Key Insights

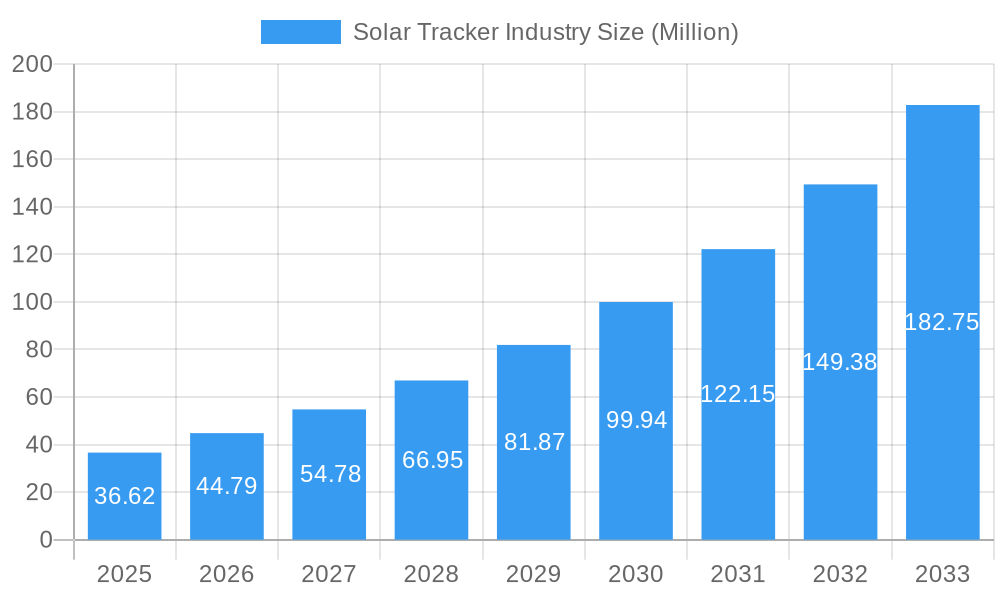

The global solar tracker market is poised for substantial expansion, projected to reach a market size of $36.62 million and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 22.38% during the forecast period of 2025-2033. This robust growth is primarily fueled by the escalating global demand for renewable energy sources, driven by increasing environmental consciousness, supportive government policies, and the declining costs of solar technology. Solar trackers, by optimizing solar panel orientation to capture maximum sunlight, significantly enhance energy generation efficiency, making them an indispensable component in large-scale solar projects. The market is expected to witness strong adoption across various applications, from utility-scale solar farms to commercial and industrial installations, as stakeholders seek to maximize their return on investment and meet ambitious renewable energy targets.

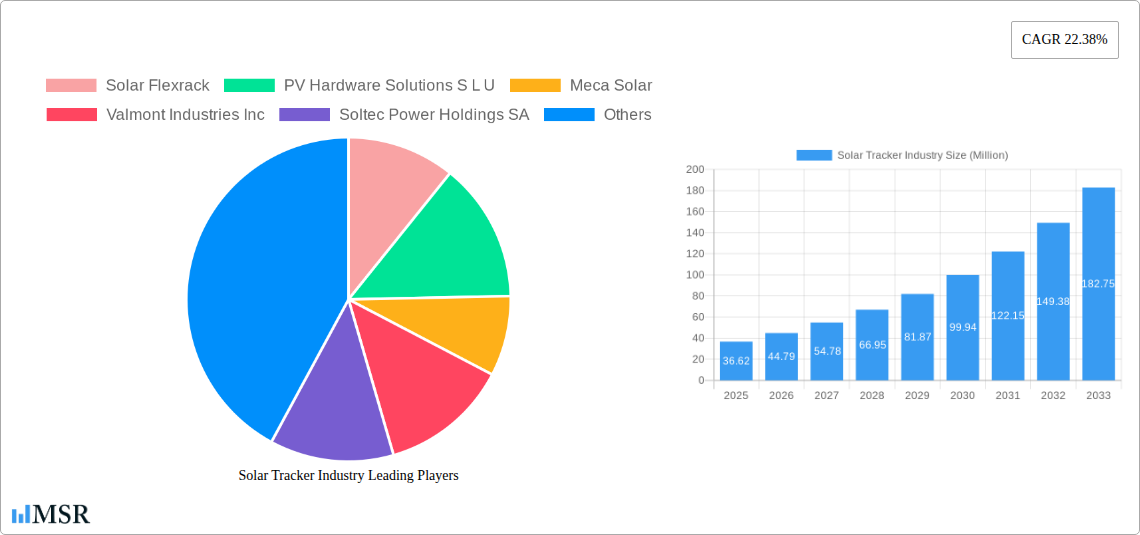

Solar Tracker Industry Market Size (In Million)

Key drivers propelling the solar tracker industry include government incentives and subsidies for solar power development, corporate commitments to sustainability, and the ongoing technological advancements in tracker systems, leading to improved durability, reliability, and cost-effectiveness. Emerging trends such as the integration of artificial intelligence and machine learning for predictive maintenance and optimized tracking algorithms, alongside the development of bifacial solar panel compatible trackers, are expected to further stimulate market growth. While the market enjoys strong tailwinds, potential restraints such as high initial installation costs for certain advanced tracker systems and the need for skilled labor for installation and maintenance might pose localized challenges. However, the overwhelming economic and environmental benefits associated with solar trackers are anticipated to outweigh these concerns, ensuring a dynamic and thriving market landscape. The market is segmented into Single Axis and Dual Axis trackers, with both experiencing growing demand, reflecting diverse project requirements and site-specific considerations.

Solar Tracker Industry Company Market Share

Unlock the Future of Solar Energy: Comprehensive Solar Tracker Industry Report (2019-2033)

Dive deep into the dynamic solar tracker market with this in-depth analysis, forecasting a robust growth trajectory for solar tracking systems. This report provides critical insights into the solar energy industry, focusing on advancements in single-axis trackers and dual-axis trackers. Discover the latest solar tracker innovations, market trends, and regulatory landscapes shaping the future of renewable energy. Essential for solar project developers, EPC companies, investors, and manufacturers, this study offers actionable intelligence to capitalize on the burgeoning solar tracker industry.

Solar Tracker Industry Market Concentration & Dynamics

The solar tracker market exhibits a moderate to high concentration, driven by key players like Nextracker Inc., Array Technologies Inc., and PV Hardware Solutions S.L.U. The innovation ecosystem is vibrant, with continuous development in tracker efficiency and smart control systems. Regulatory frameworks globally are increasingly favoring renewable energy adoption, bolstering demand for solar tracking solutions. Substitute products, primarily fixed-tilt mounting systems, are present but are gradually losing ground due to the superior energy yield offered by trackers, especially in utility-scale projects. End-user trends reveal a strong preference for advanced tracking technologies that maximize energy generation and minimize Levelized Cost of Energy (LCOE). Merger and acquisition (M&A) activities, while not at their peak, are strategic, aimed at consolidating market share and acquiring innovative technologies. The market share distribution is dynamic, with leading companies consistently vying for dominance. M&A deal counts are expected to rise as the market matures, consolidating supply chains and enhancing competitive advantages.

- Market Share: Leading companies hold substantial portions of the market, with significant regional variations.

- Innovation Ecosystem: Focus on AI-powered tracking, weather-adaptive algorithms, and improved durability.

- Regulatory Frameworks: Government incentives and renewable energy targets are key drivers.

- Substitute Products: Fixed-tilt systems are the primary alternative, but their efficiency gap is widening.

- End-User Trends: Increasing demand for higher energy yield and optimized performance.

- M&A Activities: Strategic acquisitions to gain technological prowess and market access.

Solar Tracker Industry Industry Insights & Trends

The solar tracker industry is experiencing unprecedented growth, driven by the global imperative to transition to clean energy and the inherent efficiency benefits of solar tracking systems. The market size, projected to reach an estimated $XX Million by 2025, is set to expand at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This robust growth is fueled by declining solar panel costs, advancements in tracker technology, and supportive government policies worldwide. The increasing adoption of solar energy for utility-scale power generation, coupled with rising demand for higher energy yields in commercial and industrial (C&I) sectors, further propels market expansion. Technological disruptions are at the forefront, with innovations focusing on enhanced reliability, reduced installation time, and intelligent control systems that optimize energy capture based on real-time environmental data. Evolving consumer behaviors, particularly the growing corporate social responsibility initiatives and demand for sustainable energy solutions, are creating new avenues for market penetration. The ongoing development of the solar PV tracker market is intrinsically linked to the broader renewable energy revolution, with trackers playing a pivotal role in unlocking the full potential of solar power generation.

- Market Size (Estimated Year): $XX Million

- CAGR (Forecast Period): XX%

- Growth Drivers: Declining solar panel costs, policy support, efficiency gains.

- Technological Disruptions: AI integration, smart controls, improved structural designs.

- Consumer Behaviors: Growing demand for clean energy and sustainability.

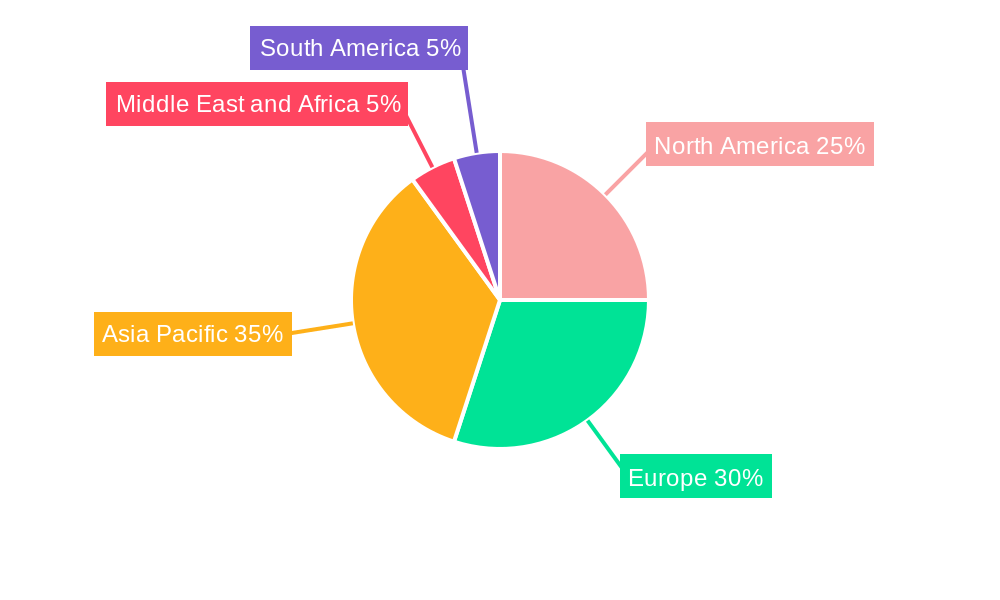

Key Markets & Segments Leading Solar Tracker Industry

The single-axis solar tracker segment is currently the dominant force in the global solar tracker market, primarily due to its cost-effectiveness and superior energy yield compared to fixed-tilt systems. This segment's leadership is further solidified by its widespread adoption in large-scale utility solar projects. Key markets driving this dominance include North America, driven by supportive policies and significant solar development, and Asia-Pacific, propelled by rapid industrialization and increasing renewable energy targets. Economic growth in these regions translates to higher investment in solar infrastructure, directly benefiting the demand for single-axis trackers. The development of large solar farms, often in vast, open terrains, perfectly suits the capabilities of single-axis systems to optimize panel orientation throughout the day.

- Dominant Segment: Single Axis Trackers.

- Drivers: Cost-effectiveness, higher energy yield compared to fixed systems, suitability for utility-scale projects.

- Economic Growth: Increased investment in renewable energy infrastructure.

- Infrastructure Development: Expansion of solar farms and power grids.

The dual-axis solar tracker segment, while smaller in market share, presents significant growth potential, particularly in regions with limited space and a strong emphasis on maximizing energy output per unit area. These trackers offer the highest energy gains by following the sun's path both horizontally and vertically. Their adoption is often seen in smaller, distributed generation projects or in niche applications where land availability is a constraint. Future growth in this segment is expected to be driven by technological advancements that reduce costs and improve the reliability of dual-axis systems, making them more competitive for a wider range of applications.

- Emerging Segment: Dual Axis Trackers.

- Drivers: Maximizing energy output in limited space, high efficiency potential.

- Technological Advancements: Cost reduction and improved reliability.

- Niche Applications: Rooftop solar and concentrated solar power (CSP) systems.

Solar Tracker Industry Product Developments

The solar tracker industry is witnessing continuous product innovation focused on enhancing efficiency, reducing installation costs, and improving durability. Companies are investing in smart features like predictive stowing for extreme weather, advanced algorithms for optimal sun tracking, and more robust, yet lighter, structural designs. These advancements aim to provide greater energy yield, increase the lifespan of solar installations, and streamline the deployment process. The competitive edge for manufacturers lies in their ability to offer integrated solutions that combine hardware with sophisticated software for monitoring and control.

Challenges in the Solar Tracker Industry Market

Despite the robust growth, the solar tracker industry faces several challenges. High initial capital expenditure for tracking systems compared to fixed mounts can be a barrier, especially for smaller projects. Supply chain disruptions, global component shortages, and rising raw material prices can impact manufacturing costs and project timelines. Stringent land-use regulations and permitting processes in certain regions can also slow down project development. Furthermore, the increasing complexity of tracker technology requires skilled labor for installation and maintenance, posing a challenge in some markets.

- High Initial Capital Cost: Compared to fixed-tilt systems.

- Supply Chain Vulnerabilities: Component shortages and price volatility.

- Regulatory Hurdles: Permitting and land-use restrictions.

- Skilled Labor Requirements: For installation and maintenance.

Forces Driving Solar Tracker Industry Growth

Several powerful forces are propelling the solar tracker industry forward. The relentless global push for decarbonization and the urgent need to combat climate change are creating an unprecedented demand for renewable energy solutions. Government incentives, tax credits, and favorable renewable energy policies in key markets provide significant financial impetus for solar project development, including the integration of trackers. Technological advancements in solar PV technology itself, leading to more efficient solar panels, enhance the value proposition of solar trackers. Moreover, the increasing economic competitiveness of solar energy, often outperforming fossil fuels in terms of LCOE, makes solar trackers an essential component for maximizing this economic advantage.

- Global Decarbonization Efforts: Strong governmental and corporate commitments.

- Supportive Renewable Energy Policies: Subsidies, tax incentives, and mandates.

- Advancements in Solar Panel Technology: Increased efficiency of PV modules.

- Economic Competitiveness: Falling LCOE of solar energy.

Challenges in the Solar Tracker Industry Market

Long-term growth catalysts for the solar tracker industry are intrinsically linked to continuous innovation and market expansion. The ongoing development of more sophisticated AI-driven tracking algorithms, designed to optimize energy capture under diverse and dynamic weather conditions, will further enhance the value of trackers. Strategic partnerships between tracker manufacturers, module suppliers, and project developers are crucial for creating integrated, cost-effective solutions. Expanding into emerging markets with high solar potential but lower adoption rates will unlock significant new demand. Furthermore, the integration of trackers with energy storage solutions presents a substantial opportunity to enhance grid stability and increase the utilization of solar power.

- AI-Powered Tracking Algorithms: Enhanced performance in variable conditions.

- Strategic Partnerships: Collaborations across the solar value chain.

- Emerging Market Expansion: Tapping into new geographical areas.

- Integration with Energy Storage: Maximizing solar power utilization.

Emerging Opportunities in Solar Tracker Industry

Emerging opportunities in the solar tracker industry are diverse and promising. The growing trend of agrivoltaics, where solar panels are integrated with agricultural land, presents a unique application for specialized trackers that can optimize sun exposure while minimizing shading of crops. The burgeoning floating solar market, known as "floatovoltaics," also requires innovative tracking solutions adapted to water-based installations. Furthermore, the increasing demand for distributed solar generation and rooftop solar installations in urban environments is creating opportunities for compact, efficient, and aesthetically pleasing tracking systems. The development of bifacial solar panels, which capture sunlight from both sides, is also driving the need for tracker designs that can maximize their performance.

- Agrivoltaics: Integrating solar tracking with agricultural land.

- Floating Solar (Floatovoltaics): Specialized trackers for water-based installations.

- Distributed Solar & Rooftop Systems: Compact and efficient tracking solutions.

- Bifacial Solar Panels: Optimizing energy capture from both sides of the module.

Leading Players in the Solar Tracker Industry Sector

- Solar Flexrack

- PV Hardware Solutions S L U

- Meca Solar

- Valmont Industries Inc

- Soltec Power Holdings SA

- Nextracker Inc

- DCE Solar

- Ideematec Deutschland GmbH

- Arctech Solar Holdings Co Ltd

- Array Technologies Inc

Key Milestones in Solar Tracker Industry Industry

- Feb 2023: PV Hardware (PVH), a leading solar PV tracker manufacturer from Spain's Gransolar Group, plans to build the world's largest solar tracker factory in Spain's Valencia, expanding its annual global manufacturing and supply capability to 25 GW. This signifies a major expansion in manufacturing capacity, addressing potential supply chain bottlenecks and demonstrating strong market confidence.

- Oct 2022: Gonvarri Solar Steel announced an agreement to supply approximately 1.2 GW of solar trackers and rack solutions for several solar projects in the Iberian Peninsula. Iberdrola SA ordered 289 MW of Gonvarri Solar Steel's TracSmarT+ 1V single and double row trackers and 938 MW of its RackSmarT fixed structures. This milestone highlights significant project wins and the growing demand for integrated solar mounting solutions.

- Sept 2022: FTC Solar Inc. launched its new and differentiated module in portrait (1P) Solar Tracker Solution called Pioneer. This launch signifies a key product innovation, offering a potentially more efficient and versatile tracking option for a wider range of solar panel configurations.

Strategic Outlook for Solar Tracker Industry Market

The solar tracker industry is poised for sustained and accelerated growth, driven by a confluence of technological advancements, supportive global policies, and the increasing economic viability of solar energy. The strategic outlook for the market is overwhelmingly positive, with continued investments in R&D expected to yield more efficient, cost-effective, and resilient tracking solutions. The expansion of solar energy infrastructure in both developed and emerging economies will continue to fuel demand. Key growth accelerators include the adoption of smart technologies, such as AI and IoT integration for optimized performance and predictive maintenance, as well as the growing synergy between solar trackers and energy storage systems. Strategic opportunities lie in penetrating new geographical markets, developing specialized trackers for niche applications like agrivoltaics and floating solar, and fostering strong collaborations across the entire solar value chain.

Solar Tracker Industry Segmentation

-

1. Axis Type

- 1.1. Single Axis

- 1.2. Dual Axis

Solar Tracker Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Mexico

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Italy

- 2.5. Spain

- 2.6. NORDIC

- 2.7. Turkey

- 2.8. Russia

- 2.9. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Malaysia

- 3.6. Thailand

- 3.7. Indonesia

- 3.8. Vietnam

- 3.9. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. South Africa

- 4.4. Qatar

- 4.5. Nigeria

- 4.6. Egypt

- 4.7. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Colombia

- 5.3. Chile

- 5.4. Rest of South America

Solar Tracker Industry Regional Market Share

Geographic Coverage of Solar Tracker Industry

Solar Tracker Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Clean Energy Sources4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Single Axis Solar Trackers to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Axis Type

- 5.1.1. Single Axis

- 5.1.2. Dual Axis

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Axis Type

- 6. North America Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Axis Type

- 6.1.1. Single Axis

- 6.1.2. Dual Axis

- 6.1. Market Analysis, Insights and Forecast - by Axis Type

- 7. Europe Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Axis Type

- 7.1.1. Single Axis

- 7.1.2. Dual Axis

- 7.1. Market Analysis, Insights and Forecast - by Axis Type

- 8. Asia Pacific Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Axis Type

- 8.1.1. Single Axis

- 8.1.2. Dual Axis

- 8.1. Market Analysis, Insights and Forecast - by Axis Type

- 9. Middle East and Africa Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Axis Type

- 9.1.1. Single Axis

- 9.1.2. Dual Axis

- 9.1. Market Analysis, Insights and Forecast - by Axis Type

- 10. South America Solar Tracker Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Axis Type

- 10.1.1. Single Axis

- 10.1.2. Dual Axis

- 10.1. Market Analysis, Insights and Forecast - by Axis Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Solar Flexrack

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PV Hardware Solutions S L U

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Meca Solar

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Valmont Industries Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Soltec Power Holdings SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nextracker Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DCE Solar

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ideematec Deutschland GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Arctech Solar Holdings Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Array Technologies Inc *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Solar Flexrack

List of Figures

- Figure 1: Global Solar Tracker Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 3: North America Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 4: North America Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 7: Europe Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 8: Europe Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 11: Asia Pacific Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 12: Asia Pacific Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East and Africa Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 15: Middle East and Africa Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 16: Middle East and Africa Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East and Africa Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Solar Tracker Industry Revenue (Million), by Axis Type 2025 & 2033

- Figure 19: South America Solar Tracker Industry Revenue Share (%), by Axis Type 2025 & 2033

- Figure 20: South America Solar Tracker Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Solar Tracker Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 2: Global Solar Tracker Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 4: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Mexico Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 9: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Italy Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: NORDIC Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Turkey Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 20: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Malaysia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Thailand Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Indonesia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Vietnam Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 31: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Saudi Arabia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: United Arab Emirates Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: South Africa Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Qatar Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Nigeria Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Egypt Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Solar Tracker Industry Revenue Million Forecast, by Axis Type 2020 & 2033

- Table 40: Global Solar Tracker Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Brazil Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Colombia Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Chile Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of South America Solar Tracker Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Solar Tracker Industry?

The projected CAGR is approximately 22.38%.

2. Which companies are prominent players in the Solar Tracker Industry?

Key companies in the market include Solar Flexrack, PV Hardware Solutions S L U, Meca Solar, Valmont Industries Inc, Soltec Power Holdings SA, Nextracker Inc, DCE Solar, Ideematec Deutschland GmbH, Arctech Solar Holdings Co Ltd, Array Technologies Inc *List Not Exhaustive.

3. What are the main segments of the Solar Tracker Industry?

The market segments include Axis Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 36.62 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Clean Energy Sources4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Single Axis Solar Trackers to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

Feb 2023: PV Hardware (PVH), a leading solar PV tracker manufacturer from Spain's Gransolar Group, plans to build the world's largest solar tracker factory in Spain's Valencia. It will expand its annual global manufacturing and supply capability to 25 GW.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Solar Tracker Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Solar Tracker Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Solar Tracker Industry?

To stay informed about further developments, trends, and reports in the Solar Tracker Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence