Key Insights

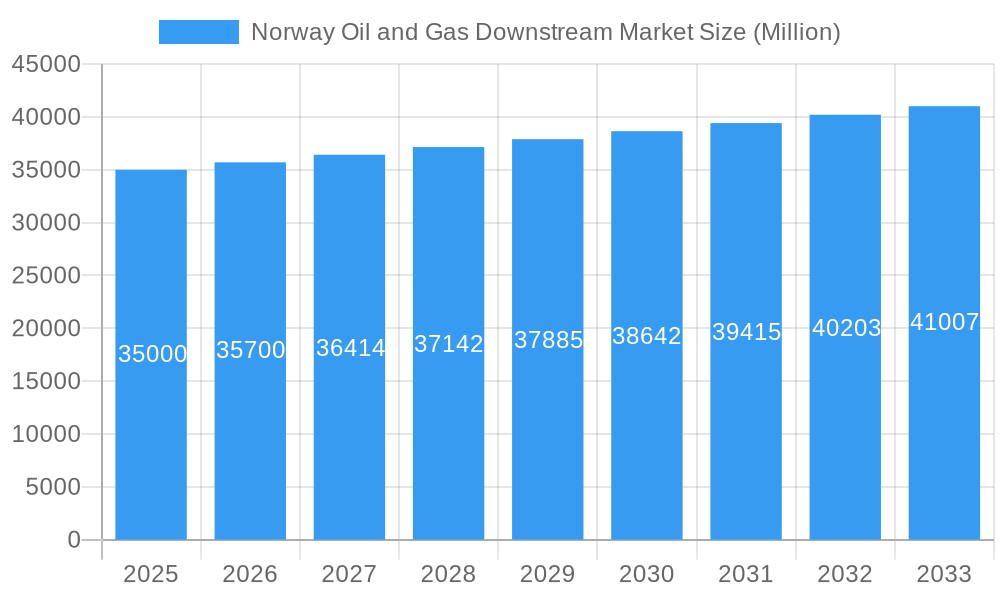

The Norway Oil and Gas Downstream Market is projected for robust expansion, with an anticipated market size of $25 billion by 2024. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 2% from 2024 to 2033. This sustained growth is driven by consistent demand for refined petroleum products and petrochemicals vital for the nation's industrial and energy sectors. Investments in modernizing refinery infrastructure and expanding petrochemical facilities are crucial for meeting evolving market needs and enhancing operational efficiency. The downstream sector, encompassing refineries and petrochemical plants, is fundamental to transforming crude oil and natural gas into essential products, supporting key Norwegian industries.

Norway Oil and Gas Downstream Market Market Size (In Billion)

While resilient, the market faces potential challenges, including increasingly stringent environmental regulations and the global transition to renewable energy, which could gradually affect long-term demand for fossil fuels. Nevertheless, the strategic significance of oil and gas to Norway's economy, alongside substantial investments from major players such as Equinor ASA, Wintershall Dea AG, Exxon Mobil Corporation, Aker BP AS, Lundin Energy Norway, Royal Dutch Shell PLC, and Total S.A., indicates a strong continuation of downstream activities. These companies are actively optimizing operations and exploring product diversification to adapt to the dynamic energy landscape. The Norwegian downstream sector is recognized for its advanced technological capabilities and commitment to sustainable industry practices.

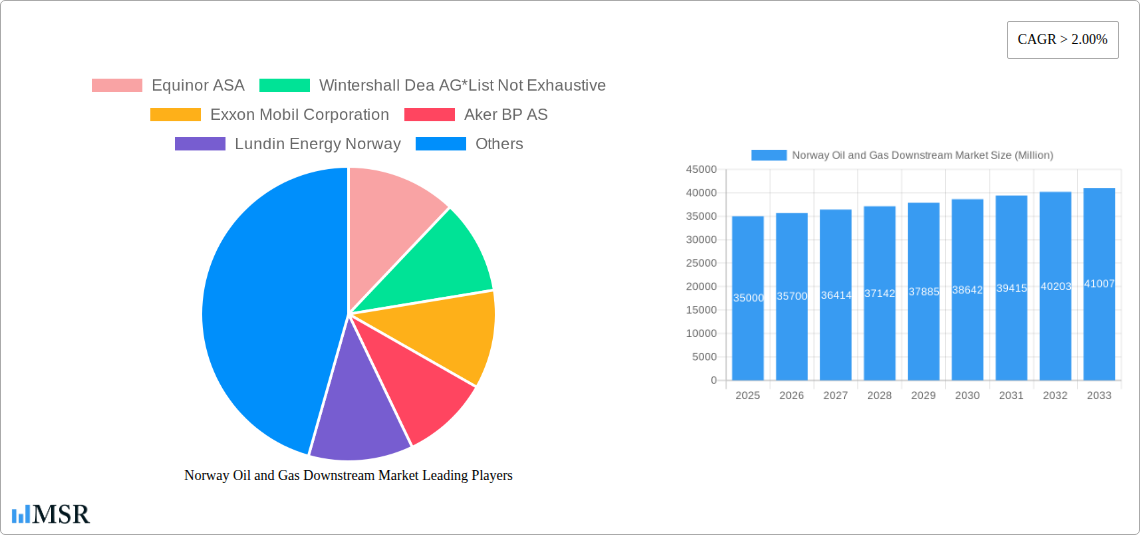

Norway Oil and Gas Downstream Market Company Market Share

Gain critical insights into the Norway oil and gas downstream market with our comprehensive report, detailing market dynamics, industry trends, key segments, and future outlook from 2024–2033. This report is an essential resource for oil and gas companies, refinery operators, petrochemical manufacturers, investors, and policymakers navigating the evolving Norwegian downstream sector.

Achieve a competitive advantage with data-driven analysis of Norway's refinery capacity, petrochemical production, and the impact of green technology initiatives. We provide an in-depth examination of the Norwegian energy sector, offering actionable intelligence on market concentration, innovation, regulatory frameworks, and M&A activities. With a base year of 2024 and a forecast period of 2024–2033, our analysis delivers robust projections for strategic planning.

This report offers unparalleled value through detailed analyses of market size, CAGR, and key growth drivers. Explore the pivotal role of refineries and petrochemical plants within the Norwegian market, and understand the technological advancements and evolving consumer behaviors shaping its future.

Norway Oil and Gas Downstream Market Market Concentration & Dynamics

The Norway oil and gas downstream market exhibits a moderate to high concentration, largely influenced by the significant presence of established integrated energy companies and specialized downstream operators. Innovation ecosystems are actively fostering advancements in green technology and operational efficiency. Regulatory frameworks, driven by national energy policies and environmental mandates, play a pivotal role in shaping market strategies, particularly concerning decarbonization efforts. The threat of substitute products, while nascent, is growing with the increasing adoption of alternative energy sources. End-user trends are shifting towards more sustainable fuel options and specialized petrochemical derivatives. Mergers and acquisitions (M&A) activities, though not at peak levels historically, are strategic, focusing on asset optimization and expansion into new technological frontiers. For instance, the Electra project signifies a significant investment towards electrifying vinyl chloride production, indicating a proactive approach to reducing the carbon footprint.

Norway Oil and Gas Downstream Market Industry Insights & Trends

The Norway oil and gas downstream market is a dynamic sector undergoing significant transformation, driven by global energy transitions and a strong national commitment to sustainable practices. The market size, estimated to be in the hundreds of billions of USD in its broader context, is characterized by a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Key growth drivers include the continued demand for refined petroleum products, albeit with a gradual shift towards cleaner alternatives, and the robust growth of the petrochemical sector, fueled by diverse industrial applications. Technological disruptions are at the forefront, with substantial investments in electrification of processes, carbon capture, utilization, and storage (CCUS), and the development of bio-based and recycled feedstock for petrochemical production. Evolving consumer behaviors are influencing the demand for more environmentally friendly products and fuels, compelling downstream players to innovate and adapt their offerings. The Mongstad complex fire in July 2022, while a temporary setback, highlights the critical importance of operational resilience and the ongoing need for modernizing refinery infrastructure to meet stringent safety and environmental standards. The push towards green hydrogen production and the integration of renewable energy sources into refining processes are also significant trends shaping the industry's future.

Key Markets & Segments Leading Norway Oil and Gas Downstream Market

The Norway oil and gas downstream market is primarily led by the Refineries segment, closely followed by Petrochemical Plants. These segments form the backbone of the nation's energy and industrial output, processing crude oil and natural gas into a wide array of essential products.

- Refineries: Dominant due to their foundational role in meeting both domestic and international demand for fuels such as gasoline, diesel, and jet fuel. Their strategic location and advanced processing capabilities ensure a consistent supply chain. Economic growth, both domestically and in key export markets, directly correlates with refinery throughput and profitability. Investments in upgrading existing facilities to handle lighter crudes or to produce cleaner fuels are crucial for maintaining competitiveness.

- Petrochemical Plants: Exhibit strong growth, driven by the increasing global demand for plastics, synthetic fibers, and other chemical derivatives. Norway's abundant natural gas resources provide a competitive feedstock advantage for many petrochemical operations. Infrastructure development and innovation in specialized chemical production are key drivers for this segment. The successful implementation of projects like INOVYN's "Electra" signifies a significant move towards sustainable petrochemical production, which is expected to further bolster its market leadership and attract further investment.

Norway Oil and Gas Downstream Market Product Developments

Norway's downstream sector is witnessing significant product development focused on enhancing sustainability and creating higher-value chemical intermediates. The "Electra" project at INOVYN's Rafnes site is a prime example, aiming to electrify vinyl chloride monomer production using renewable electricity, thereby drastically reducing the carbon footprint. This innovation not only positions Norway at the forefront of green petrochemical manufacturing but also offers a competitive edge by meeting growing market demand for sustainably produced chemicals. Such advancements are crucial for maintaining market relevance and attracting investment in an increasingly environmentally conscious global market.

Challenges in the Norway Oil and Gas Downstream Market Market

The Norway oil and gas downstream market faces several key challenges. Regulatory hurdles, particularly those related to stringent environmental standards and carbon pricing mechanisms, can increase operational costs and necessitate significant capital investment for compliance. Supply chain disruptions, amplified by global geopolitical events and logistical complexities, can impact feedstock availability and product distribution. Competitive pressures from international markets with potentially lower production costs and evolving demand for fossil fuels due to the energy transition also present formidable challenges, requiring continuous innovation and efficiency improvements.

Forces Driving Norway Oil and Gas Downstream Market Growth

Several forces are propelling the growth of the Norway oil and gas downstream market. Technological advancements in process optimization, such as the electrification of chemical production ("Electra" project), are enhancing efficiency and reducing environmental impact. Favorable economic conditions in key export markets continue to support demand for refined products and petrochemicals. Government initiatives promoting the development of a green industrial sector, coupled with strategic investments in renewable energy integration, are creating a more sustainable and competitive operational environment. The focus on producing higher-value specialized chemicals also presents a significant growth avenue.

Challenges in the Norway Oil and Gas Downstream Market Market

Long-term growth catalysts for the Norway oil and gas downstream market lie in strategic partnerships and market expansions focused on sustainability. The successful implementation and scaling of green technologies, such as those pioneered by INOVYN, are crucial. Furthermore, fostering innovation in the production of advanced materials and chemicals derived from sustainable feedstocks will open new market opportunities. Collaborations between research institutions, technology providers, and downstream operators will be vital to overcome existing technological and market barriers, ensuring the sector's continued relevance and profitability in a decarbonizing world.

Emerging Opportunities in Norway Oil and Gas Downstream Market

Emerging opportunities in the Norway oil and gas downstream market are primarily concentrated in the development and production of sustainable fuels and chemicals. The growing global demand for low-carbon alternatives presents a significant avenue for Norwegian companies. Investing in technologies for green hydrogen production, advanced biofuels, and circular economy solutions for plastics are key areas. Furthermore, leveraging Norway's expertise in offshore wind to power downstream operations and exploring carbon capture and storage (CCS) integration in petrochemical plants offer substantial growth potential. Shifting towards niche, high-value specialty chemicals catering to specific industrial needs also represents a promising frontier.

Leading Players in the Norway Oil and Gas Downstream Market Sector

- Equinor ASA

- Wintershall Dea AG

- Exxon Mobil Corporation

- Aker BP AS

- Lundin Energy Norway

- Royal Dutch Shell PLC

- Total S A

Key Milestones in Norway Oil and Gas Downstream Market Industry

- October 2022: INOVYN's petrochemical site in Rafnes, Norway, took a significant step towards developing and implementing green technology with its "Electra" project, aiming to electrify vinyl chloride production using renewable electricity. A decision by Enova on 23 August 2022 to support Electra with an investment of USD 1.41 Million (subject to INEOS proceeding) underscores commitment to sustainable practices.

- July 2022: A fire at Norway's sole oil refinery, the Mongstad complex in Vestland, led to the temporary offline status of the affected section. While the main processing plant remained operational, this incident highlighted the importance of asset integrity and operational resilience in the downstream sector.

Strategic Outlook for Norway Oil and Gas Downstream Market Market

The strategic outlook for the Norway oil and gas downstream market is characterized by a strong emphasis on sustainability and innovation. Future market potential is high for companies that can successfully integrate green technology, such as the "Electra" project, into their operations. Strategic opportunities lie in expanding production of low-carbon fuels and advanced petrochemicals, capitalizing on Norway's commitment to a circular economy and renewable energy. Investments in electrification, carbon capture, and the development of bio-based feedstocks will be key growth accelerators, ensuring the sector's long-term viability and competitive advantage in the global energy transition.

Norway Oil and Gas Downstream Market Segmentation

-

1. Process Type

- 1.1. Refineries

- 1.2. Petrochemical Plants

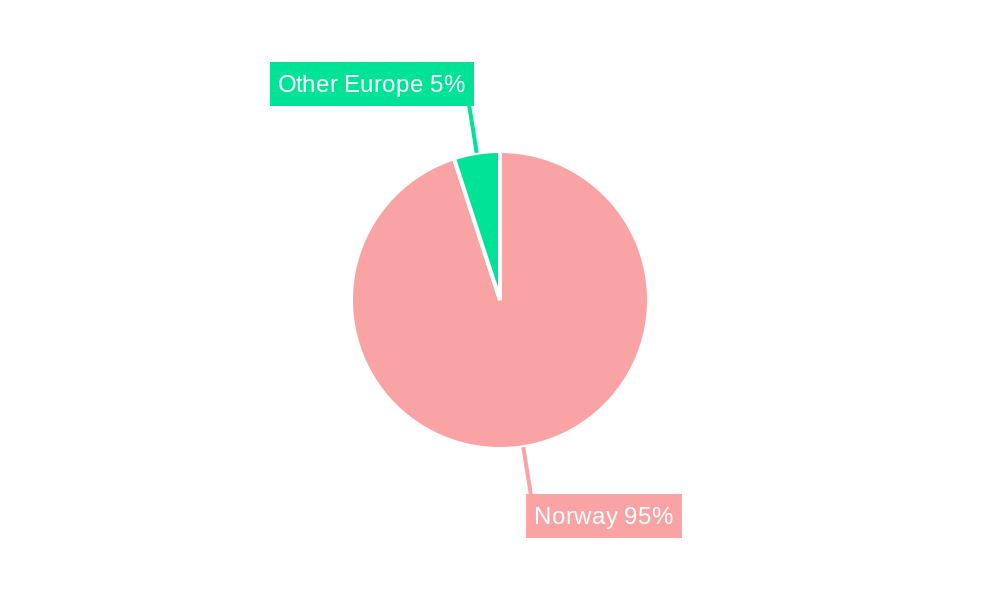

Norway Oil and Gas Downstream Market Segmentation By Geography

- 1. Norway

Norway Oil and Gas Downstream Market Regional Market Share

Geographic Coverage of Norway Oil and Gas Downstream Market

Norway Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems

- 3.3. Market Restrains

- 3.3.1. 4.; The global shift toward renewable sources for electricity generation

- 3.4. Market Trends

- 3.4.1. Refining Capacity to Remain Stagnant

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Oil and Gas Downstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Refineries

- 5.1.2. Petrochemical Plants

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Equinor ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wintershall Dea AG*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aker BP AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lundin Energy Norway

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Dutch Shell PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Total S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Equinor ASA

List of Figures

- Figure 1: Norway Oil and Gas Downstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Norway Oil and Gas Downstream Market Share (%) by Company 2025

List of Tables

- Table 1: Norway Oil and Gas Downstream Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 2: Norway Oil and Gas Downstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Norway Oil and Gas Downstream Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 4: Norway Oil and Gas Downstream Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Oil and Gas Downstream Market?

The projected CAGR is approximately 2%.

2. Which companies are prominent players in the Norway Oil and Gas Downstream Market?

Key companies in the market include Equinor ASA, Wintershall Dea AG*List Not Exhaustive, Exxon Mobil Corporation, Aker BP AS, Lundin Energy Norway, Royal Dutch Shell PLC, Total S A.

3. What are the main segments of the Norway Oil and Gas Downstream Market?

The market segments include Process Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 25 billion as of 2022.

5. What are some drivers contributing to market growth?

; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems.

6. What are the notable trends driving market growth?

Refining Capacity to Remain Stagnant.

7. Are there any restraints impacting market growth?

4.; The global shift toward renewable sources for electricity generation.

8. Can you provide examples of recent developments in the market?

October 2022: INOVYN's petrochemical site in Rafnes, Norway, takes the next step in developing and implementing green technology. As a subsidiary of INEOS, INOVYN will develop and install a new world-leading technology to electrify the production of vinyl chloride on the Rafnes site, replacing fossil fuel with renewable electricity. The project is called "Electra." A decision was made on 23 August 2022 by Enova to support Electra with an investment of USD 1.41 Million, subject to the decision by INEOS to proceed with the project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Norway Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence