Key Insights

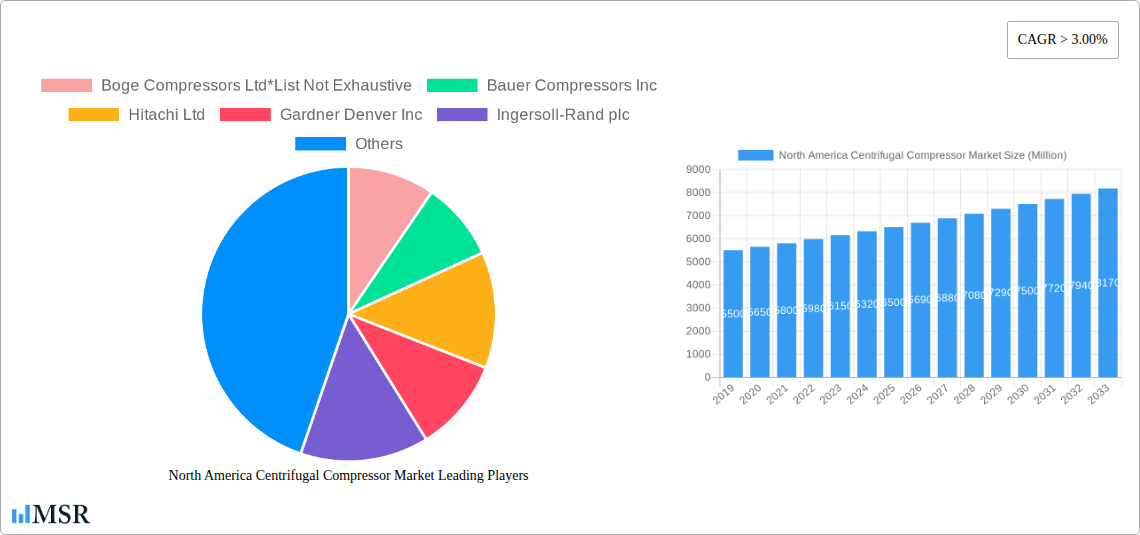

The North American centrifugal compressor market is poised for robust expansion, driven by significant investments in the energy sector and a growing demand for industrial efficiency. With a projected market size of approximately $6.5 billion in 2025, and a Compound Annual Growth Rate (CAGR) exceeding 3.00%, the market is expected to reach over $8.0 billion by 2033. This growth is underpinned by the critical role centrifugal compressors play in oil and gas exploration and production, power generation facilities seeking to optimize their output, and the chemical industry’s increasing need for reliable and high-capacity gas handling. The United States, Canada, and Mexico collectively represent a dynamic regional landscape, with the U.S. leading in adoption due to its extensive energy infrastructure and manufacturing base. Key market drivers include the ongoing need for modernized and efficient compression solutions in existing facilities, coupled with new project developments, particularly in shale gas extraction and renewable energy infrastructure.

North America Centrifugal Compressor Market Market Size (In Billion)

Despite the positive outlook, the market faces certain restraints, including the high initial capital expenditure associated with centrifugal compressor systems and the growing emphasis on energy efficiency and environmental regulations that necessitate continuous technological upgrades. However, advancements in variable speed drives, improved sealing technologies, and predictive maintenance solutions are mitigating these challenges and fostering innovation. Key companies such as Atlas Copco, Ingersoll-Rand, and GE are at the forefront, offering sophisticated centrifugal compressor technologies that enhance operational performance and reduce energy consumption. The market’s segmentation highlights the dominance of the Oil and Gas sector, followed by Power Generation and Chemicals, underscoring the essential nature of centrifugal compressors in these core industries. The North American market's trajectory indicates a sustained period of growth fueled by technological evolution and the persistent demand for robust and efficient compression solutions.

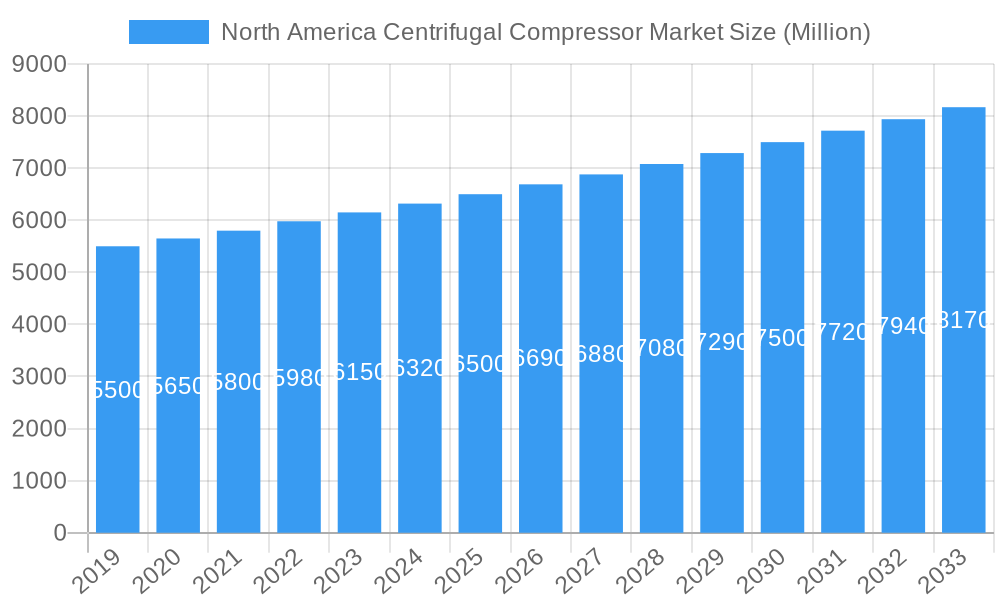

North America Centrifugal Compressor Market Company Market Share

Unlock strategic insights into the North America centrifugal compressor market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides a critical overview of market dynamics, growth drivers, key players, and emerging opportunities. Essential for industry stakeholders, this report offers actionable intelligence for navigating the evolving centrifugal compressor landscape.

North America Centrifugal Compressor Market Market Concentration & Dynamics

The North America centrifugal compressor market exhibits a moderate to high concentration, characterized by the presence of several global leaders alongside regional specialists. Key players like Atlas Copco Ltd, Ingersoll-Rand plc, and General Electric Company hold significant market share, driven by their extensive product portfolios, robust R&D investments, and established service networks. Innovation ecosystems are thriving, with a continuous focus on enhancing energy efficiency, reducing emissions, and developing smart compressor technologies. Regulatory frameworks, particularly concerning environmental standards and industrial safety, play a crucial role in shaping product development and market entry. The threat of substitute products, while present from other compressor types like screw or reciprocating compressors in specific applications, is mitigated by the unique advantages of centrifugal compressors in high-volume, continuous-flow processes. End-user trends indicate a strong demand from the oil and gas sector for exploration, refining, and petrochemical operations, alongside significant growth in power generation for plant operations and industrial air applications in the chemical sector. Merger and acquisition (M&A) activities, while not overtly dominant, are strategic and focused on acquiring niche technologies or expanding market reach. For instance, the sector has seen strategic acquisitions aimed at bolstering capabilities in digital solutions and advanced materials. The market share distribution is dynamic, with the top 5 players accounting for approximately 60-70% of the total market value. M&A deal counts have averaged 2-4 significant transactions annually over the historical period, focusing on specialized centrifugal compressor technologies and aftermarket services.

North America Centrifugal Compressor Market Industry Insights & Trends

The North America centrifugal compressor market is poised for robust growth, projected to reach a market size of approximately $XX Billion by 2033, with a Compound Annual Growth Rate (CAGR) of around XX% during the forecast period (2025-2033). This expansion is primarily fueled by increasing industrialization and infrastructure development across the region, coupled with a sustained demand from core end-user industries. Technological advancements are a significant disruptor and enabler. The integration of Industry 4.0 technologies, including IoT sensors, artificial intelligence (AI) for predictive maintenance, and advanced analytics, is transforming centrifugal compressors into intelligent assets. This not only enhances operational efficiency and reduces downtime but also allows for remote monitoring and control, a crucial development for geographically dispersed operations in the oil and gas sector. Evolving consumer behaviors, particularly in terms of environmental consciousness and the pursuit of operational cost reduction, are driving the demand for highly energy-efficient centrifugal compressors. Manufacturers are responding by developing innovative designs that minimize power consumption and reduce greenhouse gas emissions, aligning with stricter environmental regulations and corporate sustainability goals. The push towards decarbonization and the increasing adoption of renewable energy sources are also indirectly benefiting the market, as centrifugal compressors are integral to various processes within power generation facilities. Furthermore, the growing complexity of industrial processes, especially in the chemical and petrochemical sectors, necessitates the use of reliable and high-performance centrifugal compressors for critical applications like gas processing, air separation, and refrigeration. The market size in the base year of 2025 is estimated to be around $XX Billion, with a historical market size of $XX Billion in 2019. These figures highlight a consistent upward trajectory for this vital industrial equipment sector.

Key Markets & Segments Leading North America Centrifugal Compressor Market

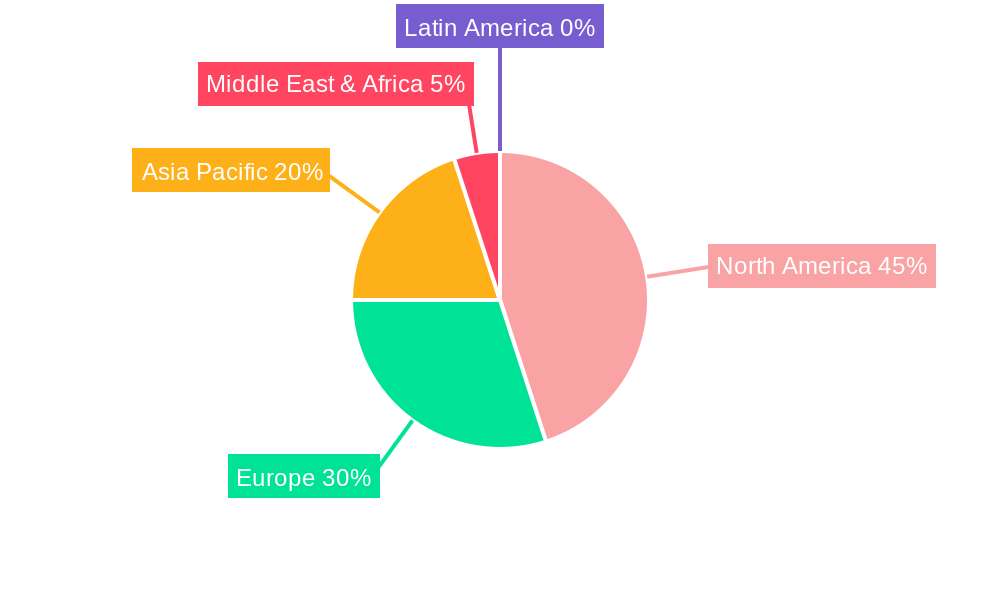

The United States stands as the dominant market within North America, commanding the largest share of the centrifugal compressor market. This leadership is propelled by a mature industrial base, significant investments in the oil and gas sector for both upstream and downstream operations, and a burgeoning power generation industry. The sheer scale of manufacturing, refining, and energy production activities within the US creates an insatiable demand for high-capacity and reliable centrifugal compressors.

- End-User: Oil and Gas: This segment is the primary revenue driver for the North America centrifugal compressor market.

- Drivers: Ongoing exploration and production activities, especially in shale gas plays, require significant compression for natural gas processing and transportation. Expansion of refining capacity and petrochemical complexes also necessitates advanced centrifugal compressors for various chemical processes. The increasing need for efficient gas reinjection and storage further fuels demand.

- End-User: Power Generation: The power generation sector is another crucial segment, driven by the need for efficient and reliable compressed air systems for plant operations, emissions control technologies (like flue gas desulfurization), and turbine drive applications.

- Drivers: The transition to cleaner energy sources, including the expansion of renewable energy infrastructure, and the need to maintain existing fossil fuel power plants contribute to sustained demand. Modernization of older power plants to meet stricter environmental standards also involves upgrading compression systems.

- End-User: Chemical: The chemical industry relies heavily on centrifugal compressors for a wide array of processes, including air separation units, refrigerant compression, and conveying of gases and powders.

- Drivers: Growth in specialty chemicals, pharmaceuticals, and industrial gases production necessitates high-performance and application-specific centrifugal compressor solutions. The increasing demand for various polymers and plastics also indirectly drives the need for compression in their manufacturing processes.

- Geography: Canada: Canada represents a significant market, largely driven by its vast oil and gas reserves, particularly in Alberta.

- Drivers: The extraction and processing of oil sands, natural gas liquefaction (LNG) projects, and the transportation of crude oil and natural gas are major consumers of centrifugal compressors. Investments in infrastructure to support these operations are also key.

- Geography: Rest of North America: This segment, while smaller than the US and Canada individually, collectively represents important markets for centrifugal compressors, often driven by specific industrial niches or regional resource development.

- Drivers: Manufacturing hubs in Mexico and specific industrial activities in other smaller North American economies contribute to demand. Cross-border trade and integrated supply chains also influence demand patterns.

The dominance of the United States is underscored by its extensive industrial infrastructure and the continuous investment in its core energy and manufacturing sectors. The oil and gas industry, in particular, is a voracious consumer of centrifugal compressors, from the extraction of raw materials to their processing and transportation. The robust growth in shale gas production has been a major catalyst, necessitating the deployment of high-capacity compressors for gathering, processing, and pipeline transmission. Furthermore, the chemical sector's demand for process gases and the power generation industry's need for efficient operation and environmental compliance solidify the position of the United States as the leading market.

North America Centrifugal Compressor Market Product Developments

Product developments in the North America centrifugal compressor market are focused on enhancing energy efficiency, reducing operational costs, and improving reliability through advanced engineering and digital integration. Innovations include the introduction of advanced impeller designs for optimized aerodynamics, variable speed drives (VSDs) for precise flow control and reduced energy consumption, and sophisticated sealing technologies to minimize leakage and maintenance requirements. The integration of IoT sensors and AI-powered analytics is leading to the development of smart compressors capable of predictive maintenance, remote diagnostics, and performance optimization. These advancements are crucial for applications in the demanding oil and gas, power generation, and chemical industries, offering competitive advantages through reduced downtime and lower total cost of ownership.

Challenges in the North America Centrifugal Compressor Market Market

The North America centrifugal compressor market faces several challenges that can impact its growth trajectory. High initial capital investment for centrifugal compressor systems can be a barrier, particularly for small and medium-sized enterprises. Stringent environmental regulations regarding emissions and noise pollution necessitate continuous product development and compliance, adding to manufacturing costs. Supply chain disruptions for critical components, exacerbated by geopolitical factors and global economic fluctuations, can lead to project delays and increased lead times. Intense competition from established players and emerging manufacturers, especially in price-sensitive segments, puts pressure on profit margins. The availability of skilled labor for installation, operation, and maintenance of complex centrifugal compressor systems is also a growing concern, requiring significant investment in training and development.

Forces Driving North America Centrifugal Compressor Market Growth

Several key forces are driving the growth of the North America centrifugal compressor market. Increasing demand for energy from growing economies and industrial sectors is a fundamental driver. Technological advancements leading to more energy-efficient and reliable compressors are crucial for meeting operational demands and environmental regulations. Government initiatives and incentives promoting industrial expansion and energy efficiency also play a significant role. The expansion of the oil and gas sector, particularly in shale gas production and processing, continues to be a major demand generator. Furthermore, the growth of the chemical industry and the need for compressed air in various manufacturing processes are contributing to sustained market expansion.

Challenges in the North America Centrifugal Compressor Market Market

While growth is robust, long-term challenges exist. The aging infrastructure in some industrial sectors may require significant upgrades, presenting opportunities but also demanding substantial investment. The increasing focus on decarbonization and sustainability presents a challenge for traditional compressor technologies, pushing for the development of greener alternatives or enhanced efficiency in existing systems. The fluctuation in commodity prices, particularly for oil and gas, can directly impact capital expenditure in those sectors, influencing compressor demand. Geopolitical uncertainties and trade policies can disrupt global supply chains and impact market access. The need for continuous innovation to stay ahead of technological curves and evolving customer expectations is paramount for long-term success.

Emerging Opportunities in North America Centrifugal Compressor Market

Emerging opportunities in the North America centrifugal compressor market lie in several key areas. The growing adoption of renewable energy sources and the development of associated infrastructure, such as hydrogen production and carbon capture, utilization, and storage (CCUS) technologies, will create new demand for specialized centrifugal compressors. The digitalization of industries and the increasing implementation of Industry 4.0 solutions offer opportunities for smart, connected compressor systems with advanced analytics and predictive maintenance capabilities. The expansion of industrial gas applications, including nitrogen and oxygen production for healthcare and manufacturing, presents a consistent growth avenue. Furthermore, the revitalization of manufacturing sectors in North America, driven by reshoring initiatives, is expected to boost demand for industrial air solutions, including centrifugal compressors. The development of more compact and modular compressor designs for niche applications and distributed industrial facilities also presents an attractive opportunity.

Leading Players in the North America Centrifugal Compressor Market Sector

- Atlas Copco Ltd

- Ingersoll-Rand plc

- General Electric Company

- Kaeser Compressors Inc

- Bauer Compressors Inc

- Hitachi Ltd

- Gardner Denver Inc

- Boge Compressors Ltd

- Campbell Hausfeld LLC

Key Milestones in North America Centrifugal Compressor Market Industry

- 2019: Increased focus on smart compressor technologies and predictive maintenance solutions.

- 2020: Impact of global supply chain disruptions on production and delivery timelines.

- 2021: Growing demand for energy-efficient compressors driven by environmental regulations.

- 2022: Significant investments in the oil and gas sector, boosting demand for high-capacity compressors.

- 2023: Advancements in AI and IoT integration for enhanced compressor performance monitoring.

- 2024: Increased adoption of variable speed drives (VSDs) for improved energy savings.

- 2025 (Base Year): Estimated market value of $XX Billion, with strong growth projected from the energy and chemical sectors.

- Ongoing (2019-2033): Continuous development of quieter and more environmentally friendly compressor designs.

- Ongoing (2019-2033): Strategic M&A activities focused on technology acquisition and market expansion.

- Ongoing (2019-2033): Expansion of centrifugal compressor applications in emerging industries like green hydrogen production.

Strategic Outlook for North America Centrifugal Compressor Market Market

The strategic outlook for the North America centrifugal compressor market is overwhelmingly positive, driven by sustained industrial activity and technological innovation. Growth accelerators will include the increasing adoption of advanced digital solutions for smart manufacturing and predictive maintenance, significantly enhancing operational efficiency and reducing lifecycle costs. The ongoing transition towards cleaner energy sources, including the development of hydrogen infrastructure and CCUS, will unlock new avenues for specialized centrifugal compressor applications. Furthermore, the trend of reshoring manufacturing in North America will further stimulate demand for reliable industrial air solutions. Strategic partnerships between compressor manufacturers and technology providers, focusing on integrated solutions and data analytics, will be crucial for capturing market share. Companies that prioritize energy efficiency, environmental compliance, and customer-centric innovation will be best positioned for long-term success in this dynamic market.

North America Centrifugal Compressor Market Segmentation

-

1. End-User

- 1.1. Oil and Gas

- 1.2. Power Generation

- 1.3. Chemical

- 1.4. Others

-

2. Geogrpahy

- 2.1. The United States

- 2.2. Canada

- 2.3. Rest of North America

North America Centrifugal Compressor Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Centrifugal Compressor Market Regional Market Share

Geographic Coverage of North America Centrifugal Compressor Market

North America Centrifugal Compressor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Replacement of Existing Grids and the Expansion of Distribution Networks

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Costs

- 3.4. Market Trends

- 3.4.1. Oil and Gas Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Centrifugal Compressor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Oil and Gas

- 5.1.2. Power Generation

- 5.1.3. Chemical

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 5.2.1. The United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Boge Compressors Ltd*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bauer Compressors Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gardner Denver Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ingersoll-Rand plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kaeser Compressors Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Campbell Hausfeld LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Atlas Copco Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Boge Compressors Ltd*List Not Exhaustive

List of Figures

- Figure 1: North America Centrifugal Compressor Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Centrifugal Compressor Market Share (%) by Company 2025

List of Tables

- Table 1: North America Centrifugal Compressor Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 2: North America Centrifugal Compressor Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 3: North America Centrifugal Compressor Market Revenue undefined Forecast, by Geogrpahy 2020 & 2033

- Table 4: North America Centrifugal Compressor Market Volume K Unit Forecast, by Geogrpahy 2020 & 2033

- Table 5: North America Centrifugal Compressor Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: North America Centrifugal Compressor Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: North America Centrifugal Compressor Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 8: North America Centrifugal Compressor Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 9: North America Centrifugal Compressor Market Revenue undefined Forecast, by Geogrpahy 2020 & 2033

- Table 10: North America Centrifugal Compressor Market Volume K Unit Forecast, by Geogrpahy 2020 & 2033

- Table 11: North America Centrifugal Compressor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: North America Centrifugal Compressor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States North America Centrifugal Compressor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States North America Centrifugal Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Centrifugal Compressor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Centrifugal Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Centrifugal Compressor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Centrifugal Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Centrifugal Compressor Market?

The projected CAGR is approximately 6.46%.

2. Which companies are prominent players in the North America Centrifugal Compressor Market?

Key companies in the market include Boge Compressors Ltd*List Not Exhaustive, Bauer Compressors Inc, Hitachi Ltd, Gardner Denver Inc, Ingersoll-Rand plc, Kaeser Compressors Inc, Campbell Hausfeld LLC, General Electric Company, Atlas Copco Ltd.

3. What are the main segments of the North America Centrifugal Compressor Market?

The market segments include End-User, Geogrpahy.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Replacement of Existing Grids and the Expansion of Distribution Networks.

6. What are the notable trends driving market growth?

Oil and Gas Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Centrifugal Compressor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Centrifugal Compressor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Centrifugal Compressor Market?

To stay informed about further developments, trends, and reports in the North America Centrifugal Compressor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence