Key Insights

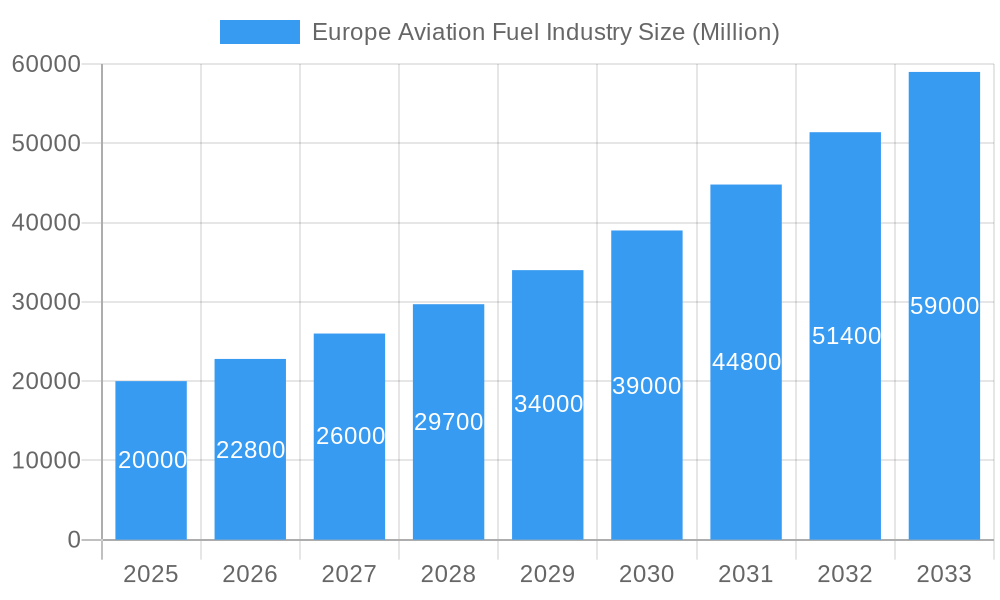

The European aviation fuel market, valued at €69.91 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 6.92% between 2025 and 2033. This growth is underpinned by the recovery of air travel, increasing passenger volumes, and the expansion of low-cost carriers. The rise of air freight, propelled by e-commerce and global supply chains, further fuels demand. A significant driver is the increasing adoption of sustainable aviation fuels (SAFs), spurred by environmental imperatives and emissions reduction mandates. Key challenges include volatile crude oil prices, geopolitical supply chain disruptions, and economic uncertainties.

Europe Aviation Fuel Industry Market Size (In Billion)

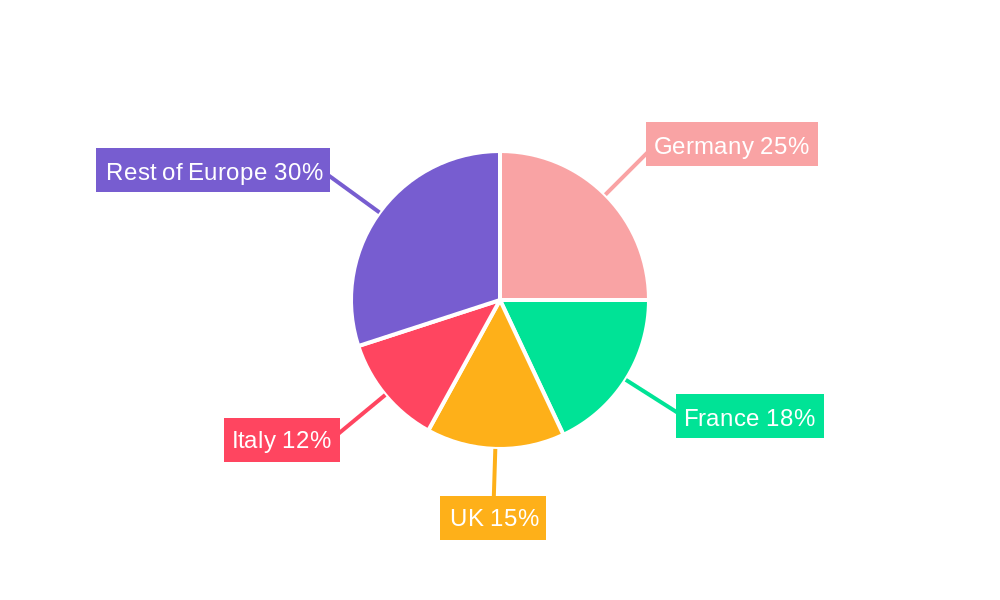

Air Turbine Fuel (ATF) leads the market segments, followed by Aviation Gasoline (AVGAS) and the burgeoning Aviation Biofuel sector. Commercial aviation dominates application segments due to high passenger and cargo flight volumes, with defense and general aviation also contributing. Major European markets include Germany, France, the United Kingdom, and Italy, which collectively drive regional consumption. Infrastructure development and enhanced air connectivity across Europe positively impact market expansion. Intense competition among key players like TotalEnergies, ExxonMobil, Gazprom Neft, Shell, Neste, BP, and Repsol is characterized by significant investments in capacity and sustainable fuel development.

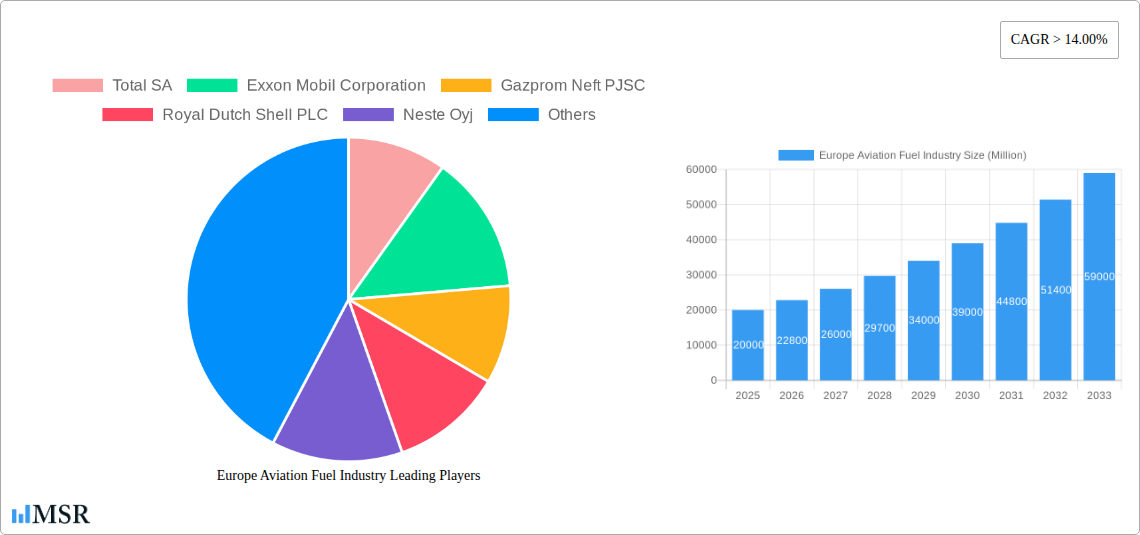

Europe Aviation Fuel Industry Company Market Share

Europe Aviation Fuel Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe aviation fuel industry, encompassing market dynamics, key players, emerging trends, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for industry stakeholders, investors, and policymakers seeking actionable insights into this dynamic sector.

Europe Aviation Fuel Industry Market Concentration & Dynamics

The European aviation fuel market exhibits moderate concentration, with major players like Total SA, Exxon Mobil Corporation, Gazprom Neft PJSC, Royal Dutch Shell PLC, Neste Oyj, BP PLC, and Repsol SA holding significant market share. However, the market is witnessing increased competition from smaller, specialized players focusing on sustainable aviation fuel (SAF).

The innovation ecosystem is characterized by substantial R&D investment in SAF technologies, driven by stringent environmental regulations and growing consumer demand for eco-friendly travel. Regulatory frameworks, such as the EU's Fit for 55 package, are progressively tightening emission standards, pushing industry players towards SAF adoption. Substitute products, while limited, include biofuels and hydrogen, but their market penetration is still nascent. End-user trends show a strong preference for airlines offering sustainable travel options, influencing purchasing decisions. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a projected xx M&A deals in the forecast period, primarily focused on securing access to SAF production capabilities and expanding distribution networks. Market share for the top 5 players is estimated at xx% in 2025.

Europe Aviation Fuel Industry Industry Insights & Trends

The European aviation fuel market is poised for significant growth, driven by the resurgence of air travel post-pandemic and increasing passenger numbers. The market size is projected to reach xx Million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions are primarily centered around the development and adoption of sustainable aviation fuels (SAF), including biofuels and synthetic fuels. Consumer behavior increasingly emphasizes sustainability, pushing airlines and fuel suppliers to prioritize SAF procurement and transparent reporting on their environmental impact. This trend is further fueled by regulatory pressures pushing for carbon emission reductions within the aviation sector. Government incentives and policies aimed at promoting SAF adoption are expected to significantly accelerate market growth in the coming years. The industry is also witnessing a growing focus on optimizing fuel efficiency and reducing operational costs through technological advancements in aircraft design and engine technology.

Key Markets & Segments Leading Europe Aviation Fuel Industry

While the commercial aviation segment dominates the European aviation fuel market, substantial growth is anticipated within the General Aviation and Defense sectors. Air Turbine Fuel (ATF) remains the leading fuel type, but the adoption rate of Aviation Biofuel (SAF) is rapidly increasing.

Dominant Segments & Drivers:

- Commercial Aviation: Driven by passenger growth, increased fleet size, and rising air travel demand across Europe.

- Air Turbine Fuel (ATF): Remains the dominant fuel type due to its established infrastructure and performance characteristics.

- Aviation Biofuel (SAF): Demonstrates the fastest growth rate, driven by environmental regulations and increasing consumer demand for sustainable aviation.

Regional Dominance: Western European countries like the UK, France, and Germany represent the largest markets, benefiting from established aviation infrastructure and high air travel demand.

Europe Aviation Fuel Industry Product Developments

Significant advancements are shaping the aviation fuel landscape, particularly in sustainable aviation fuel (SAF) production. New technologies are improving the efficiency and cost-effectiveness of biofuel and synthetic fuel production, enhancing their market competitiveness. These advancements create competitive advantages by allowing companies to meet growing environmental demands while potentially reducing fuel costs in the long term.

Challenges in the Europe Aviation Fuel Industry Market

The European aviation fuel market faces several challenges. Regulatory hurdles, particularly those concerning SAF certification and adoption, pose significant barriers to entry for new players. Supply chain disruptions, especially those affecting the production and distribution of SAF, can lead to price volatility and operational inefficiencies. Intense competition among established players further complicates the market dynamics. The geopolitical instability and its impact on crude oil prices also pose significant risk to the industry profitability. These combined factors influence market growth, impacting investment decisions and long-term sustainability.

Forces Driving Europe Aviation Fuel Industry Growth

Key growth drivers include stringent environmental regulations promoting SAF adoption, rising air travel demand, government incentives supporting SAF development, technological advancements in SAF production, and growing consumer awareness of sustainability. The EU's Fit for 55 package, for instance, sets ambitious targets for emission reductions, fostering innovation and investment in the SAF sector.

Challenges in the Europe Aviation Fuel Industry Market

Long-term growth is further propelled by increased public-private partnerships accelerating SAF innovation, expanding global SAF production capacity, and exploring alternative sustainable aviation fuels. These collaborative efforts are fundamental to achieving a greener aviation industry and ensuring sustainable long-term growth.

Emerging Opportunities in Europe Aviation Fuel Industry

Emerging opportunities exist in the development and deployment of next-generation SAF technologies, including the utilization of advanced biofuels and synthetic fuels derived from renewable sources. Expansion into underserved regional markets, particularly in Eastern Europe, presents growth potential. The increasing demand for sustainable travel options creates a significant opportunity for companies to differentiate their offerings through transparent sustainability reporting and commitment to responsible sourcing.

Leading Players in the Europe Aviation Fuel Industry Sector

Key Milestones in Europe Aviation Fuel Industry Industry

- January 2022: Turkey launched a USD 6.8 Million algae-based jet fuel laboratory, supported by the EU and the Turkish government, signifying increased investment in sustainable aviation fuel production.

- July 2022: The UK's "Jet Zero" strategy aimed to boost the SAF sector and achieve net-zero emissions in domestic aviation by 2040, indicating a growing governmental commitment to sustainable aviation.

Strategic Outlook for Europe Aviation Fuel Industry Market

The European aviation fuel market presents a compelling growth trajectory driven by the confluence of environmental regulations, technological innovation, and increasing passenger demand. Strategic opportunities exist for companies focusing on sustainable aviation fuel (SAF) production, distribution, and technological advancements. The market's future potential hinges on overcoming the challenges related to SAF scalability and cost-effectiveness while maintaining strong collaboration between industry players, governments, and research institutions.

Europe Aviation Fuel Industry Segmentation

-

1. Fuel Type

- 1.1. Air Turbine Fuel (ATF)

- 1.2. Aviation Biofuel

- 1.3. AVGAS

-

2. Application

- 2.1. Commercial

- 2.2. Defense

- 2.3. General Aviation

Europe Aviation Fuel Industry Segmentation By Geography

- 1. The United Kingdom

- 2. France

- 3. Germany

- 4. Spain

- 5. Rest of Europe

Europe Aviation Fuel Industry Regional Market Share

Geographic Coverage of Europe Aviation Fuel Industry

Europe Aviation Fuel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Declining Price of Solar Panels and Installation Costs4.; Increasing Adoption of Solar PV Systems4.; Rising Environmental Concerns About the Use of Fossil Fuels

- 3.3. Market Restrains

- 3.3.1. 4.; Transmission and Distribution Losses4.; A Lack of a Solidified Renewable Energy Policy

- 3.4. Market Trends

- 3.4.1. Commercial Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Air Turbine Fuel (ATF)

- 5.1.2. Aviation Biofuel

- 5.1.3. AVGAS

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Defense

- 5.2.3. General Aviation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. The United Kingdom

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Spain

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. The United Kingdom Europe Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Air Turbine Fuel (ATF)

- 6.1.2. Aviation Biofuel

- 6.1.3. AVGAS

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial

- 6.2.2. Defense

- 6.2.3. General Aviation

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. France Europe Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Air Turbine Fuel (ATF)

- 7.1.2. Aviation Biofuel

- 7.1.3. AVGAS

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial

- 7.2.2. Defense

- 7.2.3. General Aviation

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Germany Europe Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Air Turbine Fuel (ATF)

- 8.1.2. Aviation Biofuel

- 8.1.3. AVGAS

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial

- 8.2.2. Defense

- 8.2.3. General Aviation

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Spain Europe Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. Air Turbine Fuel (ATF)

- 9.1.2. Aviation Biofuel

- 9.1.3. AVGAS

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial

- 9.2.2. Defense

- 9.2.3. General Aviation

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. Rest of Europe Europe Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10.1.1. Air Turbine Fuel (ATF)

- 10.1.2. Aviation Biofuel

- 10.1.3. AVGAS

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Commercial

- 10.2.2. Defense

- 10.2.3. General Aviation

- 10.1. Market Analysis, Insights and Forecast - by Fuel Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Total SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Exxon Mobil Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Gazprom Neft PJSC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Royal Dutch Shell PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Neste Oyj

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BP PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Repsol SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Total SA

List of Figures

- Figure 1: Europe Aviation Fuel Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Aviation Fuel Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Aviation Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 2: Europe Aviation Fuel Industry Volume kilograms Forecast, by Fuel Type 2020 & 2033

- Table 3: Europe Aviation Fuel Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Aviation Fuel Industry Volume kilograms Forecast, by Application 2020 & 2033

- Table 5: Europe Aviation Fuel Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Aviation Fuel Industry Volume kilograms Forecast, by Region 2020 & 2033

- Table 7: Europe Aviation Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 8: Europe Aviation Fuel Industry Volume kilograms Forecast, by Fuel Type 2020 & 2033

- Table 9: Europe Aviation Fuel Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Europe Aviation Fuel Industry Volume kilograms Forecast, by Application 2020 & 2033

- Table 11: Europe Aviation Fuel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Aviation Fuel Industry Volume kilograms Forecast, by Country 2020 & 2033

- Table 13: Europe Aviation Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 14: Europe Aviation Fuel Industry Volume kilograms Forecast, by Fuel Type 2020 & 2033

- Table 15: Europe Aviation Fuel Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Europe Aviation Fuel Industry Volume kilograms Forecast, by Application 2020 & 2033

- Table 17: Europe Aviation Fuel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Aviation Fuel Industry Volume kilograms Forecast, by Country 2020 & 2033

- Table 19: Europe Aviation Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 20: Europe Aviation Fuel Industry Volume kilograms Forecast, by Fuel Type 2020 & 2033

- Table 21: Europe Aviation Fuel Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Europe Aviation Fuel Industry Volume kilograms Forecast, by Application 2020 & 2033

- Table 23: Europe Aviation Fuel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Aviation Fuel Industry Volume kilograms Forecast, by Country 2020 & 2033

- Table 25: Europe Aviation Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 26: Europe Aviation Fuel Industry Volume kilograms Forecast, by Fuel Type 2020 & 2033

- Table 27: Europe Aviation Fuel Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Europe Aviation Fuel Industry Volume kilograms Forecast, by Application 2020 & 2033

- Table 29: Europe Aviation Fuel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Aviation Fuel Industry Volume kilograms Forecast, by Country 2020 & 2033

- Table 31: Europe Aviation Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 32: Europe Aviation Fuel Industry Volume kilograms Forecast, by Fuel Type 2020 & 2033

- Table 33: Europe Aviation Fuel Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Europe Aviation Fuel Industry Volume kilograms Forecast, by Application 2020 & 2033

- Table 35: Europe Aviation Fuel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe Aviation Fuel Industry Volume kilograms Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Aviation Fuel Industry?

The projected CAGR is approximately 6.92%.

2. Which companies are prominent players in the Europe Aviation Fuel Industry?

Key companies in the market include Total SA, Exxon Mobil Corporation, Gazprom Neft PJSC, Royal Dutch Shell PLC, Neste Oyj, BP PLC, Repsol SA.

3. What are the main segments of the Europe Aviation Fuel Industry?

The market segments include Fuel Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 69.91 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The Declining Price of Solar Panels and Installation Costs4.; Increasing Adoption of Solar PV Systems4.; Rising Environmental Concerns About the Use of Fossil Fuels.

6. What are the notable trends driving market growth?

Commercial Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Transmission and Distribution Losses4.; A Lack of a Solidified Renewable Energy Policy.

8. Can you provide examples of recent developments in the market?

January 2022: Turkey opened a laboratory to grow algae to produce jet fuel, aligning with the European Union's clean aviation push. The USD 6.8 million demonstration project is funded by the Turkish government and the European Union.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in kilograms.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Aviation Fuel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Aviation Fuel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Aviation Fuel Industry?

To stay informed about further developments, trends, and reports in the Europe Aviation Fuel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence