Key Insights

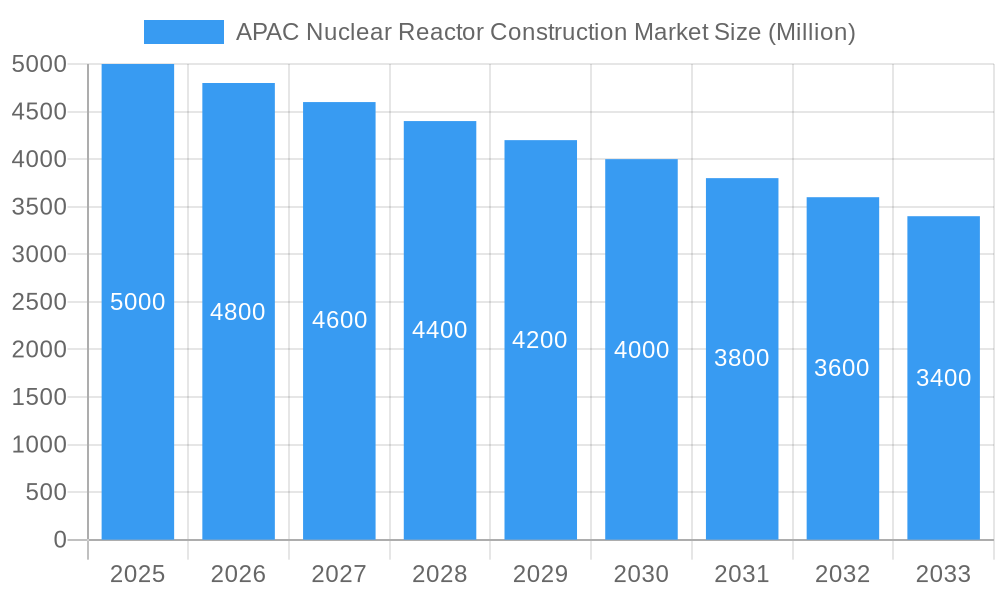

The APAC Nuclear Reactor Construction Market, currently valued at approximately 7.73 billion, is projected to experience a decline with a Compound Annual Growth Rate (CAGR) of 2.47% between the 2025 base year and 2033. This trend is influenced by evolving energy policies, significant capital investment requirements for new builds, and increasing competition from renewable energy sources. While nuclear power remains vital for baseload generation and energy security in the region, high construction costs, extended project timelines, and dynamic regulatory frameworks present challenges. The market is adapting, with a potential shift towards extending the lifespan of existing facilities and exploring Small Modular Reactor (SMR) technologies as a more agile and cost-effective alternative.

APAC Nuclear Reactor Construction Market Market Size (In Billion)

Despite the overall market contraction, specific segments within the APAC Nuclear Reactor Construction Market will exhibit varied performance. Services, including equipment and installation, will remain crucial throughout project lifecycles, though growth will be dictated by the volume of new construction. Historically, Pressurized Water Reactors (PWRs) and Boiling Water Reactors (BWRs) have dominated. However, emerging technologies such as High-temperature Gas-Cooled Reactors (HTGRs) and Liquid Metal Fast Breeder Reactors (LMFBRs) may see initial development, driven by research and energy independence initiatives. China and India are anticipated to remain key players due to ongoing expansion programs, though the pace may be moderated by market trends. The "Rest of Asia-Pacific" region presents a more diverse landscape, with adoption influenced by national energy strategies and investment capabilities. Leading industry players, including Dongfang Electric Corporation, China National Nuclear Corporation, and Westinghouse Electric Company, must adapt through operational efficiency, technological innovation, and strategic partnerships.

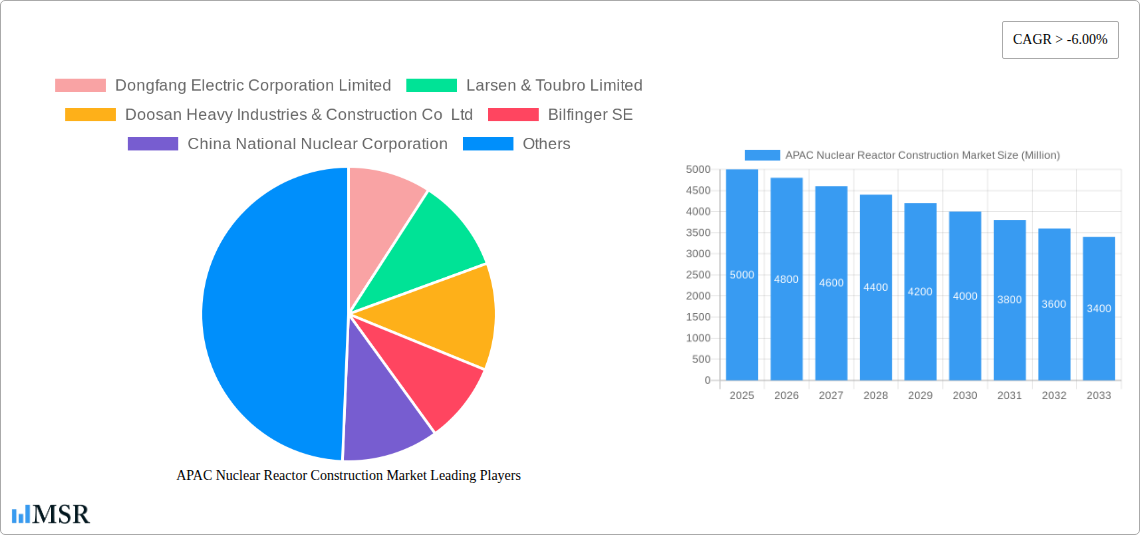

APAC Nuclear Reactor Construction Market Company Market Share

This comprehensive report provides an in-depth analysis of the APAC Nuclear Reactor Construction Market from 2019 to 2033, with 2025 as the base year. It offers detailed market dynamics, industry trends, key segments, and emerging opportunities, crucial for stakeholders navigating the nuclear energy sector in the Asia-Pacific region. The market size is projected to reach an estimated 7.73 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 2.47% during the forecast period of 2025–2033.

APAC Nuclear Reactor Construction Market Market Concentration & Dynamics

The APAC Nuclear Reactor Construction Market exhibits a moderate to high concentration, driven by the significant investments and established expertise of a few key players, alongside the growing participation of regional entities. The innovation ecosystem is rapidly evolving, with a strong emphasis on enhancing reactor safety, improving efficiency, and exploring next-generation technologies such as Small Modular Reactors (SMRs) and advanced reactor designs. Regulatory frameworks across countries like China and India are becoming increasingly streamlined to facilitate new nuclear projects, driven by ambitious energy security and decarbonization goals. However, varying levels of regulatory maturity and public acceptance in different APAC nations present a dynamic landscape. Substitute products, primarily renewable energy sources and fossil fuels, continue to offer competition, but the consistent baseload power provided by nuclear energy remains a critical differentiator. End-user trends are characterized by a strong demand for reliable, carbon-free electricity to meet burgeoning industrial and residential needs. Merger and acquisition (M&A) activities are expected to gain traction as companies seek to consolidate capabilities, expand geographical reach, and acquire technological expertise. Over the historical period (2019-2024), there were approximately 10-15 notable M&A deals within the broader energy infrastructure sector, with a growing number of strategic partnerships forming in the nuclear construction space. The market share is currently dominated by China National Nuclear Corporation and Dongfang Electric Corporation Limited, collectively holding an estimated 40-45% of the market in terms of project pipeline value.

APAC Nuclear Reactor Construction Market Industry Insights & Trends

The APAC Nuclear Reactor Construction Market is poised for significant expansion, propelled by a confluence of factors. The urgent need for reliable, baseload power to fuel rapid economic development and industrialization across the region stands as a primary growth driver. Countries are increasingly prioritizing energy security and reducing reliance on volatile fossil fuel imports, making nuclear power an attractive option. Furthermore, the global imperative to decarbonize energy grids and meet stringent climate targets is accelerating investments in low-carbon energy sources, with nuclear energy playing a crucial role. Technological advancements are revolutionizing reactor designs, focusing on enhanced safety features, modular construction techniques, and improved fuel utilization. The development of Small Modular Reactors (SMRs) is a particularly disruptive trend, offering greater flexibility, reduced upfront costs, and faster deployment timelines, which are highly appealing for the APAC market. Evolving consumer behaviors, while traditionally hesitant towards nuclear energy, are gradually shifting towards acceptance as public awareness campaigns and demonstrable safety records improve. Government policies and regulatory support are crucial enablers, with many APAC nations actively investing in nuclear infrastructure and fostering a conducive environment for construction projects. The market size for nuclear reactor construction in APAC, estimated at USD 48,000 Million in 2024, is projected to experience a robust CAGR of 6.8% from 2025 to 2033, reaching an estimated USD 78,000 Million by the end of the forecast period. This growth is underpinned by a steady pipeline of new reactor builds and significant upgrades to existing nuclear facilities.

Key Markets & Segments Leading APAC Nuclear Reactor Construction Market

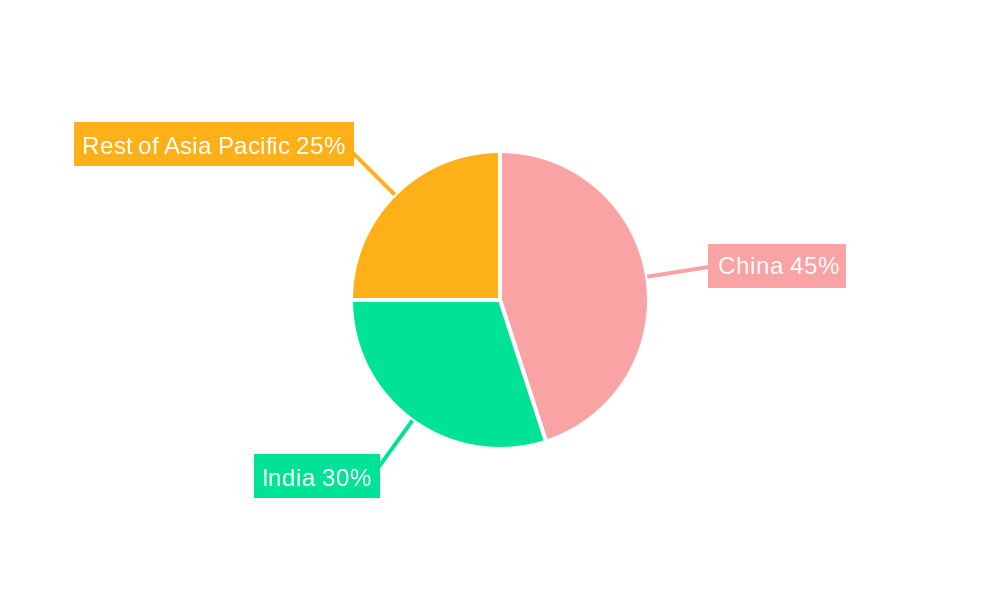

The APAC Nuclear Reactor Construction Market is experiencing dynamic growth, with China emerging as the undisputed leader, driving significant demand across various segments. Its ambitious nuclear expansion program, fueled by the dual objectives of energy independence and carbon emission reduction, accounts for a substantial portion of the global nuclear reactor construction pipeline. The Rest of Asia-Pacific region, encompassing countries like South Korea, Vietnam, and Indonesia, is also showing considerable promise, with ongoing feasibility studies and planned projects.

Dominant Region: China: China's commitment to nuclear power is unparalleled in the APAC region. It possesses a mature domestic supply chain and a strong emphasis on indigenous technological development, including advanced reactor designs. Government policies strongly support nuclear energy as a cornerstone of its future energy mix. The sheer volume of planned and under-construction reactors solidifies China's leading position.

Key Countries within Rest of Asia-Pacific:

- India: With a rapidly growing economy and an increasing energy demand, India is actively pursuing its nuclear energy program. The country focuses on both indigenous Pressurized Heavy Water Reactors (PHWRs) and collaborations for Pressurized Water Reactors (PWRs).

- South Korea: Renowned for its technological prowess, South Korea is a key player in the export of nuclear technology and construction services. It also continues to expand its domestic nuclear fleet.

- Emerging Markets (Vietnam, Indonesia, Thailand): These nations are in various stages of exploring and developing their nuclear power capabilities, presenting significant future growth potential.

Dominant Reactor Type: The Pressurized Water Reactor (PWR) segment is the most prevalent in the APAC market. This is due to its well-established safety record, proven operational efficiency, and widespread technological maturity. PWRs are favored for their ability to provide reliable baseload power, making them ideal for large-scale energy generation needs.

Dominant Service Segment: The Equipment segment within nuclear reactor construction is experiencing immense growth. This includes the manufacturing and supply of critical components such as reactor vessels, steam generators, turbines, and control systems. The robust pipeline of new builds and planned projects necessitates a substantial output of specialized nuclear equipment.

Drivers of Dominance:

- Economic Growth: Rapid industrialization and urbanization in APAC countries are driving unprecedented demand for electricity.

- Energy Security: Reducing reliance on imported fossil fuels and ensuring a stable energy supply are paramount concerns for regional governments.

- Climate Change Mitigation: Nuclear power offers a significant low-carbon energy solution, aligning with global decarbonization efforts.

- Government Support & Investment: Favorable policies, financial incentives, and strategic planning by national governments are crucial enablers for nuclear projects.

- Technological Advancements: Continuous innovation in reactor design, safety systems, and construction methodologies is making nuclear power more efficient and cost-effective.

APAC Nuclear Reactor Construction Market Product Developments

Product developments in the APAC Nuclear Reactor Construction Market are increasingly focused on enhancing safety, efficiency, and sustainability. Innovations in reactor design, such as the development and deployment of Small Modular Reactors (SMRs), are gaining significant traction due to their reduced footprint, lower upfront costs, and enhanced scalability. Advanced fuel technologies are being explored to improve fuel burn-up and reduce waste. Furthermore, digital twin technologies and AI-driven predictive maintenance are being integrated into reactor operations and construction processes to optimize performance and minimize downtime. The market relevance of these developments lies in their ability to address growing energy demands while mitigating environmental concerns and improving economic viability for nuclear projects.

Challenges in the APAC Nuclear Reactor Construction Market Market

The APAC Nuclear Reactor Construction Market faces several critical challenges that could impact its growth trajectory. Stringent regulatory approvals and licensing processes remain a significant hurdle, often leading to project delays and increased costs. Public perception and safety concerns, though improving, can still hinder project development, especially in regions with less established nuclear programs. Supply chain disruptions and the availability of skilled labor pose further challenges, particularly for complex and specialized components and expertise required for nuclear construction. The high upfront capital investment required for nuclear power plants also presents a barrier, necessitating strong government backing and long-term financing strategies.

Forces Driving APAC Nuclear Reactor Construction Market Growth

Several powerful forces are propelling the growth of the APAC Nuclear Reactor Construction Market. The relentless pursuit of energy security by regional nations, seeking to reduce dependence on volatile fossil fuel markets and ensure a stable power supply, is a paramount driver. Simultaneously, the global and regional push towards decarbonization and climate change mitigation positions nuclear power as a vital low-carbon energy source. Rapid economic expansion and industrialization across APAC translate into an ever-increasing demand for electricity, which nuclear power can reliably fulfill. Furthermore, technological advancements in reactor design, particularly the emergence of Small Modular Reactors (SMRs), offer more flexible and cost-effective solutions, making nuclear power more accessible. Favorable government policies and supportive regulatory frameworks in key countries are crucial enablers, encouraging investment and streamlining project development.

Challenges in the APAC Nuclear Reactor Construction Market Market

Beyond immediate hurdles, the APAC Nuclear Reactor Construction Market is influenced by long-term growth catalysts that shape its future trajectory. The increasing focus on advanced reactor technologies, including Generation IV reactors, promises enhanced safety, efficiency, and waste management capabilities, which will be crucial for sustained growth and public acceptance. Strategic partnerships and collaborations between international nuclear expertise providers and local players are fostering knowledge transfer and capacity building, accelerating project execution. Market expansions into emerging economies within the APAC region, driven by their growing energy needs and increasing openness to nuclear power, represent significant long-term opportunities for diversification and sustained demand.

Emerging Opportunities in APAC Nuclear Reactor Construction Market

The APAC Nuclear Reactor Construction Market is ripe with emerging opportunities for innovative companies and strategic investors. The burgeoning demand for Small Modular Reactors (SMRs) presents a significant avenue for growth, offering greater flexibility, reduced costs, and faster deployment compared to traditional large-scale reactors. Furthermore, opportunities exist in the development of advanced fuel cycles and waste management solutions, addressing long-term sustainability concerns associated with nuclear energy. The increasing focus on digitalization and smart technologies in reactor design, construction, and operation offers potential for efficiency gains and enhanced safety. Finally, the potential for nuclear energy to support hydrogen production and other industrial applications opens up new markets and revenue streams for the sector.

Leading Players in the APAC Nuclear Reactor Construction Market Sector

- Dongfang Electric Corporation Limited

- Larsen & Toubro Limited

- Doosan Heavy Industries & Construction Co Ltd

- Bilfinger SE

- China National Nuclear Corporation

- Electricite de France SA (EDF)

- KEPCO Engineering & Construction

- Westinghouse Electric Company LLC (Toshiba)

- Shanghai Electric Group Company Limited

- Rosatom State Nuclear Energy Corporation

- Mitsubishi Heavy Industries Ltd

- GE-Hitachi Nuclear Energy Inc

Key Milestones in APAC Nuclear Reactor Construction Market Industry

- 2020 October: China approves construction of the Zhangzhou nuclear power plant, adding significant capacity to its domestic pipeline.

- 2021 March: India commissions its first indigenous Pressurized Heavy Water Reactor (PHWR) at Kakrapar, showcasing domestic capabilities.

- 2021 August: South Korea's Shin Hanul 1 nuclear reactor connects to the grid, bolstering its clean energy supply.

- 2022 April: Vietnam revives discussions on its stalled nuclear power program, indicating renewed interest.

- 2022 September: China National Nuclear Corporation (CNNC) announces advancements in its Hualong One reactor technology, enhancing safety and efficiency.

- 2023 January: Mitsubishi Heavy Industries Ltd. announces a partnership to explore Small Modular Reactor (SMR) development in Japan.

- 2023 June: Larsen & Toubro Limited secures a major contract for critical equipment supply for a new nuclear power project in India.

- 2023 November: GE-Hitachi Nuclear Energy Inc. collaborates with a regional utility on SMR feasibility studies for the APAC market.

- 2024 February: Rosatom State Nuclear Energy Corporation begins construction of a new nuclear power plant in an undisclosed APAC location, signaling international expansion.

Strategic Outlook for APAC Nuclear Reactor Construction Market Market

The strategic outlook for the APAC Nuclear Reactor Construction Market is exceptionally positive, driven by robust underlying demand and technological advancements. The continued emphasis on energy security and decarbonization will ensure sustained government support and investment in nuclear projects. Strategic opportunities lie in the rapid development and deployment of Small Modular Reactors (SMRs), which can cater to diverse energy needs and smaller grids. Furthermore, fostering domestic manufacturing capabilities and skilled workforce development will be crucial for long-term competitiveness and reduced reliance on external expertise. Collaboration between leading international and regional players will accelerate the adoption of best practices and innovative technologies, paving the way for a significant expansion of nuclear power generation across the Asia-Pacific region.

APAC Nuclear Reactor Construction Market Segmentation

-

1. Service

- 1.1. Equipment

- 1.2. Installation

-

2. Reactor Type

- 2.1. Pressurized Water Reactor

- 2.2. Pressurized Heavy Water Reactor

- 2.3. Boiling Water Reactor

- 2.4. High-temperature Gas Cooled Reactor

- 2.5. Liquid Metal Fast Breeder Reactor

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Rest of Asia-Pacific

APAC Nuclear Reactor Construction Market Segmentation By Geography

- 1. China

- 2. India

- 3. Rest of Asia Pacific

APAC Nuclear Reactor Construction Market Regional Market Share

Geographic Coverage of APAC Nuclear Reactor Construction Market

APAC Nuclear Reactor Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Pressurized Water Reactor to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Equipment

- 5.1.2. Installation

- 5.2. Market Analysis, Insights and Forecast - by Reactor Type

- 5.2.1. Pressurized Water Reactor

- 5.2.2. Pressurized Heavy Water Reactor

- 5.2.3. Boiling Water Reactor

- 5.2.4. High-temperature Gas Cooled Reactor

- 5.2.5. Liquid Metal Fast Breeder Reactor

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. China APAC Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Equipment

- 6.1.2. Installation

- 6.2. Market Analysis, Insights and Forecast - by Reactor Type

- 6.2.1. Pressurized Water Reactor

- 6.2.2. Pressurized Heavy Water Reactor

- 6.2.3. Boiling Water Reactor

- 6.2.4. High-temperature Gas Cooled Reactor

- 6.2.5. Liquid Metal Fast Breeder Reactor

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. India APAC Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Equipment

- 7.1.2. Installation

- 7.2. Market Analysis, Insights and Forecast - by Reactor Type

- 7.2.1. Pressurized Water Reactor

- 7.2.2. Pressurized Heavy Water Reactor

- 7.2.3. Boiling Water Reactor

- 7.2.4. High-temperature Gas Cooled Reactor

- 7.2.5. Liquid Metal Fast Breeder Reactor

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Rest of Asia Pacific APAC Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Equipment

- 8.1.2. Installation

- 8.2. Market Analysis, Insights and Forecast - by Reactor Type

- 8.2.1. Pressurized Water Reactor

- 8.2.2. Pressurized Heavy Water Reactor

- 8.2.3. Boiling Water Reactor

- 8.2.4. High-temperature Gas Cooled Reactor

- 8.2.5. Liquid Metal Fast Breeder Reactor

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Dongfang Electric Corporation Limited

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Larsen & Toubro Limited

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Doosan Heavy Industries & Construction Co Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Bilfinger SE

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 China National Nuclear Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Electricite de France SA (EDF)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 KEPCO Engineering & Construction

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Westinghouse Electric Company LLC (Toshiba)

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Shanghai Electric Group Company Limited

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Rosatom State Nuclear Energy Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Mitsubishi Heavy Industries Ltd

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 GE-Hitachi Nuclear Energy Inc

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Dongfang Electric Corporation Limited

List of Figures

- Figure 1: Global APAC Nuclear Reactor Construction Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China APAC Nuclear Reactor Construction Market Revenue (billion), by Service 2025 & 2033

- Figure 3: China APAC Nuclear Reactor Construction Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: China APAC Nuclear Reactor Construction Market Revenue (billion), by Reactor Type 2025 & 2033

- Figure 5: China APAC Nuclear Reactor Construction Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 6: China APAC Nuclear Reactor Construction Market Revenue (billion), by Geography 2025 & 2033

- Figure 7: China APAC Nuclear Reactor Construction Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China APAC Nuclear Reactor Construction Market Revenue (billion), by Country 2025 & 2033

- Figure 9: China APAC Nuclear Reactor Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: India APAC Nuclear Reactor Construction Market Revenue (billion), by Service 2025 & 2033

- Figure 11: India APAC Nuclear Reactor Construction Market Revenue Share (%), by Service 2025 & 2033

- Figure 12: India APAC Nuclear Reactor Construction Market Revenue (billion), by Reactor Type 2025 & 2033

- Figure 13: India APAC Nuclear Reactor Construction Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 14: India APAC Nuclear Reactor Construction Market Revenue (billion), by Geography 2025 & 2033

- Figure 15: India APAC Nuclear Reactor Construction Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India APAC Nuclear Reactor Construction Market Revenue (billion), by Country 2025 & 2033

- Figure 17: India APAC Nuclear Reactor Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue (billion), by Service 2025 & 2033

- Figure 19: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue Share (%), by Service 2025 & 2033

- Figure 20: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue (billion), by Reactor Type 2025 & 2033

- Figure 21: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 22: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 3: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 7: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 10: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 11: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 15: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Nuclear Reactor Construction Market?

The projected CAGR is approximately 2.47%.

2. Which companies are prominent players in the APAC Nuclear Reactor Construction Market?

Key companies in the market include Dongfang Electric Corporation Limited, Larsen & Toubro Limited, Doosan Heavy Industries & Construction Co Ltd, Bilfinger SE, China National Nuclear Corporation, Electricite de France SA (EDF), KEPCO Engineering & Construction, Westinghouse Electric Company LLC (Toshiba), Shanghai Electric Group Company Limited, Rosatom State Nuclear Energy Corporation, Mitsubishi Heavy Industries Ltd, GE-Hitachi Nuclear Energy Inc.

3. What are the main segments of the APAC Nuclear Reactor Construction Market?

The market segments include Service, Reactor Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.73 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Pressurized Water Reactor to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Nuclear Reactor Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Nuclear Reactor Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Nuclear Reactor Construction Market?

To stay informed about further developments, trends, and reports in the APAC Nuclear Reactor Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence