Key Insights

The global Floating Production Systems (FPS) market is projected for significant growth, driven by escalating offshore oil and gas exploration and production in deepwater environments. With an estimated market size of $4.3 billion and a Compound Annual Growth Rate (CAGR) of 12.5%, the market is expected to expand considerably from its base year of 2024. This expansion is primarily attributed to the increasing demand for efficient and cost-effective solutions for hydrocarbon extraction from deepwater and ultra-deepwater reserves, where conventional fixed platforms are impractical. The rising global energy demand, coupled with technological advancements in FPS, serves as a key catalyst. Primary growth drivers include ongoing exploration of new offshore fields, the increasing complexity of reservoir characteristics, and the economic viability of marginal fields. Furthermore, the integration of renewable energy sources into FPS operations is gaining traction, contributing to market dynamism.

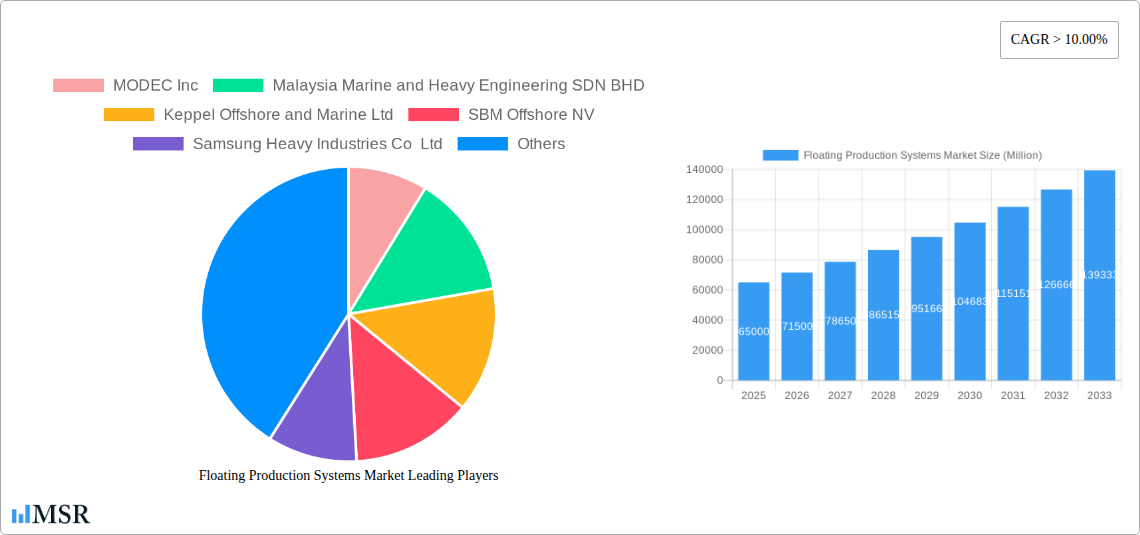

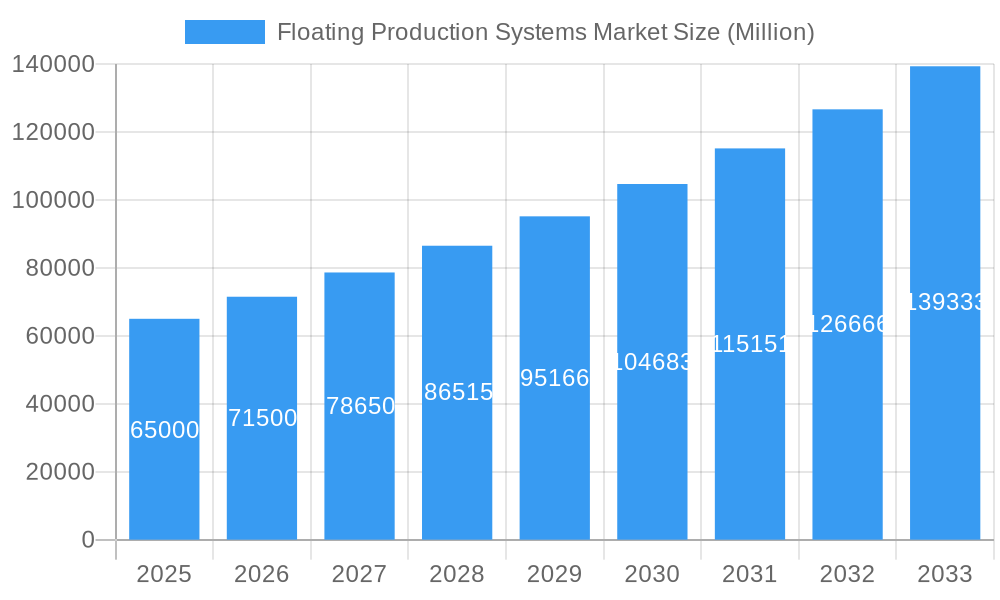

Floating Production Systems Market Market Size (In Billion)

The FPS market encompasses various types, including Floating Production Storage and Offloading (FPSO) units, Tension Leg Platforms (TLP), SPARs, and Barges. FPSOs are anticipated to lead the market due to their adaptability and cost-effectiveness. Growth is particularly strong in the deepwater and ultra-deepwater segments, reflecting the industry's strategic focus on accessing remote and challenging reserves. Despite robust market growth, significant upfront capital expenditure, stringent environmental regulations, and geopolitical uncertainties in certain regions may present challenges. However, ongoing technological innovations, such as modular FPS designs and advancements in subsea processing, are expected to offset these restraints. Leading market participants, including MODEC Inc., SBM Offshore NV, and TechnipFMC PLC, are actively investing in research and development to enhance their offerings and secure market share. The Asia Pacific region, propelled by substantial offshore activities in countries like China and Southeast Asia, is poised to become a dominant market force.

Floating Production Systems Market Company Market Share

Floating Production Systems Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a thorough analysis of the global Floating Production Systems Market, a critical sector for offshore oil and gas exploration and production. With a study period spanning from 2019 to 2033, encompassing a historical analysis (2019-2024), a base year of 2025, and an estimated year of 2025, this research offers unparalleled insights into market dynamics, key players, and future growth trajectories. The market size is projected to reach an impressive USD 45.2 Billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period of 2025-2033. This report is essential for industry stakeholders seeking to understand the evolving landscape of offshore production solutions, including FPSO (Floating Production Storage and Offloading), Tension Leg Platform (TLP), SPAR, and Barge systems, across Shallow Water, Deepwater, and Ultra-deepwater environments.

Floating Production Systems Market Market Concentration & Dynamics

The Floating Production Systems Market exhibits a moderately concentrated landscape, characterized by a few dominant global players and a growing number of specialized engineering, procurement, and construction (EPC) providers. Innovation is a key differentiator, with companies continually investing in advanced technologies to enhance efficiency, safety, and environmental compliance for complex offshore projects. Regulatory frameworks, particularly concerning environmental protection and safety standards, significantly influence market dynamics and drive the adoption of more sophisticated and sustainable solutions. The availability of viable substitute products is limited for highly demanding offshore applications, reinforcing the demand for specialized floating production units. End-user trends are increasingly focused on cost optimization, extended field life, and the ability to operate in challenging environments. Mergers and acquisitions (M&A) activities are prevalent, as larger entities seek to consolidate their market position, acquire new technologies, and expand their geographical reach. Key M&A deals are expected to further shape the competitive environment.

Floating Production Systems Market Industry Insights & Trends

The Floating Production Systems Market is on a robust growth trajectory, driven by the increasing demand for oil and gas from developing economies and the need to access previously uneconomical deepwater and ultra-deepwater reserves. The market size, valued at USD 45.2 Billion in 2025, is expected to witness significant expansion over the forecast period, underpinned by a CAGR of 6.8% from 2025 to 2033. Technological disruptions are playing a pivotal role, with advancements in mooring systems, subsea processing, and digitalization enhancing the operational capabilities and cost-effectiveness of floating production units. Evolving consumer behaviors, particularly the growing emphasis on energy security and the responsible extraction of hydrocarbons, are influencing project development and the type of floating production solutions deployed. The continuous exploration of new offshore fields, coupled with the decommissioning of older platforms, fuels the demand for new FPSO, TLP, and SPAR units. The industry is witnessing a trend towards larger, more complex FPSO vessels capable of handling higher production volumes and a wider range of crude oil types, thereby expanding the potential of the Floating Production Systems Market.

Key Markets & Segments Leading Floating Production Systems Market

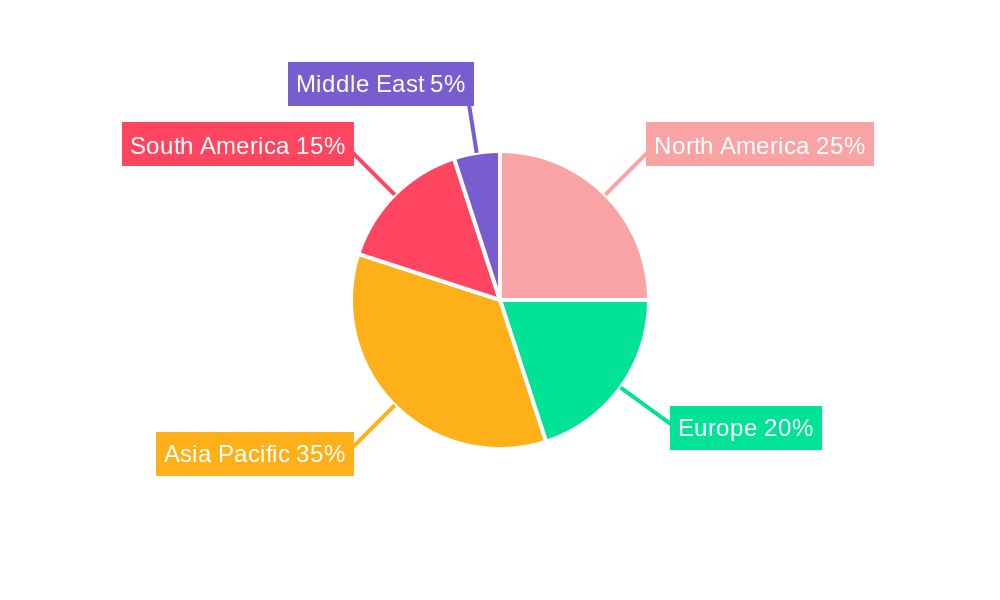

The Floating Production Systems Market is significantly led by regions with extensive offshore hydrocarbon reserves and robust exploration and production activities.

- Dominant Region: Asia-Pacific is emerging as a key driver, fueled by substantial investments in deepwater exploration in countries like China, India, and Southeast Asian nations.

- Country-Specific Dominance: Brazil, with its vast pre-salt discoveries, continues to be a major market for Floating Production, Storage, and Offloading (FPSO) vessels, driving demand for Deepwater and Ultra-deepwater solutions. West Africa also remains a critical region for FPSO deployment.

- Segment Dominance - Type:

- FPSO (Floating Production Storage and Offloading): This segment holds the largest market share due to its versatility, cost-effectiveness for long-term production, and ability to handle complex processing and storage requirements. The demand for larger and more sophisticated FPSOs is a significant trend.

- Tension Leg Platform (TLP): TLPs are crucial for Deepwater applications, offering stable platforms for production operations. Their market presence is strong in regions with consistent deepwater discoveries.

- SPAR: SPAR platforms are ideal for very deep water and harsh environments, offering excellent heave motion characteristics, making them a preferred choice for specific deepwater field developments.

- Barge: While less dominant in new large-scale projects, barge-based solutions continue to find application in shallower waters and for smaller field developments where cost-effectiveness is paramount.

- Segment Dominance - Water Depth:

- Deepwater: This segment is the primary growth engine for the Floating Production Systems Market, driven by the discovery of significant reserves in deep and ultra-deep water basins globally.

- Ultra-deepwater: As exploration technology advances, the ultra-deepwater segment is witnessing increasing investment and development, necessitating highly specialized and robust floating production solutions.

- Shallow Water: While mature, the shallow water segment continues to contribute to the market, particularly with upgrades and smaller field developments, often utilizing FPSO or barge systems.

The economic growth in emerging markets, coupled with ongoing infrastructure development for offshore oil and gas extraction, are key drivers for the dominance of these segments. The increasing technological sophistication and the need to access challenging offshore environments are propelling the demand for advanced floating production systems, especially in deep and ultra-deepwater applications.

Floating Production Systems Market Product Developments

Product innovations in the Floating Production Systems Market are primarily focused on enhancing operational efficiency, reducing costs, and improving environmental sustainability. Recent developments include the design of larger and more modular FPSOs, facilitating faster deployment and adaptability to different field requirements. Advanced mooring systems, subsea processing technologies, and enhanced oil recovery (EOR) techniques are also being integrated into floating production units. The market is also seeing advancements in digitalization and automation, enabling remote monitoring and predictive maintenance, which significantly reduces operational downtime and improves safety. These technological advancements are crucial for the competitive edge of floating production systems in increasingly challenging offshore environments.

Challenges in the Floating Production Systems Market Market

The Floating Production Systems Market faces several challenges. High upfront capital expenditure for the design, fabrication, and installation of floating production units remains a significant barrier. Volatility in global oil prices can impact investment decisions and project timelines, leading to project delays or cancellations. Stringent environmental regulations and permitting processes can also slow down project development. Furthermore, the complexity of deepwater and ultra-deepwater operations, coupled with supply chain constraints for specialized components and skilled labor, presents ongoing operational challenges. Geopolitical risks and the increasing demand for energy transition solutions also pose long-term strategic challenges.

Forces Driving Floating Production Systems Market Growth

Several key forces are driving the growth of the Floating Production Systems Market. The increasing global demand for oil and gas, particularly from emerging economies, necessitates the development of offshore reserves. Technological advancements in exploration and production, such as seismic imaging and subsea technologies, are unlocking previously inaccessible deepwater and ultra-deepwater fields. Supportive government policies and regulatory frameworks in many oil-producing nations encourage offshore exploration and production. The development of more cost-effective and efficient floating production technologies, like advanced FPSOs, is also a significant growth catalyst.

Challenges in the Floating Production Systems Market Market

Long-term growth catalysts for the Floating Production Systems Market are deeply rooted in continued innovation and strategic market expansion. The ongoing pursuit of enhanced oil recovery (EOR) techniques and the development of integrated subsea processing solutions will unlock more reserves and extend the life of existing fields. Partnerships between technology providers, EPC contractors, and oil and gas operators are crucial for developing bespoke solutions for increasingly complex offshore environments. Furthermore, the expansion into frontier offshore basins and the adaptation of floating production technologies for emerging energy sources, such as offshore wind power integration, represent significant long-term growth opportunities.

Emerging Opportunities in Floating Production Systems Market

Emerging opportunities within the Floating Production Systems Market are abundant. The growing focus on decarbonization is driving innovation in carbon capture and storage (CCS) integrated with FPSOs, creating a new market segment. The development of smaller, modular FPSOs designed for marginal fields offers cost-effective solutions for smaller discoveries. Furthermore, the increasing interest in floating wind energy solutions presents an opportunity for diversification, leveraging existing expertise in offshore structures and project management. The demand for floating storage and regasification units (FSRUs) for LNG import is also a burgeoning area.

Leading Players in the Floating Production Systems Market Sector

- MODEC Inc

- Malaysia Marine and Heavy Engineering SDN BHD

- Keppel Offshore and Marine Ltd

- SBM Offshore NV

- Samsung Heavy Industries Co Ltd

- Teekay Corporation

- Hyundai Heavy Industries Co Ltd

- TechnipFMC PLC

- Bumi Armada Berhad

- Mitsubishi Heavy Industries Ltd

Key Milestones in Floating Production Systems Market Industry

- September 2022: Keppel Offshore & Marine secured an engineering, procurement, and construction (EPC) tender from Petrobras for the P-83 FPSO, valued at USD 2.8 billion. This landmark project, scheduled for delivery in the first half of 2027, underscores the significant investment in large-scale FPSO projects.

- November 2022: Exxon Mobil Corp. announced plans to order an additional floating production storage and offloading (FPSO) vessel for its operations in Guyana from SBM Offshore. The signing of a Memorandum of Understanding (MoU) for the construction of this FPSO highlights the strategic importance of Guyana as a major deepwater production hub and the continued demand for SBM Offshore's expertise.

Strategic Outlook for Floating Production Systems Market Market

The strategic outlook for the Floating Production Systems Market is characterized by sustained growth and technological evolution. The market will continue to be driven by the global energy demand and the imperative to tap into complex offshore reserves. Key growth accelerators include further advancements in digitalization for enhanced operational efficiency, the integration of renewable energy sources to support offshore operations, and the development of more sustainable and environmentally friendly production solutions. Strategic partnerships, technological innovation, and the ability to adapt to evolving regulatory landscapes will be crucial for companies to maintain a competitive edge and capitalize on the significant future potential of the Floating Production Systems Market.

Floating Production Systems Market Segmentation

-

1. Type

- 1.1. FPSO

- 1.2. Tension Leg Platform

- 1.3. SPAR

- 1.4. Barge

-

2. Water Depth

- 2.1. Shallow Water

- 2.2. Deepwater and Ultra-deepwater

Floating Production Systems Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East

Floating Production Systems Market Regional Market Share

Geographic Coverage of Floating Production Systems Market

Floating Production Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; An Increase in the Use of LNG as an Energy Source

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Solar and Wind Energy

- 3.4. Market Trends

- 3.4.1 Floating Production

- 3.4.2 Storage

- 3.4.3 and Offloading (FPSO) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Floating Production Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. FPSO

- 5.1.2. Tension Leg Platform

- 5.1.3. SPAR

- 5.1.4. Barge

- 5.2. Market Analysis, Insights and Forecast - by Water Depth

- 5.2.1. Shallow Water

- 5.2.2. Deepwater and Ultra-deepwater

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Floating Production Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. FPSO

- 6.1.2. Tension Leg Platform

- 6.1.3. SPAR

- 6.1.4. Barge

- 6.2. Market Analysis, Insights and Forecast - by Water Depth

- 6.2.1. Shallow Water

- 6.2.2. Deepwater and Ultra-deepwater

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Floating Production Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. FPSO

- 7.1.2. Tension Leg Platform

- 7.1.3. SPAR

- 7.1.4. Barge

- 7.2. Market Analysis, Insights and Forecast - by Water Depth

- 7.2.1. Shallow Water

- 7.2.2. Deepwater and Ultra-deepwater

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Floating Production Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. FPSO

- 8.1.2. Tension Leg Platform

- 8.1.3. SPAR

- 8.1.4. Barge

- 8.2. Market Analysis, Insights and Forecast - by Water Depth

- 8.2.1. Shallow Water

- 8.2.2. Deepwater and Ultra-deepwater

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Floating Production Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. FPSO

- 9.1.2. Tension Leg Platform

- 9.1.3. SPAR

- 9.1.4. Barge

- 9.2. Market Analysis, Insights and Forecast - by Water Depth

- 9.2.1. Shallow Water

- 9.2.2. Deepwater and Ultra-deepwater

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Floating Production Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. FPSO

- 10.1.2. Tension Leg Platform

- 10.1.3. SPAR

- 10.1.4. Barge

- 10.2. Market Analysis, Insights and Forecast - by Water Depth

- 10.2.1. Shallow Water

- 10.2.2. Deepwater and Ultra-deepwater

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MODEC Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Malaysia Marine and Heavy Engineering SDN BHD

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Keppel Offshore and Marine Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SBM Offshore NV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung Heavy Industries Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teekay Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hyundai Heavy Industries Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TechnipFMC PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bumi Armada Berhad

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitsubishi Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 MODEC Inc

List of Figures

- Figure 1: Global Floating Production Systems Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Floating Production Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Floating Production Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Floating Production Systems Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 5: North America Floating Production Systems Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 6: North America Floating Production Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Floating Production Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Floating Production Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Floating Production Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Floating Production Systems Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 11: Europe Floating Production Systems Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 12: Europe Floating Production Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Floating Production Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Floating Production Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Floating Production Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Floating Production Systems Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 17: Asia Pacific Floating Production Systems Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 18: Asia Pacific Floating Production Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Floating Production Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Floating Production Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Floating Production Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Floating Production Systems Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 23: South America Floating Production Systems Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 24: South America Floating Production Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Floating Production Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Floating Production Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East Floating Production Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Floating Production Systems Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 29: Middle East Floating Production Systems Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 30: Middle East Floating Production Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Floating Production Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Floating Production Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Floating Production Systems Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 3: Global Floating Production Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Floating Production Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Floating Production Systems Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 6: Global Floating Production Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Floating Production Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Floating Production Systems Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 9: Global Floating Production Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Floating Production Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Floating Production Systems Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 12: Global Floating Production Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Floating Production Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Floating Production Systems Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 15: Global Floating Production Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Floating Production Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Floating Production Systems Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 18: Global Floating Production Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Floating Production Systems Market?

The projected CAGR is approximately 12.5%.

2. Which companies are prominent players in the Floating Production Systems Market?

Key companies in the market include MODEC Inc, Malaysia Marine and Heavy Engineering SDN BHD, Keppel Offshore and Marine Ltd, SBM Offshore NV, Samsung Heavy Industries Co Ltd, Teekay Corporation, Hyundai Heavy Industries Co Ltd, TechnipFMC PLC, Bumi Armada Berhad, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Floating Production Systems Market?

The market segments include Type, Water Depth.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; An Increase in the Use of LNG as an Energy Source.

6. What are the notable trends driving market growth?

Floating Production. Storage. and Offloading (FPSO) to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Solar and Wind Energy.

8. Can you provide examples of recent developments in the market?

In September 2022, Keppel Offshore & Marine won an engineering, procurement, and construction (EPC) tender from Petrobras for the P-83 FPSO, worth USD 2.8 billion. The FPSO is scheduled to be delivered by the first half of 2027.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Floating Production Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Floating Production Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Floating Production Systems Market?

To stay informed about further developments, trends, and reports in the Floating Production Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence