Key Insights

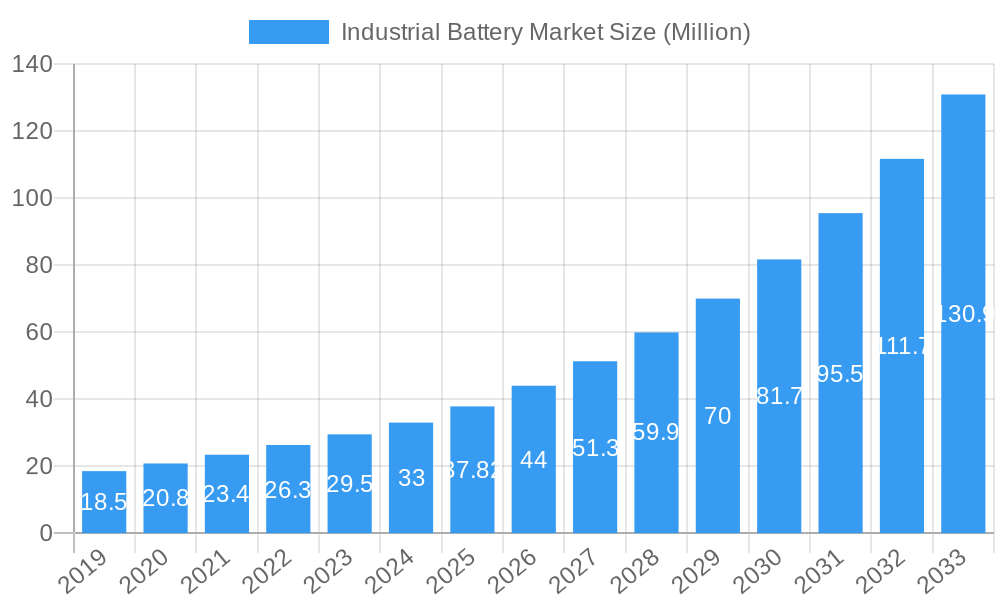

The global Industrial Battery Market is poised for substantial growth, projected to reach a market size of USD 37.82 billion by 2025. This impressive expansion is driven by a Compound Annual Growth Rate (CAGR) of 16.80% over the forecast period (2025-2033). The escalating demand for reliable and efficient energy storage solutions across various industries is a primary catalyst. Notably, the increasing adoption of electric forklifts in logistics and warehousing, coupled with the critical need for uninterrupted power supply in telecom infrastructure and Uninterruptible Power Supply (UPS) systems, are significant drivers. Furthermore, the burgeoning renewable energy sector and the growing focus on energy storage systems (ESS) for grid stabilization and backup power are creating immense opportunities for industrial battery manufacturers.

Industrial Battery Market Market Size (In Million)

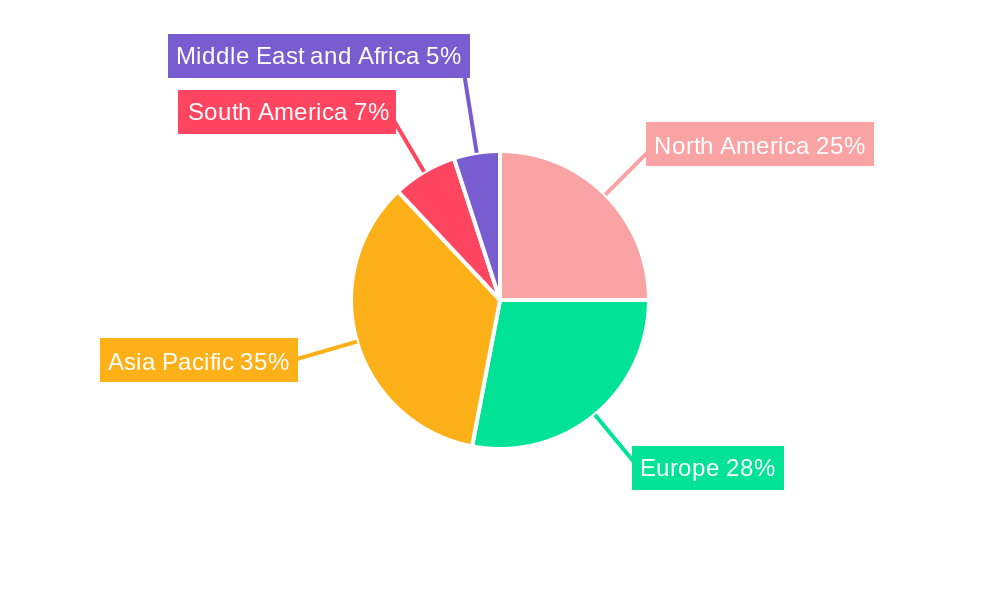

The market is characterized by a strong trend towards advanced battery technologies, with Lithium-ion batteries dominating due to their superior energy density, longer lifespan, and faster charging capabilities compared to traditional Lead-acid batteries. However, Lead-acid batteries continue to hold a significant share, particularly in cost-sensitive applications. The Power Sector, including ESS and UPS, is expected to be the largest end-user segment, followed by the burgeoning Oil & Gas and Manufacturing sectors, all seeking robust energy storage to enhance operational efficiency and reliability. Geographically, the Asia Pacific region, led by China and India, is anticipated to witness the fastest growth due to rapid industrialization and increasing investments in renewable energy infrastructure. North America and Europe remain mature markets with consistent demand driven by technological advancements and stringent regulations promoting energy efficiency.

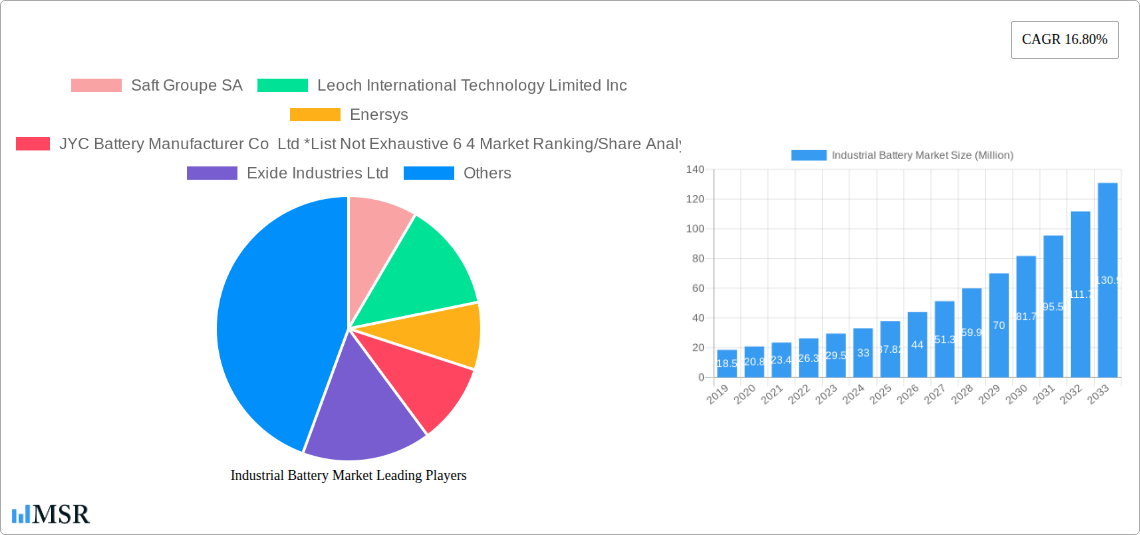

Industrial Battery Market Company Market Share

This comprehensive report delivers an in-depth analysis of the global Industrial Battery Market, a critical sector powering diverse industries worldwide. Covering the historical period from 2019 to 2024, the base and estimated year of 2025, and an extensive forecast period from 2025 to 2033, this research provides actionable insights into market dynamics, technological advancements, and future growth trajectories. With an estimated market size of $XXX Million in 2025 and a projected XX% CAGR, this report is an indispensable resource for manufacturers, suppliers, investors, and policymakers navigating the evolving landscape of industrial batteries.

Industrial Battery Market Market Concentration & Dynamics

The Industrial Battery Market exhibits a moderate to high concentration, with key players like Saft Groupe SA, Leoch International Technology Limited Inc, Enersys, and JYC Battery Manufacturer Co Ltd holding significant market share. Innovation ecosystems are flourishing, driven by escalating demand for energy-efficient and sustainable solutions. Regulatory frameworks are increasingly favoring battery energy storage systems (BESS) due to environmental concerns and grid stability needs. Substitute products, while present, are largely outpaced by the performance and lifecycle advantages of advanced industrial batteries. End-user trends point towards a strong preference for longer-lasting, higher-density power solutions. Mergers and acquisitions (M&A) are a notable feature, with strategic consolidations aimed at expanding product portfolios and geographic reach. For instance, the Enersys expansion in the US motive power market underscores this trend. Market share analysis reveals the dominance of Lithium-ion Battery technology, though Lead-acid Battery continues to hold a strong position in specific applications.

Industrial Battery Market Industry Insights & Trends

The Industrial Battery Market is experiencing robust growth, propelled by several key factors. The escalating need for reliable energy storage systems (ESS) to support renewable energy integration and grid stabilization is a primary driver. The increasing adoption of electric vehicles in industrial settings, particularly forklifts, is further bolstering demand. Furthermore, the burgeoning telecom sector, with its ever-growing data centers and mobile networks, requires continuous and dependable power, making UPS (Uninterruptible Power Supply) solutions indispensable. Technological disruptions are at the forefront, with continuous improvements in Lithium-ion Battery chemistry leading to enhanced energy density, faster charging capabilities, and extended lifespan. While Lead-acid Batteries remain a cost-effective option, their limitations in performance and environmental impact are pushing industries towards newer technologies. Evolving consumer behaviors are characterized by a growing emphasis on sustainability, reduced operational costs, and enhanced operational efficiency, all of which are catered to by advanced industrial battery solutions. The market size is projected to reach $XXX Million by 2033, with a compound annual growth rate (CAGR) of XX%.

Key Markets & Segments Leading Industrial Battery Market

The Industrial Battery Market is witnessing significant growth across various segments and end-user industries, with distinct regional dynamics at play.

Dominant Technology:

- Lithium-ion Battery: This technology is leading the market due to its superior energy density, longer cycle life, faster charging capabilities, and lighter weight compared to traditional alternatives. Its adoption is particularly strong in applications demanding high performance and extended operation. The Power Sector (incl. ESS, UPS, etc.) is a major consumer, leveraging lithium-ion for grid-scale energy storage.

- Lead-acid Battery: Despite the rise of lithium-ion, lead-acid batteries continue to maintain a significant market share, especially in cost-sensitive applications such as forklifts and stationary power backup where initial investment is a key consideration. Their reliability and established recycling infrastructure contribute to their continued relevance.

Dominant Application:

- UPS (Uninterruptible Power Supply): The unwavering demand for continuous power in critical infrastructure, data centers, hospitals, and financial institutions makes UPS a leading application. The Telecom Sector and Manufacturing Sector are significant contributors to this segment's growth.

- Forklift: The electrification of material handling equipment in warehouses, logistics hubs, and manufacturing facilities is a major growth catalyst. The increasing efficiency demands in these industries favor advanced battery solutions for forklifts.

- Other Applications: This includes applications in defense, aerospace, marine, and renewable energy integration systems, all contributing to the diverse demand for industrial batteries.

Dominant End-User Industry:

- Power Sector (incl. ESS, UPS, etc.): This sector is a powerhouse for industrial battery demand, driven by the global transition towards renewable energy sources and the need for grid stability. The development of large-scale Battery Energy Storage Systems (BESS) is a key growth accelerator. The Oil & Gas Sector is also investing in ESS for remote operations and power reliability.

- Telecom: The relentless expansion of mobile networks, 5G deployment, and data center infrastructure necessitates robust and reliable backup power solutions, making the telecom sector a consistent and growing consumer of industrial batteries, particularly for UPS applications.

- Manufacturing Sector: Automation, robotics, and the need for uninterrupted production lines drive the demand for industrial batteries in forklifts, automated guided vehicles (AGVs), and backup power systems within manufacturing plants.

Regional Dominance: While a detailed regional analysis is beyond this summary, North America and Europe are currently leading due to strong governmental support for renewable energy and established industrial infrastructure. However, the Asia-Pacific region is expected to witness the fastest growth due to rapid industrialization, increasing investments in infrastructure, and a growing focus on energy storage solutions.

Industrial Battery Market Product Developments

The Industrial Battery Market is characterized by continuous product innovation aimed at enhancing performance, safety, and sustainability. Key advancements include the development of higher energy-density Lithium-ion Battery chemistries, such as LFP (Lithium Iron Phosphate) and NMC (Nickel Manganese Cobalt), offering improved safety profiles and longer cycle lives. Solid-state battery technology is emerging as a promising next-generation solution, promising even greater safety and energy density. Alongside lithium-ion, advancements in Lead-acid Battery technology, such as enhanced plate designs and electrolyte additives, are improving their performance and lifespan for specific applications. Furthermore, intelligent battery management systems (BMS) are becoming integral, optimizing charging, discharging, and thermal management for extended battery life and operational efficiency. These developments are crucial for meeting the evolving demands of ESS, UPS, and forklift applications.

Challenges in the Industrial Battery Market Market

The Industrial Battery Market faces several significant challenges that impact its growth trajectory. Regulatory hurdles concerning battery disposal and recycling, particularly for hazardous materials, can slow down adoption. Supply chain issues, including the sourcing of critical raw materials like lithium and cobalt, and geopolitical instabilities can lead to price volatility and production delays. Competitive pressures from established and emerging players, coupled with the need for continuous R&D investment, put pressure on profit margins. The high initial cost of advanced battery technologies like lithium-ion can be a barrier for some industries, despite their long-term cost benefits. Furthermore, the need for robust infrastructure for charging and maintenance can pose challenges in certain regions.

Forces Driving Industrial Battery Market Growth

Several powerful forces are propelling the Industrial Battery Market forward. The escalating global demand for energy storage systems (ESS) to support the integration of renewable energy sources like solar and wind power is a paramount driver. Government initiatives and incentives promoting clean energy and electrification are further accelerating market expansion. The growing adoption of electric industrial vehicles, particularly forklifts, in logistics and manufacturing sectors significantly boosts demand. The continuous evolution of Lithium-ion Battery technology, offering higher energy density, faster charging, and longer lifespans, is making batteries more attractive and cost-effective for a wider range of applications. Furthermore, the increasing need for reliable backup power in critical sectors like telecom and data centers, to ensure uninterrupted operations, is a consistent growth catalyst.

Challenges in the Industrial Battery Market Market

The Industrial Battery Market is poised for substantial long-term growth, driven by several key catalysts. Continuous innovation in battery chemistries, including the development of more sustainable and cost-effective materials, will be crucial. Strategic partnerships between battery manufacturers and end-users in sectors like renewable energy and electric vehicles will foster tailor-made solutions. Market expansions into emerging economies with rapidly developing industrial bases and increasing demand for reliable energy infrastructure will open new avenues for growth. The development of advanced recycling technologies to create a circular economy for battery materials will also enhance sustainability and reduce reliance on virgin resources, thus acting as a significant long-term growth catalyst.

Emerging Opportunities in Industrial Battery Market

Emerging opportunities in the Industrial Battery Market are abundant and diverse. The increasing demand for distributed energy storage solutions, particularly for residential and commercial buildings, presents a significant growth area. The development of smart grid technologies and microgrids, which heavily rely on battery storage for grid stability and resilience, offers substantial potential. The growing trend of vehicle-to-grid (V2G) technology, where electric vehicles can provide grid services, opens up new revenue streams for battery owners. Furthermore, the exploration of novel battery chemistries beyond lithium-ion, such as sodium-ion or flow batteries, promises to offer more sustainable and cost-effective alternatives for specific applications. The increasing focus on industrial decarbonization and the electrification of heavy-duty applications also represents a fertile ground for battery innovation and adoption.

Leading Players in the Industrial Battery Market Sector

- Saft Groupe SA

- Leoch International Technology Limited Inc

- Enersys

- JYC Battery Manufacturer Co Ltd

- Exide Industries Ltd

- East Penn Manufacturing Company Inc

- GS Yuasa Corporation

- C&D Technologies Pvt Ltd

- Amar Raja Batteries Ltd

- Panasonic Corporation

Key Milestones in Industrial Battery Market Industry

- January 2023: Oil & Natural Gas Corporation (ONGC) subsidiary, ONGC Tripura Power Company, signed an agreement with Assam Power Distribution Company Limited (APDCL) for a large-scale battery storage project in Assam. The project is worth USD 245 million, and both companies will form a joint venture (JV) to develop a battery energy storage system (BESS) project with up to 250MW rated power output and 500MWh capacity. This development highlights the growing investment in grid-scale energy storage within the Power Sector.

- October 2022: EnerSys, the global leader in stored energy solutions for industrial applications, granted exclusive sales and service rights for all EnerSys motive power products, which includes industrial batteries in the Middle Tennessee Territory, with local offices in Nashville. Through this step, the company aimed to expand its presence in other different parts of the world. Additionally, Industrial Battery & Charger, Inc. (IBCI) was to deploy its team of elite sales associates and certified service technicians to help Enersys in growing its motive power product distribution and awareness. This expansion demonstrates the focus on strengthening distribution networks and global reach for motive power batteries.

Strategic Outlook for Industrial Battery Market Market

The strategic outlook for the Industrial Battery Market is exceptionally positive, characterized by sustained growth and innovation. Key growth accelerators include the accelerating global transition towards renewable energy, necessitating substantial investments in energy storage systems (ESS) for grid stabilization and reliability. The ongoing electrification of industrial equipment, particularly in logistics and manufacturing, will continue to drive demand for high-performance batteries. Furthermore, supportive government policies and regulations promoting clean energy adoption and carbon emission reductions will play a crucial role. The market will also benefit from continuous technological advancements in Lithium-ion Battery technology and the emergence of next-generation battery solutions, improving efficiency and cost-effectiveness. Strategic collaborations and expansions into emerging markets will be vital for players seeking to capitalize on future market potential.

Industrial Battery Market Segmentation

-

1. Technology

- 1.1. Lithium-ion Battery

- 1.2. Lead-acid Battery

- 1.3. Other Te

-

2. Application

- 2.1. Forklift

- 2.2. Telecom

- 2.3. UPS

- 2.4. Other Applications

-

3. End-User Industry

- 3.1. Power Sector (incl. ESS, UPS, etc.)

- 3.2. Oil & Gas Sector

- 3.3. Manufacturing Sector

- 3.4. Telecom

- 3.5. Other End-User Industries

Industrial Battery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Italy

- 2.5. Spain

- 2.6. Nordic Countries

- 2.7. Turkey

- 2.8. Russia

- 2.9. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Malaysis

- 3.6. Indonesia

- 3.7. Thailand

- 3.8. Vietnam

- 3.9. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Chile

- 4.4. Colombia

- 4.5. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Qatar

- 5.4. South Africa

- 5.5. Nigeria

- 5.6. Egypt

- 5.7. Rest of Middle East and Africa

Industrial Battery Market Regional Market Share

Geographic Coverage of Industrial Battery Market

Industrial Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Lithium-ion Battery Prices4.; Rising Renewable Energy Integration Worldwide

- 3.3. Market Restrains

- 3.3.1. 4.; Uncertainty in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Forklift Application Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-acid Battery

- 5.1.3. Other Te

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Forklift

- 5.2.2. Telecom

- 5.2.3. UPS

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Power Sector (incl. ESS, UPS, etc.)

- 5.3.2. Oil & Gas Sector

- 5.3.3. Manufacturing Sector

- 5.3.4. Telecom

- 5.3.5. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Lithium-ion Battery

- 6.1.2. Lead-acid Battery

- 6.1.3. Other Te

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Forklift

- 6.2.2. Telecom

- 6.2.3. UPS

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Power Sector (incl. ESS, UPS, etc.)

- 6.3.2. Oil & Gas Sector

- 6.3.3. Manufacturing Sector

- 6.3.4. Telecom

- 6.3.5. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Lithium-ion Battery

- 7.1.2. Lead-acid Battery

- 7.1.3. Other Te

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Forklift

- 7.2.2. Telecom

- 7.2.3. UPS

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Power Sector (incl. ESS, UPS, etc.)

- 7.3.2. Oil & Gas Sector

- 7.3.3. Manufacturing Sector

- 7.3.4. Telecom

- 7.3.5. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Lithium-ion Battery

- 8.1.2. Lead-acid Battery

- 8.1.3. Other Te

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Forklift

- 8.2.2. Telecom

- 8.2.3. UPS

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Power Sector (incl. ESS, UPS, etc.)

- 8.3.2. Oil & Gas Sector

- 8.3.3. Manufacturing Sector

- 8.3.4. Telecom

- 8.3.5. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Lithium-ion Battery

- 9.1.2. Lead-acid Battery

- 9.1.3. Other Te

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Forklift

- 9.2.2. Telecom

- 9.2.3. UPS

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Power Sector (incl. ESS, UPS, etc.)

- 9.3.2. Oil & Gas Sector

- 9.3.3. Manufacturing Sector

- 9.3.4. Telecom

- 9.3.5. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Lithium-ion Battery

- 10.1.2. Lead-acid Battery

- 10.1.3. Other Te

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Forklift

- 10.2.2. Telecom

- 10.2.3. UPS

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Power Sector (incl. ESS, UPS, etc.)

- 10.3.2. Oil & Gas Sector

- 10.3.3. Manufacturing Sector

- 10.3.4. Telecom

- 10.3.5. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Saft Groupe SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leoch International Technology Limited Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Enersys

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JYC Battery Manufacturer Co Ltd *List Not Exhaustive 6 4 Market Ranking/Share Analysi

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Exide Industries Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 East Penn Manufacturing Company Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GS Yuasa Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 C&D Technologies Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Amar Raja batteries Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Panasonic Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Saft Groupe SA

List of Figures

- Figure 1: Global Industrial Battery Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Industrial Battery Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Industrial Battery Market Revenue (Million), by Technology 2025 & 2033

- Figure 4: North America Industrial Battery Market Volume (K Unit), by Technology 2025 & 2033

- Figure 5: North America Industrial Battery Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Industrial Battery Market Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America Industrial Battery Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Industrial Battery Market Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Industrial Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Industrial Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Industrial Battery Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 12: North America Industrial Battery Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 13: North America Industrial Battery Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 14: North America Industrial Battery Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 15: North America Industrial Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Industrial Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Industrial Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Industrial Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Industrial Battery Market Revenue (Million), by Technology 2025 & 2033

- Figure 20: Europe Industrial Battery Market Volume (K Unit), by Technology 2025 & 2033

- Figure 21: Europe Industrial Battery Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Europe Industrial Battery Market Volume Share (%), by Technology 2025 & 2033

- Figure 23: Europe Industrial Battery Market Revenue (Million), by Application 2025 & 2033

- Figure 24: Europe Industrial Battery Market Volume (K Unit), by Application 2025 & 2033

- Figure 25: Europe Industrial Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 26: Europe Industrial Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 27: Europe Industrial Battery Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 28: Europe Industrial Battery Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 29: Europe Industrial Battery Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Europe Industrial Battery Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 31: Europe Industrial Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Industrial Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Industrial Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Industrial Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Industrial Battery Market Revenue (Million), by Technology 2025 & 2033

- Figure 36: Asia Pacific Industrial Battery Market Volume (K Unit), by Technology 2025 & 2033

- Figure 37: Asia Pacific Industrial Battery Market Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Asia Pacific Industrial Battery Market Volume Share (%), by Technology 2025 & 2033

- Figure 39: Asia Pacific Industrial Battery Market Revenue (Million), by Application 2025 & 2033

- Figure 40: Asia Pacific Industrial Battery Market Volume (K Unit), by Application 2025 & 2033

- Figure 41: Asia Pacific Industrial Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Asia Pacific Industrial Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Asia Pacific Industrial Battery Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 44: Asia Pacific Industrial Battery Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 45: Asia Pacific Industrial Battery Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 46: Asia Pacific Industrial Battery Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 47: Asia Pacific Industrial Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Industrial Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Industrial Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Industrial Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Industrial Battery Market Revenue (Million), by Technology 2025 & 2033

- Figure 52: South America Industrial Battery Market Volume (K Unit), by Technology 2025 & 2033

- Figure 53: South America Industrial Battery Market Revenue Share (%), by Technology 2025 & 2033

- Figure 54: South America Industrial Battery Market Volume Share (%), by Technology 2025 & 2033

- Figure 55: South America Industrial Battery Market Revenue (Million), by Application 2025 & 2033

- Figure 56: South America Industrial Battery Market Volume (K Unit), by Application 2025 & 2033

- Figure 57: South America Industrial Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: South America Industrial Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 59: South America Industrial Battery Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 60: South America Industrial Battery Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 61: South America Industrial Battery Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 62: South America Industrial Battery Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 63: South America Industrial Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 64: South America Industrial Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: South America Industrial Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Industrial Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Industrial Battery Market Revenue (Million), by Technology 2025 & 2033

- Figure 68: Middle East and Africa Industrial Battery Market Volume (K Unit), by Technology 2025 & 2033

- Figure 69: Middle East and Africa Industrial Battery Market Revenue Share (%), by Technology 2025 & 2033

- Figure 70: Middle East and Africa Industrial Battery Market Volume Share (%), by Technology 2025 & 2033

- Figure 71: Middle East and Africa Industrial Battery Market Revenue (Million), by Application 2025 & 2033

- Figure 72: Middle East and Africa Industrial Battery Market Volume (K Unit), by Application 2025 & 2033

- Figure 73: Middle East and Africa Industrial Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 74: Middle East and Africa Industrial Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 75: Middle East and Africa Industrial Battery Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 76: Middle East and Africa Industrial Battery Market Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 77: Middle East and Africa Industrial Battery Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 78: Middle East and Africa Industrial Battery Market Volume Share (%), by End-User Industry 2025 & 2033

- Figure 79: Middle East and Africa Industrial Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Industrial Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Industrial Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Industrial Battery Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Battery Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Global Industrial Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Industrial Battery Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Industrial Battery Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 7: Global Industrial Battery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Industrial Battery Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Industrial Battery Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 11: Global Industrial Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Global Industrial Battery Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Global Industrial Battery Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 15: Global Industrial Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Industrial Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Rest of North America Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of North America Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Industrial Battery Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 24: Global Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 25: Global Industrial Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Global Industrial Battery Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 28: Global Industrial Battery Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 29: Global Industrial Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Industrial Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: United Kingdom Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: United Kingdom Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Nordic Countries Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Nordic Countries Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Turkey Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Turkey Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Russia Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Russia Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Global Industrial Battery Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 50: Global Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 51: Global Industrial Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 52: Global Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 53: Global Industrial Battery Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 54: Global Industrial Battery Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 55: Global Industrial Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Industrial Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 57: China Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: China Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Japan Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: India Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: India Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Australia Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Australia Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Malaysis Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Malaysis Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Indonesia Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Indonesia Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: Thailand Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Thailand Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Vietnam Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Vietnam Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Rest of Asia Pacific Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Rest of Asia Pacific Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Global Industrial Battery Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 76: Global Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 77: Global Industrial Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 78: Global Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 79: Global Industrial Battery Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 80: Global Industrial Battery Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 81: Global Industrial Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 82: Global Industrial Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 83: Brazil Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Brazil Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 85: Argentina Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Argentina Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Chile Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Chile Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Colombia Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Colombia Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 91: Rest of South America Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of South America Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: Global Industrial Battery Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 94: Global Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 95: Global Industrial Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 96: Global Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 97: Global Industrial Battery Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 98: Global Industrial Battery Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 99: Global Industrial Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 100: Global Industrial Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 101: United Arab Emirates Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: United Arab Emirates Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 103: Saudi Arabia Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Saudi Arabia Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 105: Qatar Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 106: Qatar Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 107: South Africa Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 108: South Africa Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 109: Nigeria Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 110: Nigeria Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 111: Egypt Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 112: Egypt Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 113: Rest of Middle East and Africa Industrial Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 114: Rest of Middle East and Africa Industrial Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Battery Market?

The projected CAGR is approximately 16.80%.

2. Which companies are prominent players in the Industrial Battery Market?

Key companies in the market include Saft Groupe SA, Leoch International Technology Limited Inc, Enersys, JYC Battery Manufacturer Co Ltd *List Not Exhaustive 6 4 Market Ranking/Share Analysi, Exide Industries Ltd, East Penn Manufacturing Company Inc, GS Yuasa Corporation, C&D Technologies Pvt Ltd, Amar Raja batteries Ltd, Panasonic Corporation.

3. What are the main segments of the Industrial Battery Market?

The market segments include Technology, Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.82 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Lithium-ion Battery Prices4.; Rising Renewable Energy Integration Worldwide.

6. What are the notable trends driving market growth?

Forklift Application Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Uncertainty in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

January 2023: Oil & Natural Gas Corporation (ONGC) subsidiary, ONGC Tripura Power Company, signed an agreement with Assam Power Distribution Company Limited (APDCL) for a large-scale battery storage project in Assam. The project is worth USD 245 million, and both companies will form a joint venture (JV) to develop a battery energy storage system (BESS) project with up to 250MW rated power output and 500MWh capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Battery Market?

To stay informed about further developments, trends, and reports in the Industrial Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence