Key Insights

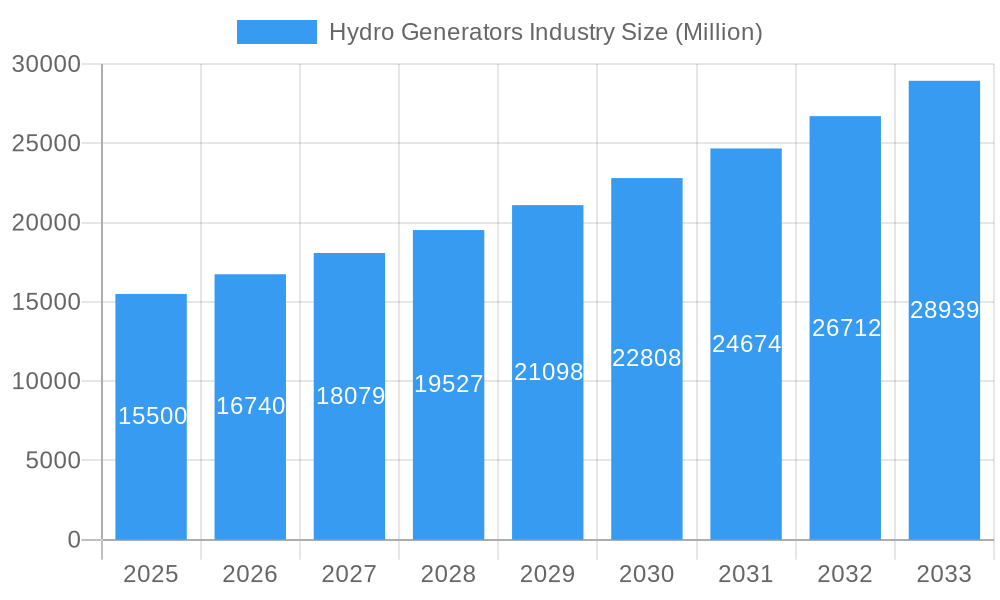

The global Hydro Generators market is projected for substantial growth, with an estimated market size of $7 billion in the base year 2025. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 4.3%, reaching significant valuations by 2033. This expansion is primarily driven by the global shift towards sustainable energy solutions and the escalating demand for renewable power generation. Supportive government policies and incentives worldwide, recognizing hydropower's vital role in decarbonization and energy security, are key accelerators. Technological advancements in hydro generator design, focusing on enhanced efficiency, improved reliability, and minimized environmental impact, are further fueling market adoption. The modernization of existing hydroelectric power plants also significantly contributes to the market's upward trend.

Hydro Generators Industry Market Size (In Billion)

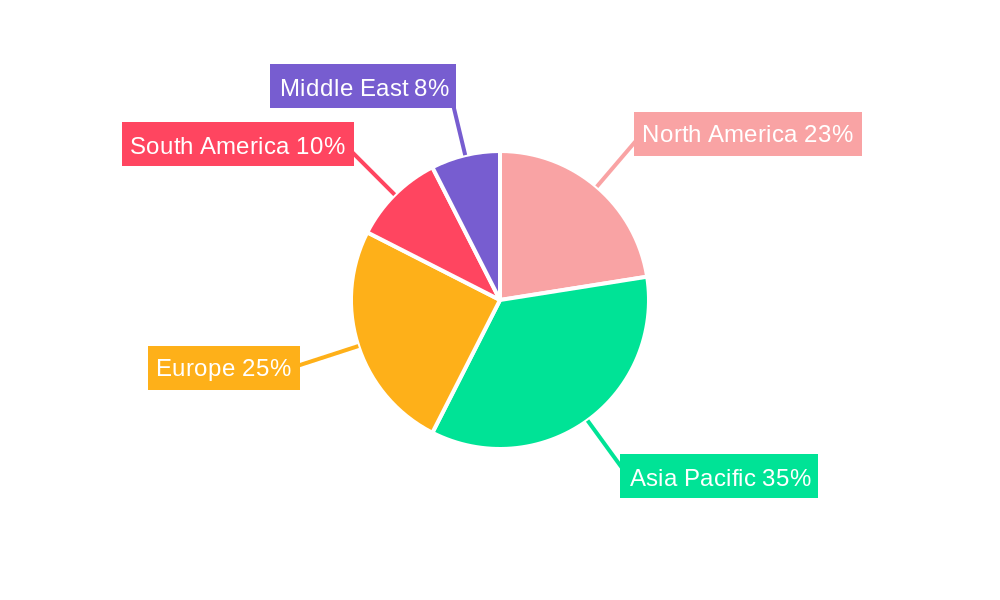

The market segmentation highlights distinct trends, with "Large" size generators currently holding a dominant position due to their application in extensive hydroelectric projects. However, "Small" and "Micro" generator segments are poised for considerable growth, spurred by distributed generation initiatives and the increasing adoption of micro-hydro systems in remote areas. Leading industry players, including Nidec Industrial Solutions, Voith GmbH & Co. KGaA, Siemens AG, and General Electric Company, are driving innovation through research and development of advanced solutions. Geographically, the Asia Pacific region is anticipated to lead market expansion, supported by significant investments in new hydropower projects and favorable government policies. North America and Europe represent mature yet crucial markets, emphasizing infrastructure upgrades and the adoption of advanced technologies.

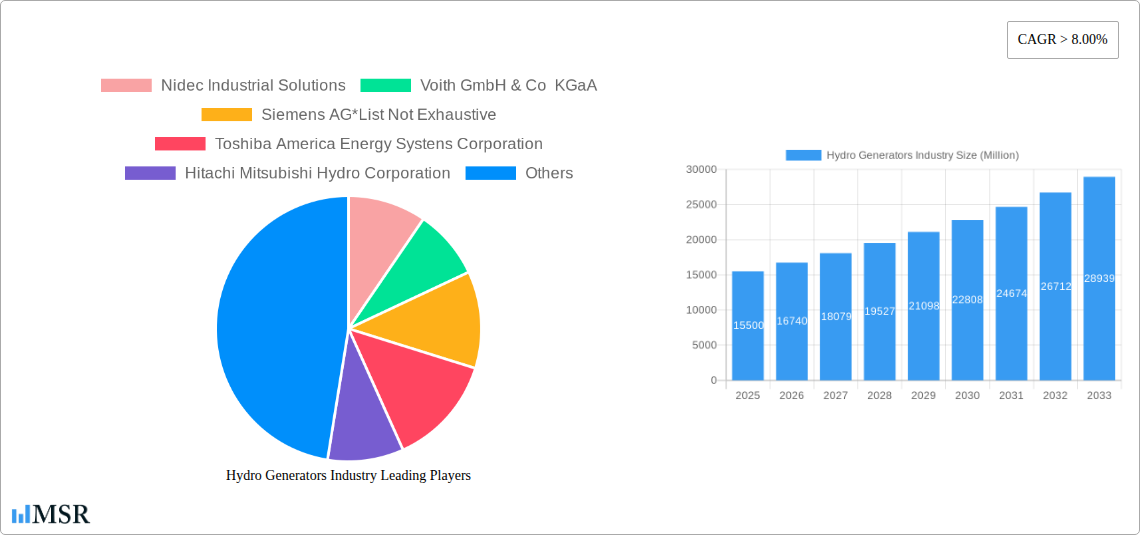

Hydro Generators Industry Company Market Share

Unlock the Power of Hydropower: Comprehensive Hydro Generators Industry Market Report (2019-2033)

Gain critical insights into the global Hydro Generators Industry with this in-depth market research report. Covering a comprehensive study period from 2019–2033, with a base year of 2025, this report provides an unparalleled analysis of market dynamics, technological advancements, key players, and future growth trajectories. Essential for industry stakeholders, investors, and policymakers seeking to navigate the evolving landscape of renewable energy generation.

This report delivers actionable intelligence on the Hydro Generators market, a vital component of the global renewable energy sector. Discover key drivers, challenges, and emerging opportunities within this critical industry.

Hydro Generators Industry Market Concentration & Dynamics

The Hydro Generators Industry exhibits a moderate to high level of market concentration, with a few dominant players controlling a significant share of the global market. Innovation ecosystems are robust, driven by continuous research and development in efficiency, reliability, and integration with smart grid technologies. Regulatory frameworks, particularly concerning environmental impact, safety standards, and grid connection policies, play a crucial role in shaping market entry and operational strategies. Substitute products, such as solar and wind power, present competition, but hydropower's unique advantages in baseload power and grid stability maintain its strong position. End-user trends are increasingly focused on sustainable energy solutions, grid modernization, and the decarbonization of power generation. Mergers & Acquisitions (M&A) activities are prevalent as larger companies seek to consolidate market share and acquire advanced technologies.

- Key Market Players: Nidec Industrial Solutions, Voith GmbH & Co KGaA, Siemens AG, Toshiba America Energy Systems Corporation, Hitachi Mitsubishi Hydro Corporation, OJSC Power Machines, General Electric Company, Global Hydro Energy GmbH, Andritz AG, WEG SA.

- M&A Deal Counts: Historically, there have been an average of 5-10 significant M&A deals annually, focused on technology acquisition and market expansion.

- Market Share: The top 5 players collectively hold approximately 65% of the global Hydro Generators market share.

Hydro Generators Industry Industry Insights & Trends

The global Hydro Generators Industry is experiencing robust growth, projected to reach an estimated market size of US$ 25,000 Million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period (2025–2033). This expansion is primarily fueled by the increasing global demand for clean and sustainable energy sources, coupled with government initiatives promoting renewable energy adoption and the decarbonization of power grids. Technological disruptions are continuously enhancing the efficiency and performance of hydro generators, leading to smaller footprints and lower operational costs. Evolving consumer behaviors, characterized by a growing preference for environmentally friendly energy solutions and a desire for energy independence, are also contributing to market growth. The industry is witnessing a surge in demand for upgrading existing hydropower facilities and developing new ones, particularly in regions with abundant water resources. The drive towards energy security and the need to balance intermittent renewable sources like solar and wind further bolster the importance of hydropower and its associated generator technologies. The continuous innovation in turbine design, generator efficiency, and control systems is making hydropower a more competitive and attractive option for a wider range of applications, from large-scale power plants to smaller, distributed generation systems.

Key Markets & Segments Leading Hydro Generators Industry

The Large segment of the Hydro Generators Industry currently dominates the global market, driven by significant investments in large-scale hydropower projects across Asia-Pacific, North America, and Europe. The robust economic growth and increasing energy demands in emerging economies within Asia-Pacific, particularly China and India, are major contributors to this dominance. These regions are undertaking substantial infrastructure development, including the construction of new dams and the expansion of existing hydropower facilities to meet their growing power needs.

- Dominant Region: Asia-Pacific leads the Hydro Generators Industry, accounting for an estimated 40% of the global market share.

- Drivers:

- Rapid industrialization and urbanization.

- Government policies promoting renewable energy targets.

- Abundant water resources.

- Investment in large-scale infrastructure projects.

- Drivers:

- Dominant Country: China is the leading country in hydropower generation and consequently, the demand for large hydro generators. Its extensive investment in the Three Gorges Dam and numerous other projects highlights its commitment to this energy source.

The Small segment is experiencing steady growth, driven by the need for reliable power in rural and remote areas, as well as the demand for decentralized power generation solutions. Countries with significant rural populations and developing energy infrastructure are key markets for small hydro generators.

- Drivers for Small Segment:

- Rural electrification initiatives.

- Demand for off-grid power solutions.

- Community-based renewable energy projects.

The Micro segment, though smaller in market share, is witnessing impressive growth rates due to the increasing adoption of pico-hydro systems for localized power generation. The development of innovative micro-hydro technologies suitable for irrigation canals and industrial drainage systems, as highlighted by recent industry developments, is significantly boosting this segment. This segment is particularly attractive for its scalability and ease of deployment in diverse settings.

- Drivers for Micro Segment:

- Advancements in pico-hydro technology.

- Applicability in niche markets (irrigation, industrial water systems).

- Growing interest in distributed energy resources.

Hydro Generators Industry Product Developments

Product development in the Hydro Generators Industry is characterized by a relentless pursuit of enhanced efficiency, increased reliability, and reduced environmental impact. Manufacturers are focusing on optimizing generator designs for improved energy conversion, incorporating advanced materials for greater durability, and developing intelligent control systems for seamless grid integration and predictive maintenance. Innovations are geared towards making generators more compact, quieter, and adaptable to a wider range of water flow conditions, thereby expanding the potential for hydropower deployment in diverse geographical and operational environments. The competitive edge lies in delivering tailored solutions that meet specific project requirements, from massive utility-scale installations to smaller, localized power generation needs.

Challenges in the Hydro Generators Industry Market

The Hydro Generators Industry faces several challenges that impact its growth and market penetration.

- Regulatory Hurdles: Stringent environmental regulations, lengthy permitting processes, and complex land acquisition procedures can significantly delay project timelines and increase development costs.

- Supply Chain Volatility: Global supply chain disruptions, coupled with the rising cost of raw materials like copper and rare earth elements, can lead to increased manufacturing costs and delivery delays for hydro generators.

- Competitive Pressures: Intense competition from other renewable energy sources, particularly solar and wind power, which often have lower upfront installation costs and shorter deployment times, poses a significant challenge.

- Intermittency Concerns: While hydropower offers better baseload capabilities than solar or wind, its reliance on consistent water flow can be affected by climate change and drought conditions in certain regions.

Forces Driving Hydro Generators Industry Growth

The Hydro Generators Industry is propelled by a confluence of powerful forces that are shaping its future.

- Technological Advancements: Continuous innovation in turbine and generator technologies is leading to higher efficiencies, increased reliability, and reduced operational costs, making hydropower more competitive.

- Government Support & Policies: Favorable government policies, including subsidies, tax incentives, and renewable energy mandates, are a major catalyst for hydropower development.

- Energy Security & Decarbonization Goals: The global imperative for energy security and the urgent need to decarbonize power generation are driving investments in clean energy sources like hydropower.

- Grid Modernization & Stability: Hydropower's ability to provide grid stability and baseload power makes it an essential component in the integration of intermittent renewable energy sources into the grid.

Challenges in the Hydro Generators Industry Market

Despite its inherent advantages, the Hydro Generators Industry must navigate several long-term growth inhibitors. The substantial upfront capital investment required for large-scale hydropower projects, coupled with the long gestation periods for planning and construction, can be a significant deterrent for investors. Public perception and environmental concerns, particularly regarding the ecological impact of large dams on riverine ecosystems and local communities, can lead to opposition and regulatory challenges, slowing down project development. Furthermore, the increasing availability and declining costs of alternative renewable energy technologies like solar and wind power present ongoing competitive pressures, requiring continuous innovation and cost optimization within the hydropower sector. The dependence on specific geographical and hydrological conditions also limits the universal applicability of hydropower.

Emerging Opportunities in Hydro Generators Industry

The Hydro Generators Industry is ripe with emerging opportunities poised to fuel future growth. The burgeoning trend of distributed energy generation is opening new avenues for micro and small hydro systems, particularly in remote and off-grid communities, and for industrial applications. Advancements in turbine runner designs and generator materials are enabling the efficient harnessing of power from lower-head and lower-flow water sources, expanding the potential for hydropower development in previously uneconomical locations. Furthermore, the increasing focus on modernizing aging hydropower infrastructure globally presents a significant market for upgrades and retrofits of existing generators, promising enhanced efficiency and extended operational life. The integration of smart grid technologies and digitalization within hydropower operations offers opportunities for improved performance monitoring, predictive maintenance, and optimized energy dispatch, creating value-added services and solutions. The growing interest in pumped-storage hydropower as a large-scale energy storage solution for balancing intermittent renewables also presents a substantial long-term opportunity.

Leading Players in the Hydro Generators Industry Sector

- Nidec Industrial Solutions

- Voith GmbH & Co KGaA

- Siemens AG

- Toshiba America Energy Systems Corporation

- Hitachi Mitsubishi Hydro Corporation

- OJSC Power Machines

- General Electric Company

- Global Hydro Energy GmbH

- Andritz AG

- WEG SA

Key Milestones in Hydro Generators Industry Industry

- January 2022: GE Renewable Energy and Avista Utilities enter into a service agreement to update four generator units at the Long Lake hydropower facility in the United States. Upon completion, the facility's installed capacity will exceed 100 MW, capable of powering approximately 80,000 homes.

- March 2022: A Japanese multinational imaging and electronics company introduces a pico-hydro generation system designed for use with irrigation canals and industrial drainage systems. Pico-hydro systems are defined as hydropower systems with a capacity of less than 5kW.

Strategic Outlook for Hydro Generators Industry Market

The strategic outlook for the Hydro Generators Industry remains exceptionally positive, driven by a global commitment to renewable energy and the inherent strengths of hydropower. Key growth accelerators include continued investment in the modernization of existing hydropower infrastructure, which offers significant opportunities for upgrades and efficiency improvements. The increasing demand for grid-scale energy storage is also a major catalyst, with pumped-storage hydropower poised for significant expansion. Furthermore, the development of advanced technologies enabling the deployment of smaller-scale and decentralized hydropower systems will unlock new markets and applications. Strategic partnerships between technology providers, utilities, and governments will be crucial for overcoming regulatory hurdles and facilitating project development. The industry's ability to adapt to evolving environmental standards and integrate seamlessly with digital technologies will define its long-term success and contribution to a sustainable energy future.

Hydro Generators Industry Segmentation

-

1. Size

- 1.1. Large

- 1.2. Small

- 1.3. Micro

Hydro Generators Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. South America

- 5. Middle East

Hydro Generators Industry Regional Market Share

Geographic Coverage of Hydro Generators Industry

Hydro Generators Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Population Growth and Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; High Operational and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Large Hydro Generator as a Prominent Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hydro Generators Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Size

- 5.1.1. Large

- 5.1.2. Small

- 5.1.3. Micro

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Asia Pacific

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Size

- 6. North America Hydro Generators Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Size

- 6.1.1. Large

- 6.1.2. Small

- 6.1.3. Micro

- 6.1. Market Analysis, Insights and Forecast - by Size

- 7. Asia Pacific Hydro Generators Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Size

- 7.1.1. Large

- 7.1.2. Small

- 7.1.3. Micro

- 7.1. Market Analysis, Insights and Forecast - by Size

- 8. Europe Hydro Generators Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Size

- 8.1.1. Large

- 8.1.2. Small

- 8.1.3. Micro

- 8.1. Market Analysis, Insights and Forecast - by Size

- 9. South America Hydro Generators Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Size

- 9.1.1. Large

- 9.1.2. Small

- 9.1.3. Micro

- 9.1. Market Analysis, Insights and Forecast - by Size

- 10. Middle East Hydro Generators Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Size

- 10.1.1. Large

- 10.1.2. Small

- 10.1.3. Micro

- 10.1. Market Analysis, Insights and Forecast - by Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nidec Industrial Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Voith GmbH & Co KGaA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens AG*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toshiba America Energy Systens Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hitachi Mitsubishi Hydro Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OJSC Power Machines

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 General Electric Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Global Hydro Energy GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Andritz AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 WEG SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nidec Industrial Solutions

List of Figures

- Figure 1: Global Hydro Generators Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Hydro Generators Industry Revenue (billion), by Size 2025 & 2033

- Figure 3: North America Hydro Generators Industry Revenue Share (%), by Size 2025 & 2033

- Figure 4: North America Hydro Generators Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Hydro Generators Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Hydro Generators Industry Revenue (billion), by Size 2025 & 2033

- Figure 7: Asia Pacific Hydro Generators Industry Revenue Share (%), by Size 2025 & 2033

- Figure 8: Asia Pacific Hydro Generators Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Asia Pacific Hydro Generators Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Hydro Generators Industry Revenue (billion), by Size 2025 & 2033

- Figure 11: Europe Hydro Generators Industry Revenue Share (%), by Size 2025 & 2033

- Figure 12: Europe Hydro Generators Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Hydro Generators Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Hydro Generators Industry Revenue (billion), by Size 2025 & 2033

- Figure 15: South America Hydro Generators Industry Revenue Share (%), by Size 2025 & 2033

- Figure 16: South America Hydro Generators Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Hydro Generators Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Hydro Generators Industry Revenue (billion), by Size 2025 & 2033

- Figure 19: Middle East Hydro Generators Industry Revenue Share (%), by Size 2025 & 2033

- Figure 20: Middle East Hydro Generators Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East Hydro Generators Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hydro Generators Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 2: Global Hydro Generators Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Hydro Generators Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 4: Global Hydro Generators Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Hydro Generators Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 6: Global Hydro Generators Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Hydro Generators Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 8: Global Hydro Generators Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Hydro Generators Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 10: Global Hydro Generators Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Hydro Generators Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 12: Global Hydro Generators Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hydro Generators Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Hydro Generators Industry?

Key companies in the market include Nidec Industrial Solutions, Voith GmbH & Co KGaA, Siemens AG*List Not Exhaustive, Toshiba America Energy Systens Corporation, Hitachi Mitsubishi Hydro Corporation, OJSC Power Machines, General Electric Company, Global Hydro Energy GmbH, Andritz AG, WEG SA.

3. What are the main segments of the Hydro Generators Industry?

The market segments include Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 7 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Population Growth and Infrastructure Development.

6. What are the notable trends driving market growth?

Large Hydro Generator as a Prominent Segment.

7. Are there any restraints impacting market growth?

4.; High Operational and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

In January 2022, In order to update four generator units at the Long Lake hydropower facility in the United States, GE Renewable Energy, and Avista Utilities, a US energy company serving four northwest states, entered into a service agreement. After the renovation project is finished, the plant will have an installed capacity that exceeds 100 MW. This quantity of energy can supply all the electricity that 80,000 houses would need.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hydro Generators Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hydro Generators Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hydro Generators Industry?

To stay informed about further developments, trends, and reports in the Hydro Generators Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence