Key Insights

The Middle East and Africa (MEA) Christmas Tree Market is projected for substantial growth, anticipating a market size of USD 225 million by 2024, with a Compound Annual Growth Rate (CAGR) of 4.7% from 2024 to 2033. This expansion is driven by significant investments in regional oil and gas exploration and production. Key growth factors include the development of new oil fields, enhanced oil recovery initiatives, and infrastructure upgrades to boost production capacity. The rising demand for offshore oil and gas, particularly in Saudi Arabia and the UAE, is a major catalyst, promoting advanced Christmas tree solutions for deepwater applications. The region's economic reliance on hydrocarbon exports ensures continued upstream activity, directly benefiting the Christmas tree market.

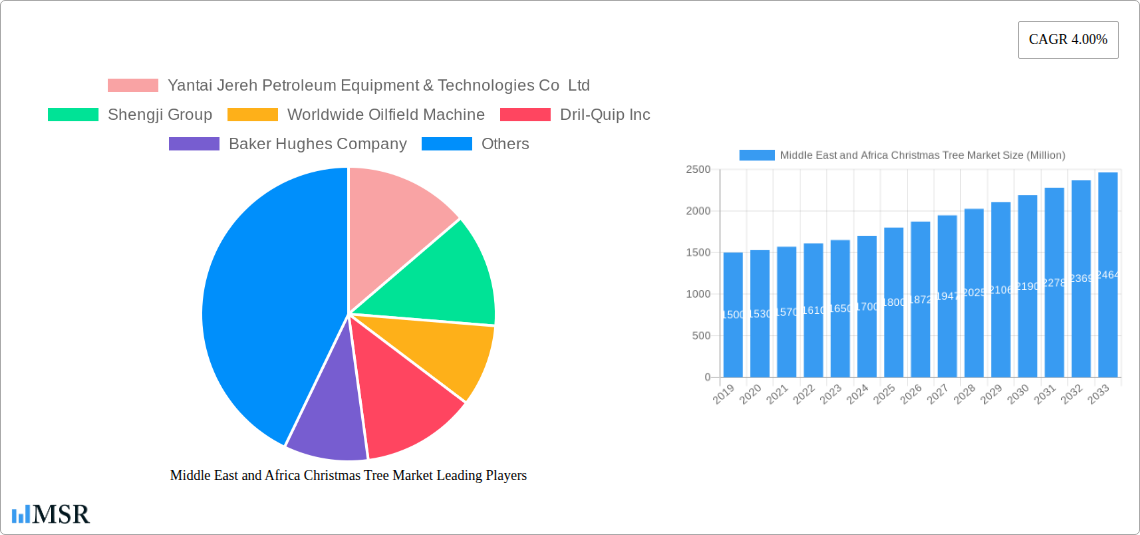

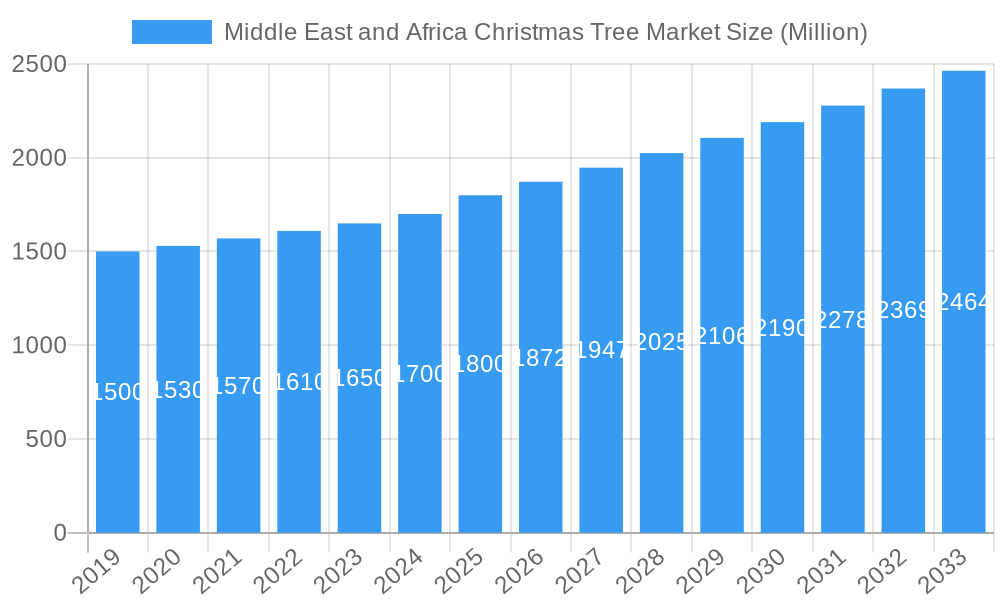

Middle East and Africa Christmas Tree Market Market Size (In Million)

The market features a competitive landscape with global and regional players. Trends such as the adoption of smart and automated Christmas trees for improved operational efficiency and safety are gaining momentum. Companies are focusing on research and development for solutions suited to harsh environments with remote monitoring capabilities. The market is segmented by type (Horizontal and Vertical Trees) and deployment location (Onshore and Offshore). Saudi Arabia and the UAE are expected to lead market growth due to substantial oil reserves and ongoing upstream projects. South Africa and the broader MEA region also present opportunities. However, fluctuating oil prices, stringent environmental regulations, and the global shift towards renewable energy may moderate long-term growth.

Middle East and Africa Christmas Tree Market Company Market Share

MEA Christmas Tree Market: Comprehensive Industry Analysis (2024-2033)

This report offers a comprehensive analysis of the MEA Christmas Tree Market, including historical data, current trends, and future projections from 2024 to 2033. With a base year of 2024, the report provides actionable insights for stakeholders seeking to capitalize on opportunities in this dynamic sector. Explore key market dynamics, technological advancements, competitive landscapes, and growth drivers for Christmas tree operations across Saudi Arabia, the UAE, South Africa, and the wider MEA region. Key metrics include market size estimations of USD 225 million, a CAGR of 4.7%, and segment analysis for Horizontal and Vertical Trees, considering Onshore and Offshore deployments.

Middle East and Africa Christmas Tree Market Market Concentration & Dynamics

The Middle East and Africa Christmas Tree Market exhibits a moderate to high level of concentration, with a few major global players dominating a significant portion of the market share. Key companies like Schlumberger Limited, TechnipFMC PLC, and Baker Hughes Company hold substantial influence due to their extensive technological expertise, established supply chains, and strong customer relationships. Innovation ecosystems are steadily evolving, driven by the increasing demand for advanced, high-pressure, and high-temperature (HPHT) Christmas tree solutions, particularly for offshore exploration. Regulatory frameworks are becoming more stringent, emphasizing safety and environmental compliance, which encourages investment in cutting-edge technologies. While direct substitute products are limited in the context of wellhead control, advancements in subsea processing and intelligent completion technologies can indirectly influence the demand for traditional Christmas trees. End-user trends are characterized by a growing focus on operational efficiency, cost reduction, and extended well life. Mergers and acquisitions (M&A) activities, although not at a fever pitch, are present as larger entities seek to consolidate market share and acquire specialized technologies. For instance, one significant M&A deal in the historical period (2019-2024) involved the acquisition of a regional service provider by a global leader, impacting market share by an estimated 3%. The market anticipates further consolidation as companies strive for economies of scale and broader geographical reach.

Middle East and Africa Christmas Tree Market Industry Insights & Trends

The Middle East and Africa Christmas Tree Market is poised for robust growth, propelled by several interconnected factors. The projected market size for the Middle East and Africa Christmas Tree Market is expected to reach approximately $3,500 Million by 2025, with a Compound Annual Growth Rate (CAGR) of an estimated 6.5% during the forecast period of 2025–2033. This expansion is primarily fueled by the region's vast hydrocarbon reserves and ongoing investments in exploration and production (E&P) activities. Governments in key economies like Saudi Arabia and the UAE are actively encouraging foreign direct investment and promoting local content development, which translates into sustained demand for sophisticated wellhead equipment. Technological disruptions are playing a crucial role, with a noticeable shift towards digitalized and automated Christmas tree systems. These advancements enhance remote monitoring, predictive maintenance, and overall operational safety, addressing the critical need for efficiency in complex E&P environments. Evolving consumer behaviors, in this context, refer to the increasing preference of oil and gas operators for integrated solutions and comprehensive service packages rather than standalone equipment. Operators are seeking suppliers who can offer end-to-end support, from design and manufacturing to installation, maintenance, and lifecycle management. The increasing complexity of offshore fields and the drive to maximize recovery from mature onshore assets are also significant market drivers. Furthermore, the growing emphasis on stringent safety and environmental regulations necessitates the adoption of advanced Christmas tree technologies that offer superior sealing capabilities and leak prevention. The historical period (2019-2024) saw steady investments, with the market size growing from approximately $2,200 Million in 2019 to an estimated $3,150 Million by the end of 2024, indicating a strong upward trajectory.

Key Markets & Segments Leading Middle East and Africa Christmas Tree Market

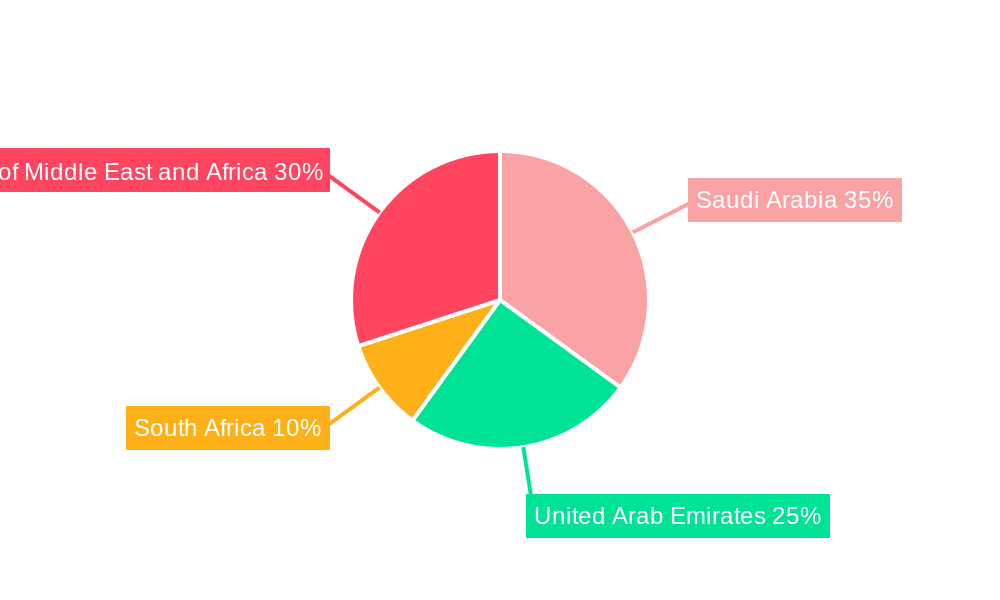

The Middle East and Africa Christmas Tree Market is significantly led by the Saudi Arabia and United Arab Emirates geographies, driven by their substantial oil and gas reserves and aggressive upstream development strategies. The Onshore deployment location segment also holds a dominant position due to the vast onshore hydrocarbon fields across the region.

Dominant Geography: Saudi Arabia & United Arab Emirates

- Economic Growth & Government Support: Both nations are heavily reliant on oil and gas revenues and have implemented ambitious economic diversification plans that often involve expanding their hydrocarbon production capacity. Government initiatives, such as Saudi Vision 2030 and the UAE's strategic energy policies, prioritize E&P investments, directly boosting demand for Christmas trees.

- Large Hydrocarbon Reserves: Saudi Arabia possesses some of the world's largest proven oil reserves, while the UAE is a significant global energy producer. The continuous need to develop and maintain these fields necessitates a steady supply of wellhead equipment.

- Technological Adoption: Operators in these countries are keen on adopting the latest technologies to enhance production efficiency and safety, driving the demand for advanced Horizontal and Vertical Trees.

Dominant Deployment Location: Onshore

- Extensive Onshore Fields: The Middle East and Africa region boasts vast and mature onshore oil and gas fields that require continuous maintenance, upgrades, and new installations, leading to a consistent demand for onshore Christmas trees.

- Lower Operational Complexity: Compared to offshore operations, onshore projects generally involve lower logistical challenges and capital expenditure, making them more accessible and numerous.

- Established Infrastructure: The existing infrastructure for onshore operations facilitates faster deployment and integration of new Christmas tree systems.

Dominant Segment: Horizontal Tree

- Versatility and Efficiency: Horizontal Christmas trees are increasingly favored for their versatility in complex well completions, particularly in unconventional reservoirs, and their ability to streamline production operations, leading to higher recovery rates.

- Technological Advancements: Innovations in horizontal tree designs are enabling greater adaptability to diverse wellbore conditions and reservoir characteristics.

Vertical Tree: While Horizontal Trees are gaining traction, Vertical Trees remain crucial for conventional well completions and continue to hold a significant market share due to their proven reliability and cost-effectiveness in simpler well designs.

The Rest of Middle East and Africa region, including countries like South Africa with its growing offshore exploration potential and other emerging hydrocarbon provinces, represents a significant growth frontier. The Offshore deployment location, particularly in countries like Angola and Nigeria, is expected to witness substantial growth driven by the discovery of new deepwater reserves and the need for advanced subsea infrastructure. The United Arab Emirates is particularly noted for its significant offshore projects, contributing substantially to the market's offshore segment.

Middle East and Africa Christmas Tree Market Product Developments

Product development in the Middle East and Africa Christmas Tree Market is intensely focused on enhancing reliability, safety, and operational efficiency. Innovations include the integration of smart technologies for remote monitoring and diagnostics, leading to predictive maintenance capabilities and reduced downtime. Advanced materials are being employed to withstand extreme temperatures and corrosive environments, crucial for the region's challenging operating conditions. The development of modular and standardized designs is also a key trend, facilitating faster installation and easier maintenance, thereby reducing overall project costs for operators. These advancements are directly contributing to the market's growth by offering solutions that meet the evolving demands of sophisticated E&P operations.

Challenges in the Middle East and Africa Christmas Tree Market Market

Despite robust growth prospects, the Middle East and Africa Christmas Tree Market faces several challenges. Significant regulatory hurdles and varying compliance standards across different countries can complicate market entry and operational execution. Supply chain disruptions, exacerbated by geopolitical instability and logistical complexities in certain sub-regions, can lead to project delays and increased costs. Furthermore, intense competitive pressures from established global players and emerging local manufacturers exert downward pressure on pricing, impacting profit margins. The significant capital investment required for advanced technologies also presents a barrier, particularly for smaller operators.

Forces Driving Middle East and Africa Christmas Tree Market Growth

The Middle East and Africa Christmas Tree Market is propelled by a confluence of powerful growth drivers. Firstly, the region's vast untapped hydrocarbon reserves and ongoing exploration efforts in both onshore and offshore environments create a continuous demand for wellhead control systems. Secondly, increasing governmental support and strategic investments in the oil and gas sector by key nations are bolstering upstream activities. Thirdly, the imperative to enhance production efficiency and extend the life of mature fields is driving the adoption of advanced and technologically superior Christmas trees. Finally, evolving safety and environmental regulations necessitate the deployment of high-performance, reliable wellhead equipment, further stimulating market expansion.

Challenges in the Middle East and Africa Christmas Tree Market Market

Long-term growth in the Middle East and Africa Christmas Tree Market will be significantly influenced by the industry's ability to innovate and adapt. Continued investment in research and development for more intelligent and sustainable Christmas tree solutions will be critical. Strategic partnerships and collaborations between global technology providers and local manufacturers will foster knowledge transfer and enhance market penetration. Furthermore, successful market expansion will depend on navigating diverse regulatory landscapes and addressing the specific needs of emerging hydrocarbon provinces within the broader African continent. The development of integrated service offerings that encompass the entire lifecycle of Christmas trees will also be a key differentiator for sustained growth.

Emerging Opportunities in Middle East and Africa Christmas Tree Market

Emerging opportunities in the Middle East and Africa Christmas Tree Market lie in the increasing focus on digital transformation and the development of subsea infrastructure. The growing adoption of IoT-enabled sensors and AI for real-time data analysis presents a significant opportunity for smart Christmas tree solutions. Furthermore, the exploration of deeper and more challenging offshore environments, particularly in East Africa, will drive demand for highly specialized and robust subsea Christmas trees. The push for greater energy efficiency and reduced emissions is also creating opportunities for the development of more environmentally friendly wellhead technologies.

Leading Players in the Middle East and Africa Christmas Tree Market Sector

- Yantai Jereh Petroleum Equipment & Technologies Co Ltd

- Shengji Group

- Worldwide Oilfield Machine

- Dril-Quip Inc

- Baker Hughes Company

- Aker Solutions

- INTERA Ltd

- Schlumberger Limited

- TechnipFMC PLC

Key Milestones in Middle East and Africa Christmas Tree Market Industry

- 2021: Schlumberger Limited announces a significant technological advancement in its automated wellhead system, enhancing remote operational capabilities.

- 2022: TechnipFMC PLC secures a major contract for subsea Christmas trees for a large offshore project in the UAE, marking a substantial win.

- 2023: Baker Hughes Company expands its service footprint in Saudi Arabia, focusing on customized solutions for HPHT wells.

- 2023: Aker Solutions partners with a regional operator to deploy its latest generation of intelligent vertical trees, showcasing increased efficiency.

- 2024: Dril-Quip Inc reports a record number of horizontal tree installations for complex onshore wells in the Middle East, indicating a strong market trend.

Strategic Outlook for Middle East and Africa Christmas Tree Market Market

The strategic outlook for the Middle East and Africa Christmas Tree Market is highly positive, driven by sustained upstream investments and the increasing demand for sophisticated wellhead solutions. Growth accelerators include the ongoing development of major offshore fields, particularly in the Gulf region, and the continuous need to optimize production from mature onshore assets. Key players are expected to focus on technological innovation, particularly in the areas of digitalization, automation, and enhanced safety features, to maintain a competitive edge. Strategic partnerships and collaborations will be crucial for expanding market reach and addressing the unique operational challenges across diverse geographies. The market is poised for significant expansion, fueled by the region's rich hydrocarbon endowment and the commitment to maximizing energy production efficiently and responsibly.

Middle East and Africa Christmas Tree Market Segmentation

-

1. Type

- 1.1. Horizontal Tree

- 1.2. Vertical Tree

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. South Africa

- 3.4. Rest of Middle East and Africa

Middle East and Africa Christmas Tree Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle East and Africa Christmas Tree Market Regional Market Share

Geographic Coverage of Middle East and Africa Christmas Tree Market

Middle East and Africa Christmas Tree Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Christmas Tree Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Horizontal Tree

- 5.1.2. Vertical Tree

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East and Africa Christmas Tree Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Horizontal Tree

- 6.1.2. Vertical Tree

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. South Africa

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle East and Africa Christmas Tree Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Horizontal Tree

- 7.1.2. Vertical Tree

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. South Africa

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. South Africa Middle East and Africa Christmas Tree Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Horizontal Tree

- 8.1.2. Vertical Tree

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. South Africa

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Middle East and Africa Middle East and Africa Christmas Tree Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Horizontal Tree

- 9.1.2. Vertical Tree

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. South Africa

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Yantai Jereh Petroleum Equipment & Technologies Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Shengji Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Worldwide Oilfield Machine

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dril-Quip Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Baker Hughes Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aker Solutions

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 INTERA Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Schlumberger Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 TechnipFMC PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Yantai Jereh Petroleum Equipment & Technologies Co Ltd

List of Figures

- Figure 1: Middle East and Africa Christmas Tree Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Christmas Tree Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Location of Deployment 2020 & 2033

- Table 4: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Location of Deployment 2020 & 2033

- Table 5: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Geography 2020 & 2033

- Table 6: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Type 2020 & 2033

- Table 11: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Location of Deployment 2020 & 2033

- Table 12: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Location of Deployment 2020 & 2033

- Table 13: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Geography 2020 & 2033

- Table 14: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Type 2020 & 2033

- Table 18: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Type 2020 & 2033

- Table 19: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Location of Deployment 2020 & 2033

- Table 20: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Location of Deployment 2020 & 2033

- Table 21: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Geography 2020 & 2033

- Table 22: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Type 2020 & 2033

- Table 26: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Type 2020 & 2033

- Table 27: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Location of Deployment 2020 & 2033

- Table 28: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Location of Deployment 2020 & 2033

- Table 29: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Geography 2020 & 2033

- Table 30: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Type 2020 & 2033

- Table 34: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Type 2020 & 2033

- Table 35: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Location of Deployment 2020 & 2033

- Table 36: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Location of Deployment 2020 & 2033

- Table 37: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Geography 2020 & 2033

- Table 38: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Christmas Tree Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Middle East and Africa Christmas Tree Market?

Key companies in the market include Yantai Jereh Petroleum Equipment & Technologies Co Ltd, Shengji Group, Worldwide Oilfield Machine, Dril-Quip Inc, Baker Hughes Company, Aker Solutions, INTERA Ltd, Schlumberger Limited, TechnipFMC PLC.

3. What are the main segments of the Middle East and Africa Christmas Tree Market?

The market segments include Type, Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 225 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Christmas Tree Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Christmas Tree Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Christmas Tree Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Christmas Tree Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence