Key Insights

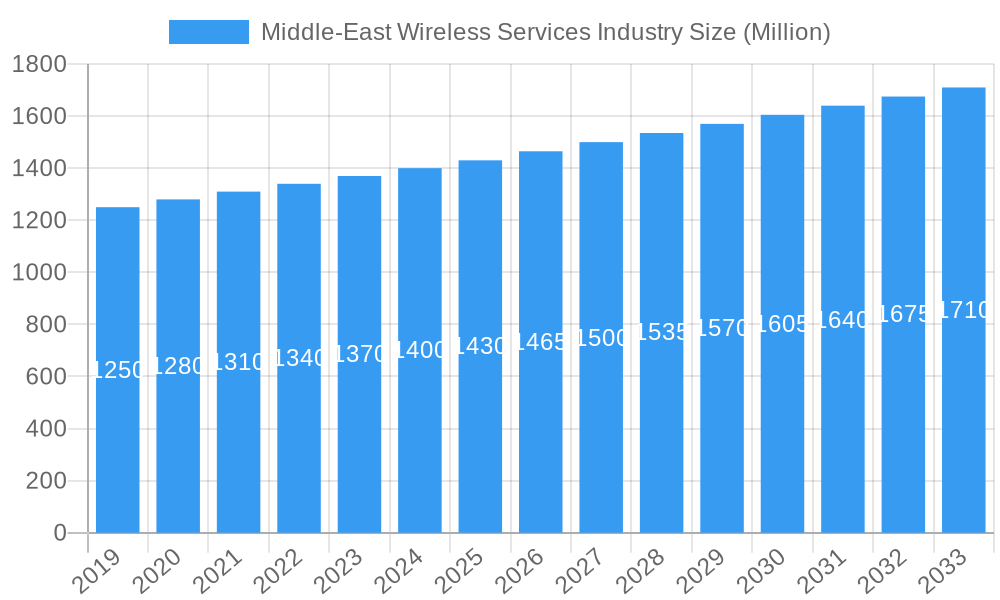

The Middle East wireless services market is projected for robust expansion, expected to reach $17.41 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.57% through 2033. This growth is primarily driven by the oil and gas sector's increasing need for efficient upstream operations, including enhanced oil recovery, production optimization, and advanced well diagnostics, all reliant on sophisticated wireless technologies. Digital transformation initiatives further accelerate the adoption of remote monitoring and control systems. The market encompasses onshore and offshore deployments, serving diverse well completion and intervention needs through electric line and slick line services, with a focus on open and cased hole applications.

Middle-East Wireless Services Industry Market Size (In Billion)

Wireless services are strategically crucial for optimizing operations in challenging terrains across Saudi Arabia, Iran, and the United Arab Emirates, and the wider Middle East. These regions, with extensive hydrocarbon reserves and complex operational environments, are prime for advanced wireless solutions. Key players like Expro Group, Weatherford International PLC, OilServ FZCO, Baker Hughes Company, Halliburton Company, and Schlumberger Limited are leading innovation. Potential restraints include stringent regulations, cybersecurity threats, and initial infrastructure investment, but the benefits of improved efficiency, reduced costs, and enhanced safety are expected to drive sustained market development.

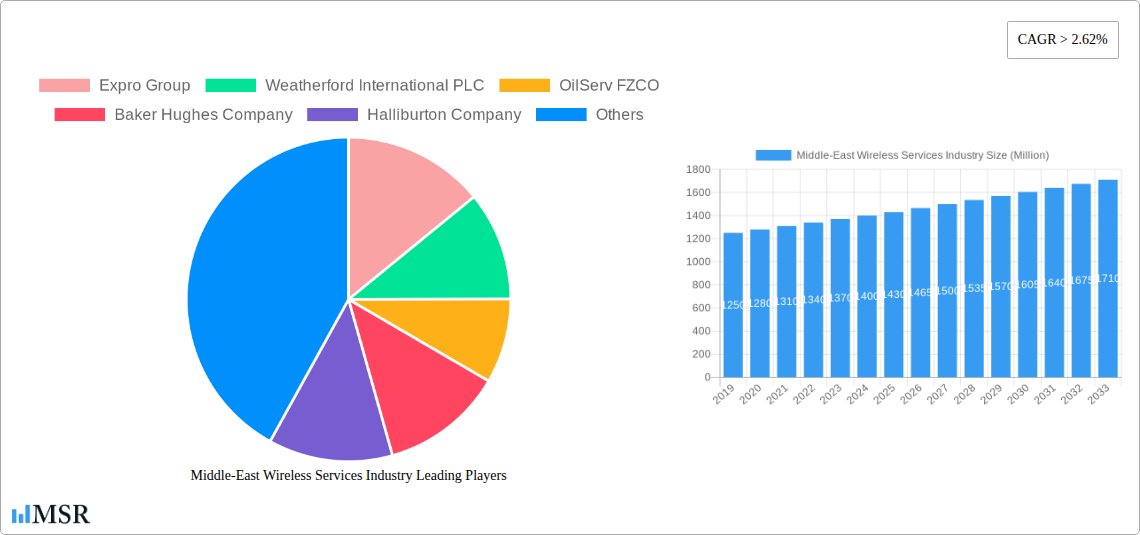

Middle-East Wireless Services Industry Company Market Share

Gain comprehensive insights into the Middle East wireless services market (2019-2033) with our detailed analysis. Discover strategic recommendations and a forward-looking outlook for stakeholders in the region's oil and gas technology sector. Fueled by substantial investments in exploration and production, technological advancements, and the demand for operational efficiency, the market is set for significant growth. This report utilizes advanced analytics and deep industry understanding for unparalleled market intelligence.

Middle-East Wireless Services Industry Market Concentration & Dynamics

The Middle-East wireless services industry exhibits a moderate to high market concentration, characterized by the dominance of a few key global oilfield service providers alongside emerging regional players. Innovation ecosystems are robust, fueled by continuous research and development in areas like real-time data acquisition, remote monitoring, and advanced diagnostic tools for onshore and offshore operations. Regulatory frameworks are evolving, with governments actively encouraging localized content and technology transfer, impacting market entry strategies. Substitute products are minimal, as specialized wireless services offer unique capabilities that are difficult to replicate with traditional methods. End-user trends highlight a strong preference for integrated solutions, enhanced data analytics, and services that optimize production efficiency and safety across Electric Line and Slick Line deployments. Merger and acquisition (M&A) activities, while not at peak levels, are strategic, focusing on acquiring niche technologies or expanding geographical reach. Key M&A deal counts are estimated at 10-15 major transactions annually during the historical period, signaling consolidation and strategic partnerships. Market share is led by global giants such as Schlumberger Limited, Halliburton Company, and Baker Hughes Company, with significant contributions from specialized providers like Expro Group and Weatherford International PLC. OilServ FZCO is emerging as a key regional player.

Middle-East Wireless Services Industry Industry Insights & Trends

The Middle-East wireless services industry is experiencing a period of accelerated growth, driven by several interconnected factors. The overall market size in 2025 is estimated at approximately $15,000 Million, with a projected Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period of 2025–2033. This expansion is underpinned by substantial investments in the upstream oil and gas sector across key geographies like Saudi Arabia, the United Arab Emirates, and Iran. The increasing complexity of oilfield operations, particularly in challenging environments such as deepwater offshore and unconventional onshore reservoirs, necessitates the adoption of advanced wireless technologies for real-time data transmission, remote diagnostics, and automated control systems. Technological disruptions are at the forefront, with the integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) revolutionizing how wireless services are deployed and utilized. This enables predictive maintenance, enhanced reservoir characterization, and improved operational efficiency, leading to significant cost savings and production optimization for operators. Evolving consumer behaviors, in this context referring to the oil and gas operators, are shifting towards more comprehensive, data-driven service offerings. There's a growing demand for integrated platforms that provide seamless data flow from downhole sensors to surface analysis, facilitating faster and more informed decision-making. The push for digital transformation within the energy sector is a primary market growth driver, encouraging investments in cutting-edge wireless solutions. Furthermore, the ongoing need to maximize recovery from mature fields and explore new reserves fuels the demand for sophisticated wireline services, including those for Open Hole and Cased Hole applications. The industry is also witnessing a trend towards more modular and deployable wireless systems, reducing downtime and enhancing flexibility in field operations.

Key Markets & Segments Leading Middle-East Wireless Services Industry

The Onshore deployment segment is currently the dominant force in the Middle-East wireless services industry, driven by the vast number of existing and developing oil and gas fields across the region, particularly in Saudi Arabia and the United Arab Emirates. This dominance is propelled by robust economic growth and significant infrastructure development dedicated to hydrocarbon extraction. The sheer volume of onshore exploration and production activities, coupled with the increasing need for enhanced oil recovery (EOR) techniques, directly translates into a higher demand for specialized wireless services.

- Drivers for Onshore Dominance:

- Extensive existing onshore infrastructure and mature field redevelopment.

- Lower logistical complexities and costs compared to offshore operations.

- Government mandates for increased domestic production and energy security.

- Advancements in wireless sensor technology suitable for onshore environments.

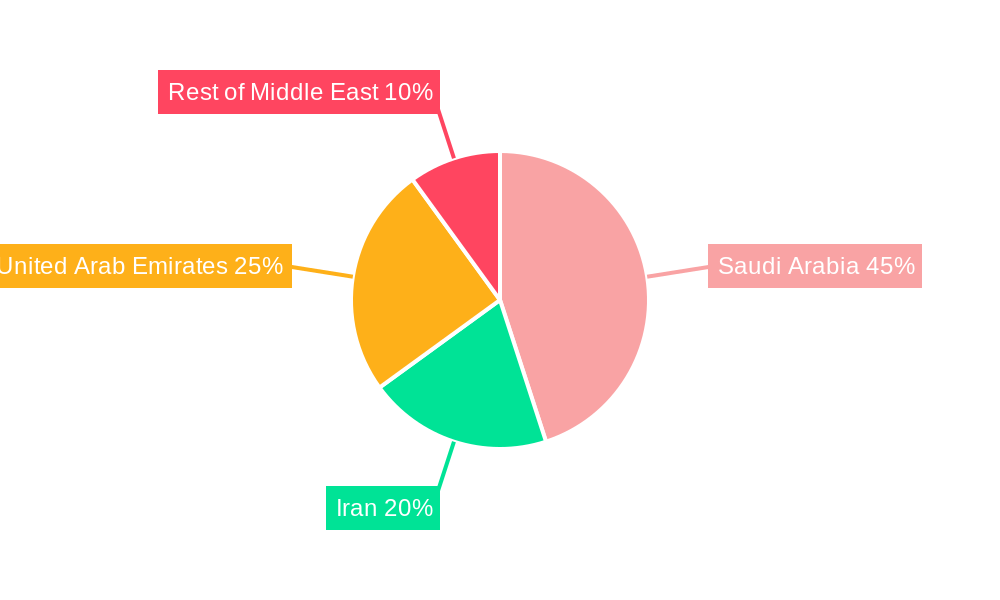

Geographically, Saudi Arabia stands out as the leading market within the Middle-East wireless services sector. The Kingdom's strategic initiatives to maintain and expand its oil production capacity, alongside significant investments in mega-projects like NEOM and the development of new gas fields, create a sustained demand for advanced oilfield services, including sophisticated wireless solutions. The United Arab Emirates follows closely, with Abu Dhabi National Oil Company (ADNOC) actively pursuing ambitious development plans, further bolstering the demand for electric line and slick line services.

In terms of service type, Electric Line services command a significant market share due to their superior data transmission capabilities and suitability for complex downhole operations, including logging, perforating, and intervention. These services are critical for detailed reservoir characterization and production optimization in both Open Hole and Cased Hole applications.

- Dominance Analysis of Key Segments:

- Deployment (Onshore vs. Offshore): While offshore operations are capital-intensive and technologically demanding, the sheer scale and prevalence of onshore fields in the Middle East presently give it an edge in terms of overall service volume and market share. However, the offshore segment is experiencing rapid growth, driven by the development of deepwater reserves.

- Type (Electric Line vs. Slick Line): Electric line services are crucial for high-density data acquisition and intervention tasks, making them indispensable for complex well interventions. Slick line services, while simpler, are vital for routine operations like fishing, swabbing, and setting/retrieving tools, ensuring continued production efficiency. The demand for both remains strong, with electric line seeing higher growth due to the increasing complexity of wells.

- Hole Type (Open Hole vs. Cased Hole): Open hole logging provides fundamental reservoir data during the initial drilling phase, while cased hole services are essential for monitoring production, diagnosing issues, and performing interventions in already completed wells. Both segments are critical, with cased hole services seeing increased demand as fields mature and require ongoing management.

- Geography (Saudi Arabia, UAE, Iran, Rest of Middle-East): Saudi Arabia and the UAE are the primary growth engines due to their massive hydrocarbon reserves and ongoing expansion projects. Iran, despite geopolitical challenges, possesses substantial reserves and requires significant investment in oilfield services. The "Rest of Middle-East" region, encompassing countries like Kuwait, Qatar, and Oman, also contributes significantly to market demand, driven by their own production targets and exploration activities.

Middle-East Wireless Services Industry Product Developments

Product developments in the Middle-East wireless services industry are heavily focused on enhancing data acquisition speed, reliability, and real-time analysis capabilities. Innovations include advanced downhole telemetry systems that enable higher bandwidth data transmission from increasingly complex well environments, including high-temperature and high-pressure (HTHP) wells. Companies are developing more robust and miniaturized sensor technologies for both Open Hole and Cased Hole logging, providing richer petrophysical and production data. Furthermore, there's a strong emphasis on integrating AI and machine learning algorithms directly into wireless service platforms, enabling predictive analytics for equipment failure and optimized production strategies. The development of swarm robotics and autonomous systems for offshore inspection and maintenance, leveraging wireless communication, is also gaining traction.

Challenges in the Middle-East Wireless Services Industry Market

The Middle-East wireless services industry faces several significant challenges that can impact its growth trajectory.

- Geopolitical Instability: Regional conflicts and political tensions can disrupt operations, deter investment, and lead to supply chain vulnerabilities, impacting the market value.

- Regulatory Hurdles: Navigating complex and sometimes inconsistent regulatory frameworks across different countries can lead to delays in project execution and increased compliance costs.

- Talent Shortage: A lack of skilled personnel with expertise in advanced wireless technologies and data analytics can hinder the adoption and effective utilization of these services.

- Cybersecurity Threats: The increasing reliance on digital and wireless communication makes the industry susceptible to cyberattacks, posing risks to sensitive operational data and infrastructure.

Forces Driving Middle-East Wireless Services Industry Growth

The growth of the Middle-East wireless services industry is primarily propelled by significant and sustained investments in the oil and gas sector across the region.

- Rising Global Energy Demand: The continued need for hydrocarbons to fuel global economies ensures ongoing exploration, development, and production activities.

- Technological Advancements: The integration of AI, IoT, and advanced analytics is enhancing operational efficiency, safety, and data insights, driving demand for sophisticated wireless solutions.

- Enhanced Oil Recovery (EOR) Initiatives: Mature fields require advanced techniques, including precise monitoring and control, which are facilitated by specialized wireless services.

- Government Support and Deregulation: Many Middle-Eastern governments are actively promoting investment in their energy sectors and implementing policies to streamline operations and attract foreign direct investment.

Challenges in the Middle-East Wireless Services Industry Market

Long-term growth catalysts for the Middle-East wireless services industry are deeply rooted in ongoing innovation and strategic market expansion. The continuous drive for digitalization across the energy value chain presents a formidable long-term growth accelerator. As companies embrace Industry 4.0 principles, the demand for integrated wireless solutions that facilitate seamless data flow, real-time monitoring, and remote operational control will only intensify. Furthermore, strategic partnerships and collaborations between global service providers and national oil companies (NOCs) are crucial for knowledge transfer, localized technology development, and enhanced market penetration. The exploration of new frontiers, including deeper offshore reserves and unconventional resources, will necessitate the deployment of more advanced and resilient wireless technologies, creating sustained demand.

Emerging Opportunities in Middle-East Wireless Services Industry

Emerging opportunities in the Middle-East wireless services industry are multifaceted, driven by technological evolution and strategic market shifts. The growing emphasis on environmental sustainability is creating a demand for wireless solutions that can monitor emissions, optimize energy consumption, and support carbon capture and storage (CCS) initiatives. The expansion of liquefied natural gas (LNG) projects in the region presents new avenues for wireless services in terminal operations and offshore liquefaction facilities. Furthermore, the development of smart oilfields, utilizing extensive sensor networks and AI-powered analytics for predictive maintenance and autonomous operations, represents a significant growth frontier. The increasing integration of drones and robotic systems for inspection and intervention, communicating wirelessly, also opens up lucrative opportunities for specialized service providers.

Leading Players in the Middle-East Wireless Services Industry Sector

- Expro Group

- Weatherford International PLC

- OilServ FZCO

- Baker Hughes Company

- Halliburton Company

- Schlumberger Limited

Key Milestones in Middle-East Wireless Services Industry Industry

- 2021 (Ongoing): Zubair Oil Field in Iraq entered rehabilitation and enhanced re-development phase, costing USD 18 billion. With 4.5 billion barrels of proven reserves, the project aims to increase production to a plateau of 700,000 barrels per day, significantly boosting demand for wireline services.

- 2021 (Ongoing): Abu Dhabi National Oil Company (ADNOC) announced the development of Hail and Ghasha sour gas fields, intended to produce 1.5 billion cubic feet per day. This initiative is projected to increase gas production in Abu Dhabi by 18%, creating substantial opportunities for wireline services.

Strategic Outlook for Middle-East Wireless Services Industry Market

The strategic outlook for the Middle-East wireless services industry market is exceptionally positive, characterized by sustained growth fueled by ongoing upstream investments and the pervasive adoption of digital technologies. The market is poised for significant expansion as operators continue to prioritize efficiency, safety, and enhanced recovery from both conventional and unconventional reserves. Strategic opportunities lie in the development and deployment of integrated wireless solutions that offer real-time data analytics, predictive maintenance capabilities, and remote operational control. Collaborations between technology providers and national oil companies will be crucial for localized innovation and market penetration. The industry's trajectory indicates a strong shift towards smart oilfields and data-driven decision-making, ensuring a robust demand for advanced wireless services throughout the forecast period.

Middle-East Wireless Services Industry Segmentation

-

1. Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Type

- 2.1. Electric Line

- 2.2. Slick Line

-

3. Hole Type

- 3.1. Open Hole

- 3.2. Cased Hole

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. Iran

- 4.3. United Arab Emirates

- 4.4. Rest of Middle-East

Middle-East Wireless Services Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. Iran

- 3. United Arab Emirates

- 4. Rest of Middle East

Middle-East Wireless Services Industry Regional Market Share

Geographic Coverage of Middle-East Wireless Services Industry

Middle-East Wireless Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Offshore to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Electric Line

- 5.2.2. Slick Line

- 5.3. Market Analysis, Insights and Forecast - by Hole Type

- 5.3.1. Open Hole

- 5.3.2. Cased Hole

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. Iran

- 5.4.3. United Arab Emirates

- 5.4.4. Rest of Middle-East

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. Iran

- 5.5.3. United Arab Emirates

- 5.5.4. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. Saudi Arabia Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Electric Line

- 6.2.2. Slick Line

- 6.3. Market Analysis, Insights and Forecast - by Hole Type

- 6.3.1. Open Hole

- 6.3.2. Cased Hole

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. Iran

- 6.4.3. United Arab Emirates

- 6.4.4. Rest of Middle-East

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Iran Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Electric Line

- 7.2.2. Slick Line

- 7.3. Market Analysis, Insights and Forecast - by Hole Type

- 7.3.1. Open Hole

- 7.3.2. Cased Hole

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. Iran

- 7.4.3. United Arab Emirates

- 7.4.4. Rest of Middle-East

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. United Arab Emirates Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Electric Line

- 8.2.2. Slick Line

- 8.3. Market Analysis, Insights and Forecast - by Hole Type

- 8.3.1. Open Hole

- 8.3.2. Cased Hole

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. Iran

- 8.4.3. United Arab Emirates

- 8.4.4. Rest of Middle-East

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Rest of Middle East Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Electric Line

- 9.2.2. Slick Line

- 9.3. Market Analysis, Insights and Forecast - by Hole Type

- 9.3.1. Open Hole

- 9.3.2. Cased Hole

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. Iran

- 9.4.3. United Arab Emirates

- 9.4.4. Rest of Middle-East

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Expro Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Weatherford International PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 OilServ FZCO

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Baker Hughes Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Halliburton Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Schlumberger Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Expro Group

List of Figures

- Figure 1: Global Middle-East Wireless Services Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Saudi Arabia Middle-East Wireless Services Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 3: Saudi Arabia Middle-East Wireless Services Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: Saudi Arabia Middle-East Wireless Services Industry Revenue (billion), by Type 2025 & 2033

- Figure 5: Saudi Arabia Middle-East Wireless Services Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Saudi Arabia Middle-East Wireless Services Industry Revenue (billion), by Hole Type 2025 & 2033

- Figure 7: Saudi Arabia Middle-East Wireless Services Industry Revenue Share (%), by Hole Type 2025 & 2033

- Figure 8: Saudi Arabia Middle-East Wireless Services Industry Revenue (billion), by Geography 2025 & 2033

- Figure 9: Saudi Arabia Middle-East Wireless Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Saudi Arabia Middle-East Wireless Services Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: Saudi Arabia Middle-East Wireless Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Iran Middle-East Wireless Services Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 13: Iran Middle-East Wireless Services Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 14: Iran Middle-East Wireless Services Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Iran Middle-East Wireless Services Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Iran Middle-East Wireless Services Industry Revenue (billion), by Hole Type 2025 & 2033

- Figure 17: Iran Middle-East Wireless Services Industry Revenue Share (%), by Hole Type 2025 & 2033

- Figure 18: Iran Middle-East Wireless Services Industry Revenue (billion), by Geography 2025 & 2033

- Figure 19: Iran Middle-East Wireless Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Iran Middle-East Wireless Services Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Iran Middle-East Wireless Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: United Arab Emirates Middle-East Wireless Services Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 23: United Arab Emirates Middle-East Wireless Services Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 24: United Arab Emirates Middle-East Wireless Services Industry Revenue (billion), by Type 2025 & 2033

- Figure 25: United Arab Emirates Middle-East Wireless Services Industry Revenue Share (%), by Type 2025 & 2033

- Figure 26: United Arab Emirates Middle-East Wireless Services Industry Revenue (billion), by Hole Type 2025 & 2033

- Figure 27: United Arab Emirates Middle-East Wireless Services Industry Revenue Share (%), by Hole Type 2025 & 2033

- Figure 28: United Arab Emirates Middle-East Wireless Services Industry Revenue (billion), by Geography 2025 & 2033

- Figure 29: United Arab Emirates Middle-East Wireless Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: United Arab Emirates Middle-East Wireless Services Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: United Arab Emirates Middle-East Wireless Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of Middle East Middle-East Wireless Services Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 33: Rest of Middle East Middle-East Wireless Services Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 34: Rest of Middle East Middle-East Wireless Services Industry Revenue (billion), by Type 2025 & 2033

- Figure 35: Rest of Middle East Middle-East Wireless Services Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Rest of Middle East Middle-East Wireless Services Industry Revenue (billion), by Hole Type 2025 & 2033

- Figure 37: Rest of Middle East Middle-East Wireless Services Industry Revenue Share (%), by Hole Type 2025 & 2033

- Figure 38: Rest of Middle East Middle-East Wireless Services Industry Revenue (billion), by Geography 2025 & 2033

- Figure 39: Rest of Middle East Middle-East Wireless Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Rest of Middle East Middle-East Wireless Services Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of Middle East Middle-East Wireless Services Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 2: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Hole Type 2020 & 2033

- Table 4: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 7: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Hole Type 2020 & 2033

- Table 9: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 12: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Hole Type 2020 & 2033

- Table 14: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 17: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Hole Type 2020 & 2033

- Table 19: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 22: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Hole Type 2020 & 2033

- Table 24: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Global Middle-East Wireless Services Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East Wireless Services Industry?

The projected CAGR is approximately 5.57%.

2. Which companies are prominent players in the Middle-East Wireless Services Industry?

Key companies in the market include Expro Group, Weatherford International PLC, OilServ FZCO, Baker Hughes Company, Halliburton Company, Schlumberger Limited.

3. What are the main segments of the Middle-East Wireless Services Industry?

The market segments include Deployment, Type, Hole Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.41 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives.

6. What are the notable trends driving market growth?

Offshore to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In 2021, Zubair Oil Field in Iraq entered the rehabilitation and enhanced re-development phase for the cost of USD 18 billion, and the field has 4.5 billion of proven reserves. The project is aimed to increase the production to the plateau of 700,000 barrels per day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East Wireless Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East Wireless Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East Wireless Services Industry?

To stay informed about further developments, trends, and reports in the Middle-East Wireless Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence