Key Insights

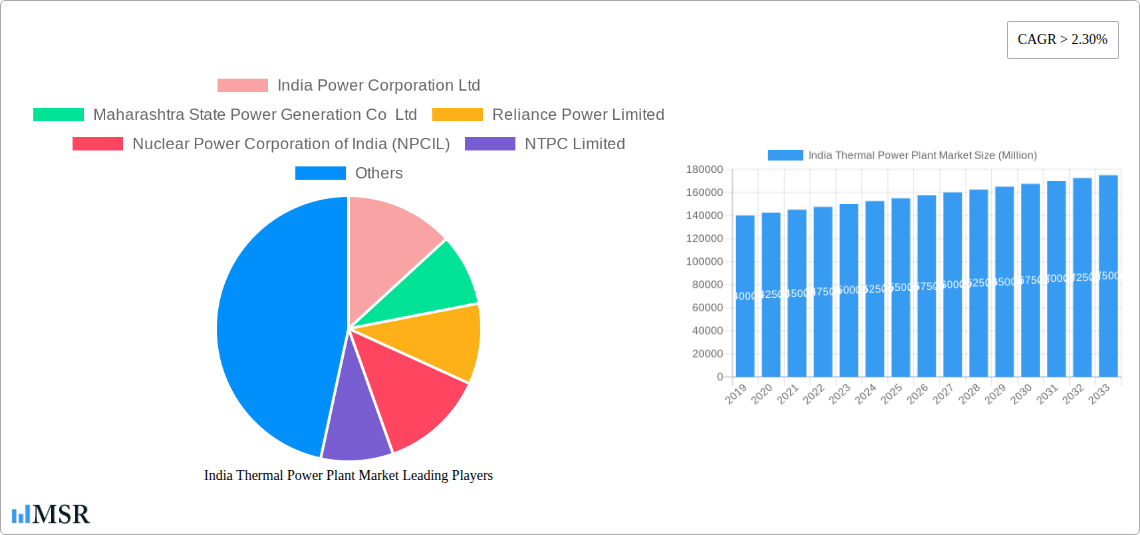

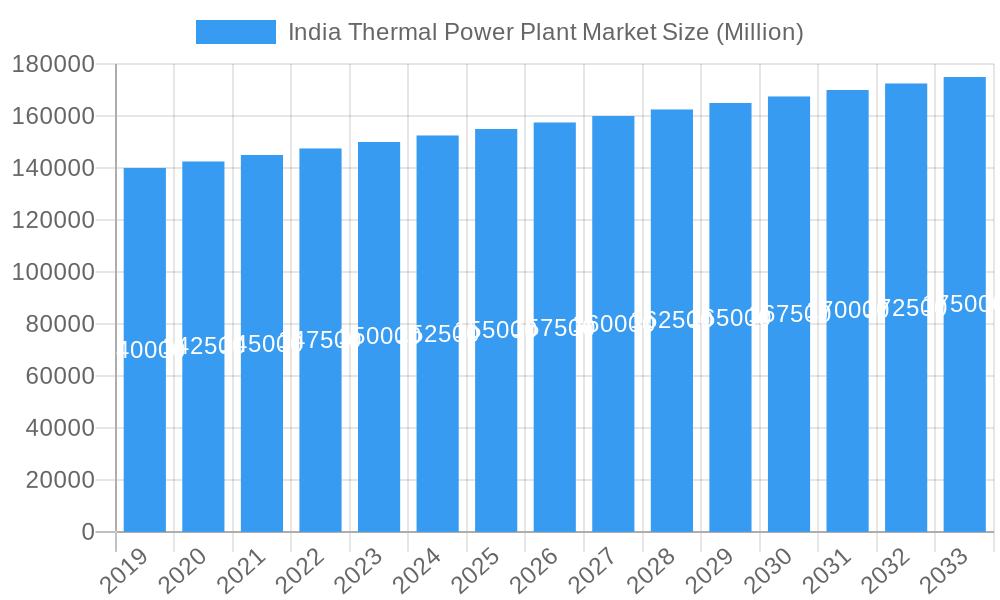

The India Thermal Power Plant Market is poised for significant expansion, with a projected market size estimated to be in the range of INR 150,000 to INR 200,000 million by 2025, growing at a Compound Annual Growth Rate (CAGR) exceeding 2.30% through 2033. This robust growth is primarily propelled by the ever-increasing demand for electricity to fuel India's burgeoning economy, rapid urbanization, and expanding industrial sector. As the nation strives to meet its energy needs for a population exceeding 1.4 billion, thermal power, particularly coal-based, continues to form the backbone of its energy matrix, ensuring baseload power availability. While the push towards cleaner energy sources is evident, the sheer scale of energy demand necessitates continued investment and operation of thermal power plants to bridge the gap, making this market a critical component of India's energy security.

India Thermal Power Plant Market Market Size (In Billion)

The market dynamics are further shaped by a complex interplay of drivers and restraints. Key drivers include supportive government policies aimed at enhancing power generation capacity, significant investments from both public and private sector players like NTPC Limited, Tata Group, and Reliance Power Limited, and the relatively lower operational costs associated with coal-fired plants. However, growing environmental concerns, stringent regulations on emissions, and the global push towards renewable energy sources present considerable restraints. Trends such as the adoption of cleaner coal technologies, increased efficiency measures, and the gradual integration of other fuel types like natural gas and nuclear power in the thermal segment are shaping the future landscape. The dominance of coal fuel type is expected to persist, though gas and nuclear segments will likely see strategic expansions to diversify the energy mix and address environmental challenges.

India Thermal Power Plant Market Company Market Share

This in-depth report offers a strategic analysis of the India Thermal Power Plant Market, providing unparalleled insights into market dynamics, growth drivers, competitive landscape, and future opportunities. Covering a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report is an essential resource for investors, stakeholders, and industry participants seeking to capitalize on the burgeoning Indian power sector. Our analysis delves into the coal power plant market India, gas power plant India, and nuclear power plant India, offering precise data on market size, CAGR, and segmentation.

India Thermal Power Plant Market Market Concentration & Dynamics

The India Thermal Power Plant Market exhibits a moderate to high concentration, with key players like NTPC Limited, Tata Group, and Adani Power Limited holding significant market share. Innovation is primarily driven by the pursuit of greater efficiency, reduced emissions, and integration of advanced technologies in coal and gas-fired plants. The regulatory framework, while evolving to encourage cleaner energy, still presents complexities for thermal power project development India. Substitute products, particularly renewable energy sources like solar and wind power, are increasingly challenging the dominance of thermal power, necessitating strategic adaptation. End-user trends point towards a sustained demand for reliable baseload power, which thermal plants continue to provide, albeit with a growing emphasis on environmental compliance. Merger and acquisition activities are observed as companies seek to consolidate their market position, expand their operational capacities, and diversify their energy portfolios. M&A deal counts are anticipated to rise as the market matures and consolidation opportunities emerge.

India Thermal Power Plant Market Industry Insights & Trends

The India Thermal Power Plant Market is poised for substantial growth, projected to reach an estimated market size of $XX Billion by 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This growth is propelled by India's escalating energy demands, driven by rapid industrialization, urbanization, and a growing population. The nation's continued reliance on thermal power as a primary source of baseload electricity underpins the market's expansion. Technological advancements are central to market evolution, with a focus on enhancing the efficiency of coal thermal power plants and optimizing the performance of gas-fired power plants. The increasing adoption of supercritical and ultra-supercritical technologies in coal plants aims to reduce fuel consumption and emissions. Furthermore, the development of more efficient gas turbines and the exploration of cleaner fuel options are reshaping the gas thermal power sector India. Evolving consumer behaviors, influenced by environmental consciousness and government mandates for cleaner energy, are creating a push for eco-friendly thermal power solutions and the integration of carbon capture technologies. The overall trend indicates a dynamic market where established thermal power generation coexists with the integration of advanced technologies and a growing consideration for environmental sustainability.

Key Markets & Segments Leading India Thermal Power Plant Market

The Coal segment currently dominates the India Thermal Power Plant Market, driven by its established infrastructure, affordability, and abundance of domestic reserves.

- Drivers for Coal Dominance:

- Cost-Effectiveness: Coal remains the most economical fuel source for large-scale power generation in India, crucial for meeting the country's vast energy needs.

- Energy Security: Significant domestic coal reserves provide a degree of energy independence and reduce reliance on imported fuels.

- Established Infrastructure: Decades of investment have resulted in a robust network of coal mines, transportation links, and coal-fired power plants across the country.

- Government Policy Support: Historically, government policies have favored coal as a primary energy source, despite increasing pressure to transition to cleaner alternatives.

The Gas segment is experiencing significant growth, fueled by government initiatives to increase the share of natural gas in the energy mix and the development of gas pipeline infrastructure.

- Drivers for Gas Growth:

- Environmental Benefits: Gas-fired power plants are generally cleaner than coal-fired plants, emitting fewer pollutants.

- Flexibility and Efficiency: Gas turbines offer quick start-up times and operational flexibility, making them suitable for meeting peak demand.

- Import Dependence Reduction: Efforts to diversify gas sources and explore domestic production aim to enhance energy security.

The Nuclear segment, though smaller, is critical for providing a stable, low-carbon baseload power source. Investments in expanding nuclear capacity are driven by the need for decarbonization and energy diversification.

- Drivers for Nuclear Growth:

- Low Carbon Emissions: Nuclear power plants produce virtually no greenhouse gas emissions during operation.

- High Power Output: Nuclear reactors can generate a significant amount of electricity from a small amount of fuel.

- Energy Security: Diversification of energy sources reduces reliance on fossil fuels.

The Other Fuel Types segment encompasses biomass and waste-to-energy plants, representing niche but growing areas driven by waste management initiatives and the push for renewable energy integration.

India Thermal Power Plant Market Product Developments

Product developments in the India Thermal Power Plant Market are focused on enhancing efficiency, reducing environmental impact, and improving operational reliability. Innovations in boiler technology, turbine efficiency, and emissions control systems are prevalent in coal-fired plants. For gas-fired plants, advancements in combined-cycle gas turbine (CCGT) technology and the integration of hybrid systems with renewables are key. Research into advanced nuclear reactor designs and fuel cycles is ongoing to improve safety and sustainability. The market relevance of these developments lies in their ability to address the dual challenge of meeting rising energy demand while adhering to stricter environmental regulations and pursuing decarbonization goals.

Challenges in the India Thermal Power Plant Market Market

The India Thermal Power Plant Market faces several significant challenges. Regulatory hurdles related to environmental clearances and fuel import policies can cause project delays. Supply chain issues, particularly concerning the consistent availability and quality of coal and gas, pose a risk to uninterrupted power generation. Intensifying competition from rapidly expanding renewable energy sources, supported by favorable government incentives, puts pressure on the cost-competitiveness of thermal power. Furthermore, the aging infrastructure of some existing thermal power plants necessitates substantial capital investment for upgrades or decommissioning. The volatile international prices of imported coal and natural gas also present a financial risk for plant operators.

Forces Driving India Thermal Power Plant Market Growth

Several forces are driving the growth of the India Thermal Power Plant Market.

- Surging Energy Demand: India's status as one of the fastest-growing major economies necessitates a significant and continuous supply of electricity for industrial, commercial, and residential use.

- Baseload Power Requirements: Thermal power, particularly coal and nuclear, remains crucial for providing stable and reliable baseload electricity, which renewable sources alone cannot consistently deliver due to their intermittent nature.

- Government's Energy Security Goals: The government prioritizes energy security, and thermal power plays a vital role in reducing dependence on energy imports and ensuring a consistent power supply.

- Technological Advancements: Continuous improvements in thermal power plant technology, such as supercritical and ultra-supercritical technologies, are enhancing efficiency and reducing the environmental footprint of coal-fired plants.

- Economic Growth and Industrialization: Accelerated industrial development and infrastructure projects across various sectors directly translate into increased electricity consumption, favoring thermal power generation.

Challenges in the India Thermal Power Plant Market Market

Despite its growth, the India Thermal Power Plant Market faces long-term challenges. The global push towards decarbonization and climate change mitigation puts significant pressure on the reliance on fossil fuels like coal. Increasingly stringent environmental regulations and the potential for carbon taxes or stricter emissions norms will require substantial investments in cleaner technologies or necessitate plant closures. Public perception and activism against coal-fired power plants due to their environmental impact can also create operational and social challenges. The long gestation periods and high capital costs associated with establishing new thermal power projects, coupled with the increasing competitiveness of renewable energy sources like solar and wind, pose a threat to future investments in the sector.

Emerging Opportunities in India Thermal Power Plant Market

Emerging opportunities in the India Thermal Power Plant Market lie in several key areas. The development and deployment of carbon capture, utilization, and storage (CCUS) technologies offer a pathway for existing and new coal-fired plants to reduce their carbon footprint. The increasing integration of hydrogen as a fuel in gas-fired power plants presents a significant opportunity for decarbonization. Furthermore, the market offers opportunities in the repowering and modernization of aging thermal power plants with more efficient and cleaner technologies. The growing demand for captive power plants by industries seeking reliable and cost-effective electricity also presents a substantial market segment. Exploration of waste-to-energy technologies linked to thermal power generation provides a synergistic opportunity for waste management and power production.

Leading Players in the India Thermal Power Plant Market Sector

- India Power Corporation Ltd

- Maharashtra State Power Generation Co Ltd

- Reliance Power Limited

- Nuclear Power Corporation of India (NPCIL)

- NTPC Limited

- Tata Group

- Jindal Steel & Power Limited

- Adani Power Limited

Key Milestones in India Thermal Power Plant Market Industry

- February 2023: The Indian government re-imposed the emergency clause of the Electricity Act, 2003, requiring all imported coal-based (ICB) power plants in India to operate and generate power at their full capacity during the ensuing summer months. This decision was a direct response to the projected peak electricity demand of 229 gigawatts (GW) in April 2023, highlighting the continued reliance on thermal power to meet immediate energy needs and ensuring grid stability.

- November 2022: Wärtsilä secured an EPC contract to construct a 15.5 MW gas-fired captive power plant in Chennai, Tamil Nadu, for Tamilnadu Petroproducts Limited (TPL). This development underscores the growing demand for captive power solutions in the industrial sector and the adoption of gas-based generation for dedicated industrial energy needs, alongside a five-year operation and maintenance agreement, signaling long-term project commitment.

Strategic Outlook for India Thermal Power Plant Market Market

The strategic outlook for the India Thermal Power Plant Market is characterized by a transition towards cleaner and more efficient operations. While coal will likely remain a significant component of India's energy mix for baseload power in the medium term, there will be an increasing emphasis on mitigating its environmental impact through technological advancements like CCUS and the adoption of higher efficiency standards. The gas power sector is poised for growth as India aims to increase the share of natural gas in its energy basket, driven by environmental considerations and the availability of infrastructure. Nuclear power will continue to play a crucial role in providing low-carbon baseload energy. Strategic opportunities lie in integrating advanced technologies, exploring cleaner fuels like hydrogen, and modernizing existing assets to ensure a sustainable and reliable energy future for India.

India Thermal Power Plant Market Segmentation

-

1. Fuel Type

- 1.1. Coal

- 1.2. Gas

- 1.3. Nuclear

- 1.4. Other Fuel Types

India Thermal Power Plant Market Segmentation By Geography

- 1. India

India Thermal Power Plant Market Regional Market Share

Geographic Coverage of India Thermal Power Plant Market

India Thermal Power Plant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Coal Substituted with Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Coal Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Thermal Power Plant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Coal

- 5.1.2. Gas

- 5.1.3. Nuclear

- 5.1.4. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 India Power Corporation Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maharashtra State Power Generation Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reliance Power Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nuclear Power Corporation of India (NPCIL)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NTPC Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tata Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jindal Steel & Power Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Adani Power Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 India Power Corporation Ltd

List of Figures

- Figure 1: India Thermal Power Plant Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Thermal Power Plant Market Share (%) by Company 2025

List of Tables

- Table 1: India Thermal Power Plant Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 2: India Thermal Power Plant Market Volume Gigawatt Forecast, by Fuel Type 2020 & 2033

- Table 3: India Thermal Power Plant Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Thermal Power Plant Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 5: India Thermal Power Plant Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 6: India Thermal Power Plant Market Volume Gigawatt Forecast, by Fuel Type 2020 & 2033

- Table 7: India Thermal Power Plant Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: India Thermal Power Plant Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Thermal Power Plant Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the India Thermal Power Plant Market?

Key companies in the market include India Power Corporation Ltd, Maharashtra State Power Generation Co Ltd, Reliance Power Limited, Nuclear Power Corporation of India (NPCIL), NTPC Limited, Tata Group, Jindal Steel & Power Limited, Adani Power Limited.

3. What are the main segments of the India Thermal Power Plant Market?

The market segments include Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities.

6. What are the notable trends driving market growth?

Coal Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Coal Substituted with Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

February 2023: The Indian government re-imposed the emergency clause of the Electricity Act, 2003, requiring all imported coal-based (ICB) power plants in India to operate and generate power at their full capacity during the ensuing summer months. According to an order issued by the Ministry of Power, peak electricity demand is expected to reach 229 gigawatts (GW) in April 2023, thus requiring the government to take this decision.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Thermal Power Plant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Thermal Power Plant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Thermal Power Plant Market?

To stay informed about further developments, trends, and reports in the India Thermal Power Plant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence