Key Insights

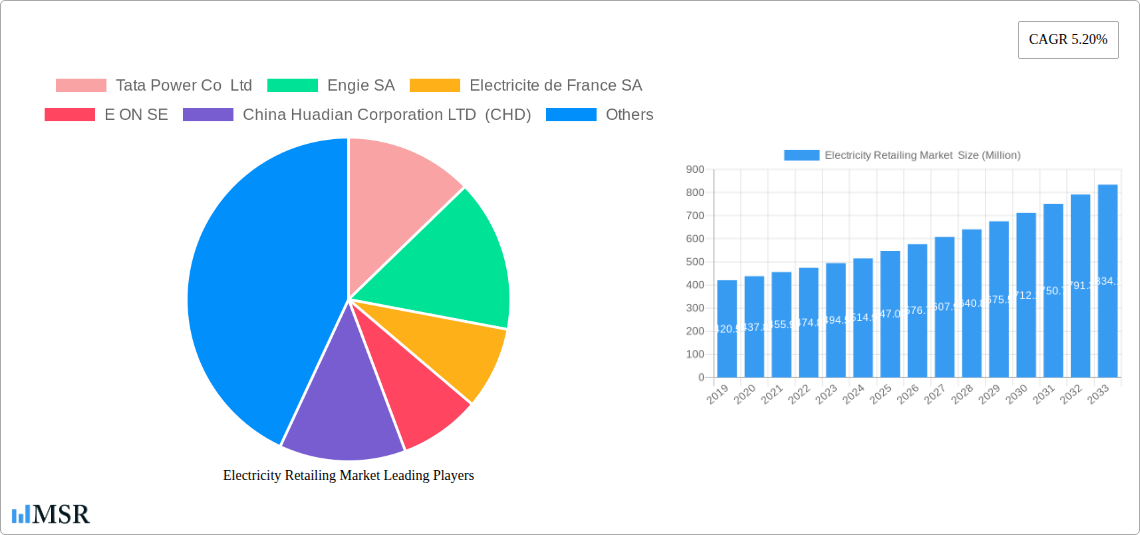

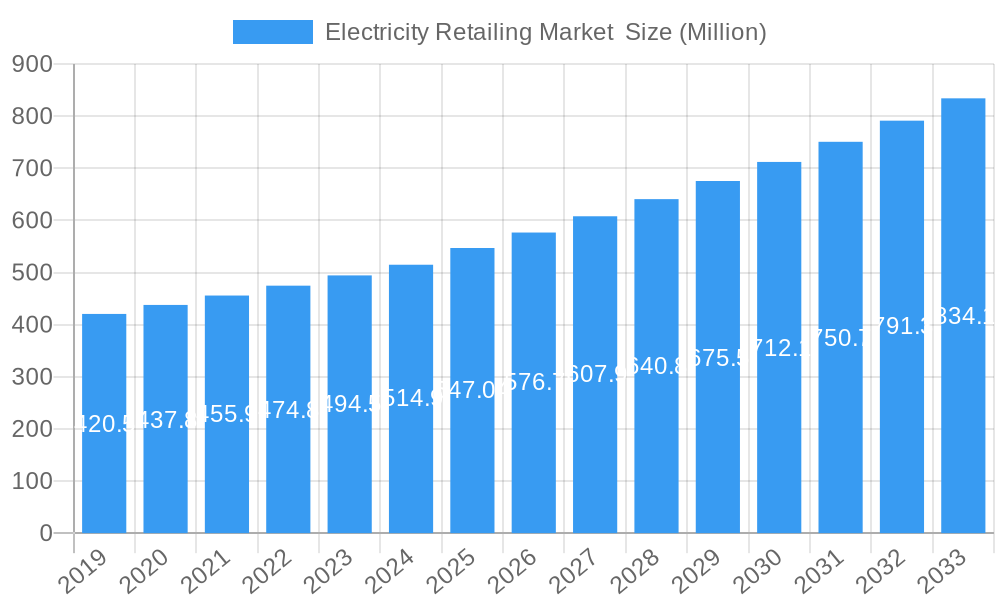

The global Electricity Retailing Market is poised for significant expansion, projected to reach approximately USD 547.04 million in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 5.20% through 2033. This upward trajectory is underpinned by several key drivers, including increasing demand for reliable and affordable electricity across residential, commercial, and industrial sectors, coupled with the ongoing liberalization of energy markets and the growing adoption of smart grid technologies. The integration of renewable energy sources into the grid, while presenting some transitional challenges, also fuels innovation in retail electricity offerings, encouraging providers to develop more flexible and customer-centric plans. Furthermore, government initiatives promoting energy efficiency and sustainability are creating a favorable environment for market growth. Key players like Tata Power, Engie, E.ON, and Duke Energy are actively investing in infrastructure, digital transformation, and the development of value-added services to capture market share in this dynamic landscape.

Electricity Retailing Market Market Size (In Million)

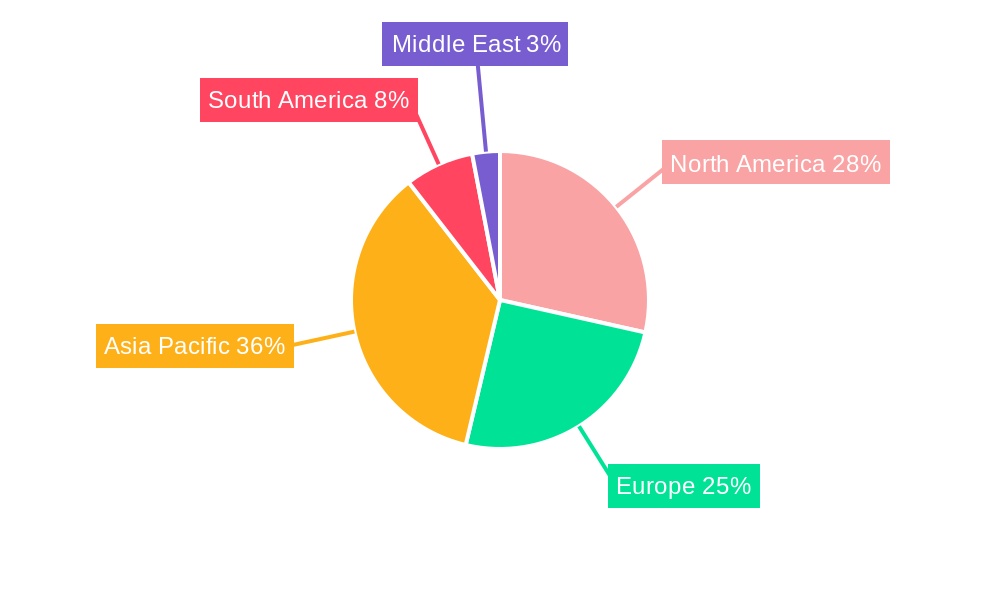

The market's segmentation into Residential, Commercial, and Industrial end-users highlights diverse consumption patterns and evolving needs. While the residential sector continues to be a primary demand driver, the commercial and industrial segments are witnessing increasing sophistication in their energy procurement strategies, often seeking tailored solutions to manage costs and environmental impact. Geographically, North America and Europe are mature markets with established regulatory frameworks and high adoption rates of advanced metering infrastructure. However, the Asia Pacific region, particularly China and India, presents immense growth potential due to rapid industrialization, urbanization, and expanding access to electricity. Emerging trends such as the rise of distributed generation, energy storage solutions, and the development of a more decentralized energy ecosystem are shaping the competitive landscape. While price volatility and regulatory uncertainties in certain regions may pose challenges, the overarching trend towards electrification, coupled with technological advancements, is expected to sustain a positive growth outlook for the Electricity Retailing Market.

Electricity Retailing Market Company Market Share

This comprehensive Electricity Retailing Market report delivers an in-depth analysis of the global electricity retail market, providing critical insights for stakeholders seeking to understand current dynamics and future trajectories. Covering a study period of 2019–2033, with a base year of 2025, this report offers actionable intelligence on market size, growth drivers, emerging trends, and competitive landscapes. We delve into the intricate details of electricity procurement, energy retail strategies, consumer electricity purchasing, and the evolving role of utility companies in the modern energy landscape.

Our analysis includes key industry developments, market concentration, and regulatory frameworks influencing electricity suppliers and energy providers. We meticulously examine end-user segments like residential electricity consumers, commercial energy users, and industrial energy consumption, identifying unique demands and opportunities within each. The report highlights product innovations, technological advancements, and sustainable energy solutions shaping the future of electricity sales.

With detailed projections for the forecast period (2025–2033) and historical data from 2019–2024, this report is an indispensable resource for energy marketers, renewable energy investors, and policy makers aiming to navigate the complexities of the global electricity market. Discover key strategies for customer engagement, demand-side management, and optimizing electricity distribution in an increasingly competitive and dynamic sector.

Electricity Retailing Market Market Concentration & Dynamics

The global electricity retailing market is characterized by a moderate level of concentration, with a mix of large, established utility giants and a growing number of agile, specialized energy retailers. Innovation ecosystems are rapidly evolving, driven by the integration of smart grid technologies, advanced metering infrastructure, and digital platforms that enhance customer engagement and operational efficiency. Regulatory frameworks play a pivotal role, with varying degrees of liberalization across regions influencing market entry, pricing mechanisms, and the promotion of competition. Substitute products, while nascent, include decentralized energy generation solutions and energy efficiency services that can reduce overall electricity consumption. End-user trends are increasingly focused on cost savings, green energy options, and personalized service offerings. Merger and acquisition (M&A) activities are a key indicator of market consolidation and strategic expansion. For instance, significant M&A deal counts have been observed in recent years as larger players seek to acquire innovative technologies or expand their customer base. Market share analysis reveals that established utilities still hold a dominant position in many regions, but independent retailers are steadily gaining traction by offering competitive tariffs and differentiated services.

Electricity Retailing Market Industry Insights & Trends

The electricity retailing market is experiencing robust growth, projected to reach a significant market size of approximately $6,500 Billion by 2025. This expansion is fueled by several interconnected factors, including increasing global electricity demand, the ongoing transition towards cleaner energy sources, and technological innovations that are reshaping how electricity is procured, distributed, and consumed. A key driver for market growth is the increasing adoption of smart grid technologies and digitalization, enabling more efficient energy management, remote monitoring, and personalized customer offerings. These advancements allow electricity retailers to optimize their operations, reduce costs, and provide enhanced services that cater to evolving consumer electricity purchasing behaviors.

Technological disruptions are at the forefront of this transformation. The proliferation of renewable energy sources such as solar and wind power, coupled with the development of energy storage solutions, is creating new business models for electricity retailing. Utility companies are increasingly offering bundled services that include renewable energy tariffs, electric vehicle charging solutions, and smart home energy management systems. This diversification is crucial for maintaining competitiveness in a market that is moving away from a one-size-fits-all approach.

Evolving consumer behaviors are also playing a critical role. Consumers are becoming more environmentally conscious and are actively seeking green electricity options and sustainable energy solutions. This demand for sustainable energy is prompting energy providers to invest more heavily in renewable energy procurement and to offer transparent reporting on the environmental impact of their energy offerings. Furthermore, the desire for greater control over energy consumption and costs is driving interest in demand-side management programs and time-of-use pricing. The residential electricity consumer segment, in particular, is showing a strong preference for flexible tariffs and digital tools that allow them to monitor and manage their energy usage effectively. The commercial energy users and industrial energy consumption sectors are also focusing on cost optimization and reliability, often seeking long-term contracts with stable pricing and a guaranteed supply of electricity. The electricity retail market is thus adapting by offering a wider array of products and services designed to meet these diverse needs, with a projected Compound Annual Growth Rate (CAGR) of approximately 5.5% for the forecast period.

Key Markets & Segments Leading Electricity Retailing Market

The Electricity Retailing Market is witnessing significant leadership across various regions and segments, driven by a confluence of economic, technological, and demographic factors. The Residential segment is a dominant force, propelled by increasing household energy needs and a growing awareness of energy efficiency and sustainability among consumers.

- Residential Segment Dominance Drivers:

- Growing Population and Urbanization: Increased population density, particularly in urban centers, directly translates to higher demand for electricity for lighting, appliances, and heating/cooling.

- Rising Disposable Incomes: As economies grow, households have more disposable income to spend on energy-consuming appliances and comfort-enhancing technologies, further boosting electricity consumption.

- Smart Home Adoption: The increasing penetration of smart home devices, from smart thermostats to smart lighting systems, is not only increasing overall electricity usage but also creating a demand for smarter, more connected electricity retail services.

- Government Incentives and Awareness Campaigns: Many governments are actively promoting energy efficiency and renewable energy adoption among residential consumers through subsidies, tax credits, and public awareness campaigns, directly influencing purchasing decisions.

- Electrification of Transportation: The growing adoption of electric vehicles (EVs) in households is creating a new, significant source of electricity demand, pushing residential consumers to seek reliable and cost-effective charging solutions from their electricity retailers.

The Commercial segment also plays a pivotal role, characterized by a diverse range of businesses with varying energy requirements, from small retail stores to large office complexes. The demand here is driven by the need for reliable and cost-effective energy to power business operations, maintain comfort for employees and customers, and support the increasing use of technology.

- Commercial Segment Drivers:

- Economic Activity and Business Growth: A thriving economy with a strong business sector naturally leads to increased demand for electricity to power commercial operations.

- Technological Advancements in Offices: The widespread use of computers, servers, advanced communication systems, and specialized equipment in commercial spaces contributes significantly to electricity consumption.

- Demand for Energy Efficiency Solutions: Businesses are increasingly looking to reduce operational costs, making them highly receptive to energy efficiency programs and smart energy management solutions offered by electricity retailers.

- Sustainability Initiatives: Corporate social responsibility and sustainability goals are driving many businesses to seek out green electricity tariffs and renewable energy procurement options, influencing their choice of energy provider.

- Building Modernization and Retrofitting: Investments in modernizing commercial buildings with energy-efficient lighting, HVAC systems, and smart building management systems can lead to both increased and optimized electricity usage.

While the Industrial segment often exhibits the highest per-unit energy consumption, its growth in the electricity retailing market is influenced by factors such as energy-intensive manufacturing processes and the strategic importance of reliable and competitively priced electricity for production costs. The dominant region leading the electricity retailing market is currently North America, driven by its large economy, significant industrial base, and advanced technological infrastructure supporting smart grids and digital energy services. Europe follows closely, with strong regulatory frameworks promoting competition and renewable energy integration. Asia-Pacific is emerging as a high-growth market, propelled by rapid industrialization and increasing urbanization. The report foresees a continued shift towards renewable energy sources and a greater emphasis on customer-centric services across all segments and leading markets.

Electricity Retailing Market Product Developments

Product developments in the electricity retailing market are increasingly focused on empowering consumers and enhancing grid stability. Innovations include smart energy management platforms that allow users to monitor and control their electricity consumption in real-time, optimizing usage for cost savings and reduced environmental impact. Many retailers are now offering bundled services that integrate electricity supply with electric vehicle (EV) charging solutions and home energy storage systems, catering to the evolving needs of modern households. Furthermore, the development of dynamic pricing models and green energy tariffs has become a key competitive edge, allowing consumers to choose options that align with their budget and sustainability preferences. These advancements are driven by a desire to create a more engaged and informed electricity consumer base, fostering loyalty and driving market differentiation.

Challenges in the Electricity Retailing Market Market

The electricity retailing market faces several significant challenges that can impede its growth and evolution. Regulatory hurdles, including complex pricing structures and market access restrictions in certain regions, can limit competition and innovation. Supply chain issues, particularly concerning the integration of intermittent renewable energy sources and the securing of necessary infrastructure, can lead to price volatility and reliability concerns. Competitive pressures from new market entrants offering disruptive business models, alongside the increasing cost of grid modernization and digitalization, also present substantial financial and operational challenges for established players. Quantifiable impacts include potential delays in renewable energy deployment and increased operational expenditures for energy providers.

Forces Driving Electricity Retailing Market Growth

The electricity retailing market is propelled by several powerful growth drivers. Technological advancements, particularly in renewable energy generation (solar, wind) and energy storage solutions, are making clean energy more accessible and affordable. Economic factors, such as increasing global energy demand driven by industrialization and population growth, create a fundamental need for electricity supply. Regulatory support, including government policies promoting renewable energy mandates, carbon emission reduction targets, and the liberalization of electricity markets, actively encourages competition and investment in the sector. Furthermore, a growing consumer awareness and demand for sustainable energy options and personalized services are compelling electricity retailers to innovate and expand their offerings.

Challenges in the Electricity Retailing Market Market

Long-term growth catalysts in the electricity retailing market are intrinsically linked to sustained innovation and strategic market expansion. Continued investment in advanced smart grid technologies and artificial intelligence for predictive analytics and grid optimization will be crucial for enhancing reliability and efficiency. Strategic partnerships between energy retailers, technology providers, and renewable energy developers are vital for creating integrated energy solutions and unlocking new revenue streams. Furthermore, expanding into emerging markets with rapidly growing energy demands and underdeveloped grid infrastructures presents significant long-term growth potential. The development of innovative financing models for renewable energy projects and smart home installations will also play a key role in accelerating market penetration and sustained growth.

Emerging Opportunities in Electricity Retailing Market

Emerging opportunities in the electricity retailing market are abundant, driven by evolving consumer preferences and technological advancements. The increasing demand for electric vehicle (EV) charging infrastructure presents a significant avenue for electricity suppliers to offer specialized tariffs and charging services. The growth of the Internet of Things (IoT) is fostering the development of smart home energy management systems, creating opportunities for retailers to offer integrated solutions and data-driven services that optimize energy consumption and reduce costs for residential electricity consumers. Furthermore, the expansion of distributed energy resources (DERs) and microgrids presents new models for energy generation and distribution, offering opportunities for energy retailers to play a more active role in local energy markets. The growing focus on sustainability and ESG (Environmental, Social, and Governance) criteria also opens doors for retailers to differentiate themselves by offering transparently sourced green electricity options and community solar programs.

Leading Players in the Electricity Retailing Market Sector

- Tata Power Co Ltd

- Engie SA

- Electricite de France SA

- E ON SE

- China Huadian Corporation LTD (CHD)

- Iberdrola SA

- Duke Energy Corporation

- Keppel Electric Pte Ltd

- AGL Energy Ltd

- Enel S p A

Key Milestones in Electricity Retailing Market Industry

- 2019: Increased investment in smart grid technologies for enhanced grid reliability and data analytics capabilities.

- 2020: Significant growth in the adoption of renewable energy tariffs and green electricity plans by residential consumers.

- 2021: Key mergers and acquisitions aimed at consolidating market share and expanding service portfolios.

- 2022: Introduction of advanced demand-side management programs by major utilities to optimize grid load.

- 2023: Rise in partnerships between electricity retailers and electric vehicle charging infrastructure providers.

- 2024: Enhanced focus on cybersecurity measures to protect critical energy infrastructure and customer data.

Strategic Outlook for Electricity Retailing Market Market

The strategic outlook for the electricity retailing market is overwhelmingly positive, driven by ongoing technological advancements and a growing global emphasis on sustainability. Growth accelerators will include the continued expansion of renewable energy integration, the widespread adoption of smart grid technologies, and the development of sophisticated digital platforms for enhanced customer engagement. Opportunities for energy providers to offer value-added services, such as EV charging solutions, home energy storage integration, and personalized energy management advice, will be crucial for differentiation and revenue growth. Furthermore, the increasing focus on ESG principles will drive innovation in green electricity options and transparent reporting, appealing to an increasingly conscious consumer base. Strategic collaborations and agile adaptation to evolving regulatory landscapes will be paramount for sustained success in this dynamic sector.

Electricity Retailing Market Segmentation

-

1. End-User

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

Electricity Retailing Market Segmentation By Geography

-

1. North America

- 1.1. United States of America

- 1.2. Canada

- 1.3. Rest of the North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Italy

- 2.4. Germany

- 2.5. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of the Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of the South America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Rest of the Middle East

Electricity Retailing Market Regional Market Share

Geographic Coverage of Electricity Retailing Market

Electricity Retailing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in the Demand for Electricity4.; Rising Adoption of Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. 4.; New Sources of Distributed Electricity Generation

- 3.4. Market Trends

- 3.4.1. Residential Segment is Expect to have a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electricity Retailing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East

- 5.2.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. North America Electricity Retailing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. Europe Electricity Retailing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Asia Pacific Electricity Retailing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. South America Electricity Retailing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Middle East Electricity Retailing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 11. United Arab Emirates Electricity Retailing Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End-User

- 11.1.1. Residential

- 11.1.2. Commercial

- 11.1.3. Industrial

- 11.1. Market Analysis, Insights and Forecast - by End-User

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Tata Power Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Engie SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Electricite de France SA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 E ON SE

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 China Huadian Corporation LTD (CHD)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Iberdrola SA *List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Duke Energy Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Keppel Electric Pte Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 AGL Energy Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Enel S p A

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Tata Power Co Ltd

List of Figures

- Figure 1: Global Electricity Retailing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Electricity Retailing Market Revenue (Million), by End-User 2025 & 2033

- Figure 3: North America Electricity Retailing Market Revenue Share (%), by End-User 2025 & 2033

- Figure 4: North America Electricity Retailing Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Electricity Retailing Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Electricity Retailing Market Revenue (Million), by End-User 2025 & 2033

- Figure 7: Europe Electricity Retailing Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: Europe Electricity Retailing Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Electricity Retailing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Electricity Retailing Market Revenue (Million), by End-User 2025 & 2033

- Figure 11: Asia Pacific Electricity Retailing Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Asia Pacific Electricity Retailing Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Electricity Retailing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Electricity Retailing Market Revenue (Million), by End-User 2025 & 2033

- Figure 15: South America Electricity Retailing Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: South America Electricity Retailing Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Electricity Retailing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Electricity Retailing Market Revenue (Million), by End-User 2025 & 2033

- Figure 19: Middle East Electricity Retailing Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: Middle East Electricity Retailing Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East Electricity Retailing Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: United Arab Emirates Electricity Retailing Market Revenue (Million), by End-User 2025 & 2033

- Figure 23: United Arab Emirates Electricity Retailing Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: United Arab Emirates Electricity Retailing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: United Arab Emirates Electricity Retailing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electricity Retailing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 2: Global Electricity Retailing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Electricity Retailing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Electricity Retailing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States of America Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of the North America Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Electricity Retailing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 9: Global Electricity Retailing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: United Kingdom Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of the Europe Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Electricity Retailing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 16: Global Electricity Retailing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: China Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: India Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Japan Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of the Asia Pacific Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Electricity Retailing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 23: Global Electricity Retailing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Brazil Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Argentina Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of the South America Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Electricity Retailing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 28: Global Electricity Retailing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global Electricity Retailing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 30: Global Electricity Retailing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Saudi Arabia Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of the Middle East Electricity Retailing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electricity Retailing Market ?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Electricity Retailing Market ?

Key companies in the market include Tata Power Co Ltd, Engie SA, Electricite de France SA, E ON SE, China Huadian Corporation LTD (CHD), Iberdrola SA *List Not Exhaustive, Duke Energy Corporation, Keppel Electric Pte Ltd, AGL Energy Ltd, Enel S p A.

3. What are the main segments of the Electricity Retailing Market ?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 547.04 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in the Demand for Electricity4.; Rising Adoption of Electric Vehicles.

6. What are the notable trends driving market growth?

Residential Segment is Expect to have a Significant Share in the Market.

7. Are there any restraints impacting market growth?

4.; New Sources of Distributed Electricity Generation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electricity Retailing Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electricity Retailing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electricity Retailing Market ?

To stay informed about further developments, trends, and reports in the Electricity Retailing Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence