Key Insights

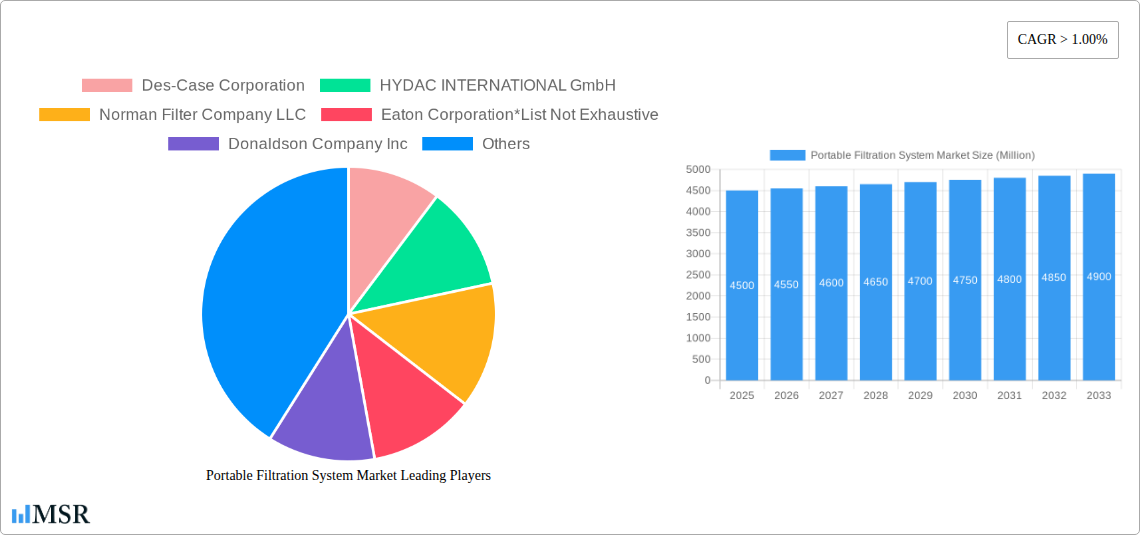

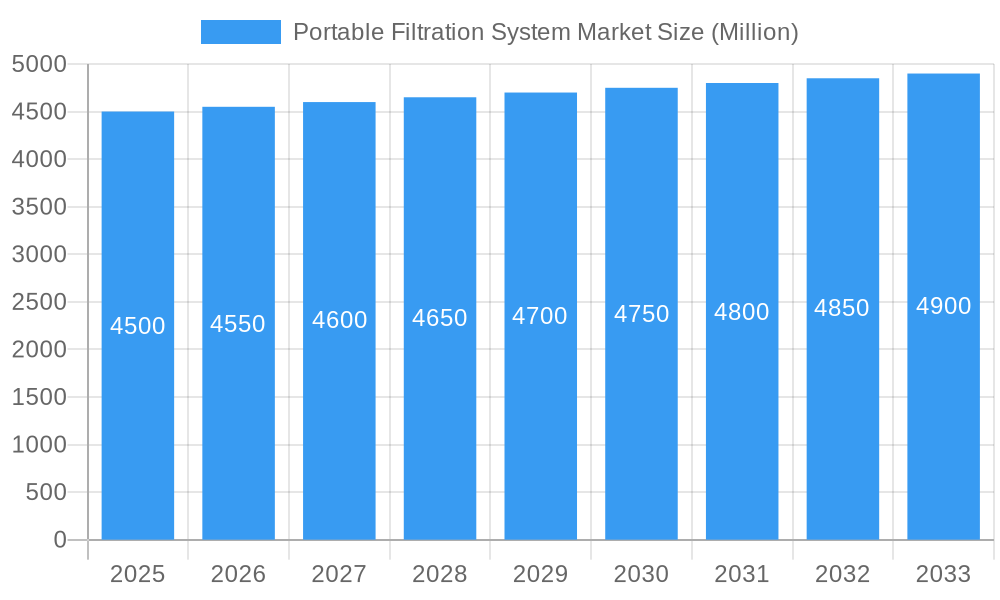

The global Portable Filtration System Market is poised for substantial growth, projected to reach an estimated USD 4,500 Million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 1.00% through 2033. This expansion is primarily fueled by increasing industrialization and the growing demand for efficient and cost-effective fluid management solutions across diverse sectors. Key drivers include the critical need for contamination control in hydraulic systems, lubricants, and coolants to enhance equipment longevity and operational efficiency. The Pulp and Paper, Oil and Gas, and Power Generation industries are leading the adoption of these systems due to stringent environmental regulations and the pursuit of optimized production processes. The ability of portable filtration systems to offer on-site maintenance and reduce downtime is a significant advantage, particularly in remote or challenging operational environments, thus driving their market penetration.

Portable Filtration System Market Market Size (In Billion)

Emerging trends such as the integration of smart technology for real-time monitoring and predictive maintenance, alongside the development of highly specialized filtration media for specific contaminants, are shaping the market's future. The increasing focus on sustainability and the circular economy further bolsters the demand for effective filtration solutions that extend fluid life and minimize waste. However, certain restraints, including the initial capital investment for advanced systems and the availability of trained personnel for their operation and maintenance, may pose challenges to widespread adoption in some regions. Despite these, the market's inherent value proposition in preventing costly equipment failures and improving overall operational performance ensures a robust growth trajectory, with key players like Parker Hannifin Corp, Eaton Corporation, and Donaldson Company Inc. at the forefront of innovation and market expansion.

Portable Filtration System Market Company Market Share

Global Portable Filtration System Market Report: Unlocking Efficiency & Sustainability

Gain a comprehensive understanding of the portable filtration system market, a critical sector driving efficiency and sustainability across diverse industries. This in-depth report provides actionable insights into the market's trajectory, from its current standing to its future potential. Explore key drivers, technological advancements, regional dominance, and emerging opportunities. This report is essential for manufacturers, suppliers, investors, and end-users seeking to capitalize on the evolving portable filtration solutions market.

Portable Filtration System Market Market Concentration & Dynamics

The portable filtration system market exhibits moderate to high concentration, with leading players like Parker Hannifin Corp, Donaldson Company Inc., and Eaton Corporation holding significant market share. Innovation is a key differentiator, evident in the continuous development of advanced filtration media and smart monitoring capabilities. Regulatory frameworks, particularly concerning environmental discharge and fluid cleanliness standards, are shaping product development and market entry strategies. The presence of substitute products, such as fixed filtration systems, necessitates a focus on the unique value proposition of portability and flexibility offered by portable filter units. End-user trends lean towards proactive maintenance, extended equipment lifespan, and reduced downtime, directly fueling demand for efficient mobile filtration systems. Mergers and acquisitions (M&A) are strategic tools for market consolidation and technology acquisition; the report details XX M&A deals within the study period, indicating a dynamic landscape of consolidation and expansion.

Portable Filtration System Market Industry Insights & Trends

The global portable filtration system market is poised for robust growth, projected to reach USD 950.7 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.2% from the base year 2025. This significant expansion is propelled by an increasing emphasis on operational efficiency and fluid management across a spectrum of industries. Technological disruptions, such as the integration of IoT sensors for real-time performance monitoring and predictive maintenance, are revolutionizing how portable fluid filtration is utilized. Evolving consumer behaviors are characterized by a growing demand for sustainable solutions, leading to an increased preference for reusable filter elements and systems that minimize waste. The oil and gas sector continues to be a major consumer, driven by the need for efficient on-site fluid purification in exploration and production. Similarly, the power generation industry relies heavily on portable oil filtration systems to maintain the integrity of critical machinery, thereby preventing costly failures. The pulp and paper industry also presents a substantial market, utilizing these systems for process water and hydraulic fluid management. The overall market size in the base year 2025 is estimated at USD 585.0 Million, underscoring the substantial growth potential ahead.

Key Markets & Segments Leading Portable Filtration System Market

The Oil and Gas segment is a dominant force in the portable filtration system market, driven by extensive infrastructure development and the constant need for efficient fluid management in remote and challenging environments. Economic growth in emerging economies, particularly in regions with significant oil and gas reserves, fuels demand for advanced on-site filtration solutions. The stringent environmental regulations and the high cost associated with equipment failure in this sector further propel the adoption of reliable portable hydraulic filter units.

- Oil and Gas: Robust demand stemming from exploration, production, and refining operations. Economic growth in key producing nations and the need for environmental compliance are major drivers.

- Power Generation: Critical for maintaining the operational efficiency of turbines, generators, and other heavy machinery. The push for renewable energy sources also necessitates sophisticated filtration for associated equipment.

- Pulp and Paper: Essential for filtering process water and maintaining the quality of hydraulic and lubrication oils, contributing to consistent production output.

- Others: This segment encompasses a wide array of applications in manufacturing, construction, and transportation, all benefiting from the flexibility and cost-effectiveness of mobile filter systems.

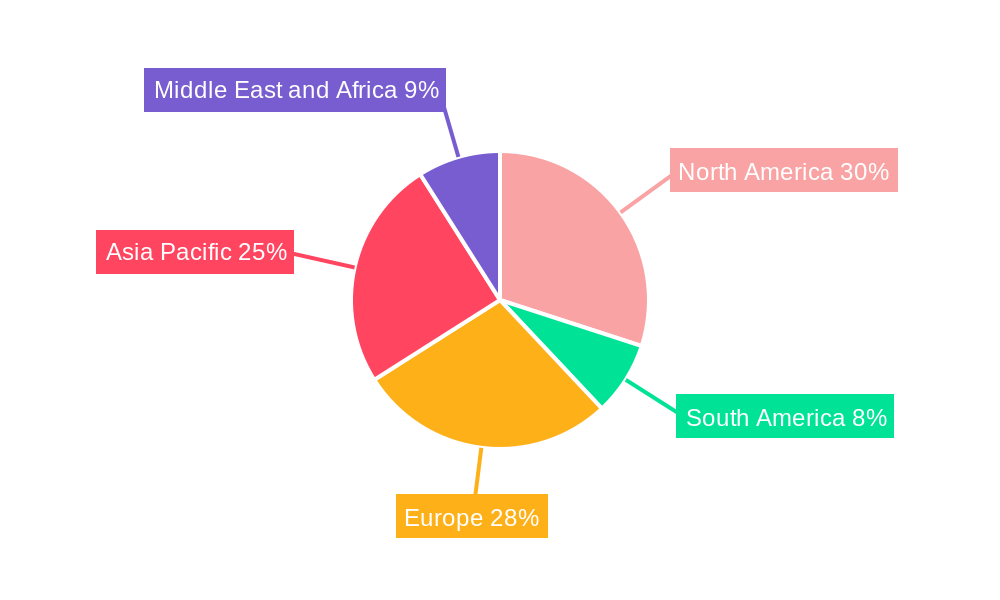

The Asia Pacific region, particularly countries like China and India, is emerging as a significant market due to rapid industrialization and increased investment in infrastructure projects, including oil and gas exploration and power generation facilities.

Portable Filtration System Market Product Developments

Recent product developments in the portable filtration system market center on enhanced filtration efficiency, user-friendliness, and smart capabilities. Innovations include advanced filtration media with higher contaminant holding capacity and improved flow rates, leading to more effective fluid purification. The integration of IoT sensors for real-time monitoring of filter performance and fluid condition is a key trend, enabling predictive maintenance and reducing unplanned downtime. Compact and lightweight designs are making portable filter machines more maneuverable and accessible for on-site applications. These advancements provide a competitive edge by offering superior performance, cost savings through extended fluid life, and increased operational reliability.

Challenges in the Portable Filtration System Market Market

The portable filtration system market faces several challenges that could impede growth. Stringent and evolving environmental regulations, while driving demand for cleaner operations, can also increase the cost of compliance and necessitate significant R&D investment for manufacturers. Supply chain disruptions, particularly for specialized components and raw materials, can lead to production delays and increased costs. Intense competitive pressure from both established players and emerging manufacturers can drive down profit margins.

Forces Driving Portable Filtration System Market Growth

Several forces are propelling the growth of the portable filtration system market. Technological advancements, including the development of more efficient filtration media and intelligent monitoring systems, are key drivers. The increasing emphasis on preventive maintenance and extending the lifespan of industrial equipment across various sectors, such as oil and gas and power generation, directly translates to higher demand. Economic factors, including industrial growth and infrastructure development in emerging markets, also contribute significantly. Furthermore, a growing awareness of the environmental impact of fluid contamination and the need for sustainable practices are bolstering the adoption of advanced filtration solutions.

Challenges in the Portable Filtration System Market Market

Long-term growth catalysts for the portable filtration system market lie in continued innovation and strategic market expansion. The development of highly specialized filtration systems tailored to specific industry needs, such as advanced coolant filtration or unique hydraulic oil filtration requirements, presents significant opportunities. Strategic partnerships between filtration manufacturers and equipment OEMs can drive wider adoption and integrate filtration solutions more seamlessly into industrial processes. Expanding into new geographical markets with nascent industrial sectors also offers substantial untapped potential for portable filtration equipment.

Emerging Opportunities in Portable Filtration System Market

Emerging opportunities in the portable filtration system market are abundant, driven by evolving industrial needs and technological frontiers. The growing adoption of Industry 4.0 principles is creating demand for smart, connected portable filter units with advanced diagnostics and remote monitoring capabilities. The burgeoning renewable energy sector, particularly wind and solar power, presents new applications for portable fluid filtration in maintaining specialized equipment. Furthermore, an increasing focus on circular economy principles is spurring innovation in reusable filter media and systems that facilitate waste reduction and resource efficiency, presenting a significant avenue for growth in the portable filtration solutions market.

Leading Players in the Portable Filtration System Market Sector

- Des-Case Corporation

- HYDAC INTERNATIONAL GmbH

- Norman Filter Company LLC

- Eaton Corporation

- Donaldson Company Inc.

- MP Filtri S p A

- Bosch Rexroth AG

- Pall Corporation

- Trico Corporation

- Parker Hannifin Corp

Key Milestones in Portable Filtration System Market Industry

- 2019: Increased adoption of IoT in portable filtration systems for remote monitoring.

- 2020: Focus on developing compact and lightweight designs for enhanced portability.

- 2021: Growing demand for sustainable filtration solutions, including reusable filter elements.

- 2022: Introduction of advanced filtration media with higher contaminant holding capacity.

- 2023: Strategic partnerships emerge to integrate portable filtration into broader industrial maintenance strategies.

- 2024: Expanded applications in the renewable energy sector and growth in emerging markets.

Strategic Outlook for Portable Filtration System Market Market

The strategic outlook for the portable filtration system market is highly positive, characterized by continuous innovation and expanding application landscapes. Growth accelerators include the increasing demand for predictive maintenance, driven by the integration of smart technologies, and the push for enhanced operational efficiency and sustainability across industries. The development of specialized filtration solutions for niche applications and the expansion into underserved geographical markets will be key to capturing future growth. Strategic collaborations and a focus on providing integrated fluid management solutions will further solidify market positions and drive long-term success in this dynamic sector.

Portable Filtration System Market Segmentation

-

1. End-User

- 1.1. Pulp and Paper

- 1.2. Oil and Gas

- 1.3. Power Generation

- 1.4. Others

Portable Filtration System Market Segmentation By Geography

- 1. North America

- 2. South America

- 3. Europe

- 4. Asia Pacific

- 5. Middle East and Africa

Portable Filtration System Market Regional Market Share

Geographic Coverage of Portable Filtration System Market

Portable Filtration System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 1.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption Of Battery-Powered Power Tools4.; Rapidly Growing Automotive Industry

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost Associated With Cordless Power Tool Equipment

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry to be a Significant Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Portable Filtration System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Pulp and Paper

- 5.1.2. Oil and Gas

- 5.1.3. Power Generation

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Asia Pacific

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. North America Portable Filtration System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Pulp and Paper

- 6.1.2. Oil and Gas

- 6.1.3. Power Generation

- 6.1.4. Others

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. South America Portable Filtration System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Pulp and Paper

- 7.1.2. Oil and Gas

- 7.1.3. Power Generation

- 7.1.4. Others

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Europe Portable Filtration System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Pulp and Paper

- 8.1.2. Oil and Gas

- 8.1.3. Power Generation

- 8.1.4. Others

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. Asia Pacific Portable Filtration System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Pulp and Paper

- 9.1.2. Oil and Gas

- 9.1.3. Power Generation

- 9.1.4. Others

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Middle East and Africa Portable Filtration System Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 10.1.1. Pulp and Paper

- 10.1.2. Oil and Gas

- 10.1.3. Power Generation

- 10.1.4. Others

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Des-Case Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HYDAC INTERNATIONAL GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Norman Filter Company LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eaton Corporation*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Donaldson Company Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MP Filtri S p A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bosch Rexroth AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pall Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Trico Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Parker Hannifin Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Des-Case Corporation

List of Figures

- Figure 1: Global Portable Filtration System Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Portable Filtration System Market Revenue (Million), by End-User 2025 & 2033

- Figure 3: North America Portable Filtration System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 4: North America Portable Filtration System Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Portable Filtration System Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Portable Filtration System Market Revenue (Million), by End-User 2025 & 2033

- Figure 7: South America Portable Filtration System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: South America Portable Filtration System Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Portable Filtration System Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Portable Filtration System Market Revenue (Million), by End-User 2025 & 2033

- Figure 11: Europe Portable Filtration System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Portable Filtration System Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Portable Filtration System Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Portable Filtration System Market Revenue (Million), by End-User 2025 & 2033

- Figure 15: Asia Pacific Portable Filtration System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Asia Pacific Portable Filtration System Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Asia Pacific Portable Filtration System Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Portable Filtration System Market Revenue (Million), by End-User 2025 & 2033

- Figure 19: Middle East and Africa Portable Filtration System Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: Middle East and Africa Portable Filtration System Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Portable Filtration System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Portable Filtration System Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 2: Global Portable Filtration System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Portable Filtration System Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Portable Filtration System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Portable Filtration System Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Portable Filtration System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Portable Filtration System Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global Portable Filtration System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Portable Filtration System Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Global Portable Filtration System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Portable Filtration System Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Portable Filtration System Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portable Filtration System Market?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Portable Filtration System Market?

Key companies in the market include Des-Case Corporation, HYDAC INTERNATIONAL GmbH, Norman Filter Company LLC, Eaton Corporation*List Not Exhaustive, Donaldson Company Inc, MP Filtri S p A, Bosch Rexroth AG, Pall Corporation, Trico Corporation, Parker Hannifin Corp.

3. What are the main segments of the Portable Filtration System Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption Of Battery-Powered Power Tools4.; Rapidly Growing Automotive Industry.

6. What are the notable trends driving market growth?

Oil and Gas Industry to be a Significant Segment.

7. Are there any restraints impacting market growth?

4.; High Cost Associated With Cordless Power Tool Equipment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portable Filtration System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portable Filtration System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portable Filtration System Market?

To stay informed about further developments, trends, and reports in the Portable Filtration System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence