Key Insights

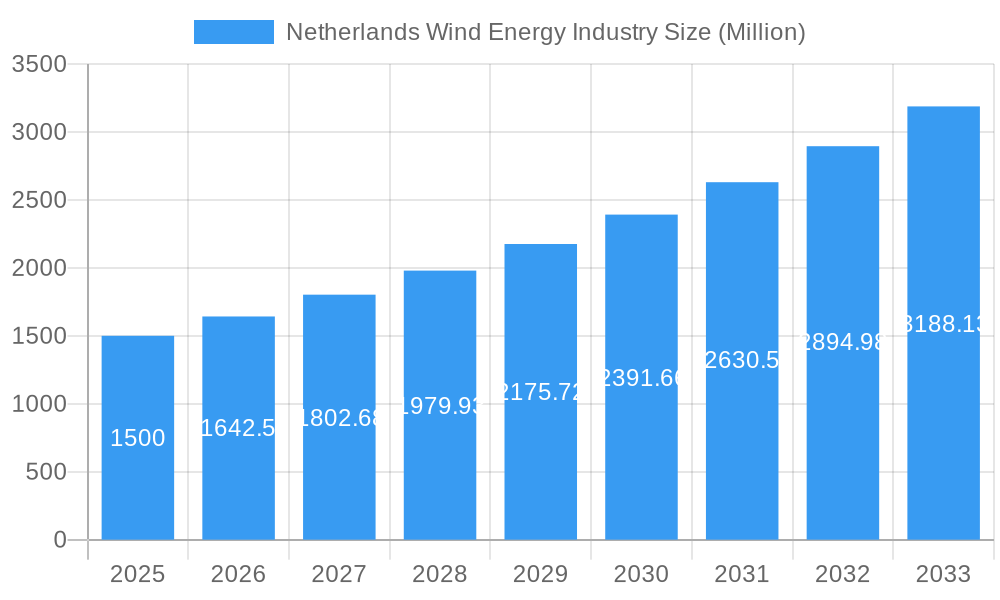

The Netherlands wind energy industry is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 9.5% from 2025 to 2033. This expansion is fueled by several key factors. The Netherlands' ambitious renewable energy targets, coupled with supportive government policies and substantial investments in offshore wind farm development, are primary drivers. Technological advancements, leading to increased efficiency and reduced costs of wind turbines, further contribute to the sector's growth. Furthermore, rising electricity demand and growing environmental awareness among consumers and businesses are creating a favorable market environment for wind energy. The onshore segment, while significant, is anticipated to experience comparatively slower growth compared to the offshore sector due to land constraints and permitting complexities. However, innovative approaches like floating offshore wind farms are expected to unlock new opportunities and significantly increase the industry's capacity.

Netherlands Wind Energy Industry Market Size (In Billion)

Despite the positive outlook, challenges remain. Grid infrastructure limitations, particularly in accommodating the influx of renewable energy from large-scale offshore projects, pose a significant restraint. Moreover, potential impacts on biodiversity and marine ecosystems from offshore wind farms necessitate careful environmental impact assessments and mitigation strategies. Nevertheless, the strong policy support, substantial private sector investment, and technological progress are expected to outweigh these challenges, ensuring the continued expansion of the Netherlands wind energy market throughout the forecast period. Key players like Vestas, Siemens Gamesa, and others are actively participating in this growth, driving innovation and competition within the sector. The Netherlands' strategic location and its commitment to renewable energy position it as a leader in European wind energy development.

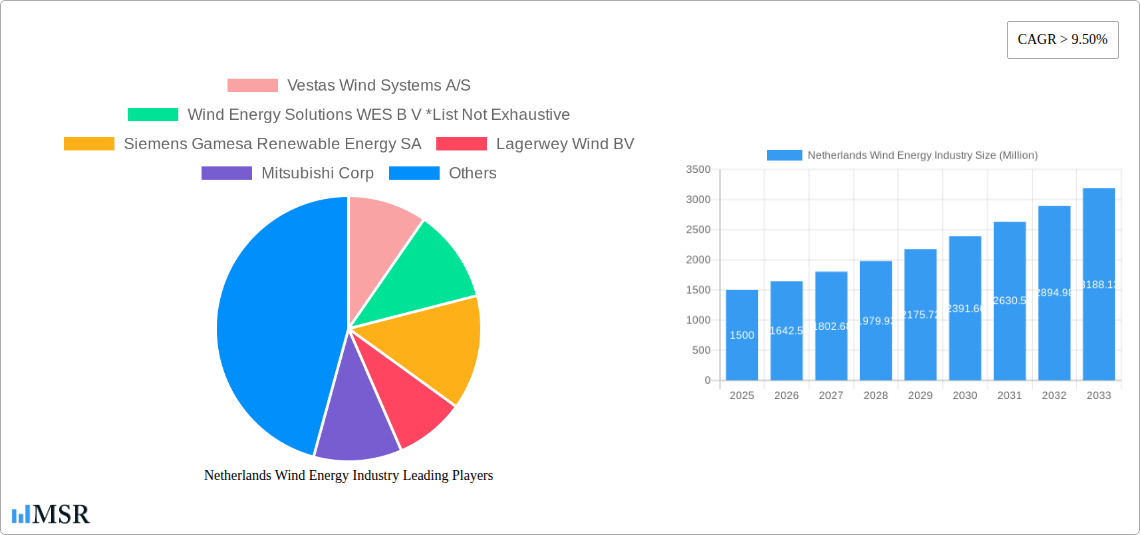

Netherlands Wind Energy Industry Company Market Share

Netherlands Wind Energy Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Netherlands wind energy industry, offering crucial insights for stakeholders across the value chain. From market concentration and dynamics to emerging opportunities and key players, this report covers all aspects of this rapidly evolving sector. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this study is an invaluable resource for strategic decision-making. The report meticulously details the onshore and offshore segments, analyzing key trends, challenges, and growth drivers impacting the multi-billion-euro market.

Netherlands Wind Energy Industry Market Concentration & Dynamics

The Netherlands wind energy market exhibits a moderately concentrated landscape, with several key players holding significant market share. While precise figures for individual market share are unavailable at this time (xx%), the industry is characterized by strong competition and a vibrant ecosystem of innovation. Key players such as Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy SA, and General Electric Company are major participants, alongside notable domestic firms like Lagerwey Wind BV. The regulatory framework, heavily influenced by EU directives and national policies promoting renewable energy, encourages both domestic and international investment. This leads to frequent M&A activity; an estimated xx M&A deals occurred between 2019 and 2024. Substitute products, such as solar power, exert some competitive pressure; however, the Netherlands' strong wind resources and supportive policies ensure the continued dominance of wind energy. End-user trends indicate a growing preference for renewable energy sources, driving demand and innovation in wind turbine technology.

- Market Concentration: Moderately concentrated (xx% market share for top 3 players).

- M&A Activity: xx deals between 2019 and 2024.

- Regulatory Framework: Supportive of renewable energy development.

- Substitute Products: Solar power represents a partial substitute.

- End-User Trends: Increasing preference for renewable energy.

Netherlands Wind Energy Industry Industry Insights & Trends

The Netherlands wind energy market has experienced significant growth over the past few years, with a total market size of €xx Billion in 2024. This is driven by substantial government investment in renewable energy, ambitious targets for renewable energy integration, and the increasing cost-competitiveness of wind power compared to fossil fuels. The market is projected to grow at a CAGR of xx% from 2025 to 2033, reaching a market size of €xx Billion by 2033. Technological disruptions, particularly in turbine design and energy storage, are further fueling growth. Consumer behavior also plays a role, with increased public awareness of climate change leading to greater acceptance of wind energy projects. Furthermore, the ongoing energy transition within the Netherlands and across the EU is a crucial driver, bolstering the country’s commitment to renewable energy.

Key Markets & Segments Leading Netherlands Wind Energy Industry

Both onshore and offshore wind power segments contribute significantly to the Netherlands' energy mix, but the offshore segment demonstrates greater potential for expansion. The North Sea's substantial wind resources and the government's substantial investments in offshore wind farm projects make it a dominant segment.

Offshore Wind Dominance Drivers:

- Abundant Offshore Wind Resources: The North Sea provides exceptional wind energy potential.

- Government Support & Subsidies: Generous financial incentives boost offshore development.

- Technological Advancements: Larger, more efficient offshore wind turbines are being deployed.

- Grid Infrastructure Development: Investments in grid infrastructure facilitate offshore energy integration.

Onshore Wind: While significant, onshore development faces greater spatial constraints. While new onshore projects are still being developed, limitations on available land constrain growth compared to the significant potential of offshore expansion. This contrasts with offshore development, where vast tracts of the North Sea can be utilized.

Netherlands Wind Energy Industry Product Developments

Significant advancements in turbine technology are transforming the Netherlands wind energy sector. Larger turbine capacities, improved efficiency, and enhanced durability are key features. The integration of smart grid technologies and digital monitoring systems optimizes energy production and reduces operational costs. This push towards innovation offers significant competitive advantages and enhances the sustainability of wind power generation.

Challenges in the Netherlands Wind Energy Industry Market

The Netherlands wind energy market faces challenges including regulatory complexities, particularly concerning permitting and grid connection processes. Supply chain disruptions, often impacting component availability and cost, and heightened competition from other renewable energy sources such as solar, represent further obstacles. These factors may impact the market’s growth trajectory, though the Netherlands’ commitment to renewable energy suggests that this impact may be marginal in the long term.

Forces Driving Netherlands Wind Energy Industry Growth

Technological advancements (larger, more efficient turbines), supportive government policies (incentives, targets), and substantial offshore wind potential all act as strong growth drivers. Additionally, the increasing cost-competitiveness of wind energy, coupled with rising energy prices, contributes to its adoption. The EU’s commitment to renewable energy sources further strengthens the sector's long-term prospects.

Challenges in the Netherlands Wind Energy Industry Market

Long-term growth hinges on overcoming challenges. Continued technological innovation, strategic partnerships (e.g., between developers, grid operators, and manufacturers), and the further expansion of offshore wind capacity are key. Successfully navigating regulatory complexities and ensuring a robust supply chain will be vital to maintain the strong growth trajectory.

Emerging Opportunities in Netherlands Wind Energy Industry

Opportunities include floating offshore wind technology, which can access deeper water resources, and the integration of wind power with energy storage systems. Further growth is anticipated through expanded offshore wind farm development and increased exploration of hybrid renewable energy projects. Furthermore, opportunities exist in optimizing existing wind farms through upgrades and the development of related services (maintenance, operations, etc.).

Leading Players in the Netherlands Wind Energy Industry Sector

- Vestas Wind Systems A/S (https://www.vestas.com/)

- Wind Energy Solutions WES B V

- Siemens Gamesa Renewable Energy SA (https://www.siemensgamesa.com/)

- Lagerwey Wind BV

- Mitsubishi Corp (https://www.mitsubishicorp.com/)

- RWE AG (https://www.rwe.com/)

- General Electric Company (https://www.ge.com/renewableenergy)

- Enercon GmbH (https://www.enercon.de/en/)

Key Milestones in Netherlands Wind Energy Industry Industry

- December 2021: GE Renewable Energy secures a contract to repower the Wind plan Groen project in Flevoland, installing 26 Cypress 6.0-164 turbines (156 MW). This showcases the growing importance of repowering existing facilities to enhance efficiency and capacity.

- May 2022: BP bids for two offshore wind leases (1.4 GW potential capacity) and development rights for Hollandse Kust (west) sites VI and VII, highlighting the increasing investor interest and the significant potential of the Dutch offshore wind market. This substantial investment underscores the growing confidence in the Dutch offshore wind sector.

Strategic Outlook for Netherlands Wind Energy Industry Market

The Netherlands wind energy market is poised for substantial growth driven by strong government support, technological innovation, and the country's advantageous geographic location. The strategic focus will be on expanding offshore wind capacity, deploying innovative technologies such as floating wind farms, and enhancing grid infrastructure to effectively integrate the growing influx of renewable energy. Continued investment and the resolution of current challenges will be crucial to realizing the full potential of the Dutch wind energy sector and sustaining its rapid growth trajectory throughout the forecast period.

Netherlands Wind Energy Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

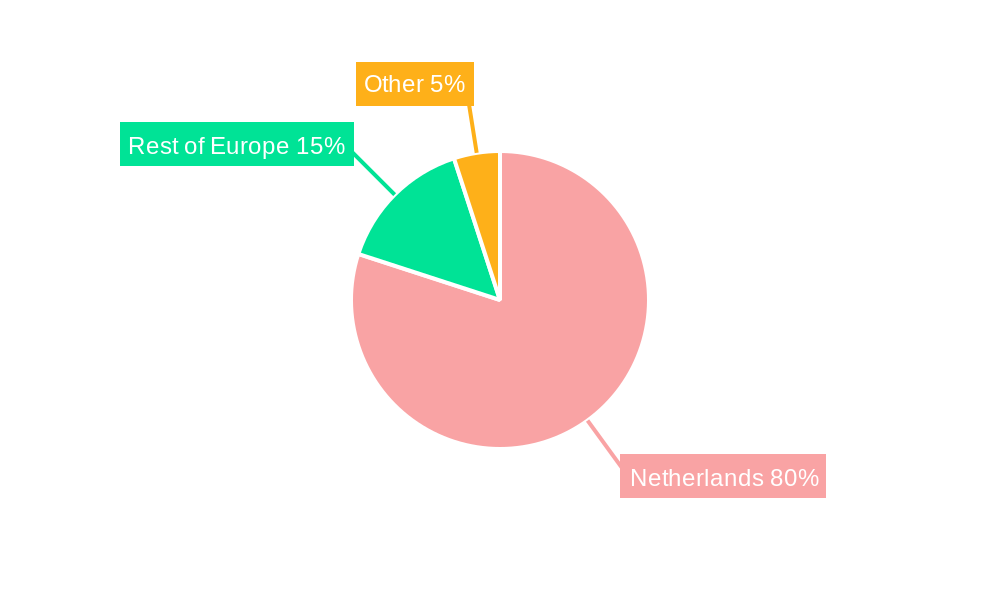

Netherlands Wind Energy Industry Segmentation By Geography

- 1. Netherlands

Netherlands Wind Energy Industry Regional Market Share

Geographic Coverage of Netherlands Wind Energy Industry

Netherlands Wind Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; High Power Demand due to the Growing Population4.; Upcoming Power Generation Projects

- 3.3. Market Restrains

- 3.3.1. 4.; The New Government's Intentions to Reduce Private Investments

- 3.4. Market Trends

- 3.4.1. Offshore Wind Energy is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Wind Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vestas Wind Systems A/S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wind Energy Solutions WES B V *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens Gamesa Renewable Energy SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lagerwey Wind BV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 RWE AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 General Electric Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Enercon GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Vestas Wind Systems A/S

List of Figures

- Figure 1: Netherlands Wind Energy Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Netherlands Wind Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Wind Energy Industry Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 2: Netherlands Wind Energy Industry Volume Gigawatt Forecast, by Location of Deployment 2020 & 2033

- Table 3: Netherlands Wind Energy Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Netherlands Wind Energy Industry Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 5: Netherlands Wind Energy Industry Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 6: Netherlands Wind Energy Industry Volume Gigawatt Forecast, by Location of Deployment 2020 & 2033

- Table 7: Netherlands Wind Energy Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Netherlands Wind Energy Industry Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Wind Energy Industry?

The projected CAGR is approximately > 9.50%.

2. Which companies are prominent players in the Netherlands Wind Energy Industry?

Key companies in the market include Vestas Wind Systems A/S, Wind Energy Solutions WES B V *List Not Exhaustive, Siemens Gamesa Renewable Energy SA, Lagerwey Wind BV, Mitsubishi Corp, RWE AG, General Electric Company, Enercon GmbH.

3. What are the main segments of the Netherlands Wind Energy Industry?

The market segments include Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; High Power Demand due to the Growing Population4.; Upcoming Power Generation Projects.

6. What are the notable trends driving market growth?

Offshore Wind Energy is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; The New Government's Intentions to Reduce Private Investments.

8. Can you provide examples of recent developments in the market?

In May 2022, BP submitted a bid for two offshore wind leases in the Netherlands with a potential generating capacity of 1.4 GW. In addition, BP has submitted a request for the development rights for Hollandse Kust (west) Wind Farm Zone (HKW) sites VI and VII. In addition to being located 53 kilometers from the country's west coast, HKW contains two wind farms totaling 176 square kilometers in area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Wind Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Wind Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Wind Energy Industry?

To stay informed about further developments, trends, and reports in the Netherlands Wind Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence