhanced safety features, reduced environmental footprints, and increased operational efficiency, will be paramount. Strategic partnerships and joint ventures between established energy companies, technology providers, and financial institutions will be crucial for de-risking large-scale projects and unlocking new investment capital. Market expansion into underserved regions and the development of flexible, smaller-scale FLNG solutions tailored to specific regional demands will further stimulate long-term growth. The industry's ability to adapt to evolving climate policies and demonstrate the role of natural gas in a low-carbon future will also be a key determinant of sustained expansion.

Emerging Opportunities in North America FLNG Market

Emerging opportunities in the North America FLNG market are diverse and promising. The development of small-scale FLNG solutions catering to smaller markets and remote locations represents a significant growth avenue. The increasing demand for LNG as a marine fuel presents a new market segment for FLNG providers. Furthermore, the potential for FLNG to support power generation in regions with limited grid infrastructure offers substantial untapped potential. Advancements in carbon capture and storage (CCS) technologies integrated with FLNG facilities could enhance their environmental appeal and create new value propositions. Exploring opportunities in regions with developing gas infrastructure and a strong desire for energy independence will be a key focus.

Leading Players in the North America FLNG Market Sector

- Shell PLC

- Chiyoda Corporation

- Technip Energies NV

- New Fortress Energy

- Eni SpA

- Black & Veatch Holding Company

Key Milestones in North America FLNG Market Industry

- July 2022: New Fortress Energy (NFE) signed a deal with Mexican state-owned petroleum company Pemex to develop the Lakach offshore gas field and deploy FLNG solutions jointly. The agreement involves the joint development of the Lakach deepwater natural gas field for Pemex to supply natural gas to Mexico's onshore domestic market and for NFE to produce LNG for export to global markets.

- April 2022: New Fortress Energy Inc. (NFE) announced plans to launch the US FLNG project in 2023. NFE's application offers the ownership, construction, operation, and eventual decommissioning of an offshore natural gas export deepwater port, known as New Fortress Energy Louisiana FLNG. The deepwater port would allow for the export of roughly 145 billion cubic feet of natural gas annually, equivalent to about 2.8 million tons per annum (MTPA) of LNG. The new offshore liquefaction terminal would sit in federal waters about 16 miles off the southeast coast of Grand Isle, Louisiana, in the United States Gulf of Mexico.

Strategic Outlook for North America FLNG Market Market

The strategic outlook for the North America FLNG market remains exceptionally strong, driven by the region's unparalleled natural gas resources and its established position as a leading LNG exporter. Future growth will be fueled by the continued development of large-scale FLNG projects, as well as the expansion of modular and smaller-scale solutions to serve niche markets. Key growth accelerators include leveraging technological advancements to enhance efficiency and sustainability, forging strategic alliances to secure project financing and mitigate risks, and capitalizing on the increasing global demand for cleaner energy alternatives. The North American FLNG market is poised to play a pivotal role in meeting global energy needs while contributing to economic growth and energy security.

North America FLNG Market Segmentation

- 1. United States

- 2. Canada

- 3. Rest of North America

North America FLNG Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America FLNG Market Regional Market Share

Geographic Coverage of North America FLNG Market

North America FLNG Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Modernization and Upgrades of Existing Military Aircraft Fleets4.; Increasing Defense Budgets

- 3.3. Market Restrains

- 3.3.1. 4.; Shift Toward Unmanned Aircraft

- 3.4. Market Trends

- 3.4.1. Upcoming FLNG Projects Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America FLNG Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by United States

- 5.2. Market Analysis, Insights and Forecast - by Canada

- 5.3. Market Analysis, Insights and Forecast - by Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by United States

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chiyoda Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Technip Energies NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 New Fortress Energy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eni SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Black & Veatch Holding Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: North America FLNG Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America FLNG Market Share (%) by Company 2025

List of Tables

- Table 1: North America FLNG Market Revenue million Forecast, by United States 2020 & 2033

- Table 2: North America FLNG Market Volume metric tonnes Forecast, by United States 2020 & 2033

- Table 3: North America FLNG Market Revenue million Forecast, by Canada 2020 & 2033

- Table 4: North America FLNG Market Volume metric tonnes Forecast, by Canada 2020 & 2033

- Table 5: North America FLNG Market Revenue million Forecast, by Rest of North America 2020 & 2033

- Table 6: North America FLNG Market Volume metric tonnes Forecast, by Rest of North America 2020 & 2033

- Table 7: North America FLNG Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: North America FLNG Market Volume metric tonnes Forecast, by Region 2020 & 2033

- Table 9: North America FLNG Market Revenue million Forecast, by United States 2020 & 2033

- Table 10: North America FLNG Market Volume metric tonnes Forecast, by United States 2020 & 2033

- Table 11: North America FLNG Market Revenue million Forecast, by Canada 2020 & 2033

- Table 12: North America FLNG Market Volume metric tonnes Forecast, by Canada 2020 & 2033

- Table 13: North America FLNG Market Revenue million Forecast, by Rest of North America 2020 & 2033

- Table 14: North America FLNG Market Volume metric tonnes Forecast, by Rest of North America 2020 & 2033

- Table 15: North America FLNG Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: North America FLNG Market Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 17: United States North America FLNG Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: United States North America FLNG Market Volume (metric tonnes) Forecast, by Application 2020 & 2033

- Table 19: Canada North America FLNG Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America FLNG Market Volume (metric tonnes) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America FLNG Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America FLNG Market Volume (metric tonnes) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America FLNG Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the North America FLNG Market?

Key companies in the market include Shell PLC, Chiyoda Corporation, Technip Energies NV, New Fortress Energy, Eni SpA, Black & Veatch Holding Company.

3. What are the main segments of the North America FLNG Market?

The market segments include United States, Canada, Rest of North America.

4. Can you provide details about the market size?

The market size is estimated to be USD 26615.3 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Modernization and Upgrades of Existing Military Aircraft Fleets4.; Increasing Defense Budgets.

6. What are the notable trends driving market growth?

Upcoming FLNG Projects Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Shift Toward Unmanned Aircraft.

8. Can you provide examples of recent developments in the market?

July 2022: New Fortress Energy (NFE) signed a deal with Mexican state-owned petroleum company Pemex to develop the Lakach offshore gas field and deploy FLNG solutions jointly. The agreement involves the joint development of the Lakach deepwater natural gas field for Pemex to supply natural gas to Mexico's onshore domestic market and for NFE to produce LNG for export to global markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America FLNG Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America FLNG Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America FLNG Market?

To stay informed about further developments, trends, and reports in the North America FLNG Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence