Key Insights

The APAC Electrical Substation Packager Market is projected for substantial expansion, anticipated to reach $38.23 billion by 2025, with a robust CAGR of 8.2% from 2025 to 2033. This growth is primarily driven by the escalating demand for reliable power distribution infrastructure across the Asia-Pacific region, fueled by rapid industrialization, urbanization, and the imperative for enhanced grid stability in burgeoning economies. Key sectors including industrial, power utilities, and commercial establishments are expected to drive significant adoption. Ongoing investments in power grid upgrades and expansion, alongside the development of new renewable energy projects, are creating a conducive environment for market advancement. The trend towards modular, pre-fabricated substation solutions, offering faster deployment and cost efficiencies, further bolsters market momentum.

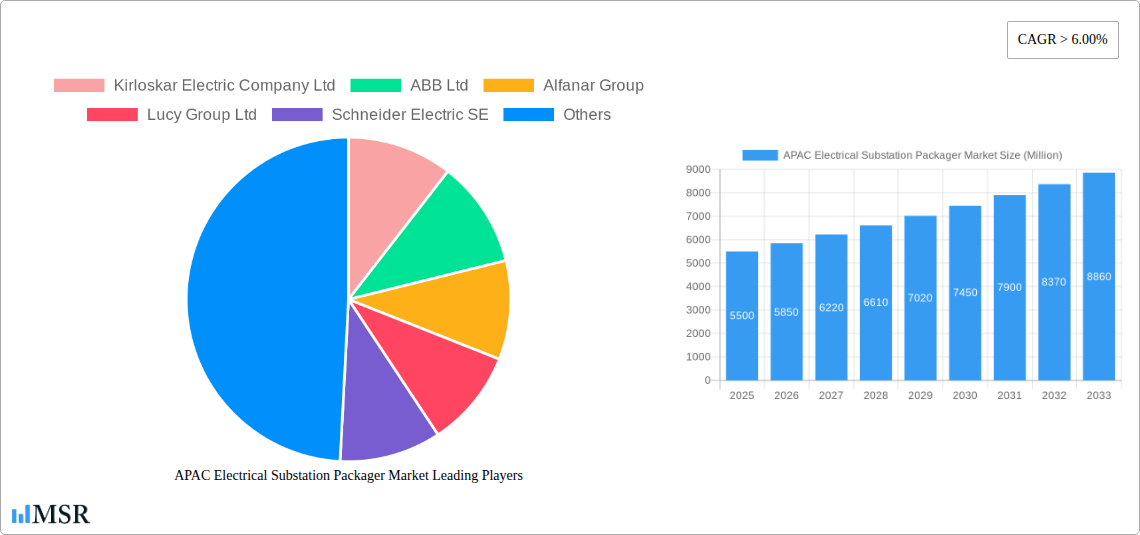

APAC Electrical Substation Packager Market Market Size (In Billion)

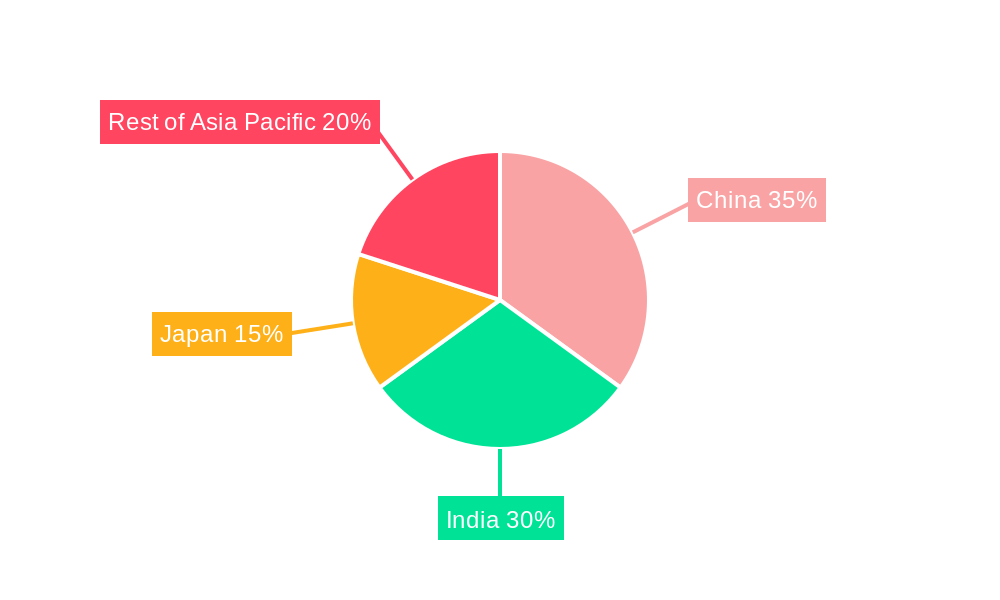

Potential restraints to market expansion include stringent regulatory approvals, high initial capital investment for substation projects, and the availability of skilled labor. Despite these challenges, the fundamental need for robust electrical infrastructure in the rapidly developing APAC region is expected to sustain market growth. China and India are anticipated to lead market share, driven by their substantial populations, extensive industrial bases, and aggressive infrastructure development plans. Japan's advanced technological landscape will also contribute significantly, while the Rest of Asia-Pacific offers promising growth opportunities as developing nations prioritize electrification and grid modernization. The market landscape features established global players and a growing number of regional manufacturers, indicating a competitive yet opportunity-rich environment for electrical substation packager solutions.

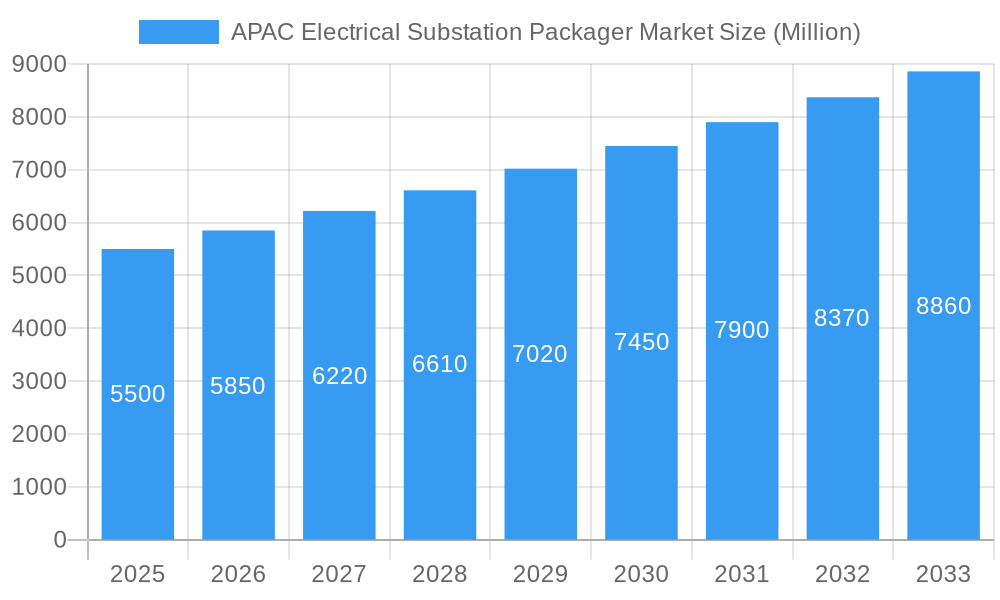

APAC Electrical Substation Packager Market Company Market Share

This comprehensive report provides critical insights, market sizing, and future forecasts for the APAC Electrical Substation Packager Market for the period 2019–2033, with a base year of 2025 and a forecast period of 2025–2033.

APAC Electrical Substation Packager Market Market Concentration & Dynamics

The APAC Electrical Substation Packager Market is characterized by a moderate to high concentration, with a few prominent global players holding significant market share. Innovation ecosystems are rapidly evolving, driven by increasing investments in smart grid technologies and renewable energy integration. Regulatory frameworks across the APAC region are progressively becoming more conducive to infrastructure development, although variations exist between countries, influencing project timelines and investment decisions. Substitute products are limited in the context of complete substation packages, but advancements in individual components can impact the overall offering. End-user trends indicate a growing demand for customized, pre-fabricated, and modular substation solutions to facilitate faster project deployment and cost optimization. Merger and acquisition (M&A) activities are on the rise as established companies seek to expand their geographical reach, technological capabilities, and product portfolios. For instance, General Electric Company's acquisition of a local electrical substation packager in China signifies a strategic move to strengthen its presence in this key market. The market is witnessing increased strategic alliances and joint ventures aimed at addressing the complex needs of power utilities and industrial sectors. With an estimated market share for the top 5 players at xx%, the competitive landscape is dynamic, driven by technological advancements and strategic expansions. M&A deal counts are projected to be xx in the forecast period, underscoring the consolidation trend.

APAC Electrical Substation Packager Market Industry Insights & Trends

The APAC Electrical Substation Packager Market is experiencing robust growth, projected to reach a market size of approximately USD 12,500 Million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period (2025–2033). This expansion is primarily fueled by escalating energy demand across the region, driven by rapid industrialization, urbanization, and growing populations in countries like India and China. Governments are actively investing in upgrading and expanding their power infrastructure to ensure reliable electricity supply and meet the demands of burgeoning economies. The increasing adoption of renewable energy sources, such as solar and wind power, necessitates the development of new and enhanced substation infrastructure to effectively integrate these intermittent sources into the grid. Technological disruptions, including the advent of digital substations, the Internet of Things (IoT) for remote monitoring and control, and advanced automation solutions, are transforming the way substations are designed, manufactured, and operated. These innovations lead to improved efficiency, reduced operational costs, enhanced safety, and greater grid stability. Evolving consumer behaviors, particularly among industrial and commercial end-users, are leaning towards flexible, scalable, and rapidly deployable substation solutions. The demand for pre-fabricated and modular substations is surging, as they offer significant advantages in terms of faster installation times, reduced on-site labor, and minimized disruption to ongoing operations. Furthermore, the focus on sustainability and environmental regulations is pushing manufacturers to develop more energy-efficient and eco-friendly substation designs. The growing need for grid modernization and smart grid initiatives further propels the market, as substations are pivotal components in creating a more resilient and intelligent power infrastructure. The shift towards distributed energy generation and the increasing electrification of transportation also contribute to the evolving landscape of substation requirements.

Key Markets & Segments Leading APAC Electrical Substation Packager Market

The China region is the undisputed leader in the APAC Electrical Substation Packager Market, driven by its massive infrastructure development projects, significant industrial output, and ambitious renewable energy targets. China's sheer scale of investment in power grid expansion and modernization makes it a primary demand hub for electrical substation packagers.

Geography:

- China: Dominates due to massive government investments in smart grids, renewable energy integration (solar, wind), and industrial expansion. The sheer volume of new power projects and grid upgrades creates a consistent demand.

- India: Rapidly growing, driven by increasing energy needs, electrification efforts, and government initiatives like "Make in India," which encourages local manufacturing and infrastructure development. The expanding industrial sector and urbanization further fuel demand.

- Rest of Asia-Pacific: Encompasses dynamic markets like Southeast Asian nations undergoing significant economic growth and infrastructure development, as well as developed economies like Japan and South Korea focused on grid modernization and smart grid technologies.

Voltage Segments:

- High Voltage: Crucial for long-distance power transmission and grid backbone infrastructure, especially in large countries like China and India, which are expanding their national grids.

- Medium Voltage: Essential for distributing power to industrial facilities, commercial complexes, and residential areas. This segment sees consistent demand due to ongoing industrialization and urbanization.

- Low Voltage: Primarily serves local distribution networks within campuses, smaller industrial units, and commercial buildings.

Application Segments:

- Power Utilities: Represents the largest segment, as public and private utility companies are the primary purchasers of substation packages for transmission, distribution, and renewable energy integration. Their continuous need for grid expansion and modernization underpins this dominance.

- Industrial: Fueled by the expansion of manufacturing, mining, and other heavy industries across the APAC region, particularly in China and India. These industries require reliable and robust power supply, often necessitating dedicated substation solutions.

- Commercial: Driven by the growth of commercial real estate, data centers, and other large commercial establishments that require dedicated power infrastructure.

The dominance of China is further amplified by its aggressive adoption of advanced technologies and its role as a global manufacturing hub. India's burgeoning economy and its commitment to universal electrification are propelling its growth at an accelerated pace. The Power Utilities application segment consistently leads due to the fundamental need for grid infrastructure.

APAC Electrical Substation Packager Market Product Developments

Product development in the APAC Electrical Substation Packager Market is characterized by a strong focus on modularity, digitalization, and enhanced reliability. Manufacturers are innovating to offer compact, pre-fabricated substation packages that significantly reduce on-site installation time and costs. The integration of digital technologies, such as IoT sensors, advanced control systems, and remote monitoring capabilities, is transforming substations into intelligent and self-optimizing assets. This allows for predictive maintenance, real-time performance analysis, and improved grid management. Furthermore, there is a growing emphasis on developing substation packages designed for specific environmental conditions and challenging terrains prevalent in the APAC region. These advancements aim to improve operational efficiency, enhance grid stability, and support the integration of renewable energy sources.

Challenges in the APAC Electrical Substation Packager Market Market

The APAC Electrical Substation Packager Market faces several challenges that can impede its growth trajectory. Regulatory hurdles and varying standards across different countries can lead to project delays and increased complexity in supply chain management. Supply chain disruptions, exacerbated by geopolitical factors and logistical complexities in the vast APAC region, can impact project timelines and costs. Intense competition from both global and local players can lead to price pressures, affecting profit margins. Skilled labor shortages for installation, maintenance, and operation of advanced substation technologies also present a significant constraint. Cybersecurity concerns related to increasingly digitized substations are a growing area of focus, requiring robust security measures. The initial high capital investment required for advanced substation infrastructure can also be a barrier for some developing markets.

Forces Driving APAC Electrical Substation Packager Market Growth

Several powerful forces are driving the growth of the APAC Electrical Substation Packager Market. Surging energy demand from rapidly industrializing economies and growing populations is a primary catalyst. Government initiatives and investments in power infrastructure upgrades and smart grid development are creating substantial opportunities. The accelerating adoption of renewable energy sources necessitates the expansion and modernization of substation capacity for efficient grid integration. Technological advancements in automation, digitalization, and IoT are leading to the development of more efficient and intelligent substation solutions. The increasing need for grid modernization to enhance reliability and resilience against disruptions is also a significant growth driver. Furthermore, the growing urbanization and infrastructure development projects across the region are creating consistent demand for electrical substation packagers.

Challenges in the APAC Electrical Substation Packager Market Market

Long-term growth catalysts in the APAC Electrical Substation Packager Market revolve around sustained technological innovation and strategic market expansion. The continued development of smart grid technologies, including AI-powered analytics for grid management and advanced energy storage solutions integrated with substations, will be crucial. Partnerships and collaborations between global technology providers and local players will foster knowledge transfer and localized solutions. Expansion into emerging economies within the APAC region, offering tailored and cost-effective substation solutions, presents significant untapped potential. The increasing focus on decentralized energy generation and microgrids will also drive demand for specialized substation packagers. Addressing evolving environmental regulations and promoting sustainable substation designs will be key to long-term success.

Emerging Opportunities in APAC Electrical Substation Packager Market

Emerging opportunities in the APAC Electrical Substation Packager Market are diverse and promising. The rapid growth of data centers across the region is creating a significant demand for reliable and high-capacity power substations. The increasing electrification of transportation, particularly electric vehicles, will necessitate the development of specialized charging infrastructure and grid support. The ongoing push for energy efficiency and demand-side management solutions will drive the need for intelligent substations capable of optimizing power flow. Furthermore, the exploration of new energy sources and advanced grid technologies like hydrogen fuel cell integration presents future growth avenues. The development of resilient and self-healing grid infrastructure to withstand natural disasters is also a growing area of opportunity.

Leading Players in the APAC Electrical Substation Packager Market Sector

- Kirloskar Electric Company Ltd

- ABB Ltd

- Alfanar Group

- Lucy Group Ltd

- Schneider Electric SE

- Eaton Corporation PLC

- LARSEN & TOUBRO LIMITED

- General Electric Company

- C&S Electric Limited

- Siemens AG

Key Milestones in APAC Electrical Substation Packager Market Industry

- 2023: ABB wins a contract to supply electrical substation packages for a hydropower plant in India, highlighting the growing investment in renewable energy infrastructure.

- 2024 (Early): Schneider Electric launches a new range of modular substation packages designed for urban applications, addressing the need for compact and rapidly deployable solutions in densely populated areas.

- 2024 (Mid): GE acquires a local electrical substation packager in China to expand its market presence and strengthen its foothold in one of the world's largest and fastest-growing markets for electrical infrastructure.

Strategic Outlook for APAC Electrical Substation Packager Market Market

The strategic outlook for the APAC Electrical Substation Packager Market is highly positive, driven by sustained economic growth, evolving energy policies, and rapid technological advancements. Key growth accelerators will include a continued focus on smart grid modernization, with an emphasis on digitalization, automation, and AI integration. The increasing commitment to renewable energy targets across the region will drive demand for substation solutions capable of handling intermittent power generation. Strategic opportunities lie in developing customized and modular solutions to cater to diverse geographical and application-specific needs. Furthermore, partnerships and joint ventures that foster local manufacturing capabilities and technology transfer will be crucial for long-term success. The market will also benefit from increased investment in grid resilience and cybersecurity measures to ensure reliable power supply in an increasingly complex energy landscape.

APAC Electrical Substation Packager Market Segmentation

-

1. Voltage

- 1.1. High

- 1.2. Medium

- 1.3. Low

-

2. Application

- 2.1. Industrial

- 2.2. Power Utilities

- 2.3. Commercial

- 2.4. Others

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia-Pacific

APAC Electrical Substation Packager Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

APAC Electrical Substation Packager Market Regional Market Share

Geographic Coverage of APAC Electrical Substation Packager Market

APAC Electrical Substation Packager Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Energy Demand4.; Renewable Energy Transition

- 3.3. Market Restrains

- 3.3.1. 4.; Phasing out of Conventional Sources of Electricity

- 3.4. Market Trends

- 3.4.1. Power Utilities Segment to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Electrical Substation Packager Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 5.1.1. High

- 5.1.2. Medium

- 5.1.3. Low

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial

- 5.2.2. Power Utilities

- 5.2.3. Commercial

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 6. China APAC Electrical Substation Packager Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 6.1.1. High

- 6.1.2. Medium

- 6.1.3. Low

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Industrial

- 6.2.2. Power Utilities

- 6.2.3. Commercial

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 7. India APAC Electrical Substation Packager Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 7.1.1. High

- 7.1.2. Medium

- 7.1.3. Low

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Industrial

- 7.2.2. Power Utilities

- 7.2.3. Commercial

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 8. Japan APAC Electrical Substation Packager Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 8.1.1. High

- 8.1.2. Medium

- 8.1.3. Low

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Industrial

- 8.2.2. Power Utilities

- 8.2.3. Commercial

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 9. Rest of Asia Pacific APAC Electrical Substation Packager Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Voltage

- 9.1.1. High

- 9.1.2. Medium

- 9.1.3. Low

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Industrial

- 9.2.2. Power Utilities

- 9.2.3. Commercial

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Voltage

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kirloskar Electric Company Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Alfanar Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Lucy Group Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Schneider Electric SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Eaton Corporation PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 LARSEN & TOUBRO LIMITED

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 General Electric Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 C&S Electric Limited*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Siemens AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Kirloskar Electric Company Ltd

List of Figures

- Figure 1: Global APAC Electrical Substation Packager Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global APAC Electrical Substation Packager Market Volume Breakdown (Gigawatt, %) by Region 2025 & 2033

- Figure 3: China APAC Electrical Substation Packager Market Revenue (billion), by Voltage 2025 & 2033

- Figure 4: China APAC Electrical Substation Packager Market Volume (Gigawatt), by Voltage 2025 & 2033

- Figure 5: China APAC Electrical Substation Packager Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 6: China APAC Electrical Substation Packager Market Volume Share (%), by Voltage 2025 & 2033

- Figure 7: China APAC Electrical Substation Packager Market Revenue (billion), by Application 2025 & 2033

- Figure 8: China APAC Electrical Substation Packager Market Volume (Gigawatt), by Application 2025 & 2033

- Figure 9: China APAC Electrical Substation Packager Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: China APAC Electrical Substation Packager Market Volume Share (%), by Application 2025 & 2033

- Figure 11: China APAC Electrical Substation Packager Market Revenue (billion), by Geography 2025 & 2033

- Figure 12: China APAC Electrical Substation Packager Market Volume (Gigawatt), by Geography 2025 & 2033

- Figure 13: China APAC Electrical Substation Packager Market Revenue Share (%), by Geography 2025 & 2033

- Figure 14: China APAC Electrical Substation Packager Market Volume Share (%), by Geography 2025 & 2033

- Figure 15: China APAC Electrical Substation Packager Market Revenue (billion), by Country 2025 & 2033

- Figure 16: China APAC Electrical Substation Packager Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 17: China APAC Electrical Substation Packager Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: China APAC Electrical Substation Packager Market Volume Share (%), by Country 2025 & 2033

- Figure 19: India APAC Electrical Substation Packager Market Revenue (billion), by Voltage 2025 & 2033

- Figure 20: India APAC Electrical Substation Packager Market Volume (Gigawatt), by Voltage 2025 & 2033

- Figure 21: India APAC Electrical Substation Packager Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 22: India APAC Electrical Substation Packager Market Volume Share (%), by Voltage 2025 & 2033

- Figure 23: India APAC Electrical Substation Packager Market Revenue (billion), by Application 2025 & 2033

- Figure 24: India APAC Electrical Substation Packager Market Volume (Gigawatt), by Application 2025 & 2033

- Figure 25: India APAC Electrical Substation Packager Market Revenue Share (%), by Application 2025 & 2033

- Figure 26: India APAC Electrical Substation Packager Market Volume Share (%), by Application 2025 & 2033

- Figure 27: India APAC Electrical Substation Packager Market Revenue (billion), by Geography 2025 & 2033

- Figure 28: India APAC Electrical Substation Packager Market Volume (Gigawatt), by Geography 2025 & 2033

- Figure 29: India APAC Electrical Substation Packager Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: India APAC Electrical Substation Packager Market Volume Share (%), by Geography 2025 & 2033

- Figure 31: India APAC Electrical Substation Packager Market Revenue (billion), by Country 2025 & 2033

- Figure 32: India APAC Electrical Substation Packager Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 33: India APAC Electrical Substation Packager Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: India APAC Electrical Substation Packager Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Japan APAC Electrical Substation Packager Market Revenue (billion), by Voltage 2025 & 2033

- Figure 36: Japan APAC Electrical Substation Packager Market Volume (Gigawatt), by Voltage 2025 & 2033

- Figure 37: Japan APAC Electrical Substation Packager Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 38: Japan APAC Electrical Substation Packager Market Volume Share (%), by Voltage 2025 & 2033

- Figure 39: Japan APAC Electrical Substation Packager Market Revenue (billion), by Application 2025 & 2033

- Figure 40: Japan APAC Electrical Substation Packager Market Volume (Gigawatt), by Application 2025 & 2033

- Figure 41: Japan APAC Electrical Substation Packager Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Japan APAC Electrical Substation Packager Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Japan APAC Electrical Substation Packager Market Revenue (billion), by Geography 2025 & 2033

- Figure 44: Japan APAC Electrical Substation Packager Market Volume (Gigawatt), by Geography 2025 & 2033

- Figure 45: Japan APAC Electrical Substation Packager Market Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Japan APAC Electrical Substation Packager Market Volume Share (%), by Geography 2025 & 2033

- Figure 47: Japan APAC Electrical Substation Packager Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Japan APAC Electrical Substation Packager Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 49: Japan APAC Electrical Substation Packager Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Japan APAC Electrical Substation Packager Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of Asia Pacific APAC Electrical Substation Packager Market Revenue (billion), by Voltage 2025 & 2033

- Figure 52: Rest of Asia Pacific APAC Electrical Substation Packager Market Volume (Gigawatt), by Voltage 2025 & 2033

- Figure 53: Rest of Asia Pacific APAC Electrical Substation Packager Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 54: Rest of Asia Pacific APAC Electrical Substation Packager Market Volume Share (%), by Voltage 2025 & 2033

- Figure 55: Rest of Asia Pacific APAC Electrical Substation Packager Market Revenue (billion), by Application 2025 & 2033

- Figure 56: Rest of Asia Pacific APAC Electrical Substation Packager Market Volume (Gigawatt), by Application 2025 & 2033

- Figure 57: Rest of Asia Pacific APAC Electrical Substation Packager Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Rest of Asia Pacific APAC Electrical Substation Packager Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Rest of Asia Pacific APAC Electrical Substation Packager Market Revenue (billion), by Geography 2025 & 2033

- Figure 60: Rest of Asia Pacific APAC Electrical Substation Packager Market Volume (Gigawatt), by Geography 2025 & 2033

- Figure 61: Rest of Asia Pacific APAC Electrical Substation Packager Market Revenue Share (%), by Geography 2025 & 2033

- Figure 62: Rest of Asia Pacific APAC Electrical Substation Packager Market Volume Share (%), by Geography 2025 & 2033

- Figure 63: Rest of Asia Pacific APAC Electrical Substation Packager Market Revenue (billion), by Country 2025 & 2033

- Figure 64: Rest of Asia Pacific APAC Electrical Substation Packager Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 65: Rest of Asia Pacific APAC Electrical Substation Packager Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of Asia Pacific APAC Electrical Substation Packager Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 2: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 3: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 5: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 7: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 9: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 10: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 11: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 13: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 15: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 17: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 18: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 19: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 21: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 23: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 26: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 27: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 29: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 31: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 33: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 34: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 35: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 37: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 39: Global APAC Electrical Substation Packager Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global APAC Electrical Substation Packager Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Electrical Substation Packager Market?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the APAC Electrical Substation Packager Market?

Key companies in the market include Kirloskar Electric Company Ltd, ABB Ltd, Alfanar Group, Lucy Group Ltd, Schneider Electric SE, Eaton Corporation PLC, LARSEN & TOUBRO LIMITED, General Electric Company, C&S Electric Limited*List Not Exhaustive, Siemens AG.

3. What are the main segments of the APAC Electrical Substation Packager Market?

The market segments include Voltage, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.23 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Energy Demand4.; Renewable Energy Transition.

6. What are the notable trends driving market growth?

Power Utilities Segment to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; Phasing out of Conventional Sources of Electricity.

8. Can you provide examples of recent developments in the market?

ABB wins a contract to supply electrical substation packages for a hydropower plant in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Electrical Substation Packager Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Electrical Substation Packager Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Electrical Substation Packager Market?

To stay informed about further developments, trends, and reports in the APAC Electrical Substation Packager Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence