Key Insights

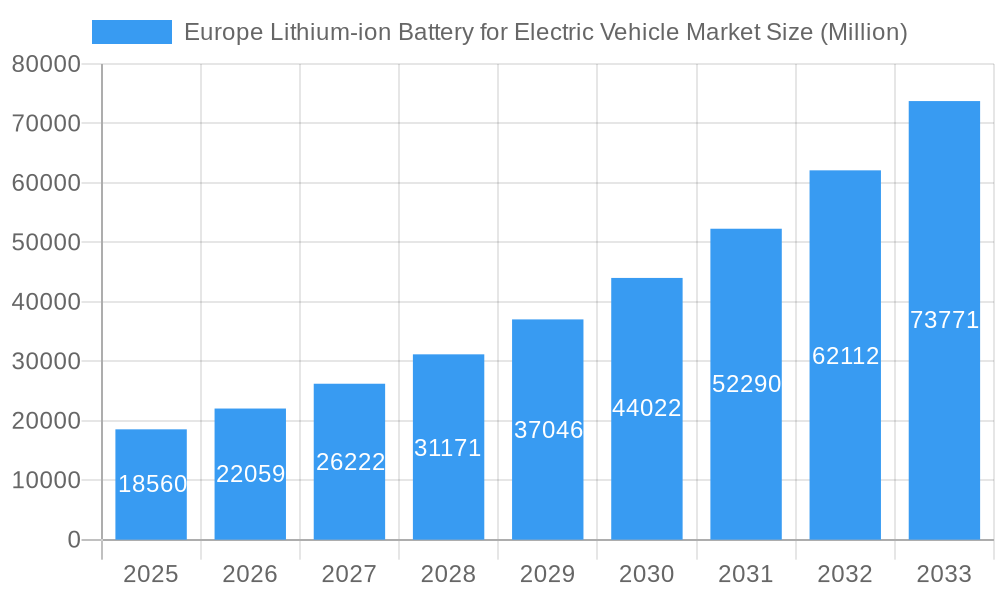

The Europe Lithium-ion Battery for Electric Vehicle Market is poised for explosive growth, projected to reach a substantial market size of $18.56 billion, driven by an impressive Compound Annual Growth Rate (CAGR) of 18.90%. This robust expansion is fueled by several critical factors. The increasing adoption of electric vehicles across all segments, from passenger cars to commercial vehicles and even two-wheelers, signifies a fundamental shift in transportation. Governments across Europe are implementing stringent emissions regulations and offering generous incentives for EV adoption, further accelerating demand. Technological advancements in battery energy density, charging speed, and safety are making EVs more practical and appealing to consumers. The growing awareness of environmental sustainability and the desire to reduce carbon footprints are also significant contributors to this market surge. Furthermore, the robust European automotive industry's commitment to electrification, coupled with significant investments in battery manufacturing facilities and research and development, is creating a self-sustaining growth ecosystem.

Europe Lithium-ion Battery for Electric Vehicle Market Market Size (In Billion)

The market's future trajectory is shaped by a dynamic interplay of forces. Key trends include the dominant rise of Battery Electric Vehicles (BEVs) as consumers increasingly opt for fully electric solutions, while Plug-in Hybrid Electric Vehicles (PHEVs) and Hybrid Electric Vehicles (HEVs) continue to play a transitional role. Innovation in battery chemistries, such as solid-state batteries, promises enhanced performance and safety, potentially revolutionizing the market in the coming years. The expansion of charging infrastructure is another crucial element, addressing range anxiety and making EV ownership more convenient. However, certain restraints could temper the pace of growth. The high upfront cost of EVs and their batteries remains a significant barrier for some consumers, although this is expected to decrease with economies of scale. Supply chain disruptions for critical raw materials like lithium and cobalt, coupled with geopolitical uncertainties, pose potential challenges. Intense competition among established automotive giants and emerging battery manufacturers, including prominent players like CATL, LG Energy Solution, Northvolt, and Samsung SDI, will drive innovation and potentially impact pricing strategies.

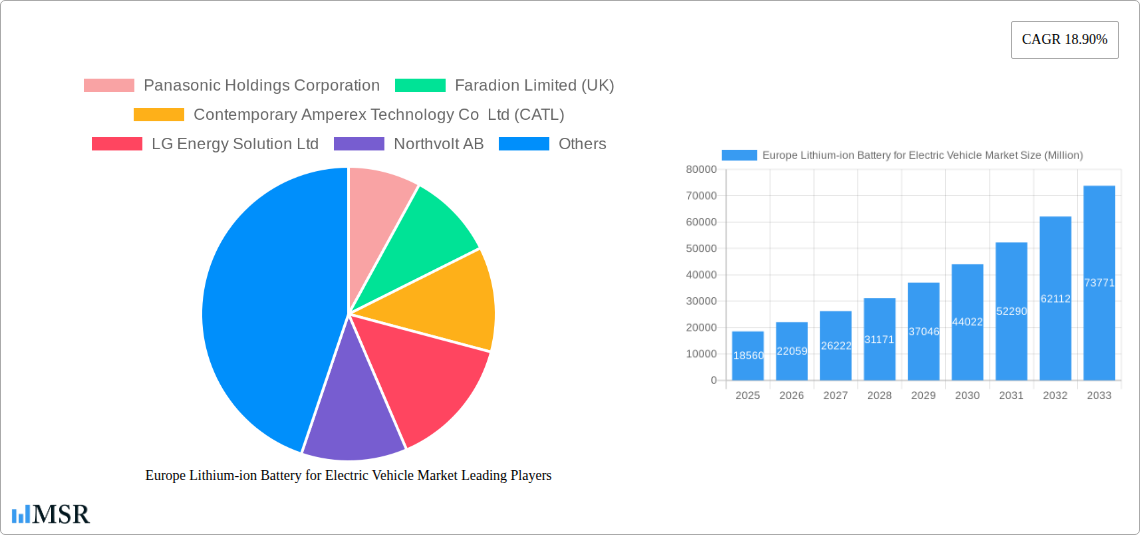

Europe Lithium-ion Battery for Electric Vehicle Market Company Market Share

Unlocking the Future: Europe Lithium-ion Battery for Electric Vehicle Market Report

Drive your business forward with unparalleled insights into the burgeoning European lithium-ion battery market for electric vehicles. This comprehensive report, covering the 2019–2033 study period with a base year of 2025, delivers granular analysis and actionable strategies for stakeholders navigating this dynamic sector. Witness the transformative power of electric mobility as we dissect market size projections, technological advancements, and key growth catalysts. With an estimated market size of XX Million in 2025 and a projected CAGR of XX% from 2025–2033, this report is your definitive guide to capitalizing on the electric vehicle revolution.

Europe Lithium-ion Battery for Electric Vehicle Market Market Concentration & Dynamics

The Europe lithium-ion battery for electric vehicle market is characterized by a dynamic interplay of established global players and ambitious European manufacturers, fostering a highly competitive and innovative landscape. Market concentration is moderately high, with a few key companies holding significant market share, yet innovation ecosystems are robust, driven by substantial R&D investments and strategic partnerships. Regulatory frameworks, particularly those focused on sustainability, battery recycling, and domestic production, are increasingly shaping market entry and operational strategies. The threat of substitute products, while present, is diminishing as lithium-ion technology continues to dominate the EV battery space due to its energy density and performance advantages. End-user trends are heavily influenced by government incentives, charging infrastructure development, and growing consumer awareness of environmental benefits. Mergers and acquisitions (M&A) activities are on the rise, indicating a consolidation phase as companies seek to secure supply chains, acquire advanced technologies, and expand their manufacturing capabilities. For instance, the increasing number of M&A deals signifies a strategic imperative for players to achieve economies of scale and enhance their competitive positioning within this rapidly evolving market.

Europe Lithium-ion Battery for Electric Vehicle Market Industry Insights & Trends

The Europe lithium-ion battery for electric vehicle market is experiencing exponential growth, propelled by a confluence of factors including stringent emissions regulations, growing environmental consciousness among consumers, and substantial government support for the transition to electric mobility. Market expansion drivers are multifaceted, encompassing increasing EV adoption rates across passenger and commercial vehicle segments, substantial investments in battery gigafactories, and continuous advancements in battery chemistries and manufacturing processes. Technological disruptions are at the forefront, with ongoing research into solid-state batteries, improved energy density, faster charging capabilities, and enhanced safety features aiming to address key consumer concerns. Evolving consumer behaviors are shifting towards greater demand for longer-range EVs, reduced charging times, and more affordable electric vehicle options, directly influencing battery design and production priorities. The market size is projected to reach XX Million by 2025, with a significant upward trajectory anticipated throughout the forecast period. The increasing electrification of fleets, coupled with the expansion of charging infrastructure across Europe, further fuels demand for advanced lithium-ion battery solutions.

Key Markets & Segments Leading Europe Lithium-ion Battery for Electric Vehicle Market

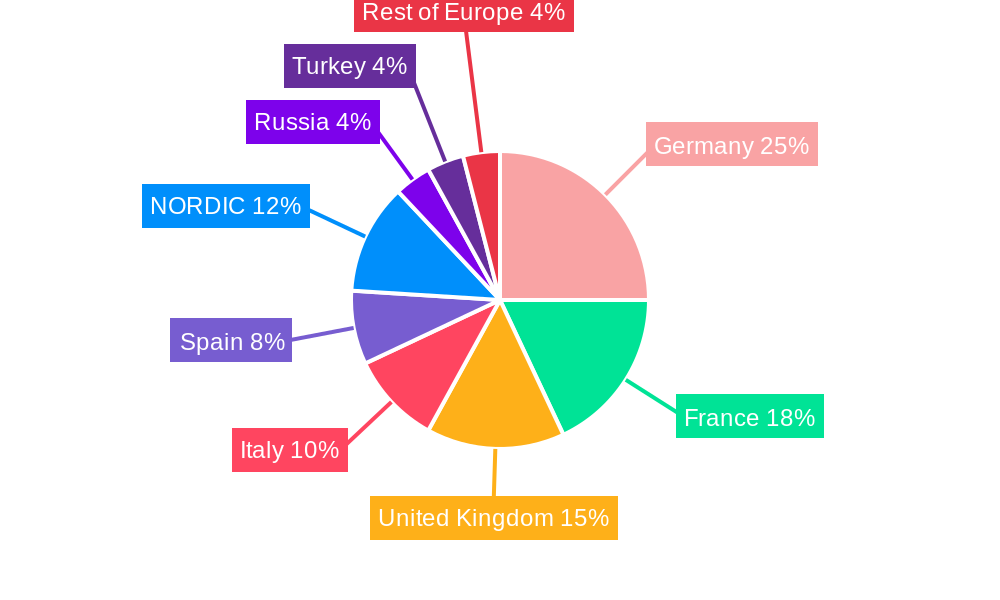

The dominance within the Europe lithium-ion battery for electric vehicle market is largely attributed to Western Europe, with Germany, France, and the UK emerging as key economic powerhouses driving demand and investment.

Dominant Vehicle Type:

- Passenger Vehicles: This segment currently commands the largest share due to widespread consumer adoption of electric cars, bolstered by government subsidies and a growing range of available EV models. The increasing affordability and improved performance of electric passenger cars are significant growth catalysts.

- Commercial Vehicles: This segment is experiencing rapid growth as businesses electrify their fleets to meet sustainability targets and reduce operational costs. Factors like the growing e-commerce sector and stricter emissions standards for logistics companies are accelerating this trend.

- Other Vehicles (Bikes, Scooters, etc.): While smaller, this segment represents a growing niche, particularly in urban areas, driven by the demand for micro-mobility solutions and last-mile delivery services.

Dominant Propulsion Type:

- Battery Electric Vehicles (BEVs): BEVs are the primary drivers of the lithium-ion battery market, benefiting from advancing battery technology that offers longer ranges and reduced charging times. Government mandates and bans on internal combustion engine (ICE) vehicles are further propelling BEV adoption.

- Plug-in Hybrid Electric Vehicles (PHEVs): PHEVs serve as a transitional technology, offering consumers the flexibility of electric power for shorter journeys and gasoline for longer trips. Their market share is expected to remain significant in the near to medium term as charging infrastructure continues to expand.

- Hybrid Electric Vehicles (HEVs): While HEVs utilize smaller batteries, their continued presence contributes to the overall demand for lithium-ion battery components. However, the focus of innovation and market growth is overwhelmingly on BEVs and PHEVs.

The expansion of charging infrastructure, supportive government policies, and the increasing availability of diverse EV models across all vehicle types are the primary drivers contributing to the strong performance of these segments.

Europe Lithium-ion Battery for Electric Vehicle Market Product Developments

Product developments in the Europe lithium-ion battery for electric vehicle market are intensely focused on enhancing energy density, improving charging speeds, and extending battery lifespan. Innovations in cathode and anode materials, alongside advancements in solid-state electrolyte technology, are paving the way for next-generation batteries that offer greater range and faster refueling. Companies are also prioritizing battery management systems (BMS) for optimal performance and safety, as well as developing modular battery designs for greater flexibility and easier repair. The increasing emphasis on sustainability is driving the development of batteries with reduced reliance on critical raw materials and improved recyclability, aligning with circular economy principles and regulatory demands. These technological leaps are crucial for maintaining a competitive edge and meeting the evolving demands of the EV market.

Challenges in the Europe Lithium-ion Battery for Electric Vehicle Market Market

The Europe lithium-ion battery for electric vehicle market faces several significant challenges that could impede its growth trajectory.

- Supply Chain Volatility: Dependence on imported raw materials like lithium, cobalt, and nickel creates vulnerabilities to geopolitical disruptions and price fluctuations. The establishment of robust European raw material sourcing and processing capabilities is a critical, yet ongoing, challenge.

- High Capital Investment: Building and scaling gigafactories requires substantial upfront capital investment, posing a barrier for new entrants and requiring significant financial backing for established players.

- Recycling Infrastructure: Developing a comprehensive and economically viable battery recycling infrastructure across Europe is crucial to manage end-of-life batteries and recover valuable materials, but this is still in its nascent stages.

- Skilled Workforce Development: A shortage of skilled labor in battery manufacturing, research, and development can hinder production capacity and innovation.

Forces Driving Europe Lithium-ion Battery for Electric Vehicle Market Growth

The Europe lithium-ion battery for electric vehicle market is propelled by a powerful combination of economic, technological, and regulatory forces.

- Government Policies and Incentives: Ambitious targets for greenhouse gas emission reductions, coupled with direct subsidies for EV purchases and investments in charging infrastructure, are creating a highly favorable environment for EV adoption.

- Technological Advancements: Continuous innovation in battery chemistry, energy density, charging speed, and safety features is making EVs more practical and appealing to a wider consumer base.

- Growing Environmental Awareness: Increasing public concern about climate change and air quality is driving consumer preference towards sustainable transportation solutions.

- Automaker Commitment: Major automotive manufacturers are making substantial investments in electrification, launching a plethora of new EV models across various segments, which in turn stimulates battery demand.

- Falling Battery Costs: Economies of scale and technological improvements are steadily reducing the cost of lithium-ion batteries, making EVs more competitive with their internal combustion engine counterparts.

Challenges in the Europe Lithium-ion Battery for Electric Vehicle Market Market

Long-term growth catalysts in the Europe lithium-ion battery for electric vehicle market are intrinsically linked to the industry's ability to innovate and adapt to evolving market demands. Key among these is the ongoing quest for next-generation battery technologies, such as solid-state batteries, which promise enhanced safety, higher energy density, and faster charging capabilities, potentially overcoming current limitations. Strategic partnerships and vertical integration across the value chain, from raw material sourcing to battery recycling, are crucial for securing supply chains, reducing costs, and fostering innovation. Furthermore, the continuous expansion and upgrading of charging infrastructure across the continent will play a pivotal role in alleviating range anxiety and encouraging wider EV adoption. Investments in research and development focused on sustainable battery chemistries and circular economy principles will not only address environmental concerns but also position European manufacturers as leaders in responsible battery production.

Emerging Opportunities in Europe Lithium-ion Battery for Electric Vehicle Market

Emerging opportunities in the Europe lithium-ion battery for electric vehicle market are ripe for exploration, driven by evolving consumer preferences and technological breakthroughs. The burgeoning demand for battery recycling and second-life applications presents a significant opportunity for companies to develop closed-loop systems, reducing reliance on virgin materials and creating new revenue streams. Advancements in battery-as-a-service (BaaS) models are also gaining traction, offering consumers flexible and potentially more affordable access to EVs by separating the cost of the battery from the vehicle purchase. The increasing electrification of other transport sectors, beyond passenger cars, such as heavy-duty trucks, buses, and even aviation, opens up new avenues for battery innovation and market expansion. Furthermore, the development of localized battery manufacturing and supply chains within Europe, supported by government initiatives, presents a substantial opportunity to reduce import dependencies and foster regional economic growth.

Leading Players in the Europe Lithium-ion Battery for Electric Vehicle Market Sector

- Panasonic Holdings Corporation

- Faradion Limited (UK)

- Contemporary Amperex Technology Co Ltd (CATL)

- LG Energy Solution Ltd

- Northvolt AB

- BMZ GmbH

- Saft Groupe SA

- FIAMM Energy Technology

- VARTA AG

- Samsung SDI Co Ltd

- Tesla Inc

Key Milestones in Europe Lithium-ion Battery for Electric Vehicle Market Industry

- November 2023: Northvolt, a European EV battery maker, announced a breakthrough in battery development, manufacturing a first-of-its-kind energy storage battery by replacing widely used critical minerals such as lithium, cobalt, nickel, and graphite. This innovation signals a significant step towards reducing reliance on scarce resources and improving the sustainability of battery production.

- May 2023: The Government of France announced plans to launch its first battery factory for electric cars. The construction of this battery industry is part of France's reindustrialization plan. The gigafactory in Billy-Berclau is owned by Automotive Cells Company, a partnership between energy giant TotalEnergies, Mercedes-Benz, and Stellantis, which produces a range of brands including Fiat, Peugeot, and Chrysler. This initiative underscores the European commitment to strengthening domestic battery manufacturing capabilities and reducing geopolitical dependencies.

Strategic Outlook for Europe Lithium-ion Battery for Electric Vehicle Market Market

The strategic outlook for the Europe lithium-ion battery for electric vehicle market is exceptionally bright, characterized by continued robust growth and significant opportunities for innovation and expansion. Key growth accelerators include the ongoing commitment of automotive manufacturers to electrification, leading to a sustained demand for advanced battery solutions. Strategic focus will likely shift towards further localization of the battery supply chain, from raw material processing to cell manufacturing and recycling, to enhance resilience and cost-competitiveness. Partnerships between battery producers, automakers, and technology developers will be crucial for accelerating the development and deployment of next-generation battery chemistries and charging technologies. Moreover, the increasing emphasis on sustainability and circular economy principles will drive innovation in battery design, manufacturing processes, and end-of-life management, positioning European companies as leaders in the global transition to electric mobility.

Europe Lithium-ion Battery for Electric Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

- 1.3. Other Vehicles (Bikes, Scooters, etc.)

-

2. Propulsion Type

- 2.1. Battery Electric Vehicles (BEVs)

- 2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 2.3. Hybrid Electric Vehicles (HEVs)

Europe Lithium-ion Battery for Electric Vehicle Market Segmentation By Geography

- 1. Germany

- 2. France

- 3. United Kingdom

- 4. Italy

- 5. Spain

- 6. NORDIC

- 7. Russia

- 8. Turkey

- 9. Rest of Europe

Europe Lithium-ion Battery for Electric Vehicle Market Regional Market Share

Geographic Coverage of Europe Lithium-ion Battery for Electric Vehicle Market

Europe Lithium-ion Battery for Electric Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Lithium-ion Battery Prices4.; Increasing Adoption of Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. 4.; Declining Lithium-ion Battery Prices4.; Increasing Adoption of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Battery Electric Vehicles (BEVs) Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Lithium-ion Battery for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.1.3. Other Vehicles (Bikes, Scooters, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Battery Electric Vehicles (BEVs)

- 5.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 5.2.3. Hybrid Electric Vehicles (HEVs)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. United Kingdom

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. NORDIC

- 5.3.7. Russia

- 5.3.8. Turkey

- 5.3.9. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Germany Europe Lithium-ion Battery for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Vehicles

- 6.1.2. Commercial Vehicles

- 6.1.3. Other Vehicles (Bikes, Scooters, etc.)

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. Battery Electric Vehicles (BEVs)

- 6.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 6.2.3. Hybrid Electric Vehicles (HEVs)

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. France Europe Lithium-ion Battery for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Vehicles

- 7.1.2. Commercial Vehicles

- 7.1.3. Other Vehicles (Bikes, Scooters, etc.)

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. Battery Electric Vehicles (BEVs)

- 7.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 7.2.3. Hybrid Electric Vehicles (HEVs)

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. United Kingdom Europe Lithium-ion Battery for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Vehicles

- 8.1.2. Commercial Vehicles

- 8.1.3. Other Vehicles (Bikes, Scooters, etc.)

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. Battery Electric Vehicles (BEVs)

- 8.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 8.2.3. Hybrid Electric Vehicles (HEVs)

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Italy Europe Lithium-ion Battery for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Vehicles

- 9.1.2. Commercial Vehicles

- 9.1.3. Other Vehicles (Bikes, Scooters, etc.)

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. Battery Electric Vehicles (BEVs)

- 9.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 9.2.3. Hybrid Electric Vehicles (HEVs)

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Spain Europe Lithium-ion Battery for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Passenger Vehicles

- 10.1.2. Commercial Vehicles

- 10.1.3. Other Vehicles (Bikes, Scooters, etc.)

- 10.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.2.1. Battery Electric Vehicles (BEVs)

- 10.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 10.2.3. Hybrid Electric Vehicles (HEVs)

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. NORDIC Europe Lithium-ion Battery for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.1.1. Passenger Vehicles

- 11.1.2. Commercial Vehicles

- 11.1.3. Other Vehicles (Bikes, Scooters, etc.)

- 11.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 11.2.1. Battery Electric Vehicles (BEVs)

- 11.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 11.2.3. Hybrid Electric Vehicles (HEVs)

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 12. Russia Europe Lithium-ion Battery for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 12.1.1. Passenger Vehicles

- 12.1.2. Commercial Vehicles

- 12.1.3. Other Vehicles (Bikes, Scooters, etc.)

- 12.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 12.2.1. Battery Electric Vehicles (BEVs)

- 12.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 12.2.3. Hybrid Electric Vehicles (HEVs)

- 12.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 13. Turkey Europe Lithium-ion Battery for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 13.1.1. Passenger Vehicles

- 13.1.2. Commercial Vehicles

- 13.1.3. Other Vehicles (Bikes, Scooters, etc.)

- 13.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 13.2.1. Battery Electric Vehicles (BEVs)

- 13.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 13.2.3. Hybrid Electric Vehicles (HEVs)

- 13.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 14. Rest of Europe Europe Lithium-ion Battery for Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 14.1.1. Passenger Vehicles

- 14.1.2. Commercial Vehicles

- 14.1.3. Other Vehicles (Bikes, Scooters, etc.)

- 14.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 14.2.1. Battery Electric Vehicles (BEVs)

- 14.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 14.2.3. Hybrid Electric Vehicles (HEVs)

- 14.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2025

- 15.2. Company Profiles

- 15.2.1 Panasonic Holdings Corporation

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Faradion Limited (UK)

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Contemporary Amperex Technology Co Ltd (CATL)

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 LG Energy Solution Ltd

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Northvolt AB

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 BMZ GmbH

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Saft Groupe SA

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 FIAMM Energy Technology

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 VARTA AG

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Samsung SDI Co Ltd

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Tesla Inc *List Not Exhaustive 6 4 List of Other Prominent Companies (Company Name Headquarter Relevant Products & Services Contact Details etc )6 5 Market Ranking Analysi

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.1 Panasonic Holdings Corporation

List of Figures

- Figure 1: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Germany Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 4: Germany Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 5: Germany Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: Germany Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 7: Germany Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 8: Germany Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Propulsion Type 2025 & 2033

- Figure 9: Germany Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 10: Germany Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Propulsion Type 2025 & 2033

- Figure 11: Germany Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Germany Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Country 2025 & 2033

- Figure 13: Germany Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Germany Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Country 2025 & 2033

- Figure 15: France Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 16: France Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 17: France Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: France Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 19: France Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 20: France Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Propulsion Type 2025 & 2033

- Figure 21: France Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 22: France Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Propulsion Type 2025 & 2033

- Figure 23: France Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 24: France Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Country 2025 & 2033

- Figure 25: France Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: France Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Country 2025 & 2033

- Figure 27: United Kingdom Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 28: United Kingdom Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 29: United Kingdom Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: United Kingdom Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 31: United Kingdom Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 32: United Kingdom Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Propulsion Type 2025 & 2033

- Figure 33: United Kingdom Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 34: United Kingdom Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Propulsion Type 2025 & 2033

- Figure 35: United Kingdom Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 36: United Kingdom Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Country 2025 & 2033

- Figure 37: United Kingdom Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: United Kingdom Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Italy Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 40: Italy Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 41: Italy Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 42: Italy Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 43: Italy Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 44: Italy Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Propulsion Type 2025 & 2033

- Figure 45: Italy Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 46: Italy Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Propulsion Type 2025 & 2033

- Figure 47: Italy Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Italy Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Italy Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Italy Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Spain Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 52: Spain Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 53: Spain Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 54: Spain Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 55: Spain Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 56: Spain Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Propulsion Type 2025 & 2033

- Figure 57: Spain Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 58: Spain Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Propulsion Type 2025 & 2033

- Figure 59: Spain Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Spain Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Spain Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Spain Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Country 2025 & 2033

- Figure 63: NORDIC Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 64: NORDIC Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 65: NORDIC Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 66: NORDIC Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 67: NORDIC Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 68: NORDIC Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Propulsion Type 2025 & 2033

- Figure 69: NORDIC Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 70: NORDIC Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Propulsion Type 2025 & 2033

- Figure 71: NORDIC Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 72: NORDIC Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Country 2025 & 2033

- Figure 73: NORDIC Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: NORDIC Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Country 2025 & 2033

- Figure 75: Russia Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 76: Russia Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 77: Russia Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 78: Russia Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 79: Russia Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 80: Russia Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Propulsion Type 2025 & 2033

- Figure 81: Russia Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 82: Russia Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Propulsion Type 2025 & 2033

- Figure 83: Russia Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 84: Russia Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Country 2025 & 2033

- Figure 85: Russia Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 86: Russia Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Country 2025 & 2033

- Figure 87: Turkey Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 88: Turkey Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 89: Turkey Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 90: Turkey Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 91: Turkey Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 92: Turkey Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Propulsion Type 2025 & 2033

- Figure 93: Turkey Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 94: Turkey Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Propulsion Type 2025 & 2033

- Figure 95: Turkey Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 96: Turkey Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Country 2025 & 2033

- Figure 97: Turkey Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: Turkey Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Country 2025 & 2033

- Figure 99: Rest of Europe Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 100: Rest of Europe Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 101: Rest of Europe Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 102: Rest of Europe Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 103: Rest of Europe Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 104: Rest of Europe Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Propulsion Type 2025 & 2033

- Figure 105: Rest of Europe Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 106: Rest of Europe Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Propulsion Type 2025 & 2033

- Figure 107: Rest of Europe Europe Lithium-ion Battery for Electric Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 108: Rest of Europe Europe Lithium-ion Battery for Electric Vehicle Market Volume (Billion), by Country 2025 & 2033

- Figure 109: Rest of Europe Europe Lithium-ion Battery for Electric Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 110: Rest of Europe Europe Lithium-ion Battery for Electric Vehicle Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 4: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Propulsion Type 2020 & 2033

- Table 5: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 9: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 10: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Propulsion Type 2020 & 2033

- Table 11: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 16: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Propulsion Type 2020 & 2033

- Table 17: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 21: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 22: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Propulsion Type 2020 & 2033

- Table 23: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 27: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 28: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Propulsion Type 2020 & 2033

- Table 29: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 34: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Propulsion Type 2020 & 2033

- Table 35: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 38: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 39: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 40: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Propulsion Type 2020 & 2033

- Table 41: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Country 2020 & 2033

- Table 43: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 44: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 45: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 46: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Propulsion Type 2020 & 2033

- Table 47: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 50: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 51: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 52: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Propulsion Type 2020 & 2033

- Table 53: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 56: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 57: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 58: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Propulsion Type 2020 & 2033

- Table 59: Global Europe Lithium-ion Battery for Electric Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Europe Lithium-ion Battery for Electric Vehicle Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Lithium-ion Battery for Electric Vehicle Market?

The projected CAGR is approximately 18.90%.

2. Which companies are prominent players in the Europe Lithium-ion Battery for Electric Vehicle Market?

Key companies in the market include Panasonic Holdings Corporation, Faradion Limited (UK), Contemporary Amperex Technology Co Ltd (CATL), LG Energy Solution Ltd, Northvolt AB, BMZ GmbH, Saft Groupe SA, FIAMM Energy Technology, VARTA AG, Samsung SDI Co Ltd, Tesla Inc *List Not Exhaustive 6 4 List of Other Prominent Companies (Company Name Headquarter Relevant Products & Services Contact Details etc )6 5 Market Ranking Analysi.

3. What are the main segments of the Europe Lithium-ion Battery for Electric Vehicle Market?

The market segments include Vehicle Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.56 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Lithium-ion Battery Prices4.; Increasing Adoption of Electric Vehicles.

6. What are the notable trends driving market growth?

Battery Electric Vehicles (BEVs) Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Declining Lithium-ion Battery Prices4.; Increasing Adoption of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

November 2023: Northvolt, a European EV battery maker, announced a breakthrough in battery development. The company manufactured a first-of-its-kind energy storage battery by replacing widely used critical minerals such as lithium, cobalt, nickel, and graphite.May 2023: The Government of France announced plans to launch its first battery factory for electric cars. The construction of the battery industry is part of France's reindustrialization plan. The gigafactory in Billy-Berclau is owned by Automotive Cells Company, a partnership between energy giant TotalEnergies, Mercedes-Benz, and Stellantis, which produces a range of brands including Fiat, Peugeot, and Chrysler.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Lithium-ion Battery for Electric Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Lithium-ion Battery for Electric Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Lithium-ion Battery for Electric Vehicle Market?

To stay informed about further developments, trends, and reports in the Europe Lithium-ion Battery for Electric Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence