Key Insights

The North America Gas Insulated Switchgear (GIS) market is projected to experience substantial growth, reaching an estimated market size of $5.8 billion by 2025. This expansion is driven by the increasing demand for reliable power distribution, grid modernization initiatives, the integration of renewable energy, and stringent safety regulations. The shift towards high-voltage and medium-voltage GIS is a key trend, supporting dense urban development and industrialization.

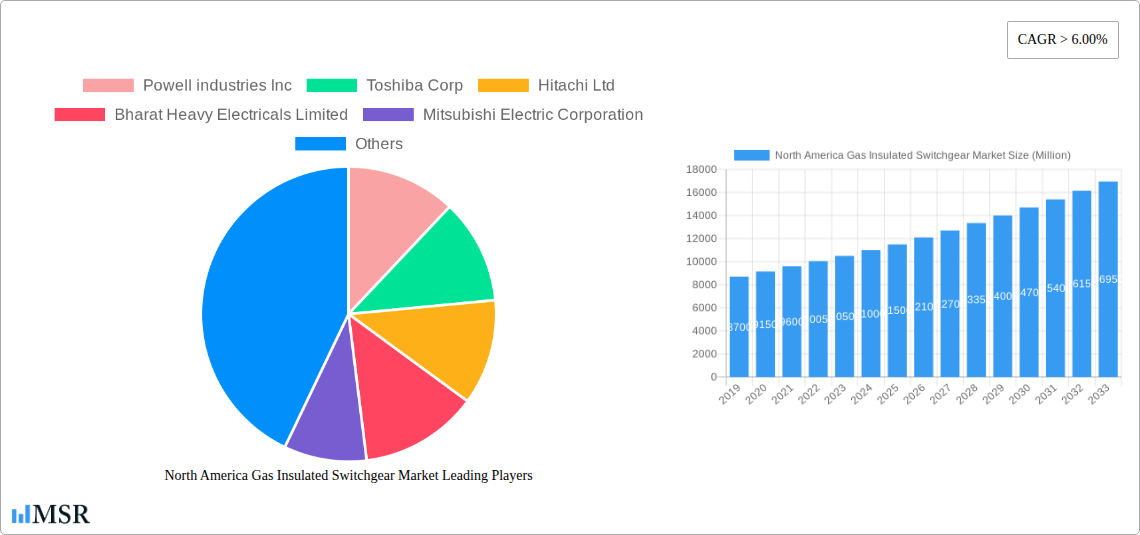

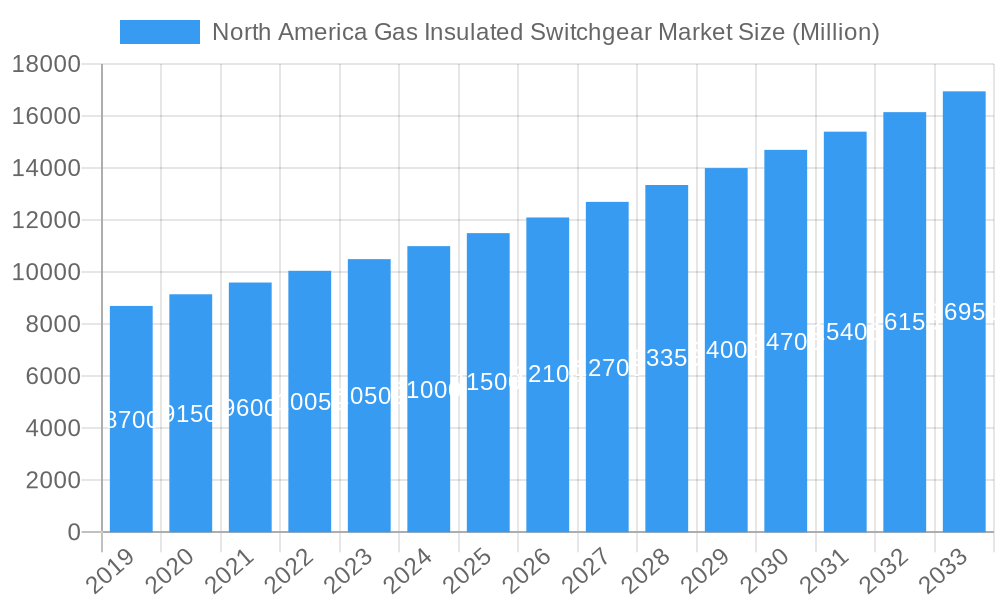

North America Gas Insulated Switchgear Market Market Size (In Billion)

Key market trends include the adoption of digital technologies like IoT for enhanced operational efficiency and predictive maintenance. While SF6 remains dominant due to its proven performance and cost-effectiveness, there's a growing preference for SF6-free and low-GWP alternatives driven by environmental concerns. High initial installation costs and the availability of Air Insulated Switchgear (AIS) are market restraints, but the long-term benefits and space-saving advantages of GIS mitigate these challenges. Leading companies are innovating to meet market demands.

North America Gas Insulated Switchgear Market Company Market Share

Gain comprehensive insights into the dynamic North America Gas Insulated Switchgear (GIS) market. This report covers the base year 2025 and forecasts to 2033, detailing market size, growth rate, segmentation, trends, drivers, challenges, and key players. The market size in the base year 2025 is estimated at $5.8 billion, with a projected CAGR of 6.8% through 2033. Analysis includes high-voltage, medium-voltage, and low-voltage GIS applications across industrial, commercial, and residential sectors in the United States, Canada, and Mexico.

North America Gas Insulated Switchgear Market Market Concentration & Dynamics

The North America Gas Insulated Switchgear market exhibits a moderate to high concentration, with a significant portion of the market share held by a few dominant players. Innovation remains a key differentiator, driven by ongoing advancements in insulation technology, miniaturization, and digital integration. Regulatory frameworks, particularly concerning environmental impact and grid modernization, play a crucial role in shaping market dynamics. The increasing demand for SF6-free alternatives, driven by environmental concerns, is fostering a vibrant innovation ecosystem. Substitute products, such as air-insulated switchgear (AIS) for certain applications, present a competitive challenge, but the superior performance and space-saving attributes of GIS continue to drive its adoption. End-user trends indicate a strong preference for compact, reliable, and digitally enabled solutions across all sectors. Merger and acquisition (M&A) activities are expected to continue, as companies seek to consolidate market position, acquire new technologies, and expand their geographical reach. The market witnessed approximately 5 significant M&A deals in the historical period, highlighting a strategic consolidation phase.

- Market Share Dominance: Key players like Siemens Energy AG, General Electric Company, and Schneider Electric SE collectively command over 50% of the market share.

- Innovation Focus: Emphasis on developing SF6-free alternatives and enhancing digital monitoring and control capabilities.

- Regulatory Influence: Strict environmental regulations push for eco-friendly insulation mediums.

- Competitive Landscape: Intense competition from both established GIS manufacturers and emerging players with innovative solutions.

North America Gas Insulated Switchgear Market Industry Insights & Trends

The North America Gas Insulated Switchgear market is experiencing robust growth, propelled by an escalating demand for enhanced grid reliability, the imperative for modernization of aging power infrastructure, and the burgeoning integration of renewable energy sources. The market size, estimated at USD 4,500 Million in the base year 2025, is projected to grow at a compound annual growth rate (CAGR) of 5.8% through 2033. Technological disruptions are at the forefront, with a significant push towards adopting vacuum interrupter technology and environmentally friendly insulation mediums like dry air and advanced gas mixtures, moving away from traditional SF6 gas due to its high global warming potential. Evolving consumer behaviors, particularly from industrial and commercial sectors, lean towards smart grid solutions that offer predictive maintenance, remote monitoring, and enhanced operational efficiency. The ongoing digital transformation of the energy sector, coupled with substantial government investments in grid modernization initiatives, further fuels the demand for advanced GIS solutions. These investments are crucial for ensuring grid stability and supporting the increasing load demands from data centers, electric vehicle charging infrastructure, and industrial automation. The transition to a more decentralized and resilient power grid necessitates the deployment of highly reliable and compact switchgear, making GIS an indispensable technology. Furthermore, the increasing complexity of power flow management due to the intermittency of renewable energy sources requires sophisticated switching and protection mechanisms that GIS provides. The report also analyzes the impact of evolving energy policies and standards that promote the adoption of energy-efficient and sustainable electrical equipment.

- Market Size (2025): USD 4,500 Million

- Projected CAGR (2025–2033): 5.8%

- Key Growth Drivers: Grid modernization, renewable energy integration, industrial expansion, and digitalization.

- Technological Advancements: Focus on SF6-free alternatives, vacuum interrupter technology, and digital integration.

- End-User Demand: Increasing need for reliable, compact, and smart grid solutions.

Key Markets & Segments Leading North America Gas Insulated Switchgear Market

The United States stands as the dominant market within the North America Gas Insulated Switchgear sector, driven by its extensive industrial base, significant investments in grid modernization, and a large-scale push towards renewable energy integration. Within the voltage segments, Medium and High Voltage GIS solutions are witnessing the most substantial adoption. This is primarily attributed to their critical role in power transmission and distribution networks, substations, and large industrial facilities where high power handling capacity and reliability are paramount. The Industrial end-user segment leads the market due to the continuous expansion and upgrades of manufacturing plants, petrochemical facilities, and data centers, all of which require robust and space-efficient switchgear solutions.

- Dominant Geography: United States

- Drivers: Extensive industrial infrastructure, significant government investment in grid modernization (e.g., Transmission Facilitation Program), and the rapid growth of renewable energy projects. The U.S. Department of Energy's initiatives to upgrade the power grid are a substantial catalyst.

- Dominant Voltage Segment: Medium and High Voltage

- Drivers: Essential for bulk power transmission and distribution, substations, and large industrial operations. These segments benefit from the need for reliable grid expansion and upgrades to accommodate growing energy demands and renewable energy integration.

- Dominant End-User: Industrial

- Drivers: Ongoing industrial growth, including manufacturing, oil & gas, mining, and data centers, which demand high-capacity, reliable, and space-saving electrical infrastructure. Industrial facilities are increasingly investing in advanced power distribution systems to ensure operational continuity and efficiency.

North America Gas Insulated Switchgear Market Product Developments

Product innovation in the North America Gas Insulated Switchgear market is characterized by a strong focus on environmental sustainability and enhanced performance. The development of SF6-free alternatives is a significant trend, with companies investing heavily in vacuum interrupter technology and dry-air insulation. For instance, Mitsubishi Electric Power Product Company, Inc. (MEPPI) has pioneered the development of 72 kV vacuum circuit breakers (VCB) with dry-air insulation, designed and tested in the USA, offering a cost-effective and environmentally responsible alternative to SF6 gas. This aligns with the industry's growing commitment to reducing greenhouse gas emissions. The emphasis is on creating compact, modular, and digitally enabled GIS solutions that simplify installation, maintenance, and operation, while providing advanced monitoring and control capabilities for smarter grid management.

Challenges in the North America Gas Insulated Switchgear Market Market

Despite its growth trajectory, the North America Gas Insulated Switchgear market faces several challenges. The high initial cost of GIS equipment compared to traditional switchgear can be a barrier, particularly for smaller utilities or projects with limited budgets. Furthermore, the availability and cost of specialized gases, though moving towards SF6 alternatives, can still pose supply chain concerns. Stringent environmental regulations, while driving innovation, also necessitate significant research and development investments to ensure compliance, potentially increasing product costs. Lastly, the skilled workforce required for the installation and maintenance of advanced GIS systems is not always readily available, posing operational challenges for some organizations.

- High Initial Investment Costs: GIS technology generally has a higher upfront cost compared to traditional air-insulated switchgear.

- Supply Chain Volatility: Fluctuations in the availability and pricing of specialized insulation mediums and components.

- Skilled Workforce Shortage: Demand for specialized technicians for installation, maintenance, and troubleshooting of complex GIS systems.

Forces Driving North America Gas Insulated Switchgear Market Growth

Several powerful forces are propelling the growth of the North America Gas Insulated Switchgear market. The relentless drive for grid modernization and the need to upgrade aging electrical infrastructure to enhance reliability and prevent blackouts are primary catalysts. The significant integration of renewable energy sources, such as solar and wind power, necessitates advanced and flexible switchgear solutions capable of managing intermittent power flows, thus boosting demand for GIS. Furthermore, increasing industrialization, particularly in sectors like manufacturing and data centers, coupled with the electrification of transportation, is driving up electricity consumption and requiring robust power distribution networks. Government initiatives and favorable policies aimed at promoting clean energy and strengthening the national grid are also significant growth accelerators.

- Infrastructure Modernization: Aging grids require upgrades for reliability and efficiency.

- Renewable Energy Integration: The growing need to manage intermittent power from solar and wind farms.

- Industrial Expansion: Increased demand from manufacturing, data centers, and other heavy industries.

- Government Support: Favorable policies and funding for grid upgrades and clean energy initiatives.

Challenges in the North America Gas Insulated Switchgear Market Market

Long-term growth catalysts in the North America Gas Insulated Switchgear market are intrinsically linked to continued technological advancements and evolving market demands. The ongoing global push towards decarbonization and sustainability is a significant driver, creating sustained demand for SF6-free and environmentally friendly GIS solutions. The increasing complexity of the power grid, with the rise of distributed energy resources (DERs) and smart grid technologies, will continue to require highly reliable and intelligent switchgear. Partnerships and collaborations between technology providers, utilities, and research institutions will foster further innovation in areas like predictive maintenance and digital twin technology, enhancing operational efficiency and asset management. Market expansion into underserved areas and the development of more cost-effective solutions for a wider range of applications will also contribute to sustained long-term growth.

- Sustainability Mandates: Continued focus on environmentally friendly and low-GWP insulation alternatives.

- Smart Grid Evolution: Integration of advanced digital technologies for enhanced grid management and control.

- R&D Investment: Continuous innovation in insulation technology, miniaturization, and digital capabilities.

Emerging Opportunities in North America Gas Insulated Switchgear Market

Emerging opportunities within the North America Gas Insulated Switchgear market are rich and diverse, offering significant avenues for growth. The increasing adoption of Electric Vehicle (EV) charging infrastructure, particularly in urban and commercial areas, presents a substantial demand for robust and reliable power distribution solutions, where GIS plays a crucial role. The development and deployment of microgrids, designed to enhance grid resilience and provide localized power supply, offer another lucrative opportunity for compact and efficient GIS solutions. Furthermore, the ongoing retrofitting and upgrading of aging industrial facilities to meet modern efficiency and safety standards will create a consistent demand for advanced GIS. The growing interest in distributed energy resources (DERs) and their integration into the main grid will also fuel the need for sophisticated GIS capable of managing bi-directional power flow and ensuring grid stability.

- Electric Vehicle (EV) Charging Infrastructure: Expansion of high-power charging stations requiring reliable distribution.

- Microgrid Development: Increasing demand for localized and resilient power systems.

- Retrofitting and Upgrades: Modernization of existing industrial and commercial facilities.

- Distributed Energy Resources (DERs): Integration of renewable energy and storage solutions into the grid.

Leading Players in the North America Gas Insulated Switchgear Market Sector

- Powell Industries Inc.

- Toshiba Corp.

- Hitachi Ltd.

- Bharat Heavy Electricals Limited

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Eaton Corporation PLC

- Siemens Energy AG

- General Electric Company

- Hyosung Heavy Industries Corp.

Key Milestones in North America Gas Insulated Switchgear Market Industry

- October 2022: Mitsubishi Electric Power Product Company, Inc. (MEPPI) announced the first shipments of its 72 kV vacuum circuit breaker (VCB) with dry-air insulation. These are designed, assembled, and tested in the United States of America. The company's 72 kV vacuum circuit breaker meets all applicable IEEE, IEC, and ANSI certification standards. The 72 kV vacuum circuit breaker employs the company's 65-year history of vacuum interrupter technology. It provides customers with a cost-effective, environmentally responsible, zero-global-warming potential alternative to SF6 gas and alternative gas-insulating mediums.

- May 2022: The federal government launched USD 2.5 billion in funds to modernize and expand the country's power grid capacity under the Transmission Facilitation Program (TFP) created by the Bipartisan Infrastructure Law. As part of this, the U.S. Department of Energy (DOE) issued a request for information (RFI) to seek public input on the structure of the new revolving fund program.

Strategic Outlook for North America Gas Insulated Switchgear Market Market

The strategic outlook for the North America Gas Insulated Switchgear market is highly promising, characterized by continuous innovation and expanding applications. The market will be shaped by an increasing emphasis on sustainable and SF6-free solutions, driving investments in research and development for advanced insulation technologies. Digitalization will remain a key growth accelerator, with the integration of IoT, AI, and advanced analytics for enhanced monitoring, control, and predictive maintenance of GIS assets. Government incentives for grid modernization and renewable energy integration will continue to provide a strong tailwind. Companies focusing on developing modular, compact, and highly reliable GIS solutions will be well-positioned to capture market share. Furthermore, strategic partnerships and collaborations will be crucial for leveraging technological advancements and expanding market reach, ensuring a robust and resilient future for the North American power grid.

North America Gas Insulated Switchgear Market Segmentation

-

1. Voltage

- 1.1. Low Voltage

- 1.2. Medium and High Voltage

-

2. End-User

- 2.1. Commercial

- 2.2. Residential

- 2.3. Industrial

-

3. Geography

- 3.1. Canada

- 3.2. United states

- 3.3. Mexico

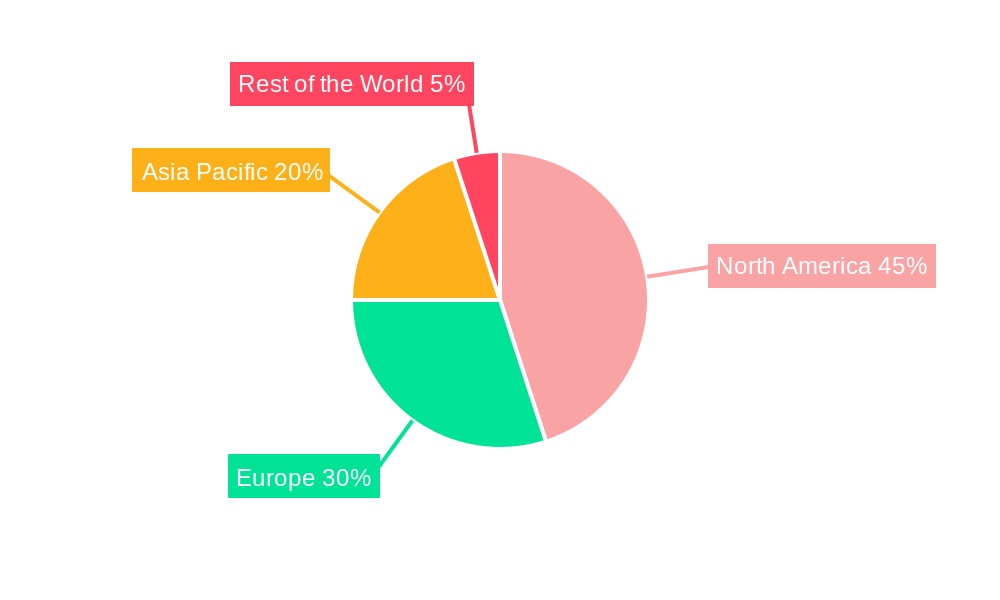

North America Gas Insulated Switchgear Market Segmentation By Geography

- 1. Canada

- 2. United states

- 3. Mexico

North America Gas Insulated Switchgear Market Regional Market Share

Geographic Coverage of North America Gas Insulated Switchgear Market

North America Gas Insulated Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Focus on Waste Management4.; Decline in Fossil-fuel based Electricity Generation

- 3.3. Market Restrains

- 3.3.1. 4.; High Price of Incinerators and Decline in Energy Price of Other Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. High Voltage Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Gas Insulated Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 5.1.1. Low Voltage

- 5.1.2. Medium and High Voltage

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Commercial

- 5.2.2. Residential

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Canada

- 5.3.2. United states

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.4.2. United states

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 6. Canada North America Gas Insulated Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 6.1.1. Low Voltage

- 6.1.2. Medium and High Voltage

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Commercial

- 6.2.2. Residential

- 6.2.3. Industrial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Canada

- 6.3.2. United states

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 7. United states North America Gas Insulated Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 7.1.1. Low Voltage

- 7.1.2. Medium and High Voltage

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Commercial

- 7.2.2. Residential

- 7.2.3. Industrial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Canada

- 7.3.2. United states

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 8. Mexico North America Gas Insulated Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 8.1.1. Low Voltage

- 8.1.2. Medium and High Voltage

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Commercial

- 8.2.2. Residential

- 8.2.3. Industrial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Canada

- 8.3.2. United states

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Powell industries Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Toshiba Corp

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Hitachi Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Bharat Heavy Electricals Limited

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Mitsubishi Electric Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Schneider Electric SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Eaton Corporation PLC

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Siemens Energy AG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 General Electric Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Hyosung Heavy Industries Corp

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Powell industries Inc

List of Figures

- Figure 1: North America Gas Insulated Switchgear Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Gas Insulated Switchgear Market Share (%) by Company 2025

List of Tables

- Table 1: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 2: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 3: North America Gas Insulated Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 5: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 7: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 9: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 10: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 11: North America Gas Insulated Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 13: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 15: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 17: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 18: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 19: North America Gas Insulated Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 20: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 21: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 23: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 26: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 27: North America Gas Insulated Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 28: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 29: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 31: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Gas Insulated Switchgear Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the North America Gas Insulated Switchgear Market?

Key companies in the market include Powell industries Inc, Toshiba Corp, Hitachi Ltd, Bharat Heavy Electricals Limited, Mitsubishi Electric Corporation, Schneider Electric SE, Eaton Corporation PLC, Siemens Energy AG, General Electric Company, Hyosung Heavy Industries Corp.

3. What are the main segments of the North America Gas Insulated Switchgear Market?

The market segments include Voltage, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Focus on Waste Management4.; Decline in Fossil-fuel based Electricity Generation.

6. What are the notable trends driving market growth?

High Voltage Hold Significant Market Share.

7. Are there any restraints impacting market growth?

4.; High Price of Incinerators and Decline in Energy Price of Other Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

October 2022: Mitsubishi Electric Power Product Company, Inc. (MEPPI) announced the first shipments of its 72 kV vacuum circuit breaker (VCB) with dry-air insulation. These are designed, assembled, and tested in the United States of America. The company's 72 kV vacuum circuit breaker meets all applicable IEEE, IEC, and ANSI certification standards. The 72 kV vacuum circuit breaker employs the company's 65-year history of vacuum interrupter technology. It provides customers with a cost-effective, environmentally responsible, zero-global-warming potential alternative to SF6 gas and alternative gas-insulating mediums.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Gas Insulated Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Gas Insulated Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Gas Insulated Switchgear Market?

To stay informed about further developments, trends, and reports in the North America Gas Insulated Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence