Key Insights

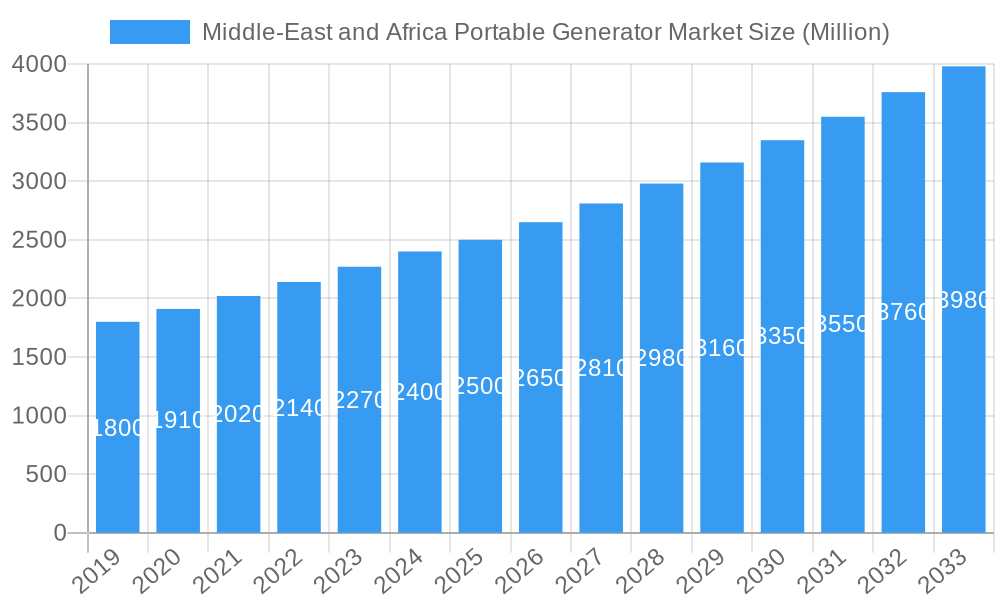

The Middle East and Africa (MEA) portable generator market is projected for significant expansion, expected to reach USD 5.11 billion by 2025, growing at a Compound Annual Growth Rate (CAGR) of 6%. This growth is propelled by increasing demand for reliable power in regions with unstable grids, expansion in the construction and infrastructure sectors, and rising adoption for residential and commercial backup. Industrial applications, especially in remote areas, and demand for outdoor/recreational use also contribute to market growth.

Middle-East and Africa Portable Generator Market Market Size (In Billion)

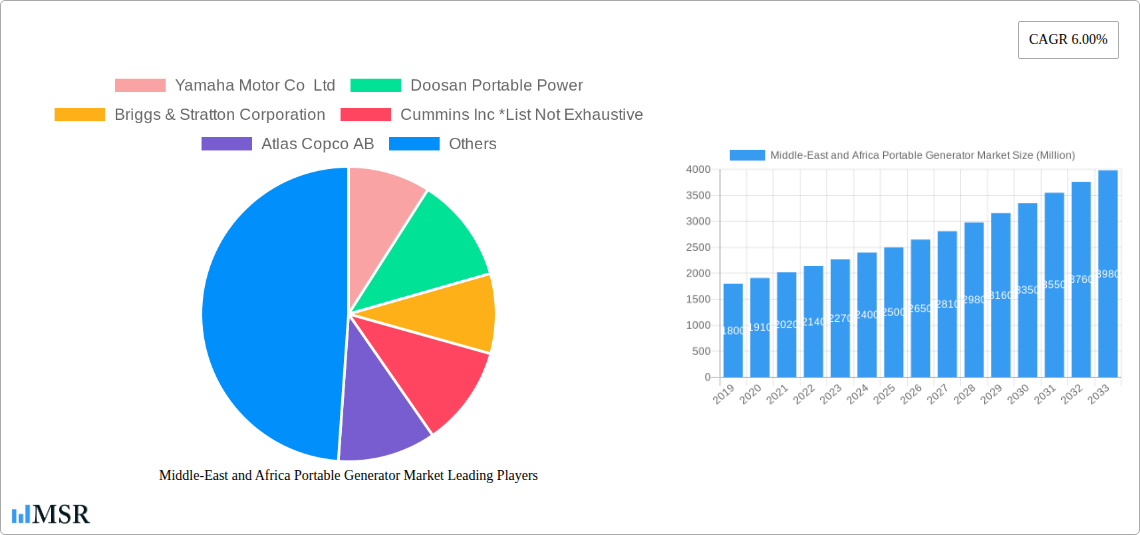

The competitive landscape features key players including Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Yamaha Motor Co. Ltd., and Briggs & Stratton Corporation. Gasoline and diesel generators currently lead in market share due to established infrastructure, though interest in alternative fuels like propane and hybrid solutions is increasing due to environmental and cost factors. Saudi Arabia and the UAE represent mature markets, while South Africa and Nigeria show rapid growth driven by infrastructure needs. Restraints like initial cost and renewable energy penetration are being countered by technological advancements and efficiency improvements.

Middle-East and Africa Portable Generator Market Company Market Share

This report provides a comprehensive analysis of the Middle East and Africa portable generator market, covering the historical period (2019-2024) and projecting to 2033, with 2025 serving as the base and estimated year. It offers critical insights for industry stakeholders, analyzing key fuel types (Gas, Diesel, Other) and applications (Residential, Commercial, Industrial) across major regions including Saudi Arabia, United Arab Emirates, South Africa, Nigeria, and the Rest of Middle East & Africa. The study details market concentration, innovations, regulatory factors, evolving end-user demands, and M&A activities. It highlights market growth drivers, technological advancements, and consumer behavior shifts, supported by market size estimates and CAGR forecasts. Leading markets and segments, economic growth, infrastructure development, and product innovations are examined, alongside challenges, growth drivers, and emerging opportunities in the portable generator industry. Key vendors featured include Yamaha Motor Co Ltd, Doosan Portable Power, Briggs & Stratton Corporation, Cummins Inc, Atlas Copco AB, Eaton Corporation PLC, Caterpillar Inc, Kohler Power Systems, Wacker Neuson SE, and Generac Holdings Inc, providing a strategic outlook for the MEA portable generator market.

Middle-East and Africa Portable Generator Market Market Concentration & Dynamics

The Middle-East and Africa portable generator market exhibits moderate to high concentration, with a few key global manufacturers dominating a significant share of the market. This concentration is driven by the high capital investment required for manufacturing sophisticated portable generators and the established brand recognition of leading players. The innovation ecosystem is steadily developing, with a growing emphasis on fuel efficiency, noise reduction, and smart features. Regulatory frameworks, particularly concerning emissions and safety standards, are becoming more stringent across various MEA nations, influencing product development and market entry strategies. Substitute products, such as grid expansion and renewable energy solutions, pose a competitive threat, especially in areas with reliable electricity infrastructure. However, the persistent need for reliable backup power in regions prone to grid instability and the rapid growth of industries like construction and data centers continue to bolster demand for portable generators. Merger and acquisition (M&A) activities, while not exceptionally high in volume, are strategic, often aimed at expanding market reach, acquiring new technologies, or consolidating market positions. For instance, Atlas Copco AB has been active in strategic acquisitions to bolster its power solutions portfolio. The market share of the top five players is estimated to be over 60%. The M&A deal count over the historical period averaged at 2-3 significant transactions annually.

- Market Concentration: Dominated by a few key global manufacturers.

- Innovation Ecosystem: Growing focus on fuel efficiency, noise reduction, and smart features.

- Regulatory Frameworks: Increasing stringency in emission and safety standards across the region.

- Substitute Products: Grid expansion and renewable energy solutions offer alternatives.

- End-User Trends: Rising demand from construction, data centers, and residential sectors for reliable backup power.

- M&A Activities: Strategic acquisitions for market expansion and technological integration.

- Estimated market share of top 5 players: >60%

- Average annual M&A deal count (2019-2024): 2-3

Middle-East and Africa Portable Generator Market Industry Insights & Trends

The Middle-East and Africa portable generator market is poised for significant expansion, driven by a confluence of robust economic development, increasing infrastructure investments, and the persistent need for reliable power solutions. The overall market size for portable generators in the MEA region is projected to reach approximately USD 4,500 Million by 2025, with a Compound Annual Growth Rate (CAGR) of around 6.5% from 2025 to 2033. This growth is fueled by several key factors. Rapid urbanization and population growth in countries like Nigeria and the UAE are creating an insatiable demand for electricity, which often outstrips the capacity of existing grids. This power deficit necessitates the adoption of portable generators for both temporary and permanent backup power needs.

The burgeoning construction sector, particularly in the GCC countries with mega-projects such as NEOM and Red Sea in Saudi Arabia, and various urban development initiatives in the UAE, is a major demand driver. These projects require substantial on-site power for machinery, lighting, and temporary facilities. Furthermore, the industrial sector, encompassing manufacturing, oil and gas, and mining, relies heavily on uninterrupted power supply to maintain operational efficiency and prevent costly downtime. Portable generators offer a flexible and cost-effective solution for these industrial operations, especially in remote locations.

Technological disruptions are also shaping the market. The increasing adoption of inverter technology in portable generators is leading to quieter operation, improved fuel efficiency, and cleaner power output, making them more attractive for residential and commercial applications. The integration of smart features, such as remote monitoring and diagnostics, is enhancing user convenience and predictive maintenance capabilities. Moreover, a growing awareness of sustainability is pushing manufacturers to develop more fuel-efficient models and explore alternative fuel options, although diesel and gasoline remain dominant for portable units due to their established infrastructure and power output.

Evolving consumer behaviors are also playing a role. In the residential segment, there is a growing demand for reliable backup power to mitigate the impact of frequent power outages, particularly in areas experiencing extreme weather conditions or with aging grid infrastructure. This trend is further accelerated by the increasing reliance on electronic devices and smart home technology. In the commercial sector, businesses are prioritizing business continuity, driving demand for portable generators that can provide immediate backup power to prevent financial losses due to power interruptions. The growing number of data centers across the region, requiring highly reliable and immediate backup power, is another significant growth catalyst. The trend towards decentralization of power generation, even for temporary needs, further solidifies the importance of portable generators in the MEA landscape.

- Market Size (Estimated Year 2025): ~ USD 4,500 Million

- CAGR (2025-2033): ~ 6.5%

- Key Growth Drivers:

- Rapid urbanization and population growth leading to power deficits.

- Booming construction sector with mega-projects in GCC.

- Industrial sector's reliance on uninterrupted power.

- Demand for business continuity in commercial applications.

- Increasing adoption of smart home technology and reliance on electronics in residential use.

- Growth of data center infrastructure requiring robust backup power.

- Technological Disruptions:

- Advancements in inverter technology for quieter, more fuel-efficient operation.

- Integration of smart features for remote monitoring and diagnostics.

- Focus on cleaner power output and emissions reduction.

- Evolving Consumer Behaviors:

- Prioritization of business continuity and disaster preparedness.

- Increased preference for convenience and user-friendly features.

- Growing demand for reliable backup power in residential settings.

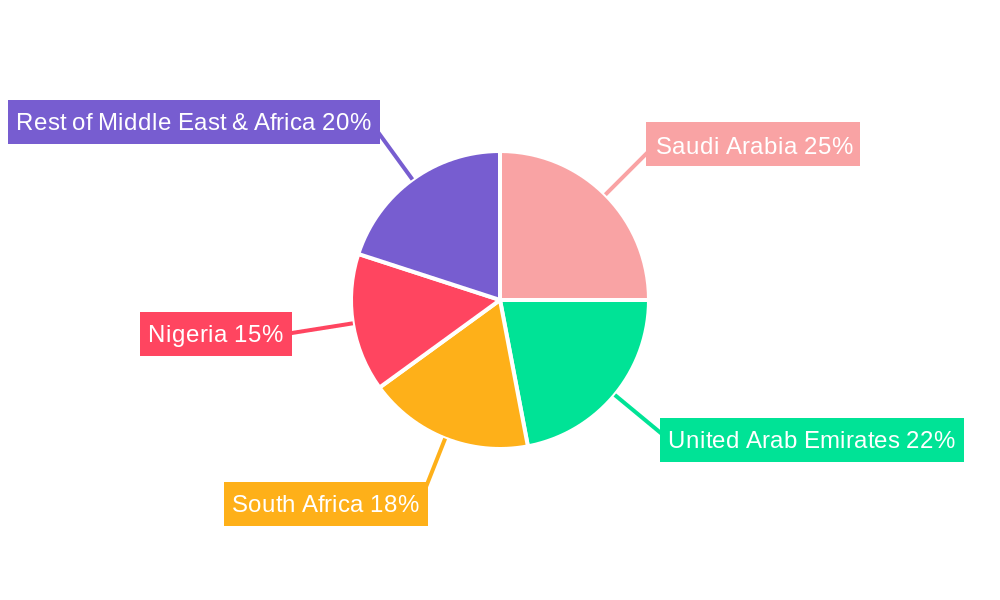

Key Markets & Segments Leading Middle-East and Africa Portable Generator Market

The Middle-East and Africa portable generator market is characterized by distinct geographical and segment leadership, driven by unique economic, demographic, and infrastructural factors.

Dominant Geography:

- Saudi Arabia and the United Arab Emirates (UAE) stand out as the leading markets within the Middle East for portable generators. This dominance is directly attributed to their massive investments in infrastructure development, including mega-projects like NEOM, Red Sea, and AMAALA in Saudi Arabia, and extensive urban and commercial expansion in the UAE. The presence of a robust oil and gas sector, which often requires portable power solutions for exploration and maintenance in remote locations, further fuels demand. The high disposable income in these nations also supports the adoption of portable generators for residential backup power.

- South Africa emerges as a key market in the African continent, driven by its relatively developed industrial base and the ongoing challenges with grid reliability, often necessitating significant reliance on portable generators for both commercial and industrial applications.

- Nigeria, despite its lower per capita income compared to the GCC, represents a significant volume market due to its large population, rapid urbanization, and chronic power shortages across residential, commercial, and industrial sectors. The demand here is largely driven by the fundamental need for basic power access.

- The Rest of Middle East & Africa region, while fragmented, presents substantial untapped potential, with emerging economies and ongoing development projects gradually increasing the demand for portable power solutions.

Dominant Segments:

Fuel Type:

- Diesel generators currently hold the largest market share due to their higher power output, durability, and the widespread availability of diesel fuel across the region. They are favored for industrial and large-scale commercial applications where power demands are significant.

- Gas generators are witnessing a steady rise, especially in areas with established natural gas infrastructure, offering a cleaner and often more cost-effective alternative for continuous operations. Propane generators are also gaining traction for their portability and cleaner burn compared to gasoline.

- Other Fuel Types, including gasoline, remain significant, particularly for smaller residential and portable use cases due to their lower initial cost and widespread availability. However, their market share is expected to see slower growth compared to diesel and gas.

Application:

- The Commercial sector is a primary driver of the portable generator market. This includes a wide range of applications such as retail stores, offices, telecommunication towers, healthcare facilities, and hospitality businesses, all requiring reliable backup power to ensure uninterrupted operations and customer service. The demand for business continuity solutions is paramount here.

- The Industrial sector represents another significant segment, driven by the needs of manufacturing plants, construction sites, mining operations, and the oil and gas industry. These applications often require heavy-duty generators capable of supplying high power outputs for extended periods.

- The Residential sector is experiencing robust growth, particularly in regions with unreliable power grids. Homeowners are increasingly investing in portable generators for backup power during outages, ensuring the functionality of essential appliances and maintaining comfort. This segment is expected to see accelerated growth driven by urbanization and increased adoption of smart home devices.

Drivers of Dominance:

- Saudi Arabia & UAE:

- Massive infrastructure investments and mega-projects.

- Strong presence of oil and gas industry.

- High disposable incomes supporting premium product adoption.

- Government initiatives promoting economic diversification and development.

- South Africa:

- Established industrial base.

- Chronic grid unreliability necessitating backup power.

- Growing mining and construction activities.

- Nigeria:

- Large population and rapid urbanization.

- Significant power deficits across all sectors.

- Demand for basic power access for homes and small businesses.

- Diesel Generators:

- High power output and durability.

- Widespread fuel availability.

- Established use in industrial and commercial applications.

- Commercial Applications:

- Essential need for business continuity and preventing financial losses.

- Diverse range of businesses requiring reliable power.

- Industrial Applications:

- Critical need for uninterrupted power in manufacturing, mining, and energy sectors.

- Requirement for heavy-duty, high-capacity generators.

- Residential Applications:

- Increasing demand due to unreliable grids and extreme weather events.

- Growing adoption of smart home technology.

Middle-East and Africa Portable Generator Market Product Developments

The Middle-East and Africa portable generator market is witnessing a wave of product innovations aimed at enhancing efficiency, reducing environmental impact, and improving user experience. Manufacturers are increasingly focusing on developing quieter, more fuel-efficient models, particularly with the integration of advanced inverter technology. This technology delivers cleaner, more stable power suitable for sensitive electronics and significantly reduces noise pollution, a critical factor for residential and urban commercial applications. There's also a growing emphasis on portability and ruggedness, with lightweight designs and robust construction to withstand the harsh environmental conditions prevalent in many parts of the MEA region. Furthermore, connectivity and smart features, such as remote monitoring, diagnostic capabilities, and integration with smart grids or home energy management systems, are becoming more prevalent, offering users greater control and convenience. The development of multi-fuel capability and extended run-time features are also key areas of innovation, catering to the diverse energy needs and operational demands across the region.

Challenges in the Middle-East and Africa Portable Generator Market Market

The Middle-East and Africa portable generator market faces several significant challenges that can impede its growth trajectory. Regulatory hurdles, including varying import duties, complex certification processes, and evolving emissions standards across different countries, can create barriers to entry and increase operational costs for manufacturers and distributors. Supply chain disruptions, exacerbated by geopolitical instability, logistical complexities, and the reliance on imported components, can lead to extended lead times and price volatility. Intense competitive pressures from both established global players and emerging local manufacturers, coupled with price sensitivity in certain segments, can compress profit margins. Furthermore, limited access to financing for end-users in some developing economies can hinder adoption, especially for larger, more expensive units. Maintenance and after-sales service infrastructure are also underdeveloped in certain remote areas, impacting the long-term reliability and customer satisfaction.

- Regulatory Hurdles: Complex import duties and varied emission standards.

- Supply Chain Disruptions: Geopolitical instability and logistical challenges affecting component availability and delivery times.

- Competitive Pressures: Price wars and intense competition from global and local players.

- Financing Access: Limited availability of credit for end-users in some regions.

- After-Sales Service: Underdeveloped maintenance and support networks in remote areas.

Forces Driving Middle-East and Africa Portable Generator Market Growth

Several powerful forces are propelling the Middle-East and Africa portable generator market forward. The most significant driver is the increasing demand for reliable backup power stemming from chronic grid instability and power outages in many parts of the region. This is compounded by rapid infrastructure development and industrial expansion, particularly in countries like Saudi Arabia and the UAE, where large-scale construction projects and growing manufacturing sectors necessitate robust on-site power solutions. Furthermore, the escalating growth of the data center industry across the MEA region creates a critical need for uninterruptible power supply, a role portable generators are well-suited to fulfill. Economic diversification initiatives in oil-dependent economies are also leading to the growth of new industries, further fueling the demand for portable power. Finally, technological advancements leading to more fuel-efficient, quieter, and smarter generators are making these solutions more attractive and accessible to a wider range of consumers.

- Unreliable Grid Infrastructure: Frequent power outages drive demand for backup solutions.

- Infrastructure Development: Mega-projects and urban expansion require extensive on-site power.

- Industrial Growth: Manufacturing, oil & gas, and mining sectors need continuous power.

- Data Center Expansion: Critical need for uninterrupted power for data infrastructure.

- Technological Advancements: Improved efficiency, reduced noise, and smart features enhance adoption.

Challenges in the Middle-East and Africa Portable Generator Market Market

The long-term growth catalysts for the Middle-East and Africa portable generator market are deeply rooted in continuous innovation and strategic market penetration. The ongoing quest for more sustainable power solutions will drive the development and adoption of generators utilizing cleaner fuels and hybrid technologies. Partnerships and collaborations between international manufacturers and local distributors will be crucial for expanding reach into underserved markets and providing localized support. The increasing adoption of smart grid technologies will create opportunities for portable generators to integrate seamlessly into broader energy management systems, offering flexibility and resilience. Furthermore, the growing awareness of disaster preparedness and the need for business continuity will continue to underpin demand across residential, commercial, and industrial sectors. The ongoing infrastructure development in emerging economies within the region, particularly in Sub-Saharan Africa, presents a vast and largely untapped market for portable generators, serving as a significant long-term growth catalyst.

Emerging Opportunities in Middle-East and Africa Portable Generator Market

Emerging opportunities within the Middle-East and Africa portable generator market are diverse and promising. The rapid expansion of the renewable energy sector, particularly solar power, presents an opportunity for hybrid generator solutions that can complement intermittent renewable sources, offering reliable power during periods of low generation. The increasing adoption of electric vehicles (EVs) in the region, coupled with the need for charging infrastructure, could spur demand for portable generators capable of powering charging stations in remote or temporary locations. The growing tourism and hospitality sector, especially in regions like the UAE and parts of North Africa, creates demand for portable generators for event power and backup in resorts. Furthermore, the increasing focus on decentralized power generation and microgrids in remote or off-grid communities offers a significant market for scalable portable generator solutions. The adoption of advanced manufacturing techniques and 3D printing for generator components could also lead to cost reductions and quicker customization, unlocking new market segments.

- Hybrid Power Solutions: Integration with renewable energy sources like solar.

- EV Charging Infrastructure: Portable generators for temporary or remote charging stations.

- Event Power Solutions: Growing demand from the tourism and hospitality sectors.

- Decentralized Power & Microgrids: Serving off-grid communities and remote locations.

- Advanced Manufacturing: Cost reduction and customization through new technologies.

Leading Players in the Middle-East and Africa Portable Generator Market Sector

- Yamaha Motor Co Ltd

- Doosan Portable Power

- Briggs & Stratton Corporation

- Cummins Inc

- Atlas Copco AB

- Eaton Corporation PLC

- Caterpillar Inc

- Kohler Power Systems

- Wacker Neuson SE

- Generac Holdings Inc

Key Milestones in Middle-East and Africa Portable Generator Market Industry

- December 2021: Enrogen, a diesel generator firm, signed an agreement to supply 30 MW of diesel generators to a major Saudi Arabian data center, highlighting the growing demand from the digital infrastructure sector.

- December 2021: KiCE Construction signed an agreement with Al Falah Readymix in the United Arab Emirates to deliver 100 generators for ongoing mega-projects in Saudi Arabia, showcasing the significant role of portable generators in large-scale construction endeavors.

Strategic Outlook for Middle-East and Africa Portable Generator Market Market

The strategic outlook for the Middle-East and Africa portable generator market is one of sustained growth, driven by a combination of fundamental demand and evolving technological landscapes. Key growth accelerators will include the continued expansion of infrastructure, the increasing need for energy security amidst grid challenges, and the burgeoning data center and industrial sectors. Manufacturers and distributors who can offer innovative, fuel-efficient, and smart generator solutions tailored to the specific needs and environmental conditions of the MEA region will be well-positioned for success. Strategic partnerships with local players, investment in robust after-sales service networks, and a keen understanding of regional regulatory frameworks will be paramount. Furthermore, exploring opportunities in hybrid power solutions and catering to the growing demand for backup power in residential and commercial segments will be crucial for capturing future market potential. The region's dynamic economic development and ongoing diversification initiatives present a fertile ground for continued growth in the portable generator sector.

Middle-East and Africa Portable Generator Market Segmentation

-

1. Fuel Type

- 1.1. Gas

- 1.2. Diesel

- 1.3. Other Fuel Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. South Africa

- 3.4. Nigeria

- 3.5. Rest of Middle East & Africa

Middle-East and Africa Portable Generator Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Nigeria

- 5. Rest of Middle East

Middle-East and Africa Portable Generator Market Regional Market Share

Geographic Coverage of Middle-East and Africa Portable Generator Market

Middle-East and Africa Portable Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; The Increasing Demand for Uninterrupted and Reliable Power Supply4.; Increased Demand from the Commercial Sector

- 3.2.2 Including the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. 4.; The Growing Demand for Generators Based on Alternative Fuels

- 3.4. Market Trends

- 3.4.1. Diesel is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Gas

- 5.1.2. Diesel

- 5.1.3. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. South Africa

- 5.3.4. Nigeria

- 5.3.5. Rest of Middle East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Nigeria

- 5.4.5. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Saudi Arabia Middle-East and Africa Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Gas

- 6.1.2. Diesel

- 6.1.3. Other Fuel Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. South Africa

- 6.3.4. Nigeria

- 6.3.5. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. United Arab Emirates Middle-East and Africa Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Gas

- 7.1.2. Diesel

- 7.1.3. Other Fuel Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. South Africa

- 7.3.4. Nigeria

- 7.3.5. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. South Africa Middle-East and Africa Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Gas

- 8.1.2. Diesel

- 8.1.3. Other Fuel Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. South Africa

- 8.3.4. Nigeria

- 8.3.5. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Nigeria Middle-East and Africa Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. Gas

- 9.1.2. Diesel

- 9.1.3. Other Fuel Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. South Africa

- 9.3.4. Nigeria

- 9.3.5. Rest of Middle East & Africa

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. Rest of Middle East Middle-East and Africa Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10.1.1. Gas

- 10.1.2. Diesel

- 10.1.3. Other Fuel Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. United Arab Emirates

- 10.3.3. South Africa

- 10.3.4. Nigeria

- 10.3.5. Rest of Middle East & Africa

- 10.1. Market Analysis, Insights and Forecast - by Fuel Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Yamaha Motor Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Doosan Portable Power

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Briggs & Stratton Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cummins Inc *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Atlas Copco AB

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eaton Corporation PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Caterpillar Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kohler Power Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wacker Neuson SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Generac Holdings Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Yamaha Motor Co Ltd

List of Figures

- Figure 1: Middle-East and Africa Portable Generator Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Portable Generator Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 2: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 6: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 10: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 14: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 18: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 22: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Portable Generator Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Middle-East and Africa Portable Generator Market?

Key companies in the market include Yamaha Motor Co Ltd, Doosan Portable Power, Briggs & Stratton Corporation, Cummins Inc *List Not Exhaustive, Atlas Copco AB, Eaton Corporation PLC, Caterpillar Inc, Kohler Power Systems, Wacker Neuson SE, Generac Holdings Inc.

3. What are the main segments of the Middle-East and Africa Portable Generator Market?

The market segments include Fuel Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.11 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The Increasing Demand for Uninterrupted and Reliable Power Supply4.; Increased Demand from the Commercial Sector. Including the Healthcare Industry.

6. What are the notable trends driving market growth?

Diesel is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Growing Demand for Generators Based on Alternative Fuels.

8. Can you provide examples of recent developments in the market?

In December 2021, Enrogen, a diesel generator firm based out of York, United Kingdom, signed an agreement to supply 30 MW of diesel generators to a big Saudi Arabian data center. The 12 2.5-MVA generators will operate as backup power for a new data center being built in the northeast of Saudi Arabia by a global computing business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Portable Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Portable Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Portable Generator Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Portable Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence