Key Insights

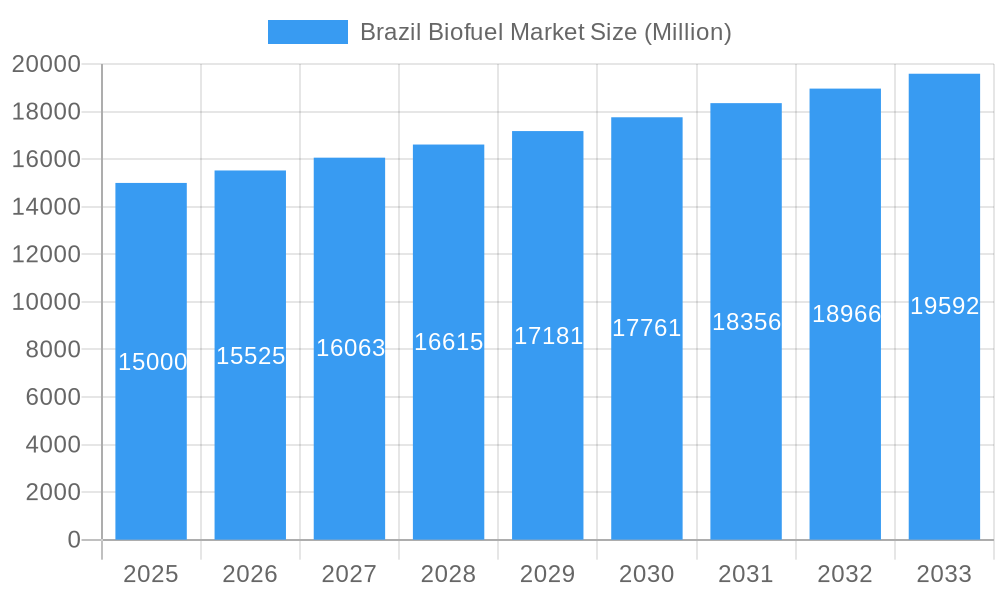

The Brazil biofuel market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided 2019-2024 data and 3.49% CAGR), is projected to experience steady growth, driven by increasing government support for renewable energy sources, rising fuel prices, and a growing awareness of environmental sustainability. Brazil's robust agricultural sector, particularly its sugarcane and soybean production, provides a significant feedstock advantage, fueling the expansion of ethanol and biodiesel production. The market is segmented by type (biodiesel, ethanol, and other types) and feedstock (coarse grain, sugar crop, vegetable oil, and other feedstocks). Sugarcane-based ethanol currently dominates the market, leveraging Brazil’s existing infrastructure and expertise. However, the biodiesel segment is expected to witness significant growth due to the increasing adoption of renewable diesel blends in transportation. Key players like Abengoa Bioenergia Brasil SA, BP Bunge Bioenergia SA, and Raizen SA are strategically investing in capacity expansion and technological advancements to capitalize on this growth trajectory. Challenges include potential land-use conflicts, fluctuating commodity prices, and the need for continuous technological improvements to enhance efficiency and reduce production costs. The forecast period of 2025-2033 presents significant opportunities for further market expansion, fueled by increasing global demand for sustainable biofuels and Brazil's position as a leading producer.

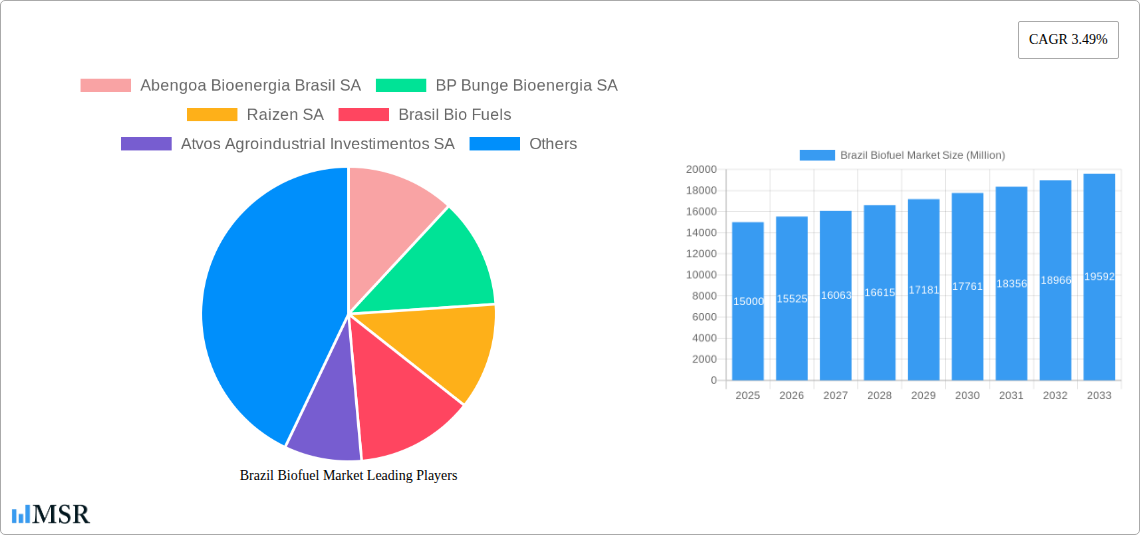

Brazil Biofuel Market Market Size (In Billion)

The forecast period will witness a continuous shift towards advanced biofuel technologies and sustainable feedstock sourcing to minimize environmental impact and improve overall sustainability. Government regulations promoting biofuel blending mandates and incentives for renewable energy will further propel market growth. The competition among existing players and potential new entrants will likely intensify, leading to price optimization and product diversification. The market’s success hinges on addressing challenges related to infrastructure development, ensuring consistent feedstock supply, and promoting the adoption of sustainable agricultural practices. The ongoing research and development efforts in biofuel technology will likely lead to the development of next-generation biofuels with improved energy efficiency and reduced greenhouse gas emissions, further solidifying Brazil's position as a global leader in the biofuel sector.

Brazil Biofuel Market Company Market Share

Brazil Biofuel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil biofuel market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market trends, key players, and future opportunities. The report leverages extensive data analysis and industry expertise to deliver actionable intelligence on market size, growth drivers, and challenges. The Brazil biofuel market, encompassing biodiesel, ethanol, and other biofuels derived from diverse feedstocks like coarse grain, sugar crops, and vegetable oils, is poised for significant expansion. This report serves as an essential resource for investors, industry professionals, and policymakers looking to gain a competitive edge in this burgeoning market.

Brazil Biofuel Market Market Concentration & Dynamics

The Brazilian biofuel market exhibits a moderately concentrated landscape, with a few dominant players controlling significant market share. Raizen SA and BP Bunge Bioenergia SA are among the leading companies, benefiting from their established infrastructure and extensive distribution networks. However, the market also features a number of smaller, specialized players focusing on niche segments or specific feedstocks. Innovation in this sector is driven by both large corporations and smaller startups, particularly in areas like advanced biofuel production technologies and sustainable feedstock sourcing. Brazil's regulatory framework, while generally supportive of biofuels, is constantly evolving, impacting market dynamics and investment decisions. The increasing demand for sustainable alternatives to fossil fuels is a major growth driver, while the availability and price of feedstocks, along with global economic conditions, influence market fluctuations. Mergers and acquisitions (M&A) activity is moderate, with larger players consolidating their positions through strategic acquisitions of smaller companies. In recent years, there have been approximately xx M&A deals per year, indicating a trend towards consolidation.

- Market Concentration: Moderately concentrated, with a few dominant players holding xx% of the market share.

- Innovation Ecosystems: Active, with both established companies and startups driving technological advancements.

- Regulatory Frameworks: Supportive but constantly evolving, influencing investment decisions.

- Substitute Products: Fossil fuels remain a key competitor, but their impact is diminishing due to environmental concerns and government policies.

- End-User Trends: Growing preference for sustainable fuels and increasing demand from various sectors are key trends.

- M&A Activities: Moderate activity observed in recent years, with xx M&A deals annually.

Brazil Biofuel Market Industry Insights & Trends

The Brazilian biofuel market is experiencing robust growth, driven by a combination of factors. The market size in 2025 is estimated at xx Million USD, reflecting a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is fueled by several key factors including increasing government incentives for biofuel production and consumption, rising environmental awareness, and the growing demand for renewable energy solutions. Technological advancements in biofuel production, such as the development of more efficient conversion technologies and the exploration of diverse feedstocks are further accelerating market expansion. Consumer behavior is also shifting, with an increasing preference for eco-friendly transportation fuels and products, supporting the growth of the biofuel sector. Technological disruptions are challenging established players to adapt and invest in R&D to enhance efficiency and reduce production costs. This leads to continuous innovation in feedstock utilization, refining processes, and distribution networks.

Key Markets & Segments Leading Brazil Biofuel Market

The Brazilian biofuel market is dominated by ethanol and biodiesel, with ethanol holding a larger market share due to its established infrastructure and widespread use in the transportation sector. Sugarcane is the primary feedstock for ethanol production, owing to Brazil's extensive sugarcane cultivation. Biodiesel production utilizes a diverse range of feedstocks including soybean oil and other vegetable oils.

Dominant Segments:

- Type: Ethanol and Biodiesel represent the largest segments.

- Feedstock: Sugarcane for ethanol and soybean oil for biodiesel are predominant.

Growth Drivers by Segment:

- Ethanol:

- Strong government support through policies like RenovaBio.

- Established infrastructure and distribution networks.

- High sugarcane productivity.

- Biodiesel:

- Growing demand for sustainable transportation fuels.

- Government mandates for biodiesel blending.

- Expansion of vegetable oil production.

The Southeast region of Brazil is the leading market due to its high population density, significant industrial activity, and established logistics networks.

Brazil Biofuel Market Product Developments

Significant product innovations are reshaping the Brazilian biofuel landscape. Recent advancements include the development of advanced biofuels, such as hydrotreated vegetable oil (HVO), showcasing improved performance characteristics and reduced emissions. The integration of innovative technologies like ICM's Selective Milling Technology (SMT), Base Tricanter System (BTS), and Fiber Separation Technology (FST) enhances efficiency and yield in ethanol production. These advancements are providing competitive advantages to producers, driving market growth, and increasing the overall sustainability of the biofuel industry.

Challenges in the Brazil Biofuel Market Market

The Brazilian biofuel market faces several challenges, including fluctuating feedstock prices, which impact production costs and profitability. Supply chain disruptions, particularly in the transportation and logistics sectors, can hinder efficient delivery to end-users. Regulatory hurdles and changes in government policies can create uncertainty and affect investment decisions. Competition from established fossil fuel producers poses a continuous challenge, requiring biofuel producers to maintain a competitive price point. These challenges contribute to a xx% reduction in projected market growth in the next 5 years.

Forces Driving Brazil Biofuel Market Growth

Several factors are driving the growth of the Brazilian biofuel market, including supportive government policies, such as mandates for biofuel blending in transportation fuels and incentives for production. Increasing environmental awareness is pushing the adoption of sustainable transportation alternatives. Technological advancements in biofuel production, leading to improved efficiency and cost-effectiveness, are contributing to market expansion. The rising global demand for renewable energy sources, particularly in the transportation sector, offers significant growth opportunities for the Brazilian biofuel industry.

Challenges in the Brazil Biofuel Market Market

Long-term growth hinges on continuous innovation in biofuel production technologies, leading to cost reductions and improved efficiency. Strategic partnerships between producers, distributors, and technology providers are crucial for scaling up production and market penetration. Expanding into new markets, both domestically and internationally, is vital to sustaining growth and mitigating the effects of regional market fluctuations. Investment in sustainable feedstock sourcing and responsible agricultural practices will ensure long-term viability.

Emerging Opportunities in Brazil Biofuel Market

The Brazilian biofuel market presents promising opportunities for growth. The rising demand for sustainable aviation fuels (SAFs) presents a significant new market segment for biofuel producers. Developing advanced biofuels, such as HVO, offers substantial potential due to their superior properties and reduced environmental impact. Expanding into niche markets, such as bio-based chemicals and materials, can diversify revenue streams. Exploring new feedstocks and improving feedstock utilization efficiency will further enhance the market’s growth potential.

Leading Players in the Brazil Biofuel Market Sector

- Abengoa Bioenergia Brasil SA

- BP Bunge Bioenergia SA

- Raizen SA

- Brasil Bio Fuels

- Atvos Agroindustrial Investimentos SA

- Humberg Agribrasil Comercio e Exportacao de Graos SA

Key Milestones in Brazil Biofuel Market Industry

- November 2021: Brasil Biofuels announces plans to build Brazil's first HVO plant.

- March 2022: ICM and Agribrasil sign an agreement to develop a new grain ethanol production facility, incorporating advanced technologies like SMT, BTS, and FST, signifying significant advancements in production efficiency and yield.

Strategic Outlook for Brazil Biofuel Market Market

The future of the Brazilian biofuel market is bright, with strong growth potential driven by increasing demand for renewable energy and sustainable transportation solutions. Strategic investments in research and development, coupled with strategic partnerships and market diversification, are vital for long-term success. The adoption of advanced biofuel technologies and sustainable agricultural practices will play a crucial role in the market's future growth trajectory. The market is poised for considerable expansion, benefiting from both domestic and international demand.

Brazil Biofuel Market Segmentation

-

1. Type

- 1.1. Biodiesel

- 1.2. Ethanol

- 1.3. Other Types

-

2. Feedstock (Qualitative Analysis Only)

- 2.1. Coarse Grain

- 2.2. Sugar Crop

- 2.3. Vegetable Oil

- 2.4. Other Feedstocks

Brazil Biofuel Market Segmentation By Geography

- 1. Brazil

Brazil Biofuel Market Regional Market Share

Geographic Coverage of Brazil Biofuel Market

Brazil Biofuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Uninterrupted and Reliable Power Supply and Heavy Deployment of DG (diesel generator) Set4.; Improvement in Technology of Diesel Generator

- 3.3. Market Restrains

- 3.3.1. 4.; The Growing Trend of Renewable Power Generation

- 3.4. Market Trends

- 3.4.1. Ethanol Likely to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Biofuel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Biodiesel

- 5.1.2. Ethanol

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Feedstock (Qualitative Analysis Only)

- 5.2.1. Coarse Grain

- 5.2.2. Sugar Crop

- 5.2.3. Vegetable Oil

- 5.2.4. Other Feedstocks

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Abengoa Bioenergia Brasil SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BP Bunge Bioenergia SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Raizen SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Brasil Bio Fuels

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Atvos Agroindustrial Investimentos SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Humberg Agribrasil Comercio e Exportacao de Graos SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Abengoa Bioenergia Brasil SA

List of Figures

- Figure 1: Brazil Biofuel Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Brazil Biofuel Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Biofuel Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Brazil Biofuel Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Brazil Biofuel Market Revenue undefined Forecast, by Feedstock (Qualitative Analysis Only) 2020 & 2033

- Table 4: Brazil Biofuel Market Volume Million Forecast, by Feedstock (Qualitative Analysis Only) 2020 & 2033

- Table 5: Brazil Biofuel Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Brazil Biofuel Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Brazil Biofuel Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Brazil Biofuel Market Volume Million Forecast, by Type 2020 & 2033

- Table 9: Brazil Biofuel Market Revenue undefined Forecast, by Feedstock (Qualitative Analysis Only) 2020 & 2033

- Table 10: Brazil Biofuel Market Volume Million Forecast, by Feedstock (Qualitative Analysis Only) 2020 & 2033

- Table 11: Brazil Biofuel Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Brazil Biofuel Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Biofuel Market?

The projected CAGR is approximately 8.44%.

2. Which companies are prominent players in the Brazil Biofuel Market?

Key companies in the market include Abengoa Bioenergia Brasil SA, BP Bunge Bioenergia SA, Raizen SA, Brasil Bio Fuels, Atvos Agroindustrial Investimentos SA, Humberg Agribrasil Comercio e Exportacao de Graos SA.

3. What are the main segments of the Brazil Biofuel Market?

The market segments include Type, Feedstock (Qualitative Analysis Only).

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Uninterrupted and Reliable Power Supply and Heavy Deployment of DG (diesel generator) Set4.; Improvement in Technology of Diesel Generator.

6. What are the notable trends driving market growth?

Ethanol Likely to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Growing Trend of Renewable Power Generation.

8. Can you provide examples of recent developments in the market?

In March 2022, ICM and Agribrasil signed an agreement to develop a greenfield dry-mill grain ethanol production facility in Mato Grosso, Brazil. The facility is expected to utilize ICM's process technologies, including patented Selective Milling Technology (SMT) for milling optimization, Base Tricanter System (BTS) for corn oil recovery, and patented Fiber Separation Technology (FST) for fiber removal before fermentation. These technologies are expected to allow Agribrasil to maximize its ethanol and corn oil production efficiently. The plant's design is also expected to feature a distributed control system (DCS), allowing operators to automate production levels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Biofuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Biofuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Biofuel Market?

To stay informed about further developments, trends, and reports in the Brazil Biofuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence