Key Insights

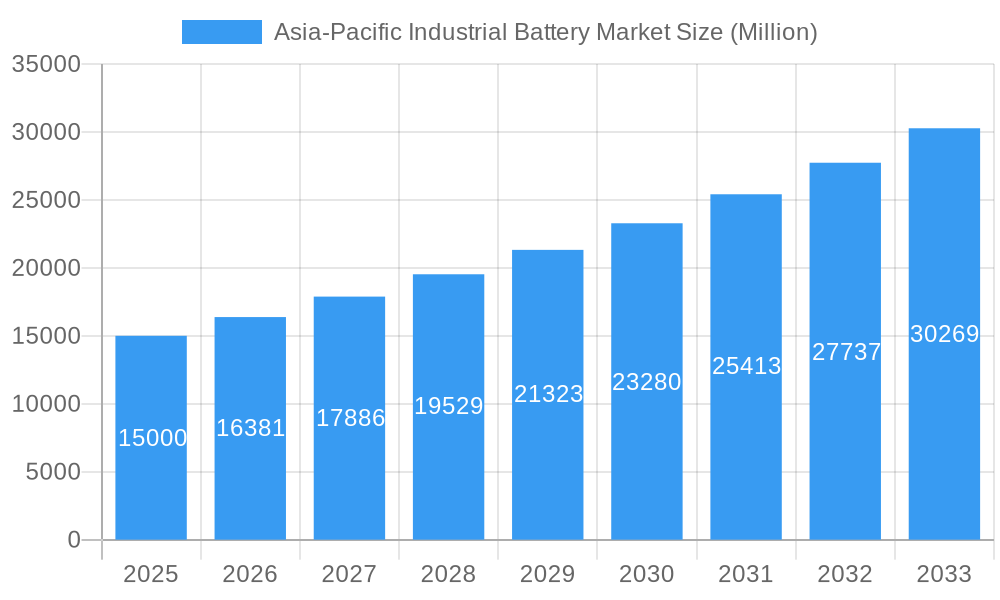

The Asia-Pacific industrial battery market is poised for robust expansion, projected to surpass a valuation of $XX billion by 2033, fueled by a compound annual growth rate (CAGR) exceeding 9.21%. This significant growth trajectory is underpinned by a confluence of escalating industrialization across the region, the rapid adoption of electric mobility solutions, and the increasing demand for reliable backup power in critical sectors like telecommunications and data centers. Lithium-ion batteries are anticipated to dominate the market landscape due to their superior energy density, longer lifespan, and faster charging capabilities, making them the preferred choice for applications ranging from forklifts to electric vehicles. However, lead-acid batteries will continue to hold a substantial market share, particularly in cost-sensitive applications and existing infrastructure, owing to their established reliability and lower initial investment. Emerging technologies in battery chemistry and advanced manufacturing processes are also set to influence market dynamics, driving innovation and offering enhanced performance characteristics.

Asia-Pacific Industrial Battery Market Market Size (In Billion)

Key market drivers include the burgeoning manufacturing sector, particularly in China and India, which necessitates substantial power storage solutions for operational efficiency and grid stability. The widespread deployment of 5G networks and the exponential growth of cloud computing are creating an insatiable demand for uninterrupted power supply, thereby boosting the UPS segment. Furthermore, the push towards decarbonization and the increasing integration of renewable energy sources are driving the need for industrial batteries for energy storage. While the market presents immense opportunities, certain restraints, such as fluctuating raw material prices (especially for lithium and cobalt), stringent environmental regulations regarding battery disposal, and the initial high cost of advanced battery technologies, could temper growth. Nevertheless, continuous technological advancements, economies of scale, and supportive government policies are expected to mitigate these challenges, paving the way for sustained market expansion.

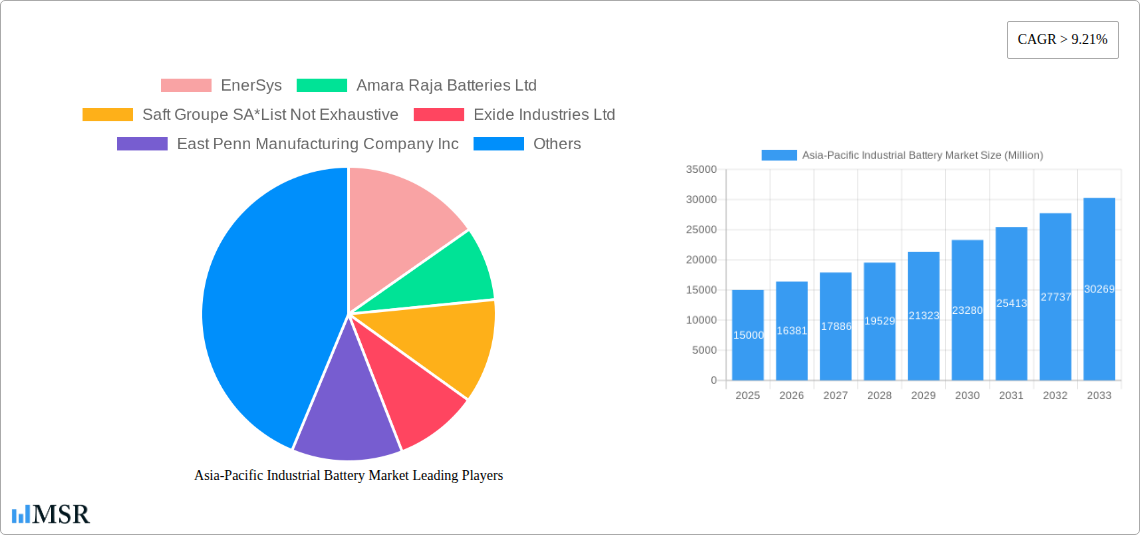

Asia-Pacific Industrial Battery Market Company Market Share

Gain actionable insights into the dynamic Asia-Pacific industrial battery market. This in-depth report provides a data-driven analysis of market size, growth drivers, technological advancements, and competitive landscapes, empowering stakeholders to navigate this rapidly expanding sector. Essential for investors, manufacturers, and policymakers seeking to capitalize on the region's burgeoning demand for reliable energy storage solutions.

Asia-Pacific Industrial Battery Market Market Concentration & Dynamics

The Asia-Pacific industrial battery market is characterized by a moderate to high concentration, with a few key players dominating significant market share. Innovation ecosystems are flourishing, driven by substantial investments in research and development, particularly in advanced battery chemistries like Lithium-ion. Regulatory frameworks are evolving across the region, with governments increasingly implementing policies to support renewable energy integration and emissions reduction, thereby bolstering the industrial battery sector. The threat of substitute products, while present, is mitigated by the specific performance requirements of industrial applications. End-user trends indicate a strong preference for higher energy density, longer lifespan, and enhanced safety features, pushing manufacturers towards continuous product improvement. Merger and acquisition (M&A) activities are on the rise as established companies seek to expand their technological capabilities, geographic reach, and market penetration. The recent surge in M&A deals highlights a consolidation trend, driven by the pursuit of economies of scale and strategic partnerships to address the growing demand.

- Market Share Dynamics: Key players hold substantial portions of the market, with a competitive landscape fostering innovation.

- M&A Deal Counts: Increasing M&A activities signal strategic consolidation and expansion efforts.

- Innovation Focus: Emphasis on R&D for Lithium-ion battery advancements and enhanced safety features.

- Regulatory Influence: Supportive government policies are a significant driver for market growth.

Asia-Pacific Industrial Battery Market Industry Insights & Trends

The Asia-Pacific industrial battery market is poised for substantial expansion, with an estimated market size of USD 25,500 Million in 2025, projected to reach USD 42,800 Million by 2033. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Several interconnected factors are fueling this upward trajectory. Foremost among these are the escalating demands from the telecom sector, driven by the relentless rollout of 5G infrastructure and the increasing need for reliable backup power solutions. Similarly, the UPS (Uninterruptible Power Supply) segment is experiencing significant growth, fueled by the digitization of industries, the proliferation of data centers, and the critical requirement for uninterrupted power to safeguard sensitive operations. The forklift application, a cornerstone of logistics and warehousing, is witnessing a transition towards electric models, propelled by environmental regulations and operational efficiency benefits, directly increasing demand for industrial batteries.

Technological disruptions are a pivotal force. The rapid advancement and cost reduction of Lithium-ion battery technology, particularly LFP (Lithium Iron Phosphate) and NMC (Nickel Manganese Cobalt) chemistries, are making them increasingly competitive against traditional Lead-acid batteries in various industrial applications. While Lead-acid batteries continue to hold a significant share due to their cost-effectiveness and established reliability, the superior energy density, longer cycle life, and faster charging capabilities of Lithium-ion solutions are driving their adoption. Beyond these dominant technologies, the "Other" category encompassing emerging chemistries like solid-state batteries, while nascent, holds significant long-term potential. Evolving consumer behaviors and industry preferences are leaning towards sustainable, efficient, and high-performance energy storage. This includes a growing awareness of the environmental impact of battery production and disposal, leading to increased demand for batteries with better recyclability and extended lifespan. The shift towards electrification across various industrial sectors, from material handling to stationary energy storage, further amplifies the market's growth prospects.

Key Markets & Segments Leading Asia-Pacific Industrial Battery Market

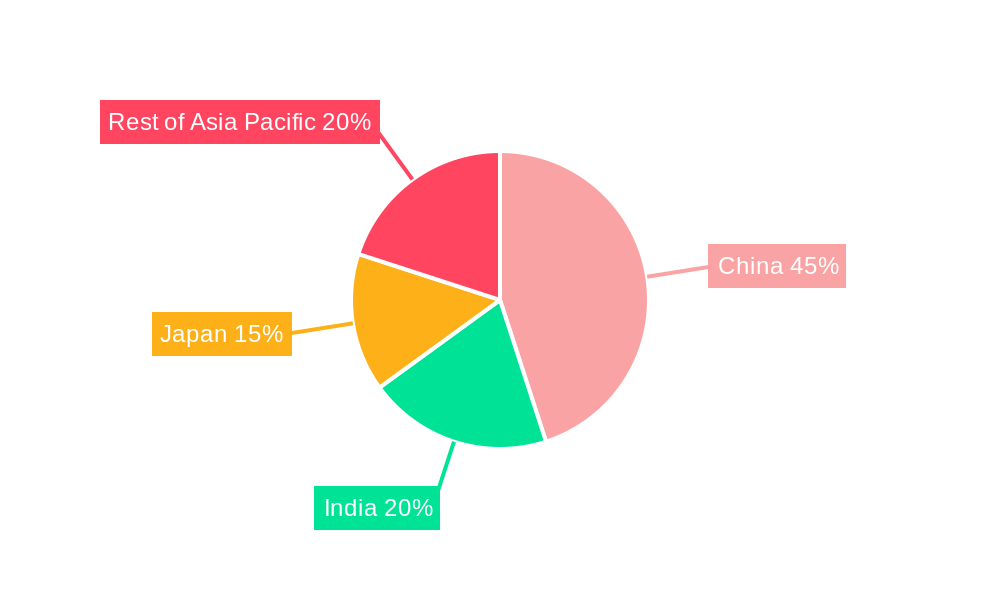

China stands as the undisputed leader in the Asia-Pacific industrial battery market, driven by its colossal manufacturing base, extensive industrial activities, and proactive government support for new energy technologies. The sheer scale of its industrial operations, encompassing manufacturing, logistics, and telecommunications, creates an insatiable demand for reliable and advanced battery solutions. Economic growth in China has consistently outpaced other nations in the region, leading to increased investment in infrastructure and industrial modernization, both of which are heavily reliant on industrial batteries.

Within the technology segment, Lithium-ion Battery technology is rapidly gaining dominance. The drivers for this ascendancy are manifold:

- Superior Performance Metrics: Higher energy density, longer cycle life, and faster charging capabilities offer significant advantages over Lead-acid batteries in demanding industrial applications.

- Cost Reduction: Continuous innovation and economies of scale in manufacturing have led to a significant decrease in the per-unit cost of Lithium-ion batteries, making them increasingly accessible.

- Government Subsidies and Policies: Favorable government incentives and regulations aimed at promoting electric vehicles and renewable energy storage have accelerated Lithium-ion adoption.

- Technological Advancements: Ongoing research into new cathode materials and battery management systems further enhances the performance and safety of Lithium-ion batteries.

In terms of applications, the Telecom sector is a major growth engine. The rapid expansion of 5G networks across Asia-Pacific necessitates robust and reliable backup power, driving significant demand for industrial batteries to ensure uninterrupted service. This is closely followed by the UPS segment, crucial for data centers, industrial automation, and critical infrastructure. The increasing reliance on digital technologies and the growing volume of data generated necessitate uninterrupted power supply, making UPS systems and their associated batteries indispensable.

Asia-Pacific Industrial Battery Market Product Developments

Continuous product innovation is a defining characteristic of the Asia-Pacific industrial battery market. Manufacturers are focused on enhancing energy density, improving cycle life, and ensuring robust safety features across all battery chemistries. Developments in Lithium-ion battery technology, such as the refinement of LFP and NMC chemistries, are yielding batteries with greater lifespan and faster charging capabilities, crucial for high-throughput industrial applications like forklifts. Furthermore, the integration of advanced Battery Management Systems (BMS) is improving performance monitoring, safety, and overall efficiency. Research into next-generation battery technologies, including solid-state batteries, is also gaining momentum, promising even higher energy densities and enhanced safety profiles for future industrial applications.

Challenges in the Asia-Pacific Industrial Battery Market Market

Despite its robust growth, the Asia-Pacific industrial battery market faces several critical challenges. Supply chain disruptions, particularly for raw materials like lithium and cobalt, can lead to price volatility and production delays, impacting market stability. Evolving and sometimes fragmented regulatory hurdles across different countries can create complexities for manufacturers and hinder cross-border trade. High initial capital costs for certain advanced battery technologies, despite declining trends, can still be a barrier for smaller enterprises. Intense competitive pressures among numerous players necessitate continuous innovation and cost optimization, putting pressure on profit margins.

Forces Driving Asia-Pacific Industrial Battery Market Growth

Several powerful forces are propelling the Asia-Pacific industrial battery market forward. The rapid industrialization and economic growth across the region are creating an unprecedented demand for energy storage solutions to power manufacturing, logistics, and infrastructure development. The accelerating adoption of electric vehicles (EVs), both for personal transportation and industrial fleets like forklifts, is a significant demand driver. Furthermore, government initiatives and policies aimed at promoting renewable energy integration and achieving carbon emission reduction targets are creating a favorable environment for industrial battery deployment as stationary energy storage solutions. The continuous technological advancements in battery chemistries, leading to improved performance and reduced costs, are making industrial batteries more attractive and accessible across various applications.

Challenges in the Asia-Pacific Industrial Battery Market Market

Long-term growth catalysts in the Asia-Pacific industrial battery market are intrinsically linked to sustained innovation and strategic market expansions. The ongoing shift towards electrification of transportation and industrial machinery will continue to be a primary growth engine. Further reductions in the cost of Lithium-ion battery production, driven by economies of scale and technological breakthroughs, will unlock new market segments. The increasing emphasis on grid modernization and renewable energy storage for grid stability and peak load management presents a massive long-term opportunity. Strategic partnerships and collaborations between battery manufacturers, technology providers, and end-users will foster ecosystem development and accelerate the adoption of advanced solutions.

Emerging Opportunities in Asia-Pacific Industrial Battery Market

Emerging opportunities in the Asia-Pacific industrial battery market are diverse and promising. The burgeoning e-commerce and logistics sector is driving demand for electric forklifts and warehouse automation, requiring high-performance industrial batteries. The increasing deployment of 5G infrastructure necessitates reliable backup power solutions for numerous base stations. Opportunities also lie in the stationary energy storage market, supporting renewable energy integration for industrial facilities and residential communities. Furthermore, the development of second-life battery applications, repurposing used EV batteries for less demanding industrial uses, presents a sustainable and cost-effective avenue. The growing focus on circular economy principles and battery recycling infrastructure will also create new business models and investment prospects.

Leading Players in the Asia-Pacific Industrial Battery Market Sector

- EnerSys

- Amara Raja Batteries Ltd

- Saft Groupe SA

- Exide Industries Ltd

- East Penn Manufacturing Company Inc

- GS Yuasa Corporation

- C&D Technologies Pvt Ltd

- Panasonic Corporation

Key Milestones in Asia-Pacific Industrial Battery Market Industry

- January 2022: China Lithium Battery Technology signed two contracts with two cities in the southern Chinese province of Guangdong to build new production facilities with an annual capacity of 50 GWh. The factories will be located in Guangzhou and Jiangmen, significantly boosting regional production capacity.

- January 2022: BYD and FAW announced plans for a production facility for electric car batteries with an annual capacity of 45 GWh in north-eastern China. The establishment of the joint venture, FAW FinDreams New Energy Technology, with BYD holding a 51% stake, underscores strategic alliances to expand battery manufacturing capabilities and cater to the growing EV market.

Strategic Outlook for Asia-Pacific Industrial Battery Market Market

The strategic outlook for the Asia-Pacific industrial battery market is exceptionally positive, driven by sustained demand from key sectors and ongoing technological advancements. Growth accelerators will include the continued electrification of industrial operations, particularly in logistics and manufacturing. The increasing integration of renewable energy sources will further boost the demand for industrial batteries as energy storage solutions for grid stability. Investments in research and development for next-generation battery technologies, such as solid-state batteries, will create a competitive edge for early adopters. Strategic partnerships and collaborations will be crucial for expanding market reach and addressing complex supply chain challenges. The market is poised for a period of robust growth, offering significant opportunities for innovation and expansion.

Asia-Pacific Industrial Battery Market Segmentation

-

1. Technology

- 1.1. Lithium-ion Battery

- 1.2. Lead-acid Battery

- 1.3. Other Te

-

2. Application

- 2.1. Forklift

- 2.2. Telecom

- 2.3. UPS

- 2.4. Others

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia-Pacific

Asia-Pacific Industrial Battery Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific Industrial Battery Market Regional Market Share

Geographic Coverage of Asia-Pacific Industrial Battery Market

Asia-Pacific Industrial Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Lithium-ion Battery Prices4.; Rising Renewable Energy Integration Worldwide

- 3.3. Market Restrains

- 3.3.1. 4.; Uncertainty in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery (LIB) Technology to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-acid Battery

- 5.1.3. Other Te

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Forklift

- 5.2.2. Telecom

- 5.2.3. UPS

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. China Asia-Pacific Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Lithium-ion Battery

- 6.1.2. Lead-acid Battery

- 6.1.3. Other Te

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Forklift

- 6.2.2. Telecom

- 6.2.3. UPS

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. India Asia-Pacific Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Lithium-ion Battery

- 7.1.2. Lead-acid Battery

- 7.1.3. Other Te

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Forklift

- 7.2.2. Telecom

- 7.2.3. UPS

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Japan Asia-Pacific Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Lithium-ion Battery

- 8.1.2. Lead-acid Battery

- 8.1.3. Other Te

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Forklift

- 8.2.2. Telecom

- 8.2.3. UPS

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of Asia Pacific Asia-Pacific Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Lithium-ion Battery

- 9.1.2. Lead-acid Battery

- 9.1.3. Other Te

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Forklift

- 9.2.2. Telecom

- 9.2.3. UPS

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 EnerSys

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Amara Raja Batteries Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Saft Groupe SA*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Exide Industries Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 East Penn Manufacturing Company Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 GS Yuasa Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 C&D Technologies Pvt Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Panasonic Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 EnerSys

List of Figures

- Figure 1: Asia-Pacific Industrial Battery Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Industrial Battery Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 10: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 11: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 18: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 19: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 26: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 27: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 34: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 35: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 37: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Industrial Battery Market?

The projected CAGR is approximately 16.33%.

2. Which companies are prominent players in the Asia-Pacific Industrial Battery Market?

Key companies in the market include EnerSys, Amara Raja Batteries Ltd, Saft Groupe SA*List Not Exhaustive, Exide Industries Ltd, East Penn Manufacturing Company Inc, GS Yuasa Corporation, C&D Technologies Pvt Ltd, Panasonic Corporation.

3. What are the main segments of the Asia-Pacific Industrial Battery Market?

The market segments include Technology, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Lithium-ion Battery Prices4.; Rising Renewable Energy Integration Worldwide.

6. What are the notable trends driving market growth?

Lithium-ion Battery (LIB) Technology to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; Uncertainty in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

January 2022: China Lithium Battery Technology signed two contracts with two cities in the southern Chinese province of Guangdong to build new production facilities with an annual capacity of 50 GWh. The factories will be located in Guangzhou and Jiangmen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Industrial Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Industrial Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Industrial Battery Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Industrial Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence