Key Insights

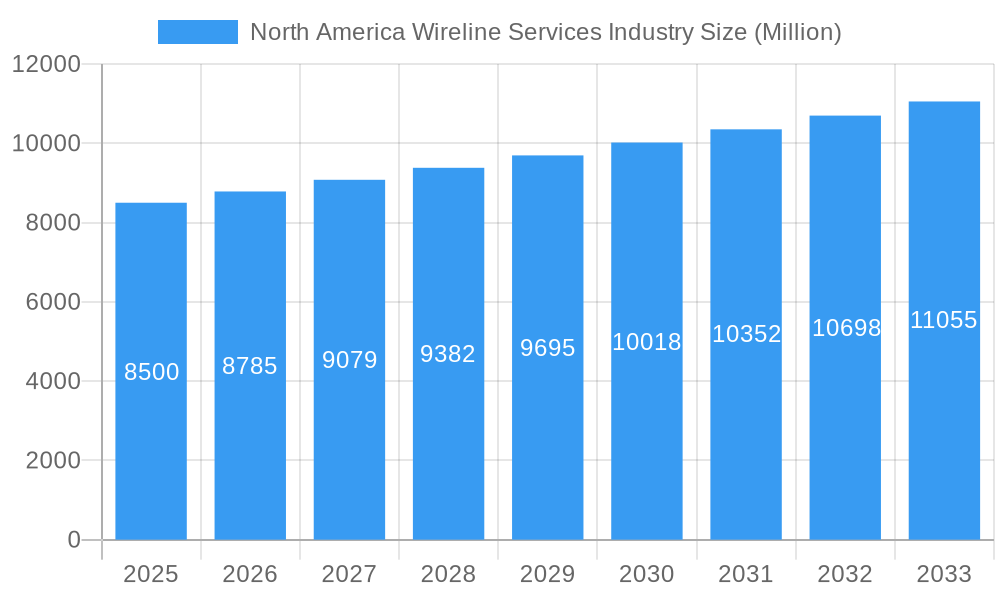

The North America Wireline Services Industry is projected for substantial growth, anticipated to reach a market size of USD 10.83 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.18% through the forecast period of 2025-2033. This expansion is driven by escalating oil and gas exploration and production activities across the region. Key growth catalysts include the development of unconventional resources, such as shale plays, which require advanced wireline services for well intervention, logging, and completion. Technological advancements in digital logging tools and data analytics are also enhancing operational efficiency and reservoir characterization, further stimulating demand for these specialized services. The industry benefits from the strategic focus on maximizing production from mature fields through Enhanced Oil Recovery (EOR) techniques, which heavily rely on precise wireline operations.

North America Wireline Services Industry Market Size (In Billion)

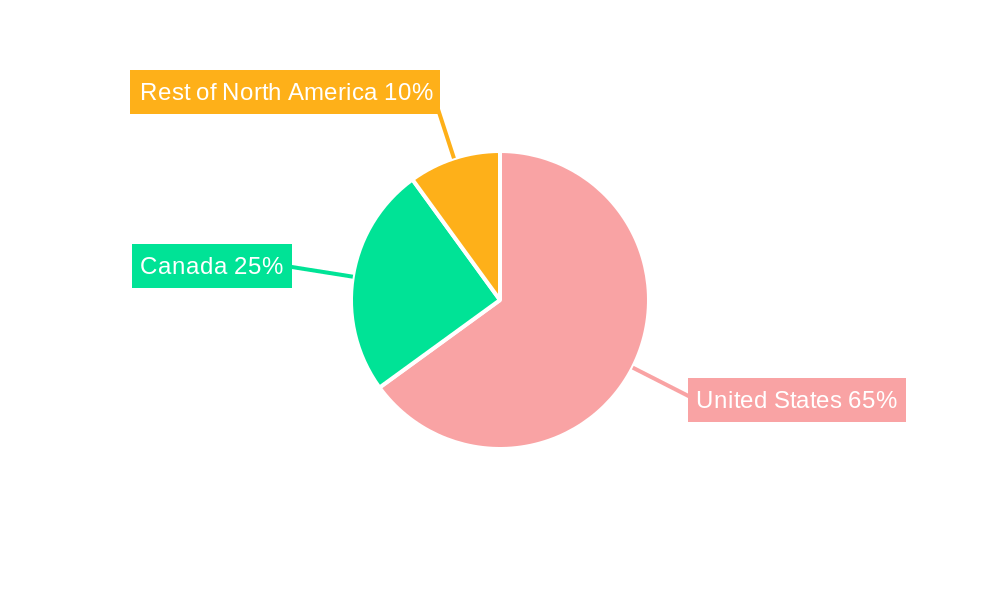

The market is segmented by Electric Line and Slick Line services, serving both Open Hole and Cased Hole environments. Onshore deployments currently dominate, reflecting the extensive land-based reserves in North America. Offshore operations are expected to see significant growth, particularly in the Gulf of Mexico and the Canadian Arctic, as exploration ventures into deeper waters. The United States leads the market share, driven by its prominent oil and gas production, followed by Canada, with other North American regions also contributing consistently. Leading companies such as Schlumberger Limited, Baker Hughes Company, and Halliburton Company are investing in R&D and expanding service portfolios to meet evolving industry demands, focusing on innovation in real-time data acquisition and artificial lift optimization.

North America Wireline Services Industry Company Market Share

This comprehensive report provides a strategic analysis of the North America Wireline Services Industry, detailing its current status, growth drivers, challenges, and future outlook. It examines the dynamics of electric line and slick line services across onshore and offshore applications in the United States, Canada, and the Rest of North America. This research is vital for stakeholders aiming to leverage emerging opportunities and navigate market complexities. The study period spans from 2019 to 2033, with a base year of 2025, offering robust forecasts and actionable insights for strategic decision-making in the oil and gas wireline sector.

North America Wireline Services Industry Market Concentration & Dynamics

The North America wireline services market exhibits a moderate to high degree of concentration, with Schlumberger Limited, Halliburton Company, and Baker Hughes Company holding significant market share. These oilfield service companies invest heavily in R&D and possess extensive operational capabilities, influencing market dynamics and competitive landscapes. Innovation ecosystems are driven by the continuous demand for improved efficiency, safety, and data acquisition in well logging, completion services, and production optimization. Regulatory frameworks, primarily concerning environmental protection and operational safety, are increasingly stringent, impacting operational costs and technology adoption. Substitute products, such as coiled tubing services, offer alternative solutions for certain well interventions, albeit with distinct advantages and limitations. End-user trends are shifting towards demand for integrated solutions, advanced analytics, and services that support enhanced oil recovery (EOR) and unconventional resource development. Merger and acquisition (M&A) activities are prevalent as major players seek to consolidate market position, acquire specialized technologies, and expand geographical reach. Notable M&A activities include the acquisition of wireline assets by Caliber Completion Services, LLC, demonstrating consolidation within the industry. The overall market is characterized by a dynamic interplay of established giants and agile niche players.

North America Wireline Services Industry Industry Insights & Trends

The North America Wireline Services Industry is poised for significant growth, projected to reach an estimated market size of $25,000 Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.2% forecasted from 2025 to 2033. This expansion is primarily fueled by a confluence of factors including sustained upstream investment in the oil and gas sector, the ongoing development of complex shale plays in the United States, and the increasing demand for sophisticated downhole data acquisition and well intervention services. Technological disruptions are at the forefront, with advancements in fiber optic sensing, digital logging tools, and robotics revolutionizing data quality, operational efficiency, and safety protocols. The increasing adoption of these advanced wireline technologies enables operators to gain deeper insights into reservoir performance, optimize production, and mitigate operational risks more effectively. Evolving consumer behaviors, or rather end-user preferences within the oil and gas industry, are leaning towards service providers offering integrated, data-driven solutions that deliver measurable economic benefits and support environmental, social, and governance (ESG) initiatives. The push for decarbonization is also indirectly influencing wireline services, with increased demand for technologies supporting carbon capture, utilization, and storage (CCUS) projects and the monitoring of geothermal wells. Furthermore, the ongoing need for efficient exploration and production (E&P) activities, coupled with the drive to maximize recovery from existing and mature fields, will continue to be a primary market growth driver. The electric line services segment, crucial for high-resolution logging and formation evaluation, is expected to witness substantial growth, while slick line services will remain vital for routine operations and well interventions. The integration of artificial intelligence (AI) and machine learning (ML) in data analysis is also a significant trend, enabling predictive maintenance and optimizing intervention strategies, further enhancing the value proposition of wireline services.

Key Markets & Segments Leading North America Wireline Services Industry

The United States stands as the dominant market within the North America Wireline Services Industry, driven by its vast unconventional resource base and continuous exploration and production activities. This dominance is further amplified by the robust demand for both onshore and offshore wireline services, catering to diverse geological formations and operational environments. Within the segments, Electric Line services are particularly influential due to their critical role in high-resolution formation evaluation, wellbore imaging, and production logging, essential for optimizing extraction from complex reservoirs.

Dominant Geography: United States

- Drivers: Extensive shale oil and gas reserves, ongoing exploration of mature and frontier basins, significant investment in infrastructure, and a mature oilfield services ecosystem.

- The United States market is characterized by a high volume of well completions and interventions, necessitating sophisticated wireline solutions for efficient data acquisition and wellbore management. The Permian Basin, Eagle Ford Shale, and Bakken Shale regions are significant demand centers.

Dominant Deployment: Onshore

- Drivers: The sheer scale of onshore oil and gas production, particularly in shale formations, makes this the largest deployment segment. Cost-effectiveness and accessibility are key advantages.

- Onshore wireline services are crucial for drilling, completion, and production phases in vast land-based fields. The development of advanced electric line and slick line tools designed for challenging onshore conditions further cements its leadership.

Dominant Hole Type: Open Hole

- Drivers: Essential for initial formation evaluation during the drilling phase, providing critical data for reservoir characterization and wellbore placement.

- Open Hole logging services are fundamental for understanding reservoir properties such as porosity, permeability, and fluid content, guiding drilling decisions and completion strategies.

Dominant Service Type: Electric Line

- Drivers: Superior data acquisition capabilities, high resolution, and the ability to deploy complex downhole tools for logging, perforating, and setting completion equipment.

- The increasing complexity of wells, including horizontal drilling and multi-stage fracturing, necessitates the precision and advanced capabilities offered by electric line services.

While Canada also represents a significant market, particularly for offshore operations in the Atlantic and Arctic regions, and Cased Hole services are vital for the integrity and production optimization of existing wells, the sheer volume and technological sophistication of activity in the United States position it as the leading force. The Rest of North America, comprising Mexico, contributes to the overall market but with a lesser impact compared to the two major economies.

North America Wireline Services Industry Product Developments

Product innovations in the North America Wireline Services Industry are focused on enhancing data acquisition, operational efficiency, and safety. Advancements in fiber optic sensing are enabling continuous, real-time monitoring of downhole conditions, providing crucial insights for production optimization and integrity management. The development of more compact, robust, and intelligent logging tools for both electric line and slick line operations allows for deeper penetration into complex formations and faster data transmission. Emerging technologies include AI-powered data interpretation platforms and robotic solutions for remote operations, minimizing human exposure to hazardous environments. These developments offer significant competitive advantages by improving accuracy, reducing intervention times, and lowering operational costs for oil and gas operators.

Challenges in the North America Wireline Services Industry Market

The North America Wireline Services Industry faces several significant challenges. Regulatory hurdles, including stricter environmental compliance and safety standards, increase operational costs and necessitate continuous investment in compliant technologies. Supply chain disruptions, as experienced in recent years, can lead to delays in equipment availability and impact project timelines. Intense competitive pressures among numerous service providers, particularly for commoditized services, can lead to price erosion and impact profitability. Furthermore, the volatile price of crude oil and natural gas directly influences exploration and production budgets, thereby affecting demand for wireline services. The ongoing energy transition and increasing scrutiny on the fossil fuel industry also present long-term strategic challenges.

Forces Driving North America Wireline Services Industry Growth

Several key forces are driving the growth of the North America Wireline Services Industry. The sustained global demand for energy, particularly from unconventional resources in the United States and Canada, ensures continued upstream investment. Technological advancements in wireline logging tools, completion technologies, and data analytics are enabling operators to unlock new reserves and optimize production from existing fields. The need for enhanced oil recovery (EOR) techniques, often facilitated by sophisticated wireline interventions, is also a significant growth driver. Government policies supporting domestic energy production and infrastructure development further contribute to market expansion. The increasing focus on operational efficiency and cost reduction by E&P companies also favors providers of advanced and integrated wireline solutions.

Challenges in the North America Wireline Services Industry Market

Long-term growth catalysts for the North America Wireline Services Industry are centered on innovation and adaptation. The increasing complexity of hydrocarbon reservoirs, including deepwater and ultra-deepwater prospects, necessitates the development and deployment of cutting-edge wireline technologies capable of operating under extreme conditions. Partnerships and collaborations between wireline service providers and technology developers are crucial for accelerating the pace of innovation. Market expansions into emerging unconventional plays and the increasing demand for wireline services in geothermal energy and carbon capture projects present new avenues for growth. Furthermore, the adoption of digital transformation strategies, including the integration of IoT and AI, will be critical for enhancing service delivery and creating new value propositions for clients.

Emerging Opportunities in North America Wireline Services Industry

Emerging opportunities in the North America Wireline Services Industry are diverse and promising. The growing interest in geothermal energy presents a new market for well intervention and logging services, leveraging existing expertise. The expansion of carbon capture, utilization, and storage (CCUS) projects requires specialized wireline services for well integrity monitoring and injection well management. Advancements in remote sensing and autonomous wireline operations offer significant potential for reducing operational costs and improving safety, particularly in challenging or remote locations. Furthermore, the increasing demand for real-time data analytics and predictive maintenance solutions is creating opportunities for service providers to offer value-added services beyond traditional wireline operations. The development of more environmentally friendly wireline fluids and techniques also presents a growing niche.

Leading Players in the North America Wireline Services Industry Sector

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International Plc

- Expro Group

- Superior Energy Services Inc

- Nextier Oilfield Solutions Inc

- SGS SA

- Pioneer Energy Services Corp

- Recon Petrotechnologies Ltd

Key Milestones in North America Wireline Services Industry Industry

- Q3 2022: Schlumberger was awarded multiple scopes for an enhanced oil recovery pilot project by Denbury Onshore, LLC. The award covers downhole logging, coring and core laboratory analysis, downhole completions equipment, electric submersible REDA pumps configured to handle a high concentration of CO2 in the produced fluids, and permanent distributed temperature and acoustic sensing using Optiq Schlumberger fiber-optic solutions. This milestone highlights the growing demand for integrated EOR solutions and advanced monitoring technologies.

- Q3 2022: BP Canada Energy Group ULC (bp) awarded Schlumberger an integrated well construction and evaluation contract for its Ephesus deepwater exploration well in Canada offshore. The contract is scheduled to commence in 2023 and includes well construction and reservoir evaluation products and services. This significant award underscores the continued importance of offshore exploration and the need for comprehensive wireline expertise in challenging deepwater environments.

- May 2022: Caliber Completion Services, LLC acquired substantially all the wireline assets from ClearWell Dynamics, LLC's subsidiary, formerly known as Pioneer Wireline Services, LLC. This acquisition signifies consolidation within the market, reflecting a strategic move to enhance service capabilities and market reach, potentially leading to more streamlined offerings and increased efficiency.

Strategic Outlook for North America Wireline Services Industry Market

The strategic outlook for the North America Wireline Services Industry is one of sustained growth and evolution, driven by ongoing energy demand and technological innovation. Key growth accelerators include the continued exploitation of unconventional resources, particularly in the United States, and the increasing demand for sophisticated well intervention and formation evaluation services. The industry's ability to adapt to the energy transition by offering solutions for new energy sectors like geothermal and CCUS will be crucial. Strategic opportunities lie in developing and deploying advanced digital solutions, including AI-powered analytics and remote operational capabilities, to enhance efficiency and deliver greater value to clients. Furthermore, strategic partnerships and acquisitions will continue to shape the competitive landscape, allowing companies to consolidate expertise, expand service portfolios, and strengthen their market positions in this dynamic and essential sector of the energy industry.

North America Wireline Services Industry Segmentation

-

1. Type

- 1.1. Electric Line

- 1.2. Slick Line

-

2. Hole Type

- 2.1. Open Hole

- 2.2. Cased Hole

-

3. Deployment

- 3.1. Onshore

- 3.2. Offshore

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Rest of North America

North America Wireline Services Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Wireline Services Industry Regional Market Share

Geographic Coverage of North America Wireline Services Industry

North America Wireline Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Wireline Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electric Line

- 5.1.2. Slick Line

- 5.2. Market Analysis, Insights and Forecast - by Hole Type

- 5.2.1. Open Hole

- 5.2.2. Cased Hole

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. Onshore

- 5.3.2. Offshore

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Wireline Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Electric Line

- 6.1.2. Slick Line

- 6.2. Market Analysis, Insights and Forecast - by Hole Type

- 6.2.1. Open Hole

- 6.2.2. Cased Hole

- 6.3. Market Analysis, Insights and Forecast - by Deployment

- 6.3.1. Onshore

- 6.3.2. Offshore

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Wireline Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Electric Line

- 7.1.2. Slick Line

- 7.2. Market Analysis, Insights and Forecast - by Hole Type

- 7.2.1. Open Hole

- 7.2.2. Cased Hole

- 7.3. Market Analysis, Insights and Forecast - by Deployment

- 7.3.1. Onshore

- 7.3.2. Offshore

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North America Wireline Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Electric Line

- 8.1.2. Slick Line

- 8.2. Market Analysis, Insights and Forecast - by Hole Type

- 8.2.1. Open Hole

- 8.2.2. Cased Hole

- 8.3. Market Analysis, Insights and Forecast - by Deployment

- 8.3.1. Onshore

- 8.3.2. Offshore

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Expro Group

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Superior Energy Services Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Weatherford International Plc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Pioneer Energy Services Corp

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Recon Petrotechnologies Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 SGS SA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Nextier Oilfield Solutions Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Baker Hughes Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Halliburton Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Schlumberger Limited

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Expro Group

List of Figures

- Figure 1: North America Wireline Services Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Wireline Services Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Wireline Services Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Wireline Services Industry Revenue billion Forecast, by Hole Type 2020 & 2033

- Table 3: North America Wireline Services Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 4: North America Wireline Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Wireline Services Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Wireline Services Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: North America Wireline Services Industry Revenue billion Forecast, by Hole Type 2020 & 2033

- Table 8: North America Wireline Services Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 9: North America Wireline Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Wireline Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: North America Wireline Services Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: North America Wireline Services Industry Revenue billion Forecast, by Hole Type 2020 & 2033

- Table 13: North America Wireline Services Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 14: North America Wireline Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America Wireline Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Wireline Services Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: North America Wireline Services Industry Revenue billion Forecast, by Hole Type 2020 & 2033

- Table 18: North America Wireline Services Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 19: North America Wireline Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Wireline Services Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Wireline Services Industry?

The projected CAGR is approximately 5.18%.

2. Which companies are prominent players in the North America Wireline Services Industry?

Key companies in the market include Expro Group, Superior Energy Services Inc, Weatherford International Plc, Pioneer Energy Services Corp, Recon Petrotechnologies Ltd, SGS SA, Nextier Oilfield Solutions Inc, Baker Hughes Company, Halliburton Company, Schlumberger Limited.

3. What are the main segments of the North America Wireline Services Industry?

The market segments include Type, Hole Type, Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.83 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Electric Vehicles.

8. Can you provide examples of recent developments in the market?

Q3 2022: Schlumberger was awarded multiple scopes for an enhanced oil recovery pilot project by Denbury Onshore, LLC. The award covers downhole logging, coring and core laboratory analysis, downhole completions equipment, electric submersible REDA pumps configured to handle a high concentration of CO2 in the produced fluids, and permanent distributed temperature and acoustic sensing using Optiq Schlumberger fiber-optic solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Wireline Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Wireline Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Wireline Services Industry?

To stay informed about further developments, trends, and reports in the North America Wireline Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence