Key Insights

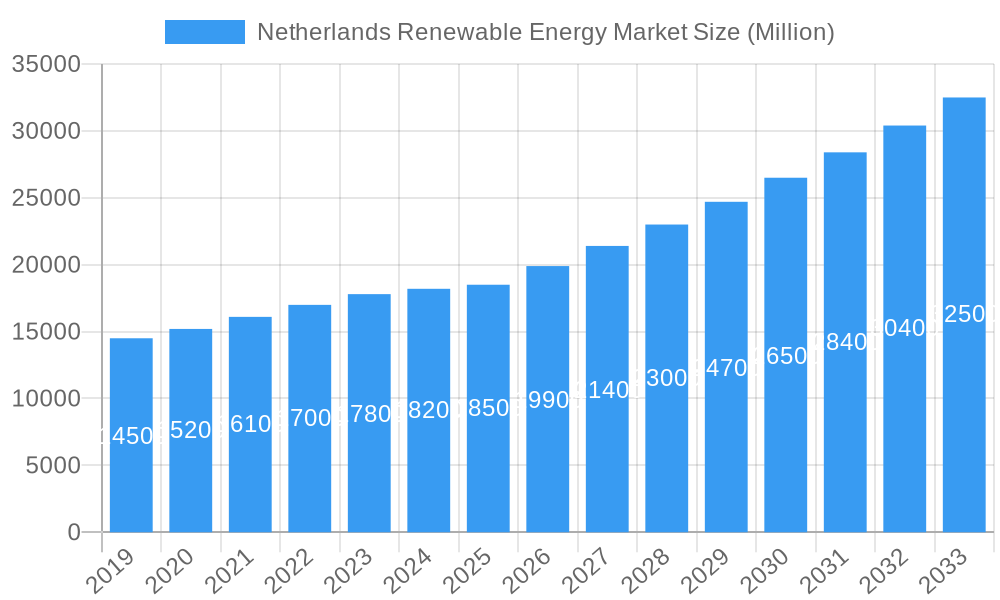

The Netherlands renewable energy market is set for substantial growth, driven by government mandates and heightened environmental awareness. Projected to reach 12.75 billion in 2024, the sector is experiencing a dynamic expansion. Strategic investments in offshore wind and solar energy, alongside favorable policies and incentives, are key drivers. As traditional energy sources decline, demand for clean electricity is escalating, fostering innovation in green hydrogen and advanced energy storage. The Netherlands is actively developing and exporting renewable technologies, solidifying its leadership in Europe's green transition.

Netherlands Renewable Energy Market Market Size (In Billion)

The Netherlands renewable energy market is forecast to grow at a compound annual growth rate (CAGR) of 12.3% from 2024 to 2033. This growth is supported by a diverse range of renewable sources, with offshore wind leading the energy mix, complemented by significant advancements in solar energy. The nation's decarbonization efforts extend to heating and transportation, with investments in grid modernization and smart technologies essential for integrating intermittent renewable sources. Emerging technologies like tidal and wave energy offer future diversification opportunities, reinforcing the Netherlands' role as a global leader in sustainable energy solutions.

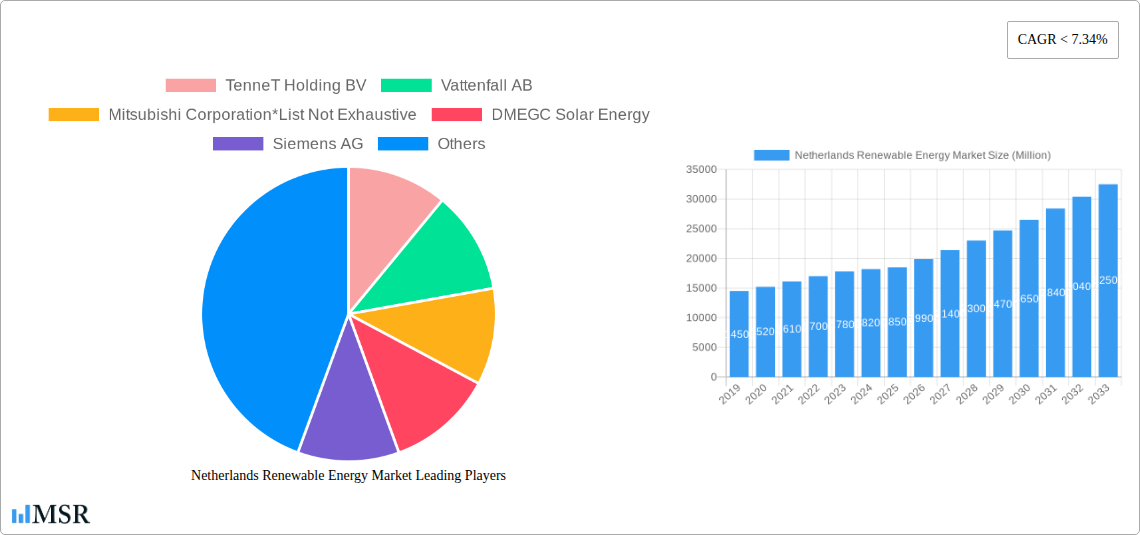

Netherlands Renewable Energy Market Company Market Share

Netherlands Renewable Energy Market Report: Driving Sustainable Growth and Innovation 2019-2033

Unlock critical insights into the burgeoning Netherlands renewable energy market with this comprehensive report. Spanning from 2019 to 2033, with a base year of 2025 and a detailed forecast period of 2025-2033, this analysis delves deep into market dynamics, key players, and future opportunities. Discover how the Dutch commitment to a greener future is shaping a robust and expanding renewable energy sector. This report provides actionable intelligence for investors, policymakers, and industry stakeholders seeking to capitalize on the transition to clean energy in the Netherlands.

Netherlands Renewable Energy Market Market Concentration & Dynamics

The Netherlands renewable energy market exhibits a moderate concentration, with a significant presence of established utility companies and a growing influx of specialized renewable energy developers. Innovation ecosystems are thriving, fueled by supportive government policies and increasing private investment. Regulatory frameworks are robust, emphasizing ambitious CO2 reduction targets and incentivizing clean energy adoption. Substitute products, primarily fossil fuels, are steadily losing ground as renewable alternatives become more cost-competitive and technologically advanced. End-user trends show a strong preference for sustainable energy solutions, driven by environmental consciousness and rising energy costs. Mergers and acquisitions (M&A) activities are on the rise as larger players seek to consolidate their market position and acquire innovative technologies. Recent M&A deal counts stand at xx, reflecting a dynamic and consolidating market landscape. Key players like TenneT Holding BV and Vattenfall AB are actively involved in strategic partnerships and acquisitions to expand their renewable energy portfolios.

Netherlands Renewable Energy Market Industry Insights & Trends

The Netherlands renewable energy market is poised for significant expansion, driven by a confluence of technological advancements, supportive government policies, and increasing public demand for sustainable energy solutions. The market size is projected to reach xx Million by 2033, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Key growth drivers include ambitious national targets for renewable energy generation, such as the Climate Agreement aiming for a substantial reduction in greenhouse gas emissions. Technological disruptions are continuously enhancing the efficiency and affordability of renewable energy sources. Innovations in solar panel technology, advanced wind turbine designs, and energy storage solutions are accelerating the transition away from fossil fuels. Evolving consumer behaviors, characterized by a growing awareness of climate change and a desire for eco-friendly living, are further bolstering demand for renewable energy. The integration of smart grid technologies and decentralized energy systems is also playing a crucial role in optimizing energy distribution and consumption. The historical period (2019-2024) has witnessed substantial investment and capacity additions, laying a strong foundation for future growth. The estimated market size in the base year of 2025 is xx Million, with continuous upward trajectory expected.

Key Markets & Segments Leading Netherlands Renewable Energy Market

The Wind segment currently leads the Netherlands renewable energy market, capitalizing on the country's extensive coastline and favorable offshore wind conditions. Significant investments in offshore wind farms, supported by government auctions and subsidies, have propelled this sector's dominance. Economic growth in the Netherlands, coupled with the need for energy security, further bolsters wind power development. Infrastructure development, including grid connections and port facilities, is crucial for the expansion of wind energy projects, both onshore and offshore.

- Drivers for Wind Dominance:

- Favorable geographical conditions for wind power generation.

- Strong government support through subsidies and offshore wind lease agreements.

- Technological advancements in turbine efficiency and scale.

- Established supply chains and expertise in offshore wind development.

The Solar segment is rapidly gaining momentum, driven by declining panel costs and increasing rooftop solar installations. Supportive policies like net metering and solar panel subsidies are encouraging both residential and commercial adoption. The government's commitment to increasing solar capacity aligns with national climate goals, making it a key growth area.

- Drivers for Solar Growth:

- Decreasing costs of solar photovoltaic (PV) technology.

- Growing demand for decentralized energy generation.

- Government incentives and tax benefits for solar installations.

- Increased availability of suitable land and rooftop spaces.

While Biomass continues to contribute to the renewable energy mix, its growth is influenced by sustainability concerns and feedstock availability. Other Sources, including geothermal and hydropower, represent niche markets with potential for future development as technology matures and diversifies the energy landscape.

Netherlands Renewable Energy Market Product Developments

Product innovations in the Netherlands renewable energy market are focused on enhancing efficiency, reducing costs, and improving integration. Advancements in solar panel technology include higher conversion efficiencies and bifacial panels that capture sunlight from both sides. In the wind sector, larger and more powerful turbines are being developed, along with innovations in floating offshore wind platforms to access deeper waters. Energy storage solutions, such as advanced battery technologies and green hydrogen production, are crucial for grid stability and the broader adoption of intermittent renewable sources. These technological advancements are critical for maintaining a competitive edge and meeting the Netherlands' ambitious renewable energy targets.

Challenges in the Netherlands Renewable Energy Market Market

The Netherlands renewable energy market faces several challenges. Regulatory hurdles and lengthy permitting processes can delay project development. Supply chain issues, particularly for components like rare earth metals used in wind turbines and solar panels, can lead to price volatility and availability constraints. Grid connection constraints and the need for significant grid upgrades to accommodate increased renewable generation pose a substantial barrier. Furthermore, public acceptance and land use conflicts for large-scale renewable projects can create opposition. Competitive pressures from established energy providers and the cost of initial investment for new technologies also present ongoing challenges.

Forces Driving Netherlands Renewable Energy Market Growth

Several key forces are driving the growth of the Netherlands renewable energy market. Ambitious government targets for renewable energy adoption and CO2 emission reduction are a primary catalyst. Technological advancements are making solar and wind power more efficient and cost-effective. Economic incentives, including subsidies and tax credits, are encouraging investment in renewable projects. Growing environmental awareness among the public and businesses is creating demand for sustainable energy solutions. Finally, energy security concerns are prompting the Netherlands to diversify its energy sources away from fossil fuels.

Challenges in the Netherlands Renewable Energy Market Market

Long-term growth catalysts for the Netherlands renewable energy market lie in continued innovation in energy storage technologies, such as advanced battery systems and green hydrogen production, which are essential for grid stability and reliable power supply. Strategic partnerships and collaborations between energy companies, technology providers, and research institutions will accelerate the development and deployment of cutting-edge solutions. Market expansions into new geographical areas within the Netherlands and exploring international collaborations will further drive growth. The ongoing development of smart grid infrastructure and the integration of digital technologies will optimize energy management and enhance the overall efficiency of the renewable energy system.

Emerging Opportunities in Netherlands Renewable Energy Market

Emerging opportunities in the Netherlands renewable energy market are abundant. The growing demand for green hydrogen as a clean fuel for industry and transportation presents a significant growth avenue. The development of offshore renewable energy hubs that integrate wind, solar, and potentially wave energy, coupled with energy storage, is another promising area. Circular economy principles applied to renewable energy technologies, focusing on recycling and material reuse, are gaining traction. Furthermore, energy-as-a-service models and innovative financing mechanisms are opening up new market segments and making renewable energy more accessible to a wider range of consumers.

Leading Players in the Netherlands Renewable Energy Market Sector

- TenneT Holding BV

- Vattenfall AB

- Mitsubishi Corporation

- DMEGC Solar Energy

- Siemens AG

- Sunstroom Engineering BV

- Orsted AS

Key Milestones in Netherlands Renewable Energy Market Industry

- January 2022: Energie Coöperatie Bunnik (ECB) and IX Zon announced plans to build a 16MW solar park along the A12 motorway in Gelderland province. This project, under development since 2019, is expected to generate approximately 14.6GWh annually, contributing significantly to local renewable energy capacity.

- November 2021: Falck Renewables SpA received approval for a five-turbine wind farm in the Dutch province of Gelderland. Expected to be operational by 2025, this development will add substantial wind power capacity to the region.

- March 2021: RWE AG announced its intention to construct its first floating solar project in the Netherlands, located on a lake near the Amer power plant in Geertruidenberg, Noord-Brabant. This 6.1 MW project, comprising 13,400 solar panels, signifies innovation in utilizing water bodies for solar energy generation.

Strategic Outlook for Netherlands Renewable Energy Market Market

The strategic outlook for the Netherlands renewable energy market is highly positive, driven by a strong political will and a conducive investment climate. Future market potential is substantial, fueled by ongoing technological advancements and increasing global demand for clean energy. Growth accelerators include the continued expansion of offshore wind capacity, significant investments in solar energy infrastructure, and the burgeoning green hydrogen sector. Strategic opportunities lie in developing integrated energy systems that combine generation, storage, and smart grid management. The Netherlands is well-positioned to become a leader in the European renewable energy transition, attracting further investment and fostering innovation.

Netherlands Renewable Energy Market Segmentation

-

1. Source

- 1.1. Wind

- 1.2. Solar

- 1.3. Biomass

- 1.4. Other Sources

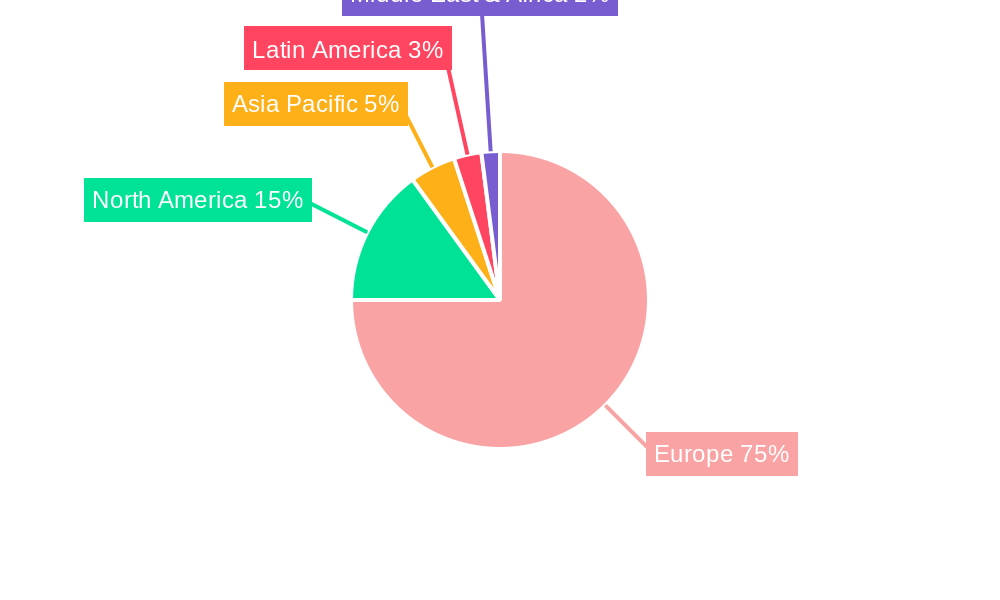

Netherlands Renewable Energy Market Segmentation By Geography

- 1. Netherlands

Netherlands Renewable Energy Market Regional Market Share

Geographic Coverage of Netherlands Renewable Energy Market

Netherlands Renewable Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Penetration of the Technology in Long-Duration Energy Storage Applications4.; Increasing Adoption of Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Low Energy of Battery Cells

- 3.4. Market Trends

- 3.4.1. Wind Energy is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Renewable Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Wind

- 5.1.2. Solar

- 5.1.3. Biomass

- 5.1.4. Other Sources

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TenneT Holding BV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vattenfall AB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mitsubishi Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DMEGC Solar Energy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sunstroom Engineering BV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Orsted AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 TenneT Holding BV

List of Figures

- Figure 1: Netherlands Renewable Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Netherlands Renewable Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Renewable Energy Market Revenue billion Forecast, by Source 2020 & 2033

- Table 2: Netherlands Renewable Energy Market Volume gigawatt Forecast, by Source 2020 & 2033

- Table 3: Netherlands Renewable Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Netherlands Renewable Energy Market Volume gigawatt Forecast, by Region 2020 & 2033

- Table 5: Netherlands Renewable Energy Market Revenue billion Forecast, by Source 2020 & 2033

- Table 6: Netherlands Renewable Energy Market Volume gigawatt Forecast, by Source 2020 & 2033

- Table 7: Netherlands Renewable Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Netherlands Renewable Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Renewable Energy Market?

The projected CAGR is approximately 12.3%.

2. Which companies are prominent players in the Netherlands Renewable Energy Market?

Key companies in the market include TenneT Holding BV, Vattenfall AB, Mitsubishi Corporation*List Not Exhaustive, DMEGC Solar Energy, Siemens AG, Sunstroom Engineering BV, Orsted AS.

3. What are the main segments of the Netherlands Renewable Energy Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.75 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Penetration of the Technology in Long-Duration Energy Storage Applications4.; Increasing Adoption of Renewable Energy.

6. What are the notable trends driving market growth?

Wind Energy is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Low Energy of Battery Cells.

8. Can you provide examples of recent developments in the market?

In January 2022, Energie Coöperatie Bunnik (ECB) and IX Zon were planning to build a 16MW solar park along the A12 motorway connecting the Hague with the German border in the Gelderland province in the eastern Netherlands. The project has been under development since 2019, and it is expected to generate around 14.6GWh per year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Renewable Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Renewable Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Renewable Energy Market?

To stay informed about further developments, trends, and reports in the Netherlands Renewable Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence